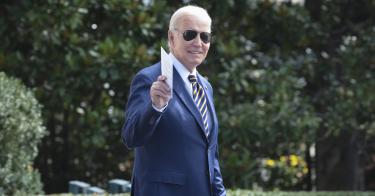

Listening to the Biden White House on economic issues is always a surreal experience.

It calls to mind Charles Dickens' famous line—“It was the best of times, it was the worst of times.”

They can't keep it straight.

While President Biden claims “Bidenomics is working,” his Vice President Kamala Harris bemoans the fact that “[m]ost Americans are a $400 unexpected expense away from bankruptcy.”

So, which is it?

Here's a clue.

New numbers out Thursday morning showed inflation ticked up to 3.2 percent in July, from 3 percent in June, bucking a 12-month streak of falling consumer price increases.

>>> The Latest Iteration of Bidenomics: “Tip-Flation”

And right now, only 46 percent of Americans say they could cover an unexpected $400 bill without taking on debt.

That’s not to mention that a majority are living paycheck to paycheck.

Credit card debt tops $1 trillion for the first time in U.S. history.

And, in the second quarter of 2023, 36 percent more people drained their retirement accounts to make ends meets, compared to the same period last year, according to Bank of America's analysis of its clients' employee benefits programs.

So, obviously, not the best of times.

The broader economic picture is also far less sunny than Biden would have us believe.

The credit rating agency Fitch recently downgraded its rating on U.S. debt from a top-tier AAA score to AA+ because it expects “fiscal deterioration over the next three years.”

Fitch is projecting “tighter credit conditions, weakening business investment, and a slowdown in consumption” pushing the U.S. economy into a “recession” at the end of this year or the beginning of 2024.

That doesn't really sound like the best of times either.

Even Steve Schwarzman, CEO of the world's largest asset manager, BlackRock, Inc., admitted that “the numbers justify [the downgrade], regrettably.”

Is it any surprise that the American people have noticed?

A mere 37 percent of Americans approve of Biden's handling of the economy in the latest CNN poll. Two-thirds of Biden's 2020 voters surveyed by Reuters/Ipsos said the economy was “worse” or “about the same” as it was in 2020 during the pandemic—under President Trump.

The vast gulf between how Biden views his economic prowess and how Americans feel is befuddling—until one remembers that this President has a nasty habit of denying reality.

Recall that the White House once assured the country that rising inflation was either “highly unlikely,” “transitory,” “temporary,” decelerating, and/or peaking, as it climbed to 9.1 percent in June 2022.

Now as the inflation growth rate finally ebbs from its highs, as it inevitably would after the Federal Reserve hiked interest rates, Biden is claiming credit. But that's like an arsonist taking a bow after the fire department arrives to extinguish the blaze he set.

Inflation spiked in March of 2021 as “Bidenomics” poured $1.9 trillion in completely unnecessary “pandemic relief” spending—for a COVID crisis that had effectively ended—on an American economy already in recovery.

As a result, inflation exploded, and the country is now picking through the charred ruins.

Biden expects us to thank him for it. No, we're not stupid.

The Bureau of Labor Statistic publishes the Consumer Price Index (CPI) each month, a common measure of inflation. CPI takes a basket of commonly purchased goods and services and prices them on a monthly basis.

In January of 2021 when Biden took office, that basket cost about $261.50. In July of this year, the same basket cost $305.70. That's a huge 16.9 percent increase in only two and a half years.

It's also larger than the CPI increase for any full four-year presidential term since the 1980s.

The wages of working-class Americans have not kept pace with these rising costs. And it's not just the poor bearing the brunt of Bidenomics.

>>> Question Biden’s Mismanagement at Your Own Financial Risk

Fifty-three percent of those who earn between $50,000 to $100,000 per year are living hand to mouth.

All the money coming in the door is just flying back out again to cover monthly bills and expenses, which means nest eggs are being cracked open and debt is piling up.

When Biden took office, Americans had $2.3 trillion in personal savings. That number shot up to $5.7 trillion following Biden's so-called “American Rescue Plan.”

Today, savings sit around a much diminished $862 billion. The average middle-class household has lost over $33,000 in real wealth in just the past year, according to one analysis.

So, no. Bidenomics is not working, and everyone knows it.

Americans are burning through their savings, maxing out credit cards and imperilling their retirements.

In that sense, Biden does deserve credit—although he's doing all he can to avoid it.

This piece originally appeared in the Daily Mail