Summary

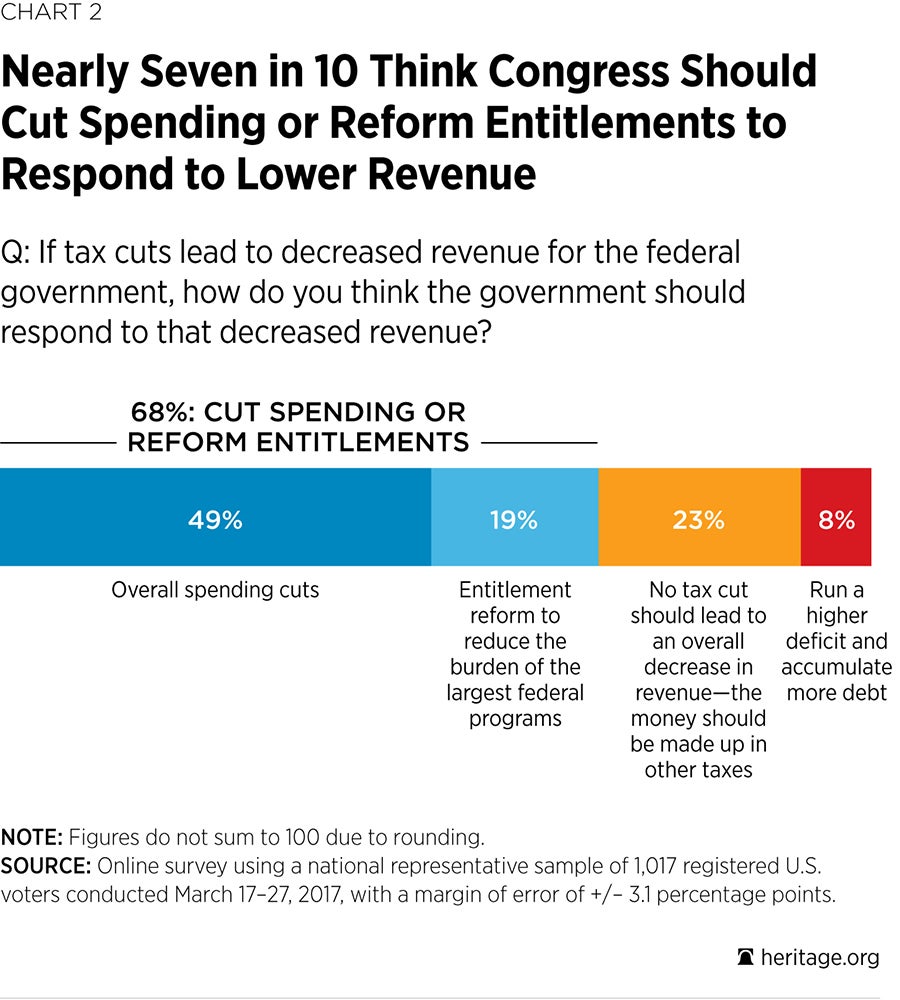

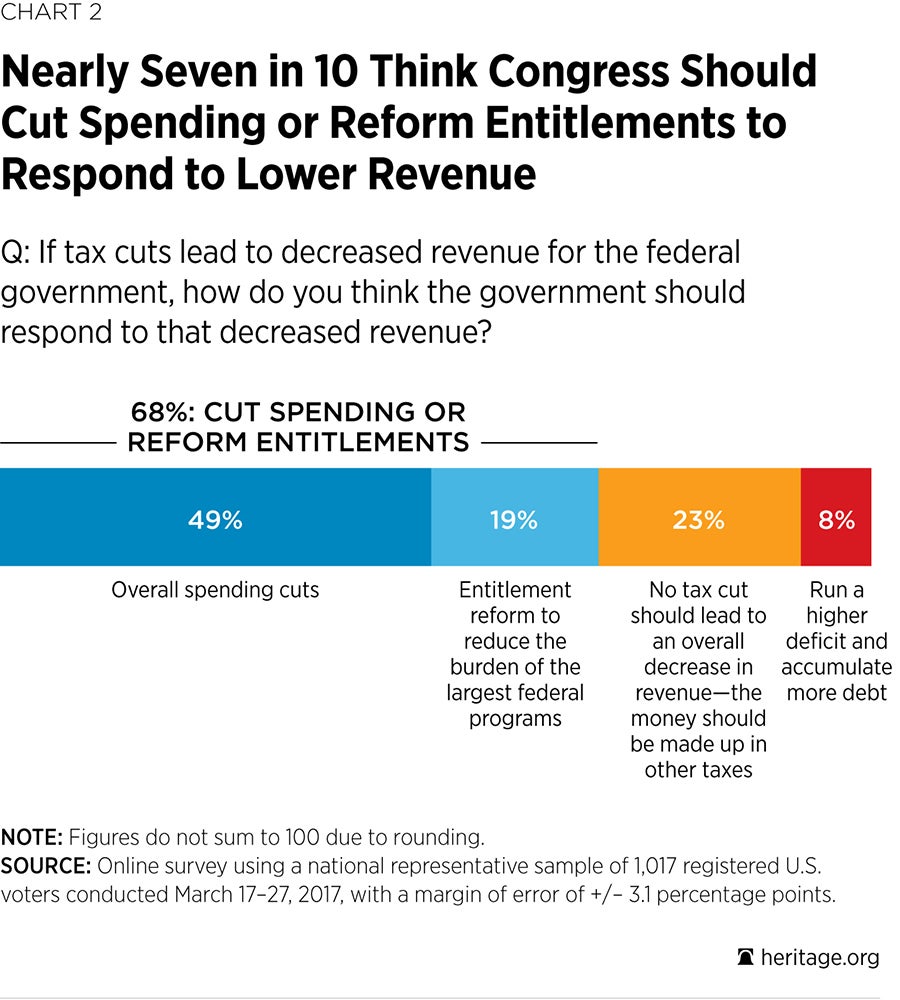

A majority of Americans (69%) think that if tax cuts lead to decreased revenue for the federal government, it should be offset by decreased spending.

About half (49%) think decreased revenue should lead to overall spending cuts.

An additional two in ten (19%) think decreased revenue should lead to lower spending through entitlement reform.

Senior Brand Advisor, Operations

By activating your membership you'll become part of a committed group of fellow patriots who stand for America's Founding principles.

Receive a clause-by-clause analysis of the Constitution with input from more than 100 scholars and legal experts.

In this FREE, extensive eBook, you will learn about how our Founders used intellect, prudence, and courage to create the greatest nation in the world.

REPORT 1 min read

REPORT 1 min read