In June, the House passed the Financial CHOICE Act, a comprehensive financial regulatory reform bill that would replace large parts of the 2010 Dodd-Frank law.

Because the Republicans hold a slim majority in the Senate, passing such a comprehensive reform package is difficult, at best. Nonetheless, the Senate Banking, Housing, and Urban Affairs Committee, led by Chairman Mike Crapo, R-Idaho, recently passed its own reform bill with bipartisan support.

That bill—the Economic Growth, Regulatory Relief, and Consumer Protection Act—is a more targeted financial reform bill than the CHOICE Act, but there’s a great deal of overlap between the two measures.

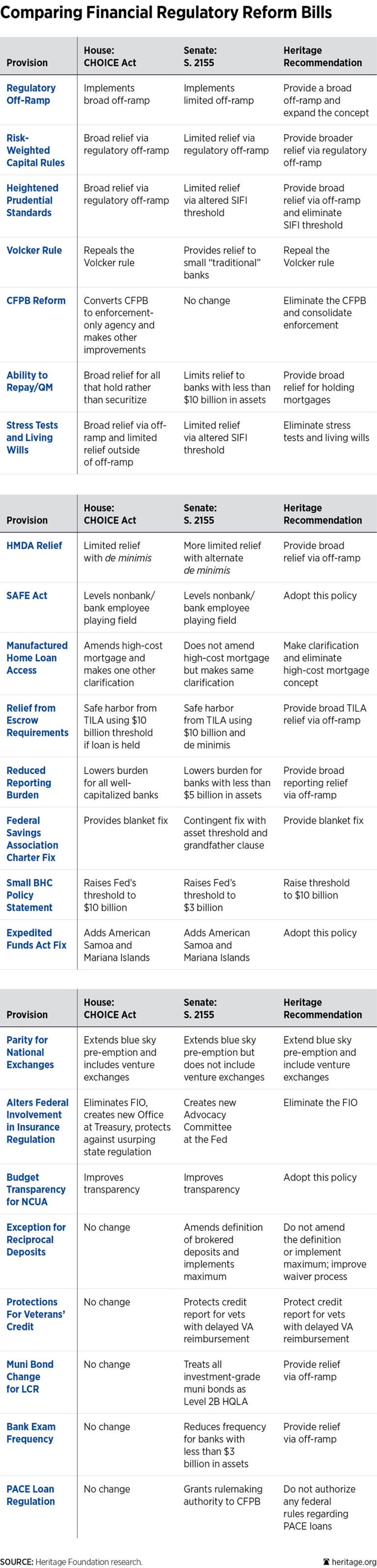

The following chart provides an overview of the key differences and similarities between the two bills. (For more details, see this Heritage Foundation issue brief and backgrounder).

One of the most important areas of overlap between the House and Senate bills is that each includes its own version of a regulatory off-ramp. Although the Senate bill includes a more limited regulatory off-ramp than the CHOICE Act, the two versions are not irreconcilable.

Overall, the Senate bill includes similar versions of about 15 CHOICE Act provisions.

These efforts by the House and Senate give hope that Congress can enact important financial regulatory reforms, with the Senate possibly voting on its bipartisan bill as early as this month.

To help the most Americans, members of Congress should enact—and broaden—as many of these reforms as they can agree to.

This piece originally appeared in The Daily Signal