The 2016 presidential campaign is already well underway. As it progresses, candidates seeking the presidency will increasingly face questions about how they would address federal tax policy. Foremost among them will be how they will pursue tax reform should they become President. They will be asked whether they favor it, why, and to explain their own reform plans.

There is clear public support for major tax reform: 71 percent of the American public believes that the U.S. tax system “needs major changes and reform.” Only 5 percent think the tax system is “working just fine”; 75 percent believe that “taxes should be kept as low as possible to stimulate investment and growth.”[1]

Tax reform is a complicated issue that encompasses a wide variety of sub-issues with which candidates will need to grapple if they are to answer those questions effectively. The following discussion will help them prepare.

Principles of Tax Reform

- The tax system should raise the revenue necessary to fund a limited government at the lowest level possible for constitutionally appropriate activities. In particular, the tax system should: (a) apply the least economically destructive forms of taxation; (b) have low tax rates, on a broad tax base; (c) minimize interference with the operation of the free market and free enterprise; and (d) minimize the cost to taxpayers of compliance with and administration of the tax system.

- The tax system should minimize its adverse impact on the core institutions of civil society.

- To help preserve the rights to life, liberty, and property, the tax system should: (a) impose no unreasonable burdens; (b) apply consistently, with special privileges for none; and (c) afford due process to respect taxpayer rights.

- The entire tax burden imposed (including all forms of taxation) should be transparent and understandable to taxpayers.

- No aspect of the existing tax system should be immune to change, given the complexity and economic incoherence of the existing tax code.

Why America Needs Fundamental Tax Reform

The country needs tax reform because the tax code stifles economic freedom, preventing the economy from being vibrant and prosperous. Fundamental tax reform would alleviate the harm caused by the tax system and significantly increase the size of the economy. This stronger economic growth would substantially improve the incomes of all Americans and enhance economic opportunities.

The current tax system harms the economy for many reasons—tax reform based on sound principles would address each of them.

High Marginal Tax Rates. Tax rates for families, individuals, businesses, and investors are too high. After the fiscal cliff tax increase in early 2013, Americans in some states now pay marginal tax rates exceeding 50 percent. That rate includes just a family’s federal and state income taxes, not the myriad of other taxes they pay. Such high marginal rates discourage work, savings, investment, and entrepreneurial risk taking—the building blocks of economic growth. By reducing incentives to engage in them, the tax code reduces the size of the economy.

Improper Tax Base. The current tax base causes double taxation of savings and investment and is therefore biased against savings and investment. This bias reduces the amount of investment in the economy, which reduces productivity growth, real wages, and employment.

Income that is saved or invested is taxed, and the return on that savings or investment is then taxed again. Moreover, income from investments in corporations is double taxed again—first at the corporate level and then when individuals receive dividends or pay capital gains stock on corporate stock. By double or treble taxing saving and investment at high rates, the tax code deters families from saving for retirement, education, a rainy day, or for any other purpose they desire. This bias against savings and investment results in less capital formation, a less productive economy, and lower real wages.

Picking Winners and Losers. A further problem with the tax base is that Congress has loaded it with too many politically motivated credits, deductions, and exemptions. These provisions inhibit economic growth by eroding the tax base, which necessitates higher tax rates for other activities in order to raise a certain level of revenue. They also alter the decisions of families and businesses. Market forces should determine those decisions, not Washington lawmakers. When government policy picks winners and losers in such a way, it reduces economic efficiency because resources are not put to their highest-valued use. The economy suffers because of the distortion. The most glaring example of such policies are the myriad of tax breaks for the production and consumption of politically favored types of energy and energy-efficient products.

Anachronistic Business Tax System. The way the tax code treats business is the biggest inhibitor of growth in the tax code today. The U.S. has the highest corporate tax rate of any country in the Organization for Economic Co-operation and Development (OECD)—the 34 most industrialized countries in the world. The federal rate is 35 percent and states add over 4 percentage points on average for a combined rate of 39.1 percent. However, rates in some states are much higher than the average. Businesses in those states face a combined rate well in excess of 40 percent. For instance, the rate in California is 8.84 percent, so businesses there pay a total rate of almost 44 percent. High rates make it unattractive for businesses, both foreign and domestic, to locate new investment in the U.S.

Further inhibiting investment is the fact that the U.S. is effectively the only developed nation that taxes its businesses on the income they earn in foreign countries. This taxation creates another disincentive for U.S. businesses to invest,[2] which further suppresses wage growth and job creation for American workers. The worldwide system also makes it attractive for foreign firms to buy U.S. firms, or for U.S. firms to merge with foreign corporations and move the new company’s headquarters abroad—as was the case in the spate of inversions in 2014.[3] In either case, the new business moves its headquarters and legal domicile abroad to avoid the impact of U.S. worldwide taxation.

The U.S. also has one of the worst systems in the industrialized world for businesses to deduct the cost of investments. The U.S. tax code denies businesses the ability to deduct the full cost of investments at the time businesses make them. Instead, the code applies a cumbersome depreciation system that forces businesses to deduct the cost of investment over many years—sometimes as many as 39. This raises the cost of investing because of the time value of money. Less investment due to those higher costs hurts productivity gains, wage growth, and job creation.

Small businesses face enhanced bias under the current system. After the 2013 tax increases, small business owners now pay a top federal income tax rate of 39.6 percent, and an additional 3.8 percent investment surtax that became law as part of Obamacare. It pushes the top federal tax rate on small business income to 43.4 percent. Large corporations pay a federal tax rate of 35 percent. This disparity is unfair to small businesses and puts them at a disadvantage against their larger competitors.

Complexity and Compliance Costs. The tax code is absurdly complicated. The arrival of personal computers and tax software has permitted the creativity of policymakers in Washington to run amok, creating tax complexities far beyond what even tax professionals could manage unaided by electronics. There are a multitude of credits, exemptions, and deductions, many of which are subject to special rules and phase-out[4] over different levels of income. As if this was not bad enough, there is a parallel tax called the Alternative Minimum Tax (AMT), as well as the payroll and self-employment taxes that fund Social Security and part of Medicare. All of this complexity imposed on individual taxpayers is relatively minor compared to the torturous rules and exceptions that businesses must suffer. These compliance costs have a disproportionately adverse impact on small and start-up businesses, which are ill-equipped to spend the resources necessary to deal with this absurd complexity. The compliance costs associated with the income tax have been estimated to be in the range of $125 billion to $400 billion. These costs remove productive resources from the economy and are effectively a hidden tax on families and businesses.

The Elements of Sound Tax Reform: What Reform Should Achieve

Tax reform based on the five principles detailed above would fix the problems laid out above and, therefore, dramatically improve the economy. To fix those problems properly, tax reform would have to meet certain economic objectives, while keeping non-economic objectives in mind as well.

Economic Objectives. Tax reform would greatly enhance economic performance by accomplishing five major economic objectives:

-

Lower individual and business tax rates. Tax reform must lower rates, in particular the top marginal rates, to strengthen the economy by improving incentives to work, save, and invest.

-

Establish the right tax base. Often overlooked in the tax reform debate is the fact that defining the tax base (what the tax code taxes) is as important as lowering the tax rate. Lowering rates is important, but if lower rates apply to an improper base, tax reform would then have no net benefit for the economy. Worse, if the tax base is structured poorly enough, tax reform would be a net negative for growth. The right tax base is consumption (defined in detail under “The Four Ways to Achieve Fundamental Tax Reform”), rather than the hybrid income-consumption tax base the current system uses.

-

Eliminate the bias against saving and investment. Tax reform must reduce, and ideally eliminate, the bias against saving and investing caused by double taxation. Taxing the right consumption tax base would go a long way toward accomplishing this since it should eliminate the double taxation of capital gains and dividends, and allow businesses to deduct their capital costs when incurred. Tax reform should go further by lowering the corporate tax rate and moving to a territorial and border-adjusted tax system, which is also necessary for eliminating the bias against savings and investment.

-

Eliminate tax preferences. More work is necessary to ensure that the base is neutral and does not pick winners and losers. That means that tax reform should eliminate any deductions, credits, and exemptions that are not economically justified. Tax reform should eliminate unjustified policies that Congress intended to benefit particular industries, such as those aimed at aiding particular energy sources. The best way to avoid these problems is to start tax reform by defining a proper base and maintaining it.

-

Simplify the tax system and make it more transparent so that taxpayers understand how much they pay to fund the federal government. Washington can help reduce the size of government by making the cost of government more apparent to the American people. Because of income and payroll tax withholdings, and the hidden costs of corporate, employer payroll, and excise taxes, most Americans have little idea how much they are paying to fund the federal government or how proposed policy changes will affect them. The sheer complexity of the system makes it difficult to understand the true impact of the tax system. Tax reform should strive to make that cost explicit to taxpayers. Once taxpayers know how much of their hard-earned income goes to the federal government, they will be more willing to reduce the size of government since they will better understand its cost to them. A transparent code would be simpler than the current system. Simplicity aids not only the goal of transparency (because taxpayers understand the system), but also the economic goal of lower compliance costs.

If tax reform achieved these objectives, the economy would enjoy sizeable gains. Although empirical work on the economic benefits of tax reform has been light in recent years, a recent analysis by the Tax Foundation[5] shows the economy could improve significantly from pro-growth tax reform that selects the correct tax base and administers a low, flat rate.

According to the Tax Foundation analysis, the economy could grow as much as 15 percent over 10 years because of tax reform. After those 10 years, the average American family’s wages would rise by almost 10 percent.[6] That would be an extra $5,000 in the pockets of families earning $50,000 per year, roughly the median income in the United States. This is broadly consistent with many earlier estimates of the gains to be had from fundamental tax reform.[7 ]

A stronger economy also plays a vital role in improving state, local, and federal government finances. It means higher tax revenues and lower spending needs for those temporarily distressed from unemployment. A stronger economy means better wages for all Americans. Better job opportunities are also the most powerful antidote to persistent poverty; and with less poverty comes fewer demands for anti-poverty spending.

Non-Economic Objectives. Tax reform plans should also be designed with non-economic objectives in mind. Any reform plan should limit the tax system’s adverse impact on the core institutions of civil society, including the family and voluntary civic associations, such as religious and educational institutions, charities, and community organizations.

A just political order protects individuals’ natural rights to life, liberty, and property. A just tax system adheres to this principle by imposing an equitable and reasonable burden on taxpayers, with special privileges for none, and respecting taxpayer rights to due process.

The Four Ways to Achieve Fundamental Tax Reform

There are long-standing debates about which type of tax reform plan can best deliver the objectives laid out above. Those plans generally have more in common with each other than is usually understood. In fact, the best and most popular tax reform plans use the correct consumption tax base and have identical economic effects. They vary only in how taxpayers pay them. A useful way to understand their variations is to think of them as distinct software programs used to execute the same function. They all execute that function equally well, but they interact with their users (taxpayers) differently.

For many, a consumption tax means a retail sales tax such as the one that most states levy. However, a consumption tax is any tax on income that is spent on consumption, and excludes income that is saved or invested. Consumption taxes do not include the estate and gift tax, also known as the death tax. There are several plans that fit this mold, including:

- The traditional flat tax (often referred to as the Hall–Rabushka flat tax);[8 ]

- The New Flat Tax (also known as an expenditure, or consumed-income, tax);[9 ]

- A business transfer tax (BTT);[10] and

- A national sales tax.[11 ]

Any sound tax reform plan will either adopt one of these approaches or a combination of two approaches or move the current tax system substantially in that direction.

1. Traditional Flat Tax. To arrive at a consumption base, the traditional flat tax starts on the business side. Businesses take their gross income from the sale of goods or the provision of services. It then subtracts from that amount all costs for inputs into their product, including investments in capital—such as machines, equipment, and structures. Businesses also deduct their labor costs. They are taxed at a flat rate on the remainder. Businesses only pay tax on their domestic income.

Families and individuals pay a tax on their labor income, which is mostly the wages that businesses pay them. They, too, pay a flat rate, after a standard deduction that prevents taxation of incomes below a certain amount (the poverty level, for example). Savings and investment are treated like Roth individual retirement accounts (IRAs) under the current system. Individuals accumulate savings after they pay taxes on their earnings, hence later withdrawals from the account are not taxable. Accumulations during intervening periods are not taxed, nor are there taxes on capital gains and dividends.

Financial transactions are disregarded when determining taxable income for both individuals and businesses. Thus, interest is neither taxed nor deductible.

The traditional flat tax is a consumption tax because the overall tax base is the value of all goods and services less investment.

2. The New Flat Tax. The New Flat Tax is similar to the traditional flat tax. The business tax is identical. The key difference between the two is on the individual side. The New Flat Tax has one rate for labor income, minus the amounts that families and individuals save. It uses the traditional IRA treatment for savings, which allows families to save with pre-tax dollars. The savings can be invested and grow tax-free. There are no capital gains or dividends taxes. People pay tax when they withdraw the savings.

Unlike the traditional flat tax, the New Flat Tax has deductions for charitable contributions and an optional mortgage interest deduction (where interest is deductible but taxable to the lender). The traditional flat tax could be modified to include these features, and the New Flat Tax could eliminate interest deductions altogether by exempting all interest income from taxation.

Like the traditional flat tax, the New Flat Tax is a consumption tax. It taxes only income that people have spent, which equals consumption.

Under both the traditional and new flat taxes, the existing payroll tax would be redundant because it is essentially a flat tax, too; it can be rolled into either flat tax.

3. Business Transfer Tax. A business transfer tax (BTT) would be imposed on all businesses, not on individuals except those who are sole proprietors (who would be subject to the BTT on their business income). The tax base would be revenue from the sale of goods and services minus purchases of goods and services from other businesses. Wages paid to workers are not deductible. The proposal by Senators Sam Nunn (D–GA) and Pete Domenici (R–NM) in the 1995 USA Tax Act included a BTT.

A BTT would expense capital costs. The purchases of capital goods (such as machinery and equipment) would be deductible, as would be all other purchases of goods and services.

Financial transactions (such as interest, dividends, and capital gains) are not relevant to calculating the taxable base. This is a major simplification. Many of the most problematic issues with an income tax or cash flow tax simply disappear. This is equally true of the traditional flat tax and a sales tax.

All BTTs that have been introduced are territorial and border-adjusted. Thus, income earned outside the U.S. is not taxed. Moreover, revenue from exports is excluded from the taxable base, and imports sold in the U.S. are subjected to the same tax as U.S.-produced goods.

4. National Sales Tax. A national sales tax would tax consumption directly by taxing the sales of goods and services to consumers. Intermediate (business-to-business) sales and investment goods would not be taxed. If they were, the tax would cascade (a tax on a tax), which raises their prices and hides the amount of tax that people pay. Both the proposed FairTax and its predecessor[12] have the correct tax base (all consumption goods and services but no intermediate or investment goods or services).

Businesses would collect and remit the sales tax, filing monthly sales tax returns. Both proposals provide a small credit to compensate businesses for this cost. Individuals would file no tax returns. Both sales tax proposals are progressive because they provide each family with a monthly rebate equal to the sales tax rate, times the annual poverty level, divided by 12. Thus, every family is effectively exempt from spending up to the poverty level.

A sales tax by its nature exempts exports from tax, and taxes goods produced abroad and in the U.S. alike. A sales tax should not treat contributions to charities as the purchase of charitable services, which is analogous to a charitable deduction.

The FairTax repeals payroll taxes and therefore has a higher tax rate than its predecessor (which did not repeal payroll taxes).

Other Considerations Tax Reform Must Address

There are many important issues that any tax reform plan would need to address. Although these issues do not receive as much attention as tax rates, tax reform must get them correct in order to maximize growth. They include:

- Which taxes to replace. In addition to the individual and corporate taxes, there are a host of other taxes, including a variety of excise taxes, customs fees, and the estate tax. The biggest tax is the payroll tax. Tax reform would need to consider what it would do to these other taxes.

- Revenue. Tax reform should not be used to raise taxes on Americans. It should pick an explicit revenue target, such as the historical revenue average, and adhere to it. Since the Congressional Budget Office (CBO) estimates that revenue will be above its historical average on its current trajectory, tax reform should at least lower taxes back to that level.

- Additional tax systems. There is frequent talk by some that the U.S. needs to levy a credit-invoice value-added tax (VAT). In addition to not raising taxes, tax reform should not add new tax systems on top of the existing ones. Another tax system would increase complexity and likely allow the federal government to extract higher taxes from American taxpayers.

- The family. The tax code should not have a marriage penalty. It should also include allowances for families with children that help eliminate tax on incomes below certain amounts and reflect the contributions parents make to the future prosperity of the country. Their necessity must be weighed against how much higher tax rates would rise because of them, and their tendency to remove many taxpayers from the tax rolls entirely.[13]

- Health care. Employer-provided health insurance should not be tax preferred. However, the exclusion of employer-provided health insurance has been part of the tax code for approximately 70 years. Thus, changes to it will have tax and health care implications.

- Charitable contributions. Allowing money to flow to core charitable and educational institutions on a pre-tax basis is sound policy. A robust civil society is a critical component of a free society. The contours of this deduction depend on the type of tax system implemented. There is a need to rethink the current legal treatment of both the underlying exemption and the tax treatment of business income, unrelated to the exempt purpose of the organization. There are nearly three dozen categories of tax-exempt organizations in the tax code. Many of these are multibillion-dollar organizations that run large businesses, such as AARP, Harvard University, and the NFL.

- Education. There are a host of deductions and credits in the existing tax code for educational expenses. Tax reform should reduce complexity by consolidating them into a simple policy that reflects the importance of human capital formation.

- International issues. Tax reform should create a system that is both territorial (only taxes income that businesses earn within the U.S.) and border-adjusted (to equate the tax burden on foreign and U.S.-produced goods both in U.S. markets and in foreign markets). The U.S. government should only tax economic activity in the U.S. It should also stop taxing individual Americans on their income earned abroad.

- Interest. How the tax code handles interest is a frequent topic of misunderstanding. If interest income is taxable to lenders, it should be deductible to borrowers. If interest is not taxable, it should not be deductible. Either treatment keeps taxes from influencing decisions to issue and take on debt.[14] Getting this issue right is important in tax reform because, if done incorrectly, it could have serious negative ramifications for the economy. A consumption tax can employ either treatment; however, it is likely that not taxing interest and denying a deduction can allow a larger rate reduction because of the large number of non-taxable lenders.

- State and local taxes. A deduction for state and local taxes makes sense because families cannot spend the money they use to pay those taxes in the private market. However, the deduction has the adverse impact of encouraging larger state and local governments. In addition, the deduction encourages consumption through the medium of state and local government.[15] Therefore, it is probably best for tax reform to abolish the deduction and use the revenue gained to reduce federal marginal tax rates.[16]

- Income support. The Earned Income Tax Credit (EITC) encourages work and helps low-income families. It is a welfare program, however, that should be reformed in the context of broader welfare reform.

- Taxation of government benefits. Current law generally exempts government benefits from taxation (except up to 85 percent of Social Security benefits for higher-income taxpayers and unemployment benefits). This understates the income of benefit recipients and magnifies the value of these benefits compared to income generated from work. Tax reform, in conjunction with reform to assistance programs, should contemplate whether to include those benefits as taxable income, which they rightfully are. If the benefits are excluded, the Treasury Department and the Joint Committee on Taxation should include them on their tax expenditures lists.

- Government consumption. Government consumption—federal, state, and local—is about one-third of the economy annually. The tax system should not provide an incentive to consume through government rather than privately. A tax system that taxes government employee wages generally does not create such an incentive. A sales tax or BTT needs to impose a separate tax on government purchases to ensure neutrality.

- Government enterprises. Government enterprises, such as Amtrak, commuter rail, mass transit, the Postal Service, government-owned utilities, and recreation centers, should be taxed just like their private-sector counterparts, and subsidies to these entities should be treated as taxable receipts.

- Transition issues. This seemingly technical issue involves trillions of dollars, and addressing it correctly will be a major factor that determines whether the business community and others support tax reform. The biggest single issue is the treatment of costs that businesses have not yet deducted from their income (notably equipment and structures), unused foreign tax credits, and net operating losses that they have not yet been able to deduct from income (carry forwards). Accounting treatment of deferred tax assets and liabilities in transition is vitally important to public companies. The revenue loss associated with transition rules can necessitate large rate increases over the intermediate term unless countervailing taxes are imposed on windfall gains.

- Financial intermediation services, financial institutions, and insurance companies (mutual and investor-owned). Financial intermediation services should be taxed just like other services. Doing this right is complex (but simpler than current law) and needs to be done differently in all four fundamental tax reform plans.

- Taxation of gambling. Casinos and lotteries (including state-operated lotteries) should be taxed just as other businesses are taxed. Specific rules may be required to accomplish this result, depending on the plan. Net gambling winnings are income and should be taxed to individuals.

- Taxation of pass-through entities (including S corporations, cooperatives, REITS, and RICs—such as mutual funds). Most small businesses and about half of private-sector gross domestic product are taxed as pass-through entities (such as partnerships, LLCs, and LLPs), which means that the business income is taxed on their owners’ tax returns. Tax reform should also ensure that these businesses pay the same rate as businesses that pay the corporate rate and should not expand double taxation to their income.

Conclusion

No matter what type of tax reform plan Congress institutes, a revenue collection agency will remain necessary to enforce the system. Whether that is a reformed Internal Revenue Service (IRS), or a new agency created in its place, is up to Congress. Changes to the IRS are essential because of its recent misdeeds. Each of the tax reform plans described here would aid Congress in reforming the IRS. Since each of them would make enforcing the new tax code simpler than under the current system, they would all allow a considerably smaller revenue agency.

Tax reform is essential to restoring economic prosperity for American families. The best way to maximize growth is for tax reform to establish a tax system with low rates that apply to consumption. There is more than one way to achieve a consumption base. Presidential candidates should understand this as they form their positions on tax reform.

—Curtis S. Dubay is Research Fellow in Tax and Economic Policy, and David R. Burton is Senior Fellow in Economic Policy, in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.

Appendix

The Equivalence of Consumption Tax Bases

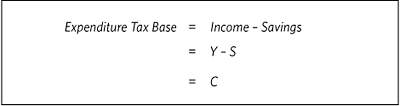

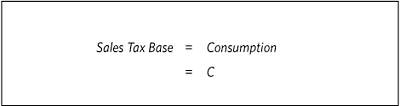

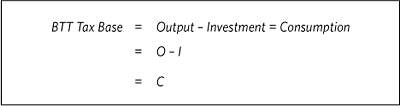

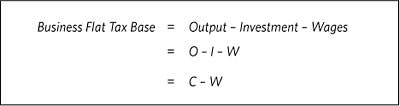

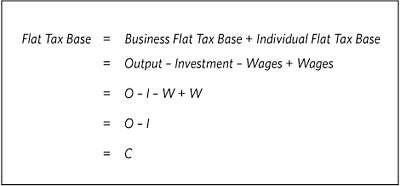

In the following discussion,[17] the tax bases for the four types of consumption taxes are expressed as an equation, with the following variables: C (Consumption), O (Output), I (Investment), W (Wages), Y (Income), and S (Savings).

Retail Sales Tax. A sales tax taxes the consumption of goods and services when sold to consumers:

Business Transfer Tax. Output is the value of all goods and services produced. Output (goods and services) is either consumption of goods and services or investment. Output would be measured as the gross receipts from the sale of goods and services by businesses. Investment would be the purchase of capital goods. Financial receipts and disbursements (such as interest and dividends) would be disregarded. The tax base is output (the value of all goods and services produced) less all intermediate and capital goods (investment) that produced the output (consumption):

The Traditional Flat Tax. In effect, the traditional Hall–Rabushka flat tax is the same as a BTT, except that businesses may deduct wages paid:

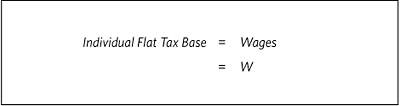

Wages—and only wages—are then taxed at the individual level:

Thus, the overall tax base is output less investment (consumption):

The New Flat Tax. Income is either used to fund consumption or it is saved. Income less net savings is another way of calculating consumption: