President Obama’s 2015 Budget—A Vision of Big and Expensive Government as a Necessity for American Success

Romina Boccia“Change won’t come from the top, I would say. Change will come from a mobilized grass roots.”[1] This was President Obama in his memoir, Dreams from My Father. Yet the President’s 2015 budget presents a vision of federal government involvement at the core of American success.

President Obama’s budget would funnel more taxpayer dollars toward inappropriate federal spending fraught with special-interest carve-outs: universal preschool programs, a Washington-centric approach to local transportation and infrastructure needs, and manufacturing innovation centers and energy efficiency subsidies to direct “innovation” in America.

With nearly $56 billion in additional discretionary spending on expensive big-government programs, President Obama encourages Congress to violate the discretionary spending caps yet again. Although the President claims that his budget does not violate the spending caps, that claim is largely an exercise in rhetoric: It depends on the definition of spending “cap.” Does President Obama’s budget propose to spend more than the current Budget Control Act caps allow? If the answer is yes, then clearly, the President’s budget would violate the caps.

While President Obama focuses on expanding inappropriate and wasteful domestic federal spending, he is falling short as commander in chief of the armed forces. As Michaela Dodge, Heritage defense and strategic policy analyst, commented:

The President’s defense budget yet again fails to adequately prepare our men and women in uniform to effectively fight current and future wars. The President chose to ignore structural reforms the Pentagon needs, including military health care, retirement, and acquisition system reforms. Thus, the President abrogated his responsibility to provide for the common defense and be a good steward of taxpayers’ dollars.[2]

Obama’s budget would have the following effects in numbers:

- Spending would go from $3.5 trillion in 2013 to nearly $6 trillion in 2024.

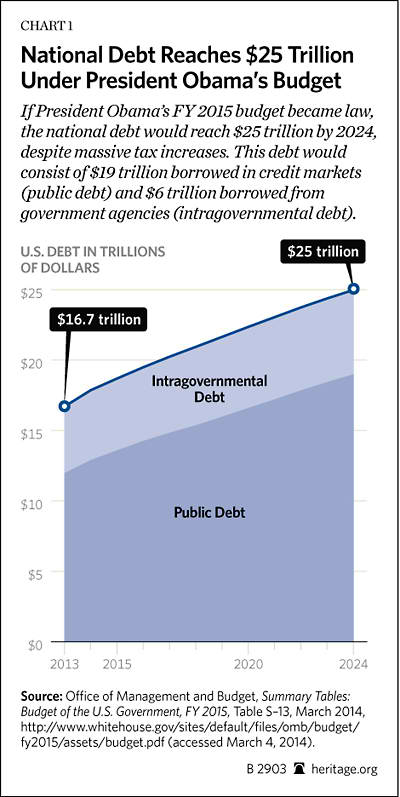

- Debt borrowed in credit markets (public debt) would grow from $12 trillion in 2013 to $19 trillion in 2024.

- The national debt, including debt owed to government agencies, would grow from $17.3 trillion today to $25 trillion in 2024.

- The President’s budget includes about $1 trillion in new spending, partly offset by other spending cuts, and about $1.2 trillion in tax increases.

- Obama claims nearly $2.2 trillion in deficit reduction over the 10-year budget window, but this figure includes massive tax increases and such well-known budget gimmicks as $700 billion in cancelled war-related spending (overseas contingency operations).[3]

Heritage Foundation President Jim DeMint’s book Falling in Love with America Again debuted the same day as the President’s budget—and stands in stark contrast to President Obama’s vision for America. In it, Senator DeMint tells stories of individuals across the country who are continuing to make America great by building their communities from the bottom up.

Budget and Taxes:

Why Obama’s Budget Should Be Dead On Arrival

Steve MoorePresident Obama keeps saying that a government program for every problem does not exist, but his new near-$4 trillion 2015 budget suggests just the opposite. There is more federal money here for everything from changing the planet’s temperature to green energy to transit-systems-to-nowhere to expanded welfare-state programs to federal day care.

This budget busts the budget caps that were already raised just late last year. It calls for spending $56 billion above the caps to be paid for by “loophole closing” tax increases to pry more money from businesses and investors. This is not allowed under the budget rules, but President Obama makes them up as he goes along.

The big increases in domestic programs are camouflaged partly by major reductions in the military budget. Budget savings in recent years have been almost exclusively from reductions in troop levels and military operations in Afghanistan and Iraq. The defense budget is down nearly $100 billion since 2011, and further cuts are on the way this year.

But instead of using those savings to start eliminating an expected half-trillion-dollar deficit, the White House wants to spend $302 billion over four years to finance transportation projects, including a new infrastructure bank. President Obama continues to claim that infrastructure spending has been underfunded, but the budget reality is quite at odds with that assessment.

Americans pay more than $100 billion a year in gas taxes, tolls, and vehicle fees to finance what should be an efficient transportation system. Total federal transportation grants, according to the President’s own budget, exceeded $60 billion last year, a 50 percent increase since 2003, at $40 billion. In 2005, George W. Bush signed the biggest transportation bill in American history—and that was followed by a bonus $48 billion in added transportation funding in the 2009 Obama stimulus bill for all those shovel-ready projects.

Total federal infrastructure spending (not counting defense) rose to $268 billion this year from $180 billion in 2000, almost a 50 percent rise after inflation.

The welfare state has expanded to new heights under President Obama with record enrollments in Medicaid, unemployment insurance, food stamps, and disability insurance. One in seven families is now collecting food stamps. Now the White House is seeking to enroll almost 6 million more Americans in the earned income tax-credit (EITC) program at a cost of $60 billion. The EITC is a cash subsidy to poor working families. President Obama is not suggesting this as a replacement for existing programs, but as an addition to the $1 trillion a year and counting diverted to the welfare state.

It is a budget that should be dead on arrival, and if by chance it still has a heartbeat, sign it up for Obamacare. That will surely be its deserved death sentence.

Another Gargantuan Tax Hike

Curtis S. DubayThe President’s budget calls for at least $1.2 trillion in higher taxes, which is similar to budgets from previous years. These tax hikes would drive tax revenues well above their historical average of 18 percent of gross domestic product (GDP) and well above the revenue levels that the Congressional Budget Office (CBO) anticipates on our current trajectory. In 2024, the Obama budget would push tax receipts to 19.9 percent of GDP, just shy of the all-time high.

All of this extra revenue would be used to grow the already bloated size of the federal government.

The biggest single tax hike (there are scores of them) is a cap on itemized deductions for high-earning families. In addition to being a step away from tax reform, it is also troubling policy because it would apply to municipal bond income, retirement savings, and health insurance.[4]

The President brings back the Buffett Rule again. It is premised on the false notion that high-earners do not pay their fair share.[5] Implementing it would make the tax code an even bigger barrier to economic growth.

Not content with the increase of the death tax in last year’s fiscal cliff deal, President Obama wants to raise it yet again. The right policy is to abolish it permanently because of the deep harm it inflicts on family-run businesses and its negative impact on entrepreneurship.[6]

A bank tax is again included on the long list of tax hikes, as is an increase in taxes for tobacco, small-business owners, unemployment insurance, and carried interest.

Instead of raising taxes, it would be better for the country and the economy if President Obama followed the lead of House Ways and Means Committee Chairman Dave Camp (R–MI) and focused on reforming the tax code so it is less of an albatross around the neck of the economy.

Obama Pays for New Spending Initiatives with Inflated Economic Assumptions

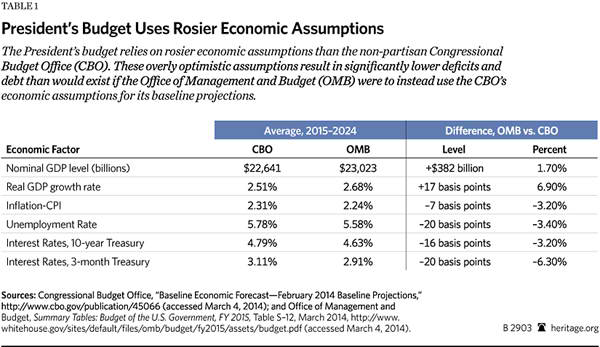

Rachel GreszlerThe President’s budget relies on rosier economic assumptions than the nonpartisan CBO. These overly optimistic assumptions result in significantly lower deficits and debt than would exist if the President’s Office of Management and Budget (OMB) were to use the CBO’s economic assumptions for its baseline projections. In other words, the President pays for some of his new spending initiatives through inflated economic assumptions.

For example, the OMB assumes that real GDP growth is 6.9 percent higher (0.17 percentage points), on average, over the 2015–2024 period than the CBO’s forecast. Similarly, the OMB assumes that the unemployment rate is 3.4 percent lower (0.2 percentage points) than projected by the CBO. Higher economic growth and lower unemployment translate into increased tax revenues and reduced spending.

The OMB also assumes that interest rates on U.S. Treasuries are lower by an average of 3.2 percent (16 basis points) for 10-year Treasuries and by 6.3 percent for three-month Treasuries. Among other things, lower interest rates translate into reduced spending through lower interest payments on the U.S. debt.

While it is true that changes in policies can affect economic growth, the provisions in the President’s budget would result in lower rather than higher economic growth. Increased taxes targeting some of the most productive individuals and businesses would depress economic growth. Redistributing those higher taxes to government-run programs and initiatives, many of which are arguably inefficient and unsuccessful, would push economic growth even further below its potential.

Defense:

President’s Defense Budget Request: Making the U.S. Less Secure

Michaela Dodge and Dakota WoodThe President’s fiscal year (FY) 2015 defense budget request[7] demonstrates the Administration’s willingness to sacrifice America’s leadership while the world grows more dangerous. If the President gets his way, all of the military services will see significant reductions in their ability to protect America’s interests abroad.

The U.S. needs to sustain forces large enough to fight and win two major regional conventional contingencies.[8] Today’s force, as well as the force proposed under the President’s budget request, is too small to meet this criterion.

A strong, engaged, and capable U.S. assures allies and deters adversaries. The U.S. is a force for good abroad and needs to continue to fulfill its role as an international leader. A credible U.S. presence abroad is essential for a wide range of domestic and national security goals, including sustaining open access to trade and travel routes critical to free trade, maintaining the flexibility to respond to emergent crises and prevent their worsening or mitigate their consequences, and protecting American citizens and those of friends and allies when disasters do happen.[9]

The budget reflects a failure of leadership because it sacrifices the security of the United States in order to preserve and even expand unsustainable levels of entitlement spending—the primary cause of U.S. fiscal woes. The budget reduces actions aimed to preserve the nation even while it increases spending in areas that undermine its viability over the long term.

The President’s proposal reduces the defense budget slightly from the current fiscal year’s level while accepting “somewhat increased levels of risk for some missions.” This is disingenuous. His own Defense Secretary, Chuck Hagel, has highlighted the woeful state of defense under this budget, requiring cuts in capacity in order to preserve modernization and readiness.[10]

Recognizing that reforms in military health care, compensation, retirement, and acquisition systems require congressional cooperation, Congress must provide its support and work with the Administration to reform these outdated systems and practices. This is no small task, but it is essential to keep the U.S. safe and prosperous, allies assured, and enemies deterred.

Education:

More Federal Support for Common Core in Budget

Lindsey BurkeWhile advocates, including the Obama Administration, continue to claim that adoption of Common Core national standards and tests is voluntary, this year’s budget owns up to the fact that the White House has driven adoption of Common Core. The President’s budget notes, “Forty-six states are implementing rigorous college- and career-ready academic standards and nearly all will field test performance-based assessments tied to those standards this spring, a movement fueled by previous RTT [Race to the Top] grants.”[11]

The budget refers to the 46 states that have adopted Common Core. The FY 2015 budget makes no bones about the fact that the Administration incentivized the adoption of these national standards through billions in prior federal grants and aims to further incentivize adoption in the budget process.

Even though many of those 46 states are having second thoughts about handing over control of the content taught in local schools to national organizations and Washington bureaucrats, the Administration continues to use the federal Department of Education as a lever to cement their adoption.[12]

President Puts D.C. Opportunity Scholarship Program on the Chopping Block—Again

Brittany CoronaIn an unsurprising yet disappointing move, the President has significantly reduced the funding stream for the D.C. Opportunity Scholarship Program (OSP) again. This time, the President is reducing funding for the OSP to just $3 million (it is currently funded at $20 million), even though demand from parents is the highest it has been since it began in 2004.[13]

The D.C. OSP is one of the most successful school choice programs in the country. More than 91 percent of OSP students graduate from high school, more than 90 percent enroll in a two-year or four-year college, and over 92 percent of current families are satisfied with their children’s scholarships.[14] Furthermore, a 2013 University of Arkansas study showed that the OSP provides a 162 percent return on each taxpayer dollar invested in the program. The D.C. OSP proves the value of school choice.[15]

Despite this evidence, the President has tried to zero-out funding for the program every year. This move is the latest indication of the Administration’s hostility toward school choice (after trying to dampen education choice in Milwaukee and Louisiana).[16] This hurts educational opportunity for children who need it most.

Excluding Student Loan Forgiveness from Taxation: Free Rein for Universities to Hike Tuition

Lindsey BurkeThe President’s budget proposes excluding student loan forgiveness from being taxed. Student loan forgiveness is income and should be treated as such. Student loan forgiveness itself is bad policy, and taxation exclusion continues a worrisome trend of ever-increasing subsidies for higher education, which do nothing to put pressure on universities to lower costs.

If the President really wanted to ease the burden of college costs, he would embrace policies to reform accreditation, such as decoupling federal financing from accreditation to enable states to have nimbler credentialing systems that actually reflect student skills that provide value to employers. Senator Mike Lee (R–UT) has just put forward such a proposal to empower states to allow any entity to credential courses.[17] Credentialing courses and acquired skills, not institutions, will be a far better reflection of the competencies valued by employers, will help bring down college costs, will create a more flexible higher-education experience for students, and will bring down the barriers to entry for innovative start-ups.

Universal Preschool: Expensive, Ineffective, and Duplicative

Lindsey BurkePresident Obama proposes spending billions of dollars to create universal preschool for every four-year-old child in the country. But is it necessary?

The federal government already operates 45 early-learning and child-care programs, along with five tax provisions that subsidize early education and care. Total federal spending on these exceeds $20 billion annually. Forty states and the District of Columbia provide subsidized preschool at the state level.[18]

At current levels of spending by the federal government and states, and with the provision of private preschool and home-based care, “a large majority of families have already made their way to existing providers.”[19] More than three-quarters of four-year-old children are already enrolled in some form of early education and care program.[20]

Moreover, many parents choose not to send their children to preschool centers, electing instead to stay home with their children during their most formative years. Strong majorities of mothers indicate that they prefer to stay home when their children are young (up to age four); 80 percent of mothers who work part-time indicate that is the ideal scenario for them.[21]

Demand for a new large-scale government preschool program is not evident. Proposals to expand government preschool appear to be duplicative of existing efforts at best or a new middle-income and upper-income subsidy at a time when deficits are at an all-time high.

Plus, the verdict is still out on the relative efficacy of preschool. Whether it works “depends on how picky you are,” notes the Brookings Institution’s Russ Whitehurst.[22] The Tennessee Voluntary State Pre-K Program, which has many of the attributes championed by the Obama Administration as “high quality”—it is full-day, teachers are licensed, child–teacher ratios are low—was found in August 2013 to be ineffective at improving child outcomes. Researchers at Vanderbilt University conducted a randomized control trial (a hallmark of scientific rigor) and found that children in the control group (the group not enrolled in the preschool program) performed better on cognitive tasks than children who went through the program.

In recent testimony before the House Education and the Workforce Committee, Whitehurst explains that

the group that experienced the Tennessee Voluntary State Pre-K Program performed less well on cognitive tasks at the end of first grade than the control group, even though 3/4 of the children in the control group had no experience as four-year-olds in a center-based early childhood program of any sort. Similar results were obtained on measures of social/emotional skills.[23]

It is not the first time that government preschool has failed to deliver on proponents’ promises. The half-century-old federal Head Start program has failed enrollees for decades, producing little to no impact on children’s cognitive abilities, their parents’ parenting practices, their socio-emotional well-being, or their health.[24]

New “Race to the Top” Equity and Opportunity Grant

Lindsey BurkeThe President’s budget includes a new $300 million “Race to the Top” Equity and Opportunity grant program “centered on increasing the academic performance of high-need students and closing the achievement gap.”[25] The grants will focus on the nation’s highest-poverty schools because, the Administration claims, “the problem of inequitable opportunities for students in the nation’s highest poverty schools denies those students the quality education needed to compete successfully in the global economy and imposes a substantial economic cost on the nation.”[26]

Liberals tend to look at equitable opportunity as a matter of increased funding for the government’s choices rather than freeing individuals to make their own choices. If improved outcomes are the goal, opportunity through educational choice is a better bet. Throwing hundreds of millions in new federal funds to high-poverty schools has shown little success in improving educational outcomes for low-income students. By contrast, studies have shown that educational choice in low-income communities is getting results.[27] Unfortunately, federal agencies have, of late, worked against the proliferation of opportunity in these exact districts.

The Department of Justice has tried repeatedly to shutter Louisiana’s scholarship program; more than 90 percent of the 5,000 vouchers awarded through the scholarship program went to minority children during the 2012–2013 school year.[28] Low-income and minority students who benefit the most from school choice are being hit particularly hard by the Justice Department’s misguided efforts. Similar tactics have been used by the Administration against Wisconsin’s school choice program, which is the oldest in the nation, and the Administration repeatedly attempts to zero-out funding for the highly successful D.C. Opportunity Scholarship Program.[29]

The White House has said nothing about newly elected New York City Mayor Bill de Blasio’s moves against charter schools. De Blasio is preventing several charter schools—run by the Success Academy charter school network—from opening or expanding, rolling back an offer made to the charter network by his predecessor, Mayor Michael Bloomberg, to co-locate in spaces not being fully used by the traditional public school system. As noted in a profile of the charter schools’ founder Eva Moskowitz in The Wall Street Journal, the stakes are high: “The 6,700 students at her 22 Success Academy Charter Schools are overwhelmingly from poor, minority families and scored in the top 1% in math and top 7% in English on the most recent state test.”[30]

A true race to the top for opportunity would mean, at the very least, not hampering state and local school choice programs with federal threats and obfuscation. Allowing school choice to flourish unencumbered by the executive branch would go a lot farther in increasing education equity than $300 million in federal grant money ever will.

Energy and the Environment:

One Billion Dollar Climate Fund: Wasteful and Duplicative

Nicolas D. LorisThe President’s budget calls for a $1 billion climate fund to collect data, help communities affected by extreme weather events, and invest in new technologies to better prepare the country for more climate extremes. The federal government already spends tens of billions of taxpayer dollars on climate research and “investing” in technologies where the private sector should be the sole driver of investment.

Before throwing another billion dollars at a non-problem, the Administration should look at the data that climatologists have already collected on climate change and extreme weather events. The available climate data simply do not indicate that there have been more frequent and volatile natural disasters.[31] As global greenhouse gas emissions have increased, floods, droughts, hurricanes, and tornadoes have not become more intense. That said, preparedness for hurricanes and other natural disasters can be an effective use of resources, but it should be driven at the local, state, and regional levels.

If President Obama is sincerely worried about the country’s ability to prepare for and respond to natural disasters, he should stop his job-killing and economy-crushing climate regulations that will shrink resources and diminish Americans’ ability to address real environmental problems.[32]

Wasteful Spending, Yes—Managing Nuclear Waste, No

Katie TubbPresident Obama’s FY 2015 budget indicates that managing the nation’s nuclear waste for the long term is not among his priorities.

It comes as no surprise that the President’s budget again provides no new funding for Yucca Mountain and instead lays the ground for his Administration’s own Strategy for Management and Disposal, released in January 2013.[33] The President’s budget proposal directs discretionary spending to fund ongoing expenses, such as salaries and studies, of the new strategy and initiates mandatory spending starting in 2018, the costs of which the Obama Administration expects to be $5.7 billion in the first 10 years. In doing so, the President’s proposal would redirect limited resources and intellectual energy toward a new plan when Congress has not yet abandoned the existing one that is still required by law and affirmed by the courts as the law of the land.

According to the Nuclear Waste Policy Act, as amended, the federal government was to begin collecting nuclear waste by 1998 in a national repository at Yucca Mountain. The Obama Administration unilaterally decided, however, that Yucca Mountain was not a viable option, even though there has yet to be a complete evaluation of the site. The Obama Administration developed a new plan of action, which the U.S. District Court determined was inconsistent with current law and therefore not viable. Regardless of the palatability of the law to the current Administration, the court determined that “unless and until Congress says otherwise or there are no appropriated funds remaining,” the President and his Administration must promptly implement the law, starting with the completion of the licensing process for Yucca Mountain by the Nuclear Regulatory Commission.[34]

Aside from the inappropriateness of working around Congress, the strategy itself lacks merit as a viable plan for nuclear waste management in the United States. According to the strategy, the new plan is to build a pilot interim storage facility, followed by a larger one, and decades from now to have a permanent repository like the one taxpayers have already been paying for in Yucca Mountain.

The government may need an interim site—liability is mounting and costing taxpayers for the government’s failure to collect nuclear waste as promised, a point the President’s budget proposal recognizes. But the nation needs a permanent site. The strategy eliminates incentive to build a permanent repository and perpetuates government inaction for decades at best. In addition, it does not address the fundamental flaws in the current approach: namely, that commercial waste producers have zero responsibility for the waste they produce, responsibility that instead has been given to politicians and bureaucrats. Unsurprisingly, what should be a largely commercial decision has been turned into a political flashpoint.

What Obama’s budget proposal envisions is government “support [for] the nuclear waste management program over the long term.”[35] Certainly there is a role for government in the management of nuclear waste, such as in regulating licensing and safety, but what is needed for a long-term solution are market reforms that make producers responsible for nuclear waste, introduce accurate pricing, and allow competition.[36]

Crop Insurance

Daren BakstPresident Obama’s budget would cut $14 billion over 10 years from the most expensive farm program, crop insurance. Reining in the costs of the crop insurance program is very important. From 2000 to 2006, crop insurance costs averaged $3.1 billion per year. The price tag has now tripled to $9 billion.[37]

Taxpayers subsidize about 62 percent of the premium that a farmer pays for crop insurance. Without appropriate reform, this excessive subsidy could hardly be called a “safety net” for many farmers who receive aid and instead amounts to a massive wealth transfer from taxpayers to farmers, often large agribusinesses. Modest reforms in the crop insurance program, such as reducing the total amount of the premium subsidy that farmers can receive, could save billions of dollars over a 10-year period.[38]

President Obama had a chance to address the crop insurance program in the farm bill that was just passed, yet he still signed the bill into law that actually increased crop-insurance costs. This was after he had proposed cutting about $12 billion in crop insurance costs in his last budget. Listing proposed cuts in the crop insurance program does not mean much unless the President takes action to make his crop insurance reforms a reality.

Health Care:

Health Care Budget: Weak on Reform, High on Cost

Robert E. Moffit, PhD, Nina Owcharenko, and Alyene SengerDespite the current health care spending crisis, President Obama’s FY 2015 budget proposal does little to reform the fiscally unsustainable Medicare and Medicaid programs and maintains the implementation of Obamacare—which has created two additional health care entitlements and adds almost $2 trillion in new entitlement spending by 2024.

Obamacare. The President’s budget requests full funding for the continued implementation of Obamacare yet does not ask Congress to make any legislative changes in the law—thereby asking American taxpayers to continue to fund an unaffordable, unworkable, and unfair law.

Medicaid. By maintaining the costly Medicaid expansion enacted under Obamacare, the President’s budget continues to paper over the fiscal crisis at the state and federal levels with policy changes that reinforce its structural deficiencies rather than making any meaningful reform in the program.

This year, the President’s budget proposes to extend and expand the temporary payment bump that Obamacare enacted for Medicaid primary care physicians. Obamacare raised Medicaid primary care physicians’ payments to Medicare levels for 2013 and 2014. The budget proposal would extend the enhanced rate through the end of 2015 and expand eligibility to mid-level providers, including physician assistants and nurse practitioners, costing an additional $5.4 billion.

The increase in Medicaid physicians’ reimbursement is designed to entice them to participate in the Medicaid program. There is a trend of reduced access for Medicaid beneficiaries. For instance, in 2011, nearly one out of three primary care physicians would not accept new Medicaid patients.[39] However, it remains unclear whether a temporary pay bump would entice physicians to participate in Medicaid. Access is a chronic issue facing Medicaid patients and it is worsened by Obamacare’s Medicaid expansion to millions of additional beneficiaries, which is projected to cost the federal government an estimated $792 billion over 10 years. Instead of continually throwing taxpayer funds at the broken program, it should be structurally reformed to support a more rational and controlled budget while addressing the existing needs of the most vulnerable populations.

Medicare. This year’s presidential budget proposal regarding Medicare mostly mirrors last year’s: far too little in terms of structural reform, a continued reliance and even expansion of the deficiencies of government regulation, and new costs for seniors.

The Medicare program is in dire need of structural reform, currently projected to be $36 trillion short on the funds needed to fulfill its benefit promises over the long term and a Hospital Insurance Trust Fund projected to be exhausted by 2026. Despite the magnitude of these financing challenges, the President’s budget offers meager tweaks to the program.

Here are a few of the notable Medicare policies the Administration is advocating in the FY 2015 budget proposal:

More Government Control in Part D: Drug Rebates

The President’s budget again proposes a mandatory Medicaid-style drug rebate for low-income seniors enrolled in Medicare Part D, for a total savings of about $117 billion over 10 years.

As Heritage explained last year: On paper, drug manufacturers would be forced to pay the rebate—a kind of tax with the consequence of a price control, but like most corporate taxes (and price controls, too), this additional cost will simply be passed on to seniors in the form of higher Part D premiums.[40]

Currently, Part D is a unique defined-contribution program that operates differently from the rest of Medicare. The President’s budget proposal would distort the Part D market and undercut the very market efficiencies that have been so successful at controlling Medicare drug costs. As Heritage has explained before:

Today, pricing is determined entirely by a negotiation between private insurers and drug manufacturers focused on the value of prescription drug products for the patients. With rebates…[d]rug manufacturers would seek to use the rebate requirement to extract higher pricing from the insurers, even as they lobbied the government to base the rebates on the most inflated measure of “average” price they could find.[41]

New Costs for Seniors

Currently, taxpayers finance almost nine of every 10 dollars spent on the Medicare program. Liberals and conservatives agree that there should be greater cost sharing among seniors to reduce taxpayer burdens. The differences are over the design or the structure of these co-payment options. The President’s are minimal and less effective than those proposed by Heritage and other independent analysts. For example:

Medigap Reform. The President’s budget proposes to add a Part B premium surcharge for new enrollees in 2018 who purchase Medigap plans with low cost-sharing requirements, called first-dollar or near-first-dollar coverage. As it states, “The surcharge would be equivalent to approximately 15 percent of the average Medigap premium (about 30 percent of the Part B premium).” This is, in effect, a new premium tax.

The President has correctly identified the problem, but a new tax on seniors is not the right answer. Today’s lower cost sharing does indeed lead to greater use of medical services and, thus, higher Medicare costs. Instead of adding a premium tax as an after-the-fact measure to claw back excessive spending, such excessive spending should be prevented in the first place. This could be done by guaranteeing catastrophic coverage in traditional Medicare, which would reduce or even eliminate reliance on Medigap or supplemental coverage in the first place. Also, Congress should restructure and simplify Medicare’s cost sharing and limit the extent to which Medigap or supplemental insurance could provide first-dollar coverage. Both seniors and current taxpayers would secure substantial premium savings from such a reform.

These changes would transform traditional Medicare from a complex and disjointed multi-part entitlement program into a health plan providing catastrophic coverage, a change that would protect seniors from the endless out-of-pocket costs they face today. Instead of adding another layer of complexity, Congress should guarantee seniors catastrophic protection in combination with simplifying and restructuring Medicare’s complex cost-sharing arrangements by combining Parts A and B with a unified premium, uniform co-insurance, and a single deductible.

Higher Part B Deductible. The President would also add new costs for certain seniors with an increased Part B deductible. The proposal would impose a $25 increase in 2018, 2020, and 2022.

This is a minor tweak to the current system, and the savings would be modest since it would apply only to new beneficiaries beginning in 2018. If Congress wants to secure greater savings, it should apply any cost-sharing rules to all, not just future, seniors entering the program.

New Home Health Co-payments. Home health care is a valuable feature of the Medicare program, but it has become a source of sharply increased Medicare spending. The President’s budget would address this problem by adding a co-payment of $100 per home health episode (applying only for episodes with five or more visits not preceded by a hospital or inpatient post-acute stay), starting in 2018. Like the Part B deductible, it would apply only to new beneficiaries and thus generate only modest savings.

The addition of a modest co-payment to home health visits is sound policy, but a better approach, outlined by Heritage in Saving the American Dream,[42] is to charge a 10 percent co-payment for each home health care episode.

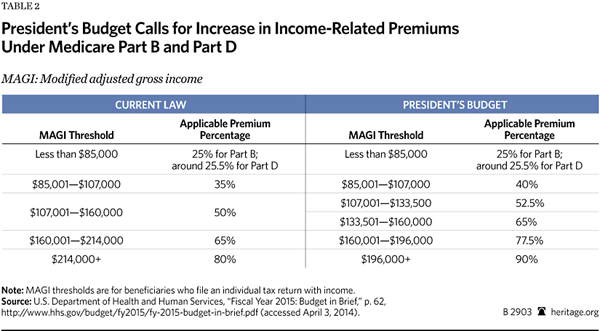

Higher Parts B and D Income-Related Premiums. The budget also proposes increasing Parts B and D premiums for upper-income beneficiaries.

This policy moves in the right direction but does not go far enough. Premiums for all enrollees, as Heritage has proposed in Saving the American Dream, should be gradually increased to cover 35 percent of total premium costs for Parts B and D while taxpayer subsidies for Part B and Part D benefits for wealthy Medicare recipients are further reduced.

Closing the Part D “Donut Hole” Early. Under current law, there is a gap in coverage where seniors pay 100 percent of the total costs of prescription drugs. This is called the “donut hole.” Similar to last year’s budget proposal, this presidential budget proposal would close the congressionally created Part D coverage gap for brand-name drugs by 2016. This is four years sooner than Obamacare closes that gap. Though closing the donut hole would certainly help the few seniors who fall into it, it is also enriching the drug benefit itself and thus making it more expensive, which results in increased Part D premiums for all seniors.[43]

Provider Payment Reductions

In addition to Obamacare’s over $700 billion in Medicare provider payment reductions, the President’s budget includes an additional $229 billion in savings from Medicare providers, which is estimated to extend the life of the Part A trust fund by five years.[44]

Reduced Payment Updates for Post-Acute Care Providers. One of the largest reductions would come from “encouraging provider efficiencies” in post-acute care. The proposal would reduce updates for inpatient rehabilitation facilities, long-term care hospitals, home health agencies, and skilled nursing facilities by adjusting payment updates by almost $98 billion over 10 years.

Reduced Medicare Advantage Reimbursements. Consistent with payment reductions already enacted under Obamacare, the budget proposes almost an additional $35 billion in spending reductions from the program by increasing the minimum Medicare Advantage (MA) coding intensity adjustment and aligning employer group waiver plan payments with average MA plan bids.

Strengthened IPAB. Despite bipartisan opposition to the Independent Payment Advisory Board (IPAB), the President’s budget once again strengthens its power. It states that “this proposal would lower the target rate applicable for 2018 and after from gross domestic product (GDP) per capita growth plus 1 percentage point to GDP per capita growth plus 0.5 percentage points.” This is estimated to allow IPAB to accumulate an additional $13 billion in savings over 10 years.

Repeal of Flawed Physician Payment Formula. Since 2003, Congress has blocked its own Medicare physician-payment-update formula from going into effect because it would impose draconian Medicare payment reductions on physicians and thus threaten patient access to care. Congress recently blocked the Medicare formula for 2014, the 17th time since the formula has been in force. The formula is clearly unworkable, and there is a bipartisan effort to repeal and replace it. The President’s budget also supports a permanent repeal.

A repeal is sound policy, but any permanent repeal must substitute physician payment that expands physician payment options, secure the doctor–patient relationship, and reduce the trend toward greater federal supervision and control of medical practice. Moreover, any repeal of the Medicare payment-update formula would entail additional Medicare spending, which must be offset. Permanent repeal must be accompanied by permanent savings and not add one more dime to the nation’s deficits. As Heritage has recommended, Medicare physician payment should be stabilized (a position the President supports), but Medicare should then be transitioned (over five years or fewer) into a premium support program (which the President does not support)—a structural reform that would allow the market to determine physicians’ payment.

Altogether, the President’s small proposed adjustments to the Medicare program do little to shore up its long-term financial problems, thus jeopardizing access to quality care for the next generation of retirees, worsening the obligation of current and future taxpayers, and compounding the difficulty of future budgetary decisions.

Transportation:

On Transportation, Obama Budget Gets Policies and Funding Wrong

Emily GoffIf history is any guide, President Obama’s FY 2015 budget proposal will get little to no attention in Congress. That is a good thing, especially regarding his proposal for a “unified” (mode-neutral) four-year transportation bill that would be paid for in part with revenue from corporate tax reform.

States do have transportation project priorities that will cost money, but under the Obama budget’s top-down approach, the states’ efforts to meet those priorities would be hampered. President Obama gets both the transportation policies and funding source wrong—again.

First, the President proposes a $302 billion, four-year transportation bill—a 38 percent increase over current annual spending—to replace what is currently a highway bill funded by highway user fees: per-gallon gasoline taxes and related taxes paid by the motorists, bus operators, and truckers who use the system. It would lump together the existing highway and bridge programs with transit systems and railways in a unified transportation bill to be funded with existing federal gas taxes and new corporate tax reform revenue.

As Heritage has previously explained, this plan is dangerous.[45] It would double down on a Washington-centric approach to transportation and fling the door wide open to special interests lobbying for diversions of increasing shares of highway user fees to non-highway, non-bridge programs. Such diversions would come at the expense of needed congestion relief, capacity expansion, and road and bridge repair projects that would benefit the motorists who contribute the user fees in the first place.

Second, President Obama’s idea to pay for this transportation bill with new revenue resulting from corporate tax reform is flawed and irresponsible. Any such revenue should be employed to lower tax rates or make other pro-growth tax policy improvements, not to pay for new spending elsewhere. Further, the states are stepping up, with over 20 states either implementing or considering plans to raise money to pay for their own transportation projects.[46]

Interest on the part of the private sector to finance expensive projects is another piece of the funding pie—and the private sector could certainly be a bigger player if Washington would step out of the way.

There are other flaws in President Obama’s transportation plan, but these two stand out. It is high time that the President refocus his efforts on reducing burdensome federal regulation in transportation and freeing the states to meet their transportation priorities. After all, they know them best.

TIGER Transportation Grant Programs Keep on Roaring

Emily GoffPresident Obama’s FY 2015 budget request calls for $1.25 billion in spending per year for the Transportation Investment Generating Economic Recovery (TIGER) program, a competitive grant program that pays for road, rail, transit, and port projects that are supposedly in the national interest. His proposal would more than double the annual spending on this program, compared to the FY 2014 level of $600 million, which was already inflated by $125 million compared to FY 2013.

Bottom line: It is too much—in fact, any spending is too much—especially for a program that was started under the stimulus bill in the name of boosting the then-anemic economy. President Ronald Reagan’s quip that “a government bureau is the nearest thing to eternal life we’ll ever see on this earth”[47] applies to TIGER grants, because here we are, six rounds of TIGER funding later, and the President wants to make this program permanent.

The first reason the TIGER program should be ended is that it is a federal program that uses federal taxpayer dollars to pay for purely local activities. It duplicates the efforts of state transportation and infrastructure agencies, adding to bureaucracy and wasting money in administrative overhead costs. And it forces states to pander to Washington bureaucrats who determine project criteria, which may not align with states’ priorities and project goals.

Further, the types of projects it funds are local in nature and would be more appropriately funded at the state and local level where any benefits would be enjoyed. In FY 2013, for example, TIGER grant money was spent on projects such as a $16 million, six-mile pedestrian mall in Fresno, California; a $10.4 million “Complete Street Initiative” (read: non-auto-friendly) project in Lee County, Florida; and a $20 million trolley car in Kansas City, Missouri.[48] This is not to say that these activities lack value or are not priorities for states and communities, but they are not federal responsibilities.

Second, the TIGER program is based on the false notion that government spending boosts the economy.[49] Americans saw what an abysmal failure that way of thinking was in the example of the stimulus program—employment levels and the health of the economy in the aggregate did not improve as promised. What the President and his economic advisers are forgetting is that every dollar spent by Washington is one less dollar the private sector would likely spend more efficiently.

Mr. President, it is time to finally end the TIGER grant program.

Welfare, Social Security, and Job Training:

Social Security Reform Abandoned

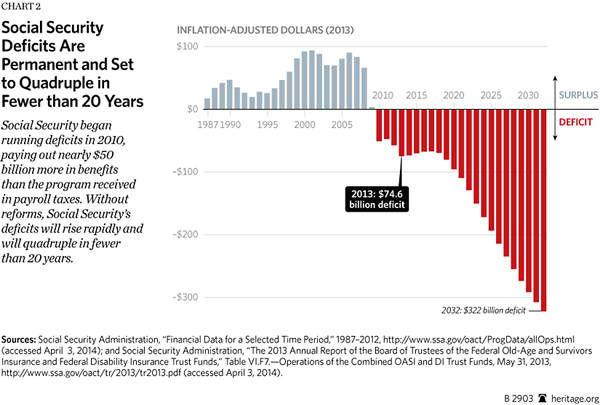

Michael SargentThe President’s budget remains a disappointment for bipartisan advocates of entitlement reform. As signaled by the Administration, the budget drops President Obama’s former proposal to enact the chained consumer price index (CPI) for cost-of-living adjustments (COLA) to Social Security benefits.[50] Adopting the chained CPI for COLAs would still allow benefits to grow over time while tying them to a more accurate measurement of inflation. The measure would save Social Security $130 billion over 10 years without cutting benefits and would continue to ensure that payments are adjusted for price changes.[51]

Abandoning this proposal typifies the fiscal irresponsibility of this Administration. Social Security is already hemorrhaging billions of dollars and is on track to run a $322 billion deficit by 2032 if no reforms are made.

While adopting the chained CPI would not solve Social Security’s fiscal woes, it would be a good step toward preserving benefits for those who need them most in the future. If the President was sincere about “working in a bipartisan way to strengthen the program for future generations,” as he stated in the 2015 budget proposal, he would have included a chained CPI proposal—and taken leadership in working toward comprehensive reform that would ensure the program’s future solvency.

Budget Squanders Money on Federal Job-Training Programs

David B. MuhlhausenIn his FY 2015 budget request, President Obama released his vision of $11.8 billion for federal job-training programs: “The Budget’s approach to skills and training is guided by the principle that all federal investments should be designed to equip the Nation’s workers and job seekers with skills matching the needs of employers looking to hire them into good jobs.”[52] However, the promise of federal job-training programs has never lived up to the rhetoric of politicians.

In my book Do Federal Social Programs Work? I present the evidence from every multi-site experimental evaluation of federal social programs, including various job-training programs, published since 1990.[53] Based on scientifically rigorous evaluations using the “gold standard” of random assignment, these studies consistently find failure. Federal training programs intended to boost the entrepreneurship and self-employment of the unemployed have not worked. Further, federal job-training programs targeting youth and young adults have been found to be extraordinarily ineffective.[54] The simple fact is that when it comes to federal job-training programs, there is a dearth of evidence suggesting that these programs work.

If Congress takes up the President’s plan, then it should insist that these programs undergo scientifically rigorous multi-site evaluations that use random assignment to ensure that taxpayers know whether their hard-earned money is being wasted or not.

Obama’s New Welfare Policy Is Anti-Marriage, Anti-Work

Robert RectorIn his new budget, President Obama proposes to spend $14 trillion in means-tested welfare programs over the next decade. These programs provide cash, food, housing, medical care, and social services to low-income and poor people. Some 75 percent of this spending would come from the federal government; the remaining 25 percent would mainly represent state expenditures in the Medicaid program.

The total spending (which does not include Social Security or Medicare) will amount to over $450,000 for each poor and low-income household in America. But according to President Obama, $14 trillion is not enough. He seeks to expand the welfare state further.

The President is proposing an expanded earned income tax credit for workers without children. Under the policy, young people who have no children to support will receive up to $1,000 in cash every year from the taxpayers. This policy is wasteful; a single person who works full time at the minimum wage already has an income 25 percent above the poverty level. Moreover, these individuals will also receive free health care funded by the taxpayers through Obamacare. Now President Obama wants to give them $1,000 in cash as well.

Contrary to the President’s claims, the new policy will not encourage work. If the President is serious about encouraging work, he should establish work requirements in the existing 80-plus welfare programs already run by the federal government. Able-bodied, non-elderly adults who receive cash, food, housing, or medical care from the taxpayers should be required to work, prepare for work, or at least look for a job as a condition of receiving aid. This policy would increase employment while reducing future welfare costs. But the Obama Administration strongly opposes strengthening workfare in any existing welfare programs.

Moreover, President Obama’s proposed policy is explicitly anti-marriage. Under the policy, a man who fathers a child and neither marries the mother nor supports the child will receive a cash bonus of up to $1,000 per year from the taxpayer. However, the moment the man marries the child’s mother and begins to support the family, the taxpayer subsidy will be eliminated.

When the War on Poverty began, 7 percent of American children were born outside of marriage. Today, the number is 42 percent.[55] The dramatic collapse in marriage has been caused at least in part by the welfare state, which for 50 years has belittled marriage and penalized low-income couples who do marry.

Most welfare programs penalize marriage by substantially reducing benefits whenever couples marry. President Obama’s new policy intensifies that anti-marriage bias. Rarely has the welfare state’s anti-marriage bias been as explicit and obvious as it is in the new Obama policy. An anti-marriage campaign in low-income communities is a good way to lose the war on poverty.