The Tennessee Valley Authority (TVA) has had 80 years of independence from the oversight, review, and budgetary control of a more traditional federal agency, as well as from the rigors of operating as a private shareholder-owned utility. Such a lack of effective oversight from either the government or the private sector has resulted in costly decisions, excessive expenses, electric rates that are higher than in all but one of the larger shareholder-owned utilities in the eight states contiguous to Tennessee, and growing liabilities for all U.S. taxpayers. The most effective way to restore efficiency to the TVA system is to sell its assets via a competitive auction and bring it under the rigors of market forces and public utility regulation. In a private-sector environment under strong executive leadership, the assets of the TVA could be worth much more than is implied by its debt-laden balance sheet and costly operations.

A Brief History of the TVA

Legislation to establish the Tennessee Valley Authority was enacted in May 1933, with the U.S. unemployment rate at a record 25 percent, and millions of citizens jobless, homeless, and standing in bread lines for their daily nourishment. A key piece in President Franklin Roosevelt’s “New Deal” vision, the TVA was designed as a large, multipurpose, powerful, well-funded government organization to revive the economically devastated Tennessee River Valley. The TVA was established to provide navigation, flood control, power generation, reforestation, and economic development in a region encompassing nine states, but principally in Tennessee, Alabama, Mississippi, and Kentucky. The TVA was to operate (and still does) through physical, economic, and social development and provide low-cost hydropower in the region to outcompete shareholder-owned electric utilities. The TVA was strongly opposed by entities such as the Alabama Power Company, which believed that competitive markets, private-sector businesses, and some federal dams would be a more effective way to deal with the Tennessee River watershed problems. There were a number of other legislative efforts to put in place TVA-like corporations around the United States, but none was enacted.[1]

Governed and operating like a private company, the TVA is overseen by a board of directors vested with the authority to hire and fire employees and executives (who are not subject to Civil Service laws), make investment decisions, prepare and execute the budget, and oversee all facets of TVA operations. However, because it is part of the federal government, the board is nominated by the President and confirmed by the Senate, and its budget approved by Congress. Further, its employees are prohibited from striking, and the TVA is exempt from state and federal antitrust laws, environmental laws (at least at the time of its founding[2]), Security and Exchange Act regulation except for reporting, state and local electric rate setting, and meaningful oversight by either the President or Congress.

Early Legal Challenges. TVA electric power was deeply subsidized by taxpayers, providing the TVA with a significant unfair competitive advantage. The TVA was selling its hydropower-generated electricity for as much as 60 percent below the price of shareholder-owned utilities in the area. Nonsubsidized, federal-income-tax-paying, shareholder-owned companies could not compete.[3]

A suit was brought before the Supreme Court in 1934 by the Alabama Power Company, charging that the federal government had no constitutional authority to sell electricity from the Wilson Dam as a primary function or for the entire TVA program. However, the Supreme Court ruled that the TVA could dispose of the power from the dam.

Within a few months, 18 utilities filed another lawsuit that the TVA, under the guise of navigation, flood control, and national defense, was entering into a huge program of power production. Again the Supreme Court affirmed the TVA statute, ruling only on the basis of standing to sue. This was the last serious constitutional challenge faced by the TVA.[4]

In addition to the TVA, Congress and President Roosevelt established the Rural Electrification Administration (REA) in 1935 to provide low-interest Treasury loans to electric cooperatives in order to provide central power station electric service in rural areas.[5] In 1936, Congress established the REA by statute and later changed its name to the Rural Utilities Service (RUS).

Rapid Growth, Environmental Violations, and Growing Debt. By 1959, the TVA had achieved its original statutory objective of completing a 650-mile navigation channel the length of the Tennessee River, along with appropriations from Congress to construct dams, build roads, and complete reforestation and reclamation work. Also that year, the Eisenhower Administration reached a compromise after years of feuding between the TVA and the surrounding privately owned electric utilities. The TVA agreed to a “statutory fence” around its service area beyond which it could not sell power, in return for the authority to issue bonds with an initial debt ceiling of $750 million. As part of this deal, the TVA also agreed to repay $1 billion of the nearly $1.3 billion that had been appropriated from 1933 to 1959 for dam building and steam power plants. The repayment of $1 billion was to be done over 54 years at about $20 million per year with an interest rate equal to the average interest rate on all Treasury debt; $258.3 million (20.5 percent) was not scheduled for repayment and instead was treated as a taxpayer’s equity contribution to the TVA.[6] Interest was not charged to the TVA for any of the appropriations from 1933 to 1959. By 1979, the TVA had pushed for and achieved a number of increases to the statutory debt ceiling reaching $30 billion—40 times the original amount authorized in 1959.

While in the 1950s the TVA had condemned private lands to build a large coal-fired power plant portfolio, in the 1960s and 1970s, the TVA attempted to meet projected electric demand growth with an ambitious nuclear program. By the early 1980s, five nuclear plants of 17 planned nuclear reactors were completed and operational. But as the TVA’s electricity prices increased due to higher costs, the Authority experienced lower demand growth. The TVA’s actual electricity demand growth in the 1970s averaged just 2.5 percent.[7]

The 1970s also brought an avalanche of nuclear safety, air and water, and endangered fish and wildlife legislation, which changed everything for electric utilities, but especially for the TVA. The TVA had grown accustomed to being independent and doing what it deemed best as determined by the board and its executive management team.

The rapid buildup in environmental and nuclear safety regulation, high inflation, rapidly increasing interest rates, and low economic growth was caused primarily by the tripling of world oil prices. Worse yet, a serious fire broke out in 1975 at the TVA’s Brown’s Ferry nuclear reactor site, and the TVA’s coal plants had become the largest sulfur dioxide polluter in the U.S., emitting over 2 million tons annually. The combination of all these events hit the TVA hard, with a final blow being that the Nuclear Regulatory Commission (NRC) forced it to shut down its five operating nuclear reactors, and then was required to retrofit many of its coal-fired power plants after losing a lawsuit with the Environmental Protection Agency.[8]

By the late 1980s, TVA electric rates had increased five times. It received 12 fines administered by the NRC, and the management of its nuclear program was accused of mismanagement and cover-ups and was thereby under investigation by Congress. The TVA had started construction of 15 nuclear power plant units, but ended up with six completed units totaling 7,200 megawatts of rated capacity. The ambitious nuclear program and coal retrofits burdened the TVA with more than $27 billion in debt.

In 1988 alone, under Chairman Marvin Runyon’s leadership, TVA employment was reduced by one-third—11,000 employees—as the TVA’s long-standing policy of using its own employees for both operations and construction had resulted in record numbers of employees before the reduction. Under Runyon, there was a major emphasis on streamlining and reducing costs to avoid rate increases.[9] After rising sharply for well over a decade, electric rates stabilized by the late 1980s, when the TVA began the process of digging out from under the avalanche of debt that had risen to over $27 billion. While the TVA was now subject to the same nuclear and environmental laws that other utilities had been under since 1970, it continues to be exempt from many others, such as federal antitrust law and certain electric-rate reviews by the Federal Energy Regulatory Commission (FERC).[10]

The same debt, the same environmental problems, and the same poor decision making continue to plague the TVA today. Three different boards approved debt-reduction plans between 1997 and 2007, each with a goal of reducing debt from the record $27 billion level to below $15 billion—none achieved the goal, although minor debt reduction was achieved. In a few years, it became clear that the TVA would not achieve much debt reduction.[11] Nonetheless, a new plan was adopted as part of the President’s fiscal year 2015 budget.

This dysfunction led to a statutory change in 2006, increasing the original three-member full-time board to a nine-member part-time board. The rationale appeared to be to align the TVA more closely with privately owned shareholder companies, even though the TVA had far less outside scrutiny than shareholder-owned utilities. Between 2007 and 2012, however, the TVA restarted its nuclear power plant construction program by proposing to complete the Watts Bar Nuclear Plant Unit 2[12] at an estimated cost of $2.5 billion, with a planned completion date of 2012 (now estimated to cost between $4 billion and $4.5 billion, with planned completion in 2015); approving construction of Bellfonte Unit 1 (after Watts Bar Unit 2’s fuel loading is complete); approving a proposal for two new Advanced Passive 1000 nuclear reactors; and signing a letter of intent to perform studies on small modular reactors. The TVA’s new board seems committed to leading the way for nuclear power.[13]

Because of the TVA’s major expenditures for its coal-fired power plants, the board imposed an environmental fee in addition to its wholesale-power rate to generate the billions in revenues needed to pay for the environmental spending.

By the end of 2012, the TVA’s average retail price per kilowatt hour (kwh) for nonprofit-distributor electric rates, which include the TVA’s wholesale power rate, had increased by 77.2 percent in 18 years, the highest percent increase in any of the eight states surrounding Tennessee. The state of Tennessee’s average retail price per kwh ranked second highest, with Georgia being the highest. The TVA’s original premise of providing low-cost electricity has vanished.

TVA: Federal Subsidies, Market Advantages

TVA management claims that, since the TVA no longer receives direct appropriations, it is not subsidized by the federal government. In fact, the TVA is deeply subsidized by the federal government and is still exempt from numerous federal laws and regulations that reduce its costs compared to shareholder-owned utilities that are subject to the laws and regulations.

Capital Subsidies. Part of the federal taxpayer’s original investment in the TVA from 1933 to 1959 has not been paid back, nor the interest thereon, and is not scheduled for payback. In 1959, the TVA owed the Treasury $1,258.3 billion for appropriations from 1933 to 1959 for principal. There was no interest charged for the appropriations for the 26 years during which the funds were appropriated and used. Had a simple interest rate been charged at long-term Treasury interest rates of 2 percent annually (about the average rate for this period) the interest is estimated at $314.4 million through 1959. From 1960 through 2013, assuming an average interest rate of 4 percent on longer-term treasuries, the interest on the interest amount becomes $2.5 billion. Since interest was not charged, the estimated interest accrued should be recognized as federal taxpayer equity in the TVA.

In 1959, the $1 billion scheduled for repayment at about $20 million per year over 54 years was at the average interest rate on all outstanding Treasury debt over the period. The average interest rate is a subsidized rate, since the TVA received a long-term loan with a 27-year average term, and should have been paying interest at the 27-year-term Treasury bond interest rate. The approximate interest subsidy is estimated at $0.5 billion.

Further, the $258.3 million that was not scheduled for repayment constitutes taxpayer equity in the TVA. The TVA paid nothing (either in dividends or interest) on this investment through 2013—a period of 54 years. At an interest rate of just 4 percent annually from 1959 forward, the investment would be an estimated $2.1 billion in 2013. And yet, the TVA has $23.6 billion in long-term debt.

Thus, taxpayer equity subsidies provided to the TVA from 1933 through 1959 were worth an estimated total of $5.1 billion at the end of 2013.

Seventy-one percent of the 56 regulated utilities have a BBB debt rating (the lowest investment grade) even though their balance sheets are stronger financially than the TVA’s.[14] In comparison, TVA debt is AAA-rated and historically traded at about 30 to 40 basis points, one-third of 1 percent higher than the U.S. Treasury rate for comparable-term maturities. If the TVA were a private utility, based on its financial condition and performance its debt could be rated as BBB and it would pay interest rates about 65 basis points more than comparable-term U.S. Treasuries. This higher rate of about two-thirds of 1 percent on $23.6 billion in long-term TVA debt would increase annual interest costs by $158 million—nearly $800 million or more over five years.

But, in addition, shareholder-owned regulated utilities must earn an adequate annual return on their balance sheet equity, which is a substantial part of their capital structure. State public utility commissions for electric-rate cases approve a specific rate of return on equity. In 2012, the average for the 56 regulated utilities was about 10 percent.[15] This level is necessary for a utility to attract capital, pay shareholder dividends, and maintain an adequate financial reserve. In 2012, the average payout for dividends of total net income was 59.4 percent by regulated utilities. The average dividend paid by regulated shareholder-owned utilities was 4.3 percent.[16] The TVA pays nothing for its equity capital, just as it does not pay dividends. At only 4 percent interest on the TVA’s capital, the annual cost would be $224 million—$1.2 billion over five years.

The TVA is able to borrow all its debt at a cost well below that of shareholder utilities, which has encouraged the TVA to borrow heavily and has resulted in a debt-heavy balance sheet. Further, the TVA pays nothing for its equity. For the TVA to meet a comparable level of equity of 43.2 percent of a shareholder-owned utility, $12.7 billion would be required.

In sum, the TVA is able to borrow to meet all its capital needs at low interest rates paid on its outstanding debt while it pays nothing for its equity. It borrows at rates close to the low U.S. Treasury interest rates, because it is a wholly owned government corporation with an implicit debt repayment guarantee, and because the TVA has electric rate-setting authority. Lenders apparently believe that if the TVA encounters debt repayment difficulties, either the federal government or the board or both will make sure the debt is repaid. The capital subsidies provided to the TVA amount to very deep subsidies. To claim that the TVA has not been subsidized because it receives no direct appropriations is simply misleading. The capital subsidies are just a part of the special privileges that the TVA enjoys.

Tax Privileges and Regulatory Relief. The TVA is not subject to federal, state, or local income taxes or other taxes. This is a major benefit, as the federal corporate income tax rate is 35 percent of annual taxable income. The TVA does make so-called tax equivalent payments to the states of 5 percent of its annual revenues. But the 5 percent is much lower than the average taxes paid by shareholder-owned utilities. Further, private TVA bondholders do not pay state income tax on the interest on TVA bonds, lowering the interest rate that the TVA pays on the bonds.

Special Loan Forgiveness. Certain TVA bonds were originally sold to the Federal Financing Bank (FFB) at an interest rate of one-eighth of 1 percent above the cost of new long-term Treasury bonds. This occurred from the late 1970s through 1998, when the TVA was made to borrow from private debt markets. In 1998, the TVA owed the FFB $3.2 billion in long-term loans, with the interest rate ranging from 8.5 percent to 11.7 percent. The FFB loan agreement required the borrower, in the event of prepayment, to pay the present value of the loans based on the interest rate on the loan agreements. As interest rates declined in the 1990s, the TVA wanted to prepay all of its high-interest-rate FFB loans and refinance at lower rates. The amount of the premium due at time of prepayment as estimated by the FFB was $1.2 billion. In 1998, the TVA convinced Congress to pass a law forgiving payment of the required $1.2 billion premium.[17] This amounted to $120 million a year in interest savings for the TVA—yet another federal subsidy.[18]

Regulatory Relief. Among the many instances of reduced red tape, the TVA enjoys exemption from FERC authority to order another utility to transmit electric power into the TVA’s service area, and does not need to provide transmission services to generators or marketers hoping to transmit power into its service territory.

Of the TVA’s 155 distributors, 107 are municipals and are publicly owned by the cities, towns, or counties they serve; 48 are electric cooperatives that are privately owned nonprofits owned by their electric rate payers. All of the municipals and the cooperatives (except those with for-profit businesses other than electric distribution) distributors are exempt from paying federal income tax. The publicly owned utilities do not have earned income and do not pay dividends. They borrow funds by using municipal bonds whose interest is largely exempt from federal income tax. The cooperatives have all borrowed from the RUS in the Department of Agriculture at the recent annual rate of $7 billion at one-eighth of 1 percent above comparable-term U.S. Treasury bond interest rates. Since 1935, RUS, and its predecessor REA, administrative expenses have been paid by the U.S. taxpayers. Also, the losses on loans made to electric cooperatives incurred by the RUS especially in the 1980s and 1990s estimated at more than $10 billion, and any that occurred thereafter, have been paid or will be paid by U.S. taxpayers.

Shareholder-owned utilities do not receive any of the preceding exemptions or benefits. It is difficult to estimate the value of all these subsidies but they total at least 10 percent to 15 percent of the TVA’s wholesale power rate. An in-depth 1995 study by Putnam, Hayes, and Bartlett concluded that the TVA subsidies were worth 23.1 percent of the power rate.[19] In other words, everything else being equal, the TVA should be able to sell power for 10 percent to 15 percent less than shareholder utilities—but the TVA and its distributor rates, on an average revenue-per-kwh basis, are higher for just Tennessee than all but one of the eight states that surround it.

Who paid for the TVA? For the past 80 years, end users of TVA electricity have paid twice for the TVA and repayment of some of the 1933–1959 appropriations on interest and privately held debt—once as customers, and once as taxpayers. In return, they receive electricity, the benefits of TVA employment, economic development and related jobs, watershed (river and reservoirs) benefits of flood control, low-cost Tennessee River transportation of goods, and water-related recreation.

Federal taxpayers living outside the TVA service area have not been repaid for their original or current ongoing investments in TVA power programs. Nor do they receive the economic benefits of those living in the TVA service area.

Is the TVA Really Providing Low-Cost Power?

A key issue for policymakers today is whether the TVA continues to meet its original goal of providing low-cost electricity to consumers and to promote economic growth in its service area. The TVA serves nearly 100 percent of Tennessee’s electricity demand. Its distributors are either publicly owned municipals or nonprofit cooperatives. Comparing Tennessee’s 2012 average revenue per kwh[20] for all types of consumers (residential, commercial, industrial) to those for surrounding states largely served by shareholder-owned utilities provides accurate information on whether the TVA and its distributors are low-priced electricity providers. The shareholder utilities serving these states are regulated integrated electric utilities providing the generation, transmission, and retail distribution of electricity.

Despite the TVA’s exemptions from federal statutes, and its many federal subsidies whose value is conservatively estimated at 10 percent to 15 percent of the TVA’s average wholesale power price, the average retail price (revenue) per kwh for Tennessee is higher than all but one (Georgia) of the other eight contiguous state shareholder-owned utility rates. Some might argue that the TVA has a large number of smaller distributors that have higher overhead costs than larger-scale shareholder-owned utilities. But if one compares the TVA’s largest very-high-density municipals that serve Memphis, Knoxville, Nashville, and Chattanooga to the larger shareholder utilities in the eight other states, the TVA still has the highest rate. (See Table 2.) Without the TVA’s major cost advantages, it would be by far the highest-cost provider in the region.

Instead, the TVA’s average has increased by 77.2 percent for Tennessee, the highest rate of increase for the eight states surrounding Tennessee.[21] In real-price terms, Tennessee’s average revenue per kwh increased by 35.5 percent in just 18 years, whereas shareholder-owned utilities decreased in real terms by 21 percent. Further, a review of the TVA’s average wholesale revenue per kwh sold from 1999 to 2012 reveals an increase of 60.5 percent. Chart 1 shows the average revenue per kwh sold by the TVA for selected years.

The TVA and its distributors have gone from the lowest-cost providers as recently as 1994, to one of the highest-cost providers in the nine southern states. Considering that the TVA is deeply subsidized, and its distributors are deeply subsidized, one can conclude that compared to shareholder-owned utilities the TVA and its distributors have become highly inefficient.

A further analysis was conducted for Alabama, Kentucky, and Mississippi, where the TVA provides significant electric service through its distributors. The results are the same: The TVA and its distributors have the highest revenue per kwh and, in two of the three states, the difference is substantial.

These comparisons show how poorly deeply subsidized public power is competing with shareholder utilities after 80 years. A very important question is: Why? The reasons are:

- Regulated shareholder-owned utilities are under state public-utility-rate regulation and must justify their rate increases to well-informed public utilities commissions and their professional staff; the TVA is not, and answers only to a part-time board.

- Regulated shareholder-owned utilities rely on private debt markets for their capital, and are subject to bond purchasers and bond holders as well as credit-rating agency scrutiny and oversight. The TVA is not, since bond raters and bond holders largely rely on the TVA’s status as a wholly owned federal corporation as a guarantee that their debt will be repaid.

- Shareholder-owned utilities rely on investors to buy and hold their stocks in very competitive world-capital markets. They must pay attractive dividends and maintain earnings growth and profitability to assure private capital is there when and as needed. Investors intensely scrutinize their finances, plans, costs, earnings, regulatory filings, and decisions. The TVA relies on its equity from federal taxpayers on a continuing basis, pays no dividends, has not repaid taxpayers’ original investment, nor is there any serious continuing outside scrutiny or oversight of the TVA either by the executive branch or Congress.

- Shareholder-owned utilities appear to be subject to more competition for electric load from other utilities.

- Finally, the TVA relies on 155, mostly small, distributors that it set up, each with its own employees, overhead, and costs. The combination of the TVA’s and its distributors’ overhead costs may be greater than the costs of a large integrated shareholder-owned utility.

The combination of effective state-rate regulation and the discipline of private credit and capital markets forces shareholder utilities to be more efficient and effective.

Has the TVA Delivered Superior Economic Achievement for Tennessee?

One of the original goals of the TVA was to improve the economic well-being of the populace in its service area. Eighty years later, the TVA service area and states around the area are much better off economically—but so are all the other surrounding states in the Southeast. Unemployment is far less than the 25 percent rate in 1933, and per capita income and wealth have improved tremendously. Only in-depth economic study would provide a more definitive answer to this question, so summarized in Table 3 is the per capita income data for the nine states, which provides some useful context. It would, for example, be difficult to conclude that Tennessee outperforms the surrounding states.

Virginia and Arkansas are the only states in the group of nine that improved their per capita income rank between 1994 and 2012. For Virginia, this most likely occurred because of its concentration of federal workers and contractors. Two states, Kentucky and Mississippi, maintained their ranking, while five states, including Tennessee, declined in rank. Per capita income over the 18-year period increased substantially for all nine states, ranging from 76 percent for Georgia to 100.3 percent for Mississippi. Tennessee clearly is one of the better off states, ranking ahead of all but Virginia and Missouri with the third-highest per capita income in 2012. But its rank has slipped from 32 to 34 and its per capita income grew at a lower rate—85.8 percent—than the national average of 91.5 percent. Also, Tennessee, North Carolina, and Georgia have nearly the same per capita income. Further, a detailed, objective evaluation of the TVA and its programs by William Chandler in 1983 concluded that the TVA had no more success with economic development than the surrounding states, which have relied largely on the private sector.[22]

Why the Sun Should Set on the TVA

It is impossible to argue or claim that the TVA’s job is not completed. The economy has recovered, the citizens of Tennessee have a decent standard of living, the navigation waterway is built if only used lightly, electricity is available throughout the service area, and the TVA and its distributors are the second-most-expensive electric-service providers for the nine states in the Southeast—exactly the opposite of the TVA’s most fundamental goal of providing low-cost electric power.

The TVA experiment may have achieved some success in its early years, but at least the past 40 years have been wrought with mistakes, costly accidents, growing costs, debt, and inefficiency. The TVA simply does not have the rigorous oversight that shareholder-owned utilities are subjected to on a daily basis. The discipline of the marketplace is what has made the shareholder utilities serving the area much more efficient, effective, and better prepared to deal with a changing electric industry—one where there may be very little demand for growth in the future, as well as increasing environmental regulation.

The TVA is subjected to little scrutiny. Its part-time board appears to be no match for the TVA management hierarchy and entrenched bureaucratic interests. The TVA is protected by certain Members of Congress, and there is little effective congressional or executive oversight of its operations, plans, or performance. This independence—which the architects of the TVA set forth in its original statute—over the long term has led to an inefficient and ineffective TVA. U.S. taxpayers should also be concerned about the TVA’s mounting debt, its informal quest for an increase to its $30 billion statutory debt ceiling, large unfunded pension costs, and operational inefficiencies. All pose a future debt-repayment risk. Instead of receiving a cash dividend for their billions in subsidy investments, taxpayers could end up with a bailout bill. The time has come to declare that the TVA’s job is done—and sell the TVA.

One would think that after three major debt-reduction plans from 1997 to 2007, sharp increases to the TVA’s electric power rates, and a major decline in long-term interest rates starting in the 1980s, the TVA would have reduced its $27 billion in debt from the late 1990s. It has not. The TVA’s total debt has flat-lined at the $25 billion to $26 billion level and could increase from there if its board-approved capital-spending plans are implemented. That is why the fourth, recently adopted TVA debt-reduction plan needs to be viewed with great skepticism. In 2013, the TVA had nearly $11 billion in annual revenues, a net profit of $271 million, total assets of $46.1 billion, total debt of $26.1 billion, total liabilities of $40.5 billion, and proprietary capital of $5.6 billion. Only the Southern Company and Duke Energy in the Southeastern U. S. have significantly more electric-generating capacity than the TVA.

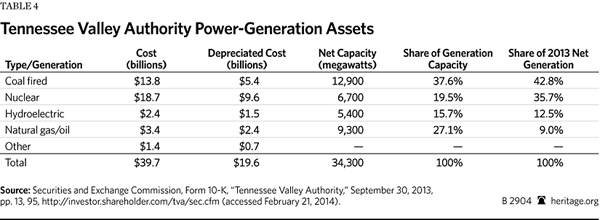

The cost of the generation assets was $39.7 billion, and the depreciated book value, including write-offs, is $19.6 billion. Nuclear power accounts for 49.0 percent of the depreciated value, while providing only 35.7 percent of the power.[23] The market value of the assets is not known, but their location is favorable and being connected to the TVA’s 16,000-plus miles of wholesale transmission system (cost of $6.3 billion and a depreciated book value of $3.7 billion) is a plus. In a private marketplace it is difficult to estimate their market value.

The TVA’s total electric-power sales in 2013 were at the same level as in 2002, at about 160.1 million kwh. The TVA’s highest sales level was in 2007, reaching 176.3 million kwh. One reason for the lack of power-sales growth is the sluggish economy. Another is that the TVA’s wholesale power rate has increased by 58.5 percent since 2002. The TVA continues to make major investments in its nuclear-power-generation plants to achieve the board-approved goal of 40 percent from nuclear energy as a percentage of all generation. For the South Atlantic region in 2012, according to data from the Edison Electric Institute , nuclear energy accounted for 25 percent of the power generated, while gas accounted for 35 percent (about four times) more than for the TVA.[24]

From 2007 to 2013, the TVA has invested $13 billion in generation and transmission assets, adding a net debt of over $4 billion. The TVA plans to continue its nuclear investment, completing the Watts Bar Unit 2 (with updated first-generation technology) originally estimated to cost $2.5 billion and to be completed by 2012, but now is estimated to cost $4 billion to $4.5 billion with a planned completion date of December 2015, assuming no further cost overruns. In addition, the Bellefonte Unit 1 cost estimate for completion is in the range of $7.5 billion to $8.7 billion, with a final cost estimate to be completed in 2014. Work has been slowed on this unit but it is being preserved for future completion. Again it is using updated first-generation nuclear technology. By way of comparison, the Southern Company and its partners are completing two advanced nuclear technology power plants with additional safety features at an estimated cost very close to that of the Bellefonte unit. In addition to completing Watts Bar and the Bellefonte units, the TVA is evaluating a site and performing studies for small modular nuclear reactors. The concept, yet to be designed or proven at any commercial level, is to manufacture small reactors of 150 megawatts to 200 megawatts in size, then ship them to sites where they would be placed in operation. How much the TVA will spend on this technology and whether it will be commercially successful is not known.

In 2013, the TVA had an adequate reserve-generating capacity margin. An outside observer might conclude that it is time to declare a moratorium on adding any more major new capacity after the Watts Bar Unit 2 is completed until electricity demand growth returns (if it does). Instead, a focus solely on debt reduction and end-use-demand reduction might be preferable to lower power rates. For a utility company with high electricity rates, costs, and debt, now does not seem to be a good time to commit funds to expensive, dated nuclear-generating capacity. Table 5 shows the Energy Information Administration’s latest estimates for the all-in costs for each type of generation, leaving out federal subsidies.

In view of the high cost of nuclear energy in the context of the current regulatory environment, the declining sales revenues in both real and nominal terms, the very high debt level, the likelihood that interest rates will increase, the enormous natural gas reserves, and production in close geographic proximity to the TVA (and, hence, low prices), the TVA has a much lower cost option than nuclear power plants, of which other utilities in the region are taking advantage in a major way. While all of these investments may seem questionable under the current economic regulatory and economic circumstances, these decisions should be made by private entities.

The rapid increase in the TVA’s operating and maintenance expenses raises a basic question about how efficiently and effectively the TVA is being managed. Since 2008, these expenses have increased by nearly 50 percent, while revenues have been stagnant and inflation has amounted to just 7.1 percent.[25] As a percent of sales revenue, these expenses have increased from 22.2 percent of total annual sales revenue to 31.3 percent. This is a whopping 41 percent increase in just five years. The TVA’s board has adopted a cost-reduction program that appears to be too little too late.

Another concern about the TVA’s finances is its employee pension-fund liability, including whether reforms are needed to reduce the very high unfunded liability. As of September 30, 2013, the fund had sufficient assets to pay just 62.6 percent of its future liabilities. The assets are $7.2 billion and the liability is $11.5 billion.[26] Standard & Poor’s 1,500 companies’ pension liabilities ended in 2013 were funded at about 95 percent, again raising a basic question about the TVA’s governance.[27]

The TVA’s Market Value

Certain financial analysts have opined that because of the TVA’s high debt levels and low book equity, it may not be worth much more than its debt if it were sold on the private market. There are a number of important factors that will heavily influence the market value: (1) the economic growth outlook; (2) electric utility industry growth; (3) long-term interest rates; (4) the method of sale and any conditions that may have to be met by purchaser(s); (5) interest rates; (6) availability of capital for a purchase; and (7) excessive expenses that can be pruned away if the asset is placed in a shareholder-owned setting. The TVA’s future market value is not known now, nor will it be known until it is actually sold.

However, there are prior examples that could be followed. In the late 1990s, Congress authorized the sale of Elk Hills, the California Naval Petroleum Reserve. Before holding an auction, the U.S. Energy Department hired a consultant to estimate what the successful bidder would pay for the government’s ownership share. The estimate was a range from $1.8 billion to $2.4 billion. The winning bid was $3.65 billion, about 73 percent higher than the mid-range of the estimate. Until a federal asset or organization is actually sold, the market value is largely unknown. The TVA may be worth far more than its debt if a carefully designed and implemented competitive auction sale method is used. (See “Options for Congress,” below, for details on how this can be accomplished.)

There are market-value indicators that can provide basic information on the value of shareholder-owned electric utilities in the region. Table 6 summarizes basic market-value information on the shareholder-owned utilities that serve the Southeast.

The TVA is not easily compared to shareholder-owned utilities for several reasons. The TVA does not own, but controls via contracts, its retail distributors; whereas shareholder-owned regulated utilities have retail distribution functions. The TVA’s net equity is $5.6 billion, but the TVA’s hydropower, reservoirs, land assets, and taxpayer equity contributions are probably understated because the book value dates back to the 1930s.

Another major factor impacting the TVA’s market value is whether there are any interested buyers with the financial capacity to buy all, or parts, of the TVA. The Edison Electric Institute has tracked mergers and acquisitions in the electric industry dating back to 1998. Since then, a total of $430.3 billion in proposed mergers and acquisitions were announced with 61 of them, totaling $324.3 billion, being successfully completed.[28]

A number of these consolidations were valued in excess of $10 billion, with several reaching into the $30 billion–$45 billion range—clearly in the range of what a TVA sale might realize. The consolidation of utilities in the electric industry has been going on for well over a decade as a way to bolster balance sheets in order to borrow the sums needed for large-scale power plants, and to realize economies of scale to hold down increases in electric rates and for other reasons.

A buyout completed in 2012 involving Duke Energy (the purchaser) and Progress Energy provides some insight into what a utility might be worth in the Southeast. Duke paid a total of $32 billion for Progress Energy. Table 7 shows a comparison of the TVA to Progress Energy.[29]

The Progress Energy buyout price was close to its total-assets book value. On that basis, the TVA could be worth between $30 billion and $40 billion or more. Any asset-sale cash proceeds in excess of TVA debt would have a favorable federal budget impact.

The TVA also has 16,000 miles of wholesale transmission assets centrally located in the Southeast. It also has land assets that include 113 hydroelectric units with a capacity of 5.4 megawatts and a net book value of $1.5 billion. But it has twice the debt of Progress and only about half the equity. A major uncertainty for any auction buyer of the TVA will be the state of Tennessee’s electric-rate-regulation policy, which does not exist but would have to be developed in order for a sale of the TVA to be successful. Tennessee does have a long-established regulator for natural gas rates and other functions.

World capital markets are awash in capital as the U.S., Japan, and other major countries pursue fully accommodating monetary policies. An example of fully accommodating monetary policy is the Federal Reserve policy of buying Treasury bonds and mortgage-backed bonds at the current rate of $55 billion per month. Another is the ballooning of the Federal Reserve balance sheet from less than $1 trillion in 2008 to over $4 trillion today. Yet another is the Japanese government’s policy of buying its own bonds. Investors are aggressively seeking opportunities to earn returns in attractive markets. The U.S. is an attractive market. A possible sale of the TVA packaged with favorable policies via an auction in an improving U.S. economy could produce attractive bids.

Options for Congress

The federal government has sunset a number of federal agencies and agency programs, including the Elk Hills Oil Field, the U.S. Enrichment Corporation, the Consolidated Rail Corporation (CONRAIL), the Synthetic Fuels Corporation, and the Alaskan Power Administration. The most successful of these were Elk Hills and CONRAIL. Both used a competitive-bid auction approach open to qualified private bidders using private capital. Both auctions involved federal entities performing private-sector business that no longer belonged in the federal government—just like the TVA.

The TVA provides vital electric services, flood control, and navigation services to the Southeast. Any transition from a government-owned corporation to shareholder-owned utility or utilities must guarantee uninterrupted continuity of these services throughout a transition period. Service can be maintained, as has been demonstrated by the many mergers and acquisitions among shareholder-owned utilities. Congress should:

- Offer the TVA’s assets in competitive auctions split into two categories. The first category would encompass all electricity-related assets, including the hydroelectric component of the TVA’s dams. The electric-asset category bid package should be offered both as a whole and also in major pieces, such as the generation assets (or groups of generation assets) and wholesale transmission assets. Offering the TVA as a whole gives the current TVA leadership the opportunity to buy the TVA. The approach would be to maximize bids either by selling the whole electricity category to one highest bidder, or separate subcategories to multiple highest bidders if that brings the highest total price. This category sale would be done first, and only private-sector bidders using private capital would be eligible to bid. They would be required to commit to keeping the asset in the private sector and the asset must be operated as a private business enterprise subject to federal, state, and local taxation and all other laws by which shareholder utilities must abide. The second category would include reservoirs, 293,000 acres of land, waterways, 650,000 acres of reservoirs, and locks (for raising and lowering ships and barges between water levels). This category would follow the sale of the TVA’s electricity business and be sold by competitive bid auction. Eligible bidders would include private companies, states, local governments, and nonprofits as long as no federal funds, credit, or assistance are used.

- Ensure that existing TVA contracts are honored and that existing TVA bondholders would be paid the present value on their bonds, consistent with the interest rate and term remaining for the bonds.

- Retain the Army Corps of Engineers for its current role of flood control and waterway management. The new, nonfederal owners would be expected to work with the Corps as appropriate.

- Require all bidders to have the necessary credentials, financial qualifications, and managerial competence to control and operate the assets on which they are bidding. For the TVA’s electricity assets, the winning bidder(s) must place the assets in the private sector and the asset must be operated as a private business enterprise subject to federal, state, and local taxation and all other laws by which shareholder utilities must abide.

The Auction. The auction would start with the public release of a bidder’s package that includes an accurate and detailed description (prospectus) of the assets to be auctioned; a detailed description of the auction process and deadlines; the required content of each bidder’s bid; a detailed description of what and how a prospective bidder must pre-qualify in order to bid, including putting up an adequate financial bond and demonstrating financial capability; and other materials necessary to support the auction.

The preparation phase would entail completing the points below. This would be done within the executive branch by a lead agency (Treasury, or the Office of Management and Budget) and other directly impacted agencies (the TVA, the Department of Energy, the Corps of Engineers, and the Bureau of Reclamation) in consultation with other affected agencies, including regulatory agencies (such as the NRC, FERC, SEC, and the Justice Department) and in consultation with Congress and states that are directly impacted. Congress should:

- Define more specifically for which amounts TVA assets will be sold in each sale category;

- Define how continuity of all TVA services will be maintained;

- Define how existing bondholders will be repaid at net present value once the auction is complete and the successful bidder(s) payment are received;

- Provide for the transition of existing employees including the pension fund;

- Define the terms and conditions of the competitive auction;

- Define bidder qualifications, bonding requirements, the application process, and certification requirements;

- Define the key criteria and weighting for each that will be used to evaluate each bid to determine whether it is a qualified bid; and define the criteria used to rank all qualifying bids for selection of the winner(s) by the selection official;

- Define how all existing TVA contracts will be honored;

- Develop market-value estimates for each category of TVA assets to be auctioned;

- Develop federal budget estimates for the sale proceeds;

- Work with FERC and the State of Tennessee to develop an electric-rate-regulation policy for the TVA and its distributors;

- Define the split of any sale cash proceeds that exceed repayment of bond holders and auction expenses;

- Define the split of any remaining auction sale cash proceeds between TVA rate payers and federal taxpayers;

- Define how the TVA’s suppliers will transition to the TVA’s new owners;

- Define the many other tasks that would need to be completed including due diligence; and

- Draft legislation to authorize the sale of TVA assets and the requisite authorities necessary to implement that sale.

The administering agency would set up a team of senior officials, including the selection official, to review and evaluate the bids and conduct meetings with bidders to clarify their bids and to ensure that the bid evaluation team thoroughly understands each bid. The team would then prepare a decision memo to the selection official for decision. Once a decision is made the winner(s) is announced, and detailed agreements prepared and ultimately signed by both organizations. Once all formal agreements are signed, the turnover process would begin and end with a complete turnover of all assets sold once full payments are received and verified.

Conclusion

The United States, the electric industry, and the economy have changed dramatically for the better in the 80 years since the TVA was established. The TVA’s job as designed by Congress has long been completed, and its assets should be auctioned to the highest bidder(s) with any net cash receipts split between U.S. taxpayers and TVA rate payers. The TVA no longer provides low-cost electricity to its consumers, and poses the threat of a bailout to taxpayers as it seeks an increase in its statutory debt ceiling. In the past, the TVA has made some costly mistakes and has never really recovered. Only new owners in a private market setting are capable of making essential changes to the TVA. The TVA has had ample time to reduce debt, reduce operating costs, and reform and fully fund its pension fund. There is little reason to believe that any of these important reforms will be completed by the TVA, as it is easier simply to ask Congress for another increase in the debt ceiling. In today’s U.S. and world economies, the TVA is a flawed, outdated concept. Even though it is deeply subsidized, the TVA cannot compete with shareholder-owned electric utilities that are state-rate regulated, must borrow in the private-sector debt markets, must maintain an investment-grade debt rating, and must pay sufficient dividends to attract investors for the long haul. Rigorous oversight is essential to maintaining competitive electric utilities.

It is high time that the TVA—as well as its customers and U.S. taxpayers—benefit from the rigorous oversight of the private sector.

—Ken G. Glozer is the president of OMB Professionals. A 26-year veteran of the Office of Management and Budget, he has served as a consultant to the energy industry since 1997.