It’s no secret that the COVID-19 pandemic has hurt the nation’s finances. Congress responded to the crisis with trillions in relief spending, causing a massive surge in debt.

That debt increase does not mean we face a crisis tomorrow. However, we now have a clear picture of what is coming our way, and it isn’t pretty.

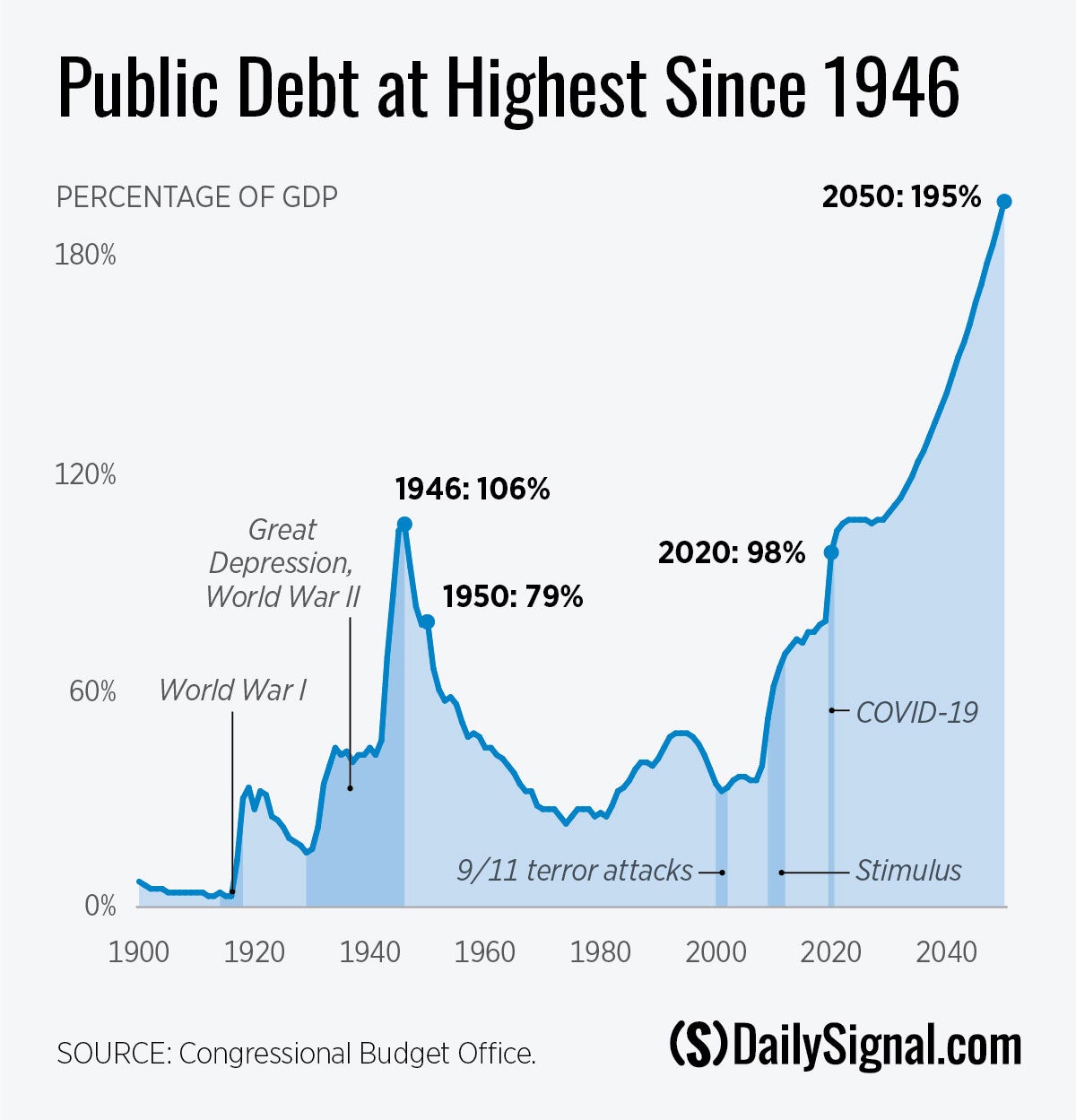

The Congressional Budget Office updated its long-term budget forecast on Sept. 21. The following charts, based on the budget forecast’s data, illustrate just how bad the numbers are.

This year, the federal government will spend over twice as much money as it raised in tax revenue. That is far from ideal, but it almost certainly will improve next year.

This year, the federal government will spend over twice as much money as it raised in tax revenue. That is far from ideal, but it almost certainly will improve next year.

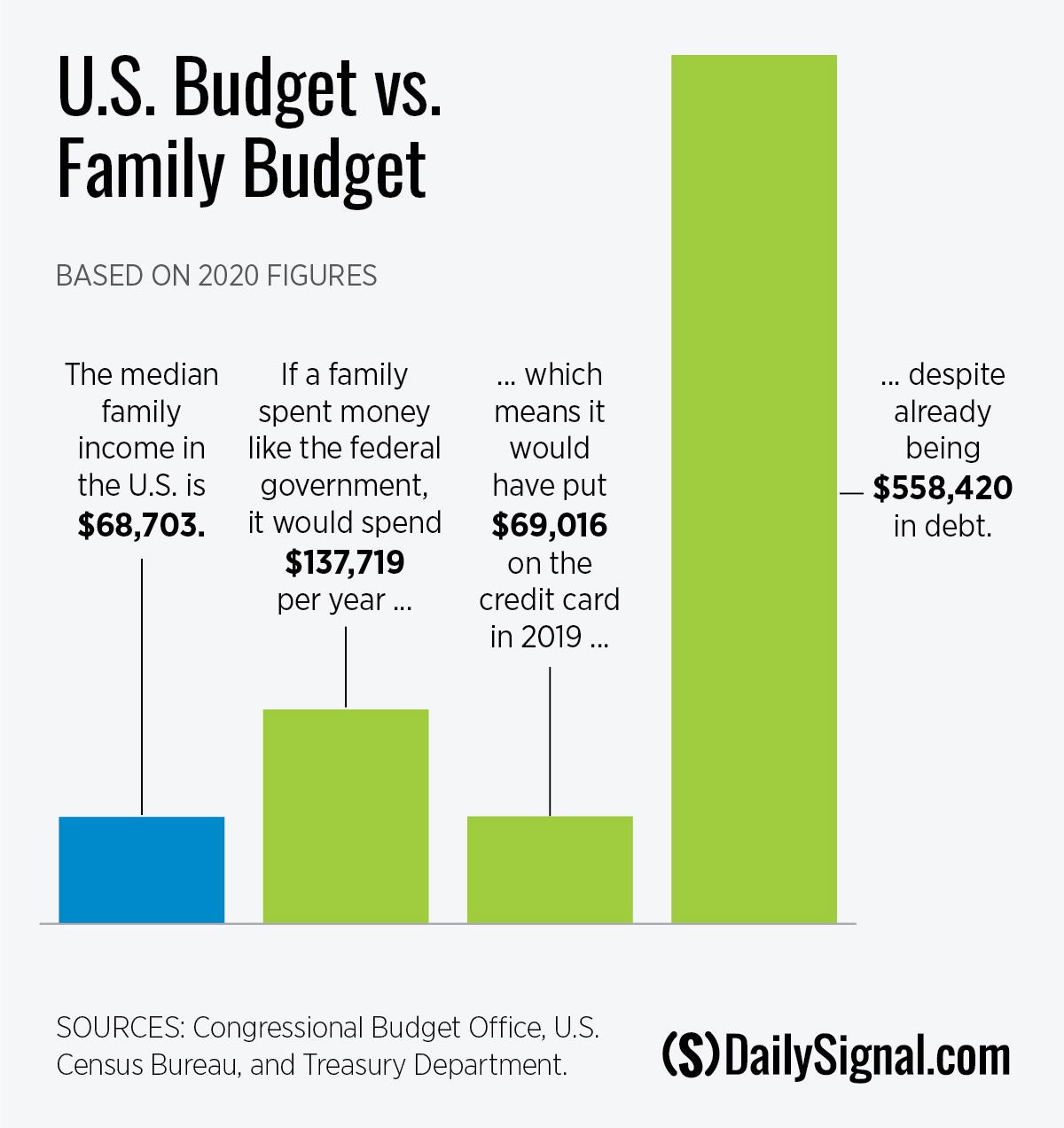

Yet, the real problem is the amount of debt we have already accumulated. Any household with finances that look like this would receive plenty of scrutiny from a responsible bank when asking for more loans.

We cannot expect the global financial system to keep providing the federal government with cheap credit forever if sky-high deficits continue. The consequences of even moderately higher interest rates would be severe.

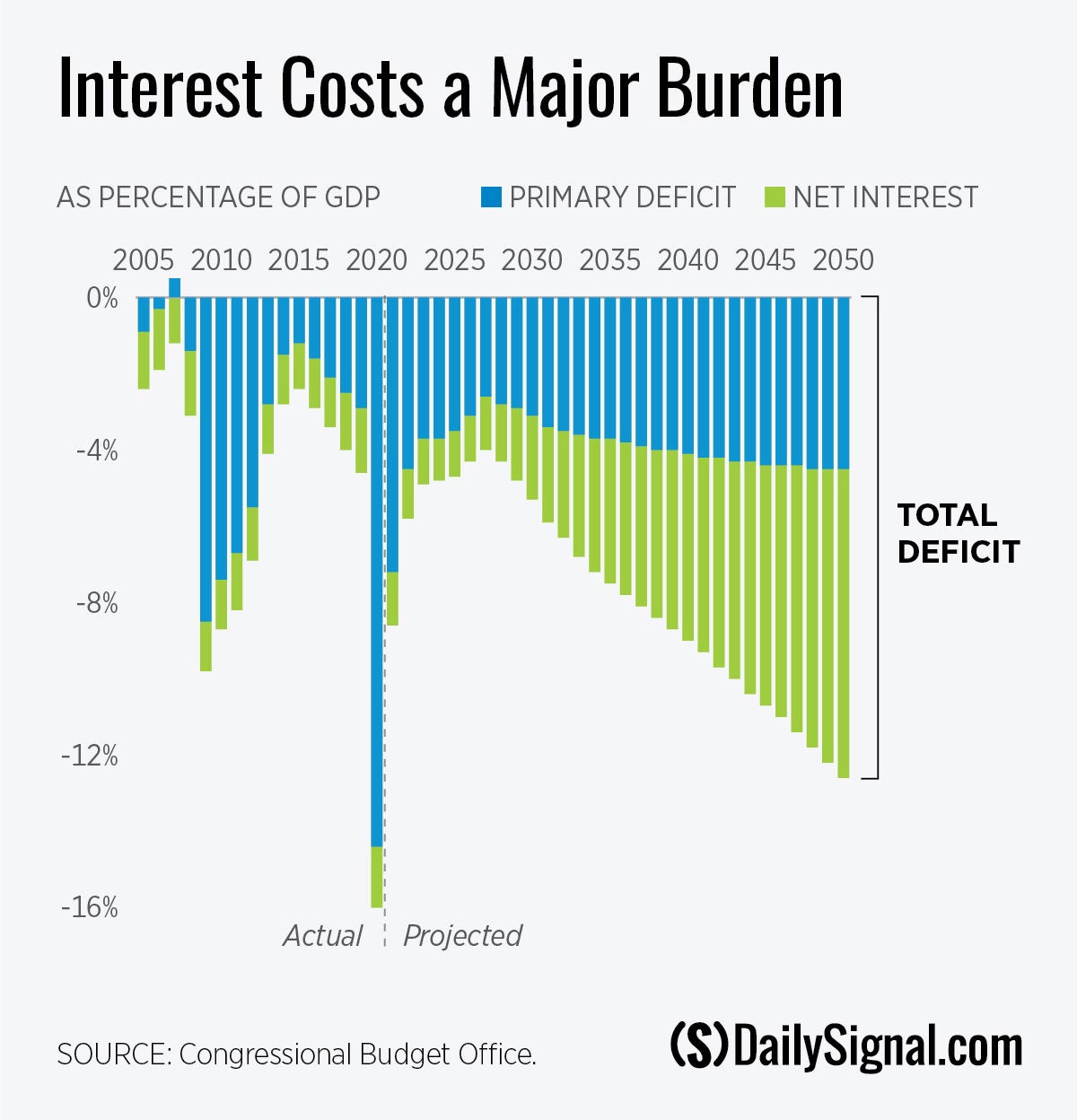

Currently, the cost of paying interest on the debt is not a huge portion of federal spending. However, if we look at it relative to the size of the annual deficit, we see how much closer we would be to balancing the budget without the burden of debt.

The Congressional Budget Office report anticipates that interest rates on federal debt will increase, although only by a few basis points. Yet even a modest rate increase on such a large public debt—currently $20.9 trillion—will cause interest payments to explode.

By 2050, paying interest on the federal debt will consume 8.1% of the nation’s output, roughly an entire month’s productivity. That would be a tremendous drag on economic growth, choking the prosperity and opportunity that are at the heart of the American Dream.

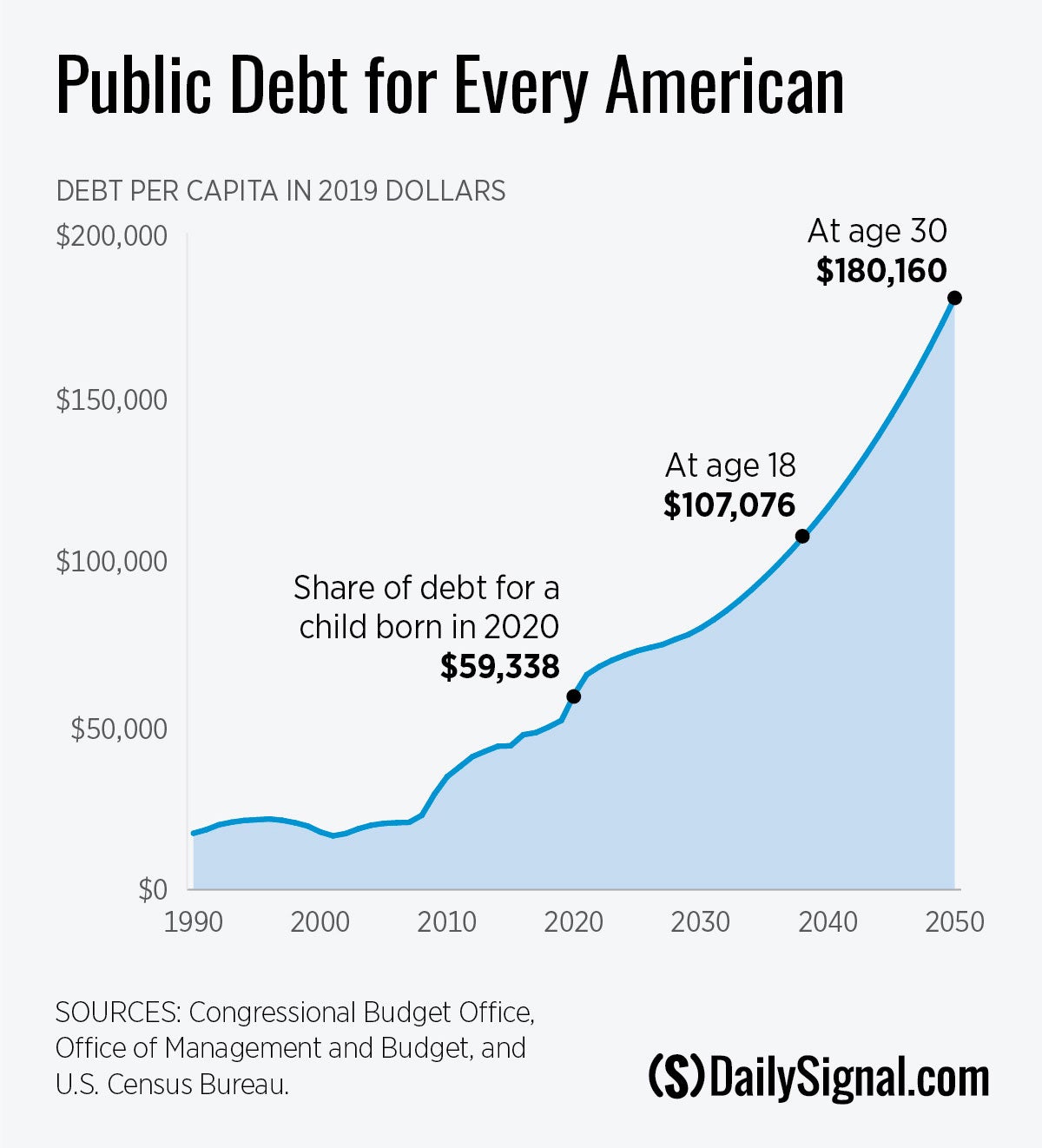

In 2019, the amount of public debt per person was approaching $50,000. Just a year later, we have added nearly $10,000 in debt for every person, from children to retirees.

Things get worse the further out we go. Today’s newborns will face a debt of over $107,000 by the time they turn 18, and a staggering $180,000 by age 30, even after adjusting for inflation.

This extra debt would not be used to pay for extravagant new benefit programs, infrastructure improvements, or a stronger national defense. In fact, that debt comes as a result of simply allowing spending on today’s programs to grow unchecked.

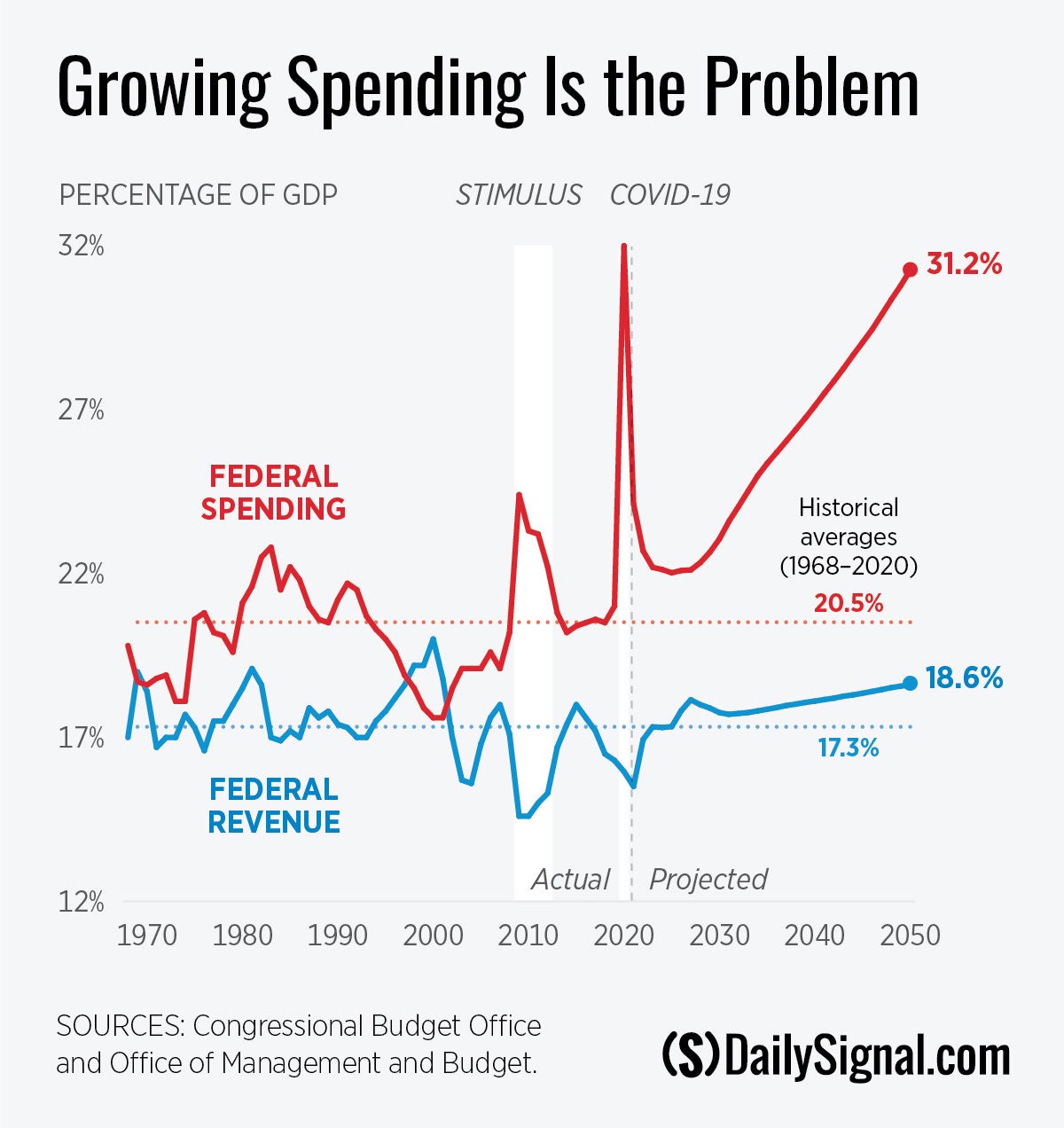

As the chart makes clear, the federal government has a spending problem. Spending was already above the historical average in 2019, and it will grow relative to the size of the economy every year from 2021 on.

In contrast, tax revenue soon will return to average levels, even if Congress makes the entire Tax Cuts and Jobs Act permanent.

The cause of the spending spike is unsustainable growth in a few programs, most notably Social Security, Medicare, and Medicaid. Reforming these programs is the single most important thing Congress can do to put America on a better financial path.

If Congress keeps waiting, only drastic measures will be strong enough to correct the imbalance.

America ran up a massive debt to fund the vital work of winning World War II. The postwar economic boom helped bring that debt down quickly.

Unfortunately, the federal debt increased relative to the economy even during the years of strong growth prior to COVID-19.

Only a combination of pro-growth economic policy and spending restraint can prevent the unprecedented levels of debt that we see on the horizon.

To focus on the nub of the spending problem, this chart provides a helpful thought exercise. Due to the rapid increase in projected spending on interest, Social Security, Medicare, and Medicaid, just those spending categories would consume all tax revenues by 2036.

This leaves out spending on national defense, operational costs for all federal agencies, veterans’ benefits, most welfare programs, natural disasters, infrastructure, and more.

Further, this projection assumes that Congress allows much of the Tax Cuts and Jobs Act to expire, meaning that even a tax hike wouldn’t solve the problem.

While the problems highlighted in the Congressional Budget Office report and these charts are serious, America has overcome greater challenges in the past.

The Heritage Foundation’s Blueprint for Balance plan provides policymakers with ideas that can put us on the path to a responsible federal budget. A combination of sustained leadership and greater public awareness can turn the ship of state in the right direction. The sooner the work begins, the better.

This piece originally appeared in The Daily Signal