Abstract: Barbara Boxer and John Kerry are pushing their climate-change legislation in the Senate. Like the Waxman-Markey bill, passed by the House last year, Boxer-Kerry is a cap-and-trade bill. Why is that bad? Because severely restricting greenhouse gas emission places an enormous burden on American families--higher gasoline prices, higher heating costs, higher energy taxes, higher unemployment. The Heritage Foundation's team of economic and climate-change experts details the extraordinary costs that will fall on businesses and families across the country should this legislation become law.

A decade of global cooling and the emerging controversy that threatens to undermine the scientific foundation of the Intergovernmental Panel on Climate Change's reports not withstanding, Senators Barbara Boxer and John Kerry continue to push their proposed Clean Energy Jobs and American Power Act (S. 1733) to severely restrict greenhouse gas emissions. As demonstrated in this paper, this proposal would have significant economic costs in terms of lost income, lost jobs, and higher energy prices, among other detrimental effects.

Should S. 1733 become law, Americans can expect the following to occur between enactment and the year 2035 (all figures are adjusted for inflation):

- Inflation-adjusted losses to gross domestic product (GDP) of $9.9 trillion;

- More than $4.6 trillion in higher energy taxes;

- Job losses exceeding 2.5 million for some years;

- Annual family-of-four energy costs rising by $1,000, including a gasoline price increase of more than $1.20 per gallon;

- Annual family-of-four energy costs plus increased cost of goods and services totaling more than $3,000;

- Average GDP loss per family of four above $4,500 per year;

- Family-of-four net worth dropping by more than $40,000; and

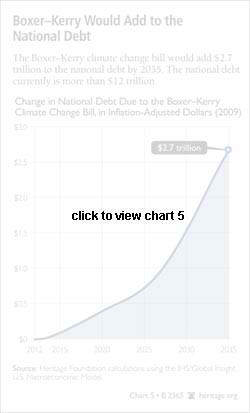

- The family of four's share of the national debt rising by an additional $27,000.

Though burdened with a variety of tangential mandates and regulations, S. 1733 at its core is a cap-and-trade bill. Under cap and trade, emitters of greenhouse gases (primarily carbon dioxide) will be required to submit permits for each ton of CO2 (or its warming equivalent for other gases) that is emitted. The initial distribution of the permits (known as allowances) varies from one version of cap and trade to another, but since the permits are tradable, their ultimate distribution should mimic the pattern of greatest willingness to pay.

Though this ultimate distribution may not depend on the initial distribution, the pattern of financial impacts depends critically on that initial distribution. The current version of Boxer-Kerry gives away about 70 percent of the allowances in the first decade.

How Cap and Trade Works

With the legislation, fewer allowances are issued than would be necessary to cover emissions in the unconstrained (baseline) case. This artificial scarcity drives up the price of allowances, which, in turn, drives up the price of fossil-fuel energy. Since fossil fuels provide about 85 percent of America's energy, cap and trade acts like an energy tax. The price of the allowances is added to the fuel cost and is passed on to consumers. Forcing higher fossil-fuel energy prices on consumers is a necessary part of cap and trade. Without these higher prices consumers will not reduce energy use and the associated CO2 emissions. As Senator Barack Obama admitted about his proposed cap-and-trade program during the presidential election campaign, "electricity prices would necessarily skyrocket."[1]

The price of the allowances, in essence the tax on energy, is determined by supply and demand. As the allowance price rises, so does the incentive for cutting energy use and for increasing the supply of non-CO2-emitting sources of energy. Logic would dictate higher energy prices when fewer allowances are issued.

In 2012, Boxer-Kerry will provide allowances to meet 97 percent of the 2005 emissions of CO2-- that is, the cap in 2012 is 97 percent of the tons of emissions for 2005. Continuing with 2005 as the reference year, the caps decline until 2050, at which time they are 83 percent below the 2005 level. As expected, the allowance price rises dramatically over the years with corresponding increases in energy prices.

Measuring the Impacts

In the absence of restrictions, CO2 emissions would rise as the economy grows. However, the trend toward greater energy efficiency is expected to continue, which means the economy will grow faster than do the CO2 emissions.

The Boxer-Kerry bill drives a wedge between the higher emissions expected without the legislation and the lower mandated emissions under the caps. That is, the legislation reduces emissions further and further below the levels that would otherwise exist. Filling the wedge requires cutting energy use, increasing non-CO2-emitting energy production, or paying to cut CO2 emissions in areas not covered by the caps. Differences in cost estimates are driven primarily by differing assumptions on how the wedge is filled. Assuming faster growth of non-CO2-emitting energy or assuming a greater availability of offsets (the CO2 cuts in other areas) reduces the projected cost of meeting the caps.

Wedge-Filling Assumptions

Nuclear Power. Nuclear power provides roughly one-fifth of all electricity consumed in the U.S. The technology and engineering capabilities exist to produce much more, but the regulatory structure and consequent economic burdens have stifled nuclear development for decades. No new nuclear power plant has been licensed in over 30 years.

In spite of this history and despite the lack of any significant legislation to remove the barriers, studies of cap-and-trade bills performed by the Environmental Protection Agency (EPA), the Congressional Budget Office, and the Energy Information Administration all assume that nuclear power production will nearly double over the next 25 years. This would be, roughly, 100 new nuclear power plants in 25 years. Seemingly oblivious to the stunning irony, Representative Ed Markey (D-MA), co-author of the similar Waxman-Markey bill (H.R. 2454), regularly speaks out against building new nuclear power plants while citing cost estimates that depend critically on a dramatic expansion of nuclear power.[2]

The Heritage assumption for the analysis presented here is that there will be a net increase of 15 gigawatts of nuclear capacity over the next 25 years due to incentives for building and expanding nuclear plants that existing legislation already provides. Though considerably less than the increase assumed by many other studies, even this amount of new nuclear capacity requires dramatic changes in regulations. The need for such change has been noted by the Congressional Budget Office: "Many experts believe that nuclear power could displace a significant amount of fossil-fuel use, but only if the regulatory framework was adjusted to allow for the greater use of nuclear power to generate electricity."[3] (Emphasis added.)

Carbon Capture and Storage (CCS). Some analyses of cap-and-trade costs, for instance those conducted by the EPA, assume technology for capturing and storing the carbon dioxide emitted from coal-fired power plants will be fully commercialized in the next 15 years.

This assumption is more than ambitious. Pilot projects are still on the drawing board. Further, even after the extraordinary technological and economic hurdles have been cleared, the political and environmental obstacles to storing tens or hundreds of millions of gallons of liquid CO2 each day must be overcome. Heritage assumes that CCS will make no more than a trivial contribution to CO2-emission reduction in the next 25 years.

Again, the CBO notes the significant regulatory and legal challenges facing CCS: "Similarly, generators would be unlikely to adopt technologies for the capture of CO2 and its sequestration in the ground unless an extensive regulatory structure was put in place to address issues involving property rights, rights-of-way for pipelines, and liability for emissions that escape from the ground."[4]

Wind and Solar Power. Programs and mandates already enacted into law at the federal, state, and regional levels provide incentives that will help energy from renewable sources to nearly double between 2010 and 2035. Renewable electricity production will rise by more than 250 percent. However, these large growth rates start out from small bases, so renewable energy sources will have a non-trivial, but limited, impact. The primary sources of renewable power generation will be wind and solar energy. A CBO summary of cost estimates for cap and trade highlights some of the problems of these sources: "Energy conservation and most renewable energy sources are projected to play relatively limited roles over the entire period, mainly because most kinds of renewable energy provide power intermittently."[5]

While achieving the baseline growth in renewables will be costly, these costs are not attributed to S. 1733 since the costs are mandated by existing legislation.

Offsets. Though S. 1733 allows the use of up to 2 billion tons of offsets (provisions that allow emitters to pay for emissions reductions by others instead of cutting emissions themselves), the availability of legitimate offsets in this quantity is highly uncertain. For instance the EPA states:

There are many institutional design issues, including the measurement, monitoring, reporting and verification requirements, surrounding estimates of offset availability. These issues must be addressed to ensure that the offset reductions are truly incremental, and represent real reductions.... Additionally, the cost and availability of offsets, particularly international offsets, is one of the greatest uncertainties in forecasting the cost of climate legislation. The U.S. will not be the only buyer of international offset credits, and the price of those credits will depend greatly on the competing demand for those credits. The stringency of climate policies adopted by other countries, the types of restrictions they place on international offset credits, and their expected reference case emissions growth all will influence the competing demand for international offset credits and the resulting price. Additionally, there is uncertainty on the supply side for both domestic and international credits that will influence the cost and availability of offsets.[6]

Due, perhaps, to problems with current offset programs in other parts of the world, S. 1733 devotes 90 pages to specifying the structure for establishing the regulations for offset certification, verification, and trading.

As these factors argue against the actual availability of 2 billion tons of offsets, this study assumes a quantity of offsets equal to an additional 15 percent of the allowances for each year.

Efficiency Mandates. The whole point of cap and trade is to let markets find the least costly ways of reducing emissions. Conversely, technology mandates reduce the market's flexibility to meet those caps while not changing the carbon dioxide caps. Nevertheless, S. 1733 includes additional mandates and subsidies. Combining these competing policies reduces efficiency and is evidence that the bill's authors either do not understand cap and trade or do not believe that it works.

The conflict between caps and mandates may not be intuitive: Imagine an employer who enacts a 50 percent pay cut for his employees and then claims to soften the blow by forcing those same employees to buy generic no-brand paper towels and cleaning products. If one's preference is to cut expenditures elsewhere, the addition of the mandate makes one's life even worse. If switching to generic cleaning products were part of one's belt-tightening anyway, the mandate is unnecessary. So, at best the mandate has zero impact. A more likely outcome is that the pain of the pay cut is compounded by the added inflexibility of the mandate.

In any event, the additional damage of mandates is well understood by economists. For instance, in analyzing the impact of performance (efficiency) standards in H.R. 2454 (the Waxman-Markey cap-and-trade bill), the CBO recognizes that, "More generally, the imposition of standards would limit the flexibility that businesses and consumers have to determine the least expensive way to reduce emissions and would instead require specific actions, regardless of cost."[7] And, "If, in fact, the standards forced technological changes that would not otherwise have occurred because of the overall cap on emissions, then the standards would lead to a lower price of allowances than CBO estimated but result in a generally higher cost to the economy."[8] (Emphasis added.)

Adele Morris, an environmental economist at the Brookings Institution, writing about combined caps and efficiency standards proposed in California, says:

Proponents argue that higher fuel economy standards are part of the climate solution. But once the emissions caps are set and firms are trading rights to emit, fuel economy and other regulatory standards produce no incremental climate benefits.... Because mandating greater automotive fuel efficiency tends to be a more costly way to reduce emissions than other methods, the California rules could only end up increasing the cost of achieving the emission target without providing additional climate benefits.[9]

Mandates and standards on efficiency and renewable energy increase the cost of achieving CO2 cuts. However, the mandates and standards set forth in S. 1733 are so numerous and complex that their modeling is nearly impossible to do in entirety. The analysis, here, incorporates none of these regulations but simply notes that the overall losses to GDP and employment are likely to be underestimated.

Further, though the mandates and standards will increase overall costs of meeting the caps, they can moderate the energy price increases. However, the EPA estimates that these moderating impacts will be small: "The resulting modeled economic impacts of the energy efficiency provisions include modest reductions in allowance prices (~1.5%), fossil fuelprices (coal and natural gas ~1%), and electricity prices (<1%) from="">[10]

Banking and Savings. Boxer-Kerry allows holders of allowances to save them for use in later years (banking). There are also provisions for limited borrowing. The intent is to allow flexibility in timing of CO2-emissions cuts while still meeting the aggregate reductions between 2012 and 2050. In theory, with banking and borrowing, the allowance price should rise no faster than by the rate of interest.

This theory depends on market actors correctly predicting future allowance prices. If the expected price rises faster than the rate of interest, banking allowances become a better than average investment and speculators will buy allowances in the earlier periods to hold for sale in the later periods. This earlier buying and later selling pushes the early-period prices up and the later-period prices down. Again, in theory, allowances will be pulled off the market and saved until the price differential between the early and later periods is narrowed enough that banking allowances no longer generate an above average return.

That's the theory. In practice, this requires a company or a person to hold billions of dollars worth of assets for decades before receiving any return on investment. Since the EPA administrator has authority to cancel allowances if emissions targets do not seem sufficiently stringent and because of many other uncertainties, savings are unlikely to match the theoretical limits.

In any event, the studies analyzing the impact of allowance saving show net savings of allowances for the first two decades so they can be used later. Since the Heritage analysis only applies to the first 24 years, Heritage analysts ignore the impact of banking allowances. But again, had Heritage analysts included this feature in their analysis, it would have exacerbated the negative aggregate economic impact of the legislation for the period they analyze.

How to Measure Costs?

Some cost estimates on carbon-limiting legislation focus on lost consumption; for example, the EPA analysis of S. 1733.[11] Though this is an important component of the cost, by definition it ignores the impact on savings and taxation. When households suffer income losses, they partially offset the impact on consumption by reducing their savings. The full cost of the impact will be missed by measuring consumption losses alone. Further, lower incomes generate lower tax revenues and have a real impact on government expenditures and debt levels.

As shown in Charts 5 and 6, S. 1733 increases the national debt and reduces household net worth, which implies lower tax revenues and lower household savings. Changes in GDP, as used here, provide a more comprehensive measure of economic impact.

The Impacts. The analysis here focuses on the economic impact driven by the cap-induced energy reductions. There will be additional costs from the caps on greenhouse gasses other than CO2. However, CO2 emissions in energy production account for 85 percent of the total covered emissions. In short, this analysis covers most, but not all, of the economic costs of S. 1733.

If the CO2 caps proposed in S. 1733 are enacted, Americans can expect to see the following impacts relative to the baseline case (all dollar values are adjusted for inflation to the 2009 price level):

- GDP will drop by an aggregate $9.9 trillion between 2012 and 2035. On a family-of-four basis, this translates to an income loss of over $108,000--a loss of over $4,500 per year.

- In 2014, employment will drop 365,000 jobs below the expected level and will not recover for the period analyzed. For the entire period analyzed, employment will average 1.4 million jobs below the no-legislation level. In some years, the employment deficit will exceed 2.5 million jobs.

- Household net worth will take continual hits. For the average year, it will be $2.1 trillion below baseline. On a family-of-four basis, the cumulative loss in net worth will exceed $40,000 by 2030.

- Gasoline prices will rise by 45 percent.

- Residential electricity prices will rise by 72 percent.

- Relative to the baseline, the higher prices will force families to cut gasoline consumption by more than 12 percent, natural gas consumption by 23 percent, and electricity consumption by 29 percent. But these cuts will not be enough to offset the higher prices completely, and a family of four will see its total energy spending rise by more than $1,000 per year by 2035--a total increase in energy expenditure of more than $16,000 between 2012 and 2035.

Conclusion

The cuts in CO2 emissions outlined in S. 1733 are severe, reaching 83 percent below the 2005 level in 2050. In turn, these caps force severe reductions in energy use and economic activity. This analysis ends in 2035, at which point the caps on emissions are 52 percent below the emissions of 2005.

In spite of the best attempts by households and businesses to adjust to these caps, the ensuing higher energy costs impose extraordinary losses on the economy. Income losses total to nearly $10 trillion and job losses exceed 2.5 million.

By 2035, the next generation of families can expect to suffer a loss in net worth of $30,000 to $40,000; income losses exceeding $8,000 per year; energy cost increases of over $1,000 annually; and ashare of the national debt that will have risen by more than $27,000.

All of these costs plus the additional costs for the years beyond our analysis will moderate world average temperatures by no more than nine hundredths of a degree in 2050 and no more than three tenths of a degree in 2100.

David W. Kreutzer, Ph.D., is Senior Policy Analyst for Energy Economics and Climate Change in the Center for Data Analysis; Karen A. Campbell, Ph.D., is Policy Analyst in Macroeconomics in the Center for Data Analysis; William W. Beach is Director of the Center for Data Analysis; Ben Lieberman is Senior Policy Analyst in Energy and the Environment in the Thomas A. Roe Institute for Economic Policy Studies; and Nicolas D. Loris is Research Assistant in the Thomas A. Roe Institute for Economic Policy Studies, at The Heritage Foundation.

Appendix:

Methodology

To meet the emissions reduction goals of S. 1733, the price of fossil-fuel energy must increase enough so that the quantity demanded drops to the target levels. The allowance price is the tax on fossil-fuel energy that causes the price to increase. The allowance price/tax will be determined as refiners, electric companies, natural gas distributors, and certain other energy users bid against each other for the allowances. As the allowance price increases, these bidders find it increasingly difficult to pass the costs on to the ultimate consumers, thus they bid for fewer allowances. This, in turn, restricts the amount of fossil fuel that will be sold and determines the added price consumers must pay for energy.

The amount of CO2 emitted per unit of energy generated depends on the type of fuel. The energy model used by the Center for Data Analysis (CDA) is based on the Global Insight Energy Module and adds the appropriate cost to each energy source for various allowance prices.[12]

Further, the model incorporates estimates of user responses to price changes (demand elasticity) for natural gas, petroleum products, coal, and electricity. Following a well-known pattern, this responsiveness to price changes grows over time.

In the CDA model, the allowance prices for all years are adjusted until the aggregate amounts of CO2 emissions from all fuels reaches the target emissions for the given year. To account for offsets, the targets are increased by 15 percent above the caps for every year. In the early years, the business-as-usual emissions are less than the allowances plus offsets. For those years, the allowance price is set at the estimated world clearing price for offsets--$20 per ton in 2012, and rising with inflation through 2017. In 2018 and beyond, the offsets and allowances are fully constraining and the allowance price rises more rapidly than inflation as the caps become tighter. The allowance price exceeds $120 per ton of CO2 by 2035.

Macroeconomic Simulation Overview. In a market-based economy, most effects of a policy are transmitted through price signals that are driven by changes in consumption and production decisions. The aggregate impact these changes have on the economy is based on how these price signals interact with other markets and thus how the economy's resources shift. Moving below the baseline means that resources are being used less efficiently and could have been used more productively under the baseline scenario than under the new policy.

Heritage analysts used the IHS/Global Insight Long-term Macroeconomic Model of the U.S. Economy to estimate the effects of S. 1733 on the overall economy.[13] The simulation was implemented by changing variables in the macroeconomic model according to the changes predicted by a microeconomic model of the energy sector maintained by the CDA (see above). In order to estimate the policy impact, three main pieces needed to be simulated: price effects, energy efficiency effects, and allowance revenue/allocation effects.

The policy changes in Boxer-Kerry affect producer prices directly in the energy sectors both through the cost of purchasing allowances and offsets and through changes in production needed to reduce emissions. The energy model estimated the change in energy production prices and retail energy prices. These prices were matched with their corresponding variables in the macroeconomic model to estimate the effect these price changes would have on the economy overall.

The energy model projects changes in fuel efficiency and changes in total highway fuel consumption. Corresponding macro model variables were changed. The effect of these changes helps mitigate some of the total increased consumer expenditure on fuel.

The macroeconomic model does not have specific variables corresponding to alternative renewable fuel sources as in the CDA energy model. The macroeconomic simulation takes into account the increase in domestic alternative fuel source supply by adjusting the imported fuel variable.

The last piece of the simulation is the allowance revenue component. The value of permits equals the entire value of these permits as government revenue, whether or not they are formally auctioned. The Boxer-Kerry bill calls for 10 percent of the allowance revenue to remain unallocated in order to pay down the federal deficit. Thus, 10 percent of the revenue was used to reduce deficits in the simulation. It was assumed that the remaining revenue allocations mimicked those of the earlier Waxman- Markey bill, the revenue allocations here followed as much as possible the memo: "Proposed Allowance Allocation" by Chairman Henry A. Waxman and Chairman Edward J. Markey dated May 14, 2009. Any unallocated allowance revenue was used for the federal government's general consumption variable and was thus allocated by the model in ways consistent with the historical pattern of government spending.