During the past three years, national caseloads in the Temporary Assistance to Needy Families (TANF) program have fallen by 37 percent. Welfare rolls in the TANF program (formerly called Aid to Families with Dependent Children, or AFDC) dropped from 4.73 million families in June 1995 to 2.98 million in June 1998.1 However, the overall national decline masks enormous variation in reductions among the states, ranging from an 84 percent drop in caseload in Wisconsin to a 7.4 percent increase in Hawaii.

Considerable debate has emerged concerning the causes of the large-scale caseload decline, with some analysts arguing that declines are driven by policy changes and others favoring strong economic growth as the principal factor. This CDA analysis examines the factors behind the wide variation in declining state TANF program participation.

We find that differences in state welfare policies--specifically stringent sanctions and immediate work requirements--are highly associated with rapid rates of caseload decline. By contrast, the relative vigor of state economies, as measured by unemployment rates, has no statistically significant effect on caseload decline. Indeed, states with higher caseload reductions, on average, had slightly higher unemployment rates.

Many analysts express concern that large declines in welfare dependence may lead to large increases in child poverty. However, the data show that the decline in the national AFDC/TANF caseload has not resulted in an increase in child poverty. When the Earned Income Tax Credit, food stamps, and other means-tested benefits are counted as income, the child poverty rate now stands at 13.8 percent, the lowest rate since 1980.2

ANALYSIS OF CASELOAD REDUCTION

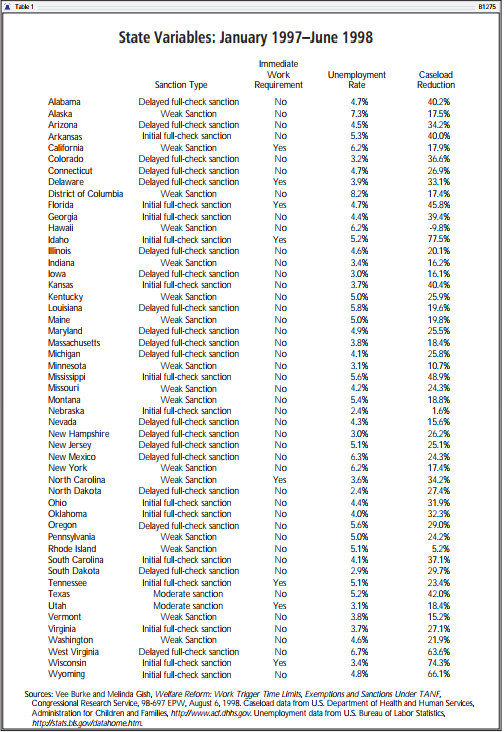

To analyze caseload reduction, we began by assigning states to four different categories based on their sanctioning procedure:3

-

Initial full-check sanction--States that have the option of sanctioning the entire TANF check at the first instance of non-performance of or non-compliance with required work or other activities.

-

Delayed full-check sanction--States that generally have a sequence of progressively more severe sanctions. But these states will sanction the full TANF check only after a number of months of non-compliance or repeated performance infractions.

-

Moderate sanction--States that may sanction more than a third of the TANF check or the full check in certain circumstances.

-

Weak sanction--States that sanction only the adult portion of the TANF check, except in unusual circumstances. This enables recipients to retain the bulk of their TANF benefits even if they fail to perform workfare or other required activities.

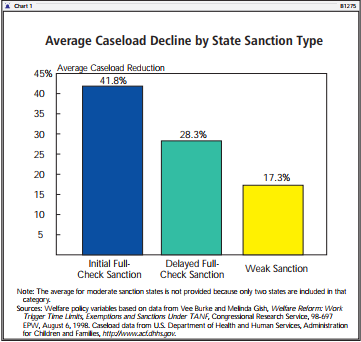

Chart 1 provides preliminary data on the effect of sanctioning on recent caseload decline. States with initial full-check sanctioning had an average caseload decline of 41.8 percent over the 18-month period between January 1997 and June 1998. By contrast, states with delayed full-check sanctions had an average caseload decline of 28.3 percent, while states with weak sanctions had a decline of only 17.3 percent during the same period.

Next, we analyzed the state's timing of work requirements, or the "work trigger time limit." The national TANF law requires all recipients to engage in work, as defined by the state, after 24 months on the rolls. However, many states require loosely defined "work activities" at an earlier date. To measure the variation, we created a second variable called the immediate work requirement. States with an immediate work requirement formally require "work activity" upon enrollment.

These welfare policy variables are quite broad; within each category, there is considerable variation in actual program operation. More detailed information, which would allow the policy categories to match the specifics of program operation more closely, undoubtedly would enhance the predictive capacity of these variables.

State Data

Table 1 summarizes the information for the 50 states and the District of Columbia regarding type of sanction, timing of formal work requirements, average unemployment rate, and percentage of caseload decline during the 18-month period.

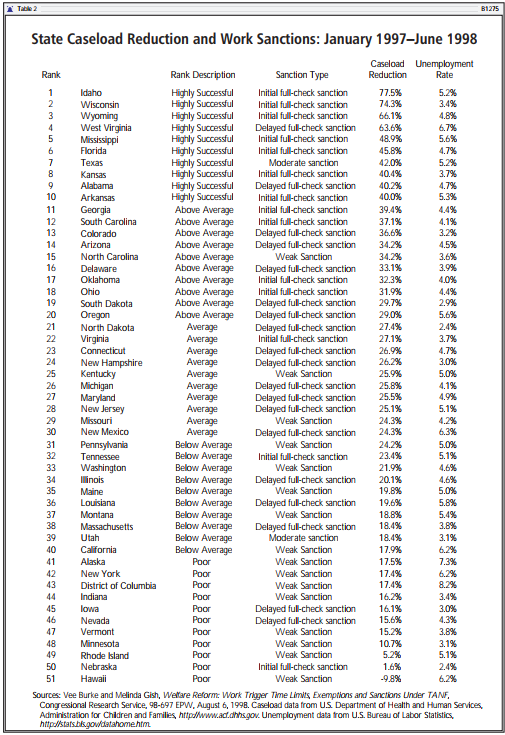

Table 2 ranks the 50 states and the District of Columbia according to caseload decline between January 1997 and June 1998, and notes their type of work sanction. The states are grouped into five categories of caseload decline:

-

Highly Successful-The 10 states with the highest levels of caseload reduction, ranked #1 through #10.

-

Above Average-The 10 states with the next highest levels of caseload reduction, ranked #11 through #20.

-

Average-The middle group of 10 states, ranked #21 trough #30.

-

Below Average-The next lowest 10 states, ranked #31 through #40.

-

Poor-The 11 jurisdictions that have the lowest rate of caseload decline (10 states plus the District of Columbia), ranked #41 through #51.

Two relationships in Table 2 are quite apparent. The first is the clustering of states with initial full-check sanctions in the top two groups, "Highly Successful" and "Above Average." The second, an even more obvious relationship, is the clustering of states with weak sanctions (affecting only the adult portion of the check) into the bottom or "Poor" performance category. The table reveals no clear linkage between unemployment rates and caseload decline.

Bivariate Correlations of Economic, Caseload, and Policy Variables

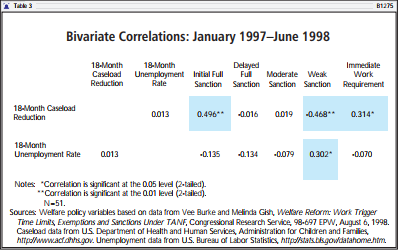

We began our statistical analysis by examining simple bivariate correlations between economic, policy, and caseload variables as shown in Table 3.

Substantial positive correlations are shown between caseload reduction and initial full-check sanctions (.496) and immediate work requirements (.314). By contrast, there is a strong negative relationship (-0.468) between weak sanctions and caseload reduction: States with lenient sanctions have less caseload decline. Finally, there is a positive correlation (.302) between a state having a weak sanction and higher unemployment.

Regression Analysis

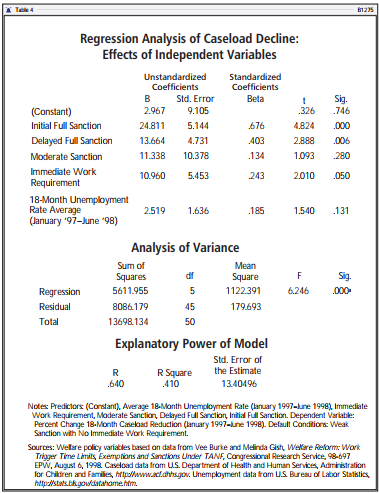

To complete the assessment, we performed a regression analysis to estimate the magnitude of the effect of policy and economic variables on caseload decline. The dependent variable is the percentage caseload decline over 18 months. The independent variables are initial full-check sanction, delayed full-check sanction, moderate sanction, weak sanction, immediate work requirement, and average state unemployment during the 18-month period.4

Table 4 summarizes the results of the regression. The independent variables of initial full-check sanction, delayed full-check sanction, and immediate work requirements were shown to have a strong and statistically significant effect on caseload reduction. By contrast, unemployment had a weak and statistically insignificant effect on caseload reduction. The sign of the unemployment variable was the opposite of the expected direction, indicating that--as stated previously--states with higher caseload reduction, on average, had slightly higher unemployment rates than states with lower caseload reductions.5 The R Square of the regression is .410, indicating that the model is able to explain about 40 percent of the variation in state caseload decline.6

The coefficient figures in Table 4 show the effect of the policy variables when compared with the default condition that represents a state with weak sanctions and no immediate work requirement. The analysis shows that:

-

States with an initial full-check sanction will, on average, have a caseload reduction rate that is 25 percentage points higher than states with weak sanctions.

-

States with a delayed full-check sanction will tend to have a caseload reduction rate that is 14 percentage points higher than states with weak sanctions.

-

States with a formal immediate work requirement will, on average, have a caseload reduction rate that is 11 percentage points higher than states without such a requirement.

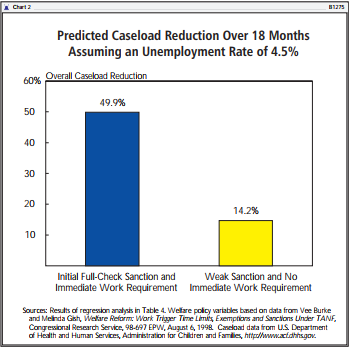

The overall effects of the model are summarized in Chart 2. Assuming an unemployment rate of 4.5 percent, a state with weak sanctions and no immediate formal work requirement has a predicted caseload reduction of 14.2 percent during the 18-month period. By contrast, in the same employment conditions, a state with initial full-check sanctions and immediate work requirements has a predicted caseload reduction of 49.9 percent, more than three times higher than the state with lenient reforms.7

WHY WORK REQUIREMENTS REDUCE DEPENDENCE

The above data indicate the effectiveness of work requirements, enforced by meaningful sanctions, in reducing dependence. There are several reasons why work requirements may have this effect:

-

Eliminating fraud. A small number of the AFDC/TANF cases represent simple fraud--cases in which a single household is receiving multiple welfare checks under different names or the recipient household never actually resided in the locality. Because such "phantom" recipients cannot show up at a workfare site or welfare office on a daily basis, a work requirement, coupled with a full-check sanction for non-compliance, will quickly remove these cases from the rolls. By contrast, under a lenient sanction system, such fraud cases are likely to remain on the welfare rolls indefinitely, albeit with a slightly reduced monthly payment.

-

Uncovering unreported earnings. A more common form of fraud is for the welfare recipient to have a job and earnings that are not reported to the welfare office. By concealing income, individuals are able to obtain welfare payments to which they are not lawfully entitled. Surveys indicate that over one-third of AFDC/TANF households have sources of income that they have failed to report to the welfare office.8 Serious work requirements make it difficult for individuals to receive AFDC benefits and simultaneously work at unreported jobs: It is virtually impossible for recipients to participate in daily activities assigned by the welfare office while continuing their concealed employment. If the welfare work requirements are enforced by a serious sanction affecting the whole TANF check, the recipient generally will be forced to choose between welfare dependence and reliance on earnings. Many simply will leave welfare and begin to rely more fully on employment for support. On the other hand, if a state employs only lenient sanctions for non-compliance with required activities, the most likely outcome is that recipients will continue on welfare, receiving slightly reduced welfare benefits which they will combine with earnings from the still-unreported job.

-

Reducing incentives for idleness. Under the traditional AFDC system, benefits were bestowed as an unconditional entitlement with no requirement that recipients undertake constructive behavior. When serious work requirements are put in place, welfare is transformed from a one-way handout to a system of reciprocal contribution. Under such a system, aid is given, but in exchange the recipient is expected to perform community service work or to undertake other significant steps toward self-sufficiency, such as a supervised job search or on-the-job training. Work requirements thus eliminate the recipient's option to receive free income from welfare; this, in turn, reduces the economic utility or attractiveness of welfare for the recipient compared with other alternatives, such as obtaining a private-sector job or relying on family and friends for support.

Because work requirements reduce the economic attractiveness of being on welfare, it is not surprising to see the number of exits from the welfare rolls increasing sharply and the number of new enrollments declining. However, if a state enforces work requirements with only lenient sanctions, the recipient, by and large, is able to continue receiving a free income from welfare without working; the economic utility of welfare is affected only marginally, and there is little incentive for the recipient to leave welfare to obtain a private-sector job. Consequently, with only lenient sanctions in force, caseloads will decline slowly.

-

Preparing for the real world of employment. Unlike welfare, real employment is seldom a one-way handout. In the private sector, employees who do not regularly perform assigned duties will not receive pay or maintain employment. When a welfare system requires community service work or other constructive activity and enforces those requirements with stiff sanctions for non-compliance, it creates an environment that will prepare the recipient for the real world of work. Under such a system, recipients are held accountable for their own actions and thus learn the habits of self-control, responsibility, and persistence, which are the hallmarks of eventual self-sufficiency. Thus, the work requirement provides the psychological preparation necessary for reducing dependence.

-

Sending a positive symbolic message. One of the key elements of national welfare reform has been to send a strong symbolic message to welfare recipients and potential recipients that society expects them to engage in work and to strive for self-sufficiency. Efforts to reduce dependence are, in a large measure, contingent on how seriously recipients regard this social message. States with serious work requirements and strong sanctions for non-compliance send a clear signal that the expected goals of work and self-sufficiency are very real. States with lenient sanctions send exactly the opposite message; in those states, recipients are informed implicitly that the entitlement nature of welfare has not really ended; that they will not really be held accountable for their own actions; and that the demand for self-sufficiency is more rhetorical than real. Thus, lenient sanctions sap the motivation that is necessary to overcome the debilitating habits of dependence.

WHY REDUCING DEPENDENCE IS CRITICAL

Evidence from other studies indicates that reducing dependence is vitally important both to recipients and to society.

Some analysts argue that being on AFDC as a child has harmful effects on a child's development that are carried on into adulthood. The negative effects of dependence become clear in comparisons of women who as children lived in families receiving AFDC and similar women who did not but who otherwise were identical in race, family income, family structure, IQ, and childhood residence. One study comparing these two groups, co-authored by Dr. June O'Neill, the former Director of the Congressional Budget Office, found that the women who received AFDC as children:

-

Were almost twice as likely to become high school dropouts;

-

Spent some 200 percent more time on welfare as adults; and

-

Were some 50 percent more likely to have a child out of wedlock.9

Some other analysts would argue that these negative effects are the result of poverty, not earlier welfare dependence. But the comparison is between women who had identical levels of family income in childhood. Thus, the negative behavioral effects cannot be explained by poverty, but are the direct result of welfare dependence.

O'Neill and Anne Hill also found that the longer a child spends in the welfare system, the lower the child's IQ compared with children who are identical in race, income, and other social and economic factors. In examining young children (with an average age of 5.5 years), O'Neill and Hill found that those who had spent at least two months of each year, since birth, on AFDC had cognitive abilities 20 percent below the cognitive abilities of those who had received no welfare--even after holding constant such variables as family income, race, and parental IQ.10 Again, the authors make it clear that it is not poverty but welfare itself that has a damaging effect on the child.

A similar study by Mary Corcoran and Roger Gordon of the University of Michigan found that the receipt of welfare income has negative effects on the long-term employment and earnings capacity of young boys.11 Holding constant the variables of race, parental education, family structure, and a range of other social variables, higher non-welfare income obtained by the family during a boy's childhood was associated with higher earnings when the boy became an adult (over age 25). However, welfare income had the opposite effect: The more welfare income received by a family while a boy was growing up, the lower the boy's earnings as an adult. The study suggests that an increase of $1,000 per year in welfare income received by a family would decrease a boy's future earnings by as much as 10 percent.

It is important to note that the Corcoran and Gordon study compares families whose average non-welfare incomes were identical. In such cases, each extra dollar in welfare represented a net increase in overall financial resources available to the family. This extra income, according to conventional welfare theory, should have positive effects on the well-being of the children. But the study shows that the extra welfare income, even though it produced a net increase in resources available to the family, had a negative impact on the development of young boys within the family. The higher the welfare income of the family, the lower the earnings obtained by the boys upon reaching adulthood. Thus, the long-term well-being of the child is improved if the family is off welfare, even if this means lowering the family's income.

CONCLUSION

There has been considerable debate about whether the recent decline in AFDC/TANF caseloads has been the result of economic factors or welfare reform. Although the overall health of the U.S. economy has been a positive background factor contributing to the reduction of welfare dependence, the economy has been neither a sufficient nor a primary factor in that reduction. The huge state variations in the rate of caseload decline cannot be attributed to differences in state economic factors. But they can be explained convincingly by differences in the rigor of the state's work-related welfare reforms. Policy reform--not economics--is the principal engine driving the decline in dependence.

There also has been widespread concern expressed that large declines in welfare dependence would lead to large increases in child poverty. In reality, decreases in dependence have beneficial effects on children's long-term development, even if they are accompanied by decreasing family income. However, the fall in the national AFDC/TANF caseload has not resulted in an increase in child poverty. When the Earned Income Tax Credit, food stamps, and other means-tested benefits are counted as income, the child poverty rate now stands at 13.8 percent, the lowest rate since 1980.

Robert E. Rector is Senior Policy Analyst in Welfare and Family Issues and Sarah E. Youssef is a former Research Assistant in Economic and Domestic Policy Studies at The Heritage Foundation.

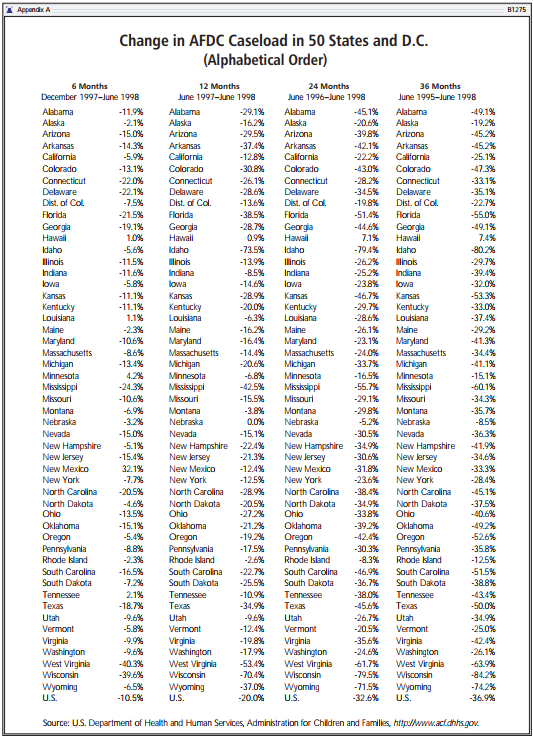

APPENDIX A:

Change in AFDC Caseload in 50 States and D.C.

(Alphabetical Order)

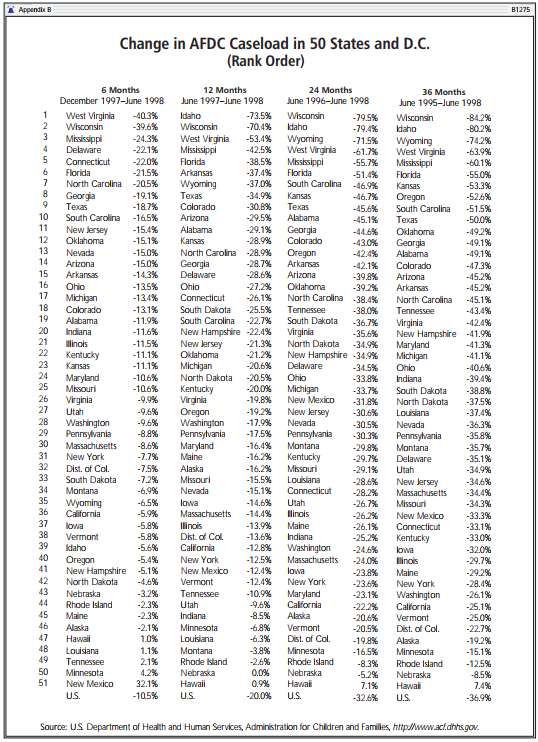

APPENDIX B:

Change in AFDC in 50 States and D.C.

(Rank Order)

1. Data from U.S. Department of Health and Human Services, Administration for Children and Families, at http://www.acf.dhhs.gov.

2. U.S. Bureau of the Census, Poverty in the United States: 1997, Current Population Report Series P60-201 (Washington, D.C.: U.S. Government Printing Office, 1998), p. 25. The 13.8 percent figure is based on Census Bureau income definition #14, which includes the Earned Income Tax Credit, food stamps, medical benefits, and other non-cash aid as income while subtracting state and federal taxes. Consistent poverty rate figures that include the effects of non-cash benefits are not available before 1979; earlier rates must be estimated. If the more common definition of income, measuring only cash, is used, the child poverty rate also shows a notable decline in recent years, with the latest figure at 19.9 percent.

3. Data on state welfare policies taken from Vee Burke and Melinda Gish, Welfare Reform: Work Trigger Time Limits, Exemptions and Sanctions Under TANF, Congressional Research Service, 98-697 EPW, August 6, 1998.

4. Initial full-check sanction, delayed full-check sanction, moderate sanction, and immediate work requirements were each entered as dichotomous dummy variables. The unemployment rate and the percentage caseload reduction were continuous variables. The unemployment rate, measured by the Bureau of Labor Statistics, was calculated as an average from January 1997 to June 1998.

5. We also used as economic variables both the 18-month change in unemployment and the 18-month change in job growth in each state. Neither variable proved significant in the regression model or accounted for a significant amount of variation in the caseload reduction variable. Tests for bias in the estimators failed to indicate bias, particularly from omitted variables.

6. To ensure that our results were not merely an accidental product of the period of time analyzed, we performed the same analysis for the last 12 months (June 1997 to June 1998) and 24 months (June 1996 to June 1998), and achieved virtually the same overall results.

7. The values predicted by the regression model conform closely to the actual observed values in the states. The mean caseload reduction over the 18-month period among the four states with both an initial full-check sanction and a formal immediate work requirement was 55.2 percent. The mean caseload reduction among the 14 states with weak sanctions and no immediate work requirement was 16 percent.

8. See, for example, California Department of Social Services and Orange County Social Services Agency and District Attorney, County of Orange Fraud Incidence Study, April 1997.

9. M. Anne Hill and June O'Neill, Underclass Behaviors in the United States: Measurement and Analysis of Determinants (New York: City University of New York, Baruch College, August 1993); analyses of data from the National Longitudinal Survey of Youth, background AFDC receipt, and family income were based on survey data from 1979. See also R. Forste and M. Tienda, "Race and Ethnic Variation in the Schooling Consequences of Female Adolescent Sexual Activity," Social Science Quarterly, March 1992, and Mwangi S. Kimeny, "Rational Choice, Culture of Poverty, and the Intergenerational Transmission of Welfare Dependency," Southern Economic Journal, April 1991.