A growing number of private, multiemployer pension plans are projected to become insolvent over the coming years, as is the Pension Benefit Guaranty Corporation (PBGC), the government entity that insures them. Absent substantial reform, the PBGC will be unable to pay promised benefits to the retirees of the failed pension plans that it insures. If Congress does not alter the rules governing multiemployer pensions and the PBGC’s multiemployer program, millions of workers could lose most or all of their promised pension benefits or federal taxpayers could be forced to finance an expensive bailout of private, union pensions.

Numerous factors are to blame for the underfunding of multiemployer pensions, including misaligned risks and incentives, poor management, declining industries, an aging workforce, and the recent financial crisis. In short, the structure and regulation of multiemployer pensions are deeply flawed, and the PBGC insurance that is supposed to improve retirement security has instead reduced the incentives for pension plans to remain solvent by promising benefit protection that the PBGC will soon be unable to provide.

The reforms necessary to maintain solvency, including cuts in promised and insured benefits, will be difficult to achieve. However, swift action can minimize losses for pension beneficiaries and protect taxpayers from a federal bailout.

What Is the PBGC?

The Pension Benefit Guaranty Corporation was created under Title IV of the Employee Retirement Income Security Act (ERISA) of 1974.[1] Prompted in large part by closure of a Studebaker automobile plant in 1963, which left more than 4,000 workers with little to nothing of their promised pension, ERISA sought to protect workers from pension losses. This included establishing the PBGC, a government agency, to provide mandatory pension insurance to all private companies with defined-benefit plans.

Nearly all private pension plans are required to participate in the PBGC by paying annual, per-worker premiums.[2] The PBGC insures pension benefits for more than 41 million workers and retirees across nearly 24,000 private pension plans.[3] In comparison, state and local government pensions cover about 27 million individuals, and the federal pension systems cover about 5.3 million individuals.[4] Since the PBGC’s establishment in 1974, roughly 4,700 private pension plans have failed, leaving the PBGC responsible for paying insured benefits to more than 1.5 million individuals today.[5]

The PBGC reports to the Department of Labor and Department of the Treasury, which govern the ERISA rules and tax laws for pension plans. Unlike other government agencies, such as the Federal Deposit Insurance Corporation (FDIC), the PBGC cannot set its own premiums or benefits, but relies on Congress to set them.[6] Without the ability to set premiums or benefits, the PBGC effectively has no control over its financial outlook and future solvency.

The PBGC’s Two Programs: Single Employers and Multiemployers

The PBGC has two separate insurance programs: one for single-employer plans and one for multiemployer plans. As the names suggest, the PBGC’s single-employer program insures pension plans that represent only one employer, and its multiemployer program insures pension plans that represent multiple employers, typically in a particular industry such as construction or trucking.

Different Plan Structures. Single-employer plans are pension plans that individual employers offer exclusively to their employees. The PBGC’s single-employer program guarantees benefits for roughly 31 million workers across more than 22,000 single-employer pension plans.[7] To date, the PBGC has provided insured benefits to nearly 4,500 failed single-employer plans representing nearly 2 million vested workers and retirees.[8]

Multiemployer plans are collectively bargained union pension plans whereby multiple employers—usually within the same industry—contribute to a shared plan. These plans most often occur in industries such as trucking and construction in which workers frequently switch back and forth between employers. The PBGC’s multiemployer program guarantees private pension benefits for about 10 million workers across roughly 1,400 multiemployer pension plans.[9] To date, the PBGC has provided financial assistance to more than 70 failed multiemployer plans.[10]

Multiemployer plans rely on collective bargaining, with unions appointing half of the trustees who oversee plan operations. Multiemployer plans were established with the goal of pooling resources across employers to offer a pension plan and to allow individuals in a particular industry to maintain their pension while working for different employers.

Multiemployer plans can offer greater protection for employees, at least initially, because the multiemployer pension plan continues to pay promised benefits to “orphaned” beneficiaries of bankrupt employers. This increases costs for remaining employers in the multiemployer plan, but the shared liability across multiemployer plans acts as a first stage of insurance protection. For single-employer plans, the PBGC acts as this first stage of insurance protection.

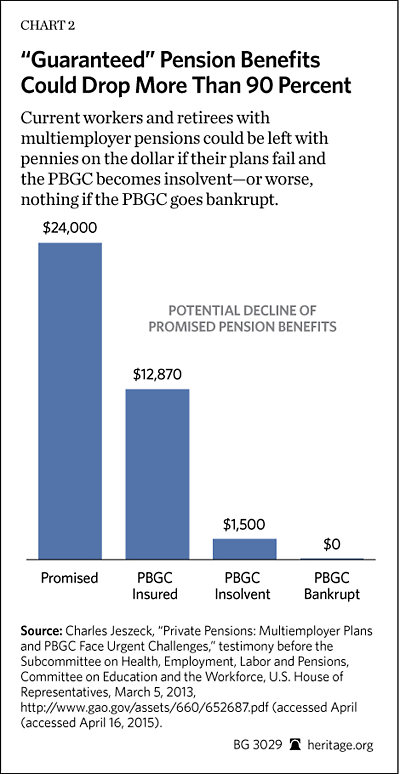

Different PBGC Premiums and Benefits. PBGC benefits differ significantly depending on whether the failed plan was a single-employer plan or multiemployer plan. Annual benefits for workers of failed multiemployer plans are capped at $12,870 per year, while beneficiaries in the PBGC’s single-employer program can receive up to $60,136 per year, depending on work history and other factors.[11]

The PBGC’s cap for multiemployer benefits is often significantly less than workers’ promised benefits, but the plan structure is supposed to serve as an additional layer of insurance protection because, when one employer goes bankrupt, the pension obligations of that insolvent employer are spread across remaining employers in the multiemployer plan. Largely due to the lower benefit cap and the additional layer of protection, multiemployer plan premiums are significantly lower than single-employer premiums. The current multiemployer premium is $26 per year per plan participant compared with $57 per year for single employers. On top of the per-participant premium, single employers pay a variable-rate premium (VRP) that depends on their plan’s unfunded vested benefits (UVBs). The 2015 variable rate is $24 per $1,000 of UVBs, with a cap of $418 per participant.[12] Additionally, certain distressed or involuntary single-employer pension plan terminations are required to pay a termination fee of $1,250 per participant for three years after the plan’s termination.[13]

PBGC premiums are much higher than just a few years ago. The Bipartisan Budget Act of 2013 nearly tripled single employers’ VRP, from $9 in 2013 to $24 today and the Multiemployer Pension Reform Act of 2014 (MPRA) increased single employer’s flat premium from $49 in 2014 to $57 in 2015. For multiemployer plans, scheduled increases along with the MPRA nearly tripled the multiemployer premium from $9 as recently as 2012 to $26 today.[14]

Different Governance. Although both single-employer and multiemployer plans must conform to the general ERISA requirements and tax laws pertaining to pension plans, the two plan types face substantial differences in governance and the rules for calculating assets and liabilities.

Each multiemployer plan is governed by a board of trustees on which employer representatives and union representatives are equally represented.[15] Trust documents of a plan typically specify how many trustees make up the board and how they are appointed or elected. Trustees serve as fiduciaries of the pension plan and must act exclusively for the benefit of the participants and beneficiaries.

Multiemployer plan trust agreements generally specify how benefits are determined. Some plans give their trustees the authority to determine plan design and benefits while other plans leave those decisions to the collective bargaining process and then give the board of trustees the authority to determine and collect sufficient fund contributions.[16] If an employer is delinquent in making the required contributions, a multiemployer pension plan can sue the employer under Section 502(g) of ERISA to obtain delinquent payments plus interest, liquidated damages, court fees, and reasonable attorney fees.[17]

The ability of plans to sue employers is an important distinction between single and multiemployer plans. Without such ability, multiemployer plans would have little control over contributions, and delinquent employers could drive up the costs of the plan.

Different Regulations: Multiemployer Plans Assume Unrealistic Returns. When calculating future assets and liabilities, pension plans rely on a variety of assumptions, such as life expectancies and interest rates earned on plan assets. While federal law requires single-employer pension plans to use interest rate assumptions that reflect current rates when calculating their liabilities, multiemployers can effectively use whatever interest rate assumptions their trustees deem reasonable.[18] Consequently, multiemployer plans assume a significantly higher interest rate which drastically reduces their unfunded liabilities.[19]

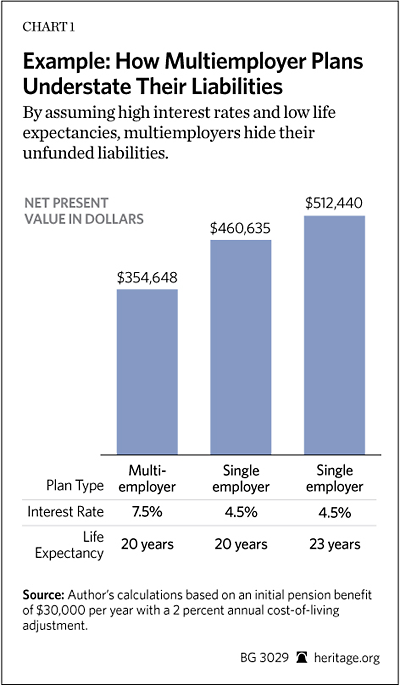

Even small changes in interest rate assumptions can profoundly affect plans’ unfunded liabilities. Multiemployer plans assume an interest rate almost twice that required by single employers: multiemployer plans commonly assume a 7.5 percent rate, while single-employer plans must use a roughly 4.5 percent rate.[20] This translates into a huge difference in plans’ estimated unfunded liabilities.

For example, a single $30,000 annual pension requires wildly different contributions depending on whether the beneficiary is in a single-employer or multiemployer plan. Using a specified 4.5 percent interest rate and 20-year life expectancy (from date of benefit eligibility), a single employer’s estimated net present value of that benefit—the money it should have on hand today to pay the future benefit—would be 28 percent higher than a multiemployer’s estimate with its a chosen rate of 7.5 percent.

Higher interest rate assumptions go a long way in improving multiemployer plans’ stated financial positions, but they do nothing to change actual solvency. Rather, they let employers skimp on contributions, ultimately meaning that plans cannot pay their promised benefits.

Interest rates are not the only assumption left to the discretion of multiemployer plans. They also can set their own mortality rate assumptions—that is, the estimates of how long their plan beneficiaries will live. By assuming shorter life expectancies, multiemployer plans can reduce their contributions.

In November 2014, the Society of Actuaries updated its mortality tables, projecting that the average 55-year-old female alive today will live 3.3 years longer than projected in 2000 and the average male will live 2.2 years longer.[21] These increased life expectancies are projected to add 3 percent to 10 percent to pension plan liabilities. Single-employer pension funds cannot ignore these higher life expectancies; they must account for them through increased contributions. However, multiemployer and public pension plans can choose whether or not to take these new projections into account.[22]

Adding three years in projected life expectancy would add nearly $35,000 in projected liabilities for a single employer’s $30,000 pension benefit, but multiemployer plans can choose to ignore these increases. If they do, the previous 28 percent gap in estimated liabilities between single employers and multiemployers for the exact same pension benefit rises to 39 percent. The lack of proper regulations concerning multiemployer plans effectively allows multiemployers to contribute significantly less to pay the exact same benefit as multiemployers. Based on the financial outlook of single employers versus multiemployers, it is clear which set of assumptions is superior.

Different Treatment for Failed Pension Plans. When a single employer’s pension plan becomes insolvent, the PBGC takes over the plan and directly pays its beneficiaries based on PBGC-insured benefits. In contrast, when a multiemployer plan effectively becomes bankrupt (usually by all employers exiting the plan), the plan and its trustees remain in place and the PBGC provides “loans” to the plan to pay the PBGC-guaranteed benefits. Since these loans are made to insolvent plans, there is no expectation of repayment. In the PBGC’s history, only one of 53 insolvent multiemployer plans has ever repaid its loans.[23]

Financial Outlook

The PBGC’s single-employer program is improving, but the multiemployer program is facing a downward spiral.

According to the PBGC’s November 2014 annual report, the PBGC has a combined deficit or unfunded liability of $61.8 billion. This marks a huge increase from $35.6 billion in 2013.[24]

Although the combined PBGC deficit rose in 2014, the increase was entirely due to the multiemployer program. The deficit for single employers declined by $8.0 billion (29 percent) from $27.4 billion to $19.4 billion. Meanwhile, the deficit for multiemployers increased more than fivefold from $8.3 billion to $42.4 billion.[25]

These projections do not include the estimated impact of the Multiemployer Pension Reform Act of 2014. These reforms, particularly the premium increases, will boost the PBGC’s finances, but not nearly enough to prevent insolvency for the multiemployer program.

Insolvent Multiemployer Program. The multiemployer program is under severe financial stress. According to the PBGC’s 2014 report (which preceded the MPRA reforms):

PBGC’s multiemployer program is itself on course to become insolvent with a significant risk of running out of money in as little as five years…. When the program becomes insolvent, PBGC will be unable to provide financial assistance to pay guaranteed benefits for insolvent plans.[26]

Precisely when the program will become insolvent is highly contingent upon the insolvency of two large, highly underfunded plans: the Central State Teamsters and the United Mineworkers. According to recent testimony by the Government Accountability Office, the insolvency of either of these two large, deeply troubled multiemployer plans would make PBGC insolvent within two to three years.[27]

Insolvency of the PBGC’s multiemployer program would affect an estimated 1 million of the 10.4 million workers insured under the PBGC’s multiemployer program.[28] Upon insolvency, PBGC beneficiaries would experience a steep decline in benefits. For example, a recent Government Accountability Office (GAO) report states:

If the [multiemployer] fund were to be drained by the insolvency of a very large and troubled plan, we estimate the benefits paid by PBGC would be reduced to less than 10 percent of the guarantee level. In this scenario, a retiree who once received [a] monthly benefit of $2,000 and whose benefit was reduced to $1,251 under the guarantee would see monthly income further reduced to less than $125, or less than $1,500 per year.[29]

In other words, a worker who was promised an annual pension of $24,000 per year would receive only $1,500 per year, or six cents for every dollar of promised benefits. As the number of PBGC beneficiaries rises and PBGC contributions decline, benefits will continue to fall and eventually cease to exist.

Such massive underfunding is unheard of in the private sector, where insurance companies must properly align premiums and benefits to attract and maintain customers. However, the PBGC is not a private company: It has no authority over its premiums or benefits, which are set by Congress, and it does not need to compete with other pension insurers because virtually all private pension plans must purchase PBGC insurance.

The premium increases and other reforms enacted in the MPRA mark a positive first step toward improving the PBGC’s multiemployer program, but these reforms merely delay insolvency. Preventing insolvency will require much more.

Many Multiemployer Pensions Face Downward Spiral. Originally considered an advantage, the structure of multiemployer pensions is now contributing to a downward death spiral for some plans.

While multiemployer plans have the benefit of being able to withstand the bankruptcy of one or a few small employers, there is a limit to how many bankruptcies a multiemployer plan can sustain. As certain industries have declined and more and more employers have closed shop, the remaining employers bear the burden of supporting not only their own retirees, but also those of their previous competitors. In 1980, multiemployer pension plans had about three active workers supporting every retiree. Today, retirees outnumber active workers, leaving less than one worker to support every retiree.[30] For underfunded plans, this effectively means that employers must contribute more than twice as much to sustain promised pension benefits.

The addition of new employers to plans would help to shore up their solvency, but employers would be crazy to join troubled multiemployer plans. That would be tantamount to agreeing to liquidate their company’s assets to pay the employee pensions of bankrupt companies.

Unable to attract new blood, troubled multiemployer pension plans face a catch-22: The very actions that are necessary to increase many multiemployer plans’ solvency could actually hasten their insolvency. Troubled plans need to raise contribution rates to remain solvent, but that could force the remaining employers out of business, leaving fewer employers to shoulder an even greater liability. For example, the troubled United Mineworkers pension fund raised its contribution rate by 10 percent to $6.05 per hour per union employee. This is a large amount considering that the minimum wage is $7.25 per hour. Yet to make the plan solvent over the long run, contribution rates would need to rise to more than $25 per union employee hour.[31]

Similarly, plans could help to prevent healthy employers from exiting the plan by raising withdrawal liabilities, but that would also prevent troubled employers from leaving the plan and could drive those employers toward bankruptcy more quickly. If an employer is likely to go bankrupt, the plan is typically better off if that employer withdraws before going bankrupt because the employer will pay a withdrawal penalty and no new accruals will be added to the plan’s liabilities.

Just to keep treading water, many multiemployer pension plans will need to unjustly burden remaining employers and active workers with higher contribution rates. But these higher costs will only exacerbate employment declines in the affected industries.

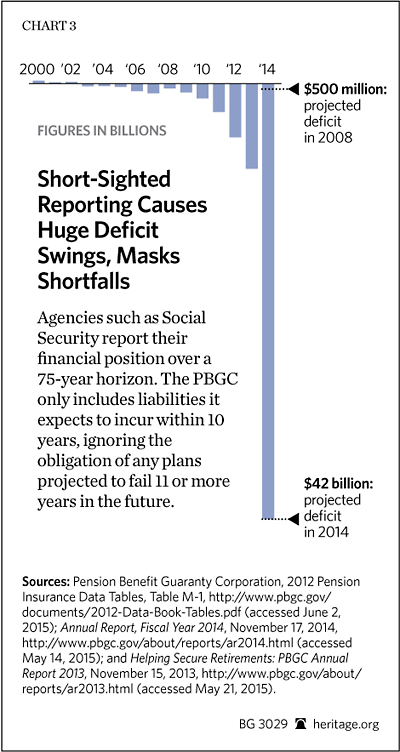

Short-Sighted Deficit Reporting Masks Underfunding. As bad as the PBGC’s multiemployer program appears, its actual unfunded liabilities are even greater than reported. Total liabilities are masked by the fact that the PBGC reports only unfunded liabilities that it expects to incur over the next 10 years. In other words, the liabilities of any plans that are expected to become insolvent in 11 years or more are excluded. In contrast, Social Security reports a 75-year unfunded liability.

Consequently, the addition of the Central States Teamsters and United Mineworkers plans (two very large multiemployer plans) to the “probable insolvency” category caused the PBGC’s multiemployer unfunded liability to surge by $26.3 billion in 2014. The addition of another 14 plans to the probable category accounted for another $9 billion of the total $34.2 billion increase in PBGC’s multiemployer unfunded liability.[32]

The fivefold increase in the PBGC’s multiemployer deficit in 2014 provides a perfect example of why the 10-year period is both misleading and detrimental to the program’s solvency. As recently as 2008, the PBGC reported a deficit of less than $500 million. A mere six years later, the 2014 deficit increased nearly 100-fold to more than $42 billion. PBGC actuaries have been aware of the program’s longer-term troubles for some time, but the focus on 10-year unfunded liabilities has masked the program’s shortfalls and hindered necessary reforms.

What Happens When PBGC’s Multi-employer Program Becomes Insolvent?

Multiemployer pensions face a downward spiral. As more and more plans fail, the PBGC’s multiemployer program will take on massive liabilities that will, without monumental reform, quickly drive the PBGC’s multiemployer program to insolvency. When that happens, who will bear the burden?

The natural consequence of insolvency or bankruptcy is a loss for creditors. In the case of the PBGC, those creditors are the beneficiaries of failed pension plans. If the PBGC becomes insolvent, workers who were promised pension protection will be left with nothing, unless Congress decides to step in and push the cost of their failure onto taxpayers.

Taxpayers on the Hook? Taxpayers should not be on the hook for the PBGC’s unfunded liabilities because the PBGC is and always has been a self-financed program. According to ERISA, the “United States is not liable for any obligation or liability incurred by the corporation.”[33]

Nevertheless, when a million or more retired workers stand to lose their entire pensions, there will no doubt be calls for some sort of bailout. Unions representing workers who stand to lose their insured pensions will no doubt lobby Congress for a taxpayer bailout, even though union trustees stood at the helm of bankrupt multiemployer pension plans.

Regrettably, the recent bailouts of Fannie Mae, Freddie Mac, and the auto industry set a dangerous precedent that federal taxpayer dollars can be used to prop up insolvent government entities and private corporations.[34]

A taxpayer bailout of the PBGC’s multiemployer program would effectively force taxpayers to:

- Insure a small subset of the population against economic and industry-specific risks, even though other taxpayers who suffered similar losses of retirement savings and other financial struggles receive no protection, and

- Back the sometimes reckless and even deceptive practices of certain union pension plans.

With an estimated unfunded liability of $42.4 billion, a bailout could cost American families $350 per household.[35] Yet this would cover only the next 10 years of insolvencies. Covering all future insolvencies and the PBGC’s single-employer program could cost significantly more.

However, a pension bailout would not stop with the PBGC. State and local pensions are underfunded by as much as $3 trillion.[36] If the government bails out private pensions, it will have difficulty not bailing out public pensions, such as those for teachers and firefighters. At roughly $25,000 per household, a public pension bailout is simply not feasible—at least not without crippling economic effects.

Unions Counting on a Bailout. Trustees of troubled multiemployer pensions have known of their impending insolvency for some time. Yet these trustees, half of whom are union representatives, have often done little to nothing to preserve solvency. Despite purporting to represent members’ best interests, some union representatives have failed to negotiate changes—such as lower wages in exchange for higher pension contributions or reduced benefits for new workers—that would protect the pension plans for the workers they represent.

Instead, they have often sat idly by and allowed the financial status of their members’ pension plans to continue to deteriorate, often while proclaiming the great promised benefits of those plans. These union trustees have either not acted in the best interest of their members—in which case they are violating their fiduciary responsibility—or are counting on taxpayers to bail out their broken promises.

Although no private-sector pension has received a bailout to date, bailout legislation has been proposed. In 2010, Representative Earl Pomeroy (D–ND) introduced the Preserve Jobs and Save Benefits Act (H.R. 3976), which would raise the PBGC’s maximum guarantee for multiemployer pension benefits from $12,870 to $21,000 and would create a fifth PBGC fund that would explicitly use taxpayer funds to pay PBGC-insured benefits for orphaned multiemployer beneficiaries. Aside from the obvious bailout, this proposal would exacerbate the PBGC’s multiemployer shortfall and move up its projected date of insolvency by increasing benefits. Any legitimate proposal must improve—not weaken—the solvencies of multiemployer pensions and the PBGC.

Despite its title “Solutions Not Bailouts,” a report from the National Coordinating Committee for Multiemployer Pensions (NCCMP), effectively proposes a bailout by suggesting that Congress explore a federal government guarantee on bond offerings to reduce multiemployer pension shortfalls. A federal bond guarantee would grant deeply troubled pension plans access to essentially unlimited funding, leaving them little incentive to address their insolvency and ultimately leaving taxpayers footing the bill when the plan cannot pay the interest or principal due on those bonds. Aside from this troubling provision, the NCCMP proposal contains some productive reform options, many of which were included in the Multiemployer Pension Reform Act of 2014.

Americans Cannot Afford a Pension Bailout. America faces a retirement crisis and private-sector pensions are only the tip of the iceberg. State and local pensions are underfunded by trillions of dollars. Social Security and Medicare face unfunded obligations of nearly $49 trillion.[37] Current and future taxpayers will have a hard enough time saving for their own retirements. They cannot afford to fund America’s insolvent entitlement programs, much less serve as the backstop for underfunded private union pensions.

Preventing Failures: Saving Pension Plans and Insured Benefits

There is no easy solution for simultaneously shoring up multiemployer pensions, preserving the PBGC’s solvency, and protecting pension beneficiaries and taxpayers. The recent MPRA reforms discussed below will delay, but not prevent the PBGC’s insolvency, and many multiemployer pensions remain deeply troubled.

According to a 2013 GAO report, about 6 percent of multiemployer plans cannot avoid insolvency.[38] For these plans, the growth in contributions needed to maintain solvency is so large that employers cannot possibly afford higher costs. For example, one plan would need to increase contributions by 24 percent each year, resulting in an 850 percent increase over 10 years.[39] This would be similar to an employer being forced to increase wages by 24 percent annually. Even minimum-wage employees ($7.25 per hour) would cost their employers more than $62 per hour in just 10 years. With pension contributions already in the $5 to $10 range for many employers, increases of this size would quickly bankrupt most employers.

Thus, when contributions fail to keep pace with benefits and these multiemployer plans fail, they will quickly drain the PBGC of its assets. Without any assets to pay benefits, multiemployer plans will be effectively uninsured. Because the financial status of the PBGC’s multiemployer program hinges on the financial well-being of multiemployer pension plans, reforms must address not only PBGC’s multiemployer program, but also the multiemployer pension plans that it insures.

A Step in the Right Direction. Along with the so-called CRomnibus of 2014, Congress passed the Multiemployer Pension Reform Act of 2014.[40] The MPRA provided some necessary reforms to shore up multiemployer pensions and the PBGC program, including:

- An increase in the multiemployer premium from a scheduled rate of $13 per participant in 2015 to $26.

- Authority for trustees of multiemployer plans in critical and declining status to suspend benefits.[41] Such authority is contingent on the suspensions resulting in plan solvency, and trustees must first pursue all other reasonable measures to avoid insolvency. Benefits cannot be reduced below 110 percent of the PBGC guarantee or below what is needed to achieve solvency, and retirees over age 80 must be exempt from reductions. Additionally, suspensions are subject to a vote by plan members. If the plan is considered “systemically important” (meaning the plan’s insolvency would add $1 billion or more to the PBGC’s projected liabilities), the Treasury Secretary can override a no vote by members.

- Authority for the PBGC to facilitate plan mergers and to grant partitions if such actions will strengthen the PBGC’s financial position.

- Repeal of some scheduled expirations of multiemployer funding rules established under the Pension Protection Act of 2006.

- Changes in withdrawal liability rules that generally make it easier for employers to withdraw from a plan.

The MPRA reforms are a step in the right direction, but much more needs to be done to preserve some of the largest, most troubled multiemployer plans and the PBGC’s multiemployer program.

Increased Authority for Plan Trustees. Each multiemployer pension plan that avoids insolvency improves the PBGC’s solvency because it means that the plan is not a liability for the PBGC. Individual plans, as well as the PBGC, could be better served by granting plan trustees additional authority to amend benefits when necessary to prevent plan insolvencies. Currently, amending benefits is very difficult because employer contributions and employee benefits are the result of contractual union and management negotiations. Thus, not only must trustees wait up to two years to renegotiate pension factors, but employees have a claim and legal case to pursue their promised benefits. However, in many cases, the money to pay promised benefits simply is not there, and once a plan is bankrupt, no lawsuit can make that money appear.

Changes in promised benefits are not popular with unions, but many multiemployer pension plans are so financially strapped that maintaining solvency will be impossible without such changes. Amending the benefit and accrual structure now—even though that would violate the original contract—could preserve or at least prolong the solvency of some multiemployer pension funds, ultimately resulting in higher overall benefits than would otherwise occur. Without changes in benefits, many individual plans and therefore the PBGC cannot keep their promises, and millions of workers and retirees will receive drastically lower pensions or no pensions at all.

Eliminate Plan Participant Vote Requirement. The Multiemployer Pension Reform Act of 2014 provided the option for about 5 percent to 10 percent of multiemployer plans to reduce certain benefits, but only as a last resort and only if plan participants vote to approve the reductions. Participant voting could prevent meaningful benefit reductions because most current and soon-to-be retirees would rather receive their full pensions as long as possible rather than preserve benefits for future retirees.[42] Given trustees’ fiduciary responsibility to plan participants, any benefit reduction that they propose should represent the best interests of participants as a whole. Therefore, policymakers should consider eliminating the requirement for a participant vote to approve recommended benefit reductions.

Expand Benefit Adjustment Authority to Include Benefit Accruals and Eligibility. In addition to benefit levels, trustees should be given the authority to amend benefit accruals and eligibility for workers who are not close to retirement age. Ending or reducing benefit accruals would be particularly helpful to troubled plans in which employers cannot afford increased contributions because changing accruals would reduce future liabilities without raising near-term costs. Likewise, increasing the retirement age would delay and reduce certain benefit payments, providing an immediate boost in plan assets.

The NCCMP plan included a similar proposal allowing trustees to amend benefit accruals and eligibility.[43] The NCCMP plan garners significant, although not universal support from both employers and unions. It specifies that plans can amend certain benefit qualifications, including freezing benefit accruals, reducing benefits, and changing the retirement age for individuals more than 10 years away from retirement.

Congress should extend the existing benefit reduction authority in MPRA to a larger number of deeply troubled multiemployer pension plans. Furthermore, it should grant plan trustees additional authority to amend other plan provisions as necessary to preserve plan solvencies and to pay out the largest possible percent of promised benefits.

Make Plan Trustees Liable for Fraudulent Management. Of course, granting plan trustees additional authority will not guarantee that they will use that authority to implement necessary reforms. Half of all plan trustees are union representatives, who have little incentive to pursue pension reductions that could threaten their reelection. For example, as United Airlines headed into bankruptcy in 2002, it increased pension benefits by 40 percent for its 23,000 ground employees. Leading up to Bethlehem Steel’s 2001 bankruptcy, the company essentially bought the union off with increased benefits and skipped three years of pension contributions, allowing liabilities to grow before passing them off to the PBGC.[44]

The structure of multiemployer pensions and the PBGC’s existence as a backstop discourage trustees from making the best decisions for plan participants. Trustees are often pressured to make promises they cannot keep. With a lack of real or near-term consequences, it is no wonder many trustees agree to unfeasible pension promises.

In cases of wrongful or fraudulent activity, courts can hold corporate officers personally liable under current law for the debts of the plans they administer. Congress should extend this liability to unions institutionally and to the trustees that they appoint. Holding unions and employers corporately liable for the plans that they help to administer could go a long way toward ensuring those plans’ long-term sustainability. With the looming threat of potentially losing their own personal assets as a result of reckless, dishonest, or fraudulent activities, pension trustees would no doubt run their plans more conservatively and would hold their ground against unrealistic demands for higher benefits or lower contributions.

The goal of imposing personal liability is not to bankrupt employers and unions, but to ensure they are not willfully or recklessly deceiving or defrauding their employees. That is why officers and executives of corporations and limited liability companies are individually exempt from the liabilities of their business under normal circumstances. However, when those officers or executives engage in wrongful or fraudulent activity or when the businesses creditors (employees and retirees in the case of pensions) suffer an unjust cost, courts can “pierce the corporate veil” and seize the assets of officers and executives.[45]

Unions and employers share equal representation in the management of multiemployer pension plans. Unions should therefore be held equally liable if they engage in wrongful, fraudulent, or reckless management of the plan. Without such liability, union trustees have the incentive to negotiate excessive benefits and to hide the impossibility of such benefits through unrealistic and reckless assumptions.

Consider Eliminating Employers’ Role in Plan Management. Currently, unionized employers must participate in multiemployer pension plans, even if participation ultimately harms the business and its employees. Although employers and employees—through the union—have equal representation in the management of multiemployer pensions, many employers have little to no effective say in the plans to which they must contribute because many plans cover hundreds or even thousands of employers, and not every employer can be represented.

In some situations, employer representatives advocate for terms that harm many employers that they represent. This could occur simply because an employer lacks direct representation, or the employer representatives could intentionally negotiate terms that harm their competitors. Although individual employers can choose to bargain separately with the union, tactics such as “most favored nation” clauses—which prohibit unions from offering better terms to individual employers than to the multiemployer association—effectively prohibit employers from bargaining individually.[46]

Employers should not be forced to participate in pension plans over which they have no control. Contributions to multiemployer pensions have become increasingly burdensome, and withdrawal liabilities are often so high that pension obligations alone can drive companies out of business. The promise of a future pension is a valuable component of employees’ overall compensation, but if faced with a choice between a job without a pension or no job at all, most workers would prefer the job.

Establishing a new structure for multiemployer pensions in which unions alone run pension plans and employers choose whether or not to contribute could offer a long-term solution to the multiemployer pension crisis. Unions would be forced to offer acceptable terms to employers and to adequately fund their plans. If not, employers would not participate. If unions fully fund their plans as would be required for employers to participate, promised benefits would be limited to vested contributions, and employers could choose to withdraw from the plan at any time. Their employees would not accrue any additional benefits, but their vested benefits would be protected. If employees considered pension contributions a fundamental component of their compensation, they could choose to leave a nonparticipating employer and instead work for a participating employer.

If unions could no longer stand behind the financial backing of employers—forcing higher contributions to fund overpromised benefits—they would need to maintain financial solvency to attract participants. Optional enrollment, therefore, would be essential to ensuring unions’ integrity. If employers can choose whether to participate and can withdraw from a plan at-will, unions will be forced to put workers’ interests before their own. The lack of financial backing from employers may justify a requirement that union-run pension plans purchase some level of private insurance protection. Of course, if plans are well-managed and sufficiently funded, such insurance would be relatively inexpensive.

One concern with this approach is irresponsible behavior by union trustees acting alone. Although unions have a fiduciary obligation to their members, in practice they face pressure to put the interests of current union members ahead of future retirees. For example, union representatives made up a majority of the trustees in Detroit’s employee pension plans. For years, union appointees consistently outvoted other trustees to award “bonus” pension checks above and beyond promised benefits. These bonuses contributed significantly to the financial insolvency of the Detroit pension system and ultimately forced pensioners to accept significant cuts in their benefits.[47]

A new, union-run multiemployer pension structure would be a stark change from more than a century of history, but the demise of many multiemployer pensions shows that stark changes may be necessary. Transitioning to a new multiemployer plan would require thoughtful planning and implementation, but conversion to union-run plans with optional employer participation deserves serious consideration.

End Preferential Treatment for Multiemployer Pensions. Multiemployer pensions and the PBGC’s multiemployer program would likely not be in such dire financial positions if they were subject to the same rules and regulations as single-employer plans. Congress should eliminate preferential treatment for multiemployer pensions, including taking away the discretion of plan trustees to use higher interest rates and unconventional mortality rates to justify lower contributions and higher promised benefits.

Additionally, Congress should change the multiemployer rules so that the PBGC takes over insolvent multiemployer plans in the same way it takes over insolvent single-employer plans. Currently, when a multiemployer plan goes bankrupt, the plan continues to function and the trustees continue to be paid by essentially sending bills to PBGC to cover insured payments, and then distributing PBGC payments to pension beneficiaries. Given the often irresponsible and incompetent track record of these insolvent plans, there is little reason to allow them to continue to exist. Doing so simply opens the door to corruption and abuse.

Structure PBGC Like Private Insurance Companies. If the PBGC continues to exist, it needs to be allowed to function more like a private insurance provider. Premiums should reflect the risk being insured. It is entirely unreasonable that some private, multiemployer pension plans pay only $26 per year in premiums when those plans are all but certain to fail and result in annual PBGC benefit payments up to 500 times as large as the premiums.

Although Congress’s recently enacted pension reforms doubled the PBGC’s multiemployer premium from $13 to $26, it still lacks a risk-based premium. Risk-based premiums—such as charging higher car insurance rates for teenage boys than for middle-aged women—are standard practice among private insurers, and a risk-based premium is included in the PBGC’s single-employer program. If all multiemployer plans are forced to purchase PBGC insurance, financially solvent plans should at least be charged lower premiums than those facing insolvency.

However, there are important considerations in setting PBGC premiums. For example, sharp increases in premiums for the most underfunded plans could force those plans into insolvency sooner and ultimately result in greater costs to the PBGC. However, the PBGC is arguably more informed and better equipped to assess the optimal premium structure than Congress.

Devolve the PBGC. In many ways, multiemployer pensions and the PBGC’s multiemployer program are incompatible with the current economy. When multiemployer plans were established, no one foresaw the significant decline in many of the industries that they represent. Consequently, the rules governing multiemployer pensions and the structure of the PBGC’s multiemployer program do not adequately protect workers’ pensions.

The PBGC has incurred significant liabilities, and it should do all it can to fulfill the greatest possible share of those liabilities. Yet ultimately, the PBGC should be devolved to the private sector. The PBGC was established to protect pension beneficiaries from a complete loss of pension benefits if their company goes bankrupt. This does not require a government provider. Rather than mandating that all private pensions participate in a single, government-designated insurance provider, pension plans should be allowed to purchase suitable pension insurance from a provider of their choice.

The PBGC’s structure has failed in multiple ways. The PBGC lacks not only the authority to operate like a private company or at least try to cover its costs, but the incentive to do so. As long as all private pension plans are required to purchase PBGC insurance, it will always be able to shift the costs of reckless plans onto more prudent plans.

The PBGC has little reason to apply risk-based premiums that would shore up pension funding levels. For starters, the PBGC does not need to attract its clients. Pension plans cannot shop around for the best insurance provider. Instead, they must accept whatever policy the PBGC provides and whatever rates it charges. Additionally, the PBGC has no choice in who it insures. Because the PBGC must provide coverage for both solvent and insolvent plans, risk-based premiums could push the most troubled plans closer to insolvency and therefore increase the PBGC’s liabilities. Consequently, the best outcome for the PBGC’s multiemployer program is to effectively allow insolvent pension plans to free ride off the solvent plans. This is not a viable option for the long term.

Consequently, the PBGC should be devolved to the private sector. The PBGC was established to protect pension beneficiaries from a complete loss of pension benefits if their company goes bankrupt. This does not require a government provider. In fact, a government provider has exacerbated the problem by providing fixed-cost insurance and promising insurance that it cannot provide, thereby encouraging riskier actions. Rather than mandating that all private pensions purchase government-run insurance, pension plans should be allowed to purchase suitable insurance from a provider of their choice that will charge premiums commensurate with risk.

The Interim Path. Of course, if all plans were immediately allowed to purchase private insurance, the healthy plans would immediately do so, stripping the PBGC of its assets and leaving all of its liabilities. This would mean a complete loss of pension benefits for millions of workers and retirees.

Therefore, before pension plans can have the option of purchasing non-PBGC insurance, the PBGC first needs to cover as great a share of its liabilities as possible. This will require a balance: workers and retirees of failed pension plans should be spared a complete loss of insured benefits, but workers of existing plans should not be forced to bear the full burden of paying for the PBGC’s unfunded liabilities. Striking the right balance will likely require otherwise unjustified actions, such as allowing plan trustees to reduce benefits and implementing unwarranted contribution and PBGC premium increases for multiemployer plans.

Conclusion

Multiemployer pensions were supposed to provide superior protection against pension losses by pooling employers, but the exact opposite has often been true. Multiemployer pensions have a flawed structure that can lead to a downward death spiral, and special preferences granted through federal regulation have contributed to plan failures. Likewise, the PBGC was established to protect against private pension losses. Instead, it has exacerbated potential losses by promising insurance that it cannot provide.

The impending failure of multiemployer pensions and the PBGC program that insures them could lead to a taxpayer bailout. Policymakers should refuse to take the bailout route because it would put federal taxpayers on the hook for the reckless promises of many union pension plans as well as the federal government’s failure to properly regulate and insure them.

Furthermore, a bailout of the PBGC and private-sector pensions would set a dangerous precedent. Multiemployer pensions and the PBGC are only the beginning. Public-sector pensions are underfunded by trillions of dollars, and Social Security and the Medicare face shortfalls in the tens of trillions of dollars. America cannot afford a pension bailout.

Congress should swiftly enact reforms that bolster the solvency of multiemployer pension plans and maximize the PBGC’s ability to make good on its insured benefits. This ultimately requires turning the role of the PBGC—with its flawed structure and perverse incentives—over to the private sector where risk-based premiums can incentivize adequate pension funding. Neither pension beneficiaries nor federal taxpayers are at fault for the reckless management of union pensions or Congress’s neglect in properly regulating and insuring them, and they should not be left pensionless or penniless as a result.

—Rachel Greszler is Senior Policy Analyst in Economics and Entitlements in the Center for Data Analysis, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation.