Given its abundance of natural resources and the recent growth in domestic energy production, the United States is in a position to export far more energy than American trade laws currently allow. Free trade is imperative to a free society, as it fosters economic growth and improves human well-being. Policymakers should treat energy like any other good or service that is traded freely around the world by allowing U.S. producers to export more energy. Providing more energy choices to both producers and consumers will generate jobs, expand the economy, and provide important geopolitical benefits to the rest of the world by increasing global energy supplies and reducing the ability of any one nation or organization to use its control of energy resources for strategic purposes. Congress and the Administration should remove government-imposed barriers to energy exports.

America’s Abundance of Natural Resources

America has an abundance of natural resources, including sufficient energy reserves to provide Americans with affordable and reliable energy well into the future. With its plentiful reserves of coal, natural gas, and oil, the United States is already a global leader in energy production and has the potential to be a major supplier to the rest of the world.

As a result of innovative, safe, advanced drilling technologies, domestic oil production has skyrocketed. In January 2006, companies in the U.S. supplied just over 5 million barrels of oil per day to the global market.[1] In June 2015, producers contributed nearly 9.3 million barrels per day (bpd).[2] In 2012, the amount of oil produced in the U.S. surpassed the amount that it imports.[3] The United States is now not only the world’s largest oil producer, overtaking Saudi Arabia, but also the largest producer of petroleum and natural gas hydrocarbons.[4]

Nearly 1.3 trillion barrels of technically recoverable oil lie beneath U.S. soil and off America’s coasts—enough to fuel more than 90 million cars and nearly 3.5 million homes for more than 50 years.[5] America’s technically recoverable resources represent only a fraction of the total oil reserves, which amount to more than 3.7 trillion barrels.[6] The U.S. alone has more than five times the amount of recoverable oil than Saudi Arabia.[7] Proven reserves continue to add to this known wealth of oil as increased exploration and technological developments make recoverable oil more viable.

The U.S. also holds an abundance of coal and natural gas. Coal generates nearly 40 percent of America’s electricity generation. Just 1 million tons of coal could yield enough energy to power 190,000 homes annually. With more than 480 billion short tons of coal recoverable with today’s technology, the United States can provide electricity for over 500 years at current consumption rates.

Furthermore, technological advancements have significantly increased the amount of recoverable natural gas in the United States. With more than 2,200 trillion cubic feet of recoverable natural gas, the U.S. has enough natural gas to meet America’s current consumption needs for nearly a century.

Oil in the Global Market. Both crude oil and gas prices at the pump[8] in the United States are tied to the global market price, as oil is a globally traded commodity. The reference price for crude oil trading is set through benchmarks, the three main benchmarks being West Texas Intermediate (WTI), Brent Crude, and Dubai Crude. A large part of the reason why many different benchmarks exist is that different qualities of crude exist in the market. Extracting a barrel of oil in Texas is not the same as a barrel extracted from Saudi Arabia. Crude can range from very light to very heavy, depending on its density,[9] and sweet to sour, depending on its sulfur content.[10] Light, sweeter crudes sell at a premium compared to heavy, sour crudes because refiners can process them more cheaply.

While different grades of crude oil exist, it is largely a fungible product. However, market and government-imposed constraints, such as the crude oil ban or transportation limitations, can fragment the market. For instance, WTI and Brent Crude have historically priced closely to one another with the difference stemming mostly from transportation costs, but the spread has grown between the two benchmarks over the past few years. The combination of a Libyan supply disruption that affected the Brent benchmark and the dramatic increase in U.S. production caused a buildup of inventories and a bottleneck in Cushing, Oklahoma, where WTI is priced, which resulted in WTI trading as low as $23 below Brent in February 2013.[11] Additional pipeline infrastructure and increased rail deliveries of crude helped relieve that bottleneck and narrow the price differential to around $3 today.[12] Opening exports would allow U.S. companies to compete in the international markets where similar crudes have higher prices. The overall increase in global supply would reduce the price of Brent and decrease the price at the pump.

Because of the interconnectedness of the oil markets, the U.S.—whether as a net importer or net exporter—will not be able to insulate Americans from price volatility. Just as U.S. self-sufficiency in food production cannot prevent problems in other parts of the world from affecting domestic U.S. food prices, a supply disruption in another part of the world can still cause pain at the pump in America. Greater oil supplies on the global market, however, will help to insulate consumers from price volatility and supply disruptions. The liberalization of markets provides more energy diversity and choice, incentivizes production, generates innovation, and establishes competitive prices.

The free flow of crude oil would also better match global refining capabilities, resulting in more economically and environmentally efficient outcomes. The shale oil production occurring in the United States produces light sweet crude; in fact, light crude production increased by 3 million bpd between 2008 and 2013. This rise has increased the share of light crude from 50 percent to more than 70 percent in terms of total oil production.[13] There has also been a substantial increase in ultra-light hydrocarbon known as “lease condensate.” Refiners across the country are equipped to process a range of crudes, which presents challenges given the glut of light crude production. Gulf Coast refineries are set up largely to handle medium and heavy crudes from Venezuela, Mexico, Canada, and the Middle East. For the past 20 years, well before the onslaught of light crude production in the U.S., companies, primarily in the Gulf Coast region, invested $100 billion in refining capabilities to handle heavier crude imports.[14]

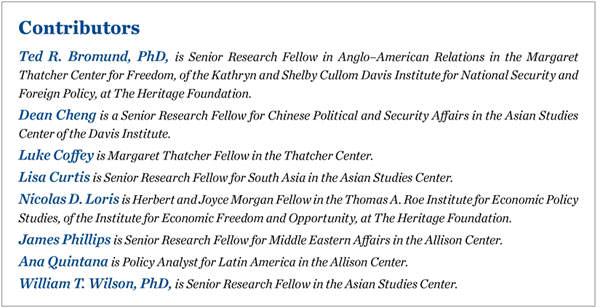

Refineries that are already set up to process light crude have almost entirely reduced their imports from West African countries that extract similar grades of oil, and a number of companies have made investments to handle more light crude.[15] Over the past four years, light oil imports decreased by two-thirds.[16] In addition to displacing light crudes, refiners have switched from medium and heavy to light when economical, and have expanded refining capabilities to process more light crudes.

However, these shifts have constraints[17] and are unlikely to keep up with American crude production; if the refining market is saturated, oil companies will stall or shut in production. In some areas of the country, this is already occurring. The discouragement of production brought on by an artificially restricted market will decrease global supplies of oil, and keep prices higher than they otherwise would be. On the other hand, allowing crude oil exports to flow freely to where markets can already process the crude would increase supply and increase overall market efficiency. There will always be lags in infrastructure buildup, but reducing artificial constraints will minimize those lags and allow better planning and improved efficiency for mid-stream (transportation) and downstream (processing) activities.

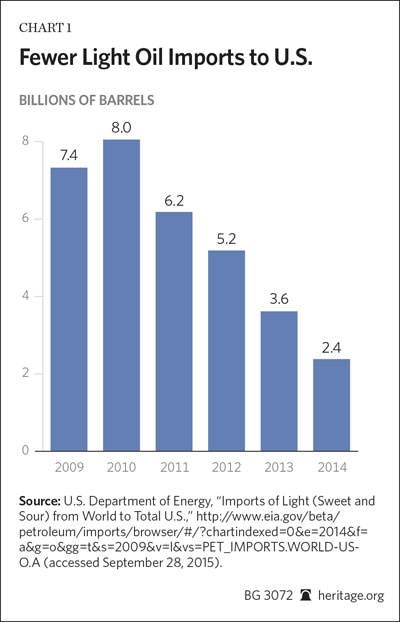

Energy Sources Not Different, but Treated So. Natural resources should be no different from wheat, corn, or any other good that U.S. companies trade around the world, yet the law treats it differently. Congress enacted the laws primarily restricting crude oil exports—the Energy Policy and Conservation Act of 1975 and the Export Administration Act of 1979[18]—in response to the 1973 Arab oil embargo.[19] Refined petroleum products are not subject to export restrictions and, consequently, have increased dramatically.

The Department of Commerce’s Bureau of Industry and Security (BIS) outlines the scenarios in which the agency will approve license applications for exporting crude oil. Currently, companies have significantly limited opportunities for exporting crude oil. Under its Short Supply Control regulations, the BIS automatically grants export licenses to crude oil produced in Alaska’s Cook Inlet, crude transported through the Trans-Alaska Pipeline, re-exported crude from foreign nations, exports in connection with refining or exchanging Strategic Petroleum Reserve oil, exports consistent with certain international agreements, and small amounts of heavy Californian crude. Additionally, companies can export American crude oil to Canada so long as the consumption occurs in Canada. The industry has been taking advantage of this as exports of crude to Canada increased tenfold over the past decade, from 30,000 bpd in 2005 all the way up to 331,000 bpd in 2014.[20] The BIS will review other applications on a case-by-case basis.

The BIS recently approved a U.S. crude oil swap with Mexico—another tool that the federal government can employ to exempt companies from the crude oil ban. Mexico’s state-owned oil company Pemex applied to swap 100,000 bpd of heavier Mexican crude oil for the light sweet crude oil produced in the U.S. in January 2015. The BIS approved the swap in August 2015; the export licenses will be valid for one year. As the Obama Administration’s Energy Information Administration points out, the swap will provide increased market efficiency, benefiting both the economy and the environment:

The swaps, which are provided for under longstanding regulations governing U.S. crude oil exports, are expected to be both economically and environmentally beneficial to both parties because of differences in crude oil qualities as well as differences in each country’s petroleum refineries. The swaps will allow a greater degree of operational efficiency in both Mexico and the United States while allowing for increased supply of lower-sulfur gasoline from Mexican refineries.[21]

While the swap is a welcome step, the BIS has also rejected potential exchanges[22] with countries in Asia and Europe, demonstrating the arbitrariness of the federal government’s role in determining where producers may send their oil.[23] The mutually beneficial exchanges enjoyed between Mexican and U.S. producers should be available to everyone, not just to those the government determines to be worthy.

When it comes to natural gas exports, no ban on exporting liquefied natural gas (LNG) exists but the federal government does have an unnecessarily obtrusive role. To export natural gas, a company must liquefy the gas at a liquefaction plant at –162 degrees Celsius. The LNG is then shipped from an export terminal and delivered to a re-gasification import terminal to be stored or distributed by pipeline at the recipient location. In order to export LNG, companies must obtain approval from both the Federal Energy Regulatory Commission (FERC) and the Department of Energy (DOE). A facility is automatically authorized if the recipient country has a free trade agreement (FTA) with the U.S. In the absence of such an agreement, the DOE can deny a permit if it deems the volume of natural gas exports not to be in the public’s interest. The decision to export natural gas should be a business decision, not a political one. The U.S. trades regularly with a number of non-FTA countries.

The United States is also an important supplier of coal to the world, exporting more than 27.5 million short tons in 2014.[24] The top importers of U.S. coal are spread across the globe—the Netherlands, the United Kingdom, Germany, Italy, Turkey, India, Brazil, Canada, Mexico, Japan, and South Korea.[25] Coal export terminals should undergo the proper environmental review and permitting process; however, opponents to U.S. coal production want the Army Corps of Engineers to consider a cumulative, programmatic environmental impact statement (EIS). This comprehensive review would assess the environmental effects and greenhouse gas emissions not only from the actual terminal, but also from the mining, rail transportation, and end use of the coal. Adding these extra layers of regulatory review would create more fodder for groups who want the coal to stay in the ground, setting a dangerous precedent for exports of goods and services that environmental activists feel have too large an environmental footprint.

The Economic and Geopolitical Benefits of Energy Free Trade

Free trade is a fundamental component of economic growth by providing consumers with more choices, better products, and lower cost. The ability to buy foreign products that other countries produce more efficiently frees up American labor and capital to be more productive in other areas, growing the economic pie and increasing prosperity for all. Opening markets for both import and export fosters innovation as companies face more competition and face challenges to retain or expand their market share. The result is innovative ideas, higher-quality products at competitive prices, and an improved standard of living. The trading of goods and services freely around the world is largely responsible for lifting hundreds of millions of people out of poverty. Companies in foreign countries that specialize in making a product at a lower cost create opportunities for Americans to import it and thus pay less for it. Further, when markets are open to imports and exports, opportunities grow, thereby increasing potential for more wealth, investment, and jobs. The increased profitable exchange of goods and services greatly benefits businesses and consumers alike.

As is the case for many other countries around the world, the United States benefits from free trade because of private property rights. When individuals produce something, it is their property and, so long as there is no threat to national security and there is no violation of the rule of law, they should be able to do what they like with their own property. Individuals, in large part, have owned and had the ability to produce America’s natural resources—which is a primary reason why the U.S. is a global energy leader.[26] Individuals extract and sell the energy sources, and the market should determine where it goes.

Americans stand to benefit from a more efficient global oil market through lower prices and an increase in economic activity. Two studies, one from Resources for the Future (RFF) and a second by ICF International commissioned by the American Petroleum Institute (API), found that lifting the crude export ban would lower gasoline prices. The RFF projects that market efficiencies would reduce gas prices from 3 cents to 7 cents per gallon, while the API study estimates that American consumers would save up to 2.3 cents per gallon on gas, heating oil, and diesel fuels.[27] The Government Accountability Office (GAO) reviewed four economic studies on lifting restrictions on crude oil exports and found that gas prices could decrease anywhere from 1.3 cents to 13 cents per gallon.[28] The Energy Information Administration conducted its own study, concluding that “[p]etroleum product prices in the United States, including gasoline prices, would be either unchanged or slightly reduced by the removal of current restrictions on crude oil exports.”[29]

Although the price impact at the pump may seem marginal, the direction is clear: Prices will fall, and, not only do the savings add up over time, so do the widely expanded economic benefits. The ICF study concludes that opening the U.S. market to crude exports will save American consumers an estimated $5.8 billion over a 20-year period, increase America’s gross domestic product by over $38 billion, and add more than 300,000 jobs by 2020.

Exporting LNG would benefit the American economy tremendously by expanding market opportunities. If the disparity between domestic and foreign prices of natural gas is large enough, opportunities for American companies to export LNG should prove to be plentiful even with the costs of transport tankers and liquefaction plants and the competition from other exporting countries. NERA Consulting, which conducted an economic analysis of LNG exports for the Energy Department in 2012, reiterated its positive economic findings in an updated study. The benefits would include tens of billions of dollars in export revenue, tens of billions of dollars in increased gross domestic product (GDP), and tens of thousands of new jobs.[30] Notably, the study found that the higher the volume of exports, the greater the economic benefits would be.

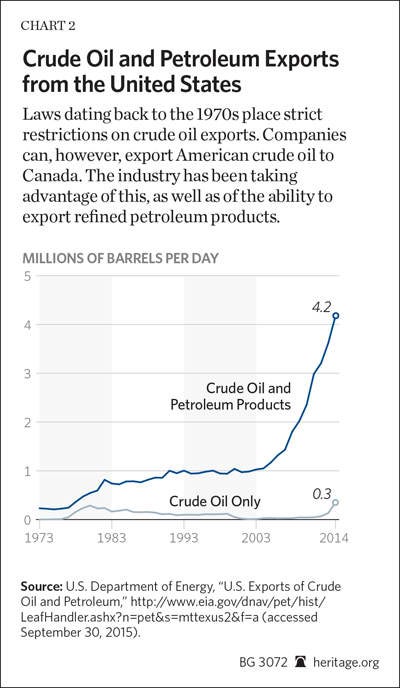

Removing restrictions on energy exports would improve national security and geopolitical conditions around the world by reducing any one nation’s ability to manipulate energy supplies for political or economic influence. The 2014 crisis in Crimea revolving around Russia’s invasion of Ukraine demonstrates how liberalizing global energy markets could be an effective geopolitical tool. Much of Russia’s power in the region derives from its control of energy supplies and distribution systems. Although the Organization of Petroleum Exporting Countries’ (OPEC) influence on the global market is often overblown,[31] opening markets would provide a diversity of suppliers and greater energy supplies for the global oil market.

Moreover, additional supplies in an open market can significantly reduce the leverage of those countries or organizations that want to choke off supplies in a restricted market. If a glut of oil or any other natural resource is available on the open market from a variety of suppliers, the ability to cut off supplies and manipulate prices for political gain is greatly diminished. The incentive to lower costs and provide supplies at competitive prices, however, is enhanced.

The Geopolitical Repercussions of U.S. Energy Exports by Region

Europe. Freely exporting energy resources with Europe will diversify the energy supply and strengthen U.S. relationships with North Atlantic Treaty Organization (NATO) allies. The U.S. is committed by the 1949 North Atlantic Treaty to defend the 26 European members of NATO—energy security is a key component. If the U.S. pursues policies rooted in economic freedom, increasing domestic energy production and lifting government-imposed restrictions on energy exports would help both the U.S. economy and Europe.

Much of Russia’s power in Europe is the result of its control of energy supplies and distribution systems. Diminishing Russia’s economic leverage in the region should be a key component of America’s commitment to transatlantic security. This could be accomplished to a large extent simply by liberalizing global energy markets. The U.S. has antiquated and unnecessary limitations on exporting LNG and crude oil, and Congress should make lifting these restrictions a priority.

More than half of Europe’s energy resources come from countries outside the European Union (EU), and this proportion has been generally rising over the past decade. Many European countries could be doing more do produce energy within their borders; however, anti-market policies generally prevent resource development. Government ownership of mineral resources, bans on hydraulic fracturing, and heavily subsidized renewable energy sources have increased costs for Europeans, both as taxpayers and energy consumers. Furthermore, Germany’s phaseout of nuclear power drove electricity rates higher and created energy poverty in parts of the country.[32]

The potential for U.S. exports to Europe is great. Currently, the EU imports more than 90 percent of its crude oil and approximately two-thirds of its natural gas needs.[33] Together, this amounts to a total import bill of more than $1.2 billion per day. To satisfy the EU’s energy demands, Russia has become one of Europe’s main suppliers—especially for natural gas. From a geopolitical and security standpoint, European dependence on Russian energy comes with risks for Europe and the U.S. Concerns about the security of supply from Russia have been further heightened by the war in Ukraine and Russia’s aggressive behavior in the Baltic region and in the South Caucasus.

Russia has used oil and gas as a strategic weapon in the past. Russia cut off gas supplies to Ukraine in 2006, from 2008 to 2009, and in 2014, and threatened to do so again in early 2015. Ukraine is an important transit country for Russian gas, and the 2009 gas dispute between Russia and Ukraine left many European countries with severe shortages. While this event served as a much-needed wakeup call for Europe, little has been done in practice to reduce this dependence on Russia.

As Europe looks for energy alternatives to Russian energy resources, it should be cautious about what kind of role Iran might play if the Iranian nuclear agreement reached in July 2015 comes into force. Iran has identified nearly 50 new oil and natural gas projects worth $185 billion once international sanctions are lifted. At least some of these projects will send Iranian oil and natural gas into Europe via the network of pipelines in the South Caucasus and Turkey.

The Iranian minister of information and communications technology, Mahmoud Vaezi, has publicly said that he hopes Tehran might soon export energy to Europe.[34] Some in Europe will be keen to import Iranian oil and gas and might even see Iran as a credible alternative to Russia. Nothing in the past 35 years has shown that Iran can be a trusted partner. Europe should avoid the temptation to import Iranian oil and gas absent any further liberalization of supply diversity or as a substitute for dependence on Russia, because any degree of dependence on Tehran will further weaken Europe’s energy security. Access to American energy supplies would provide more energy choices and increased regional diversity.

Moreover, the U.S. should not back an energy chapter in the Transatlantic Trade and Investment Partnership (TTIP). The treaty is likely a vehicle for the promotion of increased government promotion of politically preferred green energy policies. The United States does not need a treaty to achieve free trade of energy resources with other countries. The United States and European governments should adopt the appropriate free-market energy policies to establish supply diversity and reduce dependence on Russian energy.

Controlling the Flow. Moscow has long sought to control the flow of oil and gas to Europe and has never liked pipelines transporting oil and gas to Europe that bypass Russian territory. The Kremlin’s mentality is: If Europe is not buying oil and gas from Russia, it should not be buying it from anywhere else, either. To this end, where Europe is able to import from other sources, Russia has shown it can easily pose an indirect threat to supply. Some of these indirect threats posed by Russia to Europe’s energy supply in recent years have included:

- Russia’s reluctance to agree to the delineation of the Caspian Sea, which has resulted in the continuous blocking of the construction of a trans-Caspian natural gas pipeline. Were such a pipeline ever realized, it would allow Turkmenistan to export gas to Europe, providing a major alternative to Russian gas.

- In July 2015, Russia moved the administrative boundary fence dividing the Russian-occupied region of South Ossetia and the rest of Georgia—thereby placing more Georgian territory under Russian control. The new fence also places a 1-mile segment of the BP-operated Baku-Supsa pipeline inside Russian-occupied territory.[35]

- Russia continues to arm both Armenia and Azerbaijan in the ongoing Nagorno–Karabakh conflict in the South Caucasus. The Baku–Tbilisi–Ceyhan pipeline and the South Caucasus Pipeline, carrying oil and gas, respectively, from the Caspian to the Mediterranean, pass within miles of the current cease-fire line.

The Baltic Example. A good example of the energy problems faced by Europe is found in the Baltic region. The Baltic States (Estonia, Latvia, and Lithuania) are heavily dependent on Russia for energy. In 2014, Estonia, Latvia, and Lithuania imported 100 percent of their natural gas from Russia.[36] The Russian state-owned gas company Gazprom was once the sole provider of natural gas to the Baltic states, and they paid some of the highest prices for gas in Europe. For instance, in 2014 Lithuania paid 36 percent more for Russian natural gas than Germany paid.[37]

The Baltics are aggressively seeking ways to end Gazprom’s monopoly on their gas supply. One significant development in the Baltic region is Lithuania’s 10-year lease of an offshore LNG vessel that accepts LNG imports. It is docked year-round in the port of Klaipeda.[38] If it were to ever reach full capacity, the terminal could supply 80 percent of the natural gas needs of all the Baltic states.[39] The implementation of the import terminal was not the most competitive and cost-effective, as state-owned companies largely drove the project to completion and taxed Lithuanian citizens in order to pay for it.[40] Nevertheless, the desire to diversify is strong in the Baltic states. Moving forward, empowering private companies to diversify, provide choice, and build economically viable infrastructures will best meet Baltic states’ energy needs at competitive prices.

In February 2015, a Lithuanian natural gas import company signed a memorandum of understanding with an American company, Delfin LNG LLC, which is building a liquefaction and export facility in Louisiana.[41] However, export of American LNG has not yet received regulatory approval, and the new American LNG export terminal is not expected to start construction until 2019.[42] While the time frame to permit and build the facility is a multi-year process, Delfin’s application represents the problem with the DOE’s involvement in trading natural gas to non-FTA countries. Delfin filed its application for Long-term Multi-Contract Authority to Export LNG to Non-Free Trade Agreement Countries in November 2013 and those contracts are still under DOE review.[43] The DOE’s review is a completely meaningless hurdle but prohibits companies from planning and investing if their economic viability is dependent on the DOE’s determination that the company can export to non-FTA countries. Still, the signed memorandum indicates a level of interest in U.S. LNG exports.

Attempts at Diversification. Across Europe various pipeline projects are in the works. Companies are constructing interconnector systems to make it easier to move oil and natural gas throughout Europe. One region that is adding to its oil and gas infrastructure is the South Caucasus—making the region even more important for Europe’s energy diversity. This will especially be the case if a trans-Caspian natural gas pipeline becomes a reality.

Construction started this year on the Trans-Anatolian Natural Gas Pipeline (TANAP). The TANAP pipeline will run from Azerbaijan to Turkey. It will then link up with the Trans-Adriatic Pipeline (TAP). Construction for TAP also started this year and once completed will run from the Turkish–Greek border to Italy via Albania and the Adriatic Sea. Both the TANAP and TAP are expected to be completed by 2018 and will link up with the existing South Caucasus Pipeline (which connects Turkey to the Azerbaijani gas fields in the Caspian Sea, through Georgia). Together, all three pipelines will form the so-called Southern Gas Corridor.

Russia will also be competing against these new pipelines. Russia announced earlier this year that its South Stream project is cancelled and will be replaced with a so-called Turkish Stream pipeline. This new pipeline will supposedly bring Russian gas across the Black Sea to Turkey to then link up with TAP. All of these projects reaffirm Turkey’s desire to serve as a regional energy hub, but pipelines running through Turkish territory have been susceptible to terrorist attack, especially by the Kurdish PKK.

A Role for the U.S. As Europe looks for new sources of oil and gas it is clear that the U.S. offers the most potential. While there are many tools at America’s disposal when dealing with Russia and helping Europeans remain secure, one must not discount the impact that free markets and free trade can ultimately have on the situation.

To truly diminish the power that a nation garners from its control of energy markets and supplies, however, the U.S. needs to lead a broad liberalization of global energy markets. This means not only encouraging private-sector development around the world, but also allowing market-driven increases in production in the U.S.

By increasing energy supplies to the global market and diversifying global supplies, these reforms also would diminish the ability of any nation, including Russia, to use energy as a weapon to impose its will in the future.

India. Securing adequate energy supplies for its rapidly expanding and modernizing economy is a key foreign policy goal of the Indian government. India is the third-largest energy consumer in the world (behind China and the U.S.), and demand for coal, oil, and natural gas is quickly outpacing domestic production. India has been slow to invest in oil and gas exploration and will thus remain dependent on foreign energy resources for the foreseeable future. Its growing thirst for energy will increasingly impact its international relationships and drive its geopolitical goals.

It is estimated that India spends around $330 million daily on energy imports, sourcing most of its oil and natural gas import requirements from the Middle East. India has become one of the largest importers of LNG in Asia, purchasing more than 10 million tons in 2014, and projected to increase to more than 24 million tons per year by 2020.[44] The uptick in India’s LNG imports follows changes in government regulations that now allow the use of imported gas in power generation and fertilizer production.

India currently buys most of its imported LNG from Qatar, but is likely to re-engage in negotiations with Iran over a long-term LNG supply deal following the U.S. Congress’s passage of the nuclear deal with Iran. In 2008, India and Iran scrapped an earlier LNG deal in part due to U.S. pressure on India to strictly adhere to sanctions policy on Iran. Indian officials have asked the Obama Administration to remove barriers to U.S. exports.[45]

India’s internal demand for oil is set to increase from 224 metric tons in 2014 to 310 metric tons by 2030, while its gas requirement is expected to double within the same time frame. India imported nearly 200 metric tons of oil in 2014 (or nearly 90 percent of its total oil consumption).

Coal is likely to remain India’s primary source of energy in the near term, however. Coal now makes up 44 percent of India’s total energy consumption and the most recent Five-Year Plan (2012–2017) calls for more than 80 percent of additional electrical capacity to come from coal. India was self-sufficient in coal production 25 years ago, but now relies on imports to fulfill about 30 percent of its coal needs. Most Indian coal imports come from Indonesia (60 percent), Australia (17 percent), and South Africa (14 percent).

With the recent slowdown in China’s economy, in contrast with the relatively positive outlook for India’s economic growth over the next few years (its GDP is now growing at around 7.5 percent), energy exporters Russia and Iran will increasingly seek to make energy deals in India. India has already expressed interest in a gas pipeline proposed by Russia.

By placing arbitrary and time-delaying restrictions on U.S. LNG exports, the U.S. is missing both an economic and geopolitically important opportunity to help fulfill India’s growing LNG needs. The U.S. has an interest in seeing India prosper and expand its economy so that it is increasingly capable of contributing to security and stability in the Asia–Pacific region. Furthermore, supplying LNG to India would alleviate New Delhi’s need to turn to Iran and Russia or other countries whose geostrategic interests often diverge from those of the U.S.

Cooperating with India to secure its energy future will help solidify the strategic partnership between Washington and New Delhi and thus advance broader U.S. national security goals that include ensuring that no single country dominates the Asia–Pacific region.

Northeast Asia. The United States has long been the one of the world’s top oil producers, usually ranking among the top five. With the fracking revolution, however, and other new forms of oil production, the United States is now in a position to be an influential global energy exporter. While it is unlikely to eclipse Saudi Arabia in sheer volume of exports, the ability of the United States to meet some of the oil demands of key allies in the western Pacific would mark a shift in regional security dynamics.

At present, China, Japan, South Korea, and Taiwan are among the top oil importers in the world.[46] In particular, resource-poor Japan is heavily dependent upon imported energy for both power generation and transportation. While Japan has sought to diversify its energy consumption among oil, natural gas, and coal, imported energy represents 95 percent of energy consumption. The end of domestic Japanese coal production, as well as the decision to shut down Japan’s nuclear power plants in the wake of the Fukushima disaster, have only exacerbated this dependence.[47]

For Japan, but also South Korea and Taiwan, the most important source of imported energy remains the Middle East, with over half of all imported oil coming from there. This creates a dual set of vulnerabilities; not only are these states dependent on this politically volatile region for energy, but the import flow requires that a chain of very large crude carriers (VLCC) transit the Indian Ocean, the Malacca Strait, and the South China Sea (and the East China Sea in the cases of Korea and Japan) to sustain their economies.

Should the United States allow the export of oil and LNG, this would likely adjust some of these vulnerabilities. In the first place, and most obviously, it would reduce, at least marginally, global dependence upon the Middle East as the physical source of oil. This, in turn, would mean that regional instability would not necessarily rebound through the global system as quickly; right now, the closure of the Strait of Hormuz would likely generate an immediate “oil shock” that would have enormous global impacts in short order, even with record low oil prices.[48] The most effective response to any oil shock would be open markets that provide more supplies from different regions of the world. A larger American share of the global oil market would reduce, at least somewhat, the impact of instability in the Middle East.

In addition, a larger American role in the global energy markets would allow Japan, South Korea, and Taiwan to diversify the physical sources of their oil, which in turn would reduce the vulnerability of those imports. Indeed, Japan has already expanded its imports of Russian crude oil in 2015, with the added benefit of a shorter transit time.[49] It is important to recognize the limited impact that such diversification is likely to have, however, since Japan alone imports at least 4.6 million barrels of oil per day.[50] Over one-third, or some 1.2 million bpd, comes from Saudi Arabia.[51] Consequently, American oil exports are unlikely to wholly supplant Middle East suppliers. Nonetheless, a greater American supply would likely ease Japanese dependence on the Gulf region.

This, in turn, would reduce some of the vulnerability of East Asia’s sea lanes of communications (SLOCs). As in World War II, Japan is wholly reliant on the free movement of shipping on the world’s sea lanes for its economic and national survival, a situation that is duplicated for South Korea and Taiwan. The current fuel SLOCs for these players must pass along the East Asian littoral, which is dominated by China. Diversifying its fuel SLOCs would reduce their vulnerability to the People’s Liberation Army Navy (PLAN), whose capabilities are steadily improving.

Moreover, by moving them from a largely north-south orientation to incorporate an east-west component would also complicate PLAN targeting, since it would require it to range farther afield into the central Pacific, rather than compelling the U.S. Navy to operate closer to the Chinese coast. This would remove American forces from the pressures of confronting China’s anti-access/area denial capabilities, such as the recently unveiled DF-21D “carrier killer” anti-ship ballistic missile. Instead, it would require Chinese surface, subsurface, and air platforms to venture into the central Pacific or close to Japan and South Korea in order to blockade those nations, in the event of conflict.

Latin America. Traditionally, the U.S. oil sector has been heavily reliant on the Latin America/Caribbean region. The U.S. is still a net importer of crude oil and petroleum products although that figure has dropped to only 27 percent in 2014, the lowest amount of net imports since 1985.[52] More than half of U.S. imports come from the Western Hemisphere.[53] The largest suppliers of Western Hemisphere imports are Canada (28 percent); Mexico (10 percent); and Venezuela (9 percent). In comparison, Persian Gulf countries Bahrain, Iraq, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates supply 29 percent.

The removal of restrictions on crude oil exports directly benefits U.S. national security and strategic objectives in the region. First, it would reduce the liability on the U.S. and regional partners posed by Venezuela. Initiated by the late Hugo Chavez, the country’s 21st-century socialist movement has altered the once U.S.-friendly region. Utilizing its vast oil wealth, Venezuela funded various initiatives to expand the cadre of nations adopting their anti-American authoritarianism. Various schemes, such as oil shipments to the Cuban government and funding leftist candidates throughout the region, have undermined the United States. Of all the programs, the Petrocaribe initiative has bought Venezuela the most influence. Ten countries are part of the program in which Venezuela sells oil at preferential rates and loan terms. For countries such as “Jamaica, Guyana, Nicaragua and Haiti, the value of preferential Venezuelan financing for oil imports is more than 10% of government revenue and equivalent to around 4% of GDP.”[54] Petrocaribe member states are facing an uncertain future. Earlier this year, Venezuela was forced to cut nearly half of its subsidized shipments of crude oil to Petrocaribe.[55] Should Venezuela make further cuts, countries that are closer to the U.S. are increasingly vulnerable.

There is also the possibility for increased hostility against the U.S. and regional allies. The plummeting price of oil combined with socialist economic policies has destroyed the Venezuelan economy and the ruling party’s base of support. The International Monetary Fund holds that Venezuela’s budgetary expenditures need the global price of oil to hold at $117.50 per barrel. Currently, it is less than $50 and not projected to increase.[56] The annual inflation in Venezuela is hovering near 200 percent, scarcity is dire, and government approval ratings are low.[57] The Venezuelan government has long deflected attention from its economic situation. In the past few weeks, it has escalated tensions with Colombia on the shared border. Venezuelan fighter jets have begun to patrol the area and have even crossed into Colombian airspace unauthorized. The possibility for increased Venezuelan aggression is tempered by the country’s commercial dependence on the U.S. The U.S. is the fourth-largest recipient of Venezuelan crude oil and contains the closest refineries for its heavy crude oil.

Lifting of the oil export ban would have a positive impact on the U.S. and on Mexico’s energy sectors and boost their overall economies. Mexico is the third-largest crude oil supplier to the U.S. and a top trade and investment partner of the U.S. Positive movement is already being seen in this area. In August of this year, the Department of Commerce approved the licensing for export oil swaps. This comes after Mexico petitioned the U.S. for swaps of Mexico’s heavy crude in exchange for the U.S.’s high-quality light oil. The two countries can swap up to 100,000 bpd, currently 1 percent of U.S. output.[58]

While this shift is a positive development for both Mexico and the U.S., a total lifting of the ban is needed to reap the full benefits. Currently, 52 percent of the oil that Mexico extracts is heavy crude, and Mexican refineries are running at 60 percent capacity, meaning that there is a substantial market share on which the U.S. is missing out.[59] American producers should have the opportunity to fill that void should it be economically viable.

The Middle East and North Africa (MENA). Lifting the ban on U.S. oil exports would have little immediate impact on the Middle East, given the huge amount of oil produced there relative to the small amount the U.S. is likely to export. In 2014, Middle Eastern countries produced an average of 27.8 million barrels of oil per day, about 30 percent of total global oil production of 93 million bpd. U.S. oil exports would likely flow primarily to East Asia and Western Europe, which are major oil-importing regions, rather than to the Middle East, which is the world’s leading oil-exporting region.

Nevertheless, lifting the oil export ban could yield important benefits by putting downward pressure on world oil prices, increasing the flexibility and efficiency of the world oil market and improving the ability of oil-importing states to adjust to oil-supply disruptions. To the degree that U.S. oil exports help lower world oil prices, Middle East oil exporters would be hurt less than most other oil exporters because of their relatively low production costs. However, low-cost producers, such as Saudi Arabia, Kuwait, and the United Arab Emirates, would have a competitive advantage over Iran, which would be handicapped by its reliance on older, more mature oilfields that are suffering from declining yields due to poor maintenance, lack of access to modern technology, lack of investment, and the lingering effects of international sanctions.

Iran, traditionally a price hawk within OPEC because of its relatively large population and oil revenue needs, has repeatedly called for oil production cuts to prop up prices, but Saudi Arabia has opted to maintain high production rates to retain its global market share. Iran was projected to require oil prices of $140 per barrel to balance its budget in late 2014, compared to Saudi Arabia, which needed an oil price of about $80 per barrel to balance its budget.

Riyadh can rely on its huge oil reserves, about $700 billion in foreign exchange reserves, and low production costs to wear down and squeeze out other oil producers as prices fall. The Saudis also have offset the loss of about 1.9 million bpd from disruptions caused by conflicts in Iraq, Libya, Syria, and Yemen. The Saudi oil production strategy is not only aimed at maintaining its prime market share at the expense of Iran and other rival oil exporters, but ultimately at undermining the competitiveness of U.S. shale oil producers, who have much higher production costs.

U.S. oil exports also could help balance the world oil market in the event of future oil disruptions. U.S. oil exports to Israel, in particular, could enhance Israel’s energy security by diversifying its sources of oil imports at a time when it faces growing hostility from proliferating Islamist forces in the region. Israel currently imports oil from Russia, Azerbaijan, the Kurdistan Regional Government in northern Iraq, and Kazakhstan, among other sources, but some of these imports are threatened by terrorist attacks against pipelines in Turkey and Iraq.

Recommendations for Congress

With enormous oil and natural gas reserves, the U.S. is positioned to remain a global energy power well into the future if Congress adopts free-market policies that open domestic and international markets and reduce regulations that choke off resource development. To that end, Congress should:

- Lift the ban on crude oil exports. While U.S. crude oil exports have increased, they are still significantly limited. The Department of Commerce should change the definition of allowable exports, and the President should determine that exports are in the national interest. Those solutions, however, still place the decision at the hands of the government, not the market. Ultimately, Congress should end the ban.

- Lift restrictions on LNG-recipient countries. The distinction that exports to FTA countries are in the “public interest” while others are not is on the whole an arbitrary one. There are numerous non-FTA nations with which the U.S. trades regularly. Natural gas should be no different and should be treated as any other good traded around the world.

- Remove all decision rights from the Department of Energy and prohibit any federal agency from determining natural gas exports based on public interest. It should not be up to the Department of Energy, FERC, or any federal agency, to determine which amount of natural gas exports is in the public interest. Energy producers should be able to capture economic opportunities from LNG-recipient nations if they believe it is in their interest. If the Department of Energy was sincere in its role to protect the public interest, it would have accepted its own analysis that exporting as much LNG as possible is an overall benefit to economic welfare. The Department of Energy’s authorization requirement is a pointless obstacle and should be removed immediately.

- Empower state regulators to manage the environmental review and permitting process of the export facility while allowing FERC to stay involved. States already have the authority to veto LNG terminals. Rather than take an advisory role to FERC, states should play a dominant role in authorizing the construction of the terminal. A state’s environmental review and permit approval would satisfy the federal permits necessary to build an LNG terminal.[60] The state permit approval would satisfy all other necessary approvals required under the National Environmental Policy Act. A state regulator can use FERC technical or safety expertise as necessary. Export applicants would also need to meet Coast Guard security standards and the requirements under the Maritime Transportation Security Act, as well as the Department of Transportation’s Office of Pipeline Safety requirements.[61]

- Prevent threats to coal exports. Congress should prevent cumulative programmatic environmental impact statements for coal exports. Such analyses would adversely affect exports of coal and set a dangerous precedent that could be used to halt many other major economic activities that environmental activists perceive as a threat to environmental safety.

Open Markets Will Increase Global Prosperity and Improve Geopolitics

After a severe global oil supply shock during the 1970s, the United States imposed an almost blanket ban on the export of crude oil. Today, that oil ban remains largely intact, in addition to onerous export restrictions of liquefied natural gas to countries with which the U.S. has no bilateral free trade agreements—which means that Washington, not the marketplace, determines which projects move forward. When the ban on crude exports was imposed in the 1970s, the goal of the legislation was to conserve domestic oil reserves and discourage foreign oil imports after the oil embargo against the U.S. That rationale has done little, if anything, to help the United States, but a lot to restrict opportunities and grow the economy. Contrary to conventional wisdom, removing the crude export ban would not jeopardize U.S. national security. To the contrary, freely trading energy resources and technologies would strengthen national security and improve relationships with allies across the globe.