After the Arab oil embargo and the creation of the Organization of Petroleum Exporting Countries (OPEC) in the 1970s, the United States and countries around the world felt a need to hold more oil inventories for emergencies. The U.S. joined the International Energy Agency (IEA) in November 1974 to coordinate a multi-lateral response to oil supply shocks. As part of that commitment, the federal government created the Strategic Petroleum Reserve (SPR) through legislation the following year. The SPR holds nearly 700 million barrels of crude oil to serve as an emergency stockpile for supply shocks that cause price spikes. The SPR was to mitigate U.S. economic vulnerability to supply disruptions, and was not intended as a national defense stockpile. Although a strong economy is an integral component of national security, the SPR has not been used as an effective response to oil price spikes.

The reality is that the reserve has served more successfully as a political tool to boost public support of an Administration than as a mechanism to balance supply and demand. The SPR has been a useless tool for responding to supply shocks, which have occurred rarely throughout history; the free market is much more effective at responding to price signals. Eliminating the SPR would not create the perception that the U.S. is without oil reserves, as America holds an abundance of privately controlled inventory ready to distribute. America is awash in natural resources and holds more crude and petroleum products in private inventory than it does in government-controlled inventory. The U.S. should withdraw from the Agreement on an International Energy Program and Congress should authorize the Department of Energy (DOE) to sell off the entire reserve, specifying that the revenues generated go solely toward deficit reduction.

U.S. Participation in the International Energy Agency

The establishment of OPEC and oil embargoes in the early 1970s provided the spark to form the IEA. The purpose of the IEA was to coordinate a response of member nations to major disruptions in the supply of oil through the release of nations’ oil reserves.[1] An autonomous organization, the IEA consists of 29 members—all of which are Organization for Economic Co-operation and Development (OECD) countries. Chile, Iceland, Israel, Mexico, and Slovenia are members of the OECD but not the IEA. In order to be a member of the IEA, and as part of the organization’s Agreement on an International Energy Program, candidate countries must hold oil stocks at levels no less than 90 days of net imports. IEA calculates the minimum obligation based on net imports of both crude oil and refined petroleum products and the commitment “can be met through both stocks held exclusively for emergency purposes and stocks held for commercial or operational use, including stocks held at refineries, at port facilities, and in tankers in ports.”[2] Defense stocks do not count in the import-protection obligation.

Countries must also establish a demand restraint program to reduce domestic oil consumption, have legislation necessary to operate Co-ordinated Emergency Response Measures (CERM), and have legislation and measures to ensure that oil companies report information as necessary.[3] The IEA also pursues other objectives, such as a determination to reduce imports of foreign oil through long-term efforts to increase the use of renewable energy and nuclear energy, and to promote energy efficiency.[4]

Member countries have the option of meeting their 90-day inventories either through stocks that the government holds, or through industry stocks that will be available to the government should the need arise, or a combination of the two. Many member countries place minimum holding requirements on the industry. The United States is one of only three participating countries using purely government inventories,[5] though in the past the U.S. has relied on both the SPR and private stocks to meet its 90-day obligation because of high import levels. The privately held contribution to the IEA requirement was not part of any domestic law but does show how loosely enforced the IEA obligation is. Because surging domestic production has substantially reduced imports, the U.S. currently has 139 days of net import protection from the SPR, and 204 days of net import protection from the private sector, based on 2015 oil stock import levels, for a total of 343 days of public and industry oil inventories.[6]

Other countries have more loosely defined terms to meet their IEA obligation. Australia, for instance, does not have a government-controlled reserve or a minimum requirement for private companies; the country has relied on inventories of private industry to meet the requirement.[7]

The Strategic Petroleum Reserve: A Brief History and Its Use

As part of the U.S. commitment to the IEA, the federal government created the SPR through the Energy Policy and Conservation Act (EPCA) in 1975.[8] Congress initially authorized the SPR to store up to one billion barrels of petroleum products, and mandated a minimum of 150 million barrels of petroleum products.[9] The SPR, which opened in 1977, currently has the capacity for 727 million barrels of crude oil, and holds 695.1 million barrels of crude.[10] The reserves are held in salt caverns in four locations in Texas and Louisiana, chosen for their proximity to Gulf Coast refineries. The salt caverns provide low permeability and high density that make it ideal for oil or gas storage.[11] The four locations are:

- Bryan Mound in Freeport, Texas: capacity of 254 million barrels (MMB)

- Big Hill in Winnie, Texas: capacity of 160 MMB

- West Hackberry in Lake Charles, Louisiana: capacity of 227 MMB

- Bayou Choctaw in Baton Rouge, Louisiana: capacity of 76 MMB[12]

Under the EPCA, authority to make withdrawals from the SPR to address “severe energy supply disruption” is left exclusively to the President.[13] When the President makes a determination, the DOE has the ability to draw down 4.4 million barrels a day collectively from all four sites. The time it takes for the oil to reach market after the President authorizes a release is 13 days.[14]

Presidents have only sparingly used their authority to tap the SPR during times of crisis, some of which were not without controversy. President George H. W. Bush partially drew down SPR reserves during the 1991 Gulf War. The SPR has also been tapped for natural disasters, such as Hurricanes Ivan and Katrina.[15] Most recently, President Barack Obama ordered the sale of 30 million barrels to offset the supply disruption as a result of the political unrest in Libya.[16]

The DOE has the authority to withdraw reserves for test sales and oil exchanges.[17] The DOE has conducted a number of test sales to ensure that the process of getting the oil to the market operates smoothly and has offered exchanges in which the DOE provides oil “loans” to companies. For instance, if a ship cannot complete a delivery due to weather, it can borrow similar grade crude from the SPR, repaying the interest with additional crude supplies.[18]

The DOE has also offered crude to the market three times in non-emergency situations as Congress authorized sales to raise revenues. In 1996, the DOE sold 5.1 million barrels of oil to raise funds totaling $97.1 million in order to pay for the decommissioning of the Weeks Island SPR storage site in Louisiana. Congress also authorized the sale of SPR crude to reduce the federal budget deficit in 1996 and 1997. Between the two sales, the federal government sold 23 million barrels to raise $447.6 million in revenue.[19]

According to the DOE’s Office of Fossil Energy, the average cost of crude in the reserve is approximately $29.70 per barrel. To date, the taxpayer money spent on the SPR is about $27.5 billion, $5 billion invested in facilities and the remaining $20.7 billion in oil stocks.[20] The cost of maintaining the SPR, developing and maintaining storage facilities, operational readiness for withdrawal, placing petroleum into storage, and personnel and administration expenses was $200 million in 2015, and the budget request for fiscal year 2016 is $257 million.[21] The major changes and increased costs include a Vapor Pressure Mitigation, a Capacity Maintenance Program, and additional resources to restore the maximum drawdown capability of 4.4 million barrels per day.[22]

SPR: Largely Ineffective, a Political Tool, Not a Role for Federal Government

The Energy Policy and Conservation Act constrains the President’s authorities to release the reserves; the problem, however, is that the limitations and conditions for SPR drawdowns are not credible justifications for the reserve’s existence. Furthermore, the executive branch can interpret the conditions rather vaguely, making an SPR release more about domestic party politics than policy. For instance, even though drawing down SPR reserves may have little market effect, it could help a President obtain favorable polling from the public by creating the perception that the Administration is “doing something” about an alleged crisis.

The EPCA requires specified presidential findings in order for the Secretary of Energy to withdraw oil from the SPR and sell it. For example, such a withdrawal and sale can occur upon a presidential finding that there is a “severe energy supply interruption,” and the following conditions are met:

- “An emergency situation exists and there is a significant reduction in supply which is of significant scope and duration;

- “A severe increase in the price of petroleum products has resulted from such emergency situation; and

- “Such price increase is likely to cause a major adverse impact on the national economy.”[23]

Supply disruptions are not reason enough for government stockpiling and, most important, can be addressed through market forces with an abundance of private inventory, not government-controlled resources. Even so, the empirical benefits associated with the government’s use of the SPR in alleged emergencies are dubious and difficult to accurately assess because of the difficulty in isolating the release’s effect on the market, given all the other variables that affect the global oil market.

Some studies have found that SPR releases could lower oil prices by as much as 32 percent; however, these studies estimate price impacts from optimal SPR management, not actual effects of SPR releases on global oil prices or SPR releases in practice.[24] Obtaining the optimal price effect would be difficult, argues University of Wyoming economist Timothy Considine, because “a more fundamental problem arises from vesting a political entity with the inherently complex task of allocating oil across time and space—a task that is probably best left to market forces.”[25]

Considine estimates that a drawdown during a supply shock would have much less impact, only lowering prices 3.5 percent.[26] This is largely in part because other countries or private companies holding inventories could increase their own reserves, and also because the amount released is marginal compared to the global supply and demand for oil.

Using econometric modeling to show that SPR releases have no impact on lowering prices, University of California at Berkeley economist Reid Stevens drew similar conclusions about the SPR’s futility.[27] Stevens measured oil price effects of SPR purchases and withdrawals, testing effects of anticipated and unanticipated purchases of oil for the SPR and sales to the market. Reid found that no matter the certainty, SPR sales did not lower oil prices; however, unanticipated purchases to build up SPR inventory increased oil prices by 1.5 percent.[28]

The historical use of the SPR in times of unanticipated supply shocks proves this to be true. During the Gulf War, Iraq’s invasion of Kuwait took 6.5 percent of the global oil supply offline, causing prices to jump from $15 per barrel in July 1990 to $30 in October.[29] As Considine outlines, the lost supply was offset by increases in OPEC, not drawdowns from the SPR. President George H. W. Bush did not release reserves from the SPR until the U.S.-led strike on Iraq in January 1991. The price dropped more than $10 per barrel before any SPR crude reached the market.[30]

While some analysts attribute drops in prices to public announcements signaling that more supplies will reach the market, this was not likely the case during the Gulf War. The Congressional Research Service reports that the decreasing crude price was due to other factors:

Oil analysts attributed the price drop to optimistic reports about the allied forces’ crippling Iraqi air power and the diminished likelihood, despite the outbreak of war, of further jeopardy to world oil supply. There appeared to be no need for the IEA plan and the SPR drawdown to help settle markets, and there was some criticism of it. DOE offered more than 30 million barrels of SPR oil for bid, but only accepted bids on 17.3 million barrels.[31]

One problem for optimal SPR use is the federal government’s inability to predict future events and, consequently, having a slow or late response. If concerns exist, for instance, that a conflict overseas will exacerbate supply disruption, the government may hold on to the reserves. If the conflict does not worsen, the expediency that the SPR needs to be at least temporarily effective is lost. President George W. Bush ordered a quick SPR release during Hurricane Katrina but it was ineffective in mitigating price shocks because the refineries and pipelines also closed as a result of the hurricane.

In other instances, the emergency situations in which the executive branch released oil from the SPR have been questionable and controversial. In 2000, in the midst of an election year, the Clinton Administration used the SPR for political gain. As gas and home heating oil prices rose, Vice President Al Gore, running for President at the time, urged President Bill Clinton to draw down reserves in order to lower energy prices.[32] Clinton’s own Treasury Secretary, Lawrence Summers, criticized the release, saying that the SPR should not be used to manipulate market prices and using the SPR to do so would “set a dangerous precedent.”[33]

President Obama’s coordinated release with the IEA in 2011 when Libyan oil was taken offline is another instance where releasing reserves from the SPR did not pass the rational or economic muster set by the conditions for drawdowns. Libyan production of oil had been offline for almost three months when the Administration released oil from the SPR, and Libya produced only 2 percent of the world’s oil. Oil prices were high at the time because of market forces. Steadily rising global demand for the better part of a year, particularly from developing countries China and India, had increased oil prices. No emergency situation existed, and no supply shock occurred; therefore there was no need for an SPR drawdown.

Policymakers should also consider why the U.S. has international commitments to hold reserves, given the ability of the private sector to respond to price spikes and the diversity of global energy markets. Prices play a critical role in the market by efficiently allocating resources to their highest valued use. Whether a shortage or a surplus exists, the federal government should not distort the role of price signals.

U.S. Has Enough Private Inventory, and Reserve Commitment Is Arbitrary

The SPR and the IEA’s import-protection requirement may, at best, provide temporary price relief, and it ignores the ability for the private sector to respond to supply shocks. The U.S. should withdraw from the Agreement on an International Energy Program.[34] Disengaging from the IEA’s Agreement on an International Energy Program would not stop the U.S. from working with IEA member countries that promote free markets in energy, but it would stop the U.S. from committing to ineffective and unnecessary energy obligations.

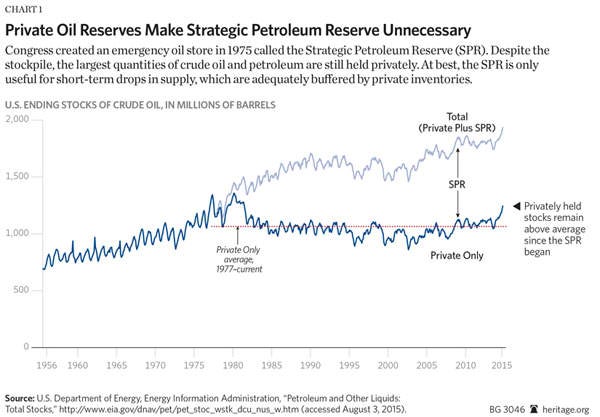

No longer maintaining the Strategic Petroleum Reserve does not mean that the U.S. will hold zero oil inventories. The United States has 461 million barrels of private crude oil inventory—approximately two-thirds of the amount held by the SPR.[35] Without a government-controlled reserve, those volumes could even be higher if the private sector believes there is more value in holding more inventories without a public stock. With U.S. net imports of crude oil and petroleum products falling dramatically, the U.S. meets its IEA obligation exclusively through private stocks.[36] According to the latest IEA data (May 2015), the U.S. meets its obligation separately with private inventories and public inventories, with 139 days of public net import protection and 204 days of private inventory import protection for a total of 343 days of import protection.[37] The latest data available from the U.S. Energy Information Administration suggests that the U.S. has even greater security, amassing 443 days’ worth of import protection of crude oil and petroleum products in public and private inventory.[38]

Even before the most recent oil boom, private industry held large quantities of crude and petroleum products. The total amount of privately held crude oil and petroleum products has always exceeded the crude volume in the SPR. The SPR has represented only between 32 percent and 42 percent of the total amount of crude oil and petroleum product inventory over the past two decades.[39]

Although changes in domestic supply and demand could eventually increase net imports to a level where the U.S. does not meet its IEA obligation through private stocks, one should question the necessity of the obligation in the first place. The 90-day obligation itself is rather arbitrary. At best, the SPR is only useful for short-run drops in supply, which are adequately buffered by private inventories. Changes in private inventories will largely offset any injection from and subsequent withdrawal to the SPR in a short-run situation. The SPR injections are futile in the presence of fundamental shifts in supply.

SPR: Ignores Market Reality of Diverse, Flexible Global Oil Market

Since a diverse mix of countries produce oil for the global market, private inventories can provide market buffers against supply shocks. Private companies respond to prices and market scenarios by building up inventories and unloading them. Private inventories among OECD countries grew to 2.72 billion barrels at the end of 2014, the highest on record, but still only the equivalent of roughly two months of consumption.[40] The Energy Information Administration projects commercial inventories to continue to grow to nearly 3 billion barrels by 2015.[41] Of the 4.1 billion barrels of oil held in reserves, only 1.4 billion barrels are government controlled.[42] The private sector is more than capable of responding to supply shocks. In fact, holding public reserves may impede the private sector’s response if a company believes a government is going to tap public reserves.

Due to improvements in advanced drilling techniques and the abundance of unconventional oil resources, the U.S. can ramp up production much more quickly than in the past. Unconventional oil and natural gas is found in “fine-grained, organic-rich, sedimentary rocks—usually shales and similar rocks” rather than petroleum reservoirs.[43] The actual process of developing hydraulically fractured oil happens much faster than conventional oil development. Changes in supply (both increases and decreases) occur more quickly from extracting unconventional reserves than with conventional oil reserves. And the technology continues to improve as “the three key measures of drilling—time to drill, wells per rig, and total distance drilled—have improved by 50–150 percent in less than five years.”[44]

The recent drop in oil prices demonstrates how quickly U.S. producers can respond to high or low prices. Because of the quick drop in prices, producers did not complete all the necessary steps in drilling an oil well, thereby holding off on producing any oil. The Manhattan Institute’s Mark Mills writes:

The U.S. currently has roughly 3,000 drilled wells awaiting completion—likely rising by the end of 2015, to more than 5,000. Given current market realities, many—if not most—such wells will remain idle. The amount of ready-to-flow oil stored in those 5,000 wells is at least four times greater than all the oil stored in steel tanks around the country. Because it takes only a few months to complete a well, such wells, once completed, could swiftly add 2–3 MMBd [million barrels per day] to U.S. supply.[45]

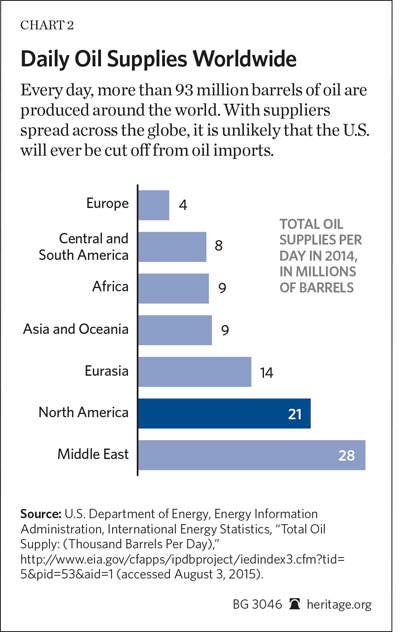

America will have access to oil for commercial use and national security, both by producing it domestically and acquiring it abroad. Even if the oil market becomes fractured in the event of a larger security crisis or a major war, both the global market of suppliers and channels to distribute oil will remain highly diversified. Oil reaches its final destination with great fluidity and if the market became segmented because one or more channels became disrupted, the U.S. would still be in a position to import oil. The route through which that oil reaches its final destination would clearly not be the most efficient if multiple shipping lanes or pipelines are unavailable, but there would still be oil—in much greater and sustainable quantities than held by the SPR—that would reach U.S. ports.

In the event of a major disruption caused by a major war or several channels taken offline, other priorities will exist than high oil prices. However, regional diversity of oil supplies will deliver better intermediate and long-term results than the short-lived release of the SPR. The late Massachusetts Institute of Technology economist M. A. Adelman reminds people that the “worry about ‘access’ assumes something queer indeed: that all of the producing countries will join in refusing to sell to some particular buyer—for what strange motive is never discussed,… [I]t takes only one other country, with a desire for gain, to cure this irrationality.”[46]

In 2008, The Heritage Foundation invited energy scholars and policy experts to participate in a computer simulation and gaming exercise assessing the economic effects of a global petroleum energy crisis. The simulation included two terrorist attacks in the Persian Gulf that created multiple supply disruptions by reducing traffic through the Strait of Hormuz and the closure of the Straits of Malacca and Sunda, causing major detours of crude to reach refineries. The magnitude of the disruption was to be catastrophic—well beyond what excess petroleum capacity and strategic petroleum reserves could easily absorb. The simulation projected that an estimated 6 MMBd would be offline (7 percent of total world production[47]) and another 15 MMBd (17 percent of total world production) could not be shipped through the most direct route. While an SPR release had some limited impact on the energy crisis in terms of short-term price reduction, the real lesson for minimizing economic losses was clear:

The more that nations rely on market principles to direct resources, the faster the global economy will recover. But reliance on market principles is unlikely. Expecting market-based responses ignores most of recorded history, and is counterintuitive to human nature. All nations will have domestic constituencies that advocate greater centralized control of national assets for the sake of national security. Contrary to the game’s players, it will be extraordinarily difficult for national leaders who advocate liberal economic policies to survive their own internal politics. After the crisis begins, it will be too late to educate the general population about market principles. They must have this understanding beforehand. Public information on handling energy crises needs to be developed in advance and promptly implemented as the crises erupt.[48]

Liquidating the SPR Will Not Endanger National Security

Eliminating the SPR will not jeopardize America’s national security, either. The original purpose of the SPR was never to create an emergency Department of Defense stockpile in the first place. The declaration of policy for the creation of the SPR in the EPCA states that:

(a) The Congress finds that the storage of substantial quantities of petroleum products will diminish the vulnerability of the United States to the effects of a severe energy supply interruption, and provide limited protection from the short-term consequences of interruptions in supplies of petroleum products. (b) It is the policy of the United States to provide for the creation of a Strategic Petroleum Reserve for the storage of up to 1 billion barrels of petroleum products to reduce the impact of disruptions in supplies of petroleum products, to carry out obligations of the United States under the international energy program, and for other purposes as provided for in this Act.[49]

Protecting national security arises in section 160(c) of the EPCA that discusses what the Secretary of Energy should take into consideration when acquiring oil for the SPR, and is a consideration listed after maximizing overall domestic supply of crude, avoiding excessive costs, and causing petroleum prices to increase and minimizing costs to the Department of Interior and Department of Energy.[50]

No matter, the Department of Defense will have access to the energy it needs to carry out its mission without the SPR. Although the Defense Department is the nation’s largest energy consumer, the department still accounts for only 1.5 percent of total consumption.[51] Plenty of oil is pumping through the United States and at the Defense Department’s disposal should that need arise. Moreover, America will have access to supplies long into the future. Nearly 1.3 trillion barrels of technically recoverable oil lie beneath U.S. soil and off America’s coasts—enough to fuel more than 90 million cars and nearly 3.5 million homes for more than 50 years.[52] America’s technically recoverable resources represent only a fraction of the estimated total (currently not technically recoverable) oil reserves, which amount to more than 3.7 trillion barrels, and Canada holds another 1.8 trillion barrels.[53]

While these resources would not be immediately available in a crisis, the pure volume of resources in North America is likely to ensure that America has access to the oil it needs for a long time. Congress recognized the availability of abundant energy two decades ago, when it voted to auction off the Elk Hill Naval Petroleum Reserve in California because it no longer served any defense purposes as intended when the land was set aside for government purposes in the early 1900s.[54] Moreover, if the world started running out of oil, price signals would shift the market to a more viable alternative, making the reserves in the SPR largely irrelevant. Higher prices act as an incentive to develop lower cost alternatives to capture a share of the market. The world will almost certainly never fully run out of oil. If resources rapidly depleted and oil remained the main source of energy for transportation, exorbitantly high prices would shift to switch to natural-gas-powered vehicles, electric vehicles, biofuels, or an innovative technology or resource not yet discovered or invented.

Closing down the SPR will not create the perception by the general public or other countries that the U.S. is powerless against oil supply disruptions. The abundance of domestic resources, the geographic diversity of oil production worldwide and the abundant quantities of private stocks all prove that the SPR has marginal strategic value both in practice and in perception. However, if the Department of Defense believes that the asset has important strategic value, the SPR should be placed under Defense Department authority to be used explicitly for defense purposes.

America’s Overblown “Dependence on Foreign Oil”

Today, as in the past, politicians and the media overstate America’s dependence on Middle Eastern oil and the influence of OPEC in the global energy economy. At any point in time, no more than 15 percent of the U.S. oil supply came from the Middle East.[55] In March 2015, nearly 50 percent of U.S. imports came from Canada and Mexico.[56] Politicians and journalists often label OPEC a cartel and the perception is that there are a small number of oil producers that can manipulate supply to affect the price and that few substitutes exist. Yet OPEC does not necessarily act like a cartel, nor has it ever been particularly effective in restricting oil supplies, even in the 1970s. In fact, OPEC is largely unable to restrict supplies and control oil prices because its members have a strong incentive to cheat and increase oil production above their quotas. William O’Keefe, president of the George Marshall Institute, notes that OPEC does not have the market-manipulating ability that cartels have, writing, “There are a large number of oil-producing countries, there are not significant barriers to entry and history has shown that OPEC cannot easily alter supply to affect price.”[57]

Although the creation of the IEA and the SPR were reactions to the Arab oil embargo, the actual embargo had minimal impacts.[58] Dr. Jeff Colgan, professor of international studies at Brown University, focusing on global energy politics, argues that while the formation of OPEC did increase energy prices in the 1970s, it was not a result of the embargo. Even though markets would act more efficiently without an embargo in place, because crude oil is fungible and oil markets are global, the U.S. could gain access to oil. The embargo created some inefficiency in the distribution of oil but did not stop it from flowing. Colgan writes:

Perhaps the biggest impact of the embargo was psychological. The embargo solidified OPEC’s image as a cartel and exacerbated fears that the world was running out of oil. The U.S. government compounded this effect by imposing domestic price controls on gasoline, leading to shortages and long lines at gasoline stations. These shortages were a consequence of U.S. domestic policy, not the embargo: if prices had been allowed to rise, the market would have cleared on its own.[59]

Colgan highlights two major components of the reason why oil prices rose in the 1970s and why OPEC had more influence than it does—and can have—today. First, OPEC raised the posted prices from $2.90 per barrel to $11.65 per barrel. The posted prices were the price point at which companies were taxed and paid royalties; the market value is what companies received for selling the oil.[60] OPEC dramatically increased the posted price to collect more revenue and consequently the market price rose. Second, OPEC pressured its members to nationalize their oil industries and six countries followed through, changing production and operation decisions. Colgan emphasizes that these two activities cannot take place again because posted prices no longer exist and companies cannot re-nationalize their oil industries; therefore it is highly unlikely that OPEC will be able to influence prices as it did in the 1970s.[61]

Selling SPR for Deficit Reduction, Withdrawing from the IEA Agreement

Selling the crude oil held by the SPR would operate much like the sales process does now. In conducting a sale, the DOE will issue a Notice of Sale outlining the conditions for the sale, including quantity available for sale, delivery modes, minimum quantity to be purchased, the federal government’s crude oil base reference price and delivery price indexing process, delivery periods, offering guaranteed letter-of-credit requirements, and ensuring compliance with existing statutory requirements for selling and transporting petroleum products.[62] The DOE will establish a sale price based on the sale of similar crudes in the region, and offers must be at or above 95 percent of the sales price estimate.[63] The DOE will then take the highest-priced offers until the entire amount offered is sold. The actual payment to the government is made on an index-price basis.

For example, in the latest test sale in March 2014, the DOE offered 5 million barrels and received 37 bids from 12 different companies.[64] As the test sale report to Congress notes,

Under the SPR Standard Sales Provisions (SSPs), SPR oil is sold on an indexed price basis to minimize oil markets risks. A base reference price of $101.4020 was established by the Government using the average five day price of Southern Green Canyon (SGC) crude traded prior to the Notice of Sale. The differential between the Offeror’s bid price and the Government’s base reference price was then used to adjust the buyer’s price at the time of delivery. The buyer’s final price was computed by applying this differential to the average five day traded SGC price surrounding the buyer’s delivery date.[65]

Receipts upwards of $468.5 million were deposited into the Treasury account with the delivery price of $93.75 per barrel, and the DOE completed the delivery over a 47-day period.[66]

Congress should authorize the DOE to auction 10 percent of the country’s previous month’s total crude production. Basing the sales on the U.S.’s previous month’s production would allow Congress to drain the SPR over a two-year to three-year timeframe and would do so without disrupting the markets.[67] Congress should then decommission the salt caverns or sell them to the private sector if a commercial interest exists to use the caverns for private inventory.

Congress should explicitly stipulate that all revenues collected from SPR sales go exclusively toward deficit reduction—with no reciprocal increase in spending. Congress has proposed using temporary SPR sales to pay for increases in spending for other bills, such as increasing funding for the Highway Trust Fund. The recognition that the DOE should eliminate the reserve is not an invitation to find ways to spend the revenue.

The United States government should also remove itself from any commitment to the IEA to hold reserves, implement demand constraints, coordinate response measures, reduce dependence on foreign oil, and transition to alternative sources of energy. The United States could simply withdraw from the Agreement or choose to remove participation from the International Energy Program altogether.[68] Breaking the agreement would not segregate the U.S. from OECD countries or international energy markets. It would simply mean the U.S. would rely on the private sector as opposed to government decisions. In fact, a stronger commitment to the international community would be to lift the ban on crude oil exports, which would help bring more oil to the market and benefit IEA members.

Withdrawing from the agreement would not entail a prohibition of working with IEA member countries. In fact, one core focus area to which IEA commits, and to which America should also remain deeply committed, is: “Ensuring the stable supply of energy to IEA member countries and promoting free markets to foster economic growth and eliminate energy poverty.”[69] Providing affordable and reliable energy to the developed and developing world through the free market will generate wealth and prosperity and better equip the world to tackle economic and environmental challenges.[70] In fact, eliminating the SPR promotes this objective by allowing markets to respond to price increases more efficiently than government-controlled reserves, which distort the actions of the private sector. Private inventories, which may be even higher in the absence of a government-owned stockpile, or which may not respond to a price shock in anticipation of a government release of SPR, would act more efficiently.

Withdraw, Liquidate, and Reduce

Although commonly perceived as such, Congress’s establishment of the SPR and joining the IEA was never meant to serve as an emergency supply specifically for defense purposes, but as an emergency response to supply shocks. However, with a diverse set of actors in the global oil markets and the ability for those actors to build and release inventories, policymakers should recognize that the private sector reacts more effectively and efficiently than any government-controlled reserve. In sum, Congress should:

- Withdraw from the Agreement on an International Energy Program and remain committed to advancing free energy markets.

- Instruct the DOE to sell the oil held by the SPR by auctioning 10 percent of the country’s previous month’s total crude production until the reserve is completely depleted. The DOE should then decommission the storage space or sell it to private companies.

- Explicitly state that all revenues collected from SPR sales are to be allocated for deficit reduction.

- Remove government-imposed domestic and international constraints on producing and selling oil, by opening access to federal lands and waters and lifting the ban on crude oil exports.

The SPR has not served its purpose, as Presidents have used the SPR as a political tool or failed to release reserves in a timely and impactful manner. It is time for Congress to recognize it is not the government’s role to respond to high prices. Congress should therefore pull the plug and drain the SPR once and for all.

—Nicolas D. Loris is Herbert and Joyce Morgan Fellow in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.