John G. Ferrari, Major General, U.S. Army (Ret.)

A popular low-cost airline advertises one-way flights from New York City to Los Angeles starting at $61, an undeniable bargain. When you go to book the flight, you realize it is a 13-hour trip, compared to the six-hour nonstop advertised by competitors. Then you notice the five-and-a-half-hour layover in Miami, in a direction the opposite of where you are traveling.

When you continue with your booking, it becomes clear that to choose your seat, bring any sort of personal item on the plane, and check a bag, you will have to spend another $65—four bucks more than the cost of the flight itself. A carry-on and one-time waived change fee will cost you an additional $15. Finally, for the right to check in with an agent at the airport, you will be squeezed for an extra $10. On the payment page, your $61 flight will have become nearly triple what you would have paid to be afforded the same amenities provided on most other flights (with the exception of complimentary in-flight beverages and snacks), and you have become the beneficiary of an unexpected five-and-a-half-hour pit stop in a Florida airport.

The Department of Defense (DOD) weapons systems and personnel cost estimates and the unnamed low-cost airline have many commonalities including misleading up-front and fixed costs, misunderstood timelines, and operational costs that are often ignored. Why make the comparison? The American public is consuming information from various sources that often mix up, confuse, and make erroneous cost projections for various DOD programs. Just as they need to be better consumers of airline flight information, American taxpayers need to be more well-informed about defense capabilities and better consumers of defense information and security.

With regard to defense costs, there are four key problems with respect to both weapons systems and personnel:

- The failure to include operating and support costs,

- Undefined timelines,

- Poor or nonexistent updating of estimates, and

- Abuse of the English language.

It is clear that some of the most prominent programs and personnel costs in the U.S. military today suffer from inconsistent and incomplete estimations, with one prominent exception: the much-maligned F-35 fighter. As complicated as the estimation process and DOD estimation guidelines are, once he or she knows where to look, anyone can determine where programs fall victim to some of the more common estimation pitfalls.

Although submitting incorrect estimations could eventually lead to bad policy decisions, it is safe to assume that few to none of these inaccuracies are the result of malicious intent. Some estimations, such as those for the F-35 program and the cost of the Iraq War, have serious political implications that may incentivize the cherry-picking of numbers, but consistent problems in DOD estimations result from a number of systemic and procedural issues. This analysis is not meant to forgive misguided budgeting but seeks rather to explain that even the “facts” may not be accurate in the end, whether miscalculations are caused by inclusion or by omission of data. As the U.S. seeks to strengthen the military’s budget, it is critical that policymakers have the right information at the right time so that they can make the best decisions and Americans can get the most national defense for their tax dollars.

Using and Understanding the Right Defense Budget Terms

How much money does Congress provide for our national defense? This is a seemingly easy question, yet most get it wrong, and they do so mostly because there are three different sets of numbers that get transposed in normal conversation. What the United States spends on national defense is not the same as what the Pentagon spends, which is not the same as how much money is appropriated by the Defense Appropriations Subcommittees of Congress. Understanding the difference between, for example, “basic economy” and merely “economy” is key to understanding what our money is buying.

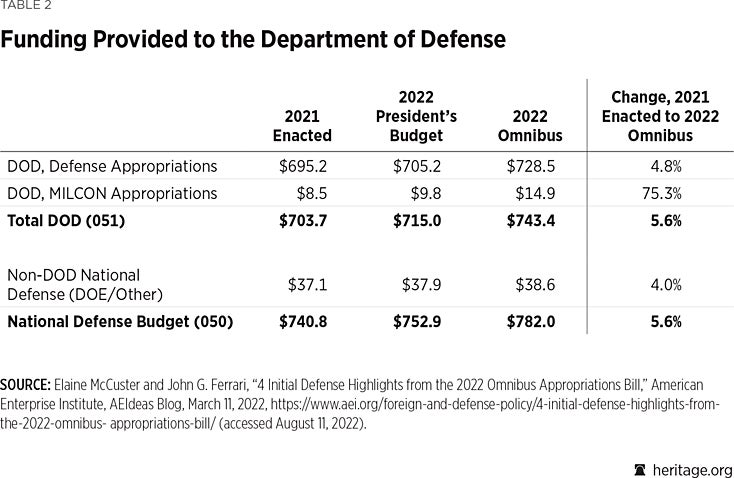

To start with, the term “national defense”—in the case of resourcing—encompasses much more than the Pentagon and includes programs run by other departments such as the nuclear program in the Department of Energy. This number is often called the “050” budget line number and aligns with the National Defense Authorization Act. For the Pentagon specifically, its funding is often called “051.” But just to make it slightly more confusing, in the congressional appropriation process, the defense appropriation does not include either the Pentagon funds for Military Construction/Family Housing, which are provided by the Appropriations Committee’s Military Construction, Veterans Affairs, and Related Agencies Subcommittee, or the non-Pentagon National Defense funds, which are provided by the Energy and Water Development and Related Agencies Subcommittee.

Table 2 is a helpful guide to understanding these numerical discrepancies and explains why the following sentence incorrectly compares budget resources: “A budget of even $770 billion [051] would be a significant increase when compared to the $728.5 billion enacted in law for the Defense Department in FY22 [defense appropriation less military construction].”1

This is just one example (albeit a simple one) of how the word “defense” has three different meanings depending upon who is using it and when. Now imagine this playing out across different programs or in the context of real versus nominal dollars. Not being specific with defense budget terms can complicate the analyses of and justifications for billions of dollars in national security decisions. One should never be afraid to ask what is meant by a word: Words matter.

PAUC vs. APUC. Anyone who wants to know how much specific weapons systems or munitions cost should be prepared to be dazzled by two different combinations—PAUC and APUC—and be prepared for both to be used interchangeably or, worse yet, not identified.

PAUC stands for Program Acquisition Unit Cost, which is set in statute and used to define cost reporting requirements to Congress.2 It is simply calculated by adding together all of the developmental costs for a program, including program-specific military construction; adding it to the projected cost of production; and then dividing that sum by the total number of systems intended to be procured throughout the system’s lifetime. If you want to make a system appear affordable, be extremely optimistic in how many you plan to acquire: The more you “intend” to buy, the more you spread the development costs, thus driving down the appearance of the per unit price. In this case, imagine you are the airline, trying to raise money from investors. If you assume lots of people on your aircraft for each flight, you can market yourself as a low-cost airline. However, if the passengers do not show up, you are now a high-cost airline.

Within DOD, analyzing the PAUC is important for programs with large up-front development costs and high projected quantities. As a smart consumer of DOD acquisition data, never take the PAUC at face value without understanding those two factors.

The second acronym is APUC: same letters, but this time they stand for Average Per Unit Cost. The APUC is calculated by taking the actual projected cost of production and dividing it by the proposed quantity. Since inflating the quantity does not get you a lower average in this case, how does this number get misused? It is called the “learning curve.” The learning curve occurs when a program assumes that the cost of production will magically decrease over time. Since there is both an art and a science to forecasting the learning curve effect in forecasted pricing, this is an area in which you should be extremely skeptical when comparing different systems.

To see it in practice, consider the recent budget documents for the F-35 and F-15EX. In 2023, the F-35 jets are Block 4 models, and the fly-away cost (APUC) is about $91.6 million each or $5 million more than the Block 3 jets, which is straightforward. If the Air Force bought 48 jets, the gross weapons system cost (PAUC) of each fighter would have been $108 million. By reducing the number of F-35s purchased/denominator to just 33 F-35As, the gross weapons systems cost (PAUC) increases by almost $8 million to $115.5 million.

Why would the Air Force do this? Because they want to buy more F-15EXs. Reducing F-35 quantities makes the $120.2 million PAUC for the F-15EX seem almost even. In other words, $120.2 million per plane seems a lot more justifiable to Congress when the other option is nearly the same price anyway. Buying only 33 enables the Air Force to level the cost comparisons. All of the math is accurate, but knowing how the costs are calculated is just as important.

Missile Defense Agency: How Excluding Costs “Looks” Cheaper

A common fallacy holds that projected cost estimates are guided by and adhere to a common set of rules and standards and that they cannot be skewed by the agency providing them. The Missile Defense Agency (MDA) has its own acquisition authority and funding lines; therefore, it does not go through the same bureaucratic process that other agencies must go through inside the Pentagon. Before the Federal Aviation Administration cracked down on the airlines, some of them excluded such things as the Passenger Facility Charge, Flight Segment Tax, September 11 Security Fee (Passenger Civil Aviation Security Service Fee), and Transportation Tax from their advertised fares. Unfortunately, we have no version of the FAA for program costing; therefore, as with a resort fee at a hotel, you need to ask about other costs.

At its core, the MDA is only supposed to procure systems, and after it is done fielding them, the intent is for the systems and all associated costs to be transferred to one of the military services. Therefore, MDA estimates tend to be limited to just the MDA’s costs—not lifetime costs. A February 2022 Government Accountability Office (GAO) report highlights this reality, noting that the U.S. Missile Defense Agency’s cost estimates included “a number of shortcomings…such as its comprehensiveness, accuracy, transparency, and traceability.”3

With regard to cost omissions, one needs to be aware that the MDA is omitting certain operational and sustainment costs from its estimates. Why is this important? Because operations and sustainment costs can often reach 70 percent of lifetime-program costs, which means that omitting or adjusting these estimates has an enormous impact not just on current funding levels, but also on future funding levels. This has hampered the MDA because, in reality, the agency has not transferred many programs to the services. Therefore, over time, the MDA finds itself spending more funds on sustainment, which is not in its mission statement, and less on research and development and procurement, which are why it exists. This error, in effect, mortgages our future to pay for the present.

The GAO also notes that the MDA is inaccurately reporting flight test cost estimates. Two recent Terminal High Altitude Area Defense (THAAD) tests cost a combined $20 million, but the flight test estimate was only $2 million.4 This discrepancy is not isolated to the Army’s THAAD system. The GAO also “found a $1.5 billion increase in development costs for the Aegis Weapon System Spiral 5.1 program between 2019 and 2020 baseline reporting,” while “MDA only reported a $664 million increase—a difference of $851 million.”5 Why is this important? Because those costs are inaccurately represented elsewhere in the budget, which means that policymakers are using bad information when assessing the cost-benefit of one system versus another.

Is the MDA doing anything malicious? Not necessarily. For the most part, it is doing estimates only for those costs that apply directly to its mission set rather than after it transfers the program to the services. The MDA will also state that, regarding test costs, assessing fixed costs across programs may not be worth the effort. In any event, an observer’s understanding of the costs for various MDA systems would be just over one-third of the actual cost: $1.3 billion reported by the MDA versus “at least $3.5 billion” uncovered by the GAO.6

However, just because it is not malicious doesn’t mean it is not a problem. Anticipating ongoing systems costs certainly needs to be included in program estimates to help the decision-makers prepare for future years’ defense spending.

Constellation-Class Frigate: The Guide to Wishful Thinking

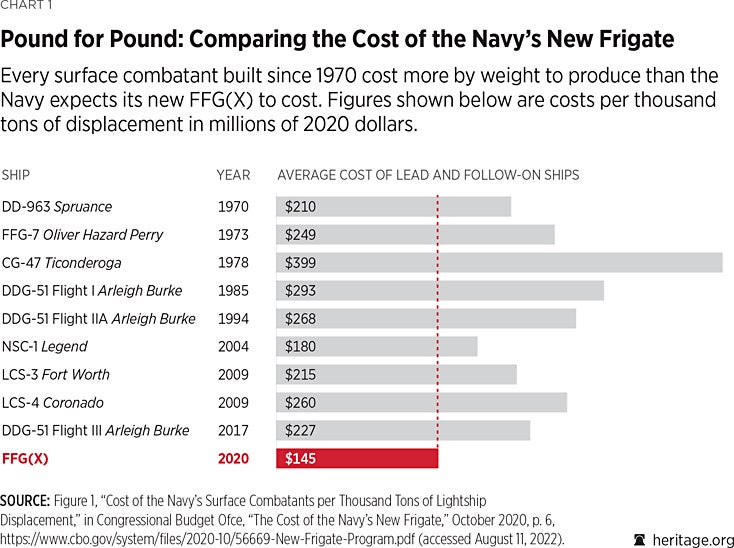

Much like the MDA, the Navy has its own unique way of calculating costs. The Navy places all of its detailed design/nonrecurring engineering (DD/NRE) costs in the procurement of the first ship for a specific class. Even taking that into account, it appears that the Navy then engages in a bit of wishful thinking on how costs can be reduced for the new class of ships, relying on intuition rather than on past data. This is analogous to someone who checks the price of an airplane ticket six weeks out and then uses that estimate to set aside funds for a ticket he intends to purchase the night before he flies.

In 2020, the Navy estimated that the Constellation-class frigate would cost about $870 million per ship, or $8.7 billion for the 10-ship project;7 Eric Labs, one of the top Congressional Budget Office (CBO) naval analysts, separately predicted that the program would cost $1.2 billion per ship, or $12.3 billion for the entire program.8 Historically, the Navy has “almost always” underestimated the cost of its shipbuilding projects.9 The Navy was able to weave together a wishful narrative that, according to the Congressional Research Service, could be true because the “FFG(X) is based on a[n Italian] design that has been in production [in Italy and France] for many years” and “[l]ittle if any new technology is being developed for it.”10 So what actually happened?

From fiscal year (FY) 2021 to FY 2022, the Navy’s estimate of the cost per ship increased by 14 percent. Specifically:

In the Navy’s FY2021 budget submission, the FFG-62 class ship to be procured in FY2022 (i.e., the third ship in the program) had an estimated procurement cost of $954.5 million. In the Navy’s FY2022 budget submission, the ship has an estimated procurement cost of $1,087.9 million—an increase of $133.4 million, or 14.0%, over the figure in the Navy’s FY2021 budget submission.11

This increase came about as a result of preparation and testing costs that were not previously included in the estimates. Looking forward, “if FFG-62s were to wind up costing about the same to construct per thousand tons of displacement as other recent U.S. military surface combatants, then the third and subsequent FFG-62s could cost 17% to 56% more than the estimate for those ships shown in the Navy’s FY2021 budget submission.”12

The military services are not immune to wishful thinking, and they also know that getting the proverbial camel’s nose under the tent is a certain way to keep a program. Very few people get promoted for saying that they will run acquisition programs that cost more than previous programs; therefore, the inherent bias to “try for” savings is not malicious in intent but is instead rational inside a large bureaucracy. But that is not to say this rationale doesn’t desperately need a cleanup.

Littoral Combat Ships: Forgetting People and the Price of Having Them

The Navy is already decommissioning its initial purchase of the Littoral Combat Ship (LCS) fleet just 14 years after the first ship set sail and, amazingly enough, even as a ship is finishing construction. What went wrong? A lot. For the purpose of this analysis, however, we will confine ourselves to the cost projections for operating costs, which turned out to be outdated and inaccurate according to the GAO.13

The initial plan called for the ship to have about 40 people with maintenance done by contractors. The Navy estimated total operating costs per year per ship at $50 million. In reality, the cost over time was closer to $71 million—a 42 percent miscalculation. While the difference between $50 million and $71 million might seem relatively small, if you account for a 42 percent mistake over a long period of time for a large fleet of ships, the cost increase gets very large, very fast.

How did the Navy get this so wrong? It turns out that outsourcing maintenance to contractors drove up the cost.14 The initial estimate of 40 crew members nearly doubled in reality to about 70, and before the Navy decided to terminate the program, the number of sailors needed was about to grow even more. Cost projections based on bad assumptions or preferred assumptions that turn out to be wrong introduce flawed data for programs; the result is policy decisions and budget commitments that prove to be terribly costly for the service and the taxpayer.

Optionally Manned Fighting Vehicle: Failing to Account for Uncertainty

One of the Army’s signature modernization programs is the Optionally Manned Fighting Vehicle (OMFV). Being optionally manned means that it could operate autonomously, a task that has never been accomplished and for which there are almost no past cost data. To fund this program in the near term, the Army is slowing down procurement of its existing systems, in essence trading current combat power for future combat power.

However, will the Army be able to afford the new program, or is it doing as it did with the Future Combat Systems and other past efforts to build ground combat systems: setting itself up for having neither current nor future ground combat capabilities while spending tens of billions of dollars? If one is to believe the GAO, the Army is substituting the precision of point estimates to mask uncertainty, which in the past has led to failure “due to immature technology and changing and complex requirements at a cost to taxpayers of roughly $23 billion.”15 In effect, reality displaces optimistic projections over time, revealing the true cost of systems that are consistently higher than originally presumed.

In the case of the OMFV, the consumer of the Army’s cost estimates needs to grapple with two important pieces of uncertainty. First, as discussed above, the Army has tried this before and failed to the tune of $23 billion. One has to ask: Why is this time different? The second question is: If this has never been done before, as we have never built an optionally manned combat platform, how can the cost estimate even be accurate?

Given these complicating factors, it might have made more sense for the Army to structure this program as a series of smaller-duration, less risky demonstration projects that can prove out the cost, technology, and feasibility of the system. The GAO did give the Army high marks for following the cost estimation process, but at $46 billion (the projected cost of the program), the uncertainty error is enormous.16 As we saw with the Navy LCS, there really may be no way to know what the actual cost will be.

The equivalent of this, for our airline ticket purchaser, is that you are going to buy an airline ticket for a flight 10 years from now and agree to pay based on the purchase price of aircraft that have yet to be purchased, the future unknown price of jet fuel, and the potential costs of developing the flight to have either a real pilot or no pilot at all. At this point, it is an open-ended commitment to spend money. Maybe this is less like buying a plane ticket than it is like buying a ticket to Mars.

Reserve Forces: The Cost of Active vs. Activating

In the past decade, both the U.S. Air Force and the U.S. Army have had financial disputes with their National Guard forces that have led to congressionally chartered commissions, both of which were triggered during periods of declining budgets and potential force structure reductions.17 The cost discussions are often difficult to understand, with both sides making “accurate” statements that lead to “different” conclusions. How can this be? It depends on how you blend personnel costs, equipment costs, and operating costs along with assumptions on Reserve use during peacetime for operational rotation missions versus wartime surge capacity. These five different variables can be, and often are, blended differently and then compared together as if they were the same.

The first and most frequently used costs are those for personnel. Since Reserve personnel are part-time personnel, it is a mathematical fact that those that are not activated are less expensive than full-time personnel. However, depending on how often and for what purpose the services activate their Reserve Component forces, they could cost more than the equivalent of an Active unit. This is due to the time—and therefore the resources—needed for mobilization and post-mobilization efforts. If used for the occasional surge operation, the costs of the Reserve over time tend to be less than those of their Active counterparts. But if used nearly continuously for operational missions (continuous boots on the ground), the costs tend to be higher.

Equipment costs, though often not discussed in relation to Reserve components, are relevant depending upon whether one treats equipment as a sunk cost because the equipment already exists or as a procurement cost that should be included in the Reserve’s total value/expense. The National Commission on the Future of the Army began over a dispute about the Apache helicopter’s force structure. Because the Army did not have enough Apaches and needed more funds to buy more aircraft, the price became a central component of the conversation.

When related to low-density, high-cost weapons platforms like the Apache, costs become more relevant because they can dwarf other investments like personnel or operations. To compare, the cost of 100 cargo trucks might be nearly negligible within the Army’s total budget for accounting purposes, but the cost of additional Apache helicopters at $13 million apiece mounts up significantly and quickly. (The less expensive trucks, however, also can add up to significant dollars if the quantity is high enough.) In other words, it matters what type of Reserve unit one is discussing, because the equipment within one type of unit can account for much more in dollar terms than the equipment in others does.

Emerging from all of these studies over many years are two fundamental premises when discussing the Active Component/Reserve Component force mix:

- “Part-time” force structure, meaning the capability delivered by traditional Reservists and Guardsmen who do not serve continuously on active duty, costs less than the force structure provided by “full-time” personnel.

- Reserve Component force structure, especially traditional Reservists, costs less than that of the Active Component, but Reserve Component forces are not always less expensive when conducting operations than are Active Component forces.

If you are trying to figure out how much it costs to travel from New York to Los Angeles, it matters whether you are flying on a private jet or a commercial jet, taking the train, or getting on a bus. For the discussion of Active versus Reserve Component costing, it matters whether you are including equipment costs, operational use, and wartime surge, broken out by various types of units.

The Cost of War: Who’s Asking?

According to the Special Inspector General for Afghanistan Reconstruction’s most recent report:

DOD’s latest Cost of War Report, dated September 30, 2021, said its cumulative obligations for Operation Enduring Freedom and Operation Freedom’s Sentinel in Afghanistan, including U.S. warfighting and DOD reconstruction programs, had reached $849.7 billion…. State, USAID, and other civilian agencies report cumulative obligations of $50.1 billion for Afghanistan reconstruction, which when added to the DOD amount results in $136.9 billion obligated for Afghanistan reconstruction through that date….18

As of March 2021, the Department of Defense estimated that emergency/overseas contingency operations (OCO) spending for the wars in Iraq, Syria, and Afghanistan totaled $1.596 trillion;19 as of June 2022, it estimated that the total had reached $1.637 trillion.20

The cost of a war is perhaps the most challenging of all cost estimates. There are, off the bat, many necessary clarifying questions such as:

- In what time span do you quantify the war?

- When do residual costs end?

- Do you count related but indirect war costs? For example, do you count related activities in Syria as part of the Iraq war’s costs?

- Does it include personnel costs, which have to be accounted for regardless of whether the servicemember is at home or abroad?

- Are you measuring what was spent that otherwise would have not been spent, or also the cost of assets and resources that would still have been costly without the war? For example, a plane is flown in peacetime if only for pilots to maintain their skills and certification.

- Is one to account for direct economic costs?

- What about costs associated with deaths, the climate, etc.?

- Do you know how you measure those?

- Do you count associated medical care for veterans of those wars?

Any estimate that professes to have determined the actual cost of war involves many subjective decisions about what to count and what not to count. Estimating the cost of the Iraq War is a chief example of this dilemma. The Brown University Costs of War Project has estimated that from FY 2001–FY 2022, the wars in Iraq and Syria cost a total of $2.058 trillion (exclusive of future veterans’ care). If one includes future veterans’ care, total costs rise to $3.158 trillion.21 A much less aggressive and comprehensive estimate by the Congressional Research Service puts obligations for Iraq at 51 percent ($759 billion) of total DOD OCO obligations from 9/11 through FY 2018.22 This would be the simplest number because it includes the fewest factors in estimated war costs.

This is very similar to trying to calculate externalities into the cost of a flight to differentiate it from the price you are actually paying. For example:

- What is the price of the carbon emissions from the flight?

- What about the cost of the taxpayer-subsidized airport?

- If the airline goes bankrupt, what pension costs will the government have to pay for in the future?

- What about the food stamp costs for the people cleaning the airplane because they do not make a living wage?

- Have we calculated the environmental damage caused by production of the jet fuel?

- While we are at it, how about the human cost of extracting the titanium needed in war-torn countries to build the aircraft?

All of a sudden, the “cost” of your flight diverges wildly from the “price” you pay for the ticket.

Such is the case with the cost of war. It encompasses not only weapons systems and personnel costs, but also the accounting difficulties within both. The question of what to count and what is being accounted for leads to incredible variance between cost estimates—whether based on projected interest or whether or not to include veterans’ care. The key here is transparency: By knowing how it is totaled, one can better assess the components of that total, whether and how it compares to others, and what capabilities the funds physically provide.

F-35: Most Expensive or Most Impressive?

The F-35 aircraft is one of the most advanced and ambitious programs that DOD has undertaken. It also is heralded as the most expensive program ever undertaken. As this is the last of the cases we will examine, it is interesting to see how the F-35 compares to some of the other programs discussed in this essay.

First, the cost is estimated over a 66-year life cycle, with a current estimate in excess of $1.7 trillion.23 (By contrast, the MDA did not estimate operational costs over the lifetime of the missiles and supporting systems it purchased.) Of the $1.7 trillion, the procurement of 2,456 aircraft accounts for just under $400 billion, while the cost of sustaining the planes over time hits nearly $1.3 trillion. This is very important, as no other DOD program has a 66-year operating cost estimate.

Second, this program has updated its cost estimates more times than almost all other programs combined. Over the course of the program, the GAO alone has issued an extensive series of reports examining the F-35’s ongoing cost estimates and the “significant challenges DOD faced in sustaining a growing F-35 fleet.”24 In April 2021, for example, the GAO reported that the Air Force needs to reduce estimated sustainment costs per plane by $3.7 million by 2036 or face $4.4 billion in costs beyond estimates.25 Each time the GAO issues a report, the cost estimates are updated. For most programs, the cost estimates are traditionally frozen in time, so this is likely the first living cost estimate in DOD’s history.

Many worry that the armed services will be unable to afford the F-35’s sustainment. This should certainly be worrisome, as this critical project faces a grim future. But in relation to the thesis of this analysis, the forewarning and guidance on reducing future expenses make this program’s cost accounting also very impressive. As a result of expansive reporting from DOD and other U.S. government agencies on current costs and program updates and estimates, the F-35 program is likely the most well-accounted major weapons program in DOD history. One cannot help but wonder what the cost would be for every other major acquisition program across DOD if the same criteria and program updates that have been applied to the F-35 program were applied to them.

Finally, in comparing F-35 procurement costs with procurement costs for other aircraft, it is obvious that other systems do not have the same in-depth cost accounting. This makes an apples-to-apples comparison impossible for anyone but the most determined budget analyst.

In a recent and relevantly titled article, “Air Force’s Math on the F-15EX and F-35 Doesn’t Add Up,”26 a comparison of the two fighter platforms reveals the impressive nature of F-35 program cost counting. The Administration cuts the F-35 procurement quantities for FY 2023 because the F-15s are “less expensive to buy and to fly” than the F-35. The Air Force’s cost data for these two weapons systems prove this to be “patently false.” The F-35’s “flyaway” cost includes all of the equipment needed to meet mission requirements. The “cheaper” F-15 estimate provided by DOD fails to include offensive systems that are included in the F-35’s “sticker” price to meet the same requirements. And while the F-35 program might be a record due to its inclusion of all elements, for FY 2022, the gross weapons systems cost—including all necessary packages, equipment, and support depots—brings the F-15EX to $120 million27 compared to the fully loaded F-35A’s $98.2 million.

Because of the F-35’s comprehensive cost estimates, the program has been able to see where changes need to be made. The fighter’s mission-capable rate has continued to rise in recent years, and DOD has reduced sustainment and readiness expenditures and timelines. Reform efforts include increasing the availability and production of spare parts, improving depot-level repair, and decreasing customer wait times.

Increased transparency may increase the apparent cost, but in the long term, it results in better decisions and informed savings. The same cannot be said with any certainty for other aircraft procurement programs because no other such program has been similarly assessed.

Conclusion

When you purchase an airline ticket these days, sites like Google Flights attempt to standardize the pricing by allowing you to adjust the ticket price for expenses like carry-on baggage and picking your seats while also measuring your carbon footprint. But even that tool is not necessarily sufficient because some airlines, such as Southwest, are simply not on their search engine, while others use techniques like fare ghosting or providing discounted rates to other sites. In essence, caveat emptor—let the buyer beware. The same is true when you read a paper, news story, or official document about how much anything in DOD costs: Know that what you read is likely not everything you should know.

First, there is no consistent standard for the updating of lifetime budget costs, which is especially problematic when actual inflation rates vary heavily from those anticipated numbers. In these cases, the estimates become obsolete. Lifetime budgets are sometimes not updated when estimates for the procurement of individual units unexpectedly increase, as in the case of the FFG-62.

Next, the updated standards for budget estimation are not high enough, and there is no consumer protection board to hear complaints or to assess penalties for bad information. Even though services consistently underestimate initial and lifetime costs of personnel and weapons systems, there is no system for ensuring adjustments before the release of official estimates, which are almost always incomplete. Think of this as “in-flight meals not included” the next time you book your trip. The remedy for this is firmer definitions regarding budget estimations, something akin to the MSRP sticker on a new car—which in reality is often much more than the price you end up paying the dealer.

Perhaps most important, the consumers of this information should channel their inner “Sy Syms.” Sy ran a series of discount clothing stores in the Northeast, and his slogan was “An educated consumer is our best customer.” From reporters to analysts to the American public, asking the right questions, understanding partial answers—and when the answers are only partial—and then acting on the information will ensure that as a nation, we make better decisions and smarter investments regarding our national security.

Endnotes

[1] Valerie Insinna, “2023 Budget Drops on March 28, but Details Will Be Missing,” Breaking Defense, March 18, 2022, https://breakingdefense.com/2022/03/2023-budget-drops-on-march-28-but-details-will-be-missing/ (accessed July 12, 2022).

[2] 10 U.S. Code § 4351(a)(1), https://www.law.cornell.edu/uscode/text/10/4351#a_1 (accessed July 24, 2022).

[3] U.S. Government Accountability Office, Missile Defense: Addressing Cost Estimating and Reporting Shortfalls Could Improve Insight into Full Costs of Programs and Flight Tests, GAO-22-104344, February 2022, p. 1, https://www.gao.gov/assets/gao-22-104344.pdf (accessed July 24, 2022).

[4] Ibid., p. 23.

[5] Ibid., p. 28.

[6] Ibid., p. 34.

[7] Ronald O’Rourke, “Navy Constellation (FFG-62) Class Frigate Program: Background and Issues for Congress,” Congressional Research Service Report for Members and Committees of Congress No. R44972, updated March 31, 2022, p. 15, https://crsreports.congress.gov/product/pdf/R/R44972/92 (accessed August 2, 2022).

[8] David B. Larter, “US Navy’s Cost Estimate for New Frigate Won’t Hold Water, Predicts Government Analyst,” Defense News, October 14, 2020, https://www.defensenews.com/naval/2020/10/14/the-us-navys-cost-estimate-for-its-new-frigate-wont-hold-water-analyst-predicts/ (accessed July 24, 2022).

[9] Ibid.

[10] O’Rourke, “Navy Constellation (FFG-62) Class Frigate Program: Background and Issues for Congress,“ p. 15.

[11] Ibid., p. 13.

[12] Ibid.

[13] Anthony Capaccio, “Troubled Littoral Ship Still Can’t Perform Mission, GAO Says,” Bloomberg, February 24, 2022, https://www.bloomberg.com/news/articles/2022-02-24/troubled-littoral-ship-still-can-t-perform-its-mission-gao-says (accessed June 13, 2022).

[14] David B. Larter, “High Operating Costs Cloud the Future of Littoral Combat ships, Budget Data Reveals,” Defense News, April 12, 2021, https://www.defensenews.com/naval/2021/04/12/high-operating-costs-cloud-the-future-of-littoral-combat-ships-budget-data-reveals/ (accessed June 13, 2022).

[15] U.S. Government Accountability Office, Next Generation Combat Vehicles: As Army Prioritizes Rapid Development, More Attention Needed to Provide Insight on Cost Estimates and Systems Engineering Risks, GAO-20-579, August 2020, p. 1, https://www.gao.gov/assets/gao-20-579.pdf (accessed July 26, 2022).

[16] Ibid., pp. 1 and 35.

[17] See National Commission on the Structure of the Air Force, Report to the President and Congress of the United States, January 30, 2014, https://policy.defense.gov/Portals/11/Documents/hdasa/AFForceStructureCommissionReport01302014.pdf (accessed July 26, 2022), and National Commission on the Future of the Army, Report to the President and the Congress of the United States, January 28, 2016, https://www.nationalguard.mil/Portals/31/Documents/ARNGpdfs/ncfa/NCFA-Full-Final-Report.pdf (accessed July 26, 2022).

[18] Special Inspector General for Afghanistan Reconstruction, Quarterly Report to the United States Congress, April 30, 2022, p. 36, https://www.sigar.mil/pdf/quarterlyreports/2022-04-30qr.pdf (accessed July 11, 2022). See also Figure F.4, “Afghanistan Cost of War and Reconstruction, Annual and Cumulative Obligations FY 2002 to FY 20021 Q4,” in ibid., p. 37.

[19] U.S. Department of Defense, Under Secretary of Defense (Comptroller), “Estimated Cost to Each U.S. Taxpayer for the Wars in Afghanistan, Iraq and Syria,” March 2021, https://comptroller.defense.gov/Portals/45/documents/Section1090Reports/Estimated_Cost_to_Each_U.S._Taxpayer_of_Each_of_the_Wars_in_Afghanistan,_Iraq_and_Syria_dated_March_2021.pdf (accessed July 11, 2022).

[20] U.S. Department of Defense, Under Secretary of Defense (Comptroller), “Estimated Cost to Each U.S. Taxpayer for the Wars in Afghanistan, Iraq and Syria,” June 2022, https://comptroller.defense.gov/Portals/45/documents/Section1090Reports/Estimated_Cost_to_Each_U.S._Taxpayer_of_Each_of_the_Wars_in_Afghanistan,_Iraq_and_Syria_dated_June_2022.pdf (accessed July 11, 2022).

[21] Table 2, “Estimated Costs Attributed to the Major War Zones, FY2001–FY2022,” in Neta C. Crawford, “The U.S. Budgetary Costs of the Post-9/11 Wars,” Brown University, Watson Institute for International and Public Affairs, Cost of War Project, September 1, 2021, https://watson.brown.edu/costsofwar/files/cow/imce/papers/2021/Costs%20of%20War_U.S.%20Budgetary%20Costs%20of%20Post-9%2011%20Wars_9.1.21.pdf (accessed July 11, 2022).

[22] Christopher T. Mann, “U.S. War Costs, Casualties, and Personnel Levels Since 9/11,” Congressional Research Service In Focus No. IF11182, April 18, 2019, https://crsreports.congress.gov/product/pdf/IF/IF11182/1 (accessed July 11, 2022).

[23] Diana Maurer, Director, Defense Capabilities and Management, U.S. Government Accountability Office, “F-35 Sustainment: Enhanced Attention to and Oversight of F-35 Affordability Are Needed,” testimony before the Subcommittees on Readiness and Tactical Air and Land Forces, Committee on Armed Services, U.S. House of Representatives, GAO-21-505T, April 22, 2021, p. 1, https://www.gao.gov/assets/gao-21-505t.pdf (accessed June 13, 2022).

[24] Ibid., pp. 4 and 21–23.

[25] Ibid., p. 16.

[26] John Venable, “Air Force’s Math on the F-15EX and F-35 Doesn’t Add Up,” Breaking Defense, April 19, 2022, https://breakingdefense.com/2022/04/air-forces-math-on-the-f-15ex-and-f-35-doesnt-add-up/?_ga=2.116581710.950593788.1650383248-951717084.1641387148 (accessed June 13, 2022).

[27] In his original article, the author quoted a price of $136.0 million. It has since been determined that the Eagle Passive Active Warning Survivability System (EPAWSS) was included in the airframe cost of the F-15EX. Subtracting that cost from the quoted price of $136.0 million results in a gross weapon systems cost for the F-15EX of $120.2 million.