Taxes: Are Not Fair, Will Not Help the Economy, Are Not Needed to Balance the Budget, and Will Not Reduce Poverty But They Will Give Lawmakers More Power—and That’s the Point

If progressive politicians have their way, tax policy will become a new tool of class warfare. Self-described socialists Rep. Alexandria Ocasio-Cortez (D-N.Y.) and Sen. Bernie Sanders (D-Vt.) say marginal tax rates should be raised to 70 percent. And Sen. Elizabeth Warren (D-Mass.), who likes to tell entrepreneurs they didn’t build their businesses, has proposed a wealth tax. Numerous liberal lawmakers and even some academics on the Left have fallen in line behind such proposals.

The justifications for such proposals range from addressing allegedly rising economic inequality, to balancing the federal budget, to funding new spending proposals such as a Green New Deal or Medicare for All.

How times have changed. In the 1980s, when Congress got to work writing what became the Reagan tax cuts, Democrats who wanted lower tax rates battled Republicans who wanted even lower tax rates. But both sides understood that high marginal tax rates were harmful, and both parties sought to reduce top tax rates. This led to the bipartisan 1986 Tax Reform Act, which dropped the top tax rate to 28 percent.

Unfortunately, that consensus for lower rates began to break down soon after President Reagan left office. Some presidents (George H.W. Bush, Bill Clinton, and Barack Obama) were willing to raise top tax rates, but it’s noteworthy that they advocated only incremental increases. And those periodic rate increases were somewhat offset by incremental cuts under George W. Bush and Donald Trump.

While there was tinkering at the margins, everybody seemed to understand that big rate increases would be destructive. As such, radical increases in tax rates were not part of the public debate—until now.

The case for such tax increases, however, remains just as faulty as it ever was. Raising marginal tax rates reduces the rewards for productive effort, reduces entrepreneurship, and reduces opportunities—for everybody, rich and poor alike.

The Economics of Marginal Tax Rates

To set the stage for this discussion, here are two simple definitions:

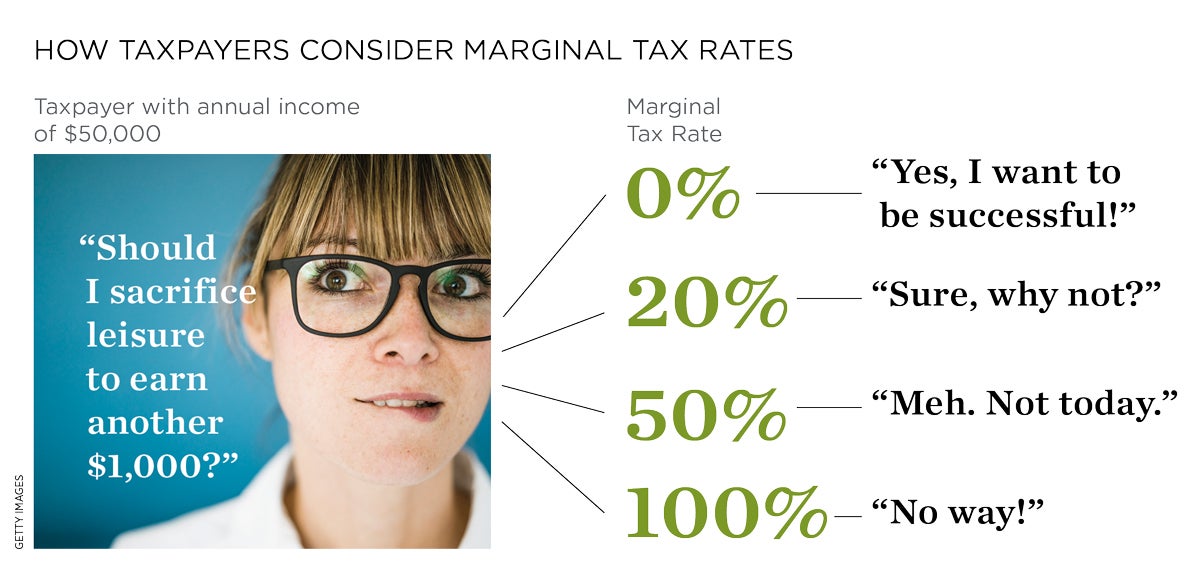

- The “average tax rate” is the share of your income taken by government. If you earn $50,000 and your total tax bill is $10,000, then your average tax rate is 20 percent.

- The “marginal tax rate” is the amount of money the government takes if you earn more income. In other words, the additional amount government would take if your income rose from $50,000 to $51,000.

These definitions are important because we want to contemplate why and how higher marginal tax rates discourage work, saving, investment, and entrepreneurship. When people are considering whether to work harder, work longer, build assets, take risks, or start businesses, they don’t worry about average tax rates.

They consider whether the extra effort will lead to a sufficiently large extra reward. The graphic below depicts a hypothetical taxpayer contemplating whether to earn more income rather than enjoy more leisure.

Taxes discourage production that would otherwise be worth having, and the higher the taxes the greater the lost production. Economists call such lost production a “deadweight loss,” a term for the value that is forgone when something (e.g., high taxes, price controls, subsidies) disrupts the markets’ signals, leading producers to make less. These deadweight losses expand geometrically as tax rates increase arithmetically.

That’s just a fancy way of saying that the economic damage of increasing tax rates from 40 percent to 50 percent is significantly greater than the damage of boosting tax rates from 30 percent to 40 percent. And pushing marginal tax rates up to 70 percent will produce significantly greater losses still.

Seven Reasons to Say No to Class Warfare Taxes

Let’s review some practical reasons why class-warfare tax policy would be misguided. The first two reasons apply to any tax increases.

1. Class-warfare tax increases are not needed to balance the budget.

Some politicians and activists on the Left openly assert that they want higher burdens on upper-income taxpayers for reasons of spite and envy. That may even be the primary motive for most of them. In many cases, though, supporters of high tax rates claim that they want to generate additional revenue to reduce red ink and balance the budget. The alternative to higher revenues, they say, is draconian spending cuts.

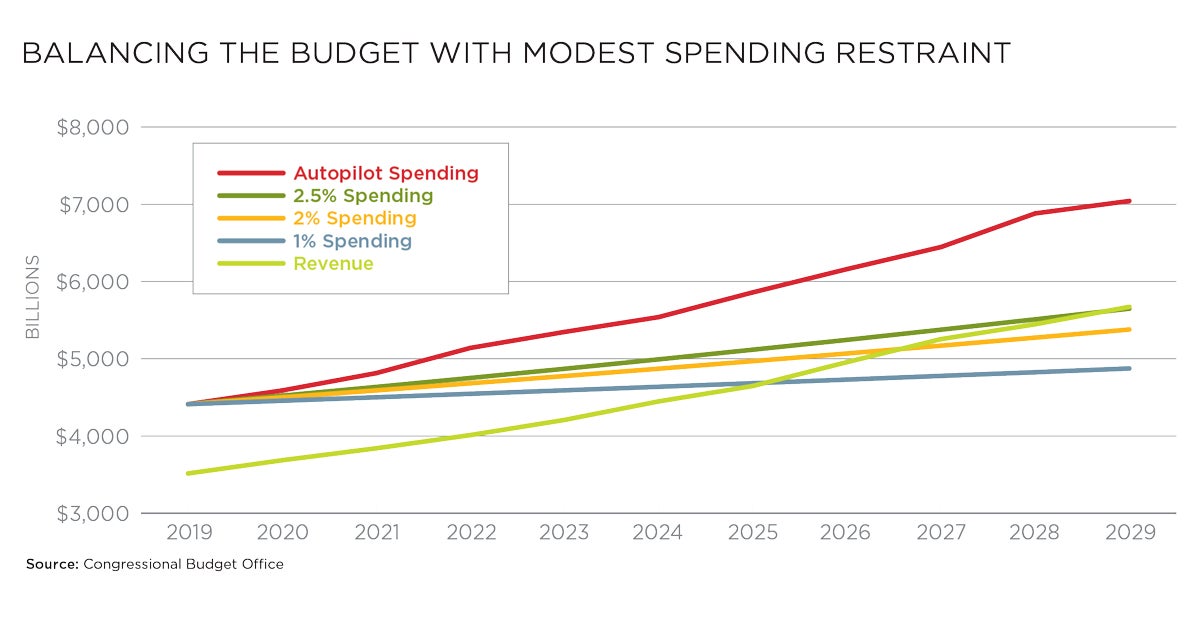

Even if they are being sincere, this argument is misguided. Based on the new numbers from the Congressional Budget Office, it’s quite simple to balance the budget with modest spending restraint. Tax revenue is projected to rise by about 5 percent annually. Reducing red ink merely requires that spending grow by less than 5 percent each year.

And if lawmakers simply limit spending so that it grows 2.5 percent per year, which is slightly faster than the projected rate of inflation, then the budget is balanced within 10 years. And if there is even more spending restraint, as illustrated by this chart, it is possible to balance the budget even faster (see above).

2. Class-warfare tax increases encourage more spending.

Another oft-cited reason for tax increases is that politicians and activists on the Left want more spending. There certainly are plenty of examples to cite, such as the Green New Deal, Medicare for All, government-funded child care, and a host of other initiatives floating around Washington to expand the burden of federal spending.

But tax increases (whether class-warfare tax hikes or general tax hikes) also have an indirect impact on spending. In part, this is because politicians realize that tax increases will irritate at least some subset of voters, which means they then feel pressure to “give” something to those voters in hopes of compensating for that angst.

Even more important, though, is the late Milton Friedman’s wise observation that, “In the long run government will spend whatever the tax system will raise, plus as much more as it can get away with.” In other words, if we send more of our income to Washington, politicians will figure out ways to buy votes with that money.

3. Class-warfare tax increases harm economic performance.

Now let’s focus on why class-warfare tax increases are particularly damaging to the economy. Revisiting our earlier discussion of marginal tax rates and deadweight loss, the core problem with various soak-the-rich tax hikes is that they almost inevitably involve imposing greater penalties on productive behavior on the part of investors, entrepreneurs, and small business owners.

- Higher income tax rates penalize them for earning income and creating wealth.

- Higher capital gains taxes discourage the most productive investments.

- Higher death taxes penalize growing businesses and building capital.

- Higher corporate taxes penalize job creation and reduce wages for workers.

That such taxes harm economic growth is pretty well established by the studies that have looked into the matter. A 2012 literature review by William McBride (“What Is the Evidence on Taxes and Growth?” Tax Foundation) concluded:

More and more, the consensus among experts is that taxes on corporate and personal income are particularly harmful to economic growth, with consumption and property taxes less so. This is because economic growth ultimately comes from production, innovation, and risk-taking.

To be sure, there are some less-destructive ways of targeting upper-income taxpayers. When state and local governments issue bonds, the interest on those bonds is exempt from tax. Eliminating the tax-free status of such “muni bonds” would generate revenue almost solely from the rich.

Eliminating tax preferences is good policy, but ideally the revenues from such reforms should be used to finance pro-growth tax reforms, such as lower rates and reduced double taxation. Otherwise, as noted above, lawmakers will simply spend the money on their pet projects.

4. Class-warfare tax increases foment social discord.

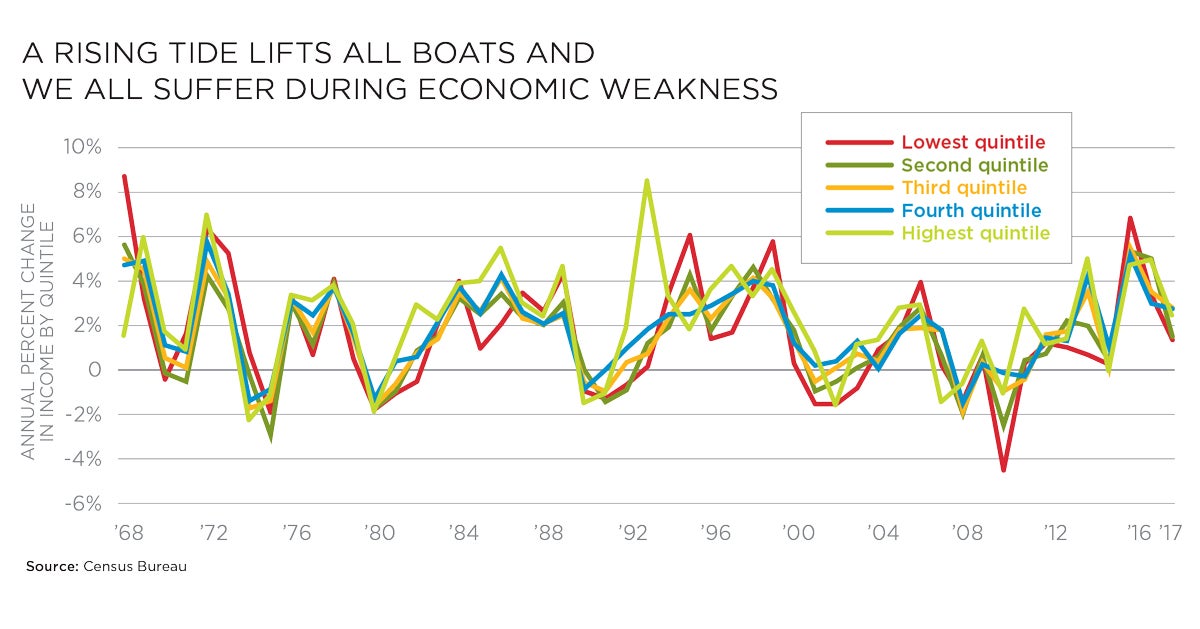

The explicit purpose of tax-the-rich schemes is to identify, isolate, and demonize a small minority of the American population. This “politics of hate and envy” may or may not be a successful political strategy, but it is corrosive. It seeks to convince ordinary voters that their lives are somehow worse because some people are very successful. This is nonsense, and there is plenty of empirical evidence demonstrating that income trends for the rich, poor, and middle class are strongly correlated. The chart above, based on Census Bureau data, confirms President John F. Kennedy’s observation that “a rising tide lifts all boats.”

But there’s another reason to be concerned about the demonization of upper-income taxpayers. In her Bourgeois Era trilogy, economic historian Deirdre McCloskey documents that the unprecedented explosion of prosperity in the West was largely triggered and enabled by a newfound cultural appreciation for entrepreneurship. The class-warfare tax agenda, by contrast, is based on the notion that highly successful people should be targeted, or, as some on the Left argue, taxed out of existence.

5. Class-warfare tax increases almost never raise as much revenue as projected.

When politicians target upper-income taxpayers, they are going after an elusive target. Unlike ordinary taxpayers, who get the lion’s share of their income in the form of wages and salaries, rich taxpayers get the vast majority of their income from business profits and investment earnings. This has enormous implications for tax policy since ordinary taxpayers are less able to change their wages and salaries quickly in response to changes in tax rates. But it’s relatively easy for upper-income taxpayers to change business operations or their investment patterns in response to shifts in tax policy.

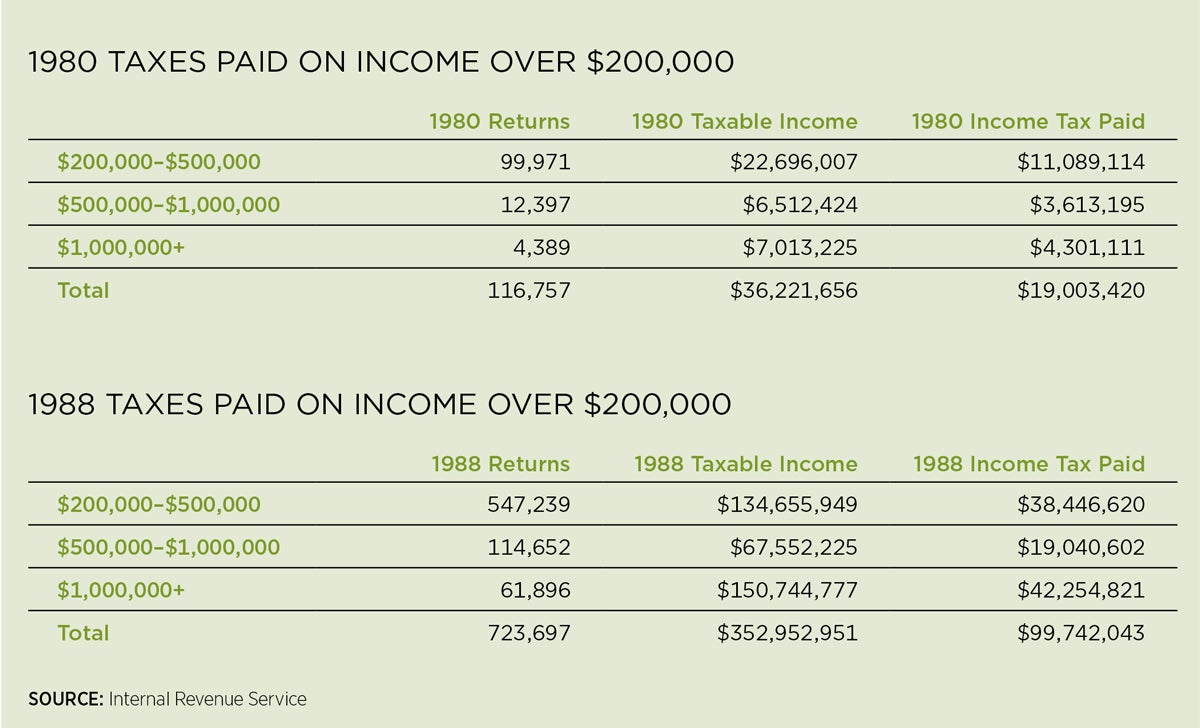

And because they have considerable control over the timing, level, and composition of their incomes, rich taxpayers can control how much taxable income they are earning and reporting on their tax returns. So when tax rates go up, they declare less income to the government. And when tax rates go down, they declare more income to the government. This means that punitive tax rates don’t necessarily generate a lot of revenue. Or even any revenue. Likewise, low tax rates may actually be the best policy to generate more tax revenue. The most famous example may be from the 1980s. According to the Internal Revenue Service’s Statistics of Income, high-earning taxpayers earned and reported far more income after President Reagan and Congress lowered the top tax rate from 70 percent to 28 percent. Taxable income was so much greater that these high earners actually paid far more money to Uncle Sam in 1988 than they did in 1980 (see above).

6. Class-warfare tax increases encourage more loopholes.

When tax rates increase, the value of a tax preference goes up by the same amount. Consider, for instance, the value of a tax deduction when the tax rate is 20 percent. Taxpayers with $100 in deductions reduce their tax burden by only $20. But if the tax rate is 70 percent, then the same $100 deduction suddenly produces tax savings of $70.

Rising rates create a perverse incentive structure. As rates go up, deductions become more valuable, which then encourages more taxpayers to make decisions that will enable them to take advantage of those deductions. That reduces the amount of tax money going to politicians, which encourages them to raise tax rates even further, which simply makes tax deductions even more valuable. In the meantime, lobbyists work to create new deductions because it is so valuable for taxpayers to protect their money.

7. Class-warfare tax increases undermine competitiveness.

It upsets some people, but it’s abundantly clear that we now live in a globalized economy. One of the implications is that investors, entrepreneurs, and businesses can easily choose where to invest money and create jobs. There are many factors that influence that decision, but tax policy plays a key role.

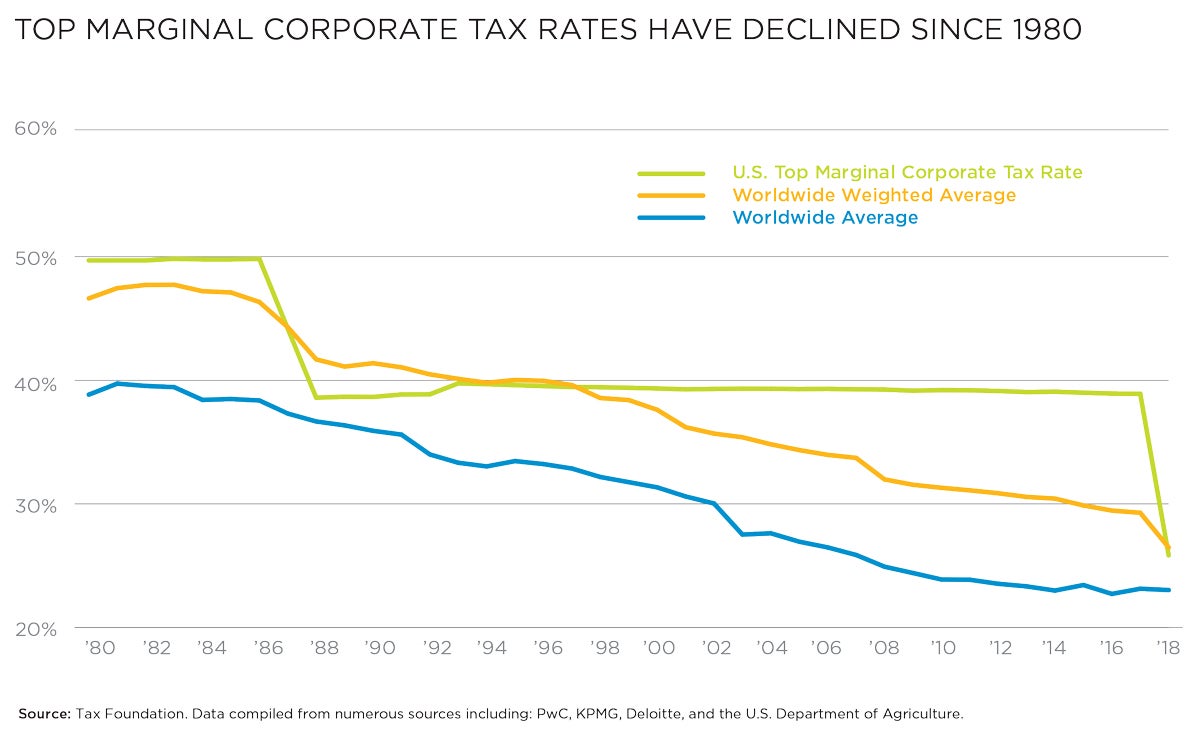

In recent decades, globalization has encouraged and enabled a very virtuous cycle of tax competition. It started when Ronald Reagan and Margaret Thatcher slashed tax rates in the United States and the United Kingdom, respectively; the tax-cutting trend has since spread all over the world. Personal tax rates are now much lower than they used to be, and the fall in corporate tax rates is even more dramatic. Countries also have lowered taxes on capital gains, and many of them have eliminated death taxes and wealth taxes (see above).

Even though the United States helped start this desirable process, it then fell behind—especially with regards to business taxation and the tax burden on investment. The 2017 Trump tax plan helped improve America’s competitive position, so it would be most unfortunate if a wave of new class-warfare tax increases reversed that reform and pushed the United States even further in the wrong direction.

Conclusion

The new wave of bad tax proposals from major Democratic lawmakers unfortunately confirms that the era of bipartisan tax reform is officially dead. What we don’t know is whether some or all of these bad tax policies will be imposed on the U.S. economy.

For the sake of workers, investors, and entrepreneurs, let’s hope the answer is no.

Mr. Mitchell is a co-founder and chairman of the Center for Freedom and Prosperity. He is the co-author, with Chris Edwards, of Tax Revolution: The Rise of Tax Competition and the Battle to Defend It (Cato Institute, 2006).