But we have to pass the bill, so you can find out what is in it, away from the fog of controversy.

—Nancy Pelosi, Speaker of the U.S. House of Representatives, March 9, 2010

It is not our job to protect the people from the consequences of their political choices.

—Chief Justice John Roberts, National Federation of Independent Business v. Sebelius, June 28, 2012

Four years after Congress enacted the Patient Protection and Affordable Care Act, commonly known as “Obamacare,” millions of Americans are learning first-hand “what is in it.” While it is the law of the land, the national debate on its future is intensifying. There is good reason for another round of debate. Speculation is largely over. After four years, Americans are almost daily experiencing the impact of the national health care law. High-profile presidential promises notwithstanding, millions of Americans must now pay higher insurance premium costs and deductibles and deal with disruption of their coverage, new financial pressures on Medicare, and new strains on the already attenuated doctor–patient relationship. They are also witnessing the exercise of enormous and arbitrary power by the Secretary of Health and Human Services (HHS) in developing, applying, and waiving rules and regulations.

The law is both a historical and constitutional anomaly. In 2010, the President and his allies in Congress enacted what is arguably the most ambitious social legislation in American history. It directly affects the personal life of every American, and it controls or regulates a complex sector of the American economy that is slightly larger than the entire economy of France. In sharp contrast to the constitutional ideal of a rational deliberation of legislative measures by the elected representatives of the people—the product of genuine compromise and consensus—this health care law was enacted on a narrowly partisan basis, in the face of popular opposition, through a profoundly flawed legislative process. It was an unusual, if not unique, conjunction of bad government and bad policy.

Before it was enacted, opponents of the law clearly outlined its likely consequences in a variety of areas: the negative impact of the tax increases on jobs and the economy; the long-term effect on the budget; the effects of the employer mandate on jobs and wages; the federal subsidy structure that creates perverse incentives for employers and employees; the insurance regulations that would undercut competition, reduce patient choice, and raise premiums; the costs to the states of expanding Medicaid; the impact of payment cuts on Medicare, which threaten seniors’ access to care; the creation of a new federal entitlement program; and the weakening of the rights of conscience in medical decisions and the protection of life. There is also the violation of personal liberty and the principle of federalism in Washington’s imposition of the individual mandate.

Dissent of the Governed. Four years ago, Jacob Hacker, a professor of political science at Yale University and a champion of the new law, prophetically warned fellow liberals: “Reformers won the war in 2010, but they lost the battle for public opinion. Americans were convinced that reform was needed but not that government could do it. Reformers cannot afford to lose the second battle for public opinion.”[1] The Administration and its allies in Congress and academia are now losing that second battle for public opinion. In its most recent assessment of the average margins of support or opposition to the law among the nation’s leading polling companies, Real Clear Politics finds that 53.3 percent oppose the law while 39.1 percent favor it.[2] Timothy Jost, a professor of law at Washington and Lee University and supporter of the law, says, “It is likely that more complaints will be heard once people actually use their ACA [Affordable Care Act] coverage.”[3]

A Familiar Pattern. The course of the current national debate is following a familiar pattern, mirrored clearly in previous national health care debates, such as the triumphant passage and bipartisan repeal of the Medicare Catastrophic Coverage Act of 1988 and the quiet collapse of the Clinton Health Security Act on the Senate floor in the fall of 1994.

In each case, public hostility to the health care legislation was stimulated by the mass disruptions, or threatened disruption, of existing health care coverage; the rapid and excessive cost increases that were initially ignored or unanticipated; and the metastasizing federal bureaucracy, issuing or threatening to issue costly, cumbersome, and intrusive rules and regulations to control Americans’ health care decisions.[4]

Arbitrary Government. In the case of the Affordable Care Act, the President and his allies made high-profile but false promises that Americans could keep their existing coverage and that costs would not only be contained, but decline. Furthermore, the President and his allies in Congress insisted on an uncompromising centralization of bureaucratic power over virtually every facet of health care.

Such administrative power, the law’s advocates believed, would streamline the transformation of American health care. Karen Davis, then president of The Commonwealth Fund, a prominent liberal think tank, predicted that “[c]ontinued implementation of the Affordable Care Act will bring clarity about the direction and shape of future change to everyone involved in the health system: the people who provide care, those who pay for care, and those who receive it.”[5] In fact, the implementation of the law has ushered in national confusion and uncertainty. According to a recent report in The Washington Post, many of the administrative changes to the law have

led to a frenzied effort among employers, insurance companies, politicians and consumers to try and understand what they might mean…. To add to the confusion, some modifications are changes to previous changes. For example, this is the second time that the administration has allowed some people to keep noncompliant plans longer than previously announced.[6]

Central planning is not a prescription for simplicity; it is a license for arbitrary regulatory power. Whole provisions of the law have been nullified, modified, delayed, or suspended. Indeed, over the past four years, there have been a total of 40 changes to the law, including various administrative, legislative, and judicial actions.[7] In a number of these cases, executive actions directly contradict or ignore the plain statutory text of the law. These are just three of many egregious examples:

- The May 23, 2012, IRS rule that premium assistance subsidies are to be available in federal exchanges, though Section 1311 only specifies that such subsidies can be provided through state-based exchanges;

- The one-year delay in the employer reporting requirements under the terms of the employer mandate issued by the Treasury Department on July 2, 2013; and

- The August 7, 2013, ruling by the U.S. Office of Personnel Management (OPM) that Congress and staff are to receive their previous employer-based insurance subsidies for enrollment in the health exchanges as if they were still enrolled in the Federal Employees Health Benefits Program, which they are not.[8]

Well beyond the issues of health care financing and delivery, the law also marks a major step backward in the American tradition of democratic governance. Instead of exercising executive responsibilities within the confines of limited government, the Administration is making up new rules as it goes along, disregarding the constitutional principles of the separation of powers and the rule of law. The implementation of the national health law is thus a textbook example of both the formidable power and the practical weaknesses inherent in the central planning of the modern administrative state.

Promises vs. Predictions: The Four-Year Record

Notwithstanding the validity of his specific claims, President Barack Obama, as a candidate and as chief executive, has always been honest and forthright in outlining the central elements of his health policy agenda: a federal standardization of health insurance benefits; a new government insurance plan to compete with private plans in a federal exchange; a mandate on employers to offer federally approved coverage or pay a penalty; a major expansion of Medicaid and the Children’s Health Insurance Program; a major change in Medicare payments, including payment reductions for Medicare Advantage plans; and major commitments to federal spending on health information technology and comparative effectiveness research.[9] Americans claiming to be surprised simply have not been paying attention.

After the 2010 enactment of the Affordable Care Act, Heritage Foundation policy analysts undertook a comprehensive examination of its key statutory provisions. The result was a series of 15 policy papers: The Case Against Obamacare.[10] Each paper focused on specific statutory provisions, their content, and their likely effects on a wide range of health policy issues. These included the likely impact of the law on employment and the economy, health insurance premiums, the competitiveness of health insurance markets, the impact on Medicare, entitlement spending and federal deficits, the role of the states in overseeing the health insurance markets, the impact of the individual and the employer mandates, and the new challenges to the traditional rights of personal conscience and religious liberty.

At the outset of the national debate, the President and his allies in Congress and elsewhere made a number of high-profile promises and claims, some of them quite extraordinary. In contrast, Heritage analysts repeatedly warned that the law is unaffordable, unworkable, and unfair and offered a series of sober predictions concerning its effects. With the first four years of the law’s implementation, the record is clear:

1. The Individual Mandate Is an Enforcement Nightmare. In his bitter primary battle with then-Senator Hillary Clinton (D–NY) for the 2008 Democratic nomination, candidate Senator Barack Obama (D–IL) strongly opposed the imposition of an individual mandate on Americans to buy health insurance. Among Obama’s key arguments was that such a mandate, if enacted, would be unenforceable.[11]

Candidate Obama was correct, but President Obama disagreed. After the 2008 election, the President reversed course and endorsed the mandate. This year, the first year that the mandate penalties are to be imposed, the President has already started backtracking on the enforcement of the provision he signed into law. In 2013, the Administration determined that millions of Americans who had received cancellations of their health insurance policies because they did not meet the new federal standards were to qualify for a “hardship” exemption from the individual mandate for one year, and then extended for two more years, through October 1, 2016.[12] As the editors of The Wall Street Journal have noted, the latest exemption, which surfaced in a “technical bulletin” is remarkably lax and requires nothing more than one’s personal attestation that one “believes” that health plans in the exchanges are either “more expensive” than one’s previous plan or otherwise “unaffordable.”[13] As Politico reports, “According to the decision this month by the administration, you may be able to escape the obligation of the mandate for the rest of the Obama presidency—if you can deal with the paperwork.”[14]

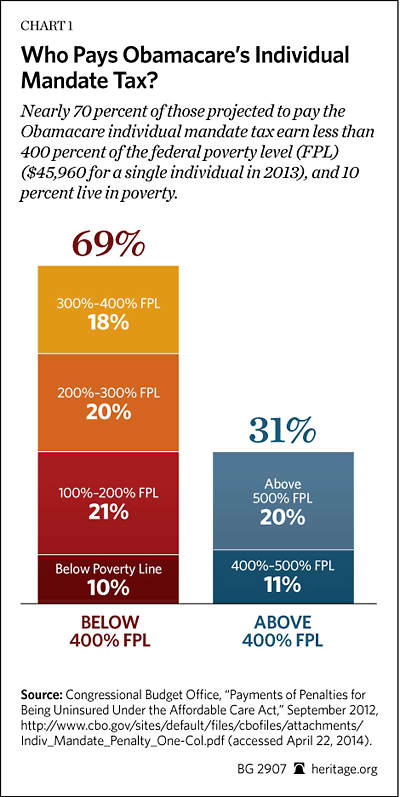

As a statutory matter, the mandate’s financial penalties are very specific. For example, beginning in 2014, the penalty is just $95 annually or 1 percent of income, whichever is greater. The Conressional Budget Office (CBO) projects that in 10 years, over the period 2015 to 2024, these penalty payments will generate $46 billion in revenue.[15] Thus far, however, beyond the statutory exemptions,[16] the administrative application of the mandate and the penalty has turned out to be far more complicated than anyone could have imagined. Scott Gottlieb, MD, a fellow at the American Enterprise Institute, has identified 15 ways that a person could conceivably avoid the tax penalty.[17]

Beyond the administrative and statutory exemptions, as Heritage predicted, its enforcement is even more problematic.[18] The task is left to the Internal Revenue Service (IRS), and the agency’s tools are limited. Under the statute, the IRS cannot impose the standard criminal penalties for those who refuse to buy the government’s level of coverage, or even impose liens, and the sheer physical task of auditing Americans to determine whether they are in compliance with an unpopular law is formidable. In some respects, it is oddly reminiscent of the federal government’s ambitious attempt to try to control personal behavior and enforce the prohibition of the sale of alcohol (“The Noble Experiment”) during the 1920s. In the case of Obamacare’s individual mandate, IRS Deputy Commissioner for Services and Enforcement Steven Miller has already indicated that mass auditing of American citizens was not envisioned and that, instead, the IRS would withhold the tax refunds of those who would not or could not demonstrate that they purchased federally approved levels of insurance coverage.[19]

Complicating the Administration’s enforcement effort is the United States Supreme Court’s 2012 ruling in NFIB v. Sebelius. In a surprising outcome, the Court basically rewrote the individual mandate, clearly enacted as a penalty under the Interstate Commerce Clause, as a constitutionally permissible “tax” under the broad congressional power of taxation. In so doing, the Court explicitly declared that people henceforth would have a “choice” whether or not to pay the tax penalty or enroll in the federal government’s mandated level of health insurance coverage.[20] As a matter of law, the exercise of a personal “choice” is far different from the incuring of a civil penalty for a deliberate violation of federal law. As a matter of public policy, it profoundly weakens the force of the individual mandate, at least on a psychological level.

2. The Law Will Create New Disincentives to Work. In February 2010, House Speaker Nancy Pelosi (D–CA) made the remarkable prediction that the national health care law would create 400,000 jobs right away, and add an estimated 4 million jobs later on.[21] Just last year, David Cutler, professor of economics at Harvard University, said that the “Affordable Care Act is the most serious effort ever made to address the myriad flaws in health care today. If it works as intended, the health of our economy—as well as our people—will be much improved.”[22]

While the Administration and its allies in Congress and academia insist that the law is good for jobs and the economy, America’s business leaders have generally reported a very different viewpoint. The imposition of higher tax rates undercuts the economic incentives for individuals to work and save, or for working harder and saving more of what they earn, which affects both job creation and economic growth. As Dennis Lockhart, president of the Federal Reserve Bank of Atlanta, remarked, “We’ve frequently heard strong comments to the effect of ‘My company won’t hire a single additional worker until we know what health insurance costs are going to be.’”[23] In February 2012, the Gallup Poll survey of small-business owners found that 48 percent were not hiring because of the potential cost of health care. Likewise, in a January 18, 2012, survey for the Chamber of Commerce, 74 percent said that the health care law makes it harder to hire more workers.[24] Even in an early assessment of its impact on the labor force, the Congressional Budget Office (CBO) reported that by 2021, the law would reduce employment by 0.5 percent—the amount of labor used in the economy by an equivalent of 800,000 jobs.[25]

Beyond the uncertainty that has been gripping the business community over the past four years, the law itself creates new disincentives for employees to work.[26] The design of Obamacare’s health insurance subsidies creates an undesirable “cliff effect.” For example, if a single person’s annual income reaches or exceeds 400 percent of the federal poverty level (FPL) ($46,680 in 2014), earning additional income results in a total loss of premium subsidies for health insurance in the exchanges. For individuals and families above 400 percent of the FPL who have lost their employer-based health insurance, the loss of the employer’s subsidy for insurance, accompanied by a generous tax break, means that such persons could face significantly higher health insurance costs in the Obamacare exchanges.

Depending on the states in which they reside, workers may not only face much higher insurance premiums, but also be required to pay much higher deductibles. The law’s exchange subsidies, given their design, will thus not only penalize upward income mobility, but also discourage work. Not surprisingly, the CBO recently issued a report stating that the health care law would reduce the nation’s employment by the equivalent of 2 million full-time workers by 2017, and, assuming the continuation of the law, that number would reach the equivalent of 2.5 million by 2024.[27]

It is worth noting in this context that the CBO’s recent projection of lower costs for the law’s subsidized coverage was largely reflective of bad economic circumstances: lower labor force participation, lower wages and salaries, and fewer eligible persons under the age of 65 than previously estimated. [28]

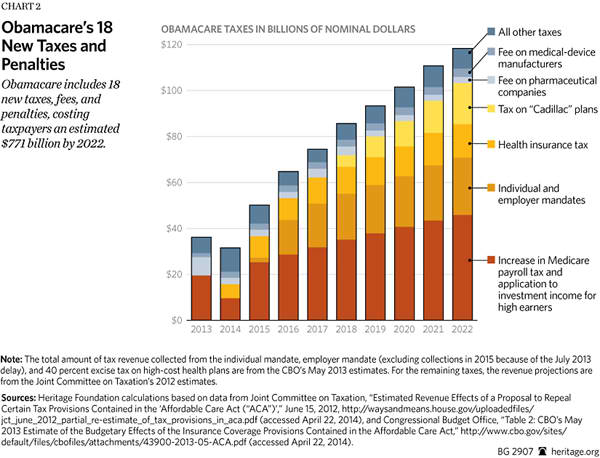

3. The Law, Particularly the Employer Mandate, Will Impose New Costs on Businesses that Undercut Jobs and Wages.[29] The law imposes 18 tax hikes. Many of these tax increases directly affect businesses, and, notwithstanding President Obama’s promises to the contrary, they also hit middle-class Americans. Every dollar taken out of the private economy is a dollar that cannot be spent on consumer purchases or investment spending—precisely the private spending that contributes to economic growth and job creation.

In a study of the direct impact of the law’s specific provisions on large corporations (those with 10,000 or more employees), researchers at the American Health Policy Institute estimated that the total cost of the law over the next 10 years will range from $151 billion to $186 billion, with per-employee costs in the range of $4,800 to $5,900.[30] These additional costs will, of course, affect the price of goods and services for all Americans.

The pending employer mandate and its penalties, once it is partially operational in 2015, will impose new costs on businesses and is likely to slow job growth and also result in significant workplace changes.[31] In anticipation of the reporting and compliance requirements of the employer mandate, workforce changes have already taken place. One of the effects of the law has been to encourage employers to start shifting more members of their workforce from full-time to part-time jobs, particularly in low-wage occupations. In California, private institutions, such as the Mexican American Opportunity Foundation and Fatburger fast-food restaurants, cut employees’ hours to fewer than 30 hours per week, while public institutions, such as the City of Long Beach and the City of San Gabriel, did the same.[32] While these new part-time workers would see their hours and wages cut, they would likely be eligible for generous premium subsidies in the exchanges. The work-reduction cycle thus imposes collateral costs: The lower these workers’ wages, the higher the subsidies and the bigger the burden on taxpayers.

Timothy Jost concedes that “[e]mployers may continue to reduce employees to thirty hours or otherwise try to avoid offering health insurance to their employees. Insured and self-insured will bear part of the cost of expanding coverage and reinsuring high cost enrollees in the individual market, increasing their costs.”[33] The impact would vary, of course, from state to state. In Illinois between 2011 and 2013, for instance, the state lost the equivalent of 63,000 jobs in the retail, food and beverage, and general merchandise sectors of the state’s economy.[34]

Peter Orszag, President Obama’s former Director of the Office of Management and Budget (OMB), applauds the delay of the penalty provisions of the employer mandates until 2015. He also concedes that “the penalty is far from perfect. At the margin, for example, it has the effect of discouraging employment of low- and moderate-wage workers—the ones who could get subsidized coverage through the exchanges—relative to high-wage workers.”[35] When the employer mandate’s reporting and penalty provisions finally take effect, it is likely that these unfavorable employment and coverage trends will accelerate throughout the country.[36]

4. The Law Undermines Competition and Further Consolidates Health Insurance Markets. At the outset of the national health care debate, President Obama argued forcefully—and correctly—that America’s health insurance markets were insufficiently competitive.[37] Researchers at the Kaiser Family Foundation say that the “long-term success of the exchanges and other ACA provisions governing market rules will be measured in part by how well they facilitate market competition, providing consumers with a diversity of choices and hopefully lower prices for insurance than would have otherwise been the case.”[38]

But a competitive health insurance market is governed by consumer demand, and carriers offer products to meet that demand. Thus, there would normally be a wide variety of different plans, combinations of benefits and premiums, new products, and innovative delivery programs. Insurance carriers, directly accountable to consumers, would respond rapidly to consumer demands or lose market share.

The health law’s exchanges are nothing like such a free and open market.[39] They are federally supervised agencies that serve as a mechanism to enforce federal insurance regulations, and they create a very different economic environment. The health law imposes standardization and uniformity. Since all plans and levels of coverage are standardized and there can be no deviation from what is permitted either by statute or regulation, the national health law substitutes central planning for economic freedom, or what some on the Left champion as “choice without complexity.”

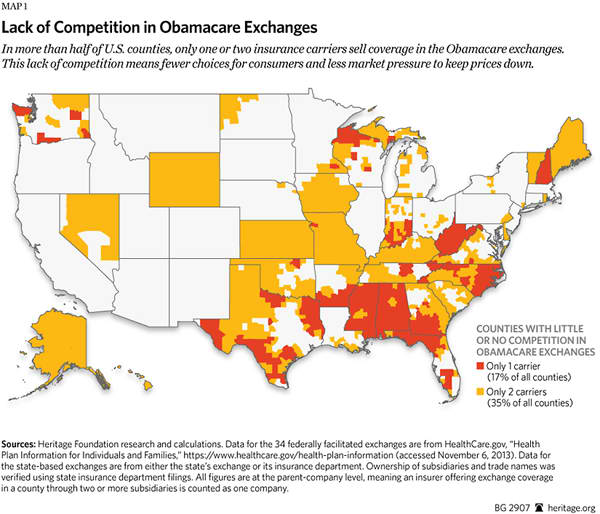

In their preliminary examination of competition in the states, Kaiser Family Foundation analysts found mixed results, with large states like California and New York being more competitive and Connecticut and Washington State being less competitive.[40] The Heritage Foundation analysis of federal and state exchanges shows that the law has, in general, reduced competition and consolidated the health insurance markets even more. Indeed, between 2013 and 2014, the number of insurers offering coverage on the individual markets in all 50 states has declined nationwide by 29 percent.[41] Worse, on a county level, health insurance market competition has resulted in 52 percent of U.S. counties having just one or two health insurance carriers.[42] Instead of robust competition in the health insurance markets, Americans are, as Heritage predicted, faced with less choice and reduced competition.[43]

5. The Law Guarantees Major Premium Increases. Among many other claims, President Obama routinely said that the enactment of his health reform agenda would result in an annual reduction in the “typical” family health insurance premiums of $2,500.[44] Likewise, Jonathan Gruber, professor of economics at MIT, asserted, “What we know for sure is that the bill will lower the cost of buying non-group health insurance.”[45]

The President’s claims were never credible. Early in the congressional debate, during consideration of the Senate bill in November 2009, the CBO reported that the measure would increase average non-group premiums between 10 percent and 13 percent.[46] Recently, the CBO revised its estimates of projected premium costs downward for a variety of reasons: The plans in the exchanges have “narrower networks” for providers than the CBO previously anticipated; doctors and other medical professionals will be paid less under the exchange plans’ contracts; and the plans appear to be imposing “tighter management” on the use of medical services than do employer-based plans.[47] While premium increases are lower than earlier estimates, the general trend is still one of steadily higher projected premiums in the exchanges, not, as the President promised, premium payment reductions.[48]

Of course, there are a variety of factors that drive premium increases in the various health insurance markets around the nation, but the national health law imposes several rules and conditions that guarantee even higher premium increases than would otherwise have been the case. For example, the law limits cost sharing for enrollees, which will require insurers to pay more of the cost of covered services. This simply shifts those costs from patients directly to the patients’ payment of plan premiums. The law also prohibits any cost sharing for specific medical services, such as preventive care services, which will doubtless stimulate higher utilization of those services and, thus, higher plan premiums. The law also requires all “qualified” health plans to cover 10 categories of medical benefits and services. These benefits or services may have been previously excluded from plan coverage, or payment for them may have been more limited.

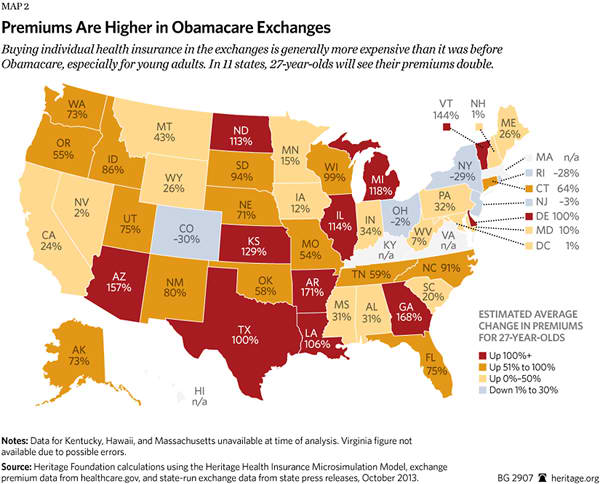

Thus, as Heritage predicted,[49] the average annual premiums for single and family coverage in 2014 are rising in the state and federal health insurance exchanges all around the country. In 11 states, premiums for 27-year-olds have more than doubled since 2013; in 13 states, premiums for 50-year-olds have increased more than 50 percent.[50]

The law is also contributing to premium increases in the group market. Based on the new insurance rules effective in 2014, the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS) estimates that 65 percent of small firms will experience premium rate increases, while 35 percent are expected to have rate reductions; and 11 million Americans employed by these firms will experience premium rate increases, while about 6 million are anticipated to have premium rate reductions.[51] An April 2014 survey by analysts with Morgan Stanley records an 11 percent increase in the small group market, with the Blue Cross Blue Shield plans reporting average rate increases of 16 percent for renewing contracts.[52]

For 2015, health insurance officials are reporting that premiums will be higher next year in the exchanges and could also jump by double digits in the employer group health insurance market.[53]

6. The Law Discourages Insurance Enrollment Among the Young. In a 2013 interview with Chris Wallace of Fox News, Neera Tanden, president of the Center for American Progress, insisted that the law will be a good deal for young Americans: “The idea of the Affordable Care Act is that they have a much better health care plan. A lot of younger people are seeing a much better deal in this whole system.… It’s just not fair to say that they’re not getting a better health care plan.”[54]

The Administration and its allies have been engaged in an intense public relations campaign to convince young Americans that its product is a “good deal” and that they should sign up for coverage in the exchanges. But when insurers are required by law to charge premiums to young people that do not comport with their own health care costs or risks, young people have strong incentives not to enter the insurance market, since they perceive the costs as outweighing the benefits. Scare tactics, gimmicky advertising schemes, and hyped-up celebrity appeals say little about the economic value in such a transaction for high-dollar insurance. A complicating factor is the sharp increase in health insurance deductibles, which turned out to be much higher in the exchanges than in employer-based coverage.[55]

In fact, for most consumers, the provisions of the law guarantee that health insurance costs will be higher in 2014 than they were in 2013. Health insurers are forbidden to apply pre-existing-condition exclusions on a person’s coverage for any reason. Moreover, the law limits the ability of insurers to increase premiums for older persons, even though higher, age-related premiums would correctly represent the actuarial risk that is to be covered by their insurance. In general, under the national health law, an older person cannot be charged more than three times the premium charged to a younger person. These rules are designed to make health insurance more affordable for older and sicker enrollees, but they jack up premiums for the younger and healthier persons and thus are likely to discourage a sufficient number of younger and healthier from enrolling.

Heritage thus predicted[56] that many younger and healthier individuals will be discouraged from buying the new federally standardized health insurance, notwithstanding the government’s threats to impose penalties on them under the individual mandate. The law’s insurance rules and new benefit mandates will make it cheaper for many younger Americans simply to remain uninsured and pay the paltry fine.

Administration officials recently announced that they reached and surpassed their March 31, 2014, goal, enrolling 8 million people in the state and federal health insurance exchanges. The CBO originally projected that 7 million people would sign up for insurance in the exchanges but subsequently revised that estimate down to 6 million in the wake of the disastrous “roll-out” of the government website on October 1, 2013.[57]

While insurance coverage is surely expanding, Administration officials concede that increase in exchange enrollment is not the same as increased insurance coverage. The Blue Cross Blue Shield Association (BCBS), which is operating in virtually every state, has already reported that between 15 percent and 20 percent of the new enrollees have not paid their initial premiums, meaning that they are not actually covered.[58] As the CBO observes, “The number of people who will have coverage through the exchanges in 2014 will not be known precisely until after the year has ended.”[59]

To discern the role of exchanges as a mechanism for reducing the numbers of those who previously were uninsured, analysts will also have to tease out the numbers of exchange enrollees who signed up because their previous policies had been cancelled. Many of these cancellations were due to the fact that previous policies, regardless of enrollees’ personal preferences, did not meet the law’s new regulatory requirements. For example, in 2013 an estimated 4.7 million people in 34 states had their previous policies cancelled,[60] though that number would surely be significantly larger if analysts had tracked or state officials reported cancellations in all 50 states. The Rand Corporation estimated that slightly more than one-third of enrollees were previously uninsured.[61] In a recent survey conducted by Bankrate.com, a personal finance website, approximately one-third of the uninsured said that they plan to remain uninsured.[62] A key reason: 41 percent of them said that the health insurance was too expensive.[63]

Sheer numbers, in any case, do not secure the stability of the exchange insurance coverage. Independent analysts will be examining the characteristics of the enrolled population and the demographic mix over the coming months. One such key variable will be health status—the number of enrollees who are in good or excellent health compared to the number who are in fair or poor health. A preliminary report from U.S. News & World Report on the first two months of exchange claims data indicates that the new enrollees are more likely to use high-cost prescription drug therapies for serious and chronic medical conditions than enrollees in employer-based health plans are.[64] The other crucial variable is, of course, the age of the enrollees. In 2013, Obama Administration officials said that their goal was for young adults between the ages of 18 and 34 to account for 40 percent of exchange enrollments.[65] Preliminary data suggest that there was indeed an increase in the number of enrollments among the young before the March 31 deadline, with Rhode Island, for example, reporting an increase from 26 percent to 28.5 percent of total sign-ups.[66]

On April 17, 2014, the White House announced that 28 percent of the enrollees in the federally administered exchanges were between 18 and 34 years of age—the crucial age bracket for a robust insurance pool—and that 35 percent of the total enrollees were under the age of 35.[67] Politico reported that those under 35 include children who are covered under the exchange plans.[68] The Department of Health and Human Services previously reported that as of March 11, 2014, 27 percent of enrollees in the nation’s exchanges were between the ages of 18 and 34, while 67 percent were age 35 and older.[69]

Another imponderable is whether those who enroll will stay enrolled, particularly the young and healthy. As Harvard’s Professor Cutler has warned, “If it becomes a permanent situation that people who are healthier stay away and people who are sicker go into the exchanges, that becomes a very big problem. That could be the beginning of a death spiral; that is, you could have a situation where the only people in the exchanges are very unhealthy people with very high premiums.”[70]

7. The Law’s Medicare Savings Would Not Financially Strengthen Medicare. With enactment of the Affordable Care Act, the savings generated from its Medicare payment reductions, according to the Administration and its allies, would simultaneously enhance Medicare “solvency” and finance other mandatory health-coverage expansions and subsidies.[71]

This was never credible. In April 2010, in their very first examination of the Affordable Care Act, the nonpartisan analysts at the Congressional Research Service (CRS) observed, “Reductions in Medicare expenditures can be used to extend the solvency of the HI [health insurance] trust fund or used to offset the costs associated with expansion of health insurance coverage; using both accounting methods at the same time would result in double counting a large share of those savings.”[72] In April 2010, Richard S. Foster, Chief Actuary at HHS, also clarified the problem:

Based on the estimated savings for Part A of Medicare, the assets of the Hospital Insurance trust fund would be exhausted in 2029 compared to 2017 under prior law—an extension of 12 years. The combination of lower Part A costs and higher tax revenues results in a lower federal deficit based on budget accounting rules. However, trust fund accounting considers the same lower expenditures and additional revenues as extending the exhaustion date of the HI trust fund. In practice, the improved HI financing cannot be simultaneously used to finance other federal outlays (such as the coverage expansions) to extend the trust fund, despite the appearance of this result from the respective accounting conventions.[73]

Congress was fully aware of the problem before Obamacare was signed into law. In January 2010, Senator Jeff Sessions (R–AL), Ranking Member on the Senate Budget Committee, had received confirmation from CBO Director Douglas Elmendorf that the law did not secure funding for future Medicare benefits: “Unified budget accounting shows that the majority of the HI trust fund savings under PPACA [Patient Protection and Affordable Care Act] would be used to pay for other spending and therefore would not enhance the ability of the government to pay for future Medicare benefits.”[74]

8. The Law’s Medicare Changes Will Result in Reduced Benefits and Threaten Seniors’ Access to Care. Within one month of the enactment of the Affordable Care Act, Richard Foster, then Chief Actuary at HHS, issued a major report on the impact of the Medicare payment reductions. The Actuary estimated that the payment reductions, primarily in Medicare Part A and Part C (Medicare Advantage), would yield an initial 10-year savings of $575 billion.[75] Foster warned that over time, the Part A cuts would undermine the ability of some Part A institutions—hospitals, home health agencies, nursing homes, and even hospice care facilities—to continue to participate in the program; that roughly 15 percent of these Part A providers would become unprofitable under the law’s financial pressures; and that without congressional intervention to reverse these reductions, seniors’ access to care would be jeopardized.[76]

Since 2010, the CBO has re-estimated the 10-year Medicare payment reductions, which have now reached $716 billion. The Administration and its allies in Congress and the media routinely downplayed the impact of these payment reductions, stressing that these were cuts to Medicare providers and overpaid health plans in Medicare Part C (Medicare Advantage) and that patients and their benefits would be held harmless. In fact, this was an exercise in rhetorical and irrelevant hair splitting. The notion that one could cut payments to medical services without negatively affecting persons dependent on those services was plainly absurd. Worse yet, these “savings” are not used to shore up Medicare solvency, but used instead to pay for other spending in the law.

In the case of Medicare Advantage, the issue of whether one could cut payments without cutting benefits was directly addressed during the congressional debate. On September 22, 2009, during the Senate Finance Committee’s consideration of the Senate version of the health care bill, Senator Mike Crapo (R–ID) closely questioned CBO Director Elmendorf. The topic was the impact of the Administration’s proposed cuts in the value of benefits in the Medicare Advantage program:

Senator Crapo: It is my understanding that under your analysis the value of the additional benefits that those in Medicare Advantage receive today would end up being reduced to about $46 a month per member in 2019. And that is a little more, but not too much more, than just half of what it is today?

Mr. Elmendorf: My notes say $42 of additional benefits per month in 2019, and I’m told that it’s a little less than half of what we would project under current law.

Senator Crapo: So, approximately half of the additional benefit would be lost to those current Medicare Advantage policy holders?

Mr. Elmendorf: For those who would be enrolled under current law, yes.

Senator Crapo: So, the current plan holders would recognize about half the benefits they see today under the current law?

Mr. Elmendorf: Yeah, that’s right.[77]

In 2011, the law provided that Medicare Advantage payment rates would be frozen. In 2012, the Obama Administration papered over the initial scheduled Medicare Advantage payment cuts by transferring more than $8 billion from a special CMS demonstration program used for “quality bonus” programs—an unusual administrative action measure to compensate for the law’s funding gap, and one of dubious legality.[78]

Payment cuts have both an acute impact and a cumulative effect, and plans and providers must account for the impact immediately and over time. Medicare Advantage plans are attempting to absorb these reductions even as they try to service a large and rapidly growing Medicare population. Private-sector providers must plan and take into consideration a variety of contingencies over which they have no control. In 2014, some high-profile Medicare Advantage plan-provider cutbacks have already taken place. United Healthcare, one of the largest Medicare Advantage participants, sent pink slips to physicians in 10 states, and the Cleveland Clinic has cut its budget by $100 million in anticipation of the law’s impact.[79]

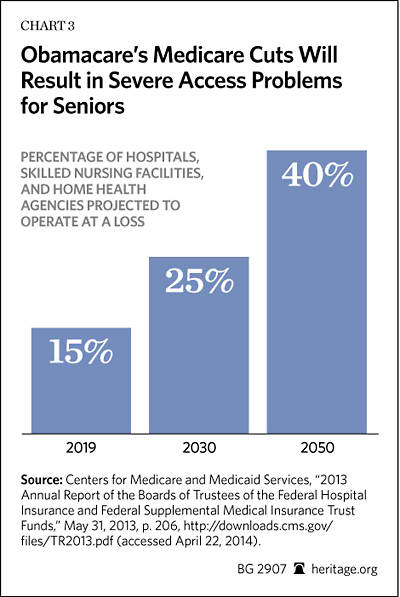

Likewise, in Part A, the Medicare payment cuts are well under way. In his 2011 report, the Medicare Actuary restated his initial estimate of the impact of the law on Part A providers. In the addendum to their 2012 report, the Medicare trustees reaffirmed the Actuary’s initial assessment that by 2019, the Medicare Part A payment cuts will cause an estimated 15 percent of Medicare providers to operate in the red, shift costs to private payers, or withdraw from treating Medicare patients altogether. By 2030, the number of these Medicare providers operating in the red would climb to 25 percent, and by 2050, that number would reach 40 percent. These assessments were reaffirmed in the 2013 Medicare Trustees Report.

The law’s impact is fairly straightforward: Fewer Medicare providers, reimbursed at rates progressively reduced over time, will create access problems for patients. Indeed, according to the Medicare Trustees, the law’s Medicare provider rates will eventually match and dip below Medicaid’s bargain-basement rates; and Medicaid patients often have trouble finding medical professionals who are willing to care for them. By 2030, Medicare providers are projected to be caring for approximately 80 million Medicare enrollees, and, under the law, they will be doing so at progressively lower rates of reimbursement.[80] The law, therefore, will not—indeed cannot—guarantee seniors’ access to future Medicare benefits.

9. The Law Compels Taxpayers to Fund Abortion and Weakens Protections of the Right of Conscience. In an August 20, 2009, speech, President Barack Obama said, “There are no plans under health reform to revoke the existing prohibition on using federal taxpayer dollars for abortions.”[81]

The President’s reassurances turned out to be untrue. Federal policy, under the Hyde amendment, established a wall of separation between federal taxpayer dollars and abortion coverage. But under Section 1334 of the ACA, Congress created multi-state plans, to be administered by the OPM, that are to compete against private health plans in the federal and state health exchanges throughout the country. There must, under the law, be at least two such plans, and only one of them must not provide abortion coverage. Also, under Section 1303, federal taxpayer dollars can go to health plans that fund abortion.[82]

Even as it expands taxpayer funding for abortion, the law’s conscience protections are limited in scope and thus routinely invite internal bureaucratic restrictions and stimulate new external legal challenges by interest groups hostile to the exercise of rights of conscience by religious organizations.[83] The clearest break with traditional American practice is, of course, the HHS regulatory mandate that forces American employers to provide coverage for abortion-inducing drugs (such as “Ella”) and applies it to employers and employees, including the Little Sisters of the Poor and other religious institutions, regardless of their conscientious objections.

Numerous organizations have filed suit against the mandate, and have won cases in the lower federal courts. With the 2014 case of Hobby Lobby v. Sebelius and the disposition of the issue before the United States Supreme Court, the Court’s decision will turn out to be one of the most important cases in American constitutional law. Nonetheless, it is safe to say that four years ago, millions of Americans did not expect that the national health care law would become a vehicle for an aggressive government infringement of personal liberty or coerce Americans to fund medical procedures and drugs in direct violation of their ethical and religious convictions.

Conclusion

Four years ago, the President and his congressional allies enacted into law a comprehensive measure to achieve universal health insurance coverage, control costs and reduce insurance premiums, improve the quality of care, and resolve the many problems that plague America’s health insurance markets.

To accomplish these ends, the Affordable Care Act prescribes a broad range of statutory requirements: mandates and penalties on individuals and employers; comprehensive and standardized health care benefits, detailing the services that must be provided; more liberal insurance rules governing enrollment; federal control of insurance administrative costs; generous taxpayer subsidies for plan premiums through the federal and state health insurance exchanges; and rules on cost sharing and special subsidies to reduce out-of-pocket health care costs for low-income persons. The President and his allies also anticipated that the law would result in greater competition in the health insurance exchanges, even as enrollment would soar with the carrot of premium and cost-sharing subsidies and the stick of an individual mandate on Americans who will be penalized if they refuse to purchase the federally required health insurance coverage.

Four years ago, many health policy analysts, including those at The Heritage Foundation, predicted that the American people would face sticker shock not only due to higher health insurance premiums, but also due to higher taxes; that patient choice and competition among insurers would decline; and that Medicare would face tougher financial pressures even as anticipated increases in new entitlement spending threaten taxpayers with enormous future obligations. Four years later, it is not surprising that these predictions are coming true. There are more to come.

—Robert E. Moffit, PhD, is Senior Fellow in the Center for Health Policy Studies at The Heritage Foundation.