Executive Summary

Over the past half-century, the American union movement has moved into government. Despite highly publicized efforts to curtail collective bargaining powers of government unions in Ohio and Wisconsin, almost all changes to government collective bargaining statutes over the past 20 years have increased, not decreased, the powers enjoyed by government unions.

This Special Report seeks to determine the extent to which unionization has increased the cost of state and local governments using three different econometric methods: (1) synthetic control, (2) regression analysis, and (3) Bayesian analysis. It includes a thorough review of statewide collective bargaining statutes across all 50 states and compares changes in these laws with changes in spending over the past six decades.

Using synthetic-control case studies, we find that collective bargaining significantly increased the cost of government for New York and New Jersey taxpayers, but had statistically insignificant effects in Ohio and South Dakota.

Expanding our analysis to use panel data for the entire country from 1957 to 2011, we find that mandatory collective bargaining increases government compensation, with little offsetting reduction in overall government employment. Instead, total state and local government spending increases by approximately $600 per person, per year. This represents a $2,300 greater annual tax burden on the average family of four.

Bayesian analysis shows an even larger effect, with mandatory collective bargaining increasing the cost of government operations by more than $750 per person, per year. This represents a $3,000 greater annual tax burden on the average family of four.

Across the United States, government unions increased spending by state and local governments by almost $127 billion in 2014, according to our regression results, and by $164 billion, according to our Bayesian results. These cost increases are concentrated in the states that grant the most aggressive powers to union leaders.

Introduction

The American labor movement was once concentrated in factories, mills, and other sites of private commerce. Few government unions existed until the 1950s. Today, half of American union members are government employees, not skilled tradesmen or factory workers.[1]

This shift partly reflects a decades-long decline in union participation among private-sector workers. It also reflects the fact that union participation rates for government employees increased sharply throughout the 1970s, and have remained stable at between 35 percent and 40 percent since the early 1980s.[2] The shift in union membership from the private sector toward government has important implications for public policy.

Government unions fundamentally differ from private-sector unions. They face little risk of losing customers if they demand too much, because the government compels taxpayers to purchase their services. Unlike private unions, government unions can help to select their own bosses. Politicians often reward government unions for their electoral assistance with higher compensation and higher staffing levels, even when politicians know these will strain public finances.

We begin with a review of the economic research on how government unions affect public finances and proceed to examine empirically how state and local government spending over the past five decades correlates with changes in government union powers. These powers are coded according to a hierarchy developed in the National Bureau of Economic Research (NBER) Collective Bargaining Law Data Set.

Our analysis reveals a direct relationship between government unions’ powers and the cost of state and local government operations. We estimate that states that extend mandatory collective bargaining powers to all state and local government employees spend $600 to $750 more per capita than states that do not. This raises the average cost of government by approximately $2,300 to $3,000 for a family of four.

We estimate that state and local governments would have spent $127 billion to $164 billion less in 2014 if none had enacted collective bargaining statutes for state and local government employees. In Appendix B, we provide information on the collective bargaining powers that government unions enjoy in each state, along with a brief legislative history of how they gained those powers.

How Government Unions Influence Public Policy

Government unions differ in many ways from their private-sector counterparts. Union organizing is easier in government because the government faces little competition.[3] This makes it easier for unions to charge taxpayers monopoly prices and deliver higher compensation to their members.[4] Government unions are also unique in that they can use political influence to select their own bosses.

Electoral Influence. Government unions have a massive influence in American political campaigns. They donate heavily to politicians that they support, their operatives volunteer on behalf of those campaigns, and their leaders encourage their members to vote as a bloc in favor of union-endorsed candidates.

These factors make a large difference. The Center for Responsive Politics reports that the second-largest donor to political campaigns nationwide since 1989 is the American Federation of State, County, and Municipal Employees. The fourth-largest donor is the National Education Association. The Service Employees International Union is the 10th-largest donor. These figures do not reflect additional, outside spending that unions also use to influence elections.[5]

Politician-Employers. Politicians have taken careful note of government unions’ ability to influence elections. Many politicians actively seek union political support. Some politicians will give government unions generous contracts in exchange for their help in getting elected. As labor economists Jeffrey Zax of Queens College and Casey Ichniowski of Columbia University observe, “The political objectives of government officials and of public employees may often be in concert rather than in conflict.”[6]

Harvard professor Richard Freeman suggests that this alignment of interests between government unions and their politician-employers is a major reason for the rapid growth of unions in government.[7] Instead of resisting union demands, politician-employers have a keen interest in encouraging unionization among government employees because the union political machines can help them to secure re-election.[ 8]

Fiscal Illusion. When government unions take such overt actions to control election outcomes, they expect compensation for their “political services.” However, as labor economists William Hunter and Carol Rankin explain, “the public has little interest in paying for political services…and thus politicians must make this compensation in a way that would not arouse public scrutiny.”[9]

Politicians can reward unions in non-obvious ways by using multiple unique pay categories to supplement base wages or salaries. For example, many government unions negotiate premium pay, allowances, and other categories, such as “longevity pay,” that are generally foreign to the private sector. In addition, politicians reward unions with generous deferred-compensation packages, including pension and health benefits for retirees. The complex accounting behind these perks makes it difficult for the public to easily understand the full cost of what politicians and unions have negotiated. Additionally, in the case of deferred-compensation packages, the full cost usually does not encumber public finances until long after the politicians leave office.

George Mason University research fellow Eileen Norcross refers to these practices as “fiscal illusion” because unions and politicians use them to intentionally obscure the public’s understanding of government compensation.[10]

Lobbying. Government unions differ from their private-sector counterparts not only in their ability to select their own bosses, but also in the fact that they can increase the demand for their services through effective lobbying. Most economists agree that private-sector unions face a trade-off between higher wages and fewer jobs. Through lobbying and marketing campaigns, government unions can increase the demand for government services, thereby securing both higher wages and greater employment simultaneously.

Bradley University economist Kevin O’Brien has examined this practice in detail and confirmed that the lobbying efforts of government unions increase government employment. O’Brien examined data for municipal police and fire departments nationwide and found that departments with collective bargaining agreements paid 13 percent to 14 percent higher wages, but that lower employment offset the higher wages, leaving total spending unchanged—consistent with standard economic theory. When these unions engaged in lobbying, however, staffing levels increased, resulting in greater department spending.[11] O’Brien concludes:

It appears that if a public employee union wants to increase its employment and wage bill, having a collective bargaining agreement is not sufficient—public employee unions must also be politically active.… Thus, political activities by unions can be viewed simply as a means to escape the wage-employment trade-off imposed on bargaining outcomes by the demand for labor.[12]

How Do Government Unions Affect Government Spending?

If government unions can increase government compensation while increasing government employment, unionizing government should increase government spending. Scholars have spent decades trying to answer just how much unions increase government spending.

In doing so it has become clear that government unions’ leverage is closely tied to the strength of their legal powers of compulsion. In other words, unions increase compensation and staffing levels in government the most when the law requires government employers to negotiate with them and to submit to a compulsory dispute-resolution process.

The Legal Environment. For this reason, researchers quickly realized that they would need to evaluate the degree to which state collective bargaining laws empower government unions. This allowed scholars to then estimate how changes in the law affected key outcomes, such as union density, government compensation and employment levels, and total government expenditures.

Robert Valletta, an economics professor at University of California, Irvine, and Harvard economist Richard Freeman, director of Labor Studies for the NBER in 1988, constructed the NBER Collective Bargaining Law Data Set.[13] The dataset extends back to 1955 so that researchers can measure changes in the law over time. Economists have updated it several times. In addition, the dataset maintains a coding unique to each of five different employee groups: (1) state workers, (2) local schoolteachers, (3) local police, (4) local firefighters, and (5) other local employees.

Freeman and Valletta analyzed Current Population Survey (CPS) data from the Census Bureau using this collective bargaining data. They found that “state public sector laws are a prime determinant of the likelihood that municipal workers are covered by collective bargaining.” Strong collective bargaining laws were also associated with higher government wages and staffing levels. They concluded: “We find that employment and wages in otherwise identical departments are higher in those with collective bargaining contracts, supporting the notion that public sector unions raise demand for labor as well as increase wages along given demand curves.”[14]

Princeton economist Henry Farber subsequently updated the NBER dataset through 2004.[15] Farber made some simplifying changes, using an ordinal 1–8 scale:

- Collective bargaining prohibited.

- No legal provision for collective bargaining.

- Collective bargaining permitted, but not required.

- Public employers are required to “meet and confer” with union leaders.

- Public employers have a compulsory duty to bargain collectively, express or implied.

- Collective bargaining is compulsory and mediation is required.

- Collective bargaining is compulsory and strikes are protected.

- Collective bargaining is compulsory and arbitration is required.

Farber concedes that it is unclear whether a protected right to strike or a required arbitration process grants greater leverage to unions, although it is reasonable to characterize arbitration as the higher form of compulsion because it is the only mechanism that guarantees a union contract. Farber found that his simplified scale strongly correlated with the key variables of interest, with coefficients similar to those found in other studies. For instance, his analysis concludes: “Compared to there being no legal provision, [government employee] earnings are 5 to 15 percent higher where the employer has a legal duty to bargain.”[16]

The current analysis extends this NBER dataset forward to 2011 in order to examine the financial impact of collective bargaining laws over a longer period and in more recent times, and to compare changes in state law with changes in state and local government spending.

Compensation and Employment. Among the most notable contributions in the research on unions and government pay, Freeman reviewed all previous studies and found that the financial impact of government unions grew over time. Later studies noticed larger differences between the compensation levels of governments that engaged in collective bargaining and the levels of those that did not. Freeman also confirmed that a preponderance of studies found that unionization causes governments to hire more workers, with “the most comprehensive study”—a comparison of 400 cities over a decade by Zax[17]—showing that unionization increases public employment by about 10 percent.

Freeman concludes: “Still, on the basis of the existing estimates of the effect of unions on employment, wages and budgets…, it is likely that public sector unions raise both taxes and public services above what they would be in the absence of unions.”[18]

Other researchers come to similar conclusions. Bahman Bahrami, John D. Bitzan, and Jay A. Leitch compare the wages of union and non-union government workers between 1998 and 2004 using CPS data. They controlled for differences in educational attainment, years on the job, and other personal characteristics. Using a sample size of nearly 130,000 government employees, they find that unionized local-government workers enjoy a wage premium between 14.6 percent and 17.4 percent, while unionized state-government workers enjoy a wage premium between 10.7 percent and 12.5 percent. Interestingly, they also found that about 40 percent to 50 percent of the differences in wages between government and private-sector workers can be attributed to differences in their qualifications or characteristics, while 50 percent to 60 percent of the difference is due to fundamental differences in the way government workers are compensated.[19]

In a subsequent study published in 2010, Bitzan and Bahrami used this dataset to examine the union effect on government wages by occupation, and compared these pay rates directly with private-sector equivalents. They generally find that public-sector pay for management positions is comparable with pay for management positions in the private sector, but that other, non-management occupations have far higher pay levels than their private-sector counterparts.[20] Table 1 reproduces some of the occupational premiums for unionized government that they identified.

Total Government Spending. While the union impact on wages and benefits is interesting, the question remains: Do government unions increase overall government spending?

Some analysis suggests they may not. Zax and Ichniowski examined how collective bargaining affected total government spending for 463 cities across five years and found ambiguous results. They found that collective bargaining increased spending on various functional areas between 5 percent and 16 percent, but that local governments at least partly offset these higher costs by cutting employment in non-union departments. For example, municipalities offset higher costs in unionized fire departments by hiring fewer non-union sanitation workers.[21]

We re-examine this question, using the updated NBER dataset on collective bargaining laws and total government expenditures, both by function area and in the aggregate. We examine annual state and local government spending from 1957 to 2011, a period spanning the introduction of all statewide collective bargaining laws. Appendix A explains how we compiled these data.

Several recent studies have examined the relationship between union density and total government spending. For instance, Michael L. Marlow and William Orzechowski found that every percentage-point increase in union coverage rates during the mid-1980s increased per-capita state and local government spending between $6.97 and $10.01.[22] All else equal, the results indicate that increasing government union density from 10 percent to 40 percent would increase government spending by $200 to $300 per capita.

In a later study, Marlow examined the relationship between union coverage rates and per capita spending by state and local governments during the mid-2000s, using similar control variables. He found that every percentage-point increase in union coverage rates led to an increase in state and local government spending of $38.39 per capita.[23] Accordingly, increasing government union density from 10 percent to 40 percent would imply a $1,150 increase in per capita state and local government spending.

Our results strengthen these findings and find similar results. We unambiguously find that government collective bargaining laws are a primary factor in determining government spending levels. We find that per capita government spending rises by $500 to $750 in states that mandate collective bargaining in the governments’ workforce.

Synthetic-Control Case Studies

We begin our analysis with four case studies that examine how requiring mandatory collective bargaining affected per capita state and local government spending in Ohio, New York, South Dakota, and New Jersey. Appendix A explains in detail why we selected these states, along with additional results from the synthetic-control analysis that we employ.

Synthetic-control case studies allow researchers to compare a treated state to a mathematically optimal group of control states in which public policy did not change. Comparing the actual states’ experience with its “synthetic” counterpart shows the effect of the public policy change, in this case requiring state and local governments to collectively bargain.

New Jersey. Chart 2 shows the results of this analysis for New Jersey. Our synthetic New Jersey closely matches per capita spending in New Jersey before the state required collective bargaining. After passage of compulsory collective bargaining laws, the two diverge markedly. A decade later, New Jersey’s state and local governments spent $846 more per person (in 2011 dollars) than in the counterfactual New Jersey without government unions.

Of course, these results could occur simply due to random chance. To determine the statistical significance of a synthetic control case study, economists run the “experiment” again for every state that did not undergo a policy change. They compared how much the treated state varied from its counterfactual to how much the other states did.

Chart 2 also shows the results of this “placebo test.” The thick line represents the difference between the synthetic New Jersey and the actual New Jersey, and the vertical line represents the year of treatment. The thin lines show the difference for those states that did not mandate collective bargaining in 1968 or thereafter.

The largest treatment effect occurs with the treated New Jersey. This effect is unusually large, larger than all of the placebo tests. It roughly equates to significance at the 5 percent level using conventional tests of statistical significance. Notably, over time, the distance between the synthetic New Jersey and the actual New Jersey widens. Government unions have significantly raised costs for New Jersey taxpayers.

New York. They appear to have done the same in New York. By 1978, New York state and local governments spent approximately $1,000 more per capita (in 2009 dollars) than did synthetic New York. This result is also statistically significant. Chart 3 shows that in the decade after New York passed its law, none of the placebo states experience an effect size as large as New York’s.

Ohio. Chart 4 shows the results for Ohio. We do not find as good a synthetic match for Ohio as for New Jersey or New York. However, after the treatment period, the difference between the synthetic Ohio and the actual Ohio grows. By 1995, government spending per capita is over $400 higher in Ohio than in its synthetic counterpart. However, these results are not statistically significant. Two other states had larger effect sizes in the placebo tests.[24] Consequently, the Ohio results are not statistically significant at conventional levels.

South Dakota. Like Ohio, our synthetic control estimates for South Dakota also found that granting unions compulsory bargaining powers slightly increased government spending. Chart 5 shows those results. By 1981, government spending had risen just under $100 more per capita in actual South Dakota than in synthetic South Dakota. Like for Ohio, this finding was not statistically significant. Most of the placebo states exhibited equally large effect sizes despite not having passed comprehensive collective bargaining reforms in this period.

Regression Analysis

The cases studies presented here provide suggestive, but not conclusive, evidence that collective bargaining increases government spending. Drawing firmer conclusions requires more comprehensive analysis. In this section, we report the results of regression analysis on panel data of state and local government spending for all 50 states between 1957 and 2011. In the following section, we analyze these data using regression analysis.

We find certain notable trends across all employee classes:

First, laws giving government unions greater powers of compulsion correlate with higher wages for the employees to which they apply.

Second, collective bargaining laws have a small impact on employment levels, which lacks statistical significance in several cases. These findings are consistent with previous literature that indicates unions can escape the wage-employment trade-off by using political activism to increase overall demand for public employment.

Third, stronger collective bargaining powers are associated with higher total government spending, not just higher pay. Reduced spending within non-union departments does not appear to entirely offset the higher labor costs in unionized departments. Giving unions powers of compulsion raises costs for taxpayers.

We present the results for the impact of collective bargaining laws on each of these variables below for each of the five major employee classes. We present results for each relationship using four different statistical approaches, including ordinary least squares (OLS) regression, under both random effects and fixed effects, and Driscoll-Kraay standard errors regression, with and without fixed effects. Our preferred specification is column 4, which accounts for state fixed effects and controls for possible geographic correlations between states. All dollar figures are inflation-adjusted to 2009 dollars using the gross domestic product deflator. Appendix A provides a detailed discussion of the statistical methodology, choice of variables, and other technical concerns.

State Workers. As seen in the first row of Table 2, a movement of one interval along the NBER scale for state workers correlates with an increase in state employee monthly pay per full-time equivalent (FTE) position in the range of approximately $25 in three of the four models, and those increases are highly statistically significant. The Driscoll–Kraay model without fixed effects finds only a marginally significant increase in state employee pay. This variable only measures wages and salaries and excludes benefits such as health care or retirement contributions.

The second row examines the impact of a one-interval movement along the NBER scale on state employment per capita, as measured by the number of FTE positions filled by state governments. While all results are significant at the 1 percent level, the models all show that changes in state collective bargaining laws have a very modest impact on state government employment.

These results imply that an upward movement along the NBER scale increases the overall taxpayer wage bill for state employees: average pay increases without any drop in employment. This does not necessarily mean that overall state spending will increase. The state may offset higher labor costs by reducing spending elsewhere.

The results in the third row of Table 2 show that such reductions do not fully offset the higher labor costs. Stronger legal powers for state employee unions increase overall state spending. Per capita state spending rises by $89 to $105 for every one-increment movement up the NBER scale. On average, a state that moves from prohibiting collective bargaining to requiring it with arbitration for state employees—increasing seven increments along the NBER scale—sees per capita costs of state government increase between $625 and $735.

The fourth row shows that total spending by state and local governments combined rises by an amount roughly equal to the spending increase at the state-government level alone when state employee unions receive more aggressive powers of compulsion.

These spending increases may reflect more than compensation increases for state employees. States that require collective bargaining for state employees often require collective bargaining for local government employees as well. A substantial portion of local government spending in many states is financed by transfers from the state government. Higher state spending may also reflect concurrent spending increases caused by unionization of local governments. We later specify a model accounting for all collective bargaining laws simultaneously.

As we discuss in Appendix A, government spending may not change linearly as states move up the NBER scale. We suspected that certain key points along the scale would have a larger fiscal impact than others. While there is clear precedent within the academic literature for using the linear NBER scale and our own analysis confirms its usefulness, we also examined the differences between states with mandatory bargaining (those scoring between 5 and 8 along the NBER scale) and states without mandatory bargaining (those scoring between 1 and 4).

Those results, presented in Table 3 for state workers, confirm a significant divergence between states with compulsory bargaining and those without it. States with compulsory bargaining for state government employees pay between $105 and $144 more monthly per FTE position, while total employment increases slightly.[25] Total state spending also increases between $420 and $500 per capita. All of these results are highly statistically significant.

K–12 Employees. We performed a similar series of analyses regarding the impact of collective bargaining laws for K–12 educational employees. This group includes teachers, administrators, and support staff. We found results similar to those for state employees.

As seen in the first row of Table 4, every one-increment movement up the NBER scale increases cash pay per FTE position in K–12 education between $13 and $21. These values are statistically significant at the 1 percent level using three of four regression techniques, but only marginally significant using Driscoll–Kraay standard errors with a fixed-effects specification. These pay increases have little effect on overall employment in the K–12 sector. Per capita FTE employment barely changes.

The third row of Table 4 shows some evidence that greater legal powers for education unions have little statistically significant effect on K–12 education spending. The OLS regressions find that each movement up the NBER scale increases spending by approximately $5 per capita. However, these regressions do not account for geographic correlations between states. The Driscoll–Kraay regressions, which do account for this potential correlation, show no statistically significant effects on K–12 education spending.

We found it curious that the coefficient on total K–12 spending was so much smaller than the relationship for collective bargaining powers for state employees. One possible explanation is that teacher unions may deploy their lobbying powers to increase government spending generally and, thus, create externalities that benefit other government unions while not internalizing all of the benefits of their actions.

The fourth row of Table 4 suggests that this occurs. At a minimum, it indicates that states do not offset higher K–12 compensation with reduced spending in other functional areas. In fact, every one-increment movement up the NBER scale for teachers is associated with a rise of $41 to $47 in per capita spending by state and local governments.

Focusing solely on the impact of mandatory bargaining laws tells a similar story. As seen in Table 5, compulsory bargaining for education employees is associated with a small rise in per capita spending on K–12 of approximately $37 under the OLS specification. The first Driscoll–Kraay model returns statistically insignificant coefficients. Our preferred specification, the Driscoll–Kraay model with fixed effects, shows a marginally significant positive effect of collective bargaining on K–12 education spending. The second row further shows that compulsory bargaining for education employees is associated with a rise in total spending by state and local governments of $175 to $243. These results are statistically significant, although the results in column 3 are only significant at the 10 percent level.

Firefighters. The first and second rows of Table 6 show that every one-increment movement up the NBER scale for firefighters is associated with an increase in monthly pay per FTE fire position of $36 to $61 with minimal negative impact on employment.

This rise in pay translates into minimal increases in fire protection spending per capita, as seen in the third row of the table. As with teacher unions, the fourth row shows little support for the notion that reduced spending on non-union functions offsets higher spending on unionized fire departments. Every one-increment movement up the NBER scale for firefighters correlates with an overall increase in local government spending of $48 to $71. In this case, we focus on local government spending because the bulk of firefighting spending occurs at that level, whereas spending on K–12 occurs at both the state and local government levels.

Compulsory bargaining laws for firefighters show a larger effect. States with compulsory bargaining laws for firefighters tend to have higher spending on fire protection of $5 to $6 per capita, as seen in the first row of Table 7. These increases are all statistically significant. These states are also associated with a rise in total spending by local governments of $207 to $295 per capita, as the second row shows. This could reflect spillover effects from firefighter union lobbying on the general demand for government services. It could also reflect states requiring collective bargaining with firefighters at the same time that they require it for other local government employees.

Police. Every one-increment movement up the NBER scale for police is associated with an increase in monthly pay per FTE police position of $50 to $69 with a small impact on total employment, as seen in the first two rows of Table 8.

This greater spending on police wages produces a statistically significant increase in total police spending of $2 to $3 per capita, as the third row of Table 8 shows. As with teachers and firefighters, total spending by local governments—where the bulk of police spending occurs—rises even faster than spending on police alone. The bottom row of Table 8 shows that spending by local governments rises by $32 to $42 with every one-increment movement up the NBER scale for police unions.

This consistent finding that spending increases considerably more overall than in particular departments that unionize undercuts the notion that spending reductions in non-union departments entirely offset the spending increases that unions cause. Indeed, for each employee class, greater powers for unions correlate with a larger rise in total government spending than in spending on the affected function alone.

Table 9 focuses solely on the difference between states with and without compulsory bargaining statutes for police unions. They show compulsory bargaining results in a rise in police spending of $12 to $18 per capita and increases total spending by local governments by $176 to $182 per capita.

Other Local Government Employees. We analyze local-government employee groups that do not fall into one of the prior employee classes together in Table 10. These include transit workers, sanitation workers, social workers, and other civil servants. The first and second rows show that each step up the NBER scale for these unions correlates with a $15 to $24 increase in monthly pay per FTE position. These pay increases come with a minimal impact on employment.

This rise in wages has no statistically significant effect on spending on these functional areas in three of the four model specifications, but total local government spending does rise appreciably.

Looking solely at the difference between states with and without compulsory bargaining statutes for these employees, Table 11 shows that localities with compulsory bargaining statutes for other local employees tend to spend $194 to $248 more per capita.

Average of Collective Bargaining Laws. These regressions show that expanded collective bargaining powers have a greater effect on overall spending than on the unit directly affected. This holds true for every class of employees except state government workers. This could indicate that the political activities of government unions increase the overall demand for government.

However, it could also reflect the fact that states tend to expand collective bargaining powers for multiple groups of employees at the same time. For example, Michigan required local governments to bargain with all employee groups—police, fire, educational, and “other” employees—in one bill in 1965. Regressions analyzing expanded collective bargaining powers for police employees on total spending conflate the effect of the police unions with the effect of other unions who gained these powers at the same time.

To estimate aggregate impact of changes in collective bargaining laws for all employee groups on state spending, we construct an interaction term that averages the values for each occupational group for each state in each year. Appendix A explains the construction of this interaction term in greater detail.

The results, in Table 12, show that when all occupational groups simultaneously experience a one-increment increase in the strength of bargaining laws, monthly pay per FTE government position increases by $23 to $35, depending on the statistical method. This increase is statistically significant in all of the models examined. The second row shows that this change has a limited impact on overall employment levels.

The third and fourth rows of Table 12 show that this simultaneous one-increment increase across all five employee classes results in increased per capita spending by local governments of $38 to $53 and by state governments of approximately $100. These spending increases are statistically significant in all specifications.

However, we cannot simply sum these impacts to determine the total impact on spending by state and local governments because of intergovernmental transfers. State-level appropriations fund much local government spending. The fifth row of Table 12 shows the results of a simultaneous one-increment increase across all five employee groups on total state and local spending net of this intergovernmental spending. A simultaneous one-increment increase in union power translates into a statistically significant increase in total spending by state and local governments of $117 to $146 per capita.

We also examined the difference between states with and without compulsory bargaining statutes for all five employee classes.[26] Table 13 shows that monthly pay per FTE position in states with compulsory bargaining laws is $76 to $134 greater than in states without these laws, with minimal impact on employment. The coefficients for monthly pay are significant at the 1 percent level using three of four statistical techniques. However, the Driscoll–Kraay model with fixed-effects specification is only marginally significant.[27] Per capita state and local government employment changes minimally.

Table 13 shows that compulsory bargaining laws for all employee classes are associated with an increase in local spending of $169 to $200 per capita, and an increase in state spending of $532 to $561 per capita.

Net of intergovernmental spending, state and local governments combined tend to spend $573 to $720 more per capita where collective bargaining is compulsory across all five employee groups. This increase is highly statistically significant. It translates into an additional tax and spending burden of $2,300 to $2,900 on an average family of four.

These findings present concrete evidence that state collective bargaining laws granting strong powers of compulsion to government unions have added significantly to the cost of state and local government operations over the past five decades.

Bayesian Analysis

This regression analysis provides strong evidence that collective bargaining powers increase the cost of government services. However, regression analysis has shortcomings. The statistical theory underlying this analysis assumes that the parameters in statistical models are fixed quantities. These methods rely heavily on large sample approximations by assuming asymptotic normality, and that the observed data are a single realization of infinitely many samples. Bayesian methods, on the other hand, assume that the parameters are random variables to which a priori assumptions are assigned via probability distributions.

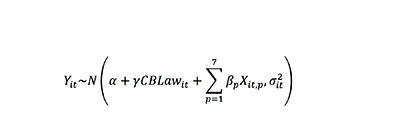

To assess the robustness of our regression results, we also estimated five Bayesian statistical models. These Bayesian models analyzed the impact of these control variables—including the NBER collective bargaining scale—on the levels of per capita state and local government expenditures. Some of these models, described in detail in Appendix A, made different assumptions about whether these variables had different effects in different states. In addition, Models IV and V included a time-varying dynamic component in their intercept terms to model the concept that there may be a certain degree of time dependence occurring between years. Table 14 shows our coefficient estimates in terms of posterior means. Appendix A presents more detailed results, including posterior standard deviations and Bayesian credible interval estimates.

These results indicate that a movement of one interval up the average NBER scale for all state and local employees correlates with a $105 to $228 increase in per capita government expenditures. We computed pseudo-Bayes factors, also discussed in Appendix A, to compare our model’s explanatory power. We found that Model V has the best predictive ability, while Model IV best fits the data. Model IV estimates that each increment a state advances along the NBER collective bargaining scale increases per capita state and local government spending by approximately $150. Model V estimates that each increment a state moves up that scale increases spending by approximately $225.

These Bayesian models find that collective bargaining has a larger effect on government spending than the regression analysis found. The preferred estimates in Table 14 are larger than the comparable regression estimates in the fifth row of Table 12. Our preferred estimate—model IV—implies that mandatory collective bargaining increases state spending by over $750 per capita. For example, one may consider a state that moves from an average of 2 on the NBER scale (no legal provision for collective bargaining in government) to an average of 7 (mandatory collective bargaining with strikes permitted). The estimates in column IV imply that state and its local governments would see their total annual spending increase by over $750 per capita. That means collective bargaining causes taxes to rise by more than $3,000 for the average family of four.

Total Effect on State Spending. Across all states, the average NBER strength of collective bargaining laws in 2011 was 5.13.[28] Based on the spending trends over the past five decades, if state and local governments had never granted such powers of compulsion to union leaders in the public sector (maintaining an NBER value of 2), the regression estimates indicate those governments nationwide would have spent $127 billion less in 2014 alone, with savings concentrated among the states with the most aggressive bargaining laws for government workers. The Bayesian model suggests that taxpayers would have saved $164 billion that year.[29]

Conclusion

Many, but not all, American states have given unions considerable power over government employees and government operations. Government unions can frequently force workers to accept their representation, require state and local governments to bargain with them, and prevent non-union workers from working for terms outside the union contract. These powers enable unions to increase compensation for government employees.

Private-sector unions face a trade-off between higher wages and fewer jobs for their members. Studies find that government unions avoid this trade-off through political activism. Their lobbying and political activities raise the demand for government services overall, enabling them to raise government pay without reducing government employment.

However, it is not clear that this raises total costs to taxpayers. Some previous research has suggested that governments offset higher costs in unionized departments with spending cuts elsewhere, leaving overall government spending little changed.

This Special Report comprehensively analyzes changes in state and local government spending between 1957 and 2011. It shows that government unions unambiguously raise total costs for taxpayers. Spending cuts elsewhere do not fully offset the costs associated with unionizing government. States that give unions collective bargaining powers increase total spending by an average of $600 to $750 per capita. Government unions cost the average family of four between $2,300 and $3,000 per year.

Nationwide, states’ decisions to give government unions collective bargaining powers have inflated spending by state and local governments, and imposed a significant fiscal burden on taxpayers. Our results indicate that somewhere between $127 billion and $164 billion in 2014 spending by these governments is attributable to public-sector collective bargaining rules—with these additional costs concentrated among the states that award the most aggressive powers to unions.

—Geoffrey Lawrence was Director of Research at the Nevada Policy Research Institute until January 2015. He left NPRI in January 2015 and is now the Assistant State Controller of Nevada. James Sherk is Research Fellow in Labor Economics in the Center for Data Analysis, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation. Kevin D. Dayaratna, PhD, is Senior Statistician and Research Programmer in the Center for Data Analysis, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation. Cameron Belt was previously a Research Assistant at the Nevada Policy Research Institute. He is now Senior Economist at RCG Economics, LLC.

Appendix A: Statistical Methodology

This study uses panel data for all independent and dependent variables for all 50 states between 1957 and 2011.[30]

We tested whether the legal environment for public-sector collective bargaining arrangements had an effect on the level of per capita government expenditures, payrolls, and full-time-equivalent (FTE) workers.

Choice of Independent Variable

While previous studies have focused on union density as a possible determinant of government spending, we focused on the strength of collective bargaining laws. By examining only union membership, previous analysts implied that a union’s size alone determines how much influence it has over public policy. However, government unions exert strong influence on public-policy decisions because they enjoy powers not enjoyed by other citizens, not simply through the size of their membership. For this reason we believe that the legal framework is a more suitable indicator of union power.

Furthermore, these two variables are highly correlated. Union density tends to be highest where unions enjoy the strongest powers of compulsion. We found that changes in the legal environment account for roughly 80 percent of the variation in government union density. In practice, the choice of either variable has little impact on our results. The strong correlation between legal powers and union density prevents us from including both variables simultaneously without creating problems with multicollinearity.

Choice of Additional Control Variables

We assembled panel data for each state and year from 1957 through 2011. We included controls for factors other than union power that could affect government financial decisions. The difficulty in obtaining annual state-level data back to 1957 limited our choice of control variables. We considered, but could not find enough data for, controls for the unemployment rate, poverty rates, and racial and linguistic demographics. Each of these variables could influence government spending by increasing the demand for government services. We instead used the number of FTE workers employed in state and local welfare divisions as a proxy for variations in the demand for government services.

We also included controls for a two-period lag of the log of state population, the log of personal disposable income, right-to-work status, the political party in power in the governor’s office, and a second-order polynomial time trend.

Both population and per capita personal income can significantly affect government expenditures.[31] Controlling for personal income per capita accounts for individual state economic conditions, such as state costs of living and economic growth. The two-period lagged growth rate of state population helps to control for growth in the demand for infrastructure spending and other public services and for a growing tax base. We use lagged data because government budgets and expenditures do not vary immediately with changes in population. Generally, the increased demands of population growth take time to change state and local government budgets. Population changes in the current year do not usually influence the current year’s budget. Moreover, we normalized the dependent variables into per capita figures. Including the current period’s population as a control variable could lead to complications from regressing on an identity. We chose a two-year lag because some states do not set budgets on an annual basis and because statistical tests showed that longer lags did little to explain variation in the dependent variables.

Researchers have, unsurprisingly, found that the political preferences of the electorate affect government spending decisions. To account for this, we include a dummy variable that has the value of 1 when a Democrat holds the governor’s office. We also include dummy variable for whether a state has a right-to-work law. This variable may have a direct economic effect, but it also serves as a proxy for public attitudes toward unions.

We considered and chose to exclude other control variables that may appear relevant. For example, previous studies have controlled for regional factors (such as whether the state is in the South), population density, and the overall state and local tax burden.

Regional factors remain constant through time and are captured by our fixed-effects estimator. Some previous studies analyzed Southern states separately because of a perceived “anti-union” cultural value. This might make sense if union density was our independent variable. However, the legal environment for government collective bargaining varies greatly throughout the country, including among Southern states. As such, we saw no reason to isolate Southern states and treat them differently.

Previous studies have analyzed whether population density affects the size of government, positing that denser areas have a greater demand for public services and infrastructure spending. However, while population density may be an appropriate measure when comparing municipal expenditures, we believe it only confuses the results when applied at the state level. For example, Western states have lower population density than the Eastern states, but several Western states have high government spending.

We did not expressly adjust for cost-of-living differences because our fixed effects estimator accounts for such state-specific effects. The variable for personal income per capita also partly accounts for it; wage differences between states largely reflect differences in living costs.

Finally, using the tax burden as a control variable makes little sense when government spending is the dependent variable: 49 states (all states except Vermont) have a balanced budget requirement that restricts state-level spending to the amount of available revenue.

Model

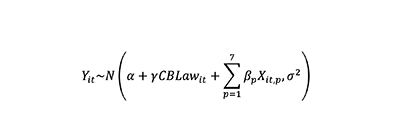

Having selected the appropriate variables, our model takes the form:

Yikt = α+ γ (CBLawikt)+ β(Xit) + εikt

where Y is the level of per capita spending, FTEs, and payrolls in state i at time t in sector k (Total, State, Local, Police, Other, and Fire). Furthermore, CBLawikt is the collective bargaining regime, Xit is the vector of control variables, εikt is the error term, and α is a fixed-effects dummy variable.

We normalized all relevant government expenditures, FTE employment levels, and total payrolls by adjusting them into per capita terms.

We present our results using ordinary least squares (OLS) in columns 1 and 2 of Tables 2–13. Panel data has the potential to introduce potential complications that could bias our estimated coefficients and attenuate standard errors, particularly heteroskedasticity, serial correlation, and cross-sectional dependence. We corrected for these problems using Driscoll–Kraay standard errors. Monte Carlo tests have shown that Driscoll–Kraay standard errors best correct these problems in panel datasets with large numbers of panels and large time series.[32] We present the Driscoll–Kraay results in columns 3 and 4 of Tables 2–13.

The model also needed to account for possible state-specific factors that could affect the variables of interest. We tested for whether estimators of state-specific fixed effects or random effects were appropriate, and found the fixed-effects estimator was the appropriate specification. The results in columns 2 and 4 of the tables display these fixed-effects estimators under OLS and Driscoll–Kraay standard errors, respectively. For the sake of completeness, we present the random-effects estimator under OLS standard errors in column 1.

Using a fixed-effects model introduces other potential complications. It eliminates differences across states and restricts identifying variation to differences within states over time. This may eliminate valuable identifying information. To address these concerns, we also ran the models without fixed effects using pooled data and with the Driscoll–Kraay robust standard errors (not a random-effects specification). We present these results in column 3 of Tables 2–13. The general similarity of the results in column 3 and column 4 provides evidence that our model is correctly identified. While we present multiple estimates, our preferred estimates are the Driscoll–Kraay standard errors with fixed effects in column 4.

We tested for unit roots in our data using the Levin–Lin–Chu test recommended for use in moderate-sized datasets.[33] These tests indicated stationarity in three of the dependent variables we examined: (1) local government FTE police employment per capita; (2) total government FTE police employment per capita; and (3) real K–12 spending per capita. The test rejected the null hypothesis of a unit root for all other dependent variables.

For the sake of presentation, we display only the regression coefficient on the collective bargaining variables in Tables 2–13. The full regression results, obtained using STATA 13, are available upon request.

Data Sources

We obtained historical data on union bargaining powers by state and year from the NBER collective bargaining scale. We updated these data through 2011. We also compiled data on the date of the enactment of state right-to-work laws and the years in which states had Democratic governors. We obtained state per capita personal income data from the Bureau of Economic Analysis. We obtained data on annual state populations from the Census Bureau.

For our dependent variables, we used different functional job classifications of real government spending, FTE employees, and payroll, all normalized by state population. We defined average earnings as the average monthly earnings for employees within the selected category. These earnings figures do not include benefits, such as pensions or health care. In all, our variables include total, state, local, and specific department (police, fire, teachers, and other) spending, payrolls, and employment.

We obtained these data from the Census Bureau’s Annual Survey of State and Local Government Finance. This annual survey began in 1977, and we merged it with the Census of Governments survey starting in 1957. For non-survey years from 1957 to 1977, the Census Bureau provides estimates of annual values. We interpolated the remaining missing observations.

We adjusted the dependent and independent variables for inflation (2009 dollars) using the gross domestic product (GDP) deflator.

Additional Considerations

One potential limitation on our model is its implicit assumption that each incremental movement along the NBER scale affects government expenditure by an equal magnitude.

We attempted a functional form using a separate dummy variable for each of the eight NBER levels of collective bargaining. Our coefficients on these dummy variables were generally statistically insignificant. This is likely due to the lack of enough variability within and across panels for each of these dummy variables to capture and explain variations within our dependent variables. For example, 70 percent to 95 percent of the separate state collective bargaining individual-level dummies are 0. However an F-test of joint significance was performed for each model. The F-test returned a p-value of 0.00 for all models. So while the dummy variables for the NBER bargaining scale are not individually significant, they are jointly significant, and we can reject the hypothesis that they have no effect on the outcome variables. Because of this result, we followed the precedent within the literature that uses this 1–8 scale as an independent variable.[34]

Nonetheless, we felt compelled to further clarify the analysis identifying the points along the NBER scale that have the greatest impact on government expenditure. Our intuition was that the greatest impact came from granting compulsory collective bargaining. We created and tested a new dummy variable equal to 1 when the collective bargaining variable was greater than or equal to 5—indicating mandatory collective bargaining—and equal to 0 when the value was 4 or less.

Using this variable in our model produced statistically significant results. In our main results, we present these results along with the results using the NBER scale. For the estimates looking at total state and local government spending across all employee classes, we created a variable equal to 1 if all five employee groups had compulsory collective bargaining powers, and 0 if they did not. In this way, we differentiated states giving the strongest powers to government unions from those that did not. While this may seem a restrictive definition, approximately one-third of all state-year observations fit this classification. In results not shown, we created a variable summing the total number of compulsory bargaining laws across all five employee classes. Using this variable, we found similar results to those presented in the paper.

Robustness Tests

We tested the robustness of our principal finding—that greater powers for government unions increase total government spending—to alternative model specifications.

Semi-Log Model. The first two rows of Appendix Table A-1 replicate the models used in the final row of Tables 12 and 13, respectively. They differ only by examining the log of per capita total state and local government expenditures as the dependent variable instead of the level of those expenditures.

Both the NBER collective bargaining scale and the dummy variable indicating whether a state mandates collective bargaining for all employee groups show a statistically significant correlation with higher government spending. The first row of Appendix Table A-1 shows that under the semi-log specification, a one-unit increase in the NBER collective bargaining scale increases total state and local government spending between 0.7 percent and 2.1 percent. This implies that total government spending would increase between 5 percent and 15 percent if a state moved up all seven units in the NBER scale.[35] Our preferred Driscoll–Kraay fixed-effect estimate implies a 5 percent increase in total government spending.

The second row of Appendix Table A-1 shows that states requiring collective bargaining for all employee groups have 3 percent to 8 percent higher total spending than states that do not.[36] The preferred Driscoll–Kraay fixed-effects specification implies 3 percent greater government spending in these states, and the result is statistically significant at the 1 percent level.

Dropping Control Variables. Appendix Tables A-2 and A-3 replicate the Driscoll–Kraay with fixed-effects regression on total government spending from Tables 12 and 13, respectively. The last column shows the complete regression results from the models in Tables 12 and 13. The remaining columns show the results of iteratively dropping each control variable in the analysis. Both the analyses using the NBER collective bargaining scale and mandatory collective bargaining for all employee groups are robust to the exclusion of most control variables. However, the NBER-scale analysis is not robust to excluding the time trend from the analysis.

Census Division Specific Time Trends. Given the necessity of controlling for time trends, we believe it important to include a time trend. However, we also explored the robustness of our results to alternative specifications of the time trend. In the third and fourth rows of Appendix Table A-1, we replicate the total government spending results from Tables 12 and 13, using a second-order polynomial time trend for each census division, rather than a nationwide time trend. This somewhat reduces the magnitude of the results, but all coefficients remain statistically significant at conventional levels.[37]

Case Studies Using Synthetic-Control Approximation. The ideal study would have a set of control states and exactly identical treatment states before the treatment period and administer the treatment at exactly the same time. This research design would provide a truly unbiased treatment effect. As is frequently the case in economics, this has not happened in the real world. We instead created a synthetic experiment using the synthetic-control method.

The synthetic-control method is primarily used in comparative case studies. It uses a data-driven procedure to create a best-matched counterfactual from a group of control states that accurately mimics the treated state in the time period prior to treatment. The method compares the observed, actual dependent variable data (for instance, per capita spending) in the post-treatment period with the created, unobserved synthetic-control observations from the best-matched group of control states in an attempt to provide a relevant counterfactual to understand what overall effect the treatment (such as a collective bargaining policy change) had on the treated state.

For the purposes of this analysis, the best possible treatment groups are states that mandated compulsory collective bargaining for all five employee classes simultaneously. In total, 10 states passed compulsory laws for all five employee groups at the same time: New York (1967), Washington (1968), New Jersey (1968), Oregon (1969), Hawaii (1970), South Dakota (1970), Minnesota (1971), Montana (1973), Florida (1974), and Ohio (1984).

We compared these states with a control group of states that either never had any compulsory laws or have never had more than two compulsory collective bargaining laws at a time. (We attempted to use a control group made up of states never exposed to compulsory collective bargaining laws, but were unable to make relevant synthetic-control groups for any of our 10 treatment states.) Appendix Table A-4 provides the complete list of control states and the number of employee categories with compulsory bargaining.

Among the treated 10 states, we were able to create four synthetic-control matches that accurately reflected the traits of the treated units in the pre-treatment period. While we would have preferred to examine more states, the data-driven procedure of the synthetic-control method statistically determined whether a state was a good candidate for analysis.

We could not create a statistically representative match in the other six states with the available pool of control states. When tested, the six states produced root mean square prediction errors (RMSPEs) ranging from two- to seven-times higher than our best fitting model, New Jersey.

State legislatures typically pass legislation in the middle of the year, and the legislation usually takes effect several months later. For example, the New York legislature passed the Taylor Law requiring collective bargaining in the state and local government in April 1967. The law took effect in September 1967. For the purposes of our analysis, we considered the treatment to begin in the first full year after the collective bargaining law passed.[40] This avoids conflating inaction before the law takes effect with the law having no effect. Following Abadie, Diamond, and Hainmueller’s pioneering work on synthetic control case studies, we constructed synthetic control matches for a decade following the initial passage of the collective bargaining law.[39] They explain that a decade is “a reasonable limit on the span of plausible prediction” under the synthetic-control method.[40]

For each state we constructed our synthetic-control match on the level of per capita state and local government spending one, five, and 10 years before the treatment took effect, the log of real GDP per capita, the log of real personal income per capita, the log of state population, and the average strength of all collective bargaining laws in place.

Charts 2 through 5 present the results of these synthetic control analyses. In each state, government spending grew faster in the actual state that required collective bargaining than in the synthetic state that did not.

To test for statistical significance, we conducted placebo tests. This involved replicating the synthetic experiment on states that did not change their collective bargaining laws. We compared the difference between the synthetic and actual states from these placebo runs with the difference for the states that changed their collective bargaining laws. Charts 2 through 5 also display the placebo tests for each of the states under analysis.

Both New Jersey and New York showed statistically significant increases in government spending. The difference between the actual and synthetic real per capita government spending grew at a faster rate in those states than in any of the placebo tests. Real per capita state and local government spending grew faster in Ohio and South Dakota than in their synthetic states, but these differences were not statistically significant.

Appendix Table A-5 shows the weights on each state used in the synthetic control matches. Appendix Table A-6 shows how closely the synthetic states match the actual states in the pre-treatment period for the matched characteristics.

Bayesian Analysis

We tested the robustness of our regression results using Bayesian analysis. Standard frequentist approaches assume that the parameters in statistical models are fixed quantities. These methods rely heavily on large sample approximations by assuming asymptotic normality and that the data observed are a single realization of infinitely many samples. On the other hand, Bayesian methods assume that each parameter’s true value is a random variable to which a priori assumptions are assigned via a probability distribution.[41] Based on both the sample data as well as the prior information, a posterior distribution regarding each parameter can be estimated conditionally on observed data.

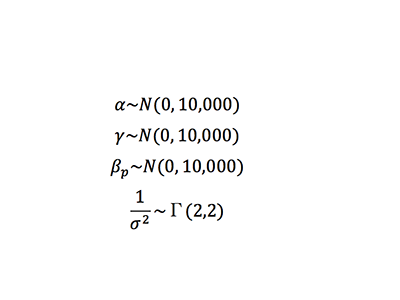

We estimated five Bayesian statistical models (Models I–V) to understand the impact of a variety of factors—in particular, the presence of right-to-work laws, the political party in power, time, income, population, government welfare spending, and the presence of collective bargaining laws—on the level of per capita government expenditures. Models I–V differed in assumptions regarding heterogeneity of intercepts as well as error terms. In addition, Model IV and Model V included a time-varying dynamic component in their intercept terms to model the concept that a certain degree of time dependence may occur between years. We present below detailed results from this Bayesian analysis, including posterior standard deviations and Bayesian credible interval estimates.

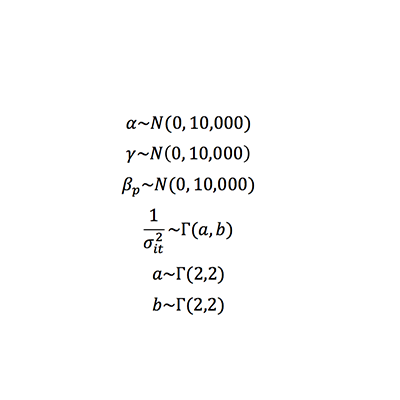

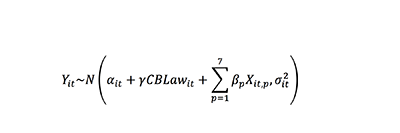

Model 1

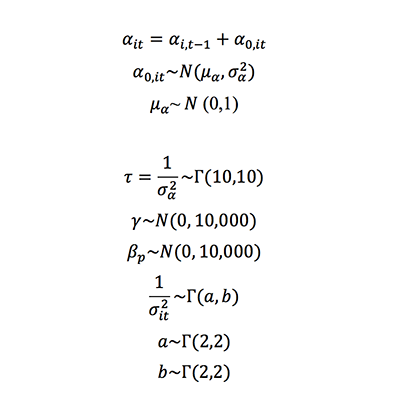

With prior specification:

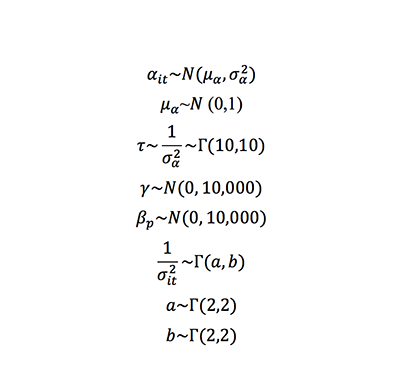

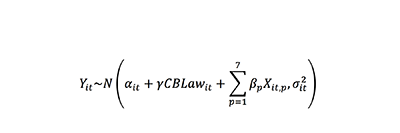

Model 2

With prior specification:

Model 3

With prior specification:

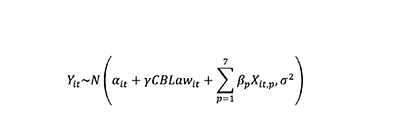

In these models, for state i and time t, Xit,1 is a binary variable indicating the presence of right-to-work laws, Xit,2 is a binary variable indicating whether the governor is a Democrat, Xit,3 represents time, Xit,4 represents time squared, Xit,5 represents the natural log of per capita personal income, Xit,6 represents the two period lagged state population, Xit,7 represents all government welfare spending for full-time employees, CBLawit represents the state’s score on the NBER collective bargaining scale, and Yit is per capita government spending.

Model 4

With prior specification:

Model 5

With prior specification:

Our models differ in intercept and variance. Model IV and V introduce a dynamic component by allowing a time-varying intercept term. Posterior distributions of the parameters in the models were estimated via the Markov Chain Monte Carlo (MCMC) simulation, using over 20,000 MCMC iterations with an additional 5,000 for burn-in. We ensured convergence to a stationary distribution by monitoring the time series of the iterations. Posterior means, standard deviations, and credible intervals are reported. We tested the robustness of our results for a variety of prior distributions beyond those specified above and found results similar to those presented here.

It is useful to assess the comparative predictive ability of our five models. Bayes factors are generally used for this purpose. The pseudo Bayes factor (PsBF) is based on a model’s cross-validation predictive density. As standard Bayes factors are often not computationally feasible to compute, the PsBF is considered a useful surrogate.[42] We computed PsBFs for Models II–V to compare them to Model I. We also checked within sample error by computing Mean Absolute Error (MAE) of the predictive posterior distribution. Both are presented in Appendix Table A-12:

These results suggest that Model V has greater predictive ability than its counterparts, while Model IV has the best fit in terms of within sample error. Model IV indicates that each increment a state advances along the NBER collective bargaining scale increases state and local government expenditures by approximately $150 per capita. Model V indicates that each step along the NBER scale is associated with spending approximately $225 higher per capita.

Appendix B: State-by-State Analysis

Appendix B provides a brief historical background on collective bargaining laws in each of the 50 states and applies the findings from our statistical analysis to draw conclusions about the impact that changes to the law might be expected to produce in each state.

This appendix focuses on statewide laws on government unions. We recognize that local governments in some states engage in collective bargaining with their employees despite no legal requirement to do so.

Judicial opinion has been divided as to whether local governments can engage in collective bargaining if the state legislature has not granted them the authority to do so. For instance, Virginia’s Supreme Court declared that local governments could not engage in collective bargaining without state authority, whereas Florida’s Supreme Court concluded otherwise. In either case, a state statute expressly authorizing collective bargaining clearly grants more leverage to government unions than the absence of one, and this distinction has been discussed at length in the academic literature.

We also provide an overview of the current labor law environment for each class of government employees, along with a ranking system that provides context for the unique provisions in each state.

Appendix B also creates a new metric for comparing the labor law environment (LLE) for government employees across the 50 states based on what the statistical analysis developed in this paper reveals to be some of the most significant variations in state collective bargaining statutes. An LLE score, ranging from 0 to 1, is computed for each state. Scores near 0 mean government unions have few powers of compulsion, while scores near 1 indicate that they have the greatest available powers of compulsion over government employees.

These scores are calculated in rough proportion to what the authors observe to be the most significant variables in state labor laws based on the results of empirical analysis developed for this paper. Specifically, a state’s LLE score is composed of:

- NBER score for the collective bargaining regime (50 percent);

- Right to work versus forced unionization (20 percent);

- Dispute-resolution mechanism (10 percent);

- Legality of strikes (10 percent); and

- Proportion of government employees covered by a union contract (10 percent).

The LLE score allows meaningful comparisons across states using a single, ratio-scale variable. Accordingly, the authors have used this new metric to rank the states based on their LLE score. Every state falls within a range of 0.013 to 0.898. States lower on this scale award fewer compulsory powers to public-sector unions and, thus, earn a higher ranking.

Virginia ranks first due to its explicit prohibitions against any coercive powers for public-sector unions, right-to-work provisions, and low union-participation rates among government workers. At the other end of the spectrum are 19 states with LLE scores greater than 0.8, with Pennsylvania ranking last.

This appendix also analyzes the prospective fiscal impacts that would result from a change in collective bargaining regimes in each state. We provide a range of figures, using the coefficients from the final row of column 4 of Table 12 and the third row of column 4 of Appendix Table A-1 that estimate the correlation between average collective bargaining powers and total state and local government spending per capita. We multiplied these coefficients by the Census Bureau’s 2014 state population estimates, the change in average collective bargaining powers, and adjusted for inflation between 2009 and 2014 to arrive at our estimate of the change in total state and local government spending.

These spending changes do not exclusively reflect spending on compensation for government employees. Government unions campaign extensively for higher taxes and against spending cuts. Their members capture some, but not all, of the financial proceeds of this lobbying. For example, in 2012, government unions in California funded a ballot measure to increase state income and sales taxes. It passed, and the state and local governments spent more than they would have in 2013. Our estimates capture the overall effect of government unions on government spending, including spillovers that increase spending outside unionized departments.

Alabama

LLE Score = 0.180

RANK: 6

Background. In June 1957, Alabama prohibited government-sector collective bargaining for all employee groups. Lawmakers partially reversed course 10 years later, when they required public employers to meet with firefighter union representatives to discuss their proposals for contract terms. Beginning in 1996, a similar requirement was imposed on local school boards, which became obliged to “meet and confer” with teacher union representatives.

Analysis. For three of five employee groups, Alabama explicitly prohibits public employers from signing contracts with union leaders. This prohibition undergirds the state’s LLE score of 0.180, ranking sixth among the states for restricting government unions’ powers of compulsion.

However, if Alabama lawmakers had never reversed the prohibition against collective bargaining for teachers and firefighters, state and local spending for 2014 would likely have been between $349 million and $739 million less in 2014. On the other hand, if the powers of compulsion currently enjoyed by teachers and firefighters had been expanded to other employee groups, 2014 spending would likely have been about $524 million to $1.1 billion higher. If all employee groups had received the most aggressive powers of compulsion (an NBER score of 8), 2014 spending would likely have been $1.6 billion to $3.6 billion higher.

Alaska

LLE Score = 0.888

RANK: 49

Background. Alaska lawmakers enacted the state’s first collective bargaining statute in April 1959, giving state and local governments the option of bargaining collectively with union representatives. By June 1970, teacher union bosses successfully prodded lawmakers to grant them compulsory collective bargaining powers along with the explicit right to strike. In September 1972, those powers were extended to unions representing all employee groups. A subsequent change in 1993 removed the explicit power to strike from police and firefighting professionals and replaced it with a binding arbitration process.

Analysis. Lawmakers in Alaska have done little to restrict government unions’ powers of compulsion over public employers, having granted compulsory bargaining along with coercive resolution techniques to every class of union. Alaska’s labor environment for government workers is among the most coercive in the nation.

If collective bargaining had remained optional for Alaska’s public employers, state and local government spending in 2014 would have been about $239 million to $585 million lower. If no collective bargaining law had ever been implemented, 2014 spending would have been about $282 million to $599 million lower. By contrast, if all employee groups had gained access to a mandatory arbitration procedure, 2012 spending would have been between $26 million to $57 million greater.

A right-to-work law would have reduced government spending by around $234 million.

Arizona

LLE Score = 0.313

RANK: 12

Background. Teacher union leaders prompted Arizona lawmakers to pass the state’s first formal collective bargaining statutes in 1973, making it optional for local school districts to enact collective bargaining ordinances. Similar powers were extended to all other employee groups beginning in 1975. In December 2008, Governor Janet Napolitano (D) issued an executive order requiring state agencies to engage in a “meet-and-confer” process with unions for state workers. Governor Jan Brewer (R) rescinded the order four months later.

Analysis. Although many local jurisdictions in Arizona participate in collective bargaining or a meet-and-confer procedure, Arizona’s statewide legal regime imposes few obligations on public employers to negotiate with unions.

If lawmakers had gone the other direction and explicitly prohibited collective bargaining, 2014 spending would have been about $808 million to $1.7 billion lower.

On the other hand, if public employers had been required to engage in compulsory collective bargaining and mandatory arbitration with all unions, 2014 spending would have been $2.1 billion to $4.2 billion greater.

Arkansas

LLE Score = 0.264

RANK: 8

Background. Lawmakers in Arkansas enacted the state’s collective bargaining statute in September 1968, which formally gives local governments the option of engaging in collective bargaining or passing ordinances that require collective bargaining. Although lawmakers revised the statute slightly in 1983, the law has remained mostly unaltered.

Analysis. Arkansas ranks alongside Arizona, Louisiana, South Carolina, and West Virginia as states that give public employers the option of negotiating with unions for all employee classes.