What is pro-growth tax reform? It hinges on the notion that people will spend their money more carefully and more productively than the government will. Letting people keep more of their earnings will therefore result in more productive spending, growing the economy and benefitting the nation and the people as a whole.

But there’s a fly in the ointment. It’s hard to roll back taxes without helping the people who pay taxes — and that bothers some people, who think it’s wrong to lessen the tax burden on people who earn more than they do.

However, those are the folks who pay most of the taxes. The top 1 percent of earners pay 40 percent of all federal income taxes; the top 10 percent pay 70 percent. Meanwhile, the bottom half of taxpayers kick in only 3 percent of federal income taxes.

Many of America’s wealthiest taxpayers are actually small businesses — S corporations or partnerships who file taxes under the individual tax code. According to the latest data from the IRS, such “wealthy” businesses making more than $200,000 per year account for nearly half of all income generated by small businesses.

The tax code should encourage small firms, not try to bleed them dry. After all, new businesses — most of which start out small — are the primary driver of economic growth and job creation in America. But slapping high taxes on work and investment discourages work and investment, which means fewer jobs, lower incomes and reduced productivity.

It’s nearly impossible to help the economy grow without encouraging more work and investment from the economy’s top producers, employers, and innovators.

How about taxpayers who aren’t wealthy or don’t own businesses? Slashing rates for middle-income families would boost growth by encouraging those taxpayers to work more, spend more, and save more. However, the biggest bang for the buck comes from reducing the top marginal tax rates. That’s where you can free up the big money to spark innovation, entrepreneurship, and investment that creates jobs and opportunities across all income groups.

People are more willing to take the risks inherent in starting a business or investing in new technology when the potential rewards are higher. When government confiscates more than 50 percent of earnings, investors, entrepreneurs, and workers have a lot less incentive to spend more time, money, and effort on growth-enhancing activities. Top rates on small businesses exceed 50 percent in several states, including California, New York, and Hawaii.

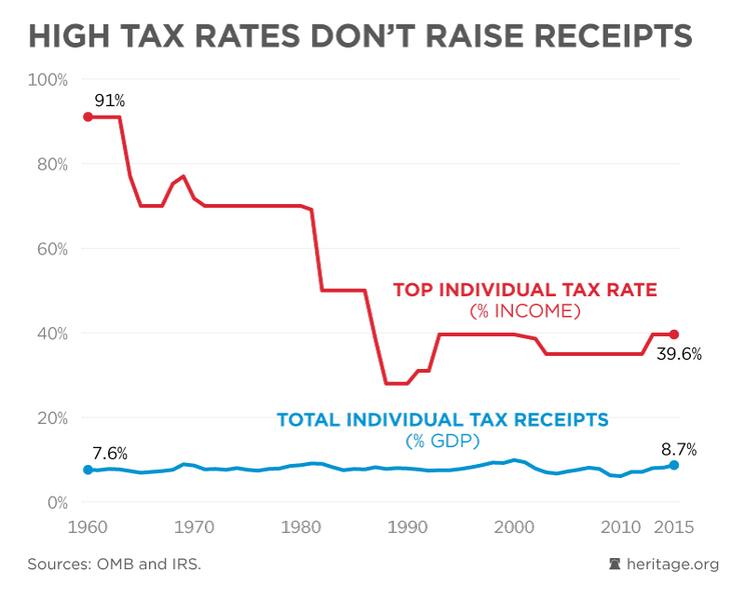

Not surprisingly, higher top marginal tax rates don’t necessarily lead to higher revenues, nor do lower top rates always lead to lower revenues.

Lower top marginal rates can help sustain small businesses. About one in three small firms fails within the first two years; only about half last as long as five years. In part, that’s because small-business profits can fluctuate significantly, particularly in the early going.

A new company may have a great first year, raking in $500,000 in profits, only to experience growing pains the next year and report a loss. If taxes were lower, small businesses would be better equipped to maintain operations — such as making payroll and paying rent — through trying times.

The current GOP tax reform package would reduce the rate on small business pass-through income to about 25 percent and the top marginal rate to 35 percent. (Both are currently 39.6 percent.) Critics revile this as a big tax cut for the “wealthy.” What they fail to mention is that it would also provide huge benefits — including more jobs and higher wages — to workers across all income groups.

Policymakers who want pro-growth tax reform should not focus on who gets the largest tax cuts. What matters is which tax cuts will produce the biggest economy. In the long run, a bigger economy — one that delivers more jobs, greater productivity, and higher incomes across the board — will be a tremendous boon for virtually all American workers and their families.

This Piece originally appeared in Real Clear Policy