The Securities Act of 1933 makes it generally illegal to sell securities unless they are registered with the Securities and Exchange Commission (SEC).[1] The act exempts various securities and transactions from this requirement.[2] In addition, the Securities Exchange Act of 1934 requires companies to register if they are listed on a national securities exchange[3] or if the company has total assets exceeding $10,000,000 and a class of equity security (other than an exempted security) held of record by either 2,000 or more persons, or 500 persons who are not accredited investors.[4] Making a registered offering (often called going public) is a very expensive proposition and well beyond the means of most small and start-up companies. In addition, registered (that is, public) companies must comply with a long list of continuing disclosure requirements.

Regulation S-K[5] is the key regulation governing non-financial statement disclosures of public companies (those registered with the SEC). Regulation S-X[6] generally governs public company financial statements in registration statements or periodic reports. These two rules, including the various rules and accounting policies that they incorporate by reference, impose the vast majority of the costs incurred by public companies.

Requiring public companies to disclose information that is material to investment decisions promotes capital formation and the efficient allocation of capital.[7] This is primarily because information disclosure promotes investor confidence in the integrity of capital markets and reduces risk, making them more willing to invest, and because information disclosure results in more accurate pricing of securities, allowing capital to flow to its best use. Excessive disclosure mandates, however, have two adverse effects.

First, excessive disclosure mandates impose unnecessary costs that have a disproportionate adverse impact on small and young firms.[8] These costs, whether direct or indirect, are routinely underestimated and sometimes simply ignored by regulators. Direct costs, imposed in the name of investor protection, are incurred by firms but ultimately borne by investors in the form of lower returns. Indirect costs include the costs of economic activity not undertaken because of actual or prospective regulatory burdens. These costs are borne more broadly by consumers, workers, and investors. Moreover, the lost economic activity also reduces state, local, and federal tax revenues.

Second, once disclosure requirements reach a certain point, they obfuscate rather than inform.[9] Investors have difficulty finding the relevant, material information in documents that are hundreds of pages long and written in dense legalese.

The High Cost of Being a Public Company

The SEC has estimated that “the average cost of achieving initial regulatory compliance for an initial public offering is $2.5 million, followed by an ongoing compliance cost, once public, of $1.5 million per year.”[10]

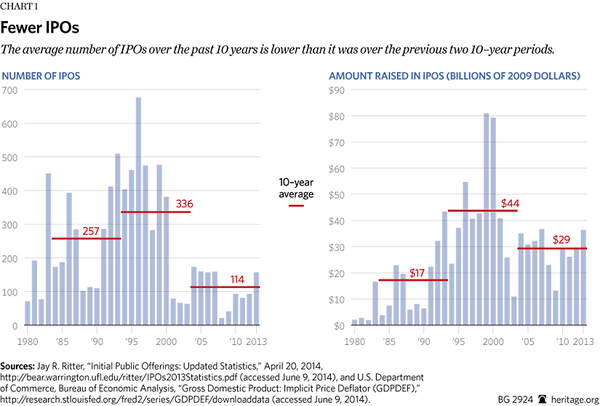

The number of U.S. initial public offerings (IPOs) is considerably lower than in the 1980s and 1990s, although the number of IPOs and amounts raised have recovered somewhat recently due to the strong stock market and the IPO “on-ramp” provisions—designed to make it easier for emerging growth companies to go public—of the Jumpstart Our Business Startups (JOBS) Act.[11]

Public company compliance costs have grown sufficiently high that many smaller firms are “going private.”[12] The Sarbanes–Oxley Act of 2002,[13] the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010,[14] and other legislation and regulatory actions have contributed to these costs. Moreover, IPO costs in the U.S. are considerably higher than those abroad.[15]

For small and medium-sized firms seeking to raise capital, these costs make access to the public capital markets prohibitively expensive. Obviously, $2.5 million imposes a hefty 10 percent deadweight cost even on a $25 million offering. A 10 percent regulatory toll charge increases the required rate of return for a company by 11.1 percent.[16] If the costs were 20 percent of the amount raised, the required rate of return on the net amount raised will increase by 25 percent.[17]

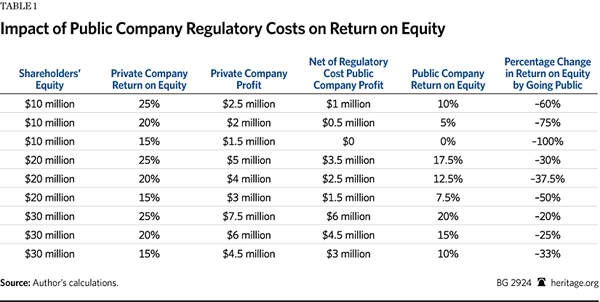

But the continuing costs—$1.5 million annually on average according to the SEC—are actually more problematic. A company with shareholders’ equity of $10 million with a healthy return on equity of 20 percent is going to earn $2 million. Net of public company regulatory costs, however, that company will earn only $500,000 and have a return on equity that is an anemic 5 percent. In effect, there is a $1.5 million toll charge for being a public company. This makes going public out of the question until companies reach sufficient size that compliance costs can be borne without having a dramatic negative impact on their earnings. Reducing this toll charge would make the public market available for more companies and enable them to grow more rapidly.

Table 1 illustrates this point. It shows the impact that $1.5 million in annual compliance costs would have on a company if it were public instead of private. It shows companies with shareholders’ equity of $10 million, $20 million, and $30 million, and returns on equity as a private company of 15 percent, 20 percent, and 25 percent. By way of comparison, the return on equity for the Standard and Poor’s 500 is generally in the 13 percent to 17 percent range.[18]

As shown in Table 1, the negative impact of continuing compliance costs on the return on equity for small companies (in the examples, those with equity up to $30 million) is negative and substantial. It reduces the return on equity by 20 percent to 100 percent. It is a particularly steep barrier for development stage companies that have limited or no current cash flow.

Another way of looking at it is to capitalize the $1.5 million annual cost. Using a discount rate[19] of 10 percent, this additional $1.5 million annual cost is the equivalent of erasing $15 million from shareholders’ equity.[20] This kind of shareholders’ equity erasure cannot be justified by the higher price-earnings ratio that a public company commands until expected risk-adjusted earnings are quite high.

“Gazelles” Create the Most Jobs—But Can’t Do So Without Capital. Economic research has increasingly demonstrated that most of the job creation in the economy comes from young, dynamic companies. These companies need equity investment to launch and to grow. Some call these companies gazelles. A recent survey of the economics literature on the subject reached the conclusion that gazelles “create all or a large share of net new jobs.”[21] These are the type of companies that seek outside investors either via Regulation D[22] or in the public market.[23] But the burdens imposed by existing regulations (primarily Regulations S-K and S-X) effectively deny these companies access to the public market and make investors less willing to invest.

The investment that does not occur because of these regulatory burdens affects a wide range of people, not just the managers and shareholders of the companies in question. Because these firms are unable to access capital:

SEC Studies Regulation S-K. Section 108 of the JOBS Act[24] required the SEC to study Regulation S-K. This study was released last December.[25] Although some privately produced compliance manuals are quite good at discussing the requirements of Regulation S-K, the SEC study is the most comprehensive and accessible study available regarding the burden on public companies caused by Regulation S-K.

- Consumers are adversely affected because new products will not be brought to market and new competitors will not enter markets to drive down prices and improve quality;

- Workers will be adversely affected because new employment opportunities will not be created that would provide employment and improve real wages; and

- Economic growth will slow, harming investors and workers, and reducing the local, state, and federal tax base.

The SEC study found:

While the study conducted in connection with this report serves as an important starting point, the staff believes that further information gathering and review is warranted in order to formulate specific recommendations regarding specific disclosure requirements. In particular, input from market participants is needed to facilitate the identification of ways to update or add requirements for disclosure that is material to an investment or voting decision, ways to streamline and simplify disclosure requirements to reduce the costs and burdens on public companies, including emerging growth companies, ways to enhance the presentation and communication of information and to understand how technology can play a role in addressing any of these issues.[26]

In the study, the SEC staff recommends “the development of a plan to systematically review…the disclosure requirements in the Commission’s rules and forms, including Regulation S-K and Regulation S-X, and the related rules concerning the presentation and delivery of information to investors and the marketplace.”[27] Thus, it appears that the SEC itself is serious about addressing this problem.

Legislation Designed to Address the Problem. The Chairman of the House Financial Services Committee Subcommittee on Capital Markets and Government-Sponsored Enterprises, Representative Scott Garrett (R–NJ), has drafted legislation designed to address this very important problem. The proposed legislation, styled the “Disclosure Modernization and Simplification Act of 2014,” has two major components.[28] First, it would require the SEC to issue a revised Regulation S-K to provide for better scaling of its disclosure requirements to reduce the burden on emerging growth companies and other small reporting companies and to simplify and modernize provisions of Regulation S-K that are “duplicative, overlapping, outdated, or unnecessary.” The SEC would be required to issue a final rule within six months. Second, the bill would require that the SEC conduct a study and provide a report to Congress about how to modernize Regulation S-K and to propose a rule doing so within a year of providing the report to Congress. The bill provides some detail about what the study should examine but provides the SEC great latitude.

This legislation might well launch a process that would substantially reduce unneeded impediments to smaller firms accessing the public capital markets. It moves beyond merely requiring the SEC to study the issue, requiring the commission to craft a proposed rule addressing the problem.

Better Data Needed. In its report, the SEC staff acknowledges the importance of considering cost and other economic considerations, and sets forth a series of factors to consider.[29] The problem is that regulation of the private capital market is done in a virtually data-free environment, and there is very little information regarding the regulation of smaller reporting companies. In most other important fields—tax, health care, labor and employment, immigration—there is robust data for policymakers to consider. This is not the case for securities regulators and congressional policymakers. The SEC does a poor job of collecting and making available to the public information about the private markets generally and the regulation of public companies, particularly smaller reporting companies.

Two relatively small but significant steps could be required of the SEC to help address this data gap. Congress should require the SEC to conduct a survey of smaller reporting companies. This survey should seek information both from firms that recently undertook an IPO and those that have been registered companies for a significant time (for example, five years or more). It should seek to determine which aspects of Regulation S-K and Regulation S-X are the major cost drivers and seek input from smaller reporting companies and their advisors about what should be changed.

In addition, the SEC should begin to collect and publish data regarding its enforcement actions relating to both the private securities markets and the public market. The commissioners, Congress, and the public need actual information—not anecdotes—about the types of disclosures, misrepresentations, or omissions that are the source of enforcement actions; types of issuers and exemptions that give rise to enforcement actions; the frequency and severity of different types of violations; and whether it is the primary or the secondary market that is the source of most problems. This will enable the SEC to make better policies with respect to Regulation S-K.

Other steps that would help provide the information to improve Regulation S-K are:

- Congress should seek GAO input. Congress should seek a study of Regulation S-K and Regulation S-X by the Government Accountability Office (GAO). It would be very useful to policymakers and the public to have an independent source of information and analysis regarding Regulation S-K and Regulation S-X.

- The SEC should seek input from smaller firms. Congress should require both the SEC and the GAO to consider the recommendations of the SEC Advisory Committee on small and emerging companies[30] and the recommendations of the SEC Government-Business Forum on small-business capital formation.[31] In addition, Congress should require both the SEC and the GAO to systematically talk to a large sample of companies (and their counsel and accountants) about which aspects of Regulation S-K and Regulation S-X that are problematic.

- The SEC should also revise Regulation S-X. Because the JOBS Act required the SEC to study Regulation S-K and that study is now complete, reform of Regulation S-K is further along than reform of Regulation S-X. Nevertheless, the burdens imposed by Regulation S-X need to be seriously evaluated. This, unfortunately, will be a more complex process because it not only involves the SEC, but also the Financial Accounting Standards Board (FASB), which establishes financial accounting standards, and the Public Company Accounting Oversight Board (PCAOB), which oversees the auditing of public companies. A process similar to that inaugurated by the JOBS Act for Regulation S-K is appropriate for Regulation S-X. It would seem appropriate, however, to seek a study not only by the SEC but also by the FASB and the PCAOB.

Alternative Solutions. The SEC has indicated that it may be willing to undertake serious reform of Regulation S-K. That may prove to be illusory, however. The SEC has shown little sensitivity to the costs imposed on small private companies when promulgating their proposed rules implementing changes to Regulation D, Regulation A+,[32] and crowdfunding[33] as required by the JOBS Act.[34]

If it proves to be the case that the SEC is not willing to reduce the burden on small public companies to a meaningful degree, a more prescriptive approach will be required in which Congress lays out a statutory scaled disclosure regime and provides less discretion to the SEC.[35]

Conclusion

SEC regulations—many of which, however, implement statutory requirements—impose very high costs on companies seeking to access the public securities markets. These costs are prohibitively high for small and medium-sized companies and impede their ability to access the capital needed to grow, innovate, and create jobs. Both Regulation S-K and Regulation S-X need to be revised to reduce these costs.

—David R. Burton is Senior Fellow in Economic Policy in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.