1. Introduction

My name is John Ligon. I am a Policy Analyst in the Center for Data Analysis at the Heritage Foundation. The views I express in this testimony are my own and should not be construed as representing any official position of the Heritage Foundation.

I thank Chairman Garrett, Ranking Member Maloney, and the rest of the committee for the opportunity to testify today.

The sections in this written testimony lead to the following conclusion: Federal housing policies related to the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, have proved costly not only to the federal taxpayer, but also to the broader financial system. We should recognize their failure and move toward a U.S. mortgage market without these finance GSEs.

2. Fannie Mae and Freddie Mac: Role in the U.S. Housing Finance Market

Fannie Mae and Freddie Mac are the Ultimate Guarantors of U.S. Mortgages. Fannie Mae, was originally chartered in 1938 as the Federal National Mortgage Association (FNMA). Freddie Mac, the Federal Home Loan Mortgage Corporation (FHLMC), was created in 1970. These institutions have grown significantly in size and scope in the U.S. mortgage market since their origination. Their asset holdings – either through mortgage securitizations or direct portfolio holdings – have increased from approximately 7 percent of total residential mortgage market originations in 1980 ($78 billion) to about 47 percent in 2003 ($3.6 trillion).[1]

By 2010, Fannie Mae and Freddie Mac owned or guaranteed approximately half of all outstanding mortgages in the United States, including a significant share of sub-prime mortgages, and financed 63 percent of new mortgages originated in that year.[2] Other federal agencies, including the Federal Housing Finance Agency and Department of Veterans Affairs, guarantee approximately an additional 23 percent of residential mortgages. This means that federal taxpayers guarantee approximately 90 percent of all new mortgage originations in the current market.[3]

Fannie Mae and Freddie Mac were placed into federal conservatorship under regulatory authority conferred to the Federal Housing Finance Agency (FHFA) in the Housing and Economic Recovery Act (HERA) of 2008.[4] These institutions faced a combined loss on net income of $108 billion in 2008 on defaulted mortgage assets in their respective portfolios, and the federal government provided the capital to cover the losses.[5] The net loss to federal taxpayers has been $143 billion—$188 billion in transfers from the federal government less $45 billion in dividend pay-outs from the GSEs.[6]

Moreover, now that Fannie Mae and Freddie Mac fall within federal conservatorship, their combined agency debt, mortgage, and mortgage-related holdings are directly guaranteed by the federal government. The federal government provides direct financing, and the agency debt is not considered official government debt – therefore not included in the accounting of federal publicly held debt. The level of agency debt is massive and has exploded over the last 40 years: in 1970 agency debt as a share of U.S. Treasury debt was 15 percent, and as of 2010, this share was 81 percent (a combined $7.5 trillion).[7]

Federally Initiated Affordable Housing Goals Undermine Homeownership. Fannie Mae and Freddie Mac have operated under congressionally mandated missions to expand mortgage credit to specific income groups and achieve specific housing goals while trying to also compete for higher profits in the U.S. mortgage and secondary mortgage markets.[8] These federally initiated affordable housing goals led to gradual deterioration of lending standards in the entire U.S. mortgage market beginning in the 1990s.

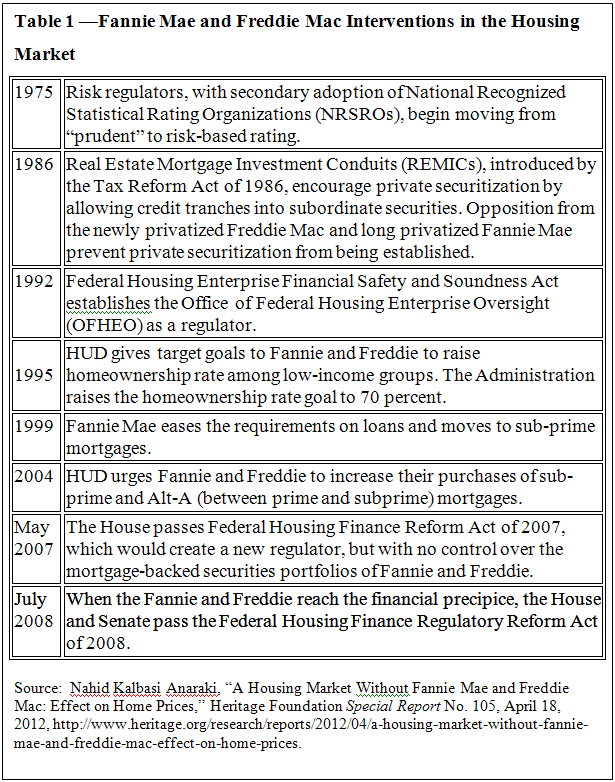

The relaxation of lending standards in the U.S. mortgage market started in earnest in the 1990s. In 1995, the Department of Housing and Urban Development (HUD) established a target goal relating to the homeownership rate among low-income groups, which was eventually set at 70 percent. Then in 1999, HUD directed Fannie Mae and Freddie Mac to relax their requirement standards on mortgage loans, including a move toward sub- and non-prime loan approval, yet maintained their inability to make moves in the non-conforming market. (See Table 1.) During the 1990s, the GSE share of mortgage loans with high loan-to-value (LTV) ratios rose from around 6 percent of purchases in 1992 to 19 percent in 1995.[9]

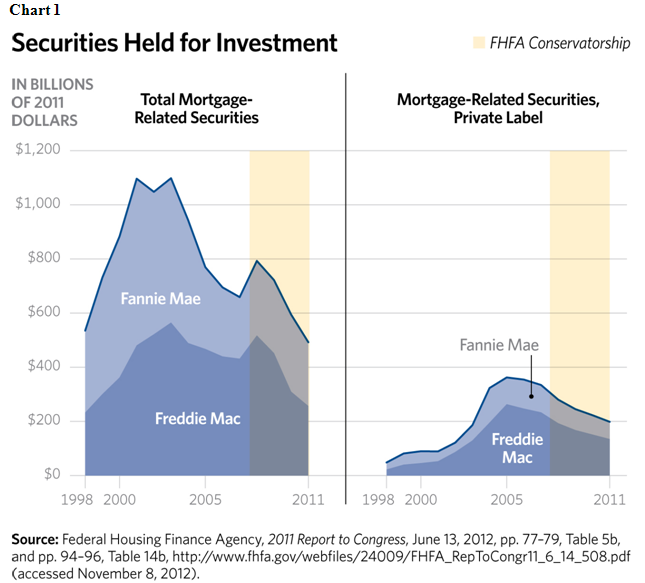

Starting in 2006, there was further easing of mortgage lending standards combined with low interest rate policy by the Federal Reserve.[10] In 2002, the private mortgage market aggressively moved toward non-conforming and jumbo mortgage loans. Fannie Mae and Freddie Mac, constrained by the conforming-mortgage thresholds set on their mortgage originations, shifted their portfolio allocations towards private label mortgage-backed securities to achieve their affordable housing goals. Between 2002 and 2006, total mortgage-related securities holdings for Fannie Mae and Freddie Mac decreased approximately by half while their combined holdings of private label mortgage-backed securities increased substantially during this same time period. (See Chart 1.)

The erosion of lending standards that stretched across the U.S. mortgage market from 2000 to 2006 weakened the quality of holdings even in the GSEs portfolios since a sizeable share of their mortgage-backed security holdings were securitized from sub-prime and non-prime mortgages. From 2001 to 2006, sub-prime loans increased from $120 billion (5.5 percent of U.S. mortgage originations) to $600 billion (20 percent of the U.S. mortgage market originations).[11] Moreover, the level of borrowing against equity in home mortgages (home equity lines of credit (HELOCs)) increased from $130 billion (6 percent of the U.S. mortgage market) in 2001 to $430 billion (about 15 percent of the U.S. mortgage market) in 2006. Thus, the total level of non-prime mortgage loans peaked at 48 percent of the mortgage market in 2006.[12] Between 2006 and 2007, Fannie Mae held 25 percent of its total loans with LTV above 80 percent and 18 percent in loans with credit scores lower than 660 and nearly 23 percent in sub-prime and other high-risk mortgages and 15 percent in interest-only loans.[13]

During the 2002 to 2006 boom period, overall debt-to-income levels rose sharply for many U.S. households. Mortgage and non-home-related debt rose at a similar pace from 1996 to 2002, but mortgage-related debt accelerated faster than non-home-related debt from 2002 to 2006.[14] While housing-related asset valuations were rising, the level of borrowing activity against the higher home values – home-equity-based borrowing – also increased. This borrowing behavior remained mostly concentrated among younger households with low credit scores or households with high initial credit card utilization rates. Between 2002 and 2006, with lower lending standards and rising home values, a significant share of these younger and lower-credit-quality homeowners aggressively borrowed against the higher value of their homes. By 2008, homeowners who had borrowed against the increased value of their homes ended up with $1.25 trillion more in total household debt.[15] These same homeowners accounted for 39 percent of total new mortgage defaults between 2006 and 2008.[16]

Since 2006, national home prices have declined substantially, and some regional markets have experienced catastrophic decreases. In many regional housing markets, since 2007, these price changes and weakening macroeconomic fundamentals (e.g., high unemployment rates and falling household incomes) have put downward pressure on both the demand and the supply of housing and mortgage credit.[17] The combination of dramatic asset price reversion and macroeconomic instability left – and still leaves – many households unable to stay current on their home payments. Consequently, beginning in 2007, the rate of defaults and delinquencies spiked as prices began to plummet.

Fannie Mae and Freddie Mac Undermined Stability in the U.S. Financial System. Because of the broad reach of the mortgage assets – including direct mortgage holdings and market securitizations – to the U.S. financial markets, the recent downturn in prices dramatically affected household wealth. The loss in value in mortgage-related assets significantly affected financial institutions, especially Fannie Mae and Freddie Mac, which were systemically part of the financial system.

As economist Lawrence J. White notes, the aggregate financial losses during the “tech” bubble of the late 1990s and financial losses from the mortgage and housing bubble of 2007 were comparable at approximately $7 trillion.[18] While households absorbed many of these losses in both bubble episodes, nearly $1.3 trillion of the losses was in key financial institutions – from depository institutions to the mortgage GSEs.[19] Many of the largest financial institutions did not have the capital to cover these losses and this led to a bailout of hundreds of billions of dollars, and bankruptcies for some. The losses led to widespread uncertainty about the viability of many of the leading financial institutions, which triggered a sharp decline in the stock market and, subsequently, the overall economy.[20]

3. Fannie Mae and Freddie Mac: Estimated Value of Taxpayer Subsidy

Prior to FHFA conservatorship and the explicit backing of the federal government, market purchasers of the GSE debt believed that Fannie Mae and Freddie Mac’s agency debt was implicitly backed by the federal government. This belief stemmed from the many borrowing, tax, and regulatory advantages not conferred to any other shareholder corporation. First, these two housing finance GSEs were exempt from many state investor protection laws, and received specific federal charters, mainly issuances of mortgage credit to income-specific groups of households.[21] Second, Fannie Mae and Freddie Mac were exempt from state and local income taxation. Third, they were exempt from Securities and Exchange Commission registration and bank regulations on security holdings. Fourth, they held a direct line of credit with the U.S. Treasury, issuing agency debt and borrowing between corporate AAA credit interest rate yields and U.S. Treasury interest rate yields. Last, they received U.S. agency status and the guarantee of the federal government on mortgage-backed securities. [22]

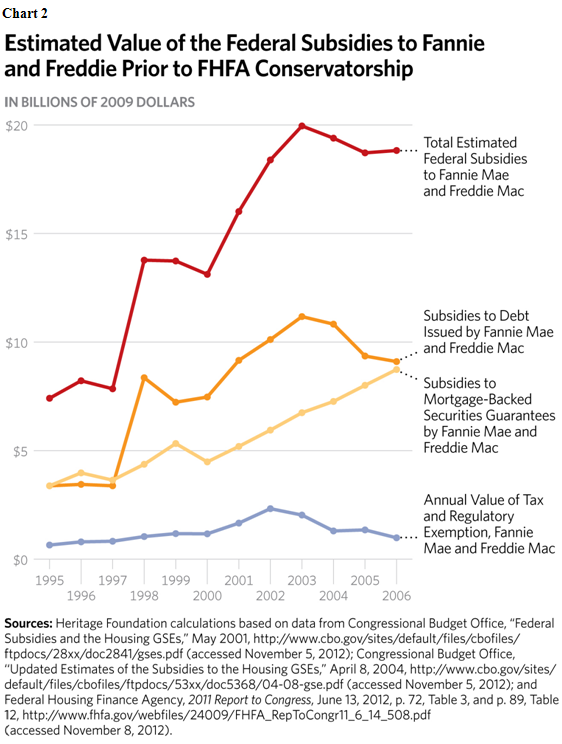

The annual estimated value of these subsidy benefits is substantial, ranging from about $7 billion to $20 billion before FHFA conservatorship. (See Chart 2.) This subsidy value translates into an estimate between 20 and 50 basis points on mortgage interest rates, a share of the value passed through to the shareholders of these firms and a share passed through to mortgage holders.

Economists have made several attempts to estimate the value of these federal subsidies. The Congressional Budget Office estimates that agency debt subsidy (lower borrowing costs) results in a 41 basis point value to shareholders and borrowers. Fannie Mae and Freddie Mac pass through 25 basis points of the subsidy value to borrowers and shareholders retain an estimated 16 basis points on each dollar of debt. These economists estimate a subsidy value on mortgage-backed securities at 30 basis points, where approximately 25 basis points are passed to the borrowers of mortgages.[23] Additionally, Wayne Passmore and his co-authors estimate a 40 basis point subsidy to GSE debt.[24] They estimate that the pass-through of the GSE debt subsidy lowers mortgage rates to homeowners by 7 basis points, or 16 percent of the total 40 basis point subsidy value.[25]

4. Fannie Mae and Freddie Mac: The Economic Impact of Ending the Taxpayer Subsidy

The cessation of activity by Fannie Mae and Freddie Mac would effectively translate into a removal of an interest rate subsidy. Recent research by analysts at the Heritage Foundation indicates that removing this subsidy would have minimal effect on the U.S. housing market and the U.S. economy more broadly. This line of research encompasses three studies that estimate the impact of removing the GSE interest rate subsidy on housing starts, home prices, and overall homeownership. In a final study, we estimate the economic effect of eliminating the subsidy.

The Heritage studies on housing starts, home prices, and homeownership indicate that changes in the housing market are more responsive to changes in overall economic fundamentals (e.g., personal income levels, real output, level of household debt, etc.) relative to changes in interest rates or certain credit approval requirements, such as down payment levels.[26] Once the housing and financial markets recover from the recent turmoil, shutting down Fannie Mae and Freddie Mac would have, at most, a minimal impact on the overall housing market.

Additionally, our research studies the likely impact of removing the interest rate subsidy in a macroeconomic framework. Opponents of eliminating GSEs in the housing finance industry assert that phasing out the GSEs would leave the housing market and economy worse off. Heritage research suggests, however, that eliminating Fannie Mae and Freddie Mac would have a minimal and predictable impact on these markets and the overall economy.[27] The average annual decline in real output over the 10-year forecast period is 0.04 percent, or a $6 billion average difference from baseline levels, smaller than the estimated average annual subsidy value to these institutions and far less than the average annual cost of these institutions to the federal taxpayer. Thus, claims of drastic economic effects are overstated.

5. Fannie Mae and Freddie Mac: Eliminating Government-Sponsored Enterprises in Housing Finance

After more than three decades of experience with boom and bust cycles in the housing market, which have affected not only household income and wealth but also financial markets, federal policymakers should seriously reconsider the federal government’s role in shaping housing policy through GSEs such as Fannie Mae and Freddie Mac. These institutions distort the U.S. housing and mortgage markets at substantial risk to households and U.S. taxpayers.

Eliminating the present role Fannie Mae and Freddie Mac play in the U.S. mortgage market could save billions of taxpayer dollars in the U.S. mortgage market through eliminating the subsidy that has induced U.S. households to take on more debt-related consumption, ending up underwater. Many households were never in position to handle such debt; therefore, subsidizing them to become homeowners is not only inconsequential in raising homeownership but also detrimental to the financial market.

The housing finance GSEs played a central role in the systemic nature of the collapse of the financial market. It is necessary to learn from the failures of this institutional model and restore properly aligned incentives to the U.S. housing and housing finance markets.[28] Congressional leaders made the mistakes of creating Fannie Mae and Freddie Mac and subsidizing their activity in the U.S. mortgage market through special access to federal funds and an implicit guarantee prior to federal conservatorship in 2008. They need to wind down the GSEs and establish a U.S housing finance market free of the distortions this institutional arrangement generates.

The Heritage Foundation is a public policy, research, and educational organization recognized as exempt under section 501(c)(3) of the Internal Revenue Code. It is privately supported and receives no funds from any government at any level, nor does it perform any government or other contract work.

The Heritage Foundation is the most broadly supported think tank in the United States. During 2013, it had nearly 600,000 individual, foundation, and corporate supporters representing every state in the U.S. Its 2013 income came from the following sources:

Individuals 80%

Foundations 17%

Corporations 3%

The top five corporate givers provided The Heritage Foundation with 2% of its 2013 income. The Heritage Foundation’s books are audited annually by the national accounting firm of McGladrey, LLP.

Members of The Heritage Foundation staff testify as individuals discussing their own independent research. The views expressed are their own and do not reflect an institutional position for The Heritage Foundation or its board of trustees.

Endnotes

[1] W. Scott Frame and Lawrence J. White, “Fussing and Fuming over Fannie Mae and Freddie Mac: How Much Smoke, How Much Fire?” Journal of Economic Perspectives, Vol. 19, No. 2 (Spring 2005), pp. 159-162.

[2] Deborah Lucas, "The Budgetary Cost of Fannie Mae and Freddie Mac and Options for the Future Federal Role in the Secondary Mortgage Market," statement before the Committee on the Budget, U.S. House of Representatives, June 2, 2011, p. 7, http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/122xx/doc12213/06-02-gses_testimony.pdf (accessed June 4, 2012).

[3] Ibid., p. 162.

[4] Prior to FHFA conservatorship, Fannie Mae and Freddie Mac were regulated by the Office of Federal Housing Enterprise Oversight (OFHEO). The Housing and Economic Recovery Act (HERA) of 2008 transferred the regulatory responsibility to the FHFA.

[5] HERA conferred to the FHFA the power to place Fannie Mae and Freddie Mac in federal conservatorship, which the FHFA did in September 2008.

[6] Rachelle Younglai, “U.S. Tightens Reins on Fannie Mae, Freddie Mac,” Reuters, at http://www.reuters.com/article/2012/08/17/us-usa-housing-idUSBRE87G0EN20120817 (accessed March 5, 2013). Through March 2011 the net loss to federal taxpayers totaled $154 billion in capital subsidies ($180 billion net $24 billion in dividends on its preferred stock). Lucas, “The Budgetary Cost of Fannie Mae and Freddie Mac,” p. 2.

[7] Alex J. Pollack, “The Government’s Four-Decade Financial Experiment,” The American, July 13, 2011, http://www.american.com/archive/2011/july/the-government2019s-four-decade-financial-experiment (accessed June 4, 2012)

[8] Frame and White, “Fussing and Fuming over Fannie and Freddie,” pp. 162-163.

[9] Karl Case indicates that during the 1990s, “[the] sum of outstanding mortgages with some form of mortgage insurance or guarantee (from the Federal Housing Administration or Veterans Affairs, or through private mortgage insurance), the risk-tranched securities of Fannie Mae and Freddie Mac, and the subprime market has increased from 16 percent to just under 40 percent of total mortgage credit.” Karl E. Case, “Real Estate and the Macroeconomy,” Brookings Papers on Economic Activity, 2000, pp. 119-162, http://www.brookings.edu/~/media/Projects/BPEA/Fall%202000/2000b_bpea_case.PDF (accessed November 6, 2012)

[10] The inflation-adjusted yield on 10-year Treasury notes fell 120 basis points from 1996 to 2006, and 190 basis points from 2000 to 2005. Edward L. Edward L. Glaeser, Joshua D. Gottlieb, and Joseph Gyourko, "Can Cheap Credit Explain the Housing Boom?" National Bureau of Economic Research Working Paper No. 16230, July 2010, http://www.nber.org/papers/w16230 (accessed November 5, 2012).Additionally, there is debate about the role that interest rates play in the pattern of home prices in the lead-up to the price peak of 2006. Numerous economists acknowledge that interest rate policy was one of many factors that drove the most recent housing bubble. See John B. Taylor, “Housing and Monetary Policy,” National Bureau of Economic Research Working Paper No. 13682, December 2007, http://www.nber.org/papers/w13682 (accessed June 4, 2012); Karl E. Case and John M. Quigley, “How Housing Busts End: Home Prices, User Cost, and Rigidities During Down Cycles,” University of California, Berkeley, Institute of Business and Economic Research, Program on Housing and Urban Policy Working Paper No. W08-008, September 1, 2009, pp. 460-471, http://www.escholarship.org/uc/item/6mh9m4ff (accessed November 5, 2012); Adam J. Levitin and Susan M. Wachter, “Explaining the Housing Bubble,” September 1, 2010, revised May 16, 2012, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1669401 (accessed June 4, 2012). Some posit that interest rate policy can substantially affect price movements during bubble periods, particularly the bubble of 2000-2005. Charles Himmelberg, Christopher Mayer, and Todd Sinai, “Assessing High House Prices: Bubbles, Fundamentals, and Misperceptions,” Journal of Economic Perspectives, Vol. 19, No. 4 (Fall 2005), pp. 67-72, http://pubs.aeaweb.org/doi/pdfplus/10.1257/089533005775196769 (accessed November 6, 2012), and Taylor, “Housing and Monetary Policy.” Case and Quigley make the case that expansionary monetary policy by the Federal Reserve induced strong demand pressures in the U.S. mortgage and housing markets, beginning in 2002 with a strong demand for refinancing. Case and Quigley, “How Housing Busts End.” Still, others argue that interest rates have little role and that other factors, such as price expectations of homeowners, matter more in the strong price movement during bubble periods. Glaeser et al., “Can Cheap Credit Explain the Housing Boom?” Additionally, Fannie Mae and Freddie Mac pass a substantial interest rate subsidy in the mortgage market due to their low-cost borrowing advantage with the Treasury. Taylor, “Housing and Monetary Policy”; Case and Quigley, “How Housing Busts End”; Levitin and Wachter, “Explaining the Housing Bubble”.

[11] Viral V. Acharya et al, Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage Finance (Princeton, NJ: Princeton University Press, 2011), p. 46.

[12] Ibid.

[13] Acharya et al, Guaranteed to Fail, p. 39.

[14] Atif Mian and Amir Sufi, “House Prices, Home Equity-Based Borrowing, and the U.S. Household Leverage Crisis,” American Economic Review, August 2011, Vol. 101, No. 5 (August 2011), pp. 2132-2156.

[15] Mian and Sufi, “House Prices,” pp. 2132-2156. Acharya et al. note that, including credit card debt, by 2008, households in the U.S. collectively owed more than 114 percent of total gross domestic product, or $16.4 trillion. By 2010, households still owed $12.8 trillion in mortgage debt and $15.8 trillion in total debt. These changes in debt levels correspond to a declining share of home equity as a share of aggregate household wealth—the share fell from 62 percent in the third quarter of 2005 to 35 percent in the first quarter of 2009. Acharya et al., Guaranteed to Fail, pp. 92-92.

[16] Mian and Sufi find that “a total of $1.25 trillion of the rise in household debt from 2002 to 2006 is attributable to existing homeowners borrowing against the increased value of their homes [and that] at least 39% of total new defaults seen between 2006 and 2008 are from 1997 homeowners who borrowed aggressively against the rising value of their houses. [Lower] credit quality households living in high house price appreciation areas experience a relative decline in default rate from 2002-2006 as they borrow heavily against their home equity, but experience very high default rates from 2006-2008. [There is] a very strong home equity-based borrowing effect for low credit quality borrowers. [In] contrast there is almost no effect for high quality borrowers.” Mian and Sufi, “House Prices,” pp. 2132-2156.

[17] Changes to mortgage credit will likely affect both supply and demand and respond to changes in home prices. Additionally, a decline in housing prices does not in itself lead to a downturn in the U.S. housing and mortgage market. First, there is a psychological attachment to homes and areas of residence. It is not easy to leave and relocate for many families. Second, homeowners, while negatively affected by dramatically declining prices, do not necessarily need to sell their homes. Homeowners’ behavior significantly affects price adjustments in housing-related asset markets, especially residential markets. In particular, there is sticky downward adjustment to market clearing equilibrium because homeowners generally hold out on lowering home prices. In many cases, if homeowners still have jobs and income to make monthly payments, they may not want to leave their location and home. Third, a drop in home prices makes it easier for non-homeowners to enter the housing market by making homes more affordable. Case and Quigley, “How Housing Busts End,” pp. 477-479.

[18] Lawrence J. White, “The Way Forward: U.S. Residential Mortgage Finance in a Post-GSE World,” March 3, 2011, pp. 11-13, http://web-docs.stern.nyu.edu/old_web/economics/docs/workingpapers/2011/white-residential%20mortgage%20finance%203.3.11.pdf (accessed November 5, 2012)

[19] Ibid.

[20] Ibid.

[21] Dwight M. Jaffee and John M. Quigley, "Housing Subsidies and Homeowners: What Role for Government-Sponsored Enterprises?" University of California, Berkeley, Institute of Business and Economic Research and Fisher Center for Real Estate and Urban Policy Working Paper No. W06-006,January 2007, pp. 120–123, http://urbanpolicy.berkeley.edu/pdf/JQ_Housing_Subsidies_Proof_053007.pdf (accessed November 8, 2012).

[22] Ibid., p.122

[23] Congressional Budget Office, “Federal Subsidies and the Housing GSEs,” May 2001, pp. 23 and 26-28, http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/28xx/doc2841/gses.pdf (accessed November 5, 2012). Douglas Holtz-Eakin, “Updated Estimates of the Subsidies to the Housing GSEs,” letter to Senator Richard C. Shelby, Chairman, Committee on Banking, Housing, and Urban Affairs, U.S. House of Representatives, April 8, 2004, http://www.cbo.gov/sites/default/files/cbofiles/ftpdocs/53xx/doc5368/04-08-gse.pdf (accessed November 5, 2012)

[24] Wayne Passmore, S. Sherlund, and G. Burgess, “The Effect of Housing Government-Sponsored Enterprises on Mortgage Rates,” Real Estate Economics, Vol. 33 No 3 (2005), pp. 19-22.

[25] Ibid.

[26] See Nahid Kalbasi Anaraki, “A Housing Market Without Fannie Mae and Freddie Mac: The Effect on Housing Starts,” Heritage Foundation Special Report No. 120, October 4, 2012, http://www.heritage.org/research/reports/2012/10/a-housing-market-without-fannie-mae-and-freddie-mac-effect-on-housing-starts. See also, Nahid Kalbasi Anaraki, “A Housing Market Without Fannie Mae and Freddie Mac: Effect on Home Prices,” Heritage Foundation Special Report No. 105, April 18, 2012, http://www.heritage.org/research/reports/2012/04/a-housing-market-without-fannie-mae-and-freddie-mac-effect-on-home-prices. See also, Nahid Kalbasi Anaraki, “A Housing Market Without Fannie Mae and Freddie Mac: Effect on the Homeownership Rate,” Heritage Foundation Special Report No. 109, June 11, 2012, http://www.heritage.org/research/reports/2012/06/a-housing-market-without-fannie-mae-and-freddie-mac-effect-on-the-homeownership-rate.

[27] John L. Ligon and William W. Beach, “A Housing Market Without of Fannie Mae and Freddie Mac: The Economic Effects of Eliminating Government-Sponsored Enterprises in Housing,” Heritage Foundation Special Report No. 127, January 8, 2013, http://www.heritage.org/research/reports/2013/01/a-housing-market-free-of-fannie-mae-freddie-mac#_ftn17 (accessed March 3, 2013)

[28] David C. John, "Free the Housing Finance Market from Fannie Mae and Freddie Mac," Heritage Foundation Backgrounder No. 2577, July 12, 2011, http://www.heritage.org/research/reports/2011/07/free-the-housing-finance-market-from-fannie-mae-and-freddie-mac.