Over the past three decades, conservatives have proposed four different types of consumption taxes:

- A national sales tax,

- A business transfer tax,

- The Hall–Rabushka–Armey–Forbes flat tax, and

- The “new flat tax,” also known as an expenditure tax, consumed income tax, inflow-outflow tax, or cash flow tax.

Few understand that, despite their administrative differences, they are economically equivalent consumption taxes.[1]

This paper demonstrates their equivalence. Each of these four tax reform proposals has an equivalent consumption base. Except for secondary design choices and the choice of which taxes they would replace, they would apply the same tax rate to raise a given amount of revenue.

A Brief History of Conservative Tax Reform Plans

Conservatives have proposed tax reform plans based on four different types of consumption taxes.

National Sales Tax. In a properly constructed sales tax, all purchases by consumers of goods and services for consumption would be taxed, but intermediate goods and capital goods used to produce those consumer goods and services would not be taxed. The output produced by capital or intermediate goods and services would be taxed when the goods or services that they produce are sold to retail consumers.[2]

Most state sales taxes are deficient in three important respects:

- They exempt most services from tax.

- They exempt many goods from tax, introducing economic distortions, unfairness, and complexity, thus requiring a higher tax rate on those goods or services that remain subject to tax.

- They tax many business inputs, creating a hidden cascading tax on a tax.[3]

Two national sales tax plans have been introduced in Congress. The first was the Schaefer–Tauzin National Retail Sales Tax Act in 1996.[4] The second was the FairTax, originally introduced by Representative John Linder (R–GA) in 1999.[5] Representative Rob Woodall (R–GA) is now the lead sponsor of the FairTax.[6] The primary difference between the two is that the FairTax replaces payroll taxes as well as the income tax and therefore has a higher tax rate because the FairTax replaces more revenue. Both tax consumption of goods and services without exception, and both exempt all inputs. Both plans contain rebates, provided monthly in advance, of sales tax paid on spending up to the poverty level to make the plan progressive.

Business Transfer Tax. A business transfer tax (BTT) is a consumption tax collected at the business level. The tax base is gross receipts from the sale of goods and services by businesses less purchases from other businesses (including the purchase of capital goods). Financial receipts and disbursements (e.g., interest and dividends) are disregarded. Thus, the overall tax base is output less investment, which equals consumption.

The first BTT was introduced as the business tax in the USA Tax by Senator Sam Nunn (D–GA) and Senator Pete Domenici (R–NM) in 1995.[7] A national sales tax–business transfer tax plan (sometimes referred to as the BEST Tax) was introduced by Senator Jim DeMint (R–SC)[8] in 2005.[9] Representative Paul Ryan (R–WI) introduced a business transfer tax as part of his A Roadmap for America’s Future in 2008.[10]

Hall–Rabushka Flat Tax. The Hall–Rabushka flat tax was proposed by economists Robert Hall and Alvin Rabushka in their 1985 book The Flat Tax.[11] It was first introduced in Congress by Senator Dennis DeConcini (D–AZ) and Senator Steven Symms (R–ID)[12] and later by House Majority Leader Dick Armey (R–TX) and Senator Richard Shelby (R–AL).[13] It was aggressively promoted by Forbes magazine editor in chief and two time presidential candidate Steve Forbes.[14] The X Tax, a graduated rate version of this tax plan, was proposed by economist David Bradford.[15] In November 2005, President George W. Bush’s Advisory Panel on Federal Tax Reform proposed a graduated rate version of this plan.[16] In the current Congress, an optional flat tax that would retain the current tax system, but permit individuals to elect to be taxed under a version of the flat tax, has been introduced by Representative Michael Burgess (R–TX).[17]

The Hall–Rabushka flat tax is the same as a business transfer tax except businesses may deduct wages paid and wages are instead taxed at the individual level. A substantial standard deduction and dependent exemption are provided to make the tax progressive.

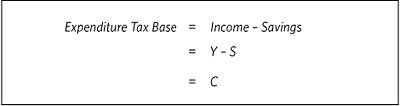

The New Flat Tax. The new flat tax imposes a tax on gross income less outlays made to earn income. Many economists over the years have regarded this as the proper definition of income for tax purposes.[18] Today, it is more typically described as having a tax base equal to income minus savings and investment, which equals consumption.

The “new flat tax” was proposed by The Heritage Foundation in 2011.[19] It is “new” in the sense of being different from the Hall–Rabushka flat tax, which has been familiar to conservatives since 1985, but the idea was proposed at least as early as 1848 by John Stuart Mill.[20] This approach to taxation has gone under many names over the years. The most notable proponent of this approach during the early 20th century was economist Irving Fisher, who argued, as did Mill before him, that this approach was the proper way to structure an income tax.[21] Economist Nicholas Kaldor called it an expenditure tax in his 1955 book.[22] During the late 20th century, it typically was called a consumed income tax, inflow-outflow tax, or cash flow tax.[23]

Graduated rate versions have been introduced in Congress, first in 1985 by Representative Cecil Heftel (D–HI)[24] and then as the individual tax in the USA Tax by Senator Nunn and Senator Domenici in 1995.[25]

Both the Heritage Foundation flat rate proposal and the graduated tax rate proposals introduced in Congress contain provisions making them progressive.

The Equivalence of Consumption Tax Bases

In the discussion below, the tax bases for the four types of consumptions taxes are expressed as an equation, with the following variables: C (Consumption), O (Output), I (Investment), W (Wages), Y (Income), and S (Savings).

Retail Sales Tax. A sales tax taxes the consumption of goods and services when sold to consumers:

Business Transfer Tax. Output is the value of all goods and services produced. Output (i.e., goods and services) is either consumption goods and services or investment. Output would be measured as the gross receipts from the sale of goods and services by businesses. Investment would be the purchase of capital goods. Financial receipts and disbursements (e.g., interest and dividends) would be disregarded. The tax base is output (the value of all goods and services produced) less all intermediate and capital goods (investment) that produced that output (i.e., consumption):

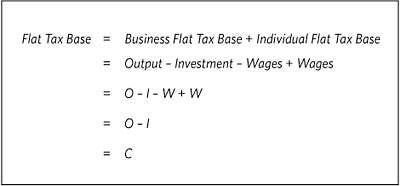

Hall–Rabushka Flat Tax. In effect, the Hall–Rabushka flat tax is the same as a business transfer tax except businesses may deduct wages paid:

Wages—and only wages—are then taxed at the individual level:

Thus, the overall tax base is output less investment, i.e., consumption:

The New Flat Tax. Income is either used to fund consumption or saved. Income less net savings is another way of calculating consumption.

Some Notes on the Above

For a consumed income tax to properly measure consumption, debt incurred must be included in taxable income and debt principal payments must be deductible. Otherwise, there may be arbitrage opportunities in which debt is incurred to fund payments into financial accounts that generate deductions.

The preceding discussion assumes away international transactions. In general, a sales tax and a business transfer tax are both destination principle and territorial taxes.[26] The Hall–Rabushka–Forbes–Armey flat tax was territorial, but origin principle.[27] The Bush tax reform panel, however, proposed a destination principle (i.e., border-adjusted) version. Most versions of a consumed income tax are territorial, but maintain a residence principle for the purposes of taxing individuals.

In almost all cases, the four tax systems can be made to emulate one another on issues such as tax-exempt organizations, the tax treatment of owner-occupied housing, the tax treatment of government consumption, the size of family and personal allowances, the tax treatment of financial intermediation services, the tax treatment of health insurance and health services, the tax treatment of insurance and risk intermediation, the tax treatment of educational and job-training expenses, the tax treatment of mixed-use property or previously used property, and transition issues. These secondary design choices lead to tax base variations in the proposals that have been introduced in Congress.

A credit invoice value-added tax (VAT), as imposed throughout the European Union, is also a consumption tax. This type of VAT is called a goods and services tax (GST) in Canada, Australia, and New Zealand. The Japanese consumption tax is also a credit invoice VAT. A credit invoice VAT is imposed at each stage of production. Businesses receive a tax credit for the tax paid on their inputs (purchases from other businesses of intermediate goods and services and capital goods). This credit prevents cascading. Although administratively complex, the overall tax base of a credit invoice VAT is output less investment, which equals consumption.[28]

Conclusion

The four conservative tax reform plans are all consumption taxes and, except for secondary design choices and the choice of which taxes to replace, would have the same tax rate to raise a given amount of tax revenue. They would also have the same economic effects. The choice among them, therefore, rests on non-economic grounds, including political and administrative considerations and judgments about issues such as transparency and whether the reform can be sustained in the long run.

—David R. Burton is Senior Fellow in Economic Policy in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.