On July 31, 2013, the Generalized System of Preferences (GSP)—the U.S. trade program designed to promote trade in developing countries—expired without renewal for the eighth time in its 30-year history. Over the past year, imports entering the U.S. under the program have incurred higher tariff rates, increasing costs for producers and consumers. Originally designed as a “trade rather than aid” scheme, the GSP has been a cornerstone of U.S. trade and foreign policy for the past three decades. Furthermore, it has provided a foundation for subsequent preference programs, including the African Growth and Opportunity Act (AGOA), the Caribbean Basin Initiative (CBI), and the Andean Trade Preference Act (ATPA).

The expiration of the GSP, while unfortunate, provides a unique opportunity to reauthorize and reform the program. While the GSP has been historically successful at promoting trade with developing countries, in recent years its trade volumes have declined. This decline reflects statutory modifications, evolving trade environments, and product and country eligibility for the program. Reform can re-orient the GSP toward better accomplishing its original mission of assisting developing nations while simultaneously bringing preferences in line with the realities of global trade. Congress and the President should pass new GSP legislation that focuses on increasing GSP imports while reducing regulatory pressures that hinder GSP utilization.

GSP Program Overview

The Generalized System of Preferences grew out of international aid discussions in the 1960s. Policymakers sought a way to promote economic development and growth in the developing world that diverged from the standard aid paradigm by providing preferential duty-free treatment for exports from poor countries. In particular, the original proponents wanted to close a gap in global trade that excluded countries of the developing world. This, in theory, would open up markets to developing countries and encourage growth as economies began to participate in the global trading network. However, preferential trade programs, in principle, violated one of the basic tenets of the multilateral trading system, most-favored-nation (MFN) treatment, which states that all countries must receive equal trade advantages.[1] To overcome this obstacle members of the General Agreement on Tariffs and Trade (GATT) introduced temporary waivers for preferential programs in 1971. In 1979, these waivers were made permanent under the enabling clause of the GATT, and were adopted by the World Trade Organization (WTO) upon its formation.[2]

The United States, originally hesitant about preferential trade programs,[3] first authorized the GSP under the Trade Act of 1974. Most of the framework of the original program is still in place today, including the zeroing-out of duties for a broad swath of product lines and a significant amount of executive branch discretion on the eligibility requirements for beneficiary developing countries (BDCs). Today, 123 countries and nearly 5,000 products are eligible for duty-free entry into the United States under the GSP program.

Much of the implementation and programmatic elements of the GSP fall to the executive branch and the multi-agency GSP subcommittee.[4] The statutory guidelines of the program can be roughly divided between automatic rules and discretionary powers.

Automatic rules apply in two key areas of the program: graduation and competitive-needs limits (CNLs). In order to keep the GSP focused on developing countries, the program was set up to graduate countries that were deemed “high income” according to World Bank guidelines. Upon graduation, countries are no longer eligible for GSP benefits. Since 2011, Equatorial Guinea and Trinidad and Tobago were graduated based on these income requirements. While this type of graduation is mandatory, the President can also graduate countries that he deems “sufficiently competitive or developed.”[5]

Automatic rules also exist on the product level. The GSP contains CNLs, which disqualify products from BDCs deemed already competitive with domestic products. CNLs were designed to protect domestic industry from BDC products that are already internationally competitive. CNLs automatically kick in if an imported product reaches a threshold of $165 million in 2014,[6] “or if 50% or more of total U.S. imports of a product entering under GSP come from a single country.”[7]

The President also has broad discretionary power over the program, especially in determining eligibility. GSP eligibility is based on guidelines outlined in the U.S. Code, but each country’s eligibility is ultimately determined by the President. Some of the parameters that define eligibility include economic development, respect for workers’ rights and intellectual property, external trade policy, and a country’s desire to be included in the program. Mandatory rules also prohibit participation by, among others, industrialized countries, sponsors of terrorism, and countries that have expropriated U.S. property.[8] Within these parameters the President can deem eligible or ineligible any country at any time. The President has particular discretion in these areas, and most recently withdrew Bangladesh’s eligibility for GSP benefits because of workers’-rights issues raised after two prominent workplace accidents in 2012 and 2013.

The President also has discretionary power over the “least-developed” designation. Among qualified countries, eligibility for duty-free treatment for certain product lines is determined by level of economic development. Eligible countries are divided between BDCs and “least-developed beneficiary developing countries” (LDBDC). BDCs qualify for 3,509 tariff lines at the eight-digit product level of the harmonized tariff schedule, while LDBDCs qualify for an additional 1,472 lines.[9] This is meant to open up to the neediest countries a larger share of the U.S. market.

Lastly, the President has some discretionary power to overrule CNLs. Countries or U.S. producers can petition the President for a CNL waiver that allows BDCs to import outside the import limits.

GSP Imports: Mixed Success

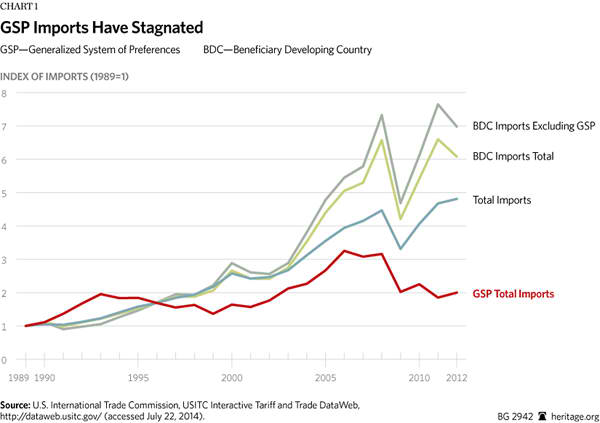

The GSP’s most recent history has been one of mixed success. While imports under the program have nearly doubled since the U.S. International Trade Commission began tracking them in 1989, most of those increases took place in the four years between 1989 and 1993. In 2012, the last full year of GSP duty-free imports before the program expired on July 31, 2013, GSP imports were at the same level as they were in 1993. This stagnation is notable as imports have not recovered since a run-up in trade in the mid-2000s. In particular, since 2006, GSP imports have declined by nearly 40 percent.

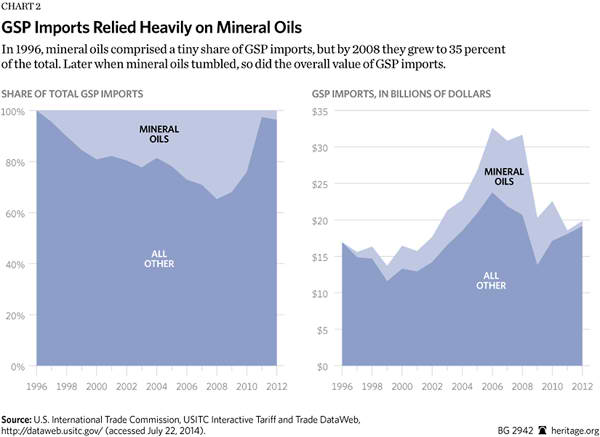

In part, the run-up and subsequent decline of GSP imports reflects the global increase in commodity prices, particularly petroleum, through 2008. Furthermore, much of the decline in GSP imports was a result of the deflation of commodity prices after the global recession of 2008 and 2009. At its height in 2008, mineral oils made up nearly 35 percent of overall imports under the GSP. Since then, oil imports have declined to less than 5 percent—around $700 million. In monetary terms, this decline has been steeper than the overall decline in GSP imports. In addition, Equatorial Guinea, a large oil importer, was graduated from the GSP in 2011. Prior to graduation, Equatorial Guinea accounted for 21 percent of GSP petroleum imports[10] in 2010, and 5 percent of all imports. Equatorial Guinea’s graduation made it ineligible for duty-free tariffs under the GSP.

While the compositional change is important, GSP imports excluding mineral oils have still declined overall since the pre-recession period, and have returned to 1993 levels. This reflects a disappointing historical pattern. Overall, GSP imports have tracked below growth in overall imports into the United States, as well as shipments from BDCs that are made outside the GSP program. After 2006, GSP imports declined in line with other imports, a reflection of the deteriorating external environment. However, the GSP has also been the anomaly since that time. Since 2006, other import categories, including overall imports and imports from BDCs, have recovered close to pre-recession levels. The GSP, however, has continued consistently to decline.

To put this in perspective: If overall GSP imports continue to decline at the same pace as they have declined since 2006, imports under the GSP program will approach zero by about 2025. While this scenario is unlikely, it is a call to action for Congress and the President that reform is needed to keep the GSP relevant for both the U.S. producers that rely on those imports and the BDCs that benefit through their economic growth.

GSP: Good Program, Bad Design

Stagnating GSP import levels reflect a number of realities about the statutory constraints that limit import growth. These restraints and the policy discretion of the program reflect the GSP’s dual role as a tool of both foreign policy and economic development. However, this reality should not limit the GSP from providing market access for BDCs at an optimal level. Indeed, the GSP becomes a more effective foreign policy tool the more it is utilized (the more imports that enter under the program). More imports mean more leverage on the beneficiary country. From the very beginning, the program was adopted to promote economic growth in developing countries by replacing aid with trade. Recently, the trade aspect of the GSP has been undermined by both the foundational structure of the program, which has not adjusted to current market realities, and legislative interference in the form of misguided reforms and uncertainty. When Congress moves to renew the GSP it should consider reforms that enhance GSP use, increase imports, and prevent irrelevance.

Reduced Margins of Preference. Shrinking margins of preference are one of the broadest cyclical trends affecting GSP imports. The steady decline of global tariff rates under both multilateral agreements, like the Uruguay Round that spawned the WTO, and regional trade agreements, like the North American Free Trade Agreement (NAFTA), have reduced the competitive margins that preferential agreements once held. Under the GSP, eligible countries qualify for duty-free access for up to 5,000 product lines. However, when overall tariff margins on a global or regional scale are decreased, the competitive advantage of this duty-free access is diminished. In some cases, it is estimated that a 40 percent reduction in current MFN tariff rates by the countries with large GSP programs (Canada, members of the European Union, Japan, and the United States) would result in a 1.7 percent decrease in least-developed-country exports. Select least-developed countries could expect to see up to an 11.5 percent loss of exports.[11] Furthermore, these estimates are derived from current MFN tariff levels, which are at historically low levels. The large decrease in margins over the past two decades had undermined the preferential advantages of GSP-eligible countries. This point has helped stall the multilateral Doha Round, and spurred calls for aid compensation.[12]

This fall in margins has been compounded by already high regulatory compliance costs for GSP exports, which increase relative costs for products claiming GSP duties. Shrinking margins of preference have bumped up against fixed regulatory costs related to, among other things, rules of origin compliance. In fact, “the costs of complying with rules of origin … can range from one to five percent of the value of the imported goods [and] have a strong tendency to wipe out the benefit of any margin of preference.”[13]

The GSP is particularly susceptible to rules-of-origin compliance costs due to the high rules-of-origin de minimis rates. Currently, the de minimis rules of origin rate for the GSP is 35 percent—in line with other preferential programs, but significantly more than recently completed free trade and trade-promotion agreements. The GSP’s 35 percent rules of origin rate means that 35 percent of the “appraised value of the article at the time of entry into the United States” must come from the originating country. This burden means that importers must provide documentation throughout the value chain for any incoming products claiming GSP benefits.

The high rules-of-origin de minimis makes the GSP less competitive for eligible countries and producers versus other trade agreements, and limits GSP imports to commodity products with little value added or assembly. In addition, according to the Government Accountability Office, rules-of-origin compliance within preferential trade programs have a negative effective on program usage rates.[14] If the GSP is meant to encourage economic growth, and program utilization, it should reduce supply-side constraints that limit adoption.

Creeping CNL Protectionism. Competitive-needs limitations are another area that restricts GSP imports and utilization. CNLs are monetary or relative limits on imports from GSP countries that are deemed internationally competitive in certain product categories.[15] When a CNL is reached, a country is barred from importing that product duty-free under the GSP until imports fall below the limit. CNLs are meant to protect U.S. firms from duty-free GSP imports of products that were directly competitive with their business. Over the past two decades, CNLs have been reformed twice, a process that has lowered the monetary value of the limit and attacked “super-competitive” imports to protect U.S. businesses. These reforms equate to a creeping protectionism that limits entry into the United States of products that would otherwise be eligible under the GSP.

The first round of reform to CNLs occurred in 1996 in an effort to broaden the distribution of GSP benefits. Before 1996, CNL limits were determined by the Trade Act of 1974, which at first set the limit at $25 million in 1974, with increases indexed to U.S. gross national product. By 1995, that limit had increased to $122 million. In place of these original limits, the GSP Renewal Act of 1996 lowered the CNL to $75 million and introduced a new percentage limit, which restricts GSP imports on products whose value totals more than 50 percent of all imports of that product in that year. In addition, the CNL monetary-limit indexing was adjusted. With 1996 reforms, the CNL would increase by $5 million each year. This new indexing formula slowed down the potential for CNL increases in the long term.[16]

In 2006, Congress again adjusted rules for CNLs, this time “in an effort to limit duty-free access for so-called ‘super-competitive’ products” by attacking CNL waivers. In the new law, CNL waivers “should” be revoked if they are older than five years and meet two conditions. First, a waiver should be removed if the product exceeds 150 percent of the competitive-need limit. Second, it should be removed if a product from a particular country exceeds 75 percent of “the total value of imports of that product from all countries.” As a result of these changes, $5.7 billion of products have lost their GSP eligibility.[17]

These reforms have undermined the GSP by limiting the eligible products and program utilization.[18] As products become more successful in penetrating U.S. markets, they lose eligibility for the GSP. Meanwhile, reforms have failed to accomplish the expressed goals. The distribution of GSP imports has changed little over the past decade, despite changes in the CNL that were meant to broaden participation.[19] Meanwhile, 2006 reforms to protect U.S. producers from “super-competitive” products of jewelry and tires simply diverted imports from GSP countries to non-GSP countries, instead of shifting production onshore. These changes simply increased costs for U.S. consumers purchasing these goods.[20]

Mismatch of Product Eligibility. Declining imports under the GSP and poor utilization of preferences were also related to a mismatch between product eligibility and BDC comparative advantage. The GSP covers a vast array of products, nearly 5,000 for LDBDCs, and 3,500 for BDCs. However, these products do not necessarily match what BDCs actually export on international markets. In addition, GSP regulations for competitive needs limit the products that BDCs are actually competitive at making internationally, and thus would receive the most benefits from a preferential program.

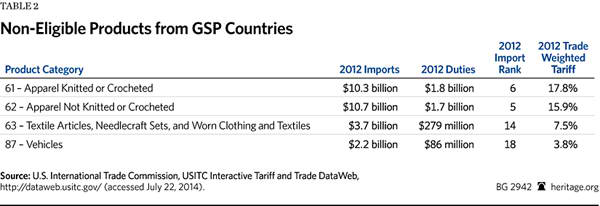

To maximize GSP benefits to developing countries and increase utilization of GSP product lines, reforms should target products that have both high import volumes (under the standard harmonized tariff schedule), and high tariff rates. Currently, the average trade-weighted tariff for BDC imports overall, both GSP and non-GSP, is 2 percent. Of the 20 top imports by BDCs into the U.S., six of them have a weighted tariff that is over the 2 percent threshold. This accounts for $11.4 billion, or 5 percent, of all BDC imports. In particular, apparel, textiles, and vehicles make up a significant portion of total exports, yet are subject to high import tariffs and reduced GSP eligibility.

In 2012,[21] four major product categories constituted the most egregious mismatch between import volume and weighted tariff: apparel (knitted), apparel (not-knitted), textiles, and vehicles. GSP import rules currently only partially cover these categories. In the case of vehicles, BDCs are eligible for only 45 percent of product lines, while LDBDCs are eligible for slightly more. In textiles, GSP countries are ineligible for most products except national flags, banners, wall hangings, folklore products, and some silk. Apparel is similar. GSP countries are ineligible except for a few categories, such as gloves and mittens, silk items, and headbands.[22]

The fact that these products are ineligible for GSP duty-free treatment means that U.S. companies pay an additional $4 billion in duties on these products. This tax eventually will be passed on to consumers in the form of higher prices, which ultimately affect economic growth in both the United States and BDCs. Incorporating these and other high-volume, high-tariff product lines into the GSP would encourage trade and growth in BDCs, while enhancing GSP utilization.

Time to Renew and Reform the GSP

The Generalized System of Preferences has been a source of growth and a vital link between developing countries and the United States over the past 30 years. Recently, however, congressional and executive complacency has let the program wane, ignoring falling participation and creeping protectionism in the program itself. Congress and the President should again take up the GSP as a vital part of its economic and foreign policy by:

- Renewing and reforming the Generalized System of Preferences. Congress should incorporate needed GSP reforms, renew the program for 10 years, and adopt an automatic renewal mechanism to ensure the stability and certainty needed to expand GSP imports and program utilization. Growth in GSP exports has been the most sustainable during long-term extensions of the program, as short-term extensions cause programmatic uncertainty.[23]

- Reducing rules of origin to levels commensurate with other trade agreements. In the 2013 WTO Bali Agreement on trade facilitation, U.S. negotiators made a commitment to making the rules of origin for least-developed countries “transparent and simple … contribut[ing] to facilitating market access.”[24] The U.S. should follow through on that commitment. Lowering rules of origin to levels equal to other free trade agreements would encourage global production integration for GSP imports and expand applicable products, helping BDCs integrate in the global economy.[25] Reducing rules of origin would have the added benefit of reducing the GSP’s reliance on oil and other commodity imports.

- Reducing rules-of-origin compliance costs. Current GSP rules of origin put an undue compliance cost on GSP imports that further undermines shrinking margins of preference. This hurts GSP utilization and imports, and increases the costs of utilization to between 1 percent and 5 percent.

- Increasing or eliminating competitive needs thresholds. Changes to CNL and CNL-waiver regulations have equated to creeping protectionism in the GSP. Eliminating or increasing the CNL threshold would encourage sustained bilateral trade between the United States and BDCs, and increase program utilization.

- Indexing any future CNL threshold increases to economic growth. Fixed indexing of the CNL threshold reduces the percentage increase in CNLs over time. Instead, competitive-needs thresholds should be indexed to total import growth or to growth in GDP.

- Expanding GSP-eligible products to meet BDC specializations. While the GSP covers up to 5,000 products for qualifying countries, it fails to cover some of the most important and competitive products for BDCs. Zeroing out duties or increasing accessibility to low tariffs for products such as apparel, textiles, and vehicles could reduce duties and tariffs by billions of dollars, including some tariffs that reach as high as 17 percent. The result would have a huge impact on BDC growth.

Time to Act

The longer the GSP sits unauthorized, the more irrelevant it becomes to potential companies and governments. It is again time to make economic freedom and free trade a centerpiece of American foreign policy by renewing the GSP and enhancing its outcomes. Failing to do so will have negative strategic and economic consequences for the United States at home and abroad.

—Ryan Olson is Research Associate in Economic Freedom in the Center for Trade and Economics, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.