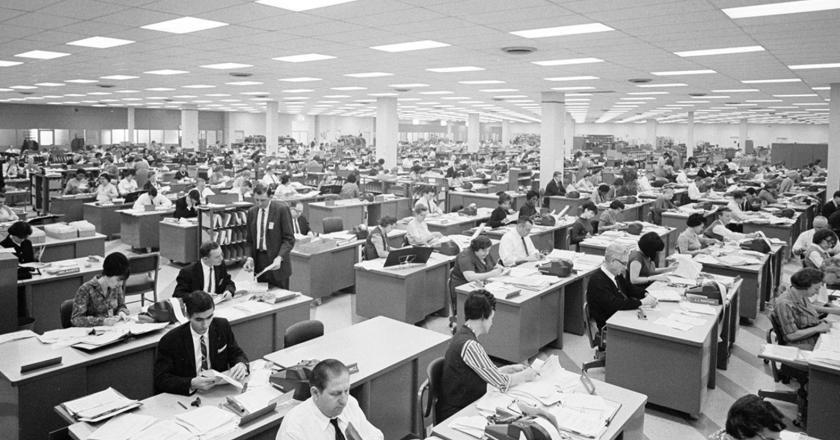

In the 1950s, effective average federal taxes were only 17 percent. Milton Ezrati weighs in on the arguments for a 70 percent top tax rate to fund a “Green New Deal”:

[Paul] Krugman and [Alexandria Ocasio-Cortez] play fast and loose when it comes to the country’s prosperity under high tax rates. It’s true that the United States prospered with a top rate of 70 percent and higher in the mid-20th century. But the tax code then included loopholes that drastically reduced the amount of income subject to those rates. All the tax cuts since then have closed those loopholes. One can forgive Ocasio-Cortez for missing the difference, as she has consistently shown economic and historical ignorance, but Krugman should know better.

In the 1960s, 1970s, and early 1980s, for instance, when the 70 percent maximum rate prevailed, taxpayers could write off all state and local taxes, with no limit—including sales taxes, licensing fees, property taxes, and income taxes. They could also write off all interest expenses without limit—on their mortgages (no matter how many), all credit-card debt, auto loans, or home-improvement loans. Imagine the benefits to a plutocrat, buying a third home or a fifth Bentley.

Ray Chavez/Digital First Media/The Mercury News via Getty Images

Ray Chavez/Digital First Media/The Mercury News via Getty Images

His tax would be calculated on net income, reduced by any fees, sales, or transfer tax, as well as all the interest expenses on the mortgages or auto loans over the years. The code included dividend exclusions and generous provisions for capital-gains preferences. Taxpayers back then could shelter unlimited amounts in IRAs. Social Security payouts were tax-free, no matter how high a person’s income. Individuals could write down their taxable income through averaging provisions and transfer as much income as they liked to their children, who paid at lower rates. There was no limit to rental-loss deduction. Business losses counted against all income.

Given these breaks and loopholes, it’s no surprise that few people actually paid those high rates on much of their income. The nonprofit Tax Foundation estimates that in the 1950s, for instance, when the top statutory rate was 92 percent, the top 1 percent of taxpayers wrote off so much income that their effective average federal tax rate was about 17 percent. If our highest earners today were offered the 2019 code or the old one, they might well go for the old rules, even at a 92 percent top rate. [Milton Ezrati, “The ‘Green New Deal’ Is a Fiscal Fantasy,” City Journal, January 14]

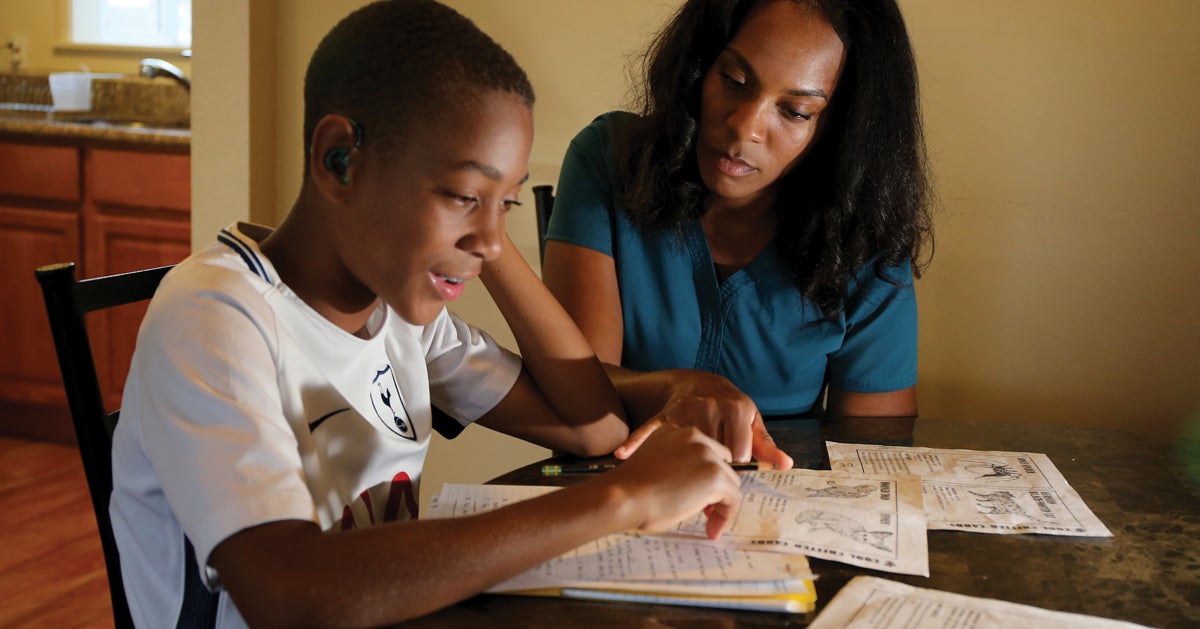

Homeschools outshine public schools. J.D. Tuccille writes:

In 2014, SAT “test scores of college-bound homeschool students were higher than the national average of all college-bound seniors that same year,” according to [the National Home Education Research Institute].

“Mean ACT Composite scores for homeschooled students were consistently higher than those for public school students” from 2001 through 2014, according to that testing organization, although private school students scored higher still.

By contrast public school kids “bombed the SAT,” reports Bloomberg. Mixed but generally disappointing results since then have education experts worrying that many public school graduates are unprepared for either higher education or the workforce.

No wonder colleges not only welcome, but actively recruit, homeschooled applicants.

But what about the impact of DIY education on the larger world—say, the development of “parallel societies” that Germany cites as grounds for banning the practice? We should be so lucky—homeschoolers seem inclined to create better societies.

“Students with greater exposure to homeschooling tend to be more politically tolerant—a finding contrary to the claims of many political theorists,” reports research published in the Journal of School Choice. Defined as “the willingness to extend civil liberties to people who hold views with which one disagrees,” this finding of greater political tolerance among the homeschooled has important ramifications in this factionalized and illiberal era.

“In other words,” writes author Albert Cheng of the University of Arkansas’s Department of Education Reform, “members of the very group for which public schooling is believed to be most essential for inculcating political tolerance (i.e., those who are more strongly committed to a particular worldview and value system) actually exhibit at least as much or more tolerance when they are exposed to less public schooling.” [J.D. Tuccille, “Homeschooling Produces Better-Educated, More-Tolerant Kids. Politicians Hate That,” Reason, January 22]

Late-term abortions are rarely done for the health of the mother. David French writes:

Late-term abortion is, fortunately, relatively rare. According to the most recent CDC data, only 1.3 percent of abortions occur after 21 weeks. However, given the sheer number of abortions in this country (638,169 reported to the CDC), that means there were at least 8,000 late-term abortions in the United States. As Jonah Goldberg notes today, the pro-abortion-rights Guttmacher Institute puts the number even higher, at roughly 12,000 late-term abortions per year. That’s a lot of babies dying late in pregnancy. To gain a sense of perspective, that number is comparable to the number of murders committed by firearms in the same time period.

So, why do these babies die? The Guttmacher Institute has looked at the reasons for late-term abortion, and the reasons are chilling. First, the top-line finding is clear: “[D]ata suggest that most women seeking later terminations are not doing so for reasons of fetal anomaly or life endangerment.” Instead, there were “five general profiles of women who sought later abortions, describing 80% of the sample.” These women were “raising children alone, were depressed or using illicit substances, were in conflict with a male partner or experiencing domestic violence, had trouble deciding and then had access problems, or were young and nulliparous [had never given birth].” [David French, “It’s Time for the Truth about Late Term Abortions,” National Review, February 1]

The Congressional Budget Office estimate was wrong—by about 460 percent. Philip Klein reports:

CBO estimates about the importance of an individual mandate to a national health care scheme prodded President Barack Obama into including the unpopular provision into the law in the first place. The mandate projections also played a key role in President Trump’s two major legislative initiatives. The fact that the CBO assumed 14 million could lose coverage mainly due to the elimination of mandate penalties helped kill the effort to repeal and replace Obamacare, while its later assumption that 13 million fewer insured individuals would mean less spending on subsidies from the federal government helped get the 2017 Republican tax cut across the finish line by improving the budgetary math. Yet those incredibly influential estimates now appear to have been wildly off.

Members of the very group for which public schooling is believed to be most essential for inculcating political tolerance actually exhibit at least as much or more tolerance when they are exposed to less public schooling.

In what was literally a footnote in its annual report on national health spending projections, actuaries for the Centers for Medicare and Medicaid Services […] estimated that the elimination of the individual mandate would have a significantly smaller impact than the CBO has long estimated. Specifically, the CMS report revealed that 2.5 million more people would go without insurance in 2019 due to the repeal of the individual mandate’s penalties, and the impact would be “smaller” thereafter. [Philip Klein, “Government Report Reveals CBO Was Scandalously Off in Obamacare Estimates,” Washington Examiner, February 20]

A federal tax credit for school choice will invite federal control—imperiling choice. Neal McCluskey points out a problem in the new school choice bill put forward by Sen. Ted Cruz, (R-Texas) and Rep. Bradley Byrne (R-Ala.):

School choice is about individualization and freedom, and almost certainly that is what [Education Secretary Betsy] DeVos, Cruz, and Byrne want. But federal initiatives are a terrible way to deliver that. The reality is that what the feds fund, even indirectly, they inevitably want to control. DeVos, Cruz, and Byrne specifically acknowledge that historical reality in federal education policy. They write, “A series of administrations on both sides of the aisle have tried to fill in the blank with more money and more control, each time expecting a different result.” Note that the primary vehicle for that control, the Elementary and Secondary Education Act, started aimed just at funding low-income districts. It eventually became the uber-controlling No Child Left Behind Act.

DeVos, Cruz, and Byrne are looking to skirt the control problem, sticking with tax credits instead of vouchers, and letting states opt in. But not only is this unconstitutional—taxes are authorized to execute specific, enumerated powers, not to lightly engineer state policy—it won’t, ultimately, prevent encroaching federal control. If enacted, the credit would spur people to demand their states participate, and as more schools benefited from federally connected scholarships all schools would be financially pressured to use them. But the federal government will have the power to decide which state programs are or are not eligible, and on what grounds. As Corey DeAngelis and others have noted, what happens when, instead of a President Trump, we have a President Sanders or Harris and they don’t like the policies of religious schools, or maybe how economics is taught? Suddenly lots of private schools and other options will be federally pressured to look very similar—shape up or credit eligibility goes away—and true choice will be curtailed.

Even the roll out of the proposal raises the specter of federal control. Though the great benefit of tax credits is they do not use government money, and hence are less prone to regulation than vouchers, DeVos, Cruz, and Byrne write that through their proposal they “are putting forward a historic investment in America’s students.” That sure sounds like the federal government is doing the funding, and what government funds it tends to control. Also, that Secretary DeVos is so prominent in the proposal release at least symbolizes not only federal intervention in education policy, but a strong connection to the executive—the dangerously regulatory—branch of the federal government. [Neal McCluskey, “Even Something as Great as School Choice Should Not Be Federalized,” Cato Institute, February 28]

JULIO CESAR AGUILAR/AFP/Getty Images

JULIO CESAR AGUILAR/AFP/Getty Images

Tariffs beget more tariffs. Veronique de Rugy explains:

In the end, the steel tariffs have made the production of American-made products more expensive. This makes those American producers who use steel less competitive on global markets.

Enter American producers of line pipe. As it happens, the raw materials these producers use in their domestic production of large-diameter welded line pipe and structural pipe are subjected to Section 232 tariffs (25 percent on steel imports from Canada, China, Greece and India, 50 percent on imports from Turkey and quotas on imports from Korea). As expected, the line pipe producers’ production costs rose. And now these producers have gone before the [U.S. International Trade Commission] to argue that they are being injured by dumping—selling in the United States at prices below “fair value”—carried out by Chinese and Indian manufacturers of allegedly subsidized line pipe.

Three of the five USITC commissioners agreed. This ruling will trigger countervailing and anti-dumping duties from the Department of Commerce, and as a result, everything will end up being more expensive.

The question is: When and where does this cascading protectionism stop? Of course, the steel tariffs have affected products other than large-diameter line pipe. All American producers that use steel as inputs are negatively affected by the administration’s import taxes. Inevitably, then, the USITC will see a surge of American manufacturers coming to ask for protection from foreign competitors for their products when, in fact, they need only protection from the Trump administration’s trade hawks, who have made input more expensive. [Veronique de Rugy, “Learning the Lessons of Protectionism the Hard Way,” The American Spectator, February 28]

It is a scandal that anybody thinks college admission is worth the cost of a bribe. Kenny Xu writes:

The bribery scheme to get privileged children into elite universities is causing parents and teachers across the country to fume with righteous indignation. But the revelations of corruption in the multibillion-dollar college-admissions industry is perhaps more indicative of how Americans’ views of college—especially among the elite—are shifting into dangerous territory.

More Americans no longer value college education for its ability to train their children with the skills needed to thrive in adult life. Instead, they obsess over college’s signaling value—the value of a school’s name and prestige.

Two women, holding signs at a federal courthouse in Boston on April 3, would like actress Lori Loughlin to pay their tuitions. Loughlin and her husband are two of dozens of parents charged in the college admissions scandal. credit: OSEPH PREZIOSO/AFP/Getty Images

Two women, holding signs at a federal courthouse in Boston on April 3, would like actress Lori Loughlin to pay their tuitions. Loughlin and her husband are two of dozens of parents charged in the college admissions scandal. credit: OSEPH PREZIOSO/AFP/Getty Images

One can see this trend amid the booming college-consulting industry, where consultants seek to do everything legally possible to get their client’s child into the best-name colleges. The number of professional college consultants among the nation’s elite has jumped from 2,000 to 5,000 in recent years. Nowadays, 26 percent of the students who got into the 70th percentile or higher on the SAT had some form of private college consulting help.

Economist Bryan Caplan puts this inversion of the goals of higher education more bluntly. Imagine if you could get a degree from Georgetown University without attending any classes. Now imagine you could take every class at Georgetown without getting a degree. Which option would you choose? Most likely, the one that signals value—the former.

The irony is that the signaling value of elite colleges is quite misplaced. According to a paper by mathematician Stacey Dale and economist Alan Krueger, if your child is smart enough to get into an elite college, but chose not to go, he or she will still end up making approximately the same as a similarly qualified applicant who did go to an elite college. [Kenny Xu, “College Admissions Bribery Scandal Shows How Higher Ed Culture Has Descended into Signaling,” The Daily Signal, March 15]

ROUND UP highlights key work produced by conservative and classical liberal think tanks. Submit ideas at [email protected]