Advocates for compulsory unionization have argued that right-to-work (RTW) laws reduce wages by 3 percent. A forthcoming Heritage Foundation Backgrounder finds instead that, when living costs are fully taken into account, private-sector workers in RTW states enjoy real wages equivalent to those in non-RTW states. Policymakers considering RTW legislation may do so confident that it will have no negative impact on private-sector wages. RTW laws do appear to slightly reduce the pay of government employees, easing constraints on hard-pressed state budgets.

Right-to-Work Laws

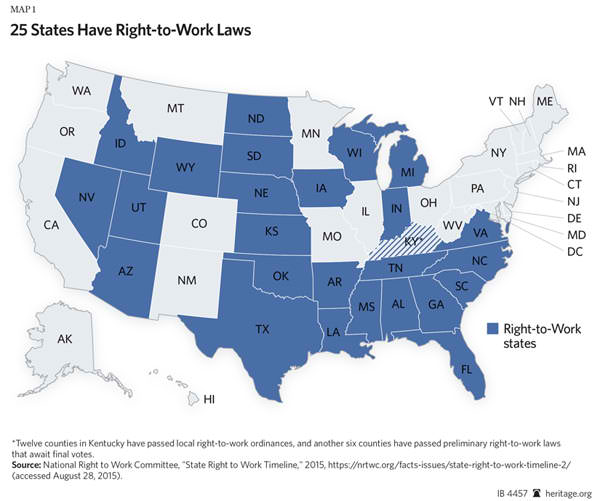

The National Labor Relations Act (NLRA) allows unions to negotiate contracts requiring workers to pay union dues. The NLRA also allows RTW laws that prohibit this compulsion. Twenty-five states have adopted RTW laws that make union dues voluntary. In the other 25 states, unions can force workers to pay union dues. Understandably, unions have much lower membership in states where workers can opt out of union membership. They represent 17 percent of workers in non-RTW states, compared to only 7 percent in RTW states.[1]

Unions and their advocates argue that, by reducing their membership, RTW laws reduce wages. They claim that weakening union power reduces the pressure on businesses to pay more.

In its new study, The Heritage Foundation has replicated the research that unions and some economists use to support that claim, and has found it fundamentally flawed, as it only partially controlled for cost-of-living differences among states.[2] Using the same model but fully controlling for price differences shows that RTW laws have no effect on private-sector workers’ purchasing power. Heritage did find that government employees make approximately 5 percent less in RTW states.

Different Living Costs

Workers earn lower nominal wages in RTW states. However, RTW states also have below-average living costs. As Map 1 shows, virtually the entire South has passed RTW laws; no Northeastern states have done so. The Northeast has higher costs of living than the South. In fact, all but one RTW state—Virginia—has living costs below the national average.[3] Consequently, the higher nominal wages in non-RTW states do not necessarily purchase more goods and services. Researchers need to account for differences in the cost of living among states to determine how RTW affects workers’ real purchasing power. Most academic studies that do this find that RTW has little effect on real wages.[4]

However, a new study from the Economic Policy Institute (EPI), a union-backed think tank, concludes that workers earn 3 percent less in RTW states, even after controlling for differences in living costs.[5] That study is fundamentally flawed.

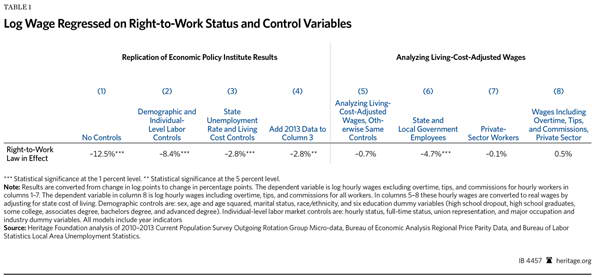

Table 1 shows how that study came to that result. In developing the table, The Heritage Foundation used the same data,[6] econometric model,[7] and control variables[8] to replicate the EPI findings. In Table 1, columns 1 through 4 replicate the main findings. Column 1 shows the raw difference in wages between RTW states and non-RTW states. Workers earn about 13 percent less in RTW states, taking nothing else into account. Column 2 adds demographic and individual-level labor market variables to the analysis. That reduces the RTW “penalty” to about 8 percent. Column 3 shows the researchers’ preferred specification, which adds state living costs and unemployment rates as control variables. Column 4 adds 2013 data; the earlier study only covered 2010 to 2012. Both columns 3 and 4 report workers earning approximately 3 percent less in RTW states.[9] That is essentially the EPI result. Unions have used that study to argue that Missouri, Kentucky, and West Virginia, among other states, should continue to force workers to pay union dues.

Accounting for Living Costs

That study has a serious flaw, albeit one invisible to most readers. The econometric model that drives the results in columns 3 and 4 only accounts for three-quarters of the difference in living costs among states.[10]

The model adjusts wages based on the cost of living in each state. But it only partially adjusts for these differences. Researchers have found that wages generally move one-for-one with living costs.[11] New Yorkers pay about 15 percent above the national average for goods and services.[12] They also earn about 15 percent above-average wages. The model to which unions point ignores about a quarter of this effect.

This artificially makes workers in RTW states—with below-average living costs—look like they have below-average real wages. The researchers claimed they accounted for cost-of-living differences, but their model does not fully do so.

A better approach is to adjust wages for purchasing power differences before running the model. This fully controls for differences in living costs among states. Column 5 of Table 1 shows how doing so changes the results.

This one change eliminates almost the entire negative relationship between RTW laws and wages. The estimate falls from 2.8 percent lower wages in RTW states to a statistically insignificant –0.7 percent. All the control variables remain the same between the economic models in columns 4 and 5. Column 5 differs only by analyzing real wages instead of nominal wages. Completely controlling for price differences eliminates the negative correlation between RTW and wages that unions allege.

Government Versus Private Sector

RTW laws affect wages differently in the private sector than in government. Unions contend that RTW reduces union membership and thus unions’ ability to pressure businesses to pay higher wages. In government, however, unions raise their members’ pay primarily by negotiating expensive contracts with friendly politicians. RTW reduces the amount of money that government unions can use to campaign for their political allies.

Because RTW laws affect wages through different channels in the government and in the private sector, analysts should examine them separately. Columns 6 and 7 show results of analyzing cost-of-living-adjusted wages separately for state and local government employees, and for private-sector workers.

Column 6 shows the results for government employees. State and local employees earn approximately 5 percent less in RTW states. This reduction in state government payrolls is an important economic benefit of RTW laws. State government employees in all but five states earn more than similarly skilled private-sector workers.[13] Private-sector workers should not pay excessive taxes so that government employees can enjoy higher living standards than they do.

Column 7 shows that RTW laws have an even smaller impact on private-sector wages than on the economy overall. Private-sector workers earn a statistically insignificant 0.1 percent less in RTW states than in non-RTW states.

Overtime, Tips, and Commissions

Column 8 shows a final specification. The EPI study used a wage measure that excluded overtime, tips, and commissions from hourly workers’ pay. Such performance-based compensation has become an increasingly large part of workers’ pay over the past generation—especially for non-union workers.[14] Column 8 shows the same calculation as column 7, but it includes overtime, tips, and commissions for all employees. This more inclusive definition of pay reverses the sign of the RTW coefficient. Using it shows that RTW laws are associated with 0.5 percent higher private-sector wages, a result that is not statistically significant. Fully controlling for living costs and including everything that private-sector workers earn shows that RTW laws have little effect on their wages.

Unions: Little Effect on Private-Sector Wages

Union allies argue that “RTW laws seek to hamstring union’s ability to help employees bargain with their employers for better wages, benefits, and working conditions.”[15] If so, RTW laws are wholly ineffective. Many workers opt out of union membership when union dues become voluntary. Nonetheless, real wages in RTW states are just as high for private-sector workers as they are in states with compulsory dues.

Policymakers have no economic justification for forcing workers to pay union dues. Workers who want to unionize have the right to do so. But the government should not force workers who see little benefit from union representation to purchase it.

—James Sherk is Research Fellow in Labor Economics in the Center for Data Analysis, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.