Introduction

We often hear that progressive promises will be paid for by “taxing the rich.” This is arithmetically impossible. Progressive promises are too expensive—and the amount of income earned by the rich is too small. Even using lower cost estimates, confiscating every dollar earned by every taxpayer with incomes of $200,000 or more (a very expansive definition of “the rich”) would only pay for about half of the progressive agenda. The reality is that progressive promises can only be funded by radical tax increases on the middle class, a dramatic increase in annual federal deficits and the national debt, or a combination of the two.

The Cost of Progressive Promises

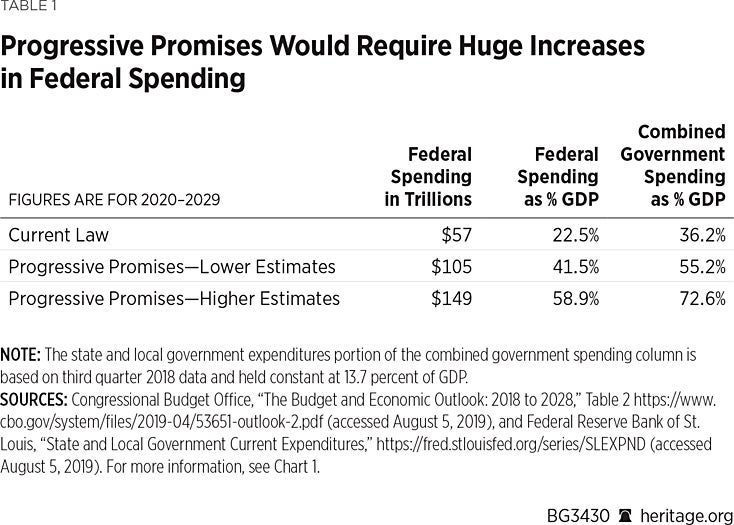

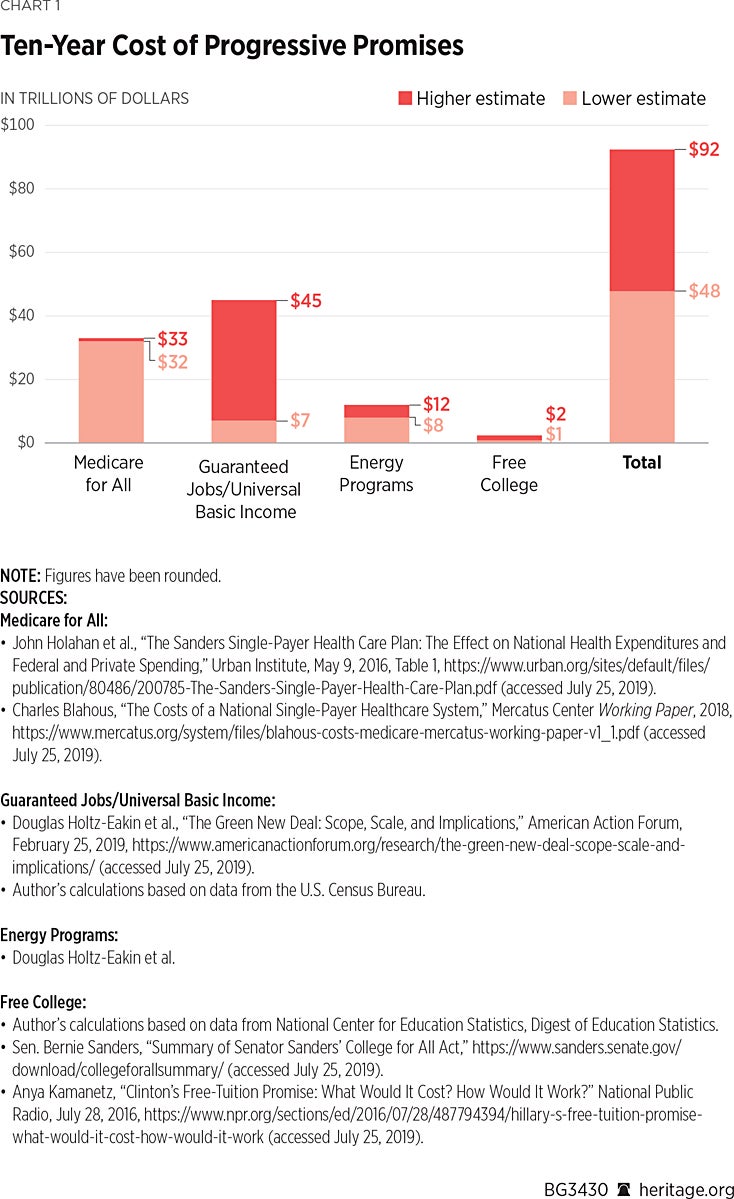

The new American progressive or socialist agenda would require nearly doubling federal expenditures. More expansive proposals could increase federal spending by 161 percent. The Congressional Budget Office (CBO) 10-year federal spending baseline projection is $57 trillion (approximately $12.4 trillion, or 22 percent of which will be debt-financed).REF Progressive proposals for single-payer health insurance would increase federal spending by $32 trillion to $33 trillion over 10 years,REF a 58 percent increase in federal spending.REF The “Green New Deal,”REF jobs guaranteesREF or a universal basic income,REF free college education,REF and other proposed programs would cost many trillions more. In the aggregate, to implement the programs that progressives or socialists have promised would cost approximately $48 trillion to $92 trillion. This would amount to an increase in federal expenditures of between 84 percent and 161 percent.REF The estimates vary in part because the nature, expansiveness, and expense of the programs vary by proposal and in part because different estimators employ different methodology.

10-Year Cost of Progressive Promises ($ trillions)

Over the 10-year period 2019–2028, the cumulative gross domestic product (GDP) is projected by the CBO to be $253 trillion.REF The current CBO baseline federal expenditures are projected to be $57 trillion, or 22.5 percent of GDP.REF

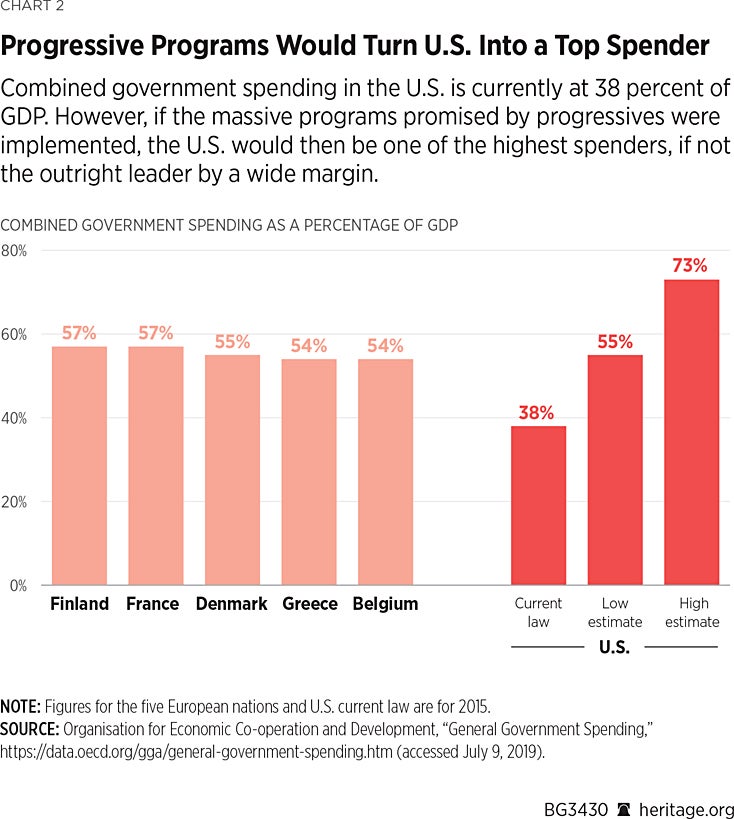

State and local governments currently spend 13.7 percent of GDP.REF Assuming state and local government spending and GDP remain constant, then combined government spending would reach 55 percent to 73 percent of GDP if progressive programs are implemented. (See Table 1.)

As shown in Chart 2, if the progressive agenda were to be implemented, then using lower-bound estimates, government spending in the U.S. would be higher than all other industrialized countries except Finland and France. If using the higher estimates based on more expansive programs and less conservative assumptions, then government expenditures in the U.S. would dwarf those in any other developed country.

Taxing the Rich

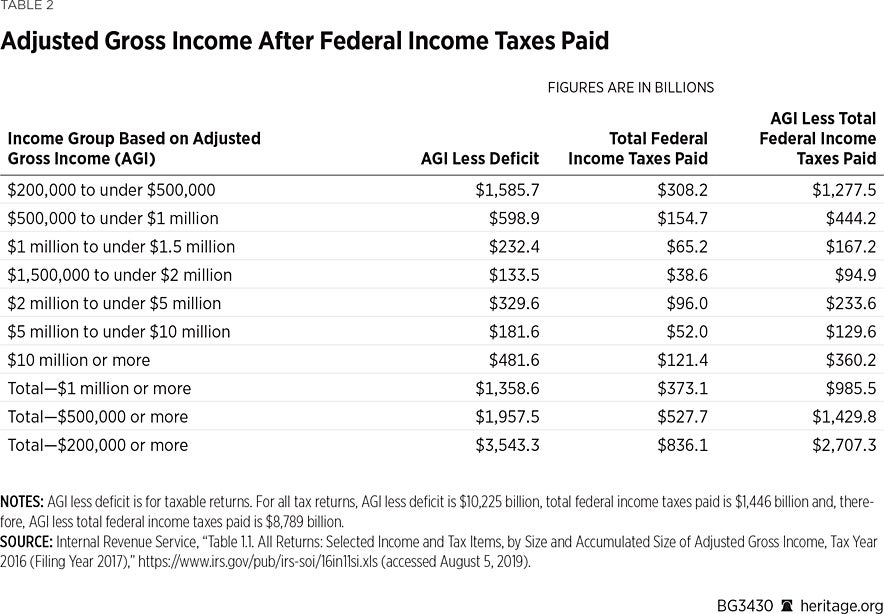

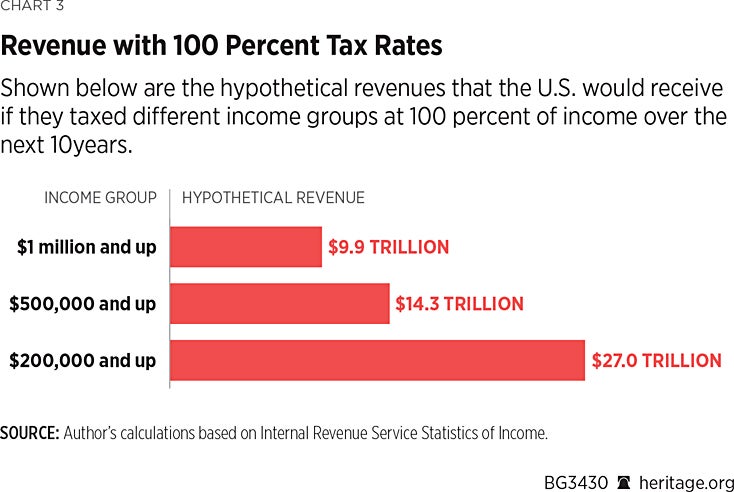

Data from the Internal Revenue Service Statistics of Income show that imposing a 100 percent flat tax with no zero bracket amount on those with incomes of $1 million or more would increase federal revenues by about $986 billion annually.REF Thus, a policy of confiscating all earnings of those with incomes over $1 million would not even eliminate the federal deficit, currently about $1.1 trillion annuallyREF—let alone pay for utopian progressive causes. This figure reflects taxation of all income, including the first $1 million, at 100 percent and does not consider federal payroll taxesREF or state and local income, property, and sales taxes (approximately $106 billion) already paid by this group.REF

Confiscating all remaining after-tax income of those with incomes of $500,000 or more would increase federal revenues by about $1.4 trillion annually. This assumes confiscation of their first $500,000 in earnings as well. This is enough to eliminate the federal deficit but not a great deal more. If, however, the federal government were to confiscate all remaining after-tax incomes of those earning $200,000, that would increase federal revenues by $2.7 trillion annually. (See Table 2.)

One-Time Revenue Increase

In reality, this would be a one-time revenue increase. Once such confiscatory taxes were imposed, these taxpayers would elect not to work, otherwise earn income, or realize capital gains upon reaching the relevant thresholds because they would keep none of it. In fact, once state and local income and payroll taxes were taken into account, earning additional income would actually cost these taxpayers money since the effective tax rate on incomes over the threshold would exceed 100 percent.

But even making the entirely fanciful assumption that they would continue to earn income with federal income tax rates alone at 100 percent, confiscating all of this income would not begin to pay for the progressive agenda. Multiplying the annual amounts by 10 to achieve an imaginary 10-year revenue increase would result in the following figures:

Thus, confiscating all income of all taxpayers earning $200,000 or more would only fund somewhat over half of the progressive agenda using the lower cost estimates from Chart 1.REF Using the higher cost estimates, a 100 percent federal tax on all taxpayers earning $200,000 or more would only fund 29 percent of the progressive agenda.REF

Corporate Taxes

The income of pass-through entities such as partnerships, limited liability companies, and S-corporations is reported on individuals’ Form 1040s and would therefore be included in the adjusted gross income figures above in Table 2. Similarly, dividends received from C-corporations or capital gains derived from the sale of C-corporation stock would be included on individual tax returns. C-corporation profits that are not paid as dividends would not be included in AGI.

Thirty-seven percent of corporate stock is owned by pension plans or other retirement accounts.REF Twenty-six percent of corporate stock is owned by foreigners.REF About 5 percent is owned by tax-exempt organizations.REF About 24 percent is owned by U.S. individuals in taxable accounts, and only some of these individuals are “rich.”REF Moreover, there is a growing literature that the U.S. corporate tax is disproportionately borne by U.S. workers since capital is mobile and labor is not.REF So corporate tax increases would disproportionately hurt U.S. workers and pension plans. But let us assume, in the furtherance of paying for the progressive agenda, this is deemed an acceptable cost.

According to the Commerce Department’s Bureau of Economic Analysis, corporate profits for the fourth quarter of 2018 were $2,311 billion (annual rate).REF Taxes on corporate income were $235 billion.REF Thus, after-tax profits were $2,076 billion. About 42 percent of these profits was earned by pass-through entities taxed by the individual income tax, including S-corporations and regulated investment companies such as mutual funds and real estate investment trusts. This income is taxed at the individual level. Fifty-eight percent ($1,208 billion) was earned by C-corporations.REF This income is taxed at the corporate level. Of these profits, $745 billion were paid as dividends and therefore also taxed by the individual tax system.REF Thus, $463 billion of after-tax retained earnings would be available for confiscation. Making the fanciful assumption that businesses and investors would continue their operations even with a 100 percent U.S. corporate tax rate, this implies a 10-year revenue increase of $4.6 trillion. This is enough to fund 10 percent of the progressive agenda using the lower estimates of its cost and about 5 percent of the higher estimates of cost.REF

An alternative means of arriving at an estimate is to examine CBO “options to reduce the deficit” estimates. The CBO estimates that the 10-year revenue increase from a one percentage point corporate rate increase would be $96.3 billion.REF Increasing the federal corporate tax rate by 79 percentage points to 100 percent would increase revenues by 79 times this amount ($7.6 trillion). This is enough to fund 16 percent of the progressive agenda using the lower estimates of its cost and about 8 percent of the higher estimates of cost. This method, however, implicitly assumes that corporate profits paid as dividends can be confiscated twice.

The Impact of the Progressive Agenda on the Middle Class

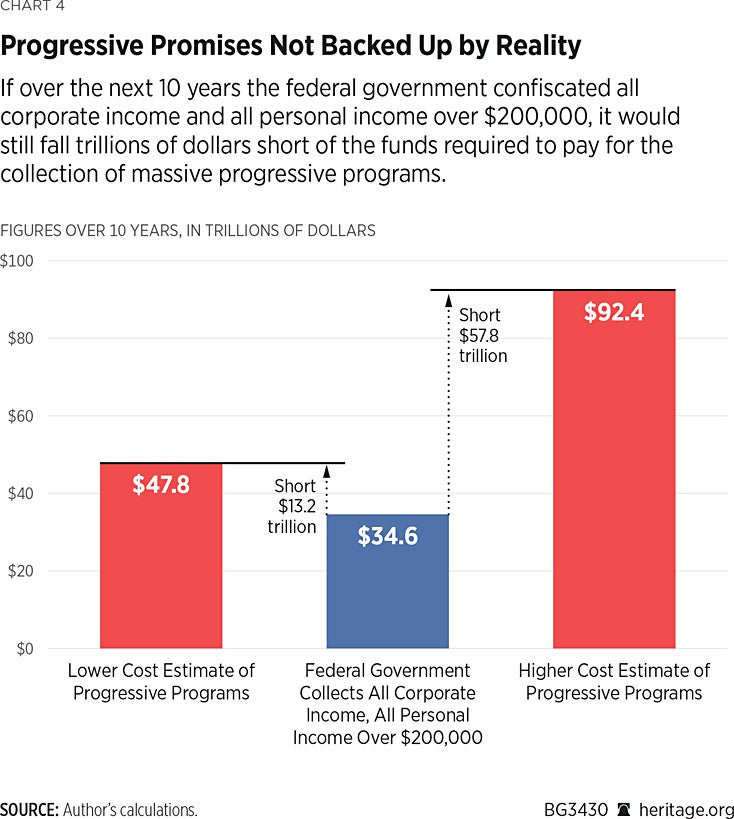

Thus, confiscating all income of all persons with incomes over $200,000 and confiscating the income of all corporations would raise—at most—$34.6 trillion, or between only 37 percent and 72 percent of the cost of the progressive agenda even in the fanciful world where people continue to work, save, and invest despite a 100 percent federal flat tax.

So how is the progressive agenda actually going to be paid for? The answer—the only arithmetically possible answer—is that the progressive agenda must be paid for by radical increases in the tax burden borne by middle-income taxpayers or dramatic increases in federal borrowing.

Federal borrowing, however, is already sufficiently high that the national debt is projected to grow relative to the size of the economy for the indefinite future.REF This is unsustainable and cannot continue indefinitely. Progressive policies, if enacted and debt-funded, would dramatically accelerate the day of reckoning. When the inevitable debt crisis occurs, taxes on the middle class will have to be raised radically.

Middle- and lower-income taxpayers do not currently bear a high federal income tax burden. In 2015 (the most recent year for which “share” data is available), the top 10 percent of U.S. taxpayers paid 70.6 percent of income taxes.REF The top quarter paid 86.6 percent of all income taxes.REF Middle-income taxpayers do pay substantial federal payroll taxes, but these taxes fund Social Security and Medicare, both of which are highly progressive once the benefit structure is taken into account.REF Moreover, Medicare taxes pay only about one-fifth of the cost of providing the program’s benefits for an average worker and three-fifths of the cost for a high-income worker.REF

Thus, even in the fantasy world where all income of those earning $200,000 or more and all corporate profits were confiscated and yet those individuals and businesses continued to earn the same income, the progressive program still comes up $13.2 trillion to $57.8 trillion short. (See Chart 4.)

Taxpayers with AGI of less than $200,000 annually paid $610 billion in income taxes in 2016.REF Ten times this amount gives a 10-year figure of $6.1 trillion. To fund the lower cost-estimate shortfall, it would be necessary to increase middle-income taxes by $13.2 trillion to three times their current level (an increase of 216 percent).REF To fund the higher cost-estimate shortfall, it would be necessary to increase middle-income taxes by $57.8 trillion to ten-and-one-half times their current level (an increase of 948 percent).REF In the real world, the necessary middle-income tax increases would be radically more since the hypothetical $27 trillion from a 100 percent flat tax will never materialize. Only a small fraction of it can be raised from taxing high-income taxpayers.

The European Experience

The European experience with large welfare states demonstrates that socialist or highly progressive policies must be funded by imposing very high consumption, payroll, and income taxes on the middle class. Notwithstanding the “tax the rich” rhetoric from progressive and socialist politicians, there simply is no alternative to dramatically raising middle-class taxes if the progressive agenda is to be implemented.

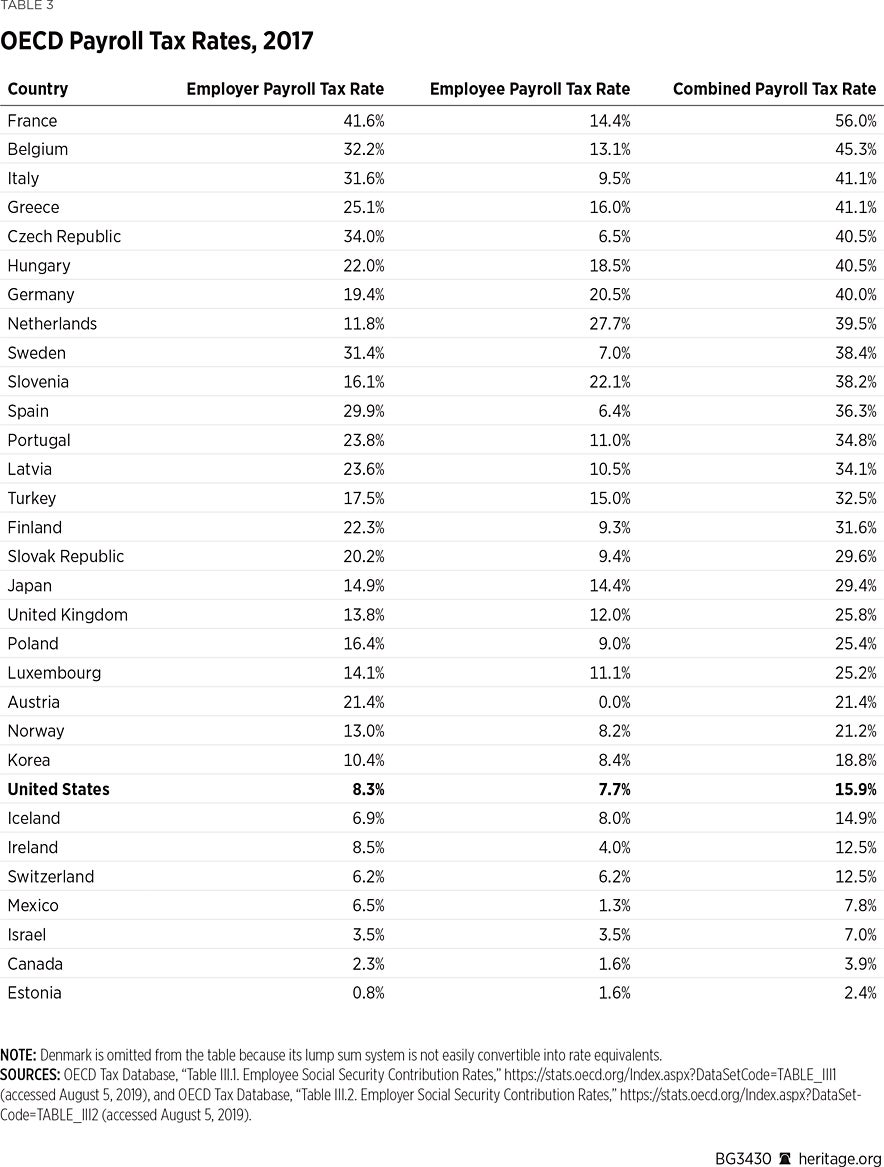

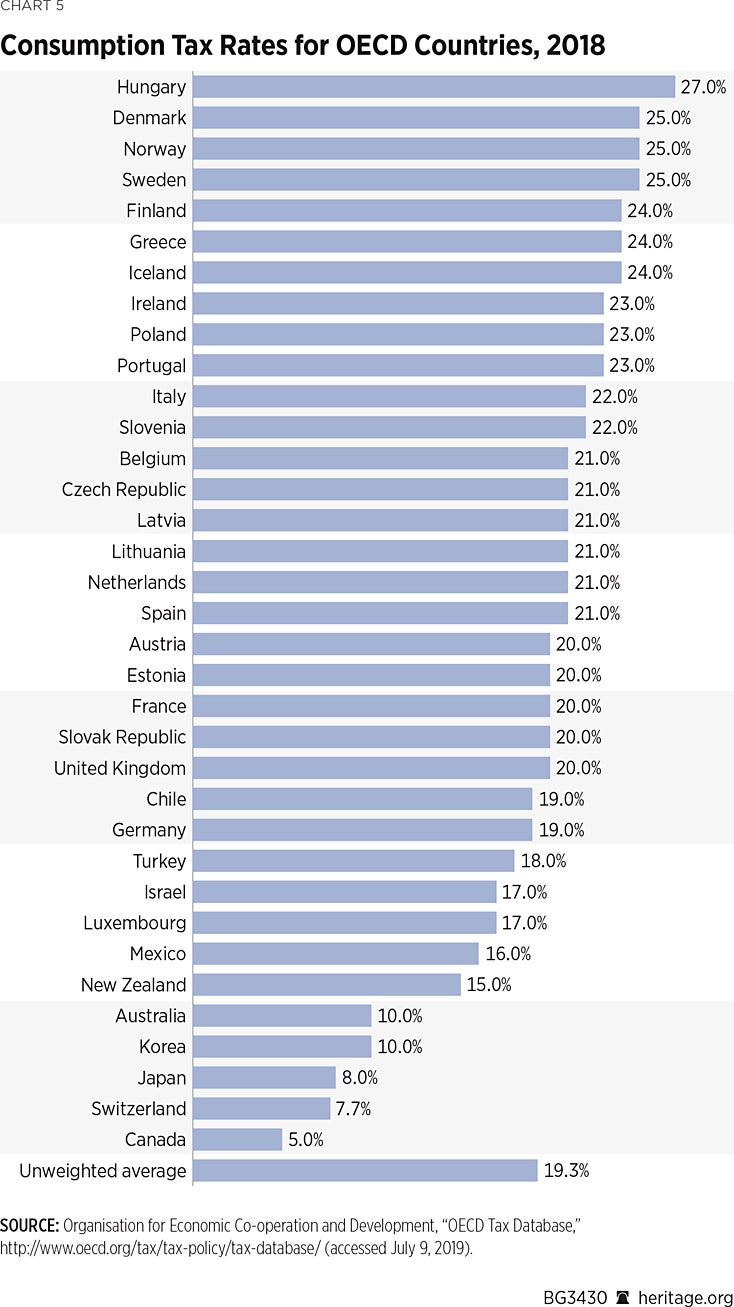

Table 3 illustrates that most European countries have payroll taxes that are two to three times as high as U.S. payroll taxes. Chart 5 illustrates that they also have high rate-consumption taxes called value-added taxes (VATs) or goods and services taxes (GSTs). In the European Union, VAT rates range from 17 percent to 27 percent. And, of course, they all have relatively high individual income taxes. Switzerland, which is not a member of the European Union, is the European exception. It has both relatively low rates of taxation and relatively low government expenditures.

In the United States, many states have sales taxes that are administratively simpler versions of VATs or GSTs. California has the highest state-level tax at 7.25 percent.REF

The reason that European countries have high VATs and high payroll taxes is simple: Those governments face the same arithmetic reality as does the U.S. It is quite literally impossible to pay for progressive or socialist promises by taxing the rich. It will require genuinely massive increases in the taxation of the American middle class.

Conclusion

It is arithmetically impossible to pay for progressive promises by “taxing the rich.” Progressive promises are too expensive, and the amount of income earned by the rich is too small. Even using lower cost estimates, confiscating every dollar earned by every taxpayer with incomes of $200,000 or more would only pay for about half of the progressive agenda. And that figure is based on the false assumption that people would continue to work, save, and invest when subject to a 100 percent flat tax. The reality is that progressive promises can only be funded by radical tax increases on the middle class or, for a limited time, dramatic increases in federal borrowing.

Even in the fantasy world where all income of those earning $200,000 or more and all corporate profits were confiscated and yet those individuals and businesses continued to earn the same income, the progressive program still comes up $13.2 trillion to $57.8 trillion short. To fund the lower cost-estimate shortfall, it would be necessary to increase middle-income taxes by $13.2 trillion to three times their current level (an increase of 216 percent). To fund the higher cost-estimate shortfall, it would be necessary to increase middle-income taxes by $57.8 trillion to 10.5 times their current level (an increase of 948 percent). In the real world, the necessary middle-income tax increases would be radically more since the hypothetical $27 trillion from a 100 percent flat tax will never materialize. Only a small fraction of it can be raised from taxing high-income taxpayers.

David R. Burton is Senior Fellow in Economic Policy in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom, at The Heritage Foundation.