The Affordable Care Act (ACA), often called Obamacare, accelerates the pernicious growth of market consolidation in American health care.[1]

The national health care law reinforces the trend of providers, including doctors and hospitals, to merge into large regional health systems that dominate local markets. The law also introduces new rules and restrictions that will reduce the degree of competition in the insurance market.

This growth of monopoly power is not the result of free-market forces, but the deliberate product of public policy. Instead of honestly budgeting in order to finance health care, policymakers have repeatedly sanctioned monopolistic hospital markets in the hope that dominant providers will use higher revenues to cross-subsidize indigent and emergency care. The purchasing power of the Medicare program has been increasingly employed by the federal government to shape the structure of the hospital industry, and its payment rates are deliberately designed to give incumbent general hospitals an advantage over less expensive specialty facilities. At the state level, policies such as certificate-of-need (CON) laws have been defended by local hospital monopolies to prevent the construction or expansion of facilities by potential competitors.

Obamacare’s Impact. The ACA eliminates many of the essential competitive checks remaining in the American health care system. Because the law relies so heavily on unfunded regulatory mandates to finance the benefit structure, it is obliged to strengthen the power of incumbent providers to prevent targeted competition from eliminating their profit centers. The provisions of the law attempt to do so by:

- Closing off alternatives to paying for health care by requiring individuals to purchase comprehensive insurance.

- Reducing the ability of insurers to compete with innovations in benefit design by requiring standardized benefit packages.

- Increasing the discriminatory subsidies that protect dominant hospitals from competition.

- Limiting patient choices by using Medicare payment policies to drive doctors and other medical professionals into a small number of integrated hospital systems.

The President’s health care reform therefore represents a concerted attempt to prevent competition in various aspects of health insurance—including health benefits, provider networks, and cost. In the process, the law has become a fountain of federal regulation. With the law’s individual mandate, forcing most Americans to purchase health insurance regardless of cost, the power of insurers and providers to profit from a captive market is likely to increase even further. The ACA adds to the array of regulatory instruments that attempt to contain the damage of anticompetitive policies.

But, the way to increase provider responsiveness to the needs of patients is not through a second set of regulations that punishes providers for doing what the first set of regulations encouraged them to do. In the absence of competition, highly integrated health care providers tend to be irresponsive to patient needs, and reliant on crude bureaucratic instruments to prevent costs from spiraling out of control. Rather than trusting monopolies to provide “uncompensated care” as desired, policymakers should remove the shackles that have been placed on competition in health care, and transparently appropriate the necessary funds for the care that they wish to subsidize.

Combating the Conglomerates. There is no shortcut for fixing the problem of monopoly power in American health care. It was deliberately constructed, and policymakers seeking to reform it must take on a formidable set of entrenched practices and policies. Specifically, they must: Eliminate unfunded mandates that are incompatible with competition; repeal legal or regulatory restraints on market entry; retarget health care subsidies and tax breaks from institutions to individuals; allow patients to shop around for less expensive options; and abolish health care benefit mandates that create captive markets for providers regardless of value for money.

The Rise of Hospital Monopolies

Within the United States, medical prices vary wildly. For instance, one California employer found itself paying between $848 and $5,984 for colonoscopies with no discernible difference in quality, while MRI scans in the D.C. metro area range from $400 to $1,861, and hip replacements have been found to cost anywhere from $11,100 to $125,798.[2]

Physicians order medical procedures for their patients, but those procedures are largely paid for by third parties (the government or insurers). Private insurers are legally obliged to cover “medically necessary” care, whatever the cost.[3] As patients have little motivation to travel far in search of competitors offering the same care at lower prices, if there is only a single hospital nearby that is able to provide that care, it can dictate high reimbursement fees.

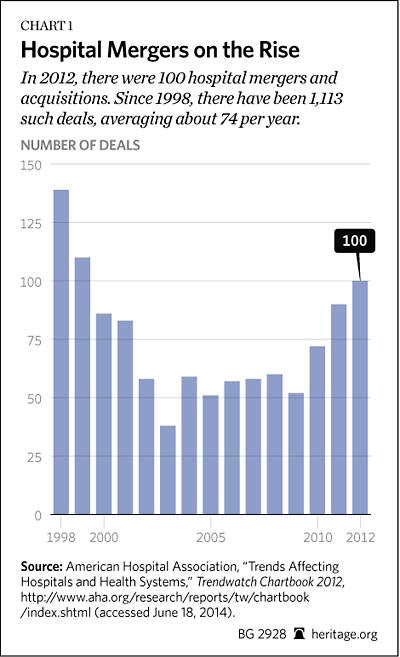

Because third-party-payment systems insulate patients from the true costs of care, hospitals without nearby competitors are able to leverage the strong patient preference for geographic convenience to demand a premium from insurers. The desire of hospitals to take advantage of this situation has yielded a cumulative process of mergers into “must have” branded units that dominate local markets.[4] There are roughly 5,000 hospitals in the United States. Between 1998 and 2012, there were 1,113 mergers and acquisitions involving a total of 2,277 hospitals.[5] Thus, hospitals have been aggregating into fewer and larger economic units, inflating market power. The principal effect of the mergers is to reduce price competition by forcing payers to negotiate with a single entity encompassing most of the hospitals in a given geographic region. That, in turn, gives the merged entities greater leverage to extract higher reimbursement from private and public payers.

Waste. Yet, the resulting problem is not primarily, or even mostly, one of supersized profits. Prices have soared at nonprofit and for-profit hospitals alike.[6] Indeed, in 2012 the vast majority of community hospitals in America (3,931 of 4,999, 79 percent) were either government-owned or not-for-profit organizations.[7] Rather than increasing profits for investors, inflated hospital incomes instead tend to be dissipated across a multitude of medical personnel, auxiliary staff, and suppliers—as well as wasted on unused capacity. The reality is that monopolies in economic sectors dominated by nonprofit organizations (such as health care or education) produce broadly diffused inefficiency, overpayment, and organizational bloating rather than supernormal profits.

These problems are particularly acute in small local markets. Empty beds can cost around $75,000, and raising occupancy from 59 percent to 79 percent has been estimated to reduce hospital operating costs by around 9 percent.[8] In some cases hospital mergers can indeed increase efficiency by eliminating duplicative overhead, reaping economies of scale in procurement, or improving quality with a greater volume of specialized procedures. Indeed, the initial wave of mergers proved beneficial to consumers, yielding average price reductions of 7 percent.[9] Thus, if markets were truly competitive, there would still likely be some hospital mergers, and those mergers would produce consumer benefits in the form of quality and access improvements as well as price reductions.

Savings from such mergers, however, are likely to be substantial only for small hospitals. While the consolidation of hospitals has often generated cost efficiencies, in hospital markets dominated by only a few providers, mergers have enabled hospitals to retain the savings rather than passing them on to consumers.[10] Beyond a modest scale, mergers tend to inflate costs, and to be sought for the sake of increasing pricing power.[11] Increasingly, hospitals are consolidating into larger systems—a process that boosts their ability to demand high prices, but does little to generate efficiencies or shed costs.[12] There is a clear consensus in the peer-reviewed economics literature that prices tend to increase by at least 20 percent following hospital mergers in concentrated markets.[13]

Market Power. Pushing back against rising hospital bills, managed-care organizations (MCOs) became increasingly prevalent during the 1990s.[14] As motivated, capable, and price-sensitive purchasers, MCOs were able to check the ability of providers to inflate costs.[15] By threatening to steer patients from one provider to another (“selective contracting”), MCOs had leverage to insist that prices be kept within reason.[16] This proved highly effective: A comparison of heart attack patients revealed that MCOs were able to provide the same treatments and health outcomes as indemnity plans at 30 percent to 40 percent lower prices.[17]

The bargaining power of hospitals, and their ability to impose price increases, therefore depends on the ease with which insurers may omit them from their provider networks.[18] Their consolidation into multi-hospital systems, which bargain collectively with insurers across multiple markets, enables hospitals to make themselves harder to exclude—allowing them to command price increases twice the size.[19] Thus, the effectiveness of selective contracting in checking hospital cost growth has been blunted in highly concentrated hospital markets.[20] The ability of insurers to insist on good prices from hospitals has further been hobbled by “any willing provider” laws in the majority of states, which require insurers to reimburse any providers willing to accept the insurer’s rates, effectively limiting the ability of health maintenance organizations (HMOs) to divert patients to preferred hospitals.[21] The effect has been to reverse the slowdown in the growth of health care expenditures that had been achieved in previous years in areas with high HMO penetration.[22]

Although dominant providers claim that their ability to command higher reimbursements allows them to invest in improving treatment outcomes, the absence of competitive pressures tends to actually produce organizational slack, weaker accountability for performance, and lower-quality care.[23] Local hospital markets dominated by a few providers are less likely to employ the best medical equipment, and it appears that heart attack patients are more likely to die when treated by hospitals in markets with less competition.[24] Indeed, better outcomes for heart attack and pneumonia patients in more competitive markets appear to be associated with the relative prevalence of private payers, who are able to vary payments to reward higher quality.[25]

Government Regulations. Evidence that monopoly power has allowed hospitals to push up prices without improving quality has led some policy analysts and political activists to claim that expanded government regulation and control of providers can make health care more affordable. To this end, a number of prominent Obamacare advocates have called for a follow-up round of reforms—subjecting hospitals to regulatory caps on prices, aggregate spending limits, cost-effectiveness requirements, and heightened antitrust prosecution.[26]

Yet, such proposals attack the symptoms of monopoly power instead of addressing its causes. As a result, they are more likely to create new problems than to solve existing ones. Any attempt to drive down costs with regulatory price controls can be expected to induce artificial scarcity that further reduces incentives for providers to invest to improve quality and respond to patient needs.[27] Similarly, the problems of inflated costs and excess capacity are unlikely to be solved by preventing mergers. Nor is genuine competition between providers to meet patient needs at the lowest cost likely to be advanced by encouraging hospitals to pursue profits through antitrust suits against each other.

Ultimately, the advocates of these regulatory solutions invariably fail to acknowledge the degree to which the problem of hospital monopolies is an artificial one—deliberately created by government regulation.

How Innovators Can Shake Up Hospital Monopolies

Absent government subsidies and regulations that protect them from competitors, hospitals are unlikely to enjoy outsized market power for long. Health care is not subject to substantial natural barriers to entry, and increased institutional size can often be more of a burden than an advantage.

Larger hospital systems face greater administrative challenges when identifying waste and motivating doctors and staff to keep costs under control. General hospitals lack internal price signals to allocate resources between departments, and must rely on bargaining and cajoling to shift them where most needed. Upgrading and rationalizing capabilities is also likely to be more difficult. Administrators have incentives to hoard spare capacity, while physicians are motivated to deem all care “necessary” to prevent resources from being reallocated elsewhere. That makes it hard for hospital managers to cross-subsidize care in practice, even when their intentions to do so are sincere.[28] Indeed, cross subsidies often tend to be dissipated by higher spending on technologies and services of uncertain value.[29]

Mature organizations often find themselves trapped in an outdated and costly web of commitments to various clients, partners, and capital projects—with the result that bloated costs are more often the product of organizational lethargy than greed. That makes it hard for larger systems to fully benefit from cost-saving innovations. Large hospitals’ administrative expenses are also notoriously elevated. For example, at one Oklahoma “non-profit” hospital system, inexpensive items are routinely billed to patients at outrageous prices ($77 for a gauze pad; $200 for a toothbrush).[30] That creates opportunities for more nimble and efficient competitors to deliver less expensive alternatives—but only if they are not stymied by regulations and reimbursement systems designed to protect incumbent providers.

Specialized Care. Ambulatory surgery centers (ASCs), for instance, have emerged as independent specialized providers of outpatient surgery, providing an alternative to costly overnight hospital care. New technologies, such as minimally invasive laparoscopic surgery, enable providers to simultaneously reduce costs and improve results. Surgeries for hernias and cataracts, and arthroscopies, can increasingly be performed on an outpatient basis.[31] In the United States, outpatient procedures rose as a proportion of total surgeries from 20 percent in 1981 to 80 percent in 2003, and these are now mostly performed outside of hospitals.[32] By 2010, there were 5,316 federally certified ASCs.[33]

Some have rightly suggested that “simplicity and repetition breed competence.”[34] Managers at these smaller facilities are better able to learn the specific needs of medical specialists, and to dedicate themselves to clearing away obstacles to the production of cost-effective care.[35] By focusing on elective surgeries, specialty hospitals are also able to avoid cancellations and disruptions arising from emergency cases, allowing them to schedule more operations for the same number of doctors and operating rooms.[36] This allows expensive trained personnel and costly equipment to be used more efficiently, just as Southwest Airlines was able to slash costs simply by reducing the time needed to “turn around” aircraft between flights.[37] Using their most expensive inputs—aircraft and skilled crews—more efficiently, Southwest and its imitators were able to offer lower-cost tickets to the flying public.

In the case of ASCs, their smaller scale allows freestanding facilities to be physician owned—reducing the agency problems inherent in the separation of ownership and control. This improves incentives for reducing waste, and frees physician control of decision making from some of the many bureaucratic intrusions.[38] This is also true of specialty hospitals. Adjusting for the mix of patients, there were 40 percent fewer adverse outcomes in specialty orthopedic hospitals than general hospitals.[39]

The market share of general hospitals has fallen significantly in areas that have seen greater ASC penetration—reducing revenues, costs, and profits.[40] As a result, the proliferation of specialty facilities focused on specific procedures has made it harder for general hospitals to cross-subsidize waste, inefficiencies, and uncompensated care. Not surprisingly, general hospitals have focused on the latter. The American Hospital Association accuses specialty hospitals of selecting the best insured, healthiest, and hence most lucrative, patients.[41] Cardiac services, for instance, can account for 25 percent to 40 percent of hospital revenue and are seen as vital to cross-subsidizing other services.

It is true that there is some evidence that medically complex cases are increasingly being avoided by ASCs and left to hospital outpatient departments.[42] However, the filtering of patients by case complexity might be exactly what makes lower-cost routine high-volume production possible, and selective competition is what usually keeps providers on their toes. Put differently, it is hard to outlaw “cherry picking” without preventing competition altogether. No major innovation to drive down costs will be distributionally neutral. The more fundamental problem is that Medicare’s administrative pricing system overcompensates for some procedures, such as cardiac services, while undercompensating for others.

Lower Costs. While specialty hospitals may focus on cases that are easier to treat, they still handle these specific cases at lower cost. One pioneering surgery center in Oklahoma has been able to offer laparoscopic hernia repair for $3,975, while nearby hospitals charge $17,000 for the same procedure—triggering a price war.[43] More generally, the entry of specialty hospitals into a local market has been found to reduce overall costs without adversely affecting care.[44]

By lowering costs, reducing recovery times, and making possible the treatment of previously inoperable conditions, the development of minimally invasive surgery has nonetheless caused spending to rise by increasing the volume of procedures. The growth of outpatient procedures (from 4 million to 23 million) between 1980 and 2005 has far exceeded the concomitant decline in inpatient surgery (from 15 million to 9 million) over the same period.[45] European countries initially restricted outpatient surgery out of fear that soaring volumes would strain public budgets. As a result, in the early 1990s, ambulatory surgery accounted for 50 percent of surgery in the U.S., but only 5 percent in France.[46]

Because the expansion of ASCs has been accompanied by a significant increase in discretionary surgery, some fear that surgeons with an ownership stake in ASCs have an incentive to inflate volumes.[47] Facilities that are wholly owned by physicians, which are most often ASCs, are exempt from the so-called Stark law that prevents the referral of Medicare and Medicaid patients by physicians to hospitals in which they have an ownership stake.[48] Lobbyists representing general hospitals that stand to lose revenue by such referrals have suggested that specialty hospitals represent an “intolerable risk,” and expressed great concern at physician conflicts of interest involved.[49]

Yet, general hospitals are subject to similar conflicts of interest. Moreover, the Stark law is little more than a gesture toward controlling the volume of services billed. The problem of incentives for over-referral is a more fundamental one, and intrinsic to third-party payment, regardless of treatment site. Indeed, given the astronomic amount of over-treating, over-billing, and outright fraud documented in Medicare and Medicaid (which dedicates only a fraction of the resources that private insurers do to police these problems), there is little reason to believe that a general hospital’s institutional structure is much of a solution to this situation.[50]

How Predatory Subsidies Fuel Market Consolidation

Hospital monopoly power is a problem, but it is not an accident. The financing of hospitals is dominated by Medicare and Medicaid. In 2011, public spending accounted for 61 percent of hospital income.[51] The expansions of Medicaid and federally subsidized exchange coverage in the PPACA will further increase this. The organizational structure of hospitals therefore largely reflects the shape of government spending—and major changes in payment, such as the introduction of Medicare or its shift to prospective payment, have altered the practice and pricing of medicine.[52]

Hospital costs are 84 percent fixed: Most of the expense of equipping, maintaining, and staffing a hospital is largely incurred whether an additional individual is treated or not.[53] Medicare reimbursements are skewed in favor of dominant hospitals, allowing them to defray overheads, and therefore do much to shut out competitors. Payment methods also inflate the marginal costs of care (the expense involved in treating each additional patient), as Medicare reimburses the same treatments at substantially higher rates if they are performed in general hospitals.

Medicare’s Role. Until the 1980 Omnibus Reconciliation Act, Medicare did not reimburse freestanding facilities not affiliated with a hospital for surgeries at all.[54] Following the 2003 Medicare Modernization Act, Medicare began to reimburse ASCs for a comprehensive range of surgeries, but reimbursed 16 percent more for the same procedures when performed in hospitals.[55] As these low-cost providers have proliferated and taken market share away from general hospitals, Medicare has adjusted the rates, so that in 2013 it paid 78 percent more on average for the same procedures performed in hospitals.[56] For instance, Medicare now pays $362 for a colonoscopy performed in a freestanding ambulatory surgery center, but $643 for the same procedure performed in a general hospital outpatient department.[57] Likewise, under the 2014 Medicare Physician Fee Schedule rate, one hour of intravenous chemotherapy costs $133.26, but the payment rate for the same service under the 2014 Hospital Outpatient Prospective Payment Schedule is 125 percent higher at $299.53.[58]

This disparity will become worse because reimbursements for outpatient surgery in general hospitals are automatically indexed to medical costs, while those in independent centers are adjusted by (much lower) general inflation rates.[59] As if that was not bad enough, the ACA requires that payments to independent surgical facilities be further reduced in line with annual improvements in “medical productivity.”[60] As a result, the assault on competitors by dominant hospitals has finally borne fruit. The growth of ASCs has slowed down substantially—from 5 percent annually in the mid-2000s to 2 percent since 2010—and also hastened a shift of physicians back to performing surgeries at hospitals.[61]

General hospitals claim that these disparities are justified by the fact that, to be eligible for the higher rates, general hospitals must provide care to patients who are sicker, more expensive to reach, and less able to pay.[62] Yet while paying more for such cases may be reasonable, there is no justification for paying the same, higher, rates to hospitals for treating patients who are no sicker, no harder to reach, and no less able to pay.

Such cross-subsidization is not transparent, so its effectiveness and efficiency are neither measurable nor reliable. Indeed, providing subsidies disconnected from outcomes, to insulate such hospitals from competitive threats, is a poor way to ensure that the additional funds reach the neediest people. This has become clear from disproportionate share hospital (DSH) programs, which provide lump sum payments to cover uncompensated costs at hospitals that depend heavily on Medicare and Medicaid. In 2011, 80 percent of hospitals received disproportionate share payments.[63]

These programs are in part justified by reference to the inadequacy of Medicare and Medicaid reimbursement for hospital services.[64] Yet, they provide incentives for nonprofit hospitals to run up huge bills, purchasing goods at inflated pretend-prices to make “losses,” so that they can then claim the need for subsidies for substantial “uncompensated care.” State governments are often complicit in attempts by hospitals to pad Medicaid DSH claims, viewing them as a way to draw matching funds from the federal taxpayer.[65] Following Massachusetts’ expansion of public insurance coverage in 2006, the volume of uncompensated care provided fell much more than the funds claimed to reimburse it.[66] Claims of “uncompensated care” by general hospitals (and states) ought therefore to be treated with a high degree of skepticism.

Similarly, general hospitals cite their obligation to provide unprofitable emergency room (ER) care to all comers as justification for higher reimbursement rates.[67] Yet, the widespread prevalence of ERs, along with their frequent expansion and refurbishment, suggest that they are not as unprofitable as subsidy-seeking general hospitals often allege.[68] Indeed, half of hospital inpatient admissions originate in emergency departments, and general hospitals have long viewed the emergency department as a kind of “loss leader” that generates substantial revenue from subsequent surgery and diagnostic testing.

What is more, freestanding for-profit ERs are proliferating, offering shorter wait times and greater convenience.[69] While they may lack costly helipads, surgery suites, and integrated administrative overheads, they too, are accused of cream-skimming “lucrative” insured patients in “the right ZIP code.”[70] Although Medicare provides subsidies to integrated full-service hospitals for “uncompensated” emergency care above the hospitals’ regular rates, it reimburses freestanding ERs only at its heavily discounted outpatient clinic rates. Even though some states have withheld tax exemptions from freestanding ERs, and others have banned them altogether, the number of freestanding ERs grew from 55 in 1978 to 222 in 2008.[71]

Rural Hospitals. The inadequacy of Medicare reimbursements is also used to justify special lump sum payments to providers based on their geographic location. The 1997 Balanced Budget Act designated a quarter of hospitals as rural “critical access hospitals” (CAHs), and altered Medicare payment rules to reimburse them according to costs claimed rather than services provided. Medicare patients account for 65 percent of CAH inpatient days.[72] However, those higher payments come with strings. The accompanying criteria require that hospitals provide a broad range of inpatient, lab, and ER services, impose restrictions on patient length of stay, and limit facilities to 25 patient beds.

The unintended, and perverse, consequence has been a dramatic reduction in the number of beds in rural hospitals. When the CAH program was established in 1997, only 15 percent of rural hospitals had fewer than 25 beds; by 2004, 45 percent did.[73] As a result, it has become very difficult for such hospitals to act as competitors to each other—even though the majority of them are less than 25 miles from another facility.[74]

These Medicare requirements effectively make nearly every rural hospital a “must have” hospital for the networks of all other payers, both private (insurers and employers) and public (state-run Medicaid and Children’s Health Insurance Programs). Conversion to CAH status has significantly increased hospital revenues, profits, and costs per discharge.[75] The result of all these payment provisions is that CAH hospital revenues increased almost three times as fast as those for non-CAH hospitals, and CAH closures have all but ceased.[76] Thus, largely protected from the risk of bankruptcy, the longer that hospitals participate as CAHs and the higher their share of Medicare patients, the more inflated their costs have become.[77] As a result, rural markets have the most overcapacity (occupancy rates were 45 percent in rural areas, compared with 65 percent in urban areas, in 2011), have the greatest additional market power created by mergers, and are most often dominated by a single hospital.[78]

Protecting Turf, Preventing Competition

When third parties are obligated to finance care, hospitals tend to provide ever more expensive services to attract patients whose costs are charged to others.[79] That results in what some have termed a “medical arms race,” producing spiraling hospital costs. As early as the 1950s, Blue Cross and Blue Shield (the then-dominant nonprofit insurer), with support from the public health establishment, sought to limit hospital cost growth by advocating the adoption of state certificates of need (CONs). CON laws empowered states to regulate hospital capital expenditures, the number of beds, the expansion of services, and the acquisition of expensive medical technologies. The stated objective was to ensure that hospital spending did not grow disproportionately relative to projected clinical needs.[80] CON laws proliferated at the state level during the 1960s, before being mandated nationwide as a condition for states receiving federal grants in 1974.[81] Although Congress rescinded this requirement in 1986, CON laws remain in force across 36 states.[82]

To prevent “unnecessary duplication of facilities,” CON laws require that new hospitals, and existing hospitals seeking to expand, demonstrate both a market need for the increased supply and an inability or unwillingness of existing providers to meet that need.[83] Government regulators must decide the merits of these claims. Incumbents are allowed to rebut claimed “need” during a review process, and opposition from competitors is a primary reason why CON applications are rejected.[84] As a result, CON laws bind only providers seeking to challenge the status quo, while powerful incumbents find it easy to obtain approval for expansion so long as they do not threaten to undercut their rivals’ prices.

States often deliberately employ CON laws to reserve lucrative captive markets for hospitals. Regulators seek to ensure the financial sustainability of facilities and manpower in otherwise unprofitable, or so-called underserved areas.[85] Regulators can also leverage the CON approval process to modify provider behavior and encourage the provision of uncompensated care.[86] As an exercise in political economics, the application of CON laws resembles the practice of ancien régime kings who sought to avoid the need to call parliaments by chartering monopolies to raise revenue. Competitive threats to this arrangement are disparaged as “cherry picking”—even though the empowerment of monopolies is an inequitable, inefficient, and unaccountable method of ensuring that resources are distributed to the needy and deserving. It is, therefore, not surprising that specialty hospitals (which pose a substantial competitive challenge to general hospitals) are more prevalent in states that have repealed their CON laws.[87]

Capacity constraints are a major source of hospital leverage in price bargaining.[88] Thus, the artificial scarcity induced by CON regulation yields higher prices at both for-profit and nonprofit hospitals—with the extra revenue generally dissipated in spending on nonclinical benefits, waste, and inefficient resource allocations. The longer that CON laws are in force, the more the cost of those inefficiencies accumulate and compound.[89] With the establishment of new facilities constrained, hospitals in states with more stringent CON regulations have experienced higher mortality rates.[90] For example, in states where CON laws significantly constrain capacity and slow the entry of new providers, the dialysis industry has seen deteriorating quality of care and increased patient mortality, as firms with market power have been able to neglect standards without loss of demand.[91]

CON laws also divert new investment to unregulated substitutes, rather than constraining costs as a whole.[92] This has led to the inefficient substitution of non-capital for capital inputs in the provision of care—for example, by shifting long-term care services toward more costly non-residential settings.[93] Indeed, by obstructing the expansion of outpatient care facilities, CON laws have regularly served to stymie the development of other more effective methods of cost-containment.[94]

As a result, states that have removed CON regulations have not experienced health care cost increases.[95] Rather, in states that repealed CON laws, the cost of cardiac surgery fell so much that total spending fell even as volume increased.[96] Indeed, as a general matter, the negative effects of CON laws on competition have driven up hospital costs for comparable patients, rather than constraining spending. Thus, under CON laws, any reductions in total spending achieved by utilization constraints are more than offset by the additional spending that results from increased provider prices.[97]

How Obamacare Consolidates Insurance Markets

When the Obama Administration lobbied for passage of the ACA, it launched a concerted campaign to blame the insurance industry for the ills of American health care. Senate Majority Leader Harry Reid (D–NV) blamed the exemption of insurers from federal antitrust laws for premium increases, for the underpayment of doctors, and somehow, even for driving up Medicare costs.[98] Yet, private insurers are largely uninvolved in Medicare Parts A and B, the traditional parts of the program that are fueling its rapid cost growth, while the federal “exemption” only exists to empower states to regulate their own insurers and to enforce their own antitrust laws.[99]

President Obama similarly attempted to justify his agenda by claiming that insurance companies were making record profits, but fact checkers in the media noted that insurance profits had actually been falling due to employees losing coverage during the recession.[100] When, in an address to Congress, Obama blamed “Wall Street’s relentless profit expectations” for the fact that 90 percent of Alabama’s insurance market was controlled by just one company—it was pointed out that the insurer was in fact a nonprofit organization, Blue Cross Blue Shield.[101]

Despite repeated attempts to scapegoat the insurance industry for premium increases prior to the enactment of Obamacare, premiums in different parts of the country largely reflect underlying health care cost trends in state and regional markets. Moreover, taken as a whole, the reality is that American health insurance has largely been more competitive than either popular perception or political rhetoric would suggest. The four largest publicly traded insurers (WellPoint, UnitedHealth, Aetna, and CIGNA) offer plans in nearly all states, along with many additional regional providers. Of these, the largest for-profit insurer (WellPoint) has national market share of only 17 percent.[102] For-profit insurers provide the two largest plans in only 28 percent of local markets.

Market concentration at the state level tends to reflect the market share of Blue Cross Blue Shield plans.[103] Those plans are often protected by state regulations to prevent “cream-skimming” by private competitors. Yet, even providers in markets that are most regulated at the state level have little pricing power, as these insurers must compete with national employer-based Employee Retirement Income Security Act (ERISA) health plans that are exempt from state regulations. When the option of ERISA plans is included, Blue Cross controls only 36 percent of even Alabama’s insurance market.[104]

The profitability (3.3 percent of revenues from 1990 to 2008) of health insurance is not unusual compared with that of other industries.[105] Nor is there any evidence of faster-rising premiums in more consolidated state insurance markets.[106] If anything, the consolidation of insurers has balanced the bargaining power of providers, and encouraged the cost-effective substitution of nurses for physicians.[107] As a result, the American Medical Association is sufficiently concerned by the potential adverse effect that it publishes an annual report denouncing consolidation in health insurance.[108]

Declining Competition. Obamacare, in fact, brings about the very problem of insurance monopoly power that its champions in Congress and the Administration promised to solve. The regulations imposed, pursuant to the law, have forced some insurers to exit the health insurance business altogether.[109] Sold as a solution to a supposedly dysfunctional insurance market, it treats competition primarily as a threat (“adverse selection”) that must be suppressed.[110] By mandating the purchase of a government-defined insurance product, it greatly inflates the power of those able to meet that definition, and eliminates many margins for competition.[111] Plans must cover “essential health benefits,” which are statutorily defined to cover all aspects of conventional medical care.[112] This has been specified by regulation to mean the “state benchmark plan”—in most states the largest small-group plan.[113] As a result, the benefit arrangements favored by the incumbent market leader are often now imposed on all. In the single year from 2013 to 2014, individual insurance competition nationwide declined by 29 percent, following reorganization to comply with federal rules for insurance sold through Obamacare exchanges.[114]

There is a genuine need for competition in health insurance to bind plan managers to serving the interests of their enrollees. The business of insurance is not merely a matter of calculating premiums from actuarial tables, but an operation that requires increasingly sophisticated benefit design and administrative capabilities to manage the challenges of moral hazard and fraudulent claims. The difficulty of these tasks can best be seen by the government’s spectacularly poor performance when it has assumed this responsibility. The Government Accountability Office estimated that Medicare fraud in 2010 amounted to $48 billion (more than $1,000 per enrollee), while improper Medicaid payments were responsible for an additional $28 billion.[115]

More Regulation. As with the desire to cross-subsidize hospital care by maintaining monopolies, Obamacare does much to prevent price competition between insurance plans by regulating premiums. “Community rating” regulations require that insurers charge enrollees the same amount regardless of the services expected to be provided, while “risk-adjustment” provisions tax providers who (even inadvertently) attract a relatively healthier pool of patients by cutting prices. With prices and benefits of health insurance increasingly regulated, only administration and advertising are left to competition—margins that are likely to reward scale, and hence consolidation.

The new “medical loss ratio” (MLR) requirement that insurers spend at least 85 percent of premium revenues for large groups (80 percent for small groups and individuals) on claims or “activities that improve health care quality” is also likely to shield incumbents from competition.[116] The need for sufficient scale to comply with MLRs is likely to impede start-up providers, while the requirement to minimize administration costs as a percentage of revenues can be expected to induce mergers.[117] MLRs are also likely to limit the capacity of small insurers to invest in the overheads needed to expand, while the punishment for retaining funds unused for medical expenses is likely to make external funding necessary for investment and therefore to lead to market dominance by for-profit plans.[118] It can also be expected to drive out insurers only partly involved with health care.

An artificial cap on “administrative costs” can be expected both to undermine efforts by managed-care plans to counter provider attempts to inflate medical bills, or to force insurers to rely on cruder methods of limiting access to care. The MLR regulation could make competition-facilitating high-deductible plans harder to provide, and may force insurers to avoid markets with greater moral hazard and relatively greater need for administrative costs. These concerns proved substantial enough that the Obama Administration provided waivers from MLR laws to states with highly concentrated insurance markets out of fear that they would cause the exit of insurers and leave pure monopolies.[119]

MLRs may also be expected to induce insurers to pass administrative and risk-bearing responsibilities “downstream” to providers, so that they can count as medical costs—increasing provider integration in response to both.[120] The desire for vertical integration is, more generally, a deliberate goal of Obamacare. By increasing the degree of third-party payment and restricting the scope for cost sharing, the ACA must rely more heavily on cruder bureaucratic methods of constraining provider prices and utilization. The former Secretary of Health and Human Services Kathleen Sebelius, responsible for the launch of Obamacare, has admitted that aspects of the ACA pushing for the coordination of care are in “constant tension” with antitrust laws.[121]

The ACO Factor. Accountable care organizations (ACOs) represent the most deliberate step in this direction. ACOs disburse capitated payments for integrated organizations to provide all-inclusive packages to Medicare enrollees, rather than reimbursing them for services provided—allowing them to keep part of the savings relative to Medicare fee-for-service. While designed to encourage the vertical integration of providers and insurers, it is also likely to encourage horizontal integration among entities that are supposed to be competitors.[122]

Rather than checking the revenues of dominant hospitals, the development of ACOs is likely to reduce their exposure to competitive threats, limit the number of independent competing providers, and facilitate collusion among incumbents. Hospitals that integrate and take up insurance services to form the basis for ACOs are unlikely to push patients towards low-cost outpatient care. Indeed, doctors may be forced to participate in ACOs if they want to be reimbursed for treating Medicare patients.[123] Attempts to move away from fee-for-service to ACO reimbursements for patients require physicians to bear risk beyond their control (such as severity of patient illness), and their unwillingness to do so is driving integration into networks of independent physicians.[124]

While ACOs attempt to control the behavior of doctors by bringing them under the aegis of hospitals, other public policies already provide substantial incentives for doctors to abandon independent practice. For instance, Medicare reimburses integrated providers at substantially higher rates, paying an additional “facility fee” for office visits undertaken in hospitals. This has led to Medicare paying twice as much for the same electrocardiograms or diagnostic colonoscopies if they were performed in hospitals, yielding reimbursements for hospital-based physicians up to 80 percent greater than those to freestanding practices.[125]

As regulatory requirements increase for physician reporting and compliance with medical practice standards both within the exchanges and in the Medicare program, physicians are increasingly impelled to participate in large medical systems that are best equipped to handle increasingly complex administrative challenges. While only a quarter of medical practices were owned by hospitals as recently as 2005, since 2008, the majority of physician practices have been hospital owned.[126]

By requiring higher overhead costs to manage utilization and contracting with providers, ACO payments increase the scale that organizations need to achieve in order to stay competitive.[127] While doctors may easily enter fee-for-service markets as independent providers, capitation precludes competitive challenge by organizations too small to offer a comprehensive portfolio of services.

The Exchanges/Medicaid Expansion. The creation of federally supervised health insurance exchanges and expansion of Medicaid under Obamacare will further marginalize the ability of new providers to undercut incumbents by offering cheaper services directly to patients.[128] Medicaid is already a heavily regulated government program, and fear of competition in the exchanges has yielded requirements that “qualified” health plans secure regulatory approval for premiums, that networks be obliged to encompass well-established providers, and that the marketing of plans encouraging risk selection be prohibited. Under such a situation, insurers are likely to gain more by merging to improve their bargaining position against the regulatory agency overseeing the exchanges than they are by seeking to undercut each other on price. Yet, over the long term, it is hard to imagine that those running the exchanges will not become increasingly cowed by fears of insurer bankruptcy—thus forcing them to accede to the demands of the few remaining, dominant firms.

The Monopoly Problem—and the Competition Solution

Policymakers have increasingly sanctioned monopoly power in health care as a makeshift instrument of public finance, designed to redistribute resources without the need for explicit appropriation of tax dollars. However, government policies premised on the operation of cross subsidies within general hospitals have effectively put health care payers at the mercy of dominant provider systems. This fostering of monopoly power has proven more harmful in health care than in other markets, because widespread third-party payment reduces the price sensitivity of consumers, which is the natural corrective to monopolistic practices.

Rather than propping up monopolists—and in the process punishing competitors for their relative efficiency—policymakers would better serve their constituents by limiting their interventions to targeted and explicitly funded measures to address specific gaps in the health care delivery system. While the justification offered for subsidizing general hospitals and allowing them to engage in monopolistic practices is a need to extend the provision of care, the result has been to create captive markets that are unresponsive to patients and able to impose unnecessarily inflated prices on the broader community. As a result, taxpayers are often forced to pay several times over for the same supposedly “uncompensated care,” which nonetheless remains inadequately supplied.

Policymakers seeking to ensure that hospitals, doctors, and insurers are focused on providing quality care at affordable prices ought to remember that competition is the only way to impose genuine accountability, and they should adhere to the following principles to enhance competition in health care:

- Refuse to prop up monopoly power. Government regulation and spending should not shield dominant providers from competitors. Monopolies are irresponsive to the needs of patients and payers. They are an unreliable method of subsidizing care that tends to both lower quality and inflate costs.

- Repeal certificate-of-need laws. Legislative constraints on the construction of additional medical capacity should be repealed. Innovative providers should be allowed to expand or establish new facilities that challenge incumbents with lower prices and better quality.

- Subsidize patients, not providers. Public policies should be provider-neutral. Payments should reimburse providers for providing care, period. In particular, publicly funded programs should not operate payment systems designed to keep certain providers in business regardless of the quality, volume, or cost of the treatments they provide. If some individuals are unable to pay for their care, policymakers should subsidize such needy individuals directly.

- Allow patients to shop around. Wherever possible governments and employers should put patients in control of the funds expended on their care, and permit them to keep any savings they obtain from seeking out more efficient providers.

- Repeal Obamacare and its mandates. Forcing individuals to purchase standardized health insurance establishes a captive market, making it easier for providers, insurers, and regulators to degrade services and inflate costs with impunity. Repealing Obamacare and its purchase mandates is essential to creating a market in which suppliers have the flexibility to respond to consumer demands for better value for their money.

Time to Reverse Course

The shackling of competition is an essential feature of Obamacare, not a bug. The health care system it establishes relies on unfunded mandates to raise revenue, seeks to cross-subsidize care with regulations, and views genuine competition as a threat to its funding structure. As a result, it is obliged to standardize insurance options and eliminate cheaper alternatives that threaten to undercut its preferred plan designs.

By inhibiting competition between insurers and encouraging their integration with providers, Obamacare further erodes the competitive checks on the monopoly power of hospitals. It strengthens incentives for hospital systems to buy up independent medical practices and surgery centers, weakens the competitive discipline on prices, and reduces the array of options available for patients.

Although some have suggested that price regulation is needed to check the monopoly power of providers, this would only further reduce the responsiveness of health care providers to patient needs. The only genuine solution to the ills of consolidation, and growing monopoly power in American health care, is to attack its root causes.

Policymakers should insist that health care be funded with honest appropriations, rather than unfunded mandates that inhibit competition. They should repeal laws that restrict the entry of new providers, and open up markets to real competition that allows disruptive innovations in financing and care delivery to flourish. In particular, Medicare should be reformed on a competitive basis so that care for seniors is purchased where the cost is lowest, rather than employed as a regulatory instrument to drive health care provision for all Americans into bloated “too-big-to-fail” local hospital monopolies where unnecessary costs cannot easily be monitored or controlled.

—Christopher M. Pope, PhD, is a former Graduate Fellow in the Center for Health Policy Studies, of the Institute for Family, Community, and Opportunity, at The Heritage Foundation.