The Department of Labor released September inflation data for both consumers and businesses this week, and the numbers aren’t good.

Inflation is high—and accelerating. Prices paid by businesses, (measured by the Producer Price Index, or PPI), rose 8.5% over the last year while prices paid by consumers, (measured by the Consumer Price Index, or CPI), rose 8.2% over that same time. In September alone, the PPI and CPI both climbed 0.4%, an acceleration from prior months. Worse yet, core inflation (which excludes food and energy) accelerated even faster, hitting a new 40-year high of 6.6% over the last year.

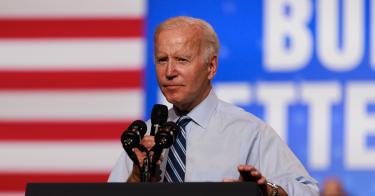

Far from being “transitory,” as the Biden administration infamously declared, inflation is thoroughly embedded in the economy. When inflation was similarly raging in 1980, then-candidate Ronald Reagan famously asked voters if they were better off compared to four years earlier. Their answer on election day was a resounding “no,” and incumbent President Carter lost in a landslide. Congressional incumbents stand to take a similar beating next month because the economy is in similar straits.

Just like in 1980, Americans today are experiencing a cost-of-living crisis. Foremost on Americans’ minds is inflation, which has hit historic highs under President Biden, reaching levels not seen in four decades, despite Biden inheriting an inflation rate of just 1.4%. It promptly rose to over 9% in just 18 months.

That inflation is a real tax on Americans and has made them demonstrably poorer. The average worker has lost the equivalent of over $3,000 in income under Biden because prices have risen so much faster than wages. And it’s not the price of yachts and caviar that is crushing Americans—it is necessities. Discretionary and luxury items are, by and large, increasing slower than the headline inflation numbers, while eggs and flour have skyrocketed 30.5% and 24.2%, respectively. Dairy products are up another 20.8% and soup 20.5%. And these price increases are just the last year.

>>> Biden’s Inflation Quickly Making Americans Poorer

Americans’ woes don’t stop with food. Just in time for winter, home heating oil’s price has risen 58.1% since September 2021 and natural gas 33.1% over that same time. The Biden administration’s estimate that it will cost Americans 28% more to heat their homes this winter seems overly optimistic.

But perhaps the worst element of the latest economic data is that core inflation just hit a new 40-year high. As the Federal Reserve’s preferred inflation metric, high core inflation is a strong indicator that the Fed will continue with its hard and fast interest rate hikes, which will compound the pain for American families.

Higher interest rates add insult to injury for Americans already suffering from 40-year-high inflation because those higher rates increase borrowing costs on everything from mortgages to auto loans to credit cards. That is particularly troubling when Americans are going increasingly into debt to cope with the higher cost of living under Biden. Rising credit card rates combined with ever-increasing credit card balances is a recipe for disaster.

But the housing market provides perhaps the best perspective on Americans dissatisfaction with the economy. Because home prices and interest rates have both risen so much under Biden, the mortgage on a median priced home is now 80% more expensive than when he took office, costing the homeowner over $10,000 more a year on that mortgage.

This is not sustainable, either financially or politically. If history is any indication, Americans may soon give congressional incumbents the same treatment they gave Carter in 1980—the last time America had a cost-of-living crisis.

This piece originally appeared in the Daily Caller