In his January 2014 State of the Union address, President Barack Obama vowed to wield his executive powers when faced with congressional resistance to his legislative agenda, stating: “America does not stand still—and neither will I. So wherever and whenever I can take steps without legislation … that’s what I am going to do.”[1]

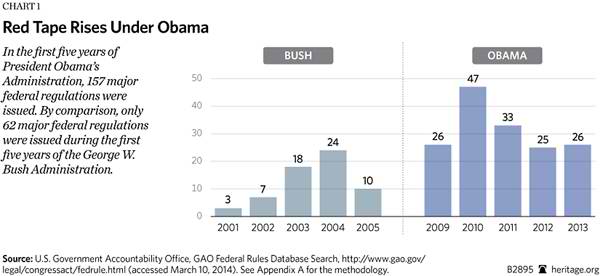

This provocative declaration was startling in its bluntness, but it was hardly a new development. For the past five years, the Obama Administration has aggressively exploited regulation to get its way. Issuing 157 new major rules at a cost to Americans approaching $73 billion annually, the Obama Administration is very likely the most regulatory in history.

Of course, regulatory overreach by the executive branch is only part of the problem. Much of the red tape imposed over the past five years has been driven by vast and vaguely worded legislation, such as the misnamed Patient Protection and Affordable Care Act (Obamacare) and the Dodd–Frank financial-regulation law, in which Congress granted broad discretion to regulatory agencies. Doing so allows lawmakers to claim credit for “doing something” while evading blame for specific regulations.

The regulatory burden swelled in 2013 with the imposition of 26 new major rules.[2] Although slightly below President Obama’s first-term annual average (33), that was still twice the annual average of his predecessor George W. Bush.

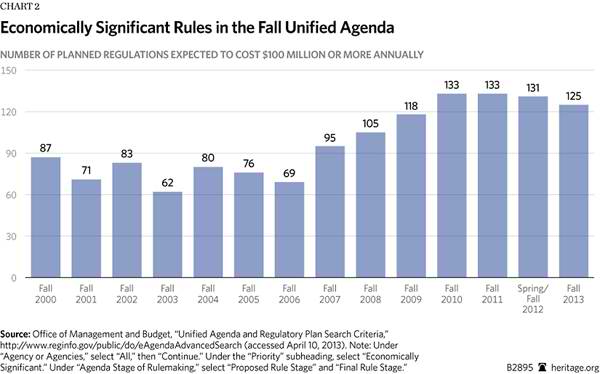

There are many more regulations to come—agencies have identified 125 additional major rules they intend to work on this year, including dozens linked to Dodd–Frank and Obamacare.

Reforms of the regulatory process are critically needed. Among these: congressional approval before any new major regulation takes effect; analyses of the regulatory consequences of all proposed legislation before a vote is held; sunset deadlines in law for all major regulations; and review of independent agencies’ regulations, such as the Securities and Exchange Commission (SEC), in the White House regulatory review process.[3]

Measuring the Red Tape

There is no official accounting of total regulatory costs as there is with federal taxation and spending. Estimates range from hundreds of billions of dollars to nearly $2 trillion each year. However, the number and cost of new regulations can be tracked, and both are growing unabated.

The most comprehensive source of data on new regulations is the Federal Rules Database maintained by the Government Accountability Office (GAO). According to the GAO data, federal regulators issued 2,185 new rules during the 2013 “presidential year” (January 21, 2013, to January 20, 2014).[4] Of these, 77 were classified as “major.”

Forty-six of these major rules were administrative or budgetary in nature, such as Medicare payment rates and hunting limits on migratory birds. A total of 26 were “prescriptive” regulations, which increase burdens on private-sector activity. Altogether, during the first five years of the Obama Administration, 157 such prescriptive rules were issued. This compares to 62 such rules imposed during George W. Bush’s first five years.

Only three of the 2013 rules decreased regulatory burdens, bringing the five-year total to 15. This compares to five such “deregulatory” actions during President Bush’s fifth year and a total of 20 during his first five years.

The cost of the new mandates and restrictions imposed by the Obama Administration now nears $73 billion annually, based on analyses performed by the regulating agencies. Regulators reported new annual costs of $2.8 billion for the 2013 rules. This is lower than the Administration’s first-term annual average of $17.5 billion, but it should be noted that actual costs were quantified for only 10 of the 26 rules issued last year.[5] The $73 billion in total costs is more than triple the estimated $22 billion in annual costs imposed at the same point in the George W. Bush Administration.[6]

There were also $466 million in reported one-time implementation costs for the 2013 rules, a slight addition to the first-term total for capital costs of $12 billion.

Regulations of 2013

Implementation of the Dodd–Frank act dominated rulemaking in 2013, accounting for 13 of the 26 new major rules issued during President Obama’s fifth year. These rules cover a broad range of financial activities from Securities and Exchange Commission regulation of brokers and municipal advisors[7] to Commodity Futures Trading Commission rules on derivatives.

Some of the most problematic new rules of 2013 came from the Consumer Financial Protection Bureau (CFPB), including four major rules restricting access to mortgage credit. These rules cover every aspect of financing a home—including mortgage options, eligibility standards, and even the structure and schedule of payments—and will limit financing options and thus further expand government control over Americans’ lives.[8]

Despite the potentially enormous impact, the CFPB failed to quantify the actual costs of these rules.

Of the 2013 rules for which costs were quantified, the most expensive was an Obamacare-related mandate jointly issued by the Internal Revenue Service, the Department of Labor, and the Department of Health and Human Services. At a cost of $1 billion annually, the regulation requires individual and group insurers, as well as group health plans, to provide “parity” in benefits between mental health or substance abuse services and medical/surgical benefits.

Ranking second was a Department of Labor rule, which extended government wage and overtime dictates to more live-in helpers for the disabled and elderly. Such “companionship” services have always been exempted from government wage control to make it possible for helpers to spend more time with their charges. Under the new rule, far fewer caretaking activities will qualify for the exemption, including dressing a client, preparing food not consumed in the caretaker’s presence, or drawing a bath.[9]

Where Is the EPA?

Conspicuously absent from the list of top regulators last year was the Environmental Protection Agency (EPA), which has consistently ranked among the most prolific regulators in the federal government. During President Obama’s first term, the agency issued some 21 major prescriptive rules[10] with an annual cost of $37.8 billion. In 2013, however, the EPA issued only two major regulations, both reconsiderations of earlier rules.[11]

The first of these was new emission standards for “stationary reciprocating internal combustion engines,” which drive factory equipment. The original rule was issued in 2010 and immediately prompted a deluge of petitions for reconsideration, legal challenges, and notice of factual errors. An amended regulation cutting estimated costs by about $139 million annually was released on January 30, 2013.

The EPA’s second major regulatory action in 2013 concerned the so-called Boiler MACT rule, which imposed stringent new emissions standards for hundreds of thousands of industrial, commercial, and institutional boilers.[12] The first iteration of the rule was issued on March 21, 2011, with an estimated cost of $1.8 billion annually. That same day, as a result of an outpouring of protest and some 5,800 comments citing technical and statutory errors, the agency also published a notice announcing its intent to reconsider select provisions of the rule. After nearly three years of deliberation, the agency last month issued an amended final rule that reduced capital costs but increased the already substantial annual operating costs by $100 million.

A slow year for the EPA, to be sure, but has the regulatory monster been tamed?

In a word: no. Whatever its actions or inactions in 2013, the EPA has grand ambitions for 2014: Three economically significant[13] new rules are already pending approval by the Office of Information and Regulatory Affairs (OIRA)[14]: (1) a new definition of “waters of the United States” under the Clean Water Act, which would expand EPA jurisdiction over all natural and artificial tributary streams, lakes, ponds, and wetlands; (2) new, more stringent motor vehicle emissions and fuel standards; and (3) new standards for cooling water intake structures. This final rule is another in a protracted effort by the agency—beginning in 2004—to control the withdrawal of water used to cool dissipating heat from industrial processes.

Understated Costs

The actual cost of new regulations issued last year is no doubt considerably higher than the totals reported by the regulatory agencies and detailed here. As a first matter, this report documents only “major” regulations. Cost-benefit analyses are not typically performed for the thousands of non-major rules issued each year, although the costs could be substantial.

But even the costs of major rules often go unquantified. Regulators last year failed to quantify any costs for seven of the 26 prescriptive regulations issued; another nine lacked cost data for key components of the rules.

The lack of analysis is a particular problem for independent agencies, such as the SEC, that are not required—as are executive branch agencies—to conduct regulatory impact (cost-benefit) analyses,[15] but even executive branch agencies fall short of the goal. For instance, the Department of Energy (DOE) reported the annual paperwork burden for its 2013 cybersecurity rule as $56 million but failed to quantify the undoubtedly substantial costs of materials, equipment, and labor that will be necessary for compliance.[16]

Some costs are impossible to quantify, such as the value of lost innovation or violations of personal liberty. What cost, for example, should be ascribed to the Department of Health and Human Services (HHS) requirement that all insurance plans cover contraceptive services, regardless of a policyholder’s moral convictions?

Often, the problem is simply inadequate or incomplete analysis, and the gatekeeper charged with ensuring thorough analyses—OIRA—is outmanned and outgunned by the regulators. With a staff of 50, OIRA is reviewing the work of agencies that have a combined total of 282,000 staffers, a personnel ratio of over 5,600: 1.[17] This would be a difficult job even with the support of the President. It is all the more difficult under the present Administration, which has hardly made controlling regulatory costs a priority.

Distorted Benefits

The Obama Administration defends its regulatory record by touting the projected benefits of the rules, but the total burden of regulation is a concern independent of benefits. Regulatory costs are like federal spending: Even if the benefits of a particular program exceed its costs, it is still important to track how much is being spent.

Moreover, benefit estimates—as calculated by the agencies—need to be considered with skepticism. Neither costs nor benefits can be perfectly quantified. While regulators have an incentive to minimize the costs of regulations, they also have an incentive to inflate their benefits.

A particularly egregious example is the DOE’s calculation of benefits for its energy conservation standards for microwave ovens.[18] The rule imposes limits on the amount of energy a microwave oven can consume when it is in standby mode or turned off (to keep the clock running and keypad lit, for example).

In attempting to justify the new standard, the agency cited the benefits of preventing the damages supposedly associated with carbon dioxide emissions from electricity use. Evidently desperate to rationalize the regulation, and without public notice or comment, DOE officials doubled the purported “social cost of carbon” that had been applied in previous rules, thereby vastly inflating the claimed benefits. The new number also is likely to be used to justify stricter energy standards on all manner of other appliances.[19]

Agencies also rely increasingly on “private benefits,” roughly defined as benefits that are paid for by the consumers who receive them. For example, the microwave regulation treats energy efficiency as a benefit to consumers—regardless of whether a consumer would choose to pay extra for a more efficient model or buy a less expensive oven and use the savings for a benefit of his own choosing. Whenever government mandates such “benefits” through regulation, individuals lose the ability to choose for themselves whether the benefit is worth the cost. That loss of consumer choice carries a steep cost.[20]

More Ahead

Hundreds of other costly regulations are also in the works. As discussed above, the EPA has a number of rules ready to finalize, but other agencies are active as well. The most recent Unified Agenda—a semiannual compendium of planned regulatory actions by agencies—lists 2,305 rules (proposed and final) in the pipeline. Of these, 125 are classified as “economically significant.” This is slightly less than the 129 economically significant rules that were listed in the spring 2013 agenda but still high by historical standards. (See Chart 2.) This year’s 125 economically significant rules in the agenda represent an increase of 123 percent from the 56 identified in 2001.

Dozens of additional Dodd–Frank rulemakings are planned or underway. Despite the prodigious output of financial service regulators in 2013, there is still a backlog of hundreds of rules waiting to be written. As of February 3, 2014, a total of 280 Dodd–Frank rulemaking deadlines had passed, but almost half of these deadlines have been missed. Regulators have not yet released proposals for about a quarter of the rules.[21]

Rulemaking for Obamacare is also ongoing, including a menu-labeling requirement[22] for which compliance will require an estimated 10 million to 15 million hours of work annually by private-sector firms. As proposed, chain restaurants and vending machine operators will be required to disclose “in a clear and conspicuous manner” myriad specific nutrition information for each of their offerings—including the buffet.

The Food and Drug Administration (FDA) is preparing to remove trans fats from the list of ingredients that are “generally recognized as safe,” an initial step toward prohibition.[23]

Officials of the Occupational Safety and Health Administration intend to complete rulemaking on a new exposure standard for crystalline silica (fine particles of sand common to mining, manufacturing, and construction). One industry analysis submitted to OIRA estimated compliance costs of $5.5 billion annually, 17,000 “person-years” of lost employment, and $3.1 billion of lost economic output each year.[24]

On the auto front, the National Highway Traffic Safety Administration is preparing a rule requiring a rear-mounted video camera and in-vehicle screen to reduce the likelihood of a vehicle striking a pedestrian while in reverse.

The active pace of rulemaking has added to an unusually large backlog of regulations awaiting approval from OIRA. According to OIRA data, 60 of the 114 regulations awaiting review in late February had been pending for more than 90 days, exceeding the maximum time allotted under Executive Order 12866, which governs the review process. Another 14 were pending for more than 60 days (but fewer than 90 days).

If the delays in OIRA’s review were the result of more thorough analyses or consideration of regulatory alternatives, that would be good news for the economy and consumers, but it is far from clear that this is the case. Nor is there any indication that the Administration as a whole has embraced a newfound skepticism toward bureaucratic overreach. The flow of red tape has continued and looks to surge again in 2014 and 2015.

Steps for Congress

Congress should increase scrutiny of new and existing regulations to ensure that each is necessary and that costs are minimized. To do so, Congress should:

- Require congressional approval of new major regulations promulgated by agencies. Congress, not regulators, should make the laws and should be accountable to the American people for the results. To help ensure this, no major regulation should be allowed to take effect until Congress explicitly approves it. The Regulations from the Executive in Need of Scrutiny (REINS) Act (H.R. 367, S. 15), approved by the House in August 2013, would impose such a requirement.[25]

- Require regulatory impact analyses of legislation before Congress. Lawmakers routinely vote on bills authorizing mandates or restrictions on Americans without any systematic assessment of the costs imposed or other potential effects. Just as a Congressional Budget Office review is required for any on-budget spending measures, a regulatory assessment should be required for any measure before it reaches the floor for a vote.

- Establish a sunset date for regulations. While every new regulation promulgated by executive branch agencies undergoes a detailed review by OIRA, there is no similar process for reviewing regulations already on the books. Old regulations tend to be left in place, even when they are no longer useful. This can be particularly harmful when, as now, there is a flood of new regulations with unknown consequences. To ensure that such retrospective review occurs, regulations should expire automatically if not explicitly reaffirmed by the relevant agency through a notice and comment rulemaking. As with any such regulatory decision, this reaffirmation would be subject to review by the courts. Sunset clauses already exist for some new regulations. Regulators and, if necessary, Congress should make them the rule, not the exception.

- Subject “independent” agencies to executive branch regulatory review. Increasingly, rulemaking is being done by so-called independent agencies outside direct executive branch control. Regulations issued by agencies such as the Federal Communications Commission, the Securities and Exchange Commission, and the Consumer Financial Protection Bureau are not subject to review by OIRA or even required to undergo cost-benefit analyses. This is a serious gap in the rulemaking process. These agencies should be fully subject to the same safeguards applied to executive branch agencies.

Conclusion

President Obama’s blunt assertion that he will use his executive authority to bypass Congress if it dares to block his agenda stirred much controversy but was nothing new for this Administration. During his five years in office, an eye-popping 157 new major regulations have been imposed at a cost of $73 billion annually, and 125 more are in the pipeline for 2014.

Congress—which shares much of the blame for enabling this flood of red tape—must stem it, ensuring that unnecessary and excessively costly rules are not imposed. Without decisive action, the costs of red tape will continue to grow, and the economy—and average Americans—will be the victims.

—James L. Gattuso is Senior Research Fellow in Regulatory Policy, and Diane Katz is Research Fellow in Regulatory Policy, in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation.

Appendix A

Methodology

Rules included are those categorized as “major” as reported in the Government Accountability Office’s Federal Rules Database (http://www.gao.gov/legal/congressact/fedrule.html). Unlike the similar database maintained by the Office of Management and Budget (OMB), the GAO’s Federal Rules Database includes independent agencies, such as the Securities and Exchange Commission, that do not undergo executive branch review. With one exception, all such rules appearing in the database as of March 14, 2014, are included. Rules adopted before that date but not yet posted in the GAO database are not included.

Only “prescriptive” rules were included. Rules that do not limit activity or mandate activity by the private sector were excluded from the totals provided. Thus, for instance, budgetary rules that set reimbursement rates for Medicaid or conditions for receipt of agricultural subsidies are excluded.

Two final rules, the reconsideration by the EPA of its 2010 new source performance standards for internal combustion engines and of its “Boiler MACT” rules, were not included in the tally of rules, as they were functionally a continuation of earlier rulemakings. The changes made on reconsideration to the internal combustion engine rule reduced the estimated burden to be imposed by the regulation by $139 million, and the boiler MACT reconsideration increased burdens by $100 million. These amounts were subtracted from the total net new burdens tally for 2013.

Cost figures are based on agency assessments of rule costs as stated when the rule was adopted, typically from regulatory impact analyses conducted by agencies issuing each rule. In calculating Bush Administration rules, the OMB estimates were used if available. If an agency did not prepare an analysis or did not quantify costs, no amount was included, although the rule was included in the count of major regulations.

The agencies’ totals were adjusted to constant 2010 dollars using the gross domestic product deflator at Areppim’s “Current to Real Dollars Converter” (http://stats.areppim.com/calc/calc_usdlrxdeflator.php).

Where applicable, a 7 percent discount rate was used. Where a range of values was given by an agency, costs were based on the most likely scenario if so indicated by the agency; otherwise, the mid-point value was used. The date of a rule was based, for classification purposes, on the date of publication in the Federal Register.

Unless otherwise noted, years refer to “presidential years,” beginning on January 21 and ending on January 20.

Appendix B

Major Rules Increasing Regulatory Burdens (1/21/2013–1/20/2014)

January 25, 2013: Department of Health and Human Services, Office of the Secretary, Modifications to the HIPPA Privacy, Security, Enforcement, and Breach Notification Rules Under the Health Information Technology for Economic and Clinical Health Act and the Genetic Information Nondiscrimination Act; other modifications to the HIPAA rules

This rule tightens requirements for securing health records and extends the security obligations to associates of health care service providers. The rule also expands individuals’ rights to receive electronic copies of their health information and modifies the required notice of privacy practices. Civil fines for violations also are increased.

Annual Cost: $13.8 million

Implementation Cost: $161.2 million

January 30, 2013: Bureau of Consumer Financial Protection, Ability-to-Repay and Qualified Mortgage Standards Under the Truth in Lending Act

The regulation, a product of the Dodd–Frank act, controls virtually every aspect of financing a home—including mortgage options, eligibility standards, and even the structure and schedule of payments. Most notable is a new requirement imposed on lenders to ensure that borrowers have the “ability to repay” a mortgage. In turn, borrowers gain a new right to sue lenders for misjudging their financial fitness. Without addressing the causes of the 2008 crash, the rule will make it harder for people to obtain financing for home purchases.[26]

Annual Cost: only partially quantified by agency

Implementation Cost: not quantified by agency

January 31, 2013: Environmental Protection Agency, National Emission Standards for Hazardous Air Pollutants for Major Sources: Industrial, Commercial, and Institutional Boilers and Process Heaters

Referred to as Boiler MACT, this regulation governs emissions of mercury, dioxin, particulate matter, hydrogen chloride, and carbon monoxide from some 200,000 boilers nationwide. These boilers burn natural gas, fuel oil, coal, biomass (e.g., wood), and refinery gas to produce steam, which is used to generate electricity or provide heat for factories and other industrial and institutional facilities. This is an amendment of a rule adopted in 2011 which was reconsidered by the EPA before going into full effect.[27]

Annual Cost (amended): $94.9 million

Implementation Cost (amended): $379.8 million

Note: This rule has not been included in the tally of major rules because it is an amendment of a rule reconsidered before going into full effect. Costs and savings have been included in net cost calculations.

February 14, 2013: Bureau of Consumer Financial Protection, Mortgage Servicing Rules Under the Real Estate Settlement Procedures Act

This rule implements Dodd–Frank provisions addressing the obligations of mortgage servicers to correct errors; to provide information to borrowers; and the conditions under which force-placed insurance is used, among other requirements.[28]

Annual Cost: $4.6 million (only partially quantified by agency)

Implementation Cost: $2.3 million

February 14, 2013: Bureau of Consumer Financial Protection, Mortgage Servicing Rules Under the Truth in Lending Act

This rule implements Dodd–Frank requirements on rate-adjustment notices, periodic statements, prompt crediting of mortgage payments, and responses to requests for payoff amounts.

Annual Cost: $5.4 million (only partially quantified by agency)

Implementation Cost: not quantified by agency

February 15, 2013: Bureau of Consumer Financial Protection, Loan Originator Compensation Requirements Under the Truth in Lending Act

This rule implements Dodd–Frank restrictions on loan originator compensation, qualifications of and registration or licensing of loan originators, compliance procedures for depository institutions, mandatory arbitration, and the financing of single-premium credit insurance. It also establishes tests for determining when loan originators can be compensated through profits-based arrangements.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

February 25, 2013: Department of Health and Human Services, Patient Protection and Affordable Care Act; Standards Related to Essential Health Benefits, Actuarial Value, and Accreditation

This rule sets standards for coverage of “essential health benefits” under Obamacare, which includes 10 statutory benefit categories, such as hospitalization, prescription drugs, and maternity and newborn care.[29]

Annual Cost: $3.3 million (only partially quantified by agency)

Implementation Cost: not quantified by agency

February 27, 2013: Department of Health and Human Services, Patient Protection and Affordable Care Act; Health Insurance Market Rules; Rate Review

This rule implements Obamacare provisions related to “fair” health insurance premiums, guaranteed insurance availability, guaranteed renewability, single-risk pools, and catastrophic plans. It also amends the standards for health insurance issuers regarding reporting, utilization, and collection of data under the federal rate review program.

Annual Cost: $15.4 million (only partially quantified by agency)

Implementation Cost: not quantified by agency

March 19, 2013: Nuclear Regulatory Commission, Physical Protection of Byproduct Material

This rule establishes security requirements for the use and transport of radioactive material.

Annual Cost: $17.6 million

Implementation Cost: $29.8 million

April 18, 2013: Department of Energy, Energy Conservation Program: Energy Conservation Standards for Distribution Transformers

This rule adopts more stringent energy conservation standards for distribution transformers.

Annual Cost: $260.9 million

Implementation Cost: not quantified by agency

April 24, 2013: Department of Homeland Security and Department of Labor, Employment Training Administration, Wage Methodology for the Temporary Non-Agricultural Employment H-2B, Part 2

This interim final rule governs certification for the employment of nonimmigrant workers in temporary or seasonal non-agricultural employment.

Annual Cost: $353.3 million

Implementation Cost: not quantified by agency

May 24, 2013: Department of Agriculture, Agriculture Marketing Service, Mandatory Country of Origin Labeling of Beef, Pork, Lamb, Chicken, Goat Meat, Wild and Farm-Raised Fish and Shellfish, Perishable Agricultural Commodities, Peanuts, Pecans, Ginseng, and Macadamia Nuts

This rule changes the labeling provisions for named commodities and amends the definition for “retailer.” Under this rule, some commodities are required to specify the production steps of birth, raising, and slaughter of the animal from which the meat is derived that took place in each country listed on the origin designation.

Annual Cost: none

Implementation Cost: $96.7 million

June 4, 2013: Commodity Futures Trading Commission, Core Principles and Other Requirements for Swap Execution Facilities

This rule applies to the registration and operation of a new type of regulated entity under Dodd–Frank—a Swap Execution Facility (SEF), which facilitates derivatives trading.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

June 17, 2013: Department of Energy, Energy Conservation Program, Energy Conservation Standards for Standby Mode and Off Mode for Microwave Ovens

This rule prescribes the maximum energy consumption allowed for microwave ovens when they are not being used to heat food.[30]

Annual Cost: $57.3 million

Implementation Cost: not quantified by agency

July 24, 2013: Securities and Exchange Commission, Disqualification of Felons and Other “Bad Actors” from Rule 506 Offerings

This rule governs eligibility for participation in general solicitation and advertising for certain securities offerings.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

August 21, 2013: Securities and Exchange Commission, Broker-Dealer Reports

The rule amends broker-dealer annual reporting, audit, and notification requirements.

Annual Cost: $124.7 million (only partially quantified by agency)

Implementation Cost: not quantified by agency

August 21, 2013: Securities and Exchange Commission, Financial Responsibility Rules for Broker-Dealers

This rule covers the net capital, customer protection, books and records, and notification rules for broker-dealers. It also updates financial responsibilities.

Annual Cost: $532.8 million (only partially quantified by agency)

Implementation Cost: $44.6 million

September 10, 2013: Federal Deposit Insurance Corporation, Regulatory Capital Rules

This interim final rule revises risk-based and leverage capital requirements for Federal Deposit Insurance Corporation–supervised institutions.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

September 24, 2013: Department of Health and Human Services, Food and Drug Administration, Unique Device Identification System

This rule requires that the label of medical devices include a “device identifier.” The labeler must submit product information to the FDA’s Global Unique Device Identification Database unless subject to an exception or alternative.

Annual Cost: $82.6 million

Implementation Cost: not quantified by agency

October 1, 2013: Department of Labor, Wage and Hour Division, Application of the Fair Labor Standards Act to Domestic Service

This rule narrows the exemption from wage and overtime provisions for live-in help for disabled and elderly companions.[31]

Annual Cost: $312.1 million

Implementation Cost: not quantified by agency

October 11, 2013: Department of the Treasury, Office of the Comptroller of the Currency, Federal Reserve System, Regulatory Capital Rules

This rule revises the risk-based and leverage capital requirements for banking organizations.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

November 12, 2013: Securities and Exchange Commission, Registration of Municipal Advisors

This rule establishes a registration regime for municipal advisors and imposes certain recordkeeping requirements on such advisors.

Annual Cost: $11.2 million (only partially quantified by agency)

Implementation Cost: $8.3 million

November 13, 2013: Department of the Treasury, Internal Revenue Service; Department of Labor, Employee Benefits Security Administration; and Department of Health and Human Services, Rules Under the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008; Technical Amendment to External Review for Multi-State Plan Program

The rules implement the Mental Health Parity and Addiction Equity Act (MHPAEA), which requires parity between mental health or substance-abuse disorder benefits and medical or surgical benefits with respect to financial requirements and treatment limitations under group health plans and group and individual health insurance coverage.

Annual Cost: $964 million

Implementation Cost: not quantified by agency

November 14, 2013: Commodity Futures Trading Commission, Enhancing Protections Afforded Customers and Customer Funds Held by Futures Commission Merchants and Derivatives Clearing Organizations

This rule requires enhanced customer protections, risk-management programs, internal monitoring and controls, capital and liquidity standards, customer disclosures, and auditing and examination programs for futures commission merchants.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

December 2, 2013: Commodity Futures Trading Commission, Derivatives Clearing Organizations and International Standards

This rule establishes new standards for derivatives-clearing organizations. The standards cover procedural requirements for opting into the regulatory regime; substantive requirements relating to governance, financial resources, and system safeguards; special default rules and procedures for uncovered losses or shortfalls; risk management; disclosure requirements; and recovery procedures.

Annual Cost: not quantified by agency

Implementation Cost: not quantified by agency

December 3, 2013: Department of Energy, Federal Energy Regulatory Commission, Version 5 Critical Infrastructure Protection Reliability Standards

This rule imposes more stringent cybersecurity controls on utilities to protect the electricity grid, including security perimeters, incident reporting and response planning, and vulnerability assessments.

Annual Cost: $53.2 million (only partially quantified by agency)

Implementation Cost: not quantified by agency

December 9, 2013: Department of Commerce, National Oceanic and Atmospheric Administration, Endangered Fish and Wildlife; Rule to Remove the Sunset Provision of the Rule Implementing Vessel Speed Restrictions to Reduce the Threat of Ship Collisions with North Atlantic Right Whales

This rule extends the vessel speed restrictions to reduce the likelihood of lethal vessel collisions with North Atlantic right whales in certain locations and at certain times of the year along the east coast of the U.S. Atlantic seaboard.

Annual Cost: $76.2 million

Implementation Cost: not quantified by agency

Appendix C

Major Rules Decreasing Regulatory Burdens (1/21/2013–1/20/2014)

January 30, 2013: Environmental Protection Agency, National Emission Standards for Hazardous Air Pollutants for Reciprocating Internal Combustion Engines; New Source Performance Standards for Stationary Internal Combustion Engines

This rule sets emissions standards for engines used at power and manufacturing plants to generate electricity and to power pumps and compressors. These engines are also used in emergencies to produce electricity and pump water for flood and fire control.

Annual Savings (amended): $138 million

Implementation Savings (amended): $257 million

Note: This action is an amendment on reconsideration of a rule adopted in 2010 and not counted in the overall tally. The savings are included in the net cost calculation.

April 11, 2013: Commodity Futures Trading Commission, Clearing Exemption for Swaps Between Affiliated Entities

The rule exempts swaps between certain affiliated entities within a corporate group from the clearing requirement under the Dodd–Frank act. The regulation includes specific conditions and reporting requirements that affiliated entities must satisfy in order to elect the exemption.

Annual Savings: not quantified by agency

Implementation Savings: not quantified by agency

July 24, 2013: Securities and Exchange Commission, Eliminating the Prohibition Against General Solicitation and General Advertising in Rule 506 and Rule 144A Offerings

The rule permits an issuer to engage in general solicitation or general advertising in offering and selling securities pursuant to Rule 506, provided that all purchasers of the securities are accredited investors and that the issuer takes reasonable steps to verify that such purchasers are accredited investors. The rule also includes a non-exclusive list of methods that issuers may use to satisfy the verification requirement for purchasers who are natural persons. The rule provides that securities may be offered pursuant to Rule 144A to persons other than qualified institutional buyers, provided that the securities are sold only to persons that the seller and any person acting on behalf of the seller reasonably believe are qualified institutional buyers.

Annual Savings: not quantified by agency

Implementation Savings: not quantified by agency

January 3, 2014: Pension Benefit Guaranty Board, Payment of Premiums; Large-Plan Flat-Rate Premium

This rule postpones the flat-rate premium due date for large pension plans to later in the premium payment year—to the same date as the variable-rate premium due date for such plans—starting with the 2014 plan year.

Annual Savings: $5.3 million

Implementation Cost: not quantified by agency