Social Security Disability Insurance (SSDI) is the federal social insurance program that provides monthly cash benefits to eligible disabled individuals and their families. In 2014, the Social Security Administration (SSA) provided these benefits to nearly 11 million disabled workers and their eligible spouses and children. Disabled workers receive an average of about $1,150 per month from the program.[1]

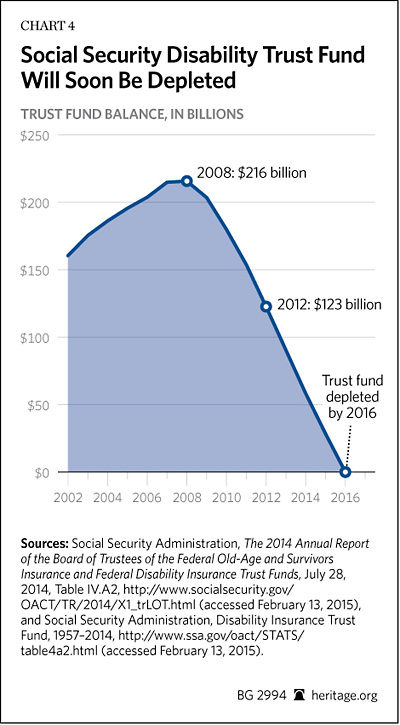

For many disabled workers, SSDI is the main source of financial support. Despite having such a profound and tangible impact on the lives of millions of Americans, knowledge of the inner workings of the program is limited. The need to understand how SSDI works is amplified by the SSDI trust fund’s imminent exhaustion projected for 2016. This Backgrounder aims to provide a clear and concise account of the application process, benefit formulas, work incentives, and financial structures behind the Social Security Disability Insurance program in order to assist policymakers in identifying areas ripe for reform.

This Backgrounder explains what Social Security Disability Insurance is and how it works, in five sections, followed by recommendations for reform:

- Who Is Eligible for Benefits?

- Which Benefits Are Available?

- How Are Benefits Determined?

- Which Factors Lead to Benefit Reductions?

- SSDI Finances

- Recommendations

Who Is Eligible for Benefits?

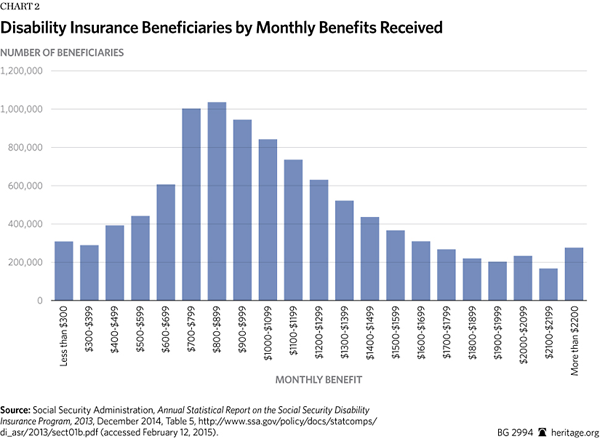

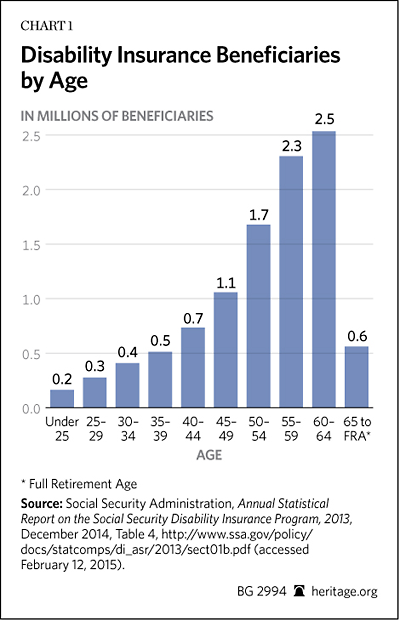

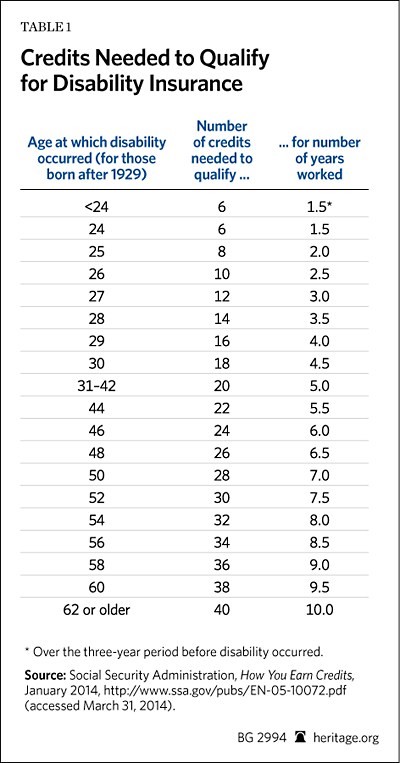

SSDI applicants must first establish a sufficient and recent work history to qualify for benefits. The Social Security Administration uses a credit system to determine benefit eligibility. In 2014, a worker earned one credit for every $1,220 of wages or self-employment income received, up to a maximum of four credits for the year. An annual income of $4,880 satisfies the full credit requirements for one year.[2] Most disability applicants need between 20 and 40 credits, or between five and 10 full years of work, to qualify for benefits, with at least 20 credits earned in the ten years immediately before the onset of the disability. The number of total required credits scales by age, with workers aged 31 to 42 needing at least 20 credits; those aged 43 to 62 needing one additional credit for every year of age; and those aged 62 and older needing 40 credits. Nearly 80 percent of SSDI beneficiaries are 45 or older.

Special exceptions are in place for workers who become disabled before the age of 31. In general, these individuals need an amount of credits equal to the difference of their age at the onset of disability and 21, times two. For example, if a worker becomes disabled at age 28, he needs 14 credits ([28 - 21] * 2) to qualify for disability benefits.[3]

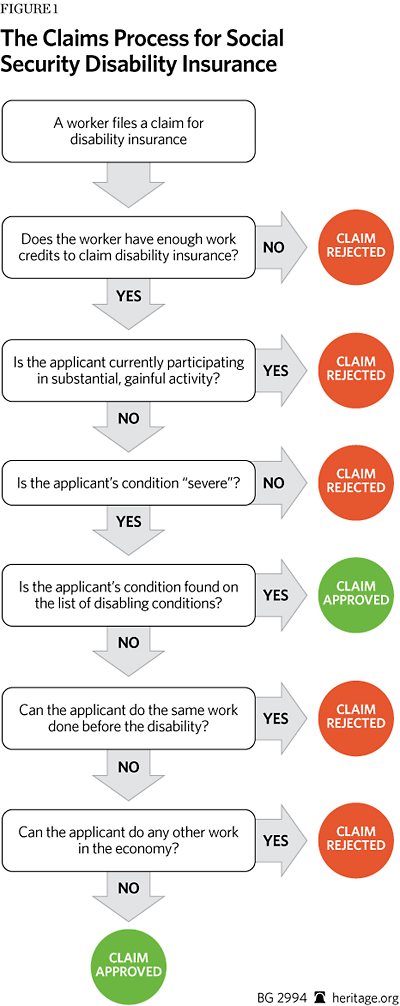

Disability Determination. If an applicant satisfies the work history requirement for disability insurance, he then enters the five-step disability-determination process to ascertain if he is eligible to receive benefits.[4] To meet the statutory definition of disability, the applicant “must not be able to engage in any substantial gainful activity because of a medically-determinable physical or mental impairment(s) that is expected to result in death, or that has lasted or is expected to last for a continuous period of at least 12 months.”[5] The initial claim is processed by regional Disability Determination Services (DDS) offices that are located in every state.

There are five questions to ascertain eligibility, explained below and presented in flowchart format in Appendix B:

1. Is the applicant currently participating in substantial gainful activity (SGA)?

The main component of the disability determination is that the impairment must be severe enough to prevent the applicant from “participating in substantial gainful activity”; in plain terms, applicants need to demonstrate that they are unable to support themselves through their own work efforts.[6] DDS makes this determination by comparing the applicant’s monthly earned income to the current year’s SGA threshold. In 2015, this threshold is $1,090 per month ($1,820 for blind individuals). The SGA threshold is indexed to the average national wage.

Not all income is counted toward the SGA limit. Impairment-Related Work Expenses (IRWE) can be deducted from an applicant’s earned income total. In general, an expenditure qualifies as an IRWE if the item or service is needed to perform the applicant’s work, the item or service is made necessary by the disability, the expenditure is not reimbursed by any other insurance, and the item or service is purchased at a reasonable price.[7] DDS may provide special exceptions for applicants who work under extraordinary circumstances (such as working irregular hours or allowed time for frequent rest breaks)[8] as well as self-employed business owners.[9] The most notable caveat on the SGA limit is that unearned income will not be counted. Unearned income includes all income from investments, pensions, other family members, and other insurance programs.[10]

Applicants for SSDI who at the time of application earn more than the SGA limit (and are therefore “participating in substantial gainful activity”) are automatically disqualified from receiving disability benefits from Social Security as long as their earnings are above the maximum. If the applicant earns less than the SGA limit, he moves on to step 2 in the determination process.

2. Is the applicant’s condition “severe”?

Applicants must show that their condition interferes significantly with their ability to carry out basic work activities. The Code of Federal Regulations defines basic work activities as “the abilities and aptitudes necessary to do most jobs,” which include “physical functions such as walking, standing, sitting, lifting, pushing, pulling, reaching, carrying, or handling,” or “capacities for seeing, hearing, and speaking,” in addition to “understanding, carrying out, and remembering simple instructions,” among other things.[11]

DDS will use medical evidence provided by the applicant to make this determination. If insufficient evidence is provided, DDS may arrange a consultative examination with the applicant’s primary source of treatment or an independent party.[12] If DDS finds that the applicant’s condition does not interfere with his ability to carry out basic work activities, his claim is denied. Otherwise, the application is moved to step 3.

3. Is the applicant’s condition found in the list of disabling conditions?

The SSA maintains a list of medical conditions that automatically qualify an individual as disabled for SSDI purposes. This comprehensive list covers all of the major organ systems of the human body and includes guidelines for evaluating the severity of the condition.[13] If DDS finds that the applicant’s condition is on the list or is equally severe to a medical condition on the list, his claim is approved. Otherwise, the application is moved to step 4.

4. Can the applicant do the work he did before?

At this point, DDS will evaluate the applicant’s ability to do work he had previously done. The applicant will be required to provide all job titles held in the past 15 years and relevant information about these positions, including duties, hours, skill requirements, physical and mental activities, and whether the applicant’s medical condition necessitated changes in his work environment. If DDS finds that the applicant is capable of doing work as he previously did, or in the manner that it is done in the general economy, the application will be denied. Otherwise, it will move to the final step.[14]

5. Can the applicant do any other type of work?

Finally, DDS will evaluate the applicant’s ability to perform other work that exists in the economy. Here, DDS will consider not only the applicant’s past job experience, but also his education, vocational training, and age. Factors that would severely limit an individual’s ability to find other work include illiteracy, poor English skills, and old age. The SSA uses several tables of rules to make this final determination of disability. If the applicant is found unable to perform other work in the economy, his application will be approved; otherwise, he should not be considered disabled for Social Security purposes.[15]

The SSA has come under scrutiny for relying on outdated Department of Labor job listings to identify whether applicants could do other jobs in the national economy.[16] The Labor Department stopped updating its Dictionary of Occupational Titles[17] in 1991, which reportedly includes listings such as “telegram messenger” and “horse-and-wagon driver,” and makes little mention of the Internet-based economy.[18] The SSA is currently in the process of testing a new system with a go-live projection date in 2016.[19]

Which Benefits Are Available?

Workers whose SSDI applications are approved will receive benefits after a five-month waiting period. These benefits will continue until workers reach full retirement age or exit the program for other reasons. Beneficiaries may also qualify for retroactive payments based on when their disability started and when they filed the initial application.[20]

Monthly benefits average about $1,150 and are determined mainly by the worker’s past earnings. The beneficiary’s current income and assets have no effect on the amount of benefit, unless his income rises above the SGA threshold or arises from workers’ compensation or other public benefits. If the beneficiary’s income rises above the SGA ($1,090 per month in 2015, $1,820 for blind beneficiaries), his or her benefits will be terminated. The SSA considers workers’ compensation and other public benefits in a total benefit calculation and reduces SSDI benefits if the total benefits exceed 80 percent of the beneficiary’s prior average earnings. Benefits may also be terminated if the beneficiary’s medical condition improves (discussed below), the beneficiary returns to work, or the beneficiary becomes incarcerated or is convicted of a felony.[21]

Benefits for Other Family Members. Certain family members of disabled workers receiving SSDI benefits may also be eligible to receive benefits. These include:

- Spouses aged 62 or older; spouses caring for a child that is under age 16 or that meets the definition of disability.

- Unmarried divorced spouses aged 62 or older whose marriages lasted at least 10 years, unless he or she qualifies for a higher amount of personal Social Security benefits.

- Children under age 18 or full-time high school students under age 20.

- Disabled children aged 18 or older whose disability started before age 22. Benefits will continue as long as the child meets the legal definition of disability.

These family members can receive benefits of up to 50 percent of the primary beneficiary’s benefit. Total family benefits are subject to a limit between 150 percent and 180 percent of the primary benefit. Divorced spousal benefits do not count toward the family limit.[22]

Automatic Eligibility for Medicare. In general, SSDI recipients will become automatically eligible for premium-free Medicare Parts A and B after 24 months of receiving SSDI benefits. For workers who have multiple periods of disability on their record, months from previous periods will be counted if the newest period of disability started within 60 months (five years) of the end of the last period (84 months or seven years for disabled widows/widowers, and for those receiving child benefits). Months from previous periods will also be counted if the current disability is the same or directly related to the impairment that was the basis for the previous periods.[23]

SSDI recipients are eligible for premium-free Medicare Part A and Part B for the remainder of their disability period. If the recipient does not leave the Social Security Disability Insurance program, this Medicare eligibility continues when SSDI benefits automatically convert into retirement benefits at full retirement age.[24]

If a beneficiary with a disabling condition leaves SSDI by returning to work, he will still receive Medicare coverage for at least 93 months after his nine-month trial work period ends, meaning a total of 13 and a half years from the time a beneficiary returns to work. At the end of that time, the worker will no longer be eligible for premium-free Medicare coverage but will have the choice of purchasing both Parts A and B coverage if he still has a disabling condition.[25]

SGA and the Trial Work Period (TWP). If, at any time, a disabled worker is receiving SSDI benefits and he is determined to be participating in substantial gainful activity (earning more than $1,090 per month), his disability benefits will stop and he will be declared ineligible for Social Security Disability Insurance. The only exceptions to loss of benefits from SGA are the trial work period (TWP) and unsuccessful work attempts.

In order to incentivize disabled workers to return to the workforce, the Social Security Administration allows them to “test” their ability to work for up to nine months. A disabled worker earning more than $780 during a single month in 2015 will be considered as engaging in a TWP, and his benefits will be protected even if his earnings exceed SGA. A worker may not participate in more than nine months of TWP in any 60-month period. The monthly earnings threshold for TWP is indexed to wage growth.[26]

After the nine-month TWP ends, a three-year extended period of eligibility (EPE) begins regardless of whether the disabled beneficiary continues to work or not. There are a number of possible benefit scenarios that can occur during the EPE:

- If the beneficiary works below the SGA, his benefits will continue throughout the EPE.

- If the beneficiary earns above the SGA, his benefits will cease.

- If the worker’s earnings fall below the SGA after benefits stopped, his benefits will be reinstated.

After the EPE ends, a worker who continues to work below the SGA will receive benefits as before. As soon as the worker earns at or above the SGA, however, his benefits will cease permanently. This worker would need to reapply for benefits and could do so through an expedited reinstatement process if his earnings fall below SGA within 60 months (five years) after his benefits were terminated.[27]

Ticket to Work and Other Work Incentives. In an effort to provide stronger incentives for disabled workers to return to the workforce, the SSA enacted the Ticket to Work Program in 1999. This free and voluntary program is available to all disabled recipients aged 18 to 64 and is administered through local employment networks and state vocational rehabilitation agencies. Eligible individuals will be able to receive workplace and vocational training from local providers to help them transition back into the workplace.

Ticket to Work participants are subject to TWP conditions as explained above and are exempt from continuing disability reviews while participating in the Ticket to Work Program. The SSA also created the Benefit Offset Pilot Demonstration (BOPD) and the Benefit Offset National Demonstration (BOND) as temporary programs to test the effectiveness of benefit offsets. Participants in both programs have their benefits reduced by $1 for every $2 in earnings above SGA instead of losing all of their benefits at once. BOPD was conducted on a very small scale in only four states (Connecticut, Utah, Vermont, and Wisconsin) starting in 2005 and ended in December 2014.[28] BOND was launched as a broader national program starting in 2012 and will be operating through 2017.[29]

In addition to Ticket to Work and other pilot programs, Social Security will allow disabled workers to claim an unsuccessful work attempt (UWA) if they earn more than SGA for six months or less and their subsequent earnings fall below SGA due to complications regarding their medical condition. UWA will not count toward a TWP and will not be considered in a disabled worker’s ability to perform SGA.[30] There is no limit to the number of UWAs that a worker can claim, provided he can demonstrate “discontinuity” between each UWA.

Discontinuity is defined as being out of work for 30 days or being required to perform different work, or work for a different employer.[31] The Social Security Administration also provides information services to educate disability recipients about workplace opportunities and to provide access to work incentives. These include Work Incentives Planning and Assistance (WIPA) projects, Work Incentive Seminar Events (WISE), and the Job Accommodation Network (JAN).[32]

Though there is no shortage of initiatives to return SSDI beneficiaries to work, such “back-to-work” programs have demonstrated only limited effectiveness. Ticket to Work has a dismal participation rate (0.4 percent of eligible ticket holders have signed on with an employment network as of 2012), making it difficult to assess the impact of the program on incentives to return to the workforce. Oversight officials attribute this low participation to lack of knowledge and awareness of the program and fear of losing benefits once workforce reintegration is achieved.[33]

BOPD showed limited signs of success in some states in terms of employment rates and earnings of disabled workers, but the larger follow-up program BOND suffers from low participation rates and methodological obstacles as well. Other back-to-work programs implemented by the SSA have not been significantly effective in moving beneficiaries from the SDDI rolls back into the workforce.[34]

How Are Benefits Determined?

SSDI benefits are calculated in a very similar manner as retirement benefits. Disability benefits are based on the worker’s earnings before the onset of disability. The worker’s average indexed monthly earnings (AIME), or average monthly salary, is calculated using a minimum of two years of indexed earnings. The AIME is then run through a formula that calculates benefits that is further explained below.

Determining Average Indexed Monthly Earnings (AIME). The first step to calculating a disabled worker’s AIME is determining the number of computational years that will be used in the formula. For disability insurance, this equals the difference between the beneficiary’s age at the onset of disability and 21, minus any “dropout years.” A disabled worker is credited one “disability dropout year” per five years of earnings after the age of 21, up to a maximum of five. Disabled workers are also credited one “childcare dropout year” for every year after the age of 21 that was spent caring for a child (at least nine months of the year). Beneficiaries may claim a maximum of two childcare dropout years; workers claiming any childcare dropout years can claim a maximum of three total dropout years; otherwise, they can claim a maximum of five disability dropout years.

In the next step of the calculation, the SSA will adjust this worker’s lifetime yearly taxable earnings data via wage growth data. Then, the SSA will select a number of the worker’s highest yearly taxable earnings equal to the number of computational years. These selected earnings are then averaged and scaled into monthly amounts, yielding this worker’s AIME.[35]

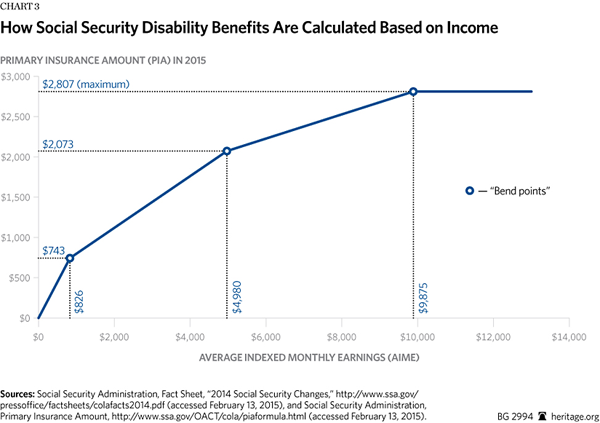

Using Bend Points to Calculate the Monthly Benefit. Once an AIME has been determined, the SSA calculates a worker’s monthly disability benefit using a formula that pays a higher benefit relative to income to lower-income workers than to higher-income workers. In 2015, the SSA will pay 90 percent of the first $826 of a worker’s AIME, 32 percent of the AIME amount between $826 and $4,980, and 15 percent of any AIME amount over $4,980. The SSA adjusts the bend points each year.

The bend points ensure that a lower-income worker receives SSDI benefits that are comparatively higher relative to pre-disability income than the benefits that upper-income workers receive. For example, a worker with an AIME of $5,000 would receive 90 percent of the first $826 ($743.40); 32 percent of the amount between $826 and $4,980 ($1,329.28); and 15 percent of the amount between $4,980 and $5,000 ($3). Thus, the worker’s monthly benefit would be $2,075.68, or about 42 percent of AIME.

On the other hand, a worker with an AIME of only $1,600 would receive 90 percent of the first $826 ($743.40) and 32 percent of the amount between $826 and $1,600 ($247.68), for a total monthly benefit of $991.08. This lower monthly benefit amount would equal 62 percent of his or her AIME.

The formula for calculating disability benefits is virtually identical to the one used for retirement benefits. Thus, if a beneficiary is receiving disability payments at full retirement age, they will be automatically converted into retirement benefits of the same amount. Retirement benefits are subject to a different set of limitations, most notably the absence of the SGA threshold.[36]

Annual COLA Increases. Once a worker’s monthly benefits have been determined, they are increased every year by the rate of inflation. This cost-of-living adjustment (COLA) is intended to preserve the purchasing power of a recipient’s benefits. The amount of the annual increase is announced each October and takes effect the following January.

The COLA is based on the inflation rate for the preceding 12 months from October 1 to September 30. For example, in October 2014, the SSA announced a COLA increase of 1.7 percent for all checks issued after January 1, 2015. This increase was based on the change in the consumer price index for urban wage earners and clerical workers (CPI-W) from October 1, 2013, through September 30, 2014. If there is no increase in inflation during that calculation period, there are no COLAs until the inflation index is higher than the level at the end of the previous measuring period.

Which Factors Lead to Benefit Reductions?

SSDI benefits could be subject to federal taxes depending on household income, but the majority of people do not need to pay taxes on their disability benefits.[37] As with most Social Security payments, a family member cannot receive both a family benefit and a personal Social Security benefit; he or she will receive an amount equal to the greater of those two.

The Dual-Entitlement Rule. A long-standing principle of Social Security holds that a worker cannot qualify for both full disability benefits and full disability spousal benefits. Accordingly, although a married worker theoretically could qualify for both disability benefits from his or her own earnings record and a spousal benefit equal to 50 percent of the spouse’s disability benefit, the dual-entitlement rule limits the spousal benefit.

The dual-entitlement rule reduces the spousal benefit dollar for dollar by the amount of the disability benefits for which a worker qualifies under his or her own earnings record. Thus, if two spouses each qualify for $1,200 per month from their own earnings records and for spousal benefits of $600 per month (one-half of the basic disability benefit), they would still receive a total benefit of only $2,400 ($1,200 per worker). Both spouses are ineligible for the $600 spousal benefit because their individual disability benefits are greater.

The Government Pension Offset. The Government Pension Offset affects the disability benefits for spouses of workers who held jobs that were not covered by Social Security. Most of these workers were either state or local government employees, or were federal employees prior to 1984. Since government workers who were not covered by Social Security do not have an earnings record for those jobs or any Social Security benefits based on that employment, they would in some cases qualify for a full spousal benefit, even though the spouse would not qualify if both workers had been part of Social Security.

Under the Government Pension Offset, two-thirds of the pension from non-covered Social Security employment is treated as if it were a Social Security benefit, and the worker’s SSDI spousal benefit is reduced dollar for dollar by this amount.

The Windfall Elimination Provision. The Windfall Elimination Provision can affect the disability benefits of workers who became disabled after 1985 and who have earned a pension from work not covered by Social Security, given certain conditions. For those who became disabled in 1990 or later, the 90 percent factor calculating the worker’s AIME is reduced to up to 40 percent, which reduces the beneficiaries’ monthly benefit amount.[38]

The Workers’ Compensation Offset. The SSA considers worker’s compensation and other public disability benefits in a total benefit calculation and reduces SSDI benefits if the total benefit were to exceed 80 percent of the beneficiaries’ prior average earnings. The following public benefits do not affect workers’ SSDI benefits: Veterans Administration benefits; state and local government benefits, if Social Security taxes were deducted from said state and local government workers; and Supplemental Security Income (SSI).[39]

Continuing Disability Reviews (CDRs). In 1980, Congress required the Social Security Administration to “review the status of a disabled individual, unless the disability has been found to have been permanent, at least once every 3 years.”[40] Further revisions to the law established a more concrete framework to the timing of CDRs. In general, beneficiaries whose medical condition is expected to improve will be reviewed six months to 18 months after they start receiving benefits. Others, whose condition could possibly improve, will receive CDRs about every three years, and those whose condition is not expected to improve will be examined once every five to seven years. The exact frequency of CDRs depends on the severity of the initial condition, though non-medical triggers, such as returning to work, may constitute grounds for a CDR.[41]

The SSA will generally perform CDRs by mail, calling for consultative examinations if more information in necessary to make a decision. If the SSA finds that the beneficiary’s medical condition has improved to the point that he is able to work, his disability benefits will be stopped.[42] However, recent growth in the number of people receiving SSDI benefits has diminished the ability of the SSA to process CDRs in a timely manner. At the end of fiscal year 2013, the SSA backlog totaled 1.3 million pending medical CDRs.[43] Furthermore, the impact of CDRs on the number of disability beneficiaries is not significant. In 2012, a mere 2.6 percent of the 728,230 terminated beneficiaries had lost their eligibility due to demonstrated medical improvement.[44] Thus, of the 443,233 medical CDRs conducted in 2012, a total of 4.3 percent of those reviews resulted in termination of benefits.[45]

The Appeals Process. In 2012, the SSA approved 33 percent of the 3 million applications it received.[46] Applicants who are denied in the initial process or lose eligibility through a CDR may submit a request for an appeal within 60 days of the decision. Applicants who would otherwise lose their benefits can opt to continue them, but they face the risk of having to pay back those benefits if their appeal is unsuccessful. There are four potential stages of the appeals process:

- Reconsideration

- Hearing by an administrative law judge

- Review by the Appeals Council

- Federal Court Review

After taking into account all levels of the appeals process, a worker who files for disability insurance has just under a 50 percent chance of having his application accepted. The odds are almost equivalent to the flip of a coin.[47]

Reconsideration. Workers whose initial application was denied can ask to have their application reconsidered by a Social Security worker who did not take part in the first decision. The applicant can also submit new medical evidence to accompany the files submitted in the initial application. If a worker is taken off the SSDI rolls through a CDR because his medical condition has improved, he can also appeal this decision by speaking with a Social Security representative.

However, reconsideration is not available in all states: Alabama, Alaska, parts of California, Colorado, Louisiana, Michigan, Missouri, New Hampshire, New York, and Pennsylvania require a worker whose initial claim was denied to proceed directly to the hearing stage for appeals.[48]

Hearing by an Administrative Law Judge. If an applicant disagrees with the outcome of reconsideration, he can request a hearing with an administrative law judge (ALJ). ALJs are certified judges primarily responsible for resolving disputes involving the decisions of government agencies and the people affected by those decisions. The Office of Disability Adjudication and Review (ODAR) is responsible for facilitating these hearings and providing an ALJ to handle each case.[49] Though all applicants have the right to submit a request for an ALJ hearing, the ALJ may simply dismiss the request for a variety of reasons, including failure to appear at the hearing or failure to submit a hearing request within 60 days of the previous decision.[50]

The hearing stage of appeals is very different from the initial application and reconsideration process. In addition to the ALJ, a vocational expert and a medical expert may be present at the hearing. The applicant may elect to have a lawyer represent him during the hearing and will also be given the opportunity to call his own witnesses. Both the ALJ and the applicant (or his legal representative) will have the opportunity to examine all witnesses and any evidence on the record. Typical lines of questioning will involve the applicant’s ability to do hypothetical work given his vocational skills and medical condition. After the hearing, the applicant is also allowed to submit additional evidence for the ALJ’s review.[51]

In 2012, administrative law judges overturned the SSA’s previous decision for 48 percent of the 825,000 requests it received. A 2014 House Oversight and Government Reform Committee report identified SSA failure to address poor decision making by ALJs “even when they demonstrate gross incompetence or negligence in handling their responsibilities,” in a process that prioritizes volume adjudications over quality decision making. The report recommends several reforms, including implementing a cap on the number of cases an ALJ may decide in a year, removing ALJs who were grossly disregarding federal disability law, and increasing emphasis on ALJ quality reviews.[52]

Review by the Appeals Council. The Appeals Council is the highest decision-making body within the Social Security Administration. If an applicant disputes the decision reached by the ALJ, he (and his legal representative) may file a request for review by the Appeals Council within 60 days. Depending on the reasons for the request, the Appeals Council may immediately deny a request for review and uphold the previous ALJ ruling. The Appeals Council may also dismiss a request for review if it is not filed within 60 days.

If the Appeals Council accepts a request for review, it will examine the applicant’s entire case, including any new evidence submitted, as well as the ALJ’s rationale behind the ruling. The council will usually look for procedural and legal errors committed by the ALJ or failures to consider the complete evidential record. At this point, the Appeals Council can decide to remand the case (send it back to the ALJ) to correct any mistakes, or it can completely overturn the ALJ’s decision if it believes the ALJ committed a serious error during the hearing.[53] In 2012, the Appeals Council received 172,500 requests for review, of which 78 percent were denied, 17 percent were remanded, and a mere 1 percent resulted in a reversal of the ALJ’s decision.[54]

Federal Court Review. The final avenue to appeal a denied application after failure at the ALJ and Appeals Council is to file suit in a Federal District Court. As usual, the applicant must file a complaint within 60 days of the previous decision. The complaint must be directed to the current Social Security Commissioner and must comply with federal court rules. Because this process is very technical and precise, many applicants will hire legal counsel to help them file the complaint and assist them in the proceeding court case. As with the Appeals Council, the Federal Court may dismiss a complaint if it is not filed properly or in a timely manner.

Much of the argumentation between the applicant and the SSA will take the form of written briefs, though some courts may schedule oral argumentation. Essentially, each side will continue to argue its position on the original ALJ ruling, though no new evidence may be presented during the case. After hearing the arguments and examining the evidence, the judge presiding over the case may issue one of three rulings: (1) He can uphold the decision of the ALJ and Appeals Council; (2) he can overturn the previous decisions; or (3) he can remand the case all the way back to the ALJ hearing level.[55] In 2012, of the 18,779 disability-related appeals to a Federal District Court, 49 percent were denied, 42 percent were remanded, and just 2 percent were approved.

SSDI Finances

Social Security Disability Insurance is part of the larger Social Security program that includes benefits for retirees and survivors. Unlike most other government programs, Social Security is funded through explicit taxes that are intended exclusively for the Social Security program. These taxes are based on a worker’s earned income and deducted from his or her paychecks. For that reason, Social Security taxes are often referred to as payroll taxes. Social Security and disability payroll taxes amount to 12.4 percent (6.2 percent for the employer and 6.2 percent for the employee). Of the 12.4 percent, 10.6 percent is dedicated to the Old-Age and Survivors program while the remaining 1.8 percent is for the Disability Insurance program. These payroll taxes are in addition to any income taxes that the worker must pay.

The Earnings Limit. In 2015, Social Security taxes will be collected on only the first $118,500 that a worker earns. This figure is the “earnings limit” and is adjusted each year based on wage growth. Social Security benefits are paid only on the amount of income that is subject to the Social Security payroll tax. Thus, in Social Security’s eyes, both Michael Jordan and Bill Gates earn $118,500 per year regardless of their actual incomes, and their Social Security disability benefits will reflect this.

The earnings limit was put in place to help Social Security maintain its goal of preventing poverty in old age. By placing a cap on the earnings that are taxed, Social Security also places a limit on benefits received. This prevents the program from paying excessively high benefits to retirees who were high-income earners prior to retirement.

Income Taxes on Disability Benefits. Since 1983, some beneficiaries are required to pay income taxes on a portion of their Social Security benefits. For the most part, individuals for whom the only source of income is Social Security do not face any tax liability. Due to the SGA limit for participation in SSDI, a majority of disabled workers do not end up paying taxes either. Any money raised from the taxation of Social Security benefits is returned to either Social Security or Medicare.

Disabled workers whose individual “combined income” (adjusted gross income + nontaxable interest + half of social security benefits) exceeds $25,000 will be required to pay tax on a portion of their benefits.[56] However, the SGA provision of disability insurance prohibits beneficiaries from earning over $1,090 a month ($1,820 for blind persons). Working just under the SGA would yield annual earnings of $13,080 for non-blind beneficiaries, which would require a monthly benefit of $1,987 to push combined earnings over the tax threshold, almost double the average monthly disability benefit of $1,150.[57] The tax threshold is easier to reach for blind individuals if they earn closer to $1,820 per month.

The Social Security Trust Funds. Contrary to popular belief, workers paying Social Security payroll taxes today are not contributing to their own Social Security benefits in the future. There is no Social Security account in a worker’s name that contains cash or investments. There is only a bookkeeping record of an individual’s yearly earnings and payroll taxes. Today’s workers are financing Social Security benefits for today’s beneficiaries. This is referred to as a pay-as-you-go system.

Social Security’s trust funds do not contain cash or saleable assets because when payroll tax contributions exceeded benefit payments in the past, any surplus was loaned to the government to finance other spending programs.

The DI Trust Fund. Social Security has two trust funds: the Old-Age and Survivors Insurance (OASI) trust fund, and the Disability Insurance (DI) trust fund. Although they are legally separate, for analytical purposes they are often referred to as a single trust fund, the Old-Age, Survivors, and Disability Insurance trust fund (OASDI).

The Disability Insurance trust fund—the smaller of the two Social Security trust funds— pays disability benefits. In 2013, the DI program marked its fifth straight year of deficits, with the trust fund declining by $32.2 billion (25 percent) from $122.7 billion to $90.4 billion. Each dollar in benefits was met with only 75 cents in payroll tax contributions. According to the Social Security trustees’ intermediate projections, the DI program faces a 10-year projected shortfall of $267 billion.[58]

Depletion of the Disability Trust Fund. Projections of the performance of the Social Security trust funds indicate that the Social Security Disability Insurance trust fund is in immediate danger of being depleted. Based on the latest Trustees Report, SSDI will continue to run substantial cash-flow deficits averaging more than $30 billion every year. Even taking interest payments from the Treasury into account, the $90.4 billion balance in the DI trust fund in 2013 will only last until 2016.[59]

Congress has several options to address this impending funding shortfall. It could direct Social Security to cut all disability benefits by about 20 percent in 2016, bringing benefit payments in line with payroll tax income. This would be particularly harmful to disability benefit recipients with little to no other income. Congress could also increase the payroll tax rate or reallocate the payroll tax components such that SSDI receives comparatively more funding; in other words, raising taxes or taking or borrowing from Social Security to pay for Disability Insurance. Congress should not agree to a reallocation, inter-fund borrowing, or increasing the DI tax rate only to evade necessary DI program reforms.[60] Congress should make statutory changes to eligibility requirements and benefit formulas.[61]

Recommendations

Congress should adopt SSDI reforms to correct flaws in the current system. Possible reforms include:

Adopting a Needs-Based Period of Disability. Congress should consider replacing permanent benefits and continuing disability reviews with a needs-based period of disability of one to two years for individuals for whom medical improvement is expected, and of two to five years for individuals for whom medical improvement is possible. Beneficiaries for whom medical improvement is not expected would continue to be subject to CDRs, as is the case in the current system. Reapplication would be based on the current expedited reinstatement (EXR) process that was adopted as part of the Ticket to Work and Work Incentives Improvement Act of 1999. The proposed Protecting Social Security Disability Act of 2014 introduced by then-Senator Tom Coburn (R–OK) grants time-limited benefits when recovery is expected, among other reforms.[62]

Encouraging Greater Use of Qualified Private Disability Insurance (QPDI). Congress should consider encouraging employers to adopt qualified private disability insurance. QPDI could replace the first two years of disability benefits for covered employees, relying on the more efficient private sector for initial disability determinations and focusing supports on work accommodations and recovery. The Protecting Social Security Disability Act requires the SSA to study incentives for employers to offer private disability insurance.

A separate proposal suggests that employers provide mandatory short-term private disability insurance to their employees.[63] However, a paper presented at the Disability Research Consortium meeting in 2014, which simulated a similar policy, argued that “such policies will place a substantial burden on the labor costs of many relatively small firms whose claims experience is relatively high.… [O]ne consequence of such policies is likely to be lower demand for low-skill workers [who] might be induced to apply for DI sooner, contrary to policy objectives.”[64] Congress should avoid unfunded employer mandates that could hurt the employment prospects of the most vulnerable in society.

Reducing Incentives for Early Retirement. Currently, SSDI beneficiaries with a sufficient work history who qualify for benefits before their full retirement age can receive the full benefit in retirement. Whereas individuals who claim early retirement benefits between age 62 and age 67 see their retirement benefits reduced by up to 30 percent. In order to discourage individuals from using the DI program as an early retirement program, Congress could either convert disabled-worker beneficiaries to retired-worker status at the early retirement age, including the subsequent benefit reduction, or phase down DI benefits for people age 53 and older to arrive at the same benefit reductions gradually.[65]

Moreover, Congress would be wise to reform the Social Security retirement and disability programs together as there are important interactions between the programs, and because they share certain features, including how benefits are earned and determined. Reforms to both programs include:

Phasing in a Maximum Flat Benefit. To better protect Social Security beneficiaries from destitution, Congress should change the programs’ needlessly complex benefit formula by adopting a flat benefit above the federal poverty level for beneficiaries eligible for full disability and retirement benefits. A flat benefit would maintain the programs’ goal of protecting disabled and elderly workers from destitution while encouraging workers with higher incomes to seek out additional private disability insurance and retirement savings. The flat benefit should be about equivalent to the average benefit today.

Targeting Benefits to Individuals with the Greatest Need. In addition to considering earned income when assessing a covered worker’s eligibility for SSDI benefits, Congress should include veterans’ benefits, state and local government benefits, and investment income to determine a disabled worker’s income needs. In this way, a flat benefit would provide a level of insurance against destitution for all Americans while targeting benefits at those who need the benefits the most. Similarly, Social Security’s retirement program was designed as a program to protect the elderly from poverty, yet it pays benefits to many millionaires while leaving many low-income recipients in need of additional welfare benefits. Lawmakers should phase out benefits for beneficiaries with high levels of non–Social Security income and provide a true system of social insurance that focuses on individuals who need benefits the most.

Computing COLA with the More Accurate Chained CPI. SSA currently uses the outdated CPI-W to compute annual COLA increases. The CPI-W, used unaltered since 1975, only takes into account price changes experienced by one-third of Americans. In addition, the CPI-W fails to consider shifts in consumer spending habits as prices change, causing it to overstate the impact of inflation on beneficiaries and leading to excess payments. The SSA should replace the CPI-W with the chained CPI, which takes into account the prices paid by all urban workers—a demographic that covers 87 percent of Americans—and is considered to be a more accurate estimate of changes in the cost of living.[66]

Conclusion

Social Security Disability Insurance provides income security to millions of disabled workers, yet few understand the complex system’s workings. The program’s beneficiaries face an immediate threat: Without congressional action, the DI Trust Fund will run dry by 2016 and benefits would be cut by nearly 20 percent indiscriminately. The program is in dire need of change to ensure that assistance will be there for the millions of disabled workers who depend on Social Security for their livelihoods. Understanding the program is a necessary first step to instituting reforms that can put SSDI on a fiscally sustainable path.

—Romina Boccia is Grover M. Hermann Fellow in Federal Budgetary Affairs in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation. Alexander Shen, a member of The Heritage Foundation Young Leaders Program, contributed to this report.

Appendix A:

A Brief History of SSDI

- 1935: President Roosevelt signs the Social Security Act into law. No disability provisions are included in the law for the next 15 years.

- 1948: The 1948 Advisory Council creates the first comprehensive plan for public disability insurance, which lays much of the groundwork for the current system. Congress ultimately rejected the plan as a whole.

- 1950: Congress passes a law establishing the Aid to the Permanently and Totally Disabled (APTD) program. The program was administered by the states and funded by federal grants-in-aid.

- 1956: Congress passes the Social Security Amendments of 1956, which establishes an official federal disability program that limits eligibility to those between the ages of 50 and 64, and disabled adult children of retired or deceased workers whose disability started before the age of 18. This preliminary disability insurance program adopted some elements of the 1948 Advisory Council’s plan, including a strict definition of disability and a six-month waiting period before benefits could be paid.

- 1960: Benefits are extended to dependents of disabled workers, and age requirements for eligibility are dropped.

- 1972: In the Social Security Amendments of 1972, lawmakers decide to extend Medicare eligibility to anyone who received disability benefits for two years or more.

- 1980: In an effort to combat the growing costs of SSDI, Congress places caps on family benefits and mandates continuing disability reviews for anyone with a disability expected to be temporary.

- 1984: Congress implements further revisions to the disability determination process, including additional considerations for mental disabilities.

- 1999: Ticket to Work becomes part of SSDI.[67]

Appendix B:

Appendix C:

Glossary of Acronyms and Common Terms

AIME—Average indexed monthly earnings. This number is calculated using the applicant’s lifetime earnings indexed to annual wage growth and will be used to determine his benefits.

ALJ—Administrative law judge. A judge who is responsible for resolving disputes between decisions by government agencies and people affected by those decisions.

CDR—Continuing Disability Review. An assessment by the Social Security Administration of current disability beneficiaries regarding improvements in medical conditions to determine continued eligibility for benefits.

COLA—Cost-of-living adjustment. An annual increase in Social Security benefits (both retirement and disability) intended to protect the beneficiary from the effects of inflation.

CPI—Consumer price index. An index that tracks the nominal price of consumer goods in order to measure inflation. The CPI is used to calculate the COLA for Social Security.

DDS—Disability Determination Services. State offices that handle the initial application filings and reconsideration appeals.

Disability—An impairment is considered a disability if the affected person is unable to engage in SGA and the impairment is expected to result in death or last for 12 months or more.

Dual-Entitlement Rule—A provision that prevents a person from collecting full personal retirement benefits and full disability spousal benefits.

FICA—Federal Insurance Contributions Act. Authorizes the government to collect payroll taxes for Social Security and part of Medicare. These specific payroll taxes are often referred to as FICA taxes.

GPO—Government Pension Offset. This provision reduces the SSDI spousal benefit of anyone who is also receiving a Civil Service retirement pension.

Medicare—A government entitlement program that provides medical services to seniors and SSDI beneficiaries. Medicare Part A generally covers services such as hospital care, nursing homes, and home health care. Part B covers many preventive services and mental health treatments.

PIA—Primary insurance amount. How much, in monthly cash benefits, a beneficiary can receive before accounting for benefit reductions such as dual entitlement.

SGA—Substantial gainful activity. If an applicant or current beneficiary is found to be participating in SGA (which means earning income of a certain level), then he will be declared ineligible for SSDI.

SSA—Social Security Administration. The executive body responsible for administering the Social Security programs and Supplemental Security Income.

SSI—Supplemental Security Income. A means-tested welfare program that pays monthly benefits to people who are disabled, blind, or age 65 or older. Blind or disabled children may also receive SSI benefits.

SSDI—Social Security Disability Insurance. A program that provides monthly cash benefits to workers who meet the statutory definition of disability and have achieved insured status.

TWP—Trial work period. A SSDI beneficiary may earn above the SGA limit without losing benefits for up to nine months in an attempt to return to the workforce. This time is called a trial work period.