The morass of laws governing the employer–employee relationship is extremely complex. These laws are primarily enforced by the Department of Labor (DOL),REF the National Labor Relations Board (NLRB),REF and the Equal Employment Opportunity Commission (EEOC).REF Among the key laws governing employment are the Fair Labor Standards Act of 1938 (FLSA);REF the Labor–Management Reporting and Disclosure Act of 1959 (LMRDA);REF the Occupational Safety and Health Act of 1970;REF the Family and Medical Leave Act of 1993 (FMLA);REF Title VII of the Civil Rights Act of 1964REF and the Civil Rights Act of 1991;REF the Equal Pay Act of 1963;REF the Age Discrimination in Employment Act of 1967;REF and the National Labor Relations Act of 1935 (NLRA).REF There are at least 19 other significant federal laws governing employmentREF and countless state and local laws.

To improve perceived fairness, correct disparities in economic power, or achieve other objectives, all of these laws replace with inflexible government mandates a voluntary, privately ordered arrangement between service providers and those that pay them. These laws impose substantial compliance costs on employers and increase the risk and cost of employment-related lawsuits or enforcement actions. They therefore raise the cost of employing people, retard job creation, reduce wages and hinder the flexibility of both employers and employees. They have a disproportionately adverse impact on small firms because compliance costs do not increase linearly with size. Thus, an uncritical acceptance of the status quo is unwarranted.REF

The primary focus of this Backgrounder is a series of federal regulatory and legislative reforms presently being actively considered. It provides a brief analysis of two dozen separate issues. It does not address workers’ compensation,REF the Americans with Disabilities Act,REF the Patient Protection and Affordable Care Act,REF the taxation of employee benefits,REF the regulation or taxation of pensionsREF or qualified retirement accounts,REF state or local employment laws,REF occupational licensing,REF employer responsibilities under the immigration laws,REF or potential fundamental reforms to labor or employment law.

Economics of the Labor Market

Wage rates are generally determined by the interaction of the demand for and the supply of labor. In this sense, the price of labor (the wage rate) is determined like prices in other competitive markets. Private, for-profit employers hire and pay employees to earn a profit. They pay no more or less than the competitive labor market requires. In general, employers will continue hiring employees until the marginal costs of hiring those employees equals their expected marginal output or marginal product. Output, and therefore the demand for labor, is influenced by invested capital and technological factors.

Employers’ costs include wages or salary, benefits, employer taxes or other mandatory payments, administrative costs, and contingent costs or risk of loss. To the extent that labor and employment laws increase benefit costs, administrative costs, and contingent costs (risk of loss), this will be borne primarily, although not exclusively, by employees in the form of lower wages and salaries.REF Employer total costs cannot exceed employee product or the firm will fail.REF Employer wages cannot long be lower than those paid by competing employers or employees will leave.

Markets and information are imperfect, and there are costs associated with job changes, so these effects are not instantaneous. Moreover, wage rates can be “sticky” downwards. But eventually, higher costs imposed by labor and employment laws will generally be borne by employees in the form of either wages and benefits that are lower than they would otherwise receive or lost jobs—or both.REF

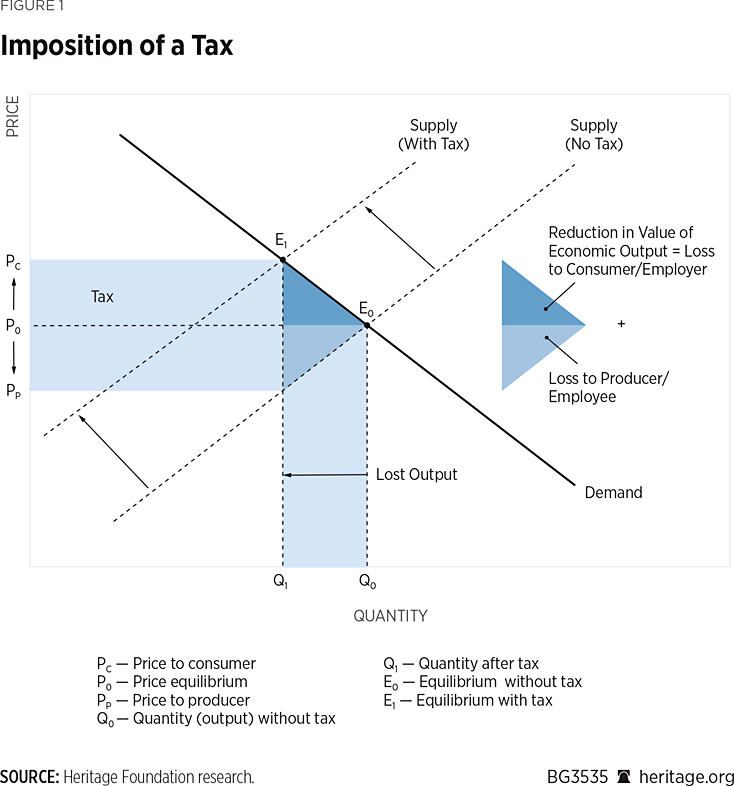

A tax, mandatory fee, or mandatory cost has a social cost (often called an excess burden or deadweight loss) and reduces output. This is illustrated in Figure 1. When a tax on a good or service is imposed, the price to the consumer or employer increases (to P0 from Pc), and the amount produced declines from Q0 to Q1. The net of tax price to producers or employees (Pp) also declines. The social cost of the tax (deadweight loss or excess burden) is measured by the shown triangle and reflects the goods and services not produced or consumed (or the work not undertaken).

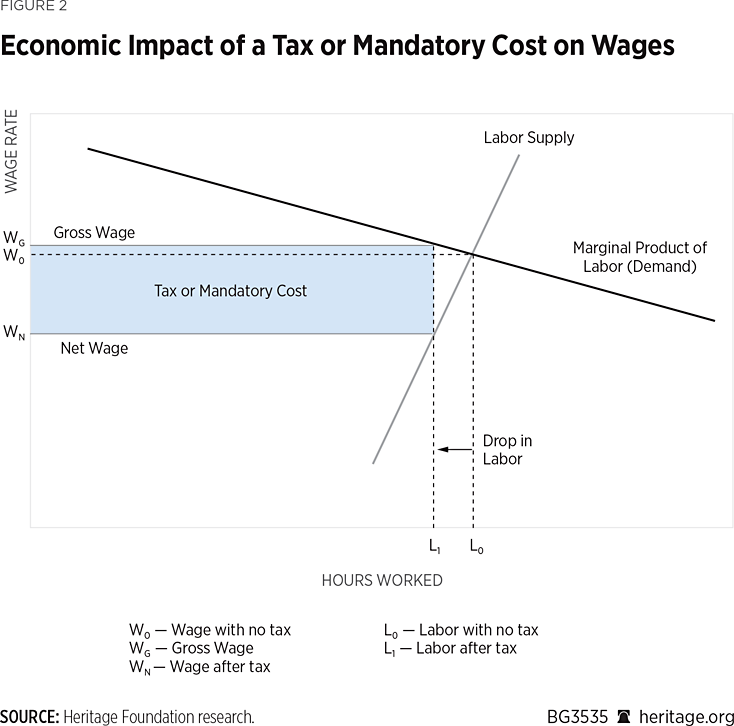

In the context of the labor market, a payroll or income tax on wages or a mandatory fee or mandatory cost associated with employment will reduce wages, employment, and hours worked. This is illustrated in Figure 2, with a decrease from L0 to L1.

In economics, an “elasticity” is how much one variable changes when another variable changes.REF The price elasticity of demand is a measure of how much the quantity of a good or service demanded decreases when prices increase. The price elasticity of supply is a measure of how much the quantity of a good or service supplied increases when prices go up. These can be thought of as a measure of the sensitivity of supply or demand to price changes. Labor demand or labor supply elasticities measure how much labor demand or supply varies with compensation (wage rates).

Because labor supply is inelastic relative to demand,REF it is relatively vertical on the diagram in Figure 2. The quantity of labor supplied does vary as wages vary but not by as much as demand varies as wages vary. This is reflected in the size of the lower triangle being larger than the upper triangle in Figure 2. Thus, the economic losses associated with labor taxes or mandatory costs are disproportionately borne by employees (the suppliers of labor).

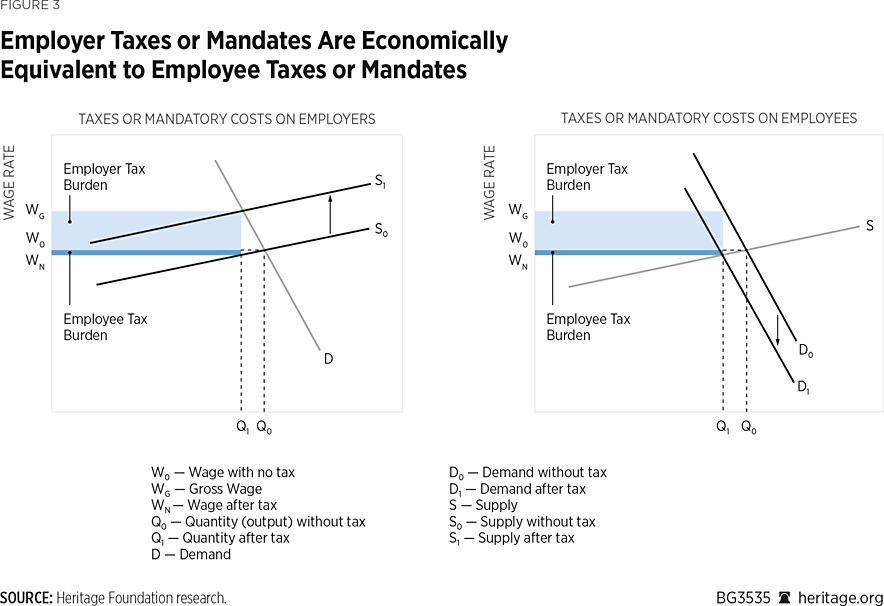

It does not matter whether the legal obligation to pay a tax or incur a cost is on the employer or employee. The economic impact is identical. This is illustrated in Figure 3.

If a tax or cost is imposed on employees, the supply curve will shift to the left since at any given pre-tax wage rate, less will be supplied because the after-tax wage is lower. The quantity of labor used will be less. If a tax or cost is imposed on employers, the demand curve will shift to the left since at any given pre-tax wage rate, less will be demanded because the after-tax wage rate is higher. The quantity of labor used will be less. The economic incidence (burden) of the tax is the same since the slopes of the demand and supply curves are the same. The legal incidence of the tax makes no economic difference.

Capital and labor are complementary factors of production. It takes both, as well as entrepreneurs and management, efficiently directing those factors toward a common objective for a business to succeed. The best way for policymakers to improve the well-being of workers is not to increase the cost and risk of employing people. Higher costs and greater risks harm employees. Instead, policymakers should seek to remove impediments to innovation and investment, which will increase worker productivity and result in higher wages.

Specific Issues

The remainder of this Backgrounder analyzes specific proposals to alter labor and employment law.

Minimum Wage

The current federal minimum wage affects approximately 2.1 percent of hourly paid workers.REF Nearly half (47 percent) of these people are age 24 or less.REF The primary effect of minimum wage laws is to make it illegal for inexperienced, low-productivity (usually young) people to work.REF This makes it difficult for them to get the experience and skills to move up the economic ladder and to demonstrate their capabilities to employers. Employers forced to pay a higher minimum wage will: (1) hire more experienced, more productive workers; (2) substitute labor-saving technology and capital equipment for labor (automation); (3) if possible, move their operations to a jurisdiction that does not impose a minimum wage; (4) hire fewer employees and produce fewer goods and services; (5) reduce benefits such as insurance or paid leave; and (6) attempt to raise customer prices—or some combination of these six responses. In the latter case, customers will, in turn, sometimes decline to pay the higher prices by substituting other goods and services or not spending.

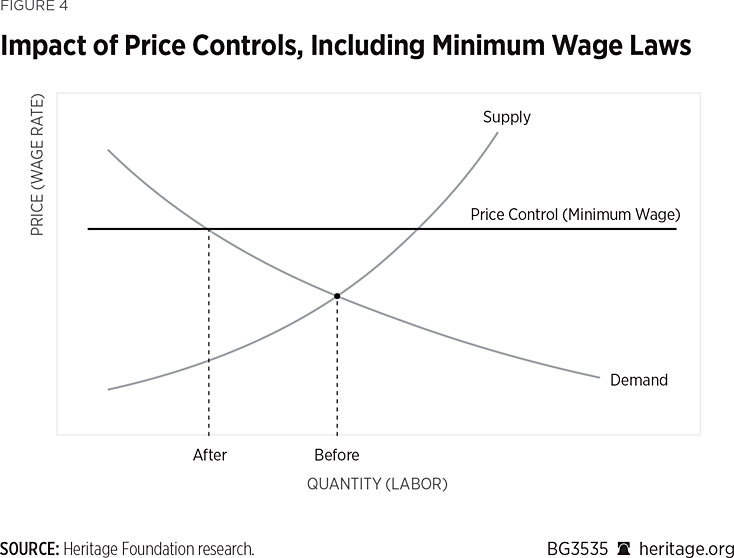

The market price of any good or service is determined by supply and demand. The price settles at a level at which supply equals demand. When government fixes a minimum price for any good or service that is above the market clearing price, supply will exceed demand. Demand, at the new higher price, will be lower. The dollar value (quantity) of market exchanges will decline.

Impact of Price Controls (Including Minimum Wage Laws)

Minimum wage laws fix the wage rate (price) of certain labor at above the market wage rate. Therefore, they result in less demand for labor at the higher price. Jobs will be lost (unemployment) and hours worked will be reduced.REF This is illustrated in Figure 4.

The Raise the Wage Act passed the House by a vote of 231–199 on July 18, 2019.REF It would gradually increase the federal minimum wage to $15.00 an hour. It would be fully phased-in after six years. This amounts to about at least $34,000 annually per full-time employee once employer taxes are considered.REF The minimum wage thereafter would be indexed to the annual percentage increase, if any, in the median hourly wage of all employees. The Congressional Budget Office has estimated that a $15 per hour minimum wage would cost 1.3 million people their jobs—although potentially as many as 3.7 million people would lose their jobs.REF

Independent Contractors

The issue of how to classify a worker as an employee or independent contractor has been contentious since at least the 1970s—and it has still not been adequately resolved. The legal criteria for determining who is and is not an employee are different for purposes of federal tax law;REF various labor, employment and pension laws;REF various state labor, employment, and workers’ compensation laws; and tort law.REF None of these standards are models of clarity. This situation causes substantial confusion and uncertainty, which in turn increases administrative costs, legal costs, and regulatory risk. This is of even greater importance given the employer mandate in ObamacareREF and the rise of Internet platforms matching customers with service providers.

Provisions should be adopted establishing bright line tests for whether a payee is definitely an employee or definitely a contractor—and allowing the employer and employee to choose in the middle ground of ambiguous cases, provided that contractors in the middle ground are subject to 1099 reporting and moderate back-up withholding. Furthermore, the definition should be harmonized for tax, labor and employment, pension, and health care law purposes.

The Modern Worker Empowerment Act would replace the current DOL and judicially created standards (often called the “economic realities” test) with the tax standards for purposes of the FLSA.REF This is a small but significant step in the direction of harmonization, and therefore welcome. However, the 20-factor tax test adopted is certainly not the model of clarity.REF Any test that has 20 factors, with the weighting of those factors undetermined, will always be problematic in practice.

The NEW GIG Act is a reasonable attempt to provide a safe harbor governing worker classification for income and employment tax purposes as an alternative to the existing 20-factor test.REF Under the legislation, a worker would be classified as an independent contractor if: (1) there is a written contract governing the terms of the work; (2) the worker incurs expenses, a significant portion of which are not reimbursed; (3) the worker agrees to work a particular amount of time, to achieve a specific result, or to complete a specific task; and (4) the arrangement also meets one of the following four criteria:

- The service provider has a significant investment in assets or training which are applicable to the service performed;

- The service provider is not required to perform services exclusively for the service recipient or payor;

- The service provider has not been treated as an employee by the service recipient or payor during the previous year; or

- The service provider is not compensated on a basis that is tied primarily to the number of hours actually worked.

This is similar to a Trump Administration Proposal included in the Administration’s fiscal year 2020 budget proposal.REF

The Protecting Independent Contractors from Discrimination Act would extend coverage of Title VII, Age Discrimination in Employment Act of 1967 (ADEA), FLSA, Americans with Disabilities Act (ADA), the Rehabilitation Act of 1973, and Genetic Information Nondiscrimination Act (GINA) to any “individual who provides work for an employer under the terms of an independent contract.”REF It would thus go a long way down the road of eliminating the category of independent contractor. This legislation can be expected to have an adverse impact on worker pay, the number of independent contractors, and the flexibility of labor markets. It would also disproportionately harm small businesses because small firms rely heavily on contractors for services they cannot perform in-house.

Protecting the Right to Organize Act

On September 25, 2019, the House Committee on Education and Labor marked up and ordered that an amended versionREF of the Protecting the Right to Organize (PRO) ActREF be reported out of committee for consideration by the full House. On February 6, 2020, it passed the House.REF The legislation would make sweeping changes to labor laws, primarily the NLRA, that are designed to aid labor organizations. The discussion below is regarding the version approved by the House.REF

Joint Employment. The PRO Act would codify the joint-employer standard the Obama-era NLRB adopted in its 2015 Browning-Ferris decision.REF Specifically, the legislation provides that “[t]wo or more persons shall be employers with respect to an employee if each such person codetermines or shares control over the employee’s essential terms and conditions of employment.” Indirect control or reserved authority to control (i.e., potential control) would suffice to trigger a joint employment determination. This would often mean that employees of franchisees would also be treated as employees of franchisors—and would endanger the franchise business modelREF used by approximately three-quarters of a million businesses that employ nearly 9 million people.REF (See the Joint Employment section below for a detailed discussion.)

Accelerated Union Elections. The PRO Act would codify the Obama-era NLRB’s changes to union election procedures that took effect in 2015, often referred to by opponents as the “ambush” or “quickie” election rule.REF (See the Accelerated Union Elections’ section below for a detailed discussion.)

Micro Unions. The PRO Act would codify the Obama-era NLRB’s 2014 Specialty Healthcare decision.REF (See the Micro Unions section below for a detailed discussion.)

Pre-emption of State Right to Work Laws. State right-to-work laws provide that no person can be compelled, as a condition of employment, to join or pay dues to a labor union. The PRO Act would pre-empt state right-to-work laws by allowing collective bargaining agreements requiring all employees to pay union dues as a condition of employment—notwithstanding any state or territorial law to the contrary.REF Twenty-seven states are currently right-to-work states.REF

Broaden the Definition of “Employee” for NLRA Purposes. The PRO Act would substantially broaden the definition of employee for purposes of the NLRA by adopting the “ABC test.”REF This test effectively establishes a presumption that workers are employees. Under the definition, an individual performing any service shall be considered an employee and not an independent contractor unless: (1) the individual is free from control and direction in connection with the performance of the service, both under the contract for the performance of service and in fact; (2) the service is performed outside the usual course of the business of the employer; and (3) the individual is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as that involved in the service performed. Prongs (2) and (3) of this standard, in particular, would classify as employees many people who are classified as independent contractors under current law. CaliforniaREF and a substantial number of other states use some version of this standard for one purpose or another (e.g., unemployment insurance, workers’ compensation, and sometimes wage and hour legislation). It is rarely used for all state labor, employment law, and state tax purposes.

Card Check. The PRO Act would impose a version of “card check”REF and allow circumvention of the use of secret ballots in union elections.REF The PRO Act would provide that even if a union lost an election using secret ballots, the NLRB would nonetheless have to certify the union if a majority of employees had signed a card authorizing the union representation—unless the employer demonstrates that alleged interference with a fair election by the employer would not have affected the outcome of the election. This would allow unions to circumvent secret ballot elections in which they allege employer interference, and further raises concerns with respect to intimidation of employee-voters.REF

Mandatory Binding Arbitration. The PRO Act would institute mandatory binding arbitration in collective bargaining negotiations.REF Mandatory arbitration would be required if an agreement is not reached within 120 days and would be binding for two years. Employees would be unable to vote on the contract determined by the arbitrators. There would be little means for an employer to challenge the arbitrators’ decision.

Employer Electronic Devices. The PRO Act would require that employers allow the use of employer computers, e-mail, and phones for Section 7 protected concerted activity.REF (See Protected Concerted Activity section below for a detailed discussion of these types of issues.)

Secondary Boycotts. The PRO Act would repeal prohibitions on “secondary boycotts”REF and “recognitional picketing”REF by unions directed toward companies that do business with the firm that the union is attempting to unionize.REF

Joint Employment

“Joint employment” occurs when two entities are both considered employers of an employee with respect to the same job. The DOL recently changed its joint-employer rules for purposes of the FLSA, narrowing the Obama-era DOL’s expansive definition of joint employment.REF The Department adopted a four-factor balancing test derived from Bonnette v. California Health & Welfare AgencyREF (but modified) to assess whether the other entity: (1) hires or fires the employee; (2) supervises and controls the employee’s work schedule or conditions of employment to a substantial degree; (3) determines the employee’s rate and method of payment; and (4) maintains the employee’s employment records. No single factor is dispositive in determining joint-employer status, and the appropriate weight to give each factor will vary depending on the circumstances. The new rule is expected to make it much less likely that franchisors and franchisees will be deemed joint employers.REF

The NLRB and the EEOC are both considering revisions to the rules governing joint employment determinations.REF The NLRB had published a proposed rule and the comment period has closed. The NLRB rule would govern determinations for purposes of the NLRA and the EEOC rules (assuming it is promulgated) would govern determinations for purposes of the various federal equal employment opportunity statutes.

The NLRB Browning-Ferris Industries decisionREF in August 2015 significantly altered its standard for evaluating joint employment. Reserving the right to control employees of another firm or indirectly controlling those employees was found sufficient to trigger a finding of joint employment. Notably, franchisors, who often reserve the right to control franchisees’ employees in certain circumstances, would often be found to be joint employers along with franchisees.REF As noted above, the PRO Act would codify the Browning-Ferris decision. Unions prefer a broad conception of joint employment because it is easier to organize one large franchisor than many small franchisees.

In December 2017, the NLRB reversed the Browning-Ferris decision in Hy-Brand Industrial Contractors and returned to the traditional rule requiring proof that one entity has exercised control over essential employment terms of another entity’s employees (rather than merely having reserved the right to exercise control) and has done so directly and immediately (rather than indirectly and in a limited manner).REF

Accelerated Union Elections

In April of 2015, the Obama-era NLRB promulgated a rule that substantially accelerated the pace of the union election process.REF It allows unions to force an election in as few as 10 days.REF The rule also gives unions access to employees’ home addresses, work locations, shifts, job classifications, and, if available to the employer, personal landline and mobile telephone numbers, and work and personal e-mail addresses. It is often referred to by opponents as the “ambush” or “quickie” election rule because it gives little time for an employer, who typically is not unionized and may know little about labor law and petitions for representation, to present its case to employees. The PRO Act would statutorily codify these rules.

The median number of days from petition to election has declined 39 percent, from 38 in fiscal year 2014 to 23 in fiscal years 2016–2019.REF From fiscal year 2014 to fiscal year 2019, the percentage of elections won by unions increased steadily from 68 percent to 88 percent,REF although there may be many reasons for this increase.

The NLRB has published a request for information as a prelude to potentially modifying or reversing the Obama-era election rule changes.REF Similarly, the NLRB indicated in its Fall 2019 Unified Agenda of Regulatory and Deregulatory Actions filing with the Office of Management and Budget that it intended to adopt a final revised set of election procedures in 2019.REF

Micro Unions

In Specialty Healthcare,REF the Obama-era NLRB started the process of dismantling the traditionally understood “community of interest” rule for determining bargaining units by allowing the initial bargaining unit to be a single job description, namely certified nursing assistants. In Specialty Healthcare, the NLRB enunciated a new standard that effectively allows unions to determine the bargaining unit (i.e., the representation election electorate)—and the union determination is presumed correct unless the employer “demonstrates that employees in the larger unit share an overwhelming community of interest with those in the petitioned-for unit.” This presumption that the union determination of bargaining unit is correct was, in practice, virtually irrebuttable.

For example, in Northrop Grumman Shipbuilding,REF the union was permitted to organize a departmental unit of 223 radiological control and other technicians out of 2,400 technical employees and 18,500 Northrop employees overall at the shipyard. A few years later, in the Bergdorf GoodmanREF case, the union sought to represent all full-time and regular part-time women’s shoes associates in the 2nd Floor Designer Shoes Department and in the 5th Floor Contemporary Shoes Department. The employer asserted that the smallest appropriate unit must be comprised of a store-wide unit, or, in the alternative, all selling associates in the store.

The NLRB allowed the union-chosen bargaining unit of 46 employees in the 2nd and 5th floor shoe departments to be separately organized. Such an approach allows unions to “cherry-pick” parts of a business in which they have majority support—even though they would lose an election in a larger bargaining unit. The Specialty Healthcare approach to bargaining-unit selection also means that even relatively small employers may be required to deal with many different unions.REF

In December of 2017, the NLRB reversed Specialty Healthcare in its PCC StructuralsREF decision and returned to the traditional community-of-interest standard for determining an appropriate bargaining unit.

NLRB Jurisdictional Threshold Amounts

The NLRA allows the NLRB to decline jurisdiction over small companies. Those thresholds are generally $500,000 in annual revenue for a retail store and as low as $50,000 for other businesses.REF At a minimum, those thresholds should be adjusted for inflation by the NLRB to $4 million for retail stores and $400,000 otherwise. Alternatively, Congress could pass legislation exempting small businesses from some or all of the NRLA. This would reduce compliance costs and regulatory risk for very small firms.

Protected Concerted Activity

Section 7 of the NLRA provides that “[e]mployees shall have the right to self-organization, to form, join, or assist labor organizations, to bargain collectively through representatives of their own choosing, and to engage in other concerted activities for the purpose of collective bargaining or other mutual aid or protection.” These provisions apply in both unionized and non-unionized companiesREF and are among the most central guarantees in the NLRA. How these provisions are interpreted, however, can have a pronounced impact on the workplace and business operations.

The Obama-era NLRB dramatically expanded the scope of protected concerted activity as part of its protected concerted activity initiative and its social media initiative. WorldMark by Wyndham, for example, held that an employee was engaged in protected concerted activity when he questioned his supervisor, in front of his coworkers, about a new dress code, and that the employer warning was unlawful.REF His actions were deemed (1) protected, (2) concerted, and (3) for the mutual aid and protection of his coworkers.

In Knauz BMW, the NLRB held that a business requiring its employees to be courteous to customers and one another is an unlawful infringement on the free speech rights implicit in the protected concerted activity protections in the NLRA.REF Section 7 should not be construed to protect “offensive, demeaning, abusive or inappropriate remarks.” It is quite likely that employers that permit the use of such language would find themselves liable under other theories (sexual harassment, civil rights violations, etc.). Federal law should not result in employer liability whether they prohibit inappropriate speech or permit it. These decisions, and others like them, are now being reversed.

In the 2019 Alstate Maintenance case, the board returned to a more traditional understanding of the distinction between protected group action and unprotected individual action.REF Moreover, the Trump-era NLRB General Counsel has issued a memorandum indicating that employer rules (1) requiring civility, (2) prohibiting workplace photography or recording, (3) prohibiting insubordination, non-cooperation, or on-the-job conduct that adversely affects operations, (4) prohibiting disruptive behavior, (5) protecting confidential, proprietary, and customer information or documents, (6) prohibiting defamation or misrepresentation, (7) prohibiting employee use of employer logos and trademarks, (8) requiring authorization to speak for the company, and (8) disloyalty, nepotism, or self-enrichment are “generally lawful, either because the rule, when reasonably interpreted, does not prohibit or interfere with the exercise of rights guaranteed by the Act,REF or because the potential adverse impact on protected rights is outweighed by the business justifications associated with the rule.”REF The memorandum also discusses employer rules that require individualized assessment or that are prohibited.

Equality Act

The Equality ActREF passed the House May 17, 2019.REF It amends the Civil Rights Act of 1964 to prohibit discrimination on the basis of sex, including sexual orientation and gender identity, in public accommodations and facilities (i.e., businesses selling to the public), education, federal funding, employment, housing, credit, and the jury system. It defines the term “gender identity” as “the gender-related identity, appearance, mannerisms, or other gender-related characteristics of an individual, regardless of the individual’s designated sex at birth.”REF It defines the term “sexual orientation” as “homosexuality, heterosexuality, or bisexuality.”REF It specifically provides that “an individual shall not be denied access to a shared facility, including a restroom, a locker room, and a dressing room, that is in accordance with the individual’s gender identity.”REF It also amends the Equal Credit Opportunity Act to prohibit discrimination on the basis of sexual orientation and gender identity.REF

The legislation would empower the federal government to force radical new definitions of marriage and biological sex on all Americans. It would adversely affect the practices, freedom of speech, and freedom of religion of hospitals, health care providers, schools, creative professionals, and countless others.REF Experience at the state level with similar laws demonstrate that it would undermine liberty, equality, privacy, and safety.REF

The RAISE Act

The Rewarding Achievement and Incentivizing Successful Employees Act (RAISE) Act would amend the NLRA to permit unionized employers to give performance-based raises without union consent.REF This would reduce the burden of collective bargaining on workplace productivity and would lead to higher wages.REF

Worker’s Choice Act

The Worker’s Choice ActREF would amend the NLRA to allow employees in a unionized workplace to independently negotiate their employment terms with their employer. This would lead to greater flexibility and potentially better compensation packages for workers who choose to exercise this option. It would only affect workers in right-to-work states; employees in non-right-to-work states would not be affected by it.REF

Family and Medical Leave

The Family and Medical Leave Act of 1993 provides covered employees with up to 12 weeks of unpaid, job-protected leave per year for the birth and care of a newborn child, for placement with the employee of a child for adoption or foster care, to care for an immediate family member (i.e., spouse, child, or parent) with a serious health condition, or to take medical leave when the employee is unable to work because of a serious health condition. It also requires that their group health benefits be maintained during the leave.

The FMLA has been found to have some unintended consequences including fewer promotions,REF potential hiring discrimination for women who are more likely to use the leave, and adverse economic consequences for employers and co-workers resulting from misuse of the FMLA.REF

The 2017 tax reform legislationREF generally provides an employer credit of 12.5 percent to 25 percent of the wages paid during any period (up to 12 weeks) in which employees are on family and medical leave, provided that the wages paid were 50 percent or more of the wages normally paid.REF This credit has been extended to the end of 2020.REF It is only available with respect to employees who earn less than $78,000 annually.REF

On December 20, 2019, the President signed into law the National Defense Authorization Act for Fiscal Year 2020,REF which included the Federal Employee Paid Leave Act.REF This Act provides up to 12 weeks of paid parental leave to many federal employees starting October 1, 2020. The legislation, however, was drafted so that a significant number of federal workers would not be eligible. Legislation has been introduced to broaden the provision to the entire federal workforce.REF

The President’s fiscal year 2021 budget includes a proposal to establish a federal-state paid parental leave benefit program within the unemployment insurance program that would provide six weeks of paid leave beginning in 2022.REF The Administration estimates that its paid parental leave proposal would cost $28.1 billion in benefit and program administration costs over 10 years.REF Legislators from both parties have introduced bills that would require paid paternal leave. For example, the Family and Medical Insurance Leave Act or the FAMILY ActREF would create an Office of Paid Family and Medical Leave within the Social Security Administration to administer a new federal entitlement program. In general, caregivers would be entitled to a benefit of between $580 and $4,000 per month for a period of up to 60 days.REF The benefit would be financed by a new payroll tax of four-tenths of 1 percent.REF The Congressional Budget Office estimates that this bill would, over 10 years, increase federal spending by $547 billion, increase taxes by $319 billion, and increase the deficit by $228 billion.REF In the 116th Congress, Senator Marco Rubio (R–FL) introduced the New Parents Act.REF Senators Joanie Ernst (R–IA) and Mike Lee (R–UT) have proposed the Child Rearing and Development Leave Empowerment Act or the CRADLE Act.REF Both of these bills would provide parents with two to three months of paid benefits in exchange for those parents delaying their normal Social Security retirement age.

At a time when the federal government is running structural federal deficits of more than $1 trillion annually—and is expected to do so for the indefinite future—the national debt is growing more rapidly than the economy and entitlement spending is an ever-increasing share of federal spending,REF the last thing Congress should do is launch a new entitlement program that is likely to cost more than estimated and grow substantially.REF Furthermore, for the reasons discussed above in the Economics of the Labor Market section, these benefits will be overwhelmingly borne by employees in the form of lower wages. Polling shows that the public does not support such benefits if they have to pay for them.REF

The programs that are funded by reducing beneficiary’s future Social Security are problematic for different reasons. Social Security is already actuarially unsound, endangering benefits for all future retirees and threatening substantial tax increases.REF Establishing the precedent of using Social Security benefits for non-retirement purposes would undoubtedly lead to further imbalances in the program, and when, in the future, benefits are reduced or delayed, calls will be made for higher taxpayer-financed benefits to make seniors “whole.”REF

The Families First Coronavirus Response Act generally requires employers to provide up to 80 hours of paid sick leave at the employee’s regular rate of pay when the employee is unable to work because the employee is quarantined or experiencing COVID-19 symptoms and seeking a medical diagnosis. In addition, the Act requires employers to provide up to 80 hours of paid sick leave at two-thirds the employee’s regular rate of pay if the employee is unable to work because of a bona fide need to care for an individual subject to quarantine. If the employee must care for a child (under 18 years of age) whose school or child care provider is closed or unavailable for reasons related to COVID-19, then up to 12 weeks of paid leave must be provided.REF Employers are provided with a 100 percent tax credit for the cost of providing this leave.REF

Overtime

The FLSA requires covered employers to pay employees a minimum wageREF and, for employees who work more than 40 hours in a week, to pay at least 1.5 times the regular rate of pay.REF Certain employees are exempt from these requirements.

In general, to qualify as exempt, an employee must be paid on a salary basis, be paid at least $35,568 per year (known as the standard salary level), and perform executive, administrative, or professional duties. The salary-level test does not apply to outside sales employees, teachers, and employees practicing law or medicine. Highly compensated employees (HCEs) earning more than $107,432 per year are usually, but not always, exempt. DOL regulations provide detail about the definitions that employers must use and some other exemptions.REF

In September 2019, the Trump Administration raised the standard salary level from $23,660, the HCE level from $100,000, and made other changes to the regulations effective January 1, 2020.REF The DOL estimates that the standard salary level increases will increase the number of employees receiving overtime pay by 1.2 million people, and the HCE level changes will affect 101,800 people.REF As a form of price control, these rules are likely to have unintended adverse consequences on newly covered employees.REF

EEOC Guidance on Criminal Background Screening. In 2012, the EEOC issued “guidance” requiring employers to do an “individualized assessment” each time they conduct a criminal background screen for employment to determine whether to do the screen and whether to rely on it. Its 52-page, 167-footnote “guidance” requires a business to balance a multitude of factors and provides no meaningful guidance.REF The EEOC has launched hundreds of enforcement actions in this area.

Businesses should be able to protect themselves, their customers, and their employees by preventing, for example, rapists or thieves from entering their customers’ homes.REF The U.S. Court of Appeals for the Fifth Circuit has held that the EEOC guidance is a substantive rule that was not promulgated in compliance with the notice-and-comment provisions of the Administrative Procedure Act—and further, that the EEOC lacks authority to promulgate substantive rules implementing Title VII.REF

The EEOC should withdraw this guidance. Congress should provide clear and reasonable rules governing criminal background screening.

Equal Opportunity Clause’s Religious Exemption

The DOL’s Office of Federal Contract Compliance Programs has proposed a rule that will broaden the civil rights protections afforded to religious organizations that contract with the federal government.

It would clarify that religious organizations may make employment decisions consistent with their sincerely held religious tenets and beliefs—without fear of sanction by the federal government. It would add to the existing regulations definitions of “exercise of religion,”REF “particular religion,” “religion,”REF “religious corporation, association, educational institution, or society,” and “sincere.”REF It would require that protection for the exercise of religion be construed broadly.REF Opponents argue that the rule “would harm countless LGBTQ workers.”REF The comment period closed September 16, 2019. The number of comments received was 109,843.REF

Working Families Flexibility Act

The Working Families Flexibility ActREF amends the FLSA to authorize employers to provide compensatory time off to private employees at a rate of not less than 1.5 hours for each hour of employment for which overtime compensation is required, but only if it is in accordance with an applicable collective bargaining agreement or, in the absence of such an agreement, an agreement between the employer and employee.

The bill prohibits an employee from accruing more than 160 hours of compensatory time. An employer must provide monetary compensation for any unused compensatory time off accrued during the preceding year. The bill requires an employer to give employees 30-day notice before discontinuing compensatory time off. In the 115th Congress, the House passed substantially similar legislation.REF The bill would increase flexibility in the labor market and enable employees to accumulate more paid leave.REF

The Davis–Bacon Act

The Davis–Bacon Act requires that workers on most federally funded or federally assisted construction projects be paid no less than the “prevailing wages,” as determined by the DOL, in the area where the project is located. Prevailing wages are typically higher than the average or median market wages. They are usually the wages paid to unionized workers.REF

The primary effect of Davis–Bacon is to raise federal construction costs by protecting unionized shops from competition. The Congressional Budget Office estimates that repealing the Davis–Bacon Act would save federal taxpayers about $12 billion over 10 years.REF Davis–Bacon should be repealed.REF

Conclusion

Laws governing the employer–employee relationship are extremely complex. These laws replace a voluntary, privately ordered arrangement between service providers (employees and contractors) and those that pay them (employers and customers) with inflexible government mandates. These laws impose substantial compliance costs on employers and increase the risk and cost of employment-related lawsuits or enforcement actions.

Economic analysis demonstrates that these costs are primarily borne by employees in the form of lower wages. The existing labor and employment laws raise the cost of employing people, retard job creation, reduce wages, and hinder the flexibility of both employers and employees. They also have a disproportionately adverse impact on small firms because compliance costs do not increase linearly with size. Thus, an uncritical acceptance of the status quo is unwarranted.

The best way for policymakers to improve the well-being of workers is not to increase the cost and risk of employing people. Higher costs and greater risks harm employees. Instead, policymakers should reform labor and employment laws to increase freedom, enhance workplace flexibility, improve productivity, and reduce administrative and legal costs. This will increase wages and promote prosperity. Moreover, policymakers should seek to remove impediments to innovation and investment, which will increase worker productivity and result in higher wages.

David R. Burton is Senior Fellow in Economic Policy in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom, at The Heritage Foundation.