Millions of young Americans seem to have given up on their economic future, turning instead to “doom spending.” Rather than save up for a house, to start a family or for retirement—which they view as fruitless—they’re spending more than they earn without a plan to get ahead.

That’s the upshot of a recent study by Intuit, the company that makes TurboTax. It shows Americans, especially the young, are spending beyond their means to alleviate stress. But like the dieter who thinks progress is impossible and gives up trying to lose weight, these doom-spenders are creating a self-fulfilling prophecy and digging the very financial abyss they fear.

The problem is becoming systemic. The study found that 96% of Americans are concerned about the economy today. (The remaining 4% are presumably politicians and their donors.) In response, 27% of Americans, about 90 million, have simply given up and turned to doom spending.

Even among those who haven’t thrown in the towel, things look bleak: Almost 60% of respondents are living paycheck to paycheck and lack sufficient savings to pay for an unexpected expense, like a major appliance breaking down. About a quarter of Americans—roughly 80 million—have zero savings.

>>> Americans in Crosshairs of Cost-of-Living Crisis

And things aren’t improving, with half of respondents saying economic conditions have deteriorated further in the last six months. Pessimism is concentrated among the young, with more than 70% of Millennials and Zoomers reporting financial anxiety. A full quarter of Zoomers, those just entering the workforce, cannot even find decent-paying jobs.

That explains why more than one-third of these young Americans are doom spending, as are more than 40% of Millennials. Consequently, adults under 30 are moving back in with their parents at rates not seen since the Great Depression, giving up on the American dream of homeownership.

What used to be the most common age to start a family—mid to late 20s—is now the exact point Americans instead give up and resign to living for today.

Like many problems, this one started in Washington, D.C.

To finance perpetual government deficit spending, the Federal Reserve kept interest rates artificially low for almost two decades, creating money for the politicians to spend. That devalued the dollar and imposed a hidden tax of inflation, which sapped the value of savings and gutted the real return on investment, while simultaneously incentivizing spendthrift behavior.

It also grossly distorted prices and created misallocations of capital. Take the construction of densely packed apartments instead of homes. This drove up home prices, helping make homeownership the exclusive purview of the wealthy. Meanwhile, those same interest rates that drove inflation suckered people to go into debt for worthless college degrees while racking up more than $1 trillion in new credit-card debt that now has an average interest rate of over 21%.

At this point, horrendous fiscal and monetary policy have created two whole generations of Americans who have largely given up. They don’t believe it’s possible to ever afford their own homes and to afford the lifestyle in which they themselves were raised. They live only for today.

>>> The Senate’s Security Supplemental Budget Bill: Key Provisions

The tree of big government has born its noxious fruit of inflation, and those who have tasted it have contracted hedonism.

After all, why scrimp and save for something in the future when the real value of those savings is taxed away through inflation? If with each passing year as home prices climb faster than incomes, an adequate down payment will be forever out of reach, leaving the young to rent with roommates for life or move back in with their parents.

Instead of running to exhaustion on this treadmill, young Americans have thrown up their hands. The end result is a broader cultural decline where family formation, community stability and the perpetuation of American ideals have lost value in the minds of our youth. They become abstract, unattainable, old-fashioned luxuries for a previous generation.

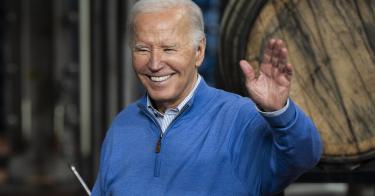

This assault on the young continues with Bidenomics, which has added another $6.5 trillion to the national debt, created 40-year-high inflation, and produced record costs of home ownership. So long as the uniparty in D.C. keeps spending like there’s no tomorrow, America’s youth will believe there’s no tomorrow for them.

This piece originally appeared in MSN