Abstract: President Obama declared: "I didn't come here to pass our problems on to the next president or the next generation--I'm here to solve them." Yet rather than "solve" the runaway spending that is projected to cause historic deficits, the President's budget doubles down on it with trillions of dollars in new spending and taxes, culminating in a doubling of the national debt. Heritage Foundation economic policy expert Brian Riedl lays out how a $3 trillion tax hike and an additional $74,000 debt burden on every U.S. household will affect the country--and why Congress should reject President Obama's budget proposal.

Obama's Budget Proposal and Tax Hikes

When he released his new budget proposal on February 1, President Barack Obama asserted that the government "simply cannot continue to spend as if deficits don't have consequences; as if waste doesn't matter; as if the hard-earned tax dollars of the American people can be treated like Monopoly money; as if we can ignore this challenge for another generation."[1]

Yet the President's new budget does exactly that-- raising taxes by $3 trillion and federal spending by $1.6 trillion over the next ten years. If enacted, this budget would increase the 2010 deficit to more than $1.5 trillion, and leave a deficit of more than $1 trillion even after an assumed return to peace and prosperity. Overall, the President's budget would double the national debt over the next decade.[2]

President Obama's Budget

- Would permanently expand the federal government by 3 percent of gross domestic product (GDP) over 2007 pre-recession levels;

- Would raise taxes onall Americans by nearly $3 trillion over the next decade;

- Would raise taxes for 3.2 million small businesses and upper-income taxpayers by an average of $300,000 over the next decade;

- Would borrow 42 cents for each dollar spent in 2010;

- Would run a $1.6 trillion deficit in 2010--$143 billion higher than the recession-driven 2009 deficit;

- Would leave permanent deficits that top $1 trillion as late as 2020;

- Would dump an additional $74,000 per household of debt into the laps of our children and grandchildren; and

- Would double the publicly held national debt to over $18 trillion.

Source: Heritage Foundation calculations based on U.S. Office of Management and Budget, Budget of the United States Government, Fiscal Year 2011 (Washington, D.C.: U.S. Government Printing Office, 2010), pp. 146-179, Tables S-1 through S-14. Also includes the cost of House-passed cap-and-trade bill, which President Obama endorsed yet excluded from his budget tables.

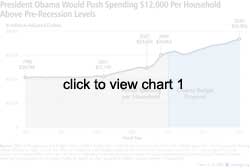

Before the recession began, annual federal spending totaled $24,000 per household. President Obama would hike that spending above $36,000 per household by 2020--an inflation-adjusted $12,000-per-household expansion of government. (See Chart 1.) But even these steep tax increases would not finance all of this new spending: The President's budget would lead to trillions in new debt over the next decade.

In fact, the President's new budget proposalcontains even more spending and debt than last year's proposal. Over the 10 years in which both budget projections overlap (fiscal years 2010 through 2019) this year's budget would add an additional $1.7 trillion in spending and an additional $2 trillion in budget deficits. (See Table 1.)[3] Overall, this year's proposal shows annual budget deficits as much as 49 percent larger than last year's proposal--raising the debt by an additional 6 percent of GDP over the same period. It is a spending spree that will drive up both taxes and deficits.

Yet Another "Stimulus"

In a triumph of hope over experience, the President proposes spending $267 billion on yet another stimulus bill. Last year's $787 billion stimulus bill (now estimated to cost $862 billion)[4] was supposed to create (not just save) 3.3 million net jobs. Since its passage one year ago, more than 3 million additional net jobs have been lost, pushing the unemployment rate to 10 percent. This failure was utterly predictable--as the United States during the Great Depression and Japan in the 1990s have shown that governments cannot spend their way out of recessions or depressions.[5]

The proper response from the government would be to repeal the unspent portion of the stimulus and stop piling more debt onto future generations. Instead, President Obama prefers to borrow an additional $267 billion from the more productive private sector so that politicians and bureaucrats can spend those dollars. This move would only weaken the economic recovery, increase the debt, and eventually push interest rates higher by draining funds from global capital markets as a massive and growing federal government competes with the private sector for resources.

Misdiagnosing the Cause of the Deficit

President Obama's misplaced budget priorities may be the result of his Administration's misdiagnosis of the cause of the deficit. During his State of the Union speech in January, the President asserted that "by the time I took office, we had a one-year deficit of over $1 trillion and projected deficits of $8 trillion over the next decade. Most of this was the result of not paying for two wars, two tax cuts, and an expensive prescription drug program."[6] That is simply not true. The various policies mentioned by President Obama were implemented in the early 2000s. Yet even with all those policies in place, the 2007 budget deficit stood at only $161 billion. The trillion-dollar deficit did not begin until 2009 (driven by financial bailouts, stimulus, and declining revenues) as the recession hit its trough.

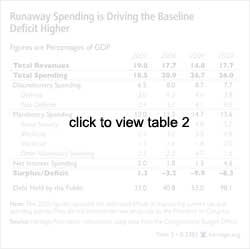

The wars, tax cuts, and prescription drug program mentioned by the President certainly could not be responsible for most of the trillion-dollar deficits projected for the next decade, given that most war spending will be phased out by then, and the tax cuts and Medicare benefit are expected to cost a combined 2.4 percent of GDP by 2020--even as the baseline budget deficit rises past 8 percent of GDP. (See Table 2.)[7] That even ignores whatever portion of the lost tax cut revenues is replenished by economic growth.

By contrast, the rising costs of Social Security, Medicare (beyond just the drug benefit), Medicaid, and net interest are responsible for nearly 5 percent in additional deficits as a share of GDP by 2020. Yet the President failed to mention this spending as driving long-term budget deficits.

There is also some hypocrisy at work in that President Obama does not want to "pay for" more than a fraction of these initiatives, either. Just like President George W. Bush, President Obama has proposed continued funding of the Medicare drug entitlement as well as the costs of the wars in Iraq and Afghanistan without any offsets. He has also proposed extending more than three-quarters of the 2001 and 2003 tax cuts without offsets. Thus, President Obama has opened himself up to the same criticism that he heaped on President Bush.

Doubling the Debt

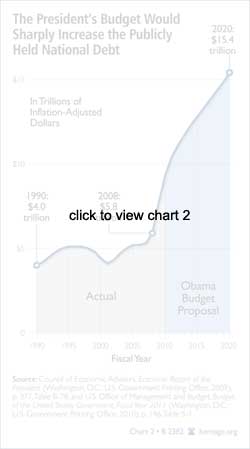

President Obama has harshly criticized the $3.3 trillion in budget deficits accumulated in eight years under President Bush.[8] Yet President Obama is now proposing to borrow $7.6 trillion during what would be his own eight years in the White House. (See Chart 2.) In fact, President Obama would add more to the national debt than every other President in American history from George Washington through George W. Bush combined.

The President has claimed that his budget deficits are a temporary result of the recession. Yet his budget would increase the deficit in 2010 even as the economy moves out of recession. The Obama budget fails to achieve his goal of cutting the budget deficit in half by the end of his first term. Even by 2020--a time of assumed peace and prosperity-- the annual budget deficit would still top $1 trillion. By that point, the debt would reach 77 percent of GDP (nearly double the level before the recession).

Eventually, this unprecedented surge of debt would increase interest rates. The United States government would find itself competing with other big-spending, deficit-ridden nations and the productive private sector to borrow massive amounts of money from the pool of global savings. Although U.S. Treasury bills are a popular investment for domestic and international investors in these uncertain economic times, many investors will shift into higher-return investments (such as stocks) when the economy fully recovers, thereby forcing Washington to offer higher interest rates to induce purchases of its debt. Eventually, this could cause a vicious circle where rising interest rates push up the cost of servicing the national debt, forcing the government to borrow even more money from the private sector--thus raising interest rates further. Moody's Investors Service has noted this potential debt-and-interest-rate spiral, and signaled that it may cost the United States government its prized AAA bond rating.[9] These high interest rates would also slow down the economic recovery by making it more costly for businesses to invest and more difficult for families to afford home and auto loans.

In the long run, Washington is dumping a colossal amount of debt into the laps of Americans' children and grandchildren. Between 2011 and 2020, President Obama's proposed budget would add $8.5 trillion ($74,000 per U.S. household) in new government debt. By 2020, 35 cents of every dollar paid in individual income taxes would be used to pay interest on this debt. Moreover, given the unsustainable costs of paying Social Security, Medicare, and Medicaid benefits to 77 million retiring baby boomers, the federal debt will continue to expand after 2020.[10] Without real reforms, the federal government will undertake the greatest intergenerational transfer of debt in American history. Younger generations, not old enough to vote when most of these policies were enacted, will be relegated to staggering tax increases, deep government debt, and slower economic growth in order to pay for their parents' and grandparents' retirement benefits. The President's budget not only does nothing to prevent this fundamentally immoral situation--it makes it worse.

Nearly $3 Trillion in Tax Increases

Last year, President Obama promised that "if your family earns less than $250,000 a year, you will not see your taxes increased a single dime. I repeat: not one single dime."[11] Yet even before the budget was released, he signed into law a 62 cent tobacco-tax increase that has a disproportionate negative effect on lower-income smokers. He has endorsed the $846 billion cap-and-trade tax passed by the House in 2009, which electric utility companies, oil refiners, natural gas producers, and other energy producers would immediately pass on to consumers, including those earning less than $250,000.[12] Consequently, President Obama's budget would raise everyone's taxes. (See Table 3.)

The President has pared back some tax cuts proposed last year (the making-work-pay tax credit would now expire in 2013). He also proposes new tax cuts, some of which are helpful (automatic enrollment in Individual Retirement Accounts would help more people save for retirement) and others that are not (expansion of the child and dependent care tax credit is biased toward those who choose paid child care over staying home with their children).

A nearly $1 trillion tax increase is reserved for couples earning more than $250,000 and individuals earning more than $200,000. Beginning in 2011, the President's budget will increase these Americans' taxes by:

- Raising the top two income tax brackets from 33 percent to 36 percent, and from 35 percent 39.6 percent ($364 billion);

- Raising capital gains and dividends tax rates from 15 percent to 20 percent ($105 billion);

- Phasing out personal exemptions and limiting itemized deductions ($208 billion); and

- Reducing the value of tax deductions by approximately one-fourth ($291 billion).

This $1 trillion tax hike would fall on the backs of only 3.2 million tax filers--an average tax hike of more than $300,000 per filer over 10 years on a group that is already shouldering an increasing portion of the income tax burden.[13]

Moreover, businesses and upper-income individuals would also pay a substantial burden of the proposed $743 billion in new taxes to finance the President's health care reform. American businesses, trying to compete globally despite the world's second-highest corporate tax rate, would also face an additional $468 billion in various new taxes at a time when they are--according to the White House--supposed to be getting back on their feet and begin hiring new employees.

Such tax increases would significantly reduce economic growth by reducing people's incentives to work, save, and invest. Specifically, higher investment taxes may prevent the economy from receiving the investment capital it needs to recover. Because most small businesses pay the individual income tax, they would face new barriers to expanding, investing, hiring, and even staying in business. Wealthier individuals would be more likely to allocate their wealth to wherever they can avoid these new taxes, instead of in areas where their wealth would be most productive for the economy.

While there is never a good time to raise taxes, President Obama's proposal to raise taxes at the beginning of a tenuous recovery is especially problematic. Even if the tax increases are not implemented until 2011, many businesses planning investment and hiring will likely begin scaling back their plans in anticipation of the coming tax hikes.

More than $1.6 Trillion in New Spending

One could, ostensibly, defend this $3 trillion tax increase as necessary to rein in the staggering deficits contained in the President's budget proposal. But even stipulating that argument, President Obama would still use more than half of these tax increases to expand government instead of reducing the deficit. Nearly $600 billion would go toward a new health care entitlement. More than $800 billion would go toward cap-and-trade energy legislation. An additional $168 billion would be spent on more failed "stimulus" spending, and $52 billion would create educational entitlements. While the President would reduce the growth of non-security discretionary spending by nearly $250 billion over 10 years, all the savings would go toward other discretionary spending.

The rest of the tax increases would be needed just to keep pace with a portion of the new automatic increases in Social Security, Medicare, and Medicaid. Once the President's $3 trillion tax increase reduced the $1.6 trillion in new spending, the additional $1.4 trillion in new revenues will cover just one-fourth of the additional costs of these three programs.

As a result, the President's budget would raise tax revenues to approximately 1.8 percent of GDP above the historical average--yet leave spending more than 3.5 percent of GDP above the historical average. Simply put, surging spending is driving the budget deficits.[14]

Too Many Gimmicks

President Obama does deserve credit for reversing President Bush's policy of not budgeting for the Alternative Minimum Tax patch (the annual reform to prevent a large tax increase), the global war on terrorism, and future unanticipated emergencies. But the Obama budget contains numerous large gimmicks, too:

- Cap-and-Trade Costs Are Not Included. Last year, the President simply left the cost of his health plan out of his aggregate budget tables.[15] This year, he budgeted for his health care plan, but removed the costs of his cap-and-trade plan. Given that the President has endorsed the House-passed bill that would raise taxes by $846 billion, and spending by $822 billion, The Heritage Foundation has incorporated this government expansion into its presidential budget estimates.[16]

- The Baseline Assumes War Spending Rises Forever. Repeating his much-maligned gimmick from last year's budget, the President first creates a baseline that assumes the Iraq surge continues forever (which was never U.S. policy), and then "saves" $728 billion against that baseline by ending the surge as scheduled under his policies. It is like a family "saving" $10,000 by first assuming an expensive vacation and then not taking it. This paper does not give credit for such savings relative to a fantasy baseline.

- The $132 Billion "Magic Asterisk." The President's budget claims $132 billion in savings over 10 years from "program integrity" reforms. Basically, this means unspecified reforms to fight waste, fraud, and abuse. The "Budget Process" section in the budget's Analytical Perspectives volume contends that such savings can be found chiefly from stronger IRS enforcement of tax laws, with some additional savings from the Social Security Administration and federal health programs.[17]Of course, government waste is easy to identify and difficult to eliminate. The federal government's track record on rooting out waste is abysmal, and promises to close the "tax gap" of unpaid taxes have not translated into progress. While the President should be applauded for trying to root out waste, it is unrealistic to assume $132 billion in savings to offset additional entitlement spending.

-

The $23 Billion Terminations and Cuts. The White House is advertising $23 billion in proposed spending cuts and terminations. Given the multitude of outdated and failed programs, many of these cuts are necessary. Yet if last year is any indication, they will not save taxpayers a dime.

Last year, Congress and President Obama agreed on $7 billon worth of terminations and spending cuts (mostly in defense)--and then plowed 100 percent of the savings into new spending (mostly non-defense). Not a dollar went toward deficit reduction.[18] There is no reason to expect this year will be any different.

The President's largest savings proposal ($8 billion in 2011), for instance, would come from eliminating the subsidized student loan program (run by banks with federal subsidies), and shepherding all students into direct loans run by the federal government. Yet the President would use all $43 billion in savings to help finance a $69 billion expansion of Pell Grants. The deficit would not be reduced at all. Using "low hanging fruit" budget cuts for new spending means that more of the higher taxes or spending cuts down the road will have to come from the remaining higher-priority policies.

- The Lowballing of Discretionary Spending. President Obama deserves credit for proposing to freeze a small sliver of discretionary funding for the next three years (albeit at an inflated level).[19] However, the President's budget projection clearly lowballs discretionary spending over the next decade--especially for the seven years following the freeze. Over the next decade, the President assumes that discretionary spending (excluding emergencies like war and "stimulus") will expand by 30 percent, just slightly faster than inflation. But in reality, discretionary spending surged by 104 percent during the past decade. Given that the Democratic congressional majority has increased non-emergency discretionary spending by 25 percent over the past three years, there is no reason to expect sudden austerity. If discretionary spending instead grows at the same rate as the economy (about 5 percent nominally per year), it would add about $400 billion to the 2020budget deficit.[20]

- PAYGO. Much of the President's budget couples specific spending increases with vague, process-based calls for future spending restraint. One example is his endorsement of the new Pay-As-You-Go (PAYGO) law (since signed into law). While the PAYGO concept--that Congress must offset the cost of any new initiative--sounds promising, its glaring loopholes will not reduce the deficit at all. PAYGO exempts all discretionary spending (which comprises 40 percent of the budget) from its constraints. It exempts the automatic annual growth of Social Security, Medicare, and Medicaid that threatens Washington's long-run solvency. It exempts the endless stream of emergency "stimulus" bills. When PAYGO is violated, nearly all spending is exempt from being cut to offset the new expansions. PAYGO is designed to serve more as a talking point than as a tool for deficit reduction.[21]

- Deficit Commission. Another example of choosing process over substance is the President's "deficit commission" that will recommend a set of policies to reduce the deficit by 2015. Although such commissions can be useful, the one appointed by the President suffers from three weaknesses: (1) The commission's recommendations are not guaranteed legislative "fast track" protections--or a congressional vote at all; (2) if Congress does vote on these recommendations, the most likely time will be after the November 2010 elections with a lame duck Congress; and (3) there is no indication that this commission will include any public hearings and thus will be more likely to create its recommendations in a back room without public input. Putting it all together, this commission will likely become a partisan exercise that fails to bring down deficits and merely kicks the can down the road. The President should lead the national dialogue by offering a specific set of entitlement reforms to bring long-term sustainability to the federal budget. If a commission is to be set up, Congress should take the responsibility to create one that solves the three problems listed above.

- Rosy Economic Scenario. Just like last year, the President's new budget assumes a rosy economic scenario. For 2011, the White House projects that the economy will grow by 3.8 percent, twice the 1.9 percent growth rate forecasted by the Congressional Budget Office (CBO). Over the next decade, the President's budget assumes 43 percent real growth, compared to the CBO estimate of 37 percent. The difference is not trivial-- The White House projects that in 2020 the economy will be nearly $1 trillion larger (adjusted for inflation) than the CBO estimates. But if the economy performs closer to the CBO projections, it will raise budget deficits even higher.[22]

An Irresponsible Budget

President Obama has offered a budget that does nothing to address the nation's serious short-term and long-term fiscal problems--and indeed makes them worse. By doubling the national debt above pre-recession levels, America could be heading toward the tipping point when debt levels will become too large for global capital markets to absorb, potentially triggering a financial crisis, an interest rate spike, and crippling tax increases.

Countries that finance U.S. debt will note that President Obama's budget includes no plan for long-term fiscal sustainability. While he talks of controlling entitlement spending, his budget would do the opposite. By supporting a trillion-dollar health care expansion that is partially offset with tax increases and Medicare cuts, he essentially takes those policies off the table for any future deficit reduction. That means higher taxes and deeper spending cuts down the road.

The President who declared to the nation that "I didn't come here to pass our problems on to the next president or the next generation--I'm here to solve them,"[23] would, over the next decade, drop an additional $74,000 per household in debt onto the laps of our children and grandchildren.

A responsible budget must rein in runaway spending and deficits. It must reject expensive cap-and-trade and health care proposals, and repeal the remaining stimulus and Troubled Asset Relief Program (TARP) funds. A responsible budget must reject devastating tax increases during a fragile recovery, and instead cap the growth of government spending at a reasonable rate. Most important, a responsible budget must propose specific reforms to address the unaffordable Social Security, Medicare, and Medicare spending trends. Congress's budget should aim to meet these standards--even though the Obama budget fails to do so.

Brian M. Riedl is Grover M. Hermann Fellow in Federal Budgetary Affairs in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation.