Introduction

Legislative proposals are pending in Congress to vastly expand federal financing and government control of medical care. The two leading House bills take divergent approaches to enlarging the federal role. H.R. 1384, a bill backed by half of all House Democrats, would establish a Medicare For All program that would abolish private medical insurance.REF H.R. 1884, the Protecting Pre-Existing Conditions and Making Health Care More Affordable Act, a House Democratic leadership bill introduced by Representative Frank Pallone (D–NJ) along with 157 co-sponsors, would instead significantly increase federal payments to insurance companies through more generous premium subsidies and the creation of a federally financed reinsurance program.REF

Despite their differences in approach, both assume that more federal spending and greater government control over the allocation of medical goods and services would improve health care. This overlooks substantial evidence that existing federal spending on health care is misallocated. Increasing federal spending will not cure this misallocation.

H.R. 1884 would increase federal spending on premium subsidies—even though existing subsidies are growing in cost and benefiting a decreasing number of people.REF It would also establish a federally funded reinsurance program, ignoring the experience of states that are successfully operating such programs without the need for additional federal resources or regulation.

Instead of increasing federal health care spending, lawmakers should pursue policies that increase health care choices and reduce costs. One promising avenue would be to redirect the estimated $1.6 trillion the federal government will spend on programs established by the Affordable Care Act (ACA, often called Obamacare) into state grants.REF Fixed federal allotments would incentivize states to devise more efficient and innovative ways to allocate resources, while protecting taxpayers against diminishing returns on open-ended federal spending.

The Federal Government’s Role in Financing Health Care

For more than half a century, the federal government has exerted increasing control over the allocation and financing of medical goods and services. Beginning with the enactment of Medicare and Medicaid in 1965 and continuing through passage of the Affordable Care Act in 2010, Congress, the executive branch, and the courts have gradually enlarged the federal government’s involvement in the allocation of medical goods and services.

This enlargement runs along several dimensions, beginning with the number of people enrolled in publicly financed programs. In 2018, 60 million people were beneficiaries of Medicare, a federal program primarily serving the elderly and people with disabilities.REF Nearly 95 million people—representing more than 29 percent of the U.S. population—were enrolled in Medicaid or the related Children’s Health Insurance Program at some point during fiscal year 2017.REF

Federal, state, and local governments spent nearly $1.6 trillion on public medical “insurance” programs in 2017.REF This eclipsed private health insurance spending, which was less than $1.2 trillion in that same year.REF Including foregone income and payroll tax revenues due to employer-sponsored coverage, health savings accounts, and other factors, economist Mark V. Pauly estimates that nearly 55 percent of medical expenditures in 2017 were publicly subsidized.REF

The full impact of government control of the allocation of medical goods and services is not captured in the number of people participating in public programs or the amount of government money spent. Pauly estimates that once the knock-on effects of government funding are taken into account the portion of government-affected medical consumption rises to 77 percent.REF

Congressional Legislation to Enlarge the Federal Government’s Role in Health Care

Congress is considering proposals to enlarge the federal government’s role in health care financing. The two leading proposals take divergent courses. H.R. 1384, the Medicare For All Act, would effectively abolish private health insurance.REF H.R. 1884, the Protecting Pre-Existing Conditions and Making Health Care More Affordable Act, would increase federal payments to private insurance companies.REF

Both measures have attracted the support of a substantial number of House Democrats.REF Despite their radically different approaches to private health insurance, 77 Members are listed as co-sponsors of both bills.

This apparent anomaly has several possible explanations. First, a lawmaker might reason that Medicare For All would likely take several years to implement. Providing more federal money to insurance companies before their liquidation could be thought to create a transitional societal benefit. Second, the two proposals, though fundamentally discordant, spring from a common assumption about the effect of increasing federal health care spending. Although Medicare For All advocates believe that government-run insurance is superior to the private-sector alternative, many lawmakers seem convinced that increasing federal spending will make health coverage more affordable and accessible.

There is disagreement among Democratic lawmakers over how much additional money the federal government should spend and how it should spend it—whether by increasing public subsidies to private insurers or effectively banning private insurance. But there is a broadly shared assumption that spending more federal money will provide a greater social benefit.REF

Misallocated Federal ACA Spending

This overlooks a central lesson of the ACA: The system of federal regulations, subsidies, and penalties has not functioned efficiently, imposing costs on the federal government and households and distorting health insurance markets. The individual market has been shrinking, as fewer people who are ineligible for subsidies have individual coverage.REF The number of insurers participating in the individual market has diminished.REF In 2019, 36.4 percent of U.S. counties have only one insurer.REF Insurers have returned to profitability by raising their rates to levels that increasingly are affordable only to customers protected by federal subsidies against those rate hikes.REF

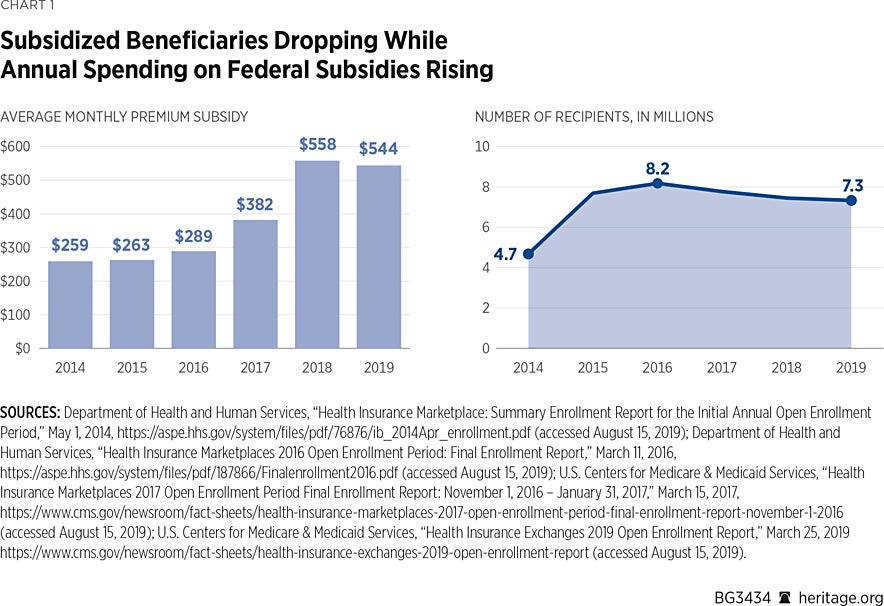

Although federal expenditures have increased and are projected to continue to increase in the future, the number of people benefiting from subsidies has been declining for three years. The Congressional Budget Office (CBO) projects that both trends will persist over the next decade, with the number of subsidized beneficiaries dropping by roughly one-fourth, while annual spending on federal subsidies rises by more than one-third.

Chart 1 compares the average cost per subsidized individual between 2014 and 2019 with the number of individuals benefiting from subsidies.

These data, drawn from the U.S. Department of Health and Human Services, show the number of people in federally facilitated health insurance exchange states deemed eligible for subsidies after each year’s open enrollment period, along with the average monthly subsidy. The number of people in these states eligible for subsidies rose from zero in 2013 (the year before the ACA subsidies took effect) to nearly 8.2 million after the 2016 open season. From there, it began a slow decline, falling by more than 10 percent to just over 7.3 million in 2019.

As the number of subsidy recipients fell, the average monthly premium subsidy rose. Between 2014 and 2018, the average monthly subsidy climbed from $258 to $558, an increase of 116 percent. Even after a slight drop in 2019, the average monthly subsidy remains more than twice the 2014 level.

The primary cause of this increase was a rise in premiums. Under the ACA, subsidies limit beneficiary premiums to a percentage of income. For example, a person with income at 150 percent of the federal poverty level (FPL)—currently $18,735—would pay no more than $749 (4 percent of her income) annually for health insurance. That would be the case whether her annual premium was $3,000 or $6,000, since subsidies rise dollar for dollar with premiums.

Government thus largely holds subsidy beneficiaries harmless with respect to premium hikes by increasing premium subsidies. But despite this important feature of subsidies, fewer people are receiving them.

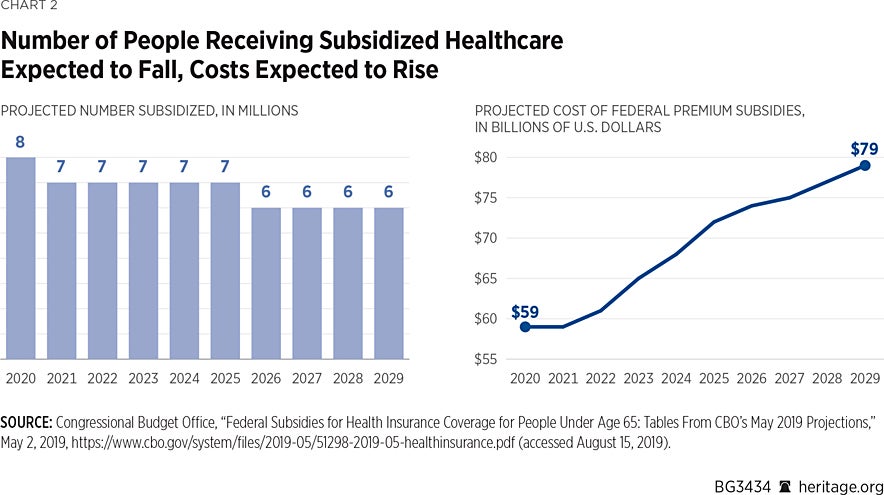

According to the CBO, government spending on premium subsidies will continue to increase and the number of subsidy recipients will continue to decline.REF The CBO’s projections are shown in Chart 2.

The CBO projects that roughly 8 million people will receive premium subsidies in 2020.REF That number will fall by roughly one-fourth before the decade is over. Annual spending on subsidies, by contrast, will rise by more than one-third over that same period, from $59 billion in 2020 to $79 billion in 2029. The CBO projects that federal outlays on premium subsidies will total $689 billion over that period.

The trend of increased federal spending to subsidize a diminishing number of beneficiaries suggests a misallocation of federal resources. In effect, government is picking up the cost of premium increases that are due, at least in part, to government policy. The combined effect of the ACA’s regime of mandates, subsidies, and penalties was to raise premiums.REF These premium increases led to a decline in the number of unsubsidized people with individual insurance coverage.REF That, in turn, led to further premium increases.

Since subsidies rise dollar for dollar with premiums, and since those subsidies are paid by the government to insurance companies, insurers that continued to sell ACA-compliant products had perverse incentives to raise premiums. Recent studies showed that insurers swung to profitability in 2018 as a result of premium increases—even as the number of customers declined.REF

H.R. 1884: Increasing Federal Spending Without Addressing Its Misallocation

The House leadership bill, H.R. 1884, would not only leave this misallocation unaddressed, but would likely worsen it by increasing federal payments to insurance companies in two important ways: (1) increasing premium subsidy payments to insurers and (2) creating a federally funded “reinsurance” program to funnel additional federal money to insurers.REF

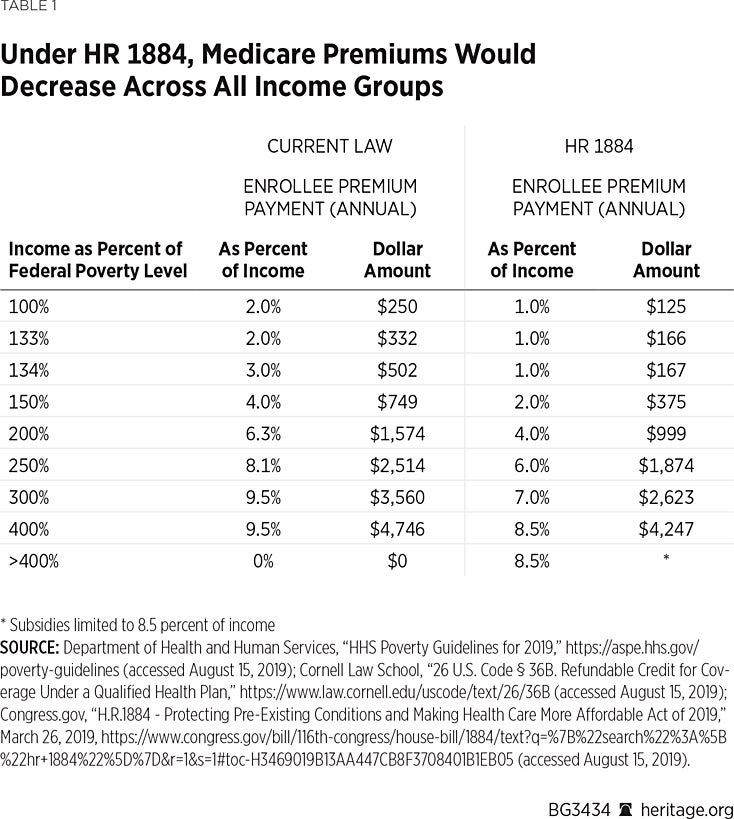

Increasing Premium Subsidies. The bill would increase federal premium subsidies in several ways, as Table 1 illustrates.

H.R. 1884 would make subsidies more generous for those already eligible for those subsidies, as well as extend them to people who currently earn too much to qualify for such assistance under current law (those with incomes above 400 percent of the federal poverty level).

With respect to the first group, net premiums would fall by half for those with incomes between 100 percent and 200 percent of the federal poverty level. Under current law, for example, an individual with income at 133 percent of poverty would spend no more than 2 percent of her income on health insurance. H.R. 1884 would reduce that to 1 percent. Thus, instead of spending $250 per year (less than $21 per month) for coverage, she would spend $125 per year (a little more than $10 per month) for coverage. The most significant change would occur at 134 percent of FPL, at which someone who currently pays $502 annually for insurance (3 percent of income) would pay just $167 annually (1 percent of income).

Such changes would seem unlikely to attract new people into the health insurance exchanges. Instead, the government would be spending additional sums on the people it already is subsidizing. Given that exchange-based enrollment already is concentrated among people with incomes between 100 percent and 200 percent of FPL, this increase in subsidies would likely result in more federal money flowing to insurance companies, rather than in more people gaining coverage.

That may change at other points on the income scale. At 300 percent of FPL ($37,470), monthly premiums would drop by a little more than $78 (7 percent of income vs. 9.5 percent). That might induce more people at that income level to enroll in coverage. But, as discussed below, households, on average, do not devote 7 percent of their gross income to health insurance premiums. In any event, the value of that subsidy erodes fairly rapidly, with the reduction in monthly premiums falling to less than $42 for those with incomes at 400 percent of FPL ($49,960). Such an individual still would be expected to spend $4,247 annually ($354 monthly), a figure amounting to 8.5 percent of income.

Whether people—particularly young adults in reasonably good health—would be willing to devote that large a portion of their incomes to health insurance premiums is a critical question, and one that is difficult to answer. Young adults, though they are among the ACA’s most enthusiastic supporters, also are most likely to be uninsured.REF Their under-representation in the ACA-compliant insurance market is among the leading reasons premiums are so high. Unless higher premium subsidies would lure people in that age demographic into the exchanges in substantial numbers, those subsidies would be unlikely to exert a significantly favorable effect on premiums.

Labor Department studies of household consumption patterns cast considerable doubt on whether the subsidy increases proposed in H.R. 1884 would effect behavioral change sufficient to substantially reduce premiums for ACA-compliant coverage.

According to data compiled by the Bureau of Labor Statistics (BLS), H.R. 1884’s subsidy enhancements would still leave net premiums far higher than young adults, on average, spend for health coverage. The BLS reports that households headed by a 25–34-year-old with earnings between $40,000 and $50,000 spent less than $2,000 on average on health insurance premiums in 2016 and 2017.REF Those in the 35–44 age bracket averaged just under $2,100 in annual health insurance premiums.REF

Those are, of course, averages. Many in those age groups may obtain coverage at far lower net costs through their employers or public programs like Medicaid. That would reduce the average. Others are uninsured, which would depress the average further. But the disparity between the proportion of their income that people actually devote to health insurance premiums and what they would be expected to pay with enhanced subsidies is nonetheless substantial.

For adults of all ages with incomes of $50,000, the disparity is nearly two to one, more than $4,200 in premiums net of subsidies compared with an average outlay of less than $2,100. Premiums for those with earnings over $50,000 would be held to 8.5 percent of income, a figure far in excess of what households, on average, spend on health insurance premiums.

The subsidy structure of H.R. 1884, though more generous than current law, still would require people to spend a larger share of their gross income on health insurance premiums than they now, on average, do.

There is good reason to doubt such a behavioral change. The vast majority of the uninsured have access to affordable coverage but—for reasons that are poorly understood—decline to enroll. This includes millions of people of modest means who qualify for free Medicaid coverage or generous premium subsidies but remain uninsured.REF

The ACA’s premium subsidies have proven especially inefficient at expanding health insurance coverage. A Kaiser Foundation analysis estimates that 8.2 million uninsured people were eligible for ACA premium subsidies in 2017.REF That is the same number of people who claimed subsidies in 2017.REF That means that the number of subsidy-eligible people who enrolled in coverage was about the same as the number of subsidy-eligible people who remained uninsured, suggesting that only half of all subsidy-eligible people enroll in coverage. The other half remain uninsured. There are any number of possible explanations, including that millions of subsidy-eligible people do not find ACA-compliant coverage appealing, even if subsidies steeply discount its cost. Policymakers would do well to try to understand why the current arrangement functions so inefficiently before committing additional federal resources to premium subsidies.

Millions with incomes sufficient to cover premiums also decline coverage, including those who refuse offers of employer-sponsored coverage.REF Limiting premiums to 8.5 percent of their income appears unlikely to effect a behavioral change to any appreciable extent.

All of this suggests that increasing federal payments to insurance companies to reduce net premiums would not reverse the existing trend of the government devoting ever-growing sums of money on behalf of a shrinking number of beneficiaries. H.R. 1884 is unlikely to meaningfully reduce the number of uninsured or improve the risk profile of individual health insurance markets. The measure’s biggest beneficiaries would likely be insurance companies, which would capture additional public spending.

Federally Funded Reinsurance Program. H.R. 1884 does contain a provision likely to have a favorable effect on premiums—but it is unnecessary, costly, and administratively convoluted. Section 206 would create a federal reinsurance program designed to relieve insurers of much of the risk presented by policyholders who incur very large medical bills. States already can obtain waivers to establish their own risk-mitigation programs in a way that is budget neutral to the federal government.

The bill would authorize $10 billion annually in federal payments to states to establish reinsurance programs or programs to reduce cost sharing in ACA-compliant plans.REF The Secretary of Health and Human Services would operate a reinsurance program in states that either fail to apply for federal money or whose applications are rejected.REF

Before allocating funds, the Secretary would have to devise a program that would spend exactly $10 billion each year, something the department found impossible to do with the temporary reinsurance program that the ACA mandated for 2014–2016.REF

Specifically, the bill requires the Secretary to estimate how much of the $10 billion “would be expended…on attachment range claims of individuals residing in states if all states used their funds only for [reinsurance]…at the dollar amounts and percentage” specified by the Secretary. The Secretary would determine those dollar amounts and percentages “in a manner to ensure that the total amount of expenditures…is estimated to equal the total amount appropriated for such year [i.e., $10 billion]…if such expenditures were used solely for [reinsurance].”

That task is administratively complex. To accomplish it, the Department first must design a reinsurance program that specifies an attachment point, a corridor, and a coinsurance rate. The attachment point sets the level above which the reinsurance program would defray the cost of claims. The corridor is defined by setting a ceiling above the attachment point beyond which the program would not pay claims. Finally, the coinsurance rate defines the percentage of claims the reinsurance program would pay within the corridor.

As an example, the Secretary could set an attachment point of $50,000, a ceiling of $250,000, and an 80 percent coinsurance rate. In that case, an insurer would submit medical claims that exceed $50,000 to the reinsurance pool, which would pay 80 percent of the costs between $50,000 and $250,000.

The bill requires the Secretary to set these parameters each year so as to spend exactly $10 billion. As noted, a similar program was in place during the first three years of the ACA’s full implementation. The Department failed to set the appropriate rates. In the first year alone, the Secretary changed the attachment point and coinsurance rates multiple times—and still missed its $10 billion spending target.REF In light of that experience, Congress should carefully consider whether it should once again saddle the Secretary with an infeasible task.

H.R. 1884 burdens the Secretary with an additional complexity. The Secretary must also estimate how much each state is entitled to under the methodology. To do so, the department must estimate how much expense people in each state enrolled in ACA-compliant individual plans would incur in reinsurance claims. Thus, the Secretary must not only set program parameters so as to spend $10 billion annually, he must also estimate how much each state should receive based on conjecture about the characteristics of its enrollees. While the ACA required the Secretary to get the overall calculation of reinsurance payments right, H.R. 1884 goes further and requires him to get 51 calculations right.REF Thus, even if he devises a program that spends exactly $10 billion, he might still fall short of the statutory requirement by providing some states with more than is necessary for reinsurance expenditures, while leaving others short of needed funds. In addition, the Secretary would have to administer the program directly in any state that failed to establish a program of its own.

Administrative infeasibility aside, the program is unnecessary. States are already free to obtain waivers to allow them to operate their own risk-mitigation programs, including reinsurance programs, without the expenditure of new federal dollars.

Section 1332 of the ACA allows states to apply for waivers to repurpose federal money that otherwise would have been paid directly to insurers in the form of premium subsidies. Seven states obtained waivers for the 2019 plan year to divert a portion of federal premium subsidy money into risk-mitigation pools.REF As of publication, waiver applications from five additional states for the 2020 plan year are pending.REF In order to win approval of its waiver application, a state must show that its plan would not increase federal spending.

The states operating these programs have achieved significant reductions in premiums.REF Premiums for benchmark plans in the seven states that have waivers in place for the 2019 plan year dropped by a median of 7.48 percent, while premiums in the other 44 states and the District of Columbia rose by a median of 3.09 percent.REF

These premium reductions, in turn, reduced the amount of premium subsidies paid to enrollees in each state’s health insurance exchange. The federal government thus was held harmless: The passthrough of federal funds to each state’s risk-mitigation pool was offset by a reduction in premium subsidies paid to exchange enrollees. The policy goal of reducing premiums was achieved without requiring the expenditure of additional federal funds or the creation of a new federal program.

The ACA offers all states the opportunity to establish risk-mitigation programs that hold the potential of reducing premiums without imposing new costs on taxpayers. Congress need not amend the statute to create a new federally financed reinsurance program. States can repurpose a portion of existing federal spending to subsidize those who incur the highest medical claims, thereby reducing premiums for ACA-compliant coverage.

A Better Approach: The Health Care Choices Proposal

The federal government has expended enormous sums of money subsidizing coverage in the tiniest segment of the health insurance market. The evidence indicates this money has been inefficiently spent, with expenditures growing, while the number of market participants, both subsidized and unsubsidized, has shrunk. Government officials project that trend to continue at least through the end of the next decade.

H.R. 1884 proposes to devote more federal resources into this flawed structure. It also proposes the creation of a new and unnecessary federally funded reinsurance program. Spending more on the current system will not cure its misallocation of resources. It is far more likely to exacerbate it.

Congress should instead pursue policies that promote greater efficiencies. The Health Care Choices Proposal (HCCP) pursues this policy direction.REF The HCCP, advanced by a group of conservative health care experts in June 2018, would redirect money earmarked for the ACA’s premium subsidies and Medicaid expansion into a program of grants to states. To receive a grant, a state would submit a plan to make health insurance affordable to its residents, regardless of income or medical condition. States that receive grants would be required to devote a portion of their allotment to risk mitigation, spend at least half their allotment on low-income residents, and provide recipients of assistance with the option to direct their subsidies to the coverage of their choice.

An analysis of the proposal by the Center for Health and the Economy concluded that the HCCP would reduce premiums by as much as 32 percent.REF The study also found that the proposal would modestly reduce the deficit, increase the number of people with private health insurance, and cut Medicaid spending.

The proposal contains other provisions to reduce costs and give consumers more control over their health care spending. It proposes expansions of health savings accounts; encourages innovative approaches to the delivery of care, including direct primary care and telemedicine; and advances reforms to reduce health care costs.

Such an approach would seek to correct the misallocation of federal resources by allowing states to develop and pursue alternative means of making health care more affordable by increasing consumer choices and reducing costs. Policymakers should consider this alternative to increasing federal payments to insurance companies.

Doug Badger is Visiting Fellow in Domestic Policy Studies, of the Institute for Family, Community, and Opportunity, at The Heritage Foundation and Senior Fellow at The Galen Institute in Alexandria, Virginia.