The federal government pays its employees substantially more than they would earn in the private sector. The current federal pay system:

- Pays hourly wages 22 percent above that of comparable private sector workers;

- Provides more generous health care and pension plans;

- Provides total compensation on the order of 30 percent to 40 percent above similarly skilled private sector workers; and

- Offers near-total job security and insulates federal employees from recessions.

Congress should not overtax all Americans to overpay the privileged workers in the federal civil service. Aligning federal compensation with market rates would save taxpayers approximately $47 billion a year. Congress should immediately act to bring equity to federal pay.

Federal Government Pays More

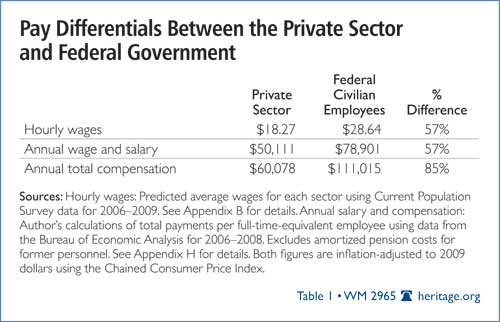

The federal government pays significantly more than the private sector: Hourly wages and annual income are 57 percent higher than in the private sector. Adding in the value of non-cash benefits increases the federal total compensation premium to 85 percent. Different skills justify part of this higher pay. The typical federal employee has more education and experience than the typical private sector worker.

However, the superior skills of federal employees explain only part of their higher pay. After controlling for observable skills and characteristics, federal employees still get cash wages 22 percent more per hour than comparable private workers. Federal employees in occupations that also exist in the private sector—such as computer programmers, human resource specialists, and accountants—enjoy a similar premium.[1] The federal government pays substantially more than the amount accounted for by federal employees’ skills.

Generous Benefits

The federal government also provides generous non-cash benefits: an average of $32,115 per employee annually, over triple the average non-cash compensation of the average private sector worker ($9,882 a year). The federal government gives its workers excellent health coverage and offers them both a defined benefit and defined contribution pensions. Federal employees get more paid leave than private sector workers and receive other perks that few private workers do —such as student loan repayments and on-site child care.[2]

The superior skills of federal workers explain even less of these generous benefits than they do hourly pay. The typical federal employee has almost four times greater odds of participating in a pension plan than a comparably skilled private sector worker.

Data limitations make measuring the precise cost of overcompensation for federal employees difficult. However, conservative estimates show that the federal government pays an average of 30–40 percent greater total compensation than comparable private sector workers would receive.[3]

Federal Employers Rarely Fired or Quit

In addition to higher earnings, federal employees enjoy far greater job security than private sector workers. Federal agencies rarely lay off employees for poor performance. The government does not let workers go in economic downturns, either.

The federal government has hired 240,000 net new employees even as private employers have shed 8 million net jobs. Unemployment among federal employees has only slightly risen—to 2.9 percent—during the recession.[4] The federal government insulates its employees from the business cycle.

Federal employees also enjoy much more comfortable working conditions than most private sector workers. As result, they rarely quit. In fact, federal employees voluntarily quit at just one-third the rate of private sector workers.[5]

Excessive average federal compensation redistributes wealth from less-well-paid private sector workers to more highly paid federal employees. Congress should not engage in this reverse redistribution of wealth. The ticket to financial success should not be the good fortune of landing a job with Uncle Sam.

Significant Taxpayer Savings from Pay Reform

Congress would save taxpayers approximately $47 billion a year if it reduced federal compensation to market rates.[6] This would not eliminate the deficit alone, but it would be an important step toward putting America’s fiscal house in better order.

However, Congress should reform federal pay wisely. Although the average federal worker earns above-market wages, not all federal workers do. Because the federal government bases raises largely on seniority and not performance, many highly skilled and high-performing federal workers do not earn above-market pay.

Uniformly cutting federal pay would inappropriately penalize productive federal employees. Instead, Congress should equitably reduce federal pay to market rates by:

- Abolishing the General Schedule and implementing market-based performance pay;

- Expanding the contracting out of non-essential tasks to the private sector;

- Reducing the generosity of the benefits the federal government provides; and

- Ending restrictions on dismissing underperforming federal employees, thus incentivizing increased productivity.

Reduce Federal Pay to Market Rates

Federal employees get substantially better wages and benefits than do the private sector workers whose taxes fund their paychecks. After controlling for education, experience, and other observable characteristics, federal employees earn cash wages 22 percent above comparable private sector workers. Adding in the value of non-cash benefits raises their total compensation premium to 30 to 40 percent.

If Congress reduced federal pay to market rates, it would save taxpayers approximately $47 billion a year. Congress should stop giving federal employees inflated earnings before considering raising taxes.

James Sherk is Senior Policy Analyst in Labor Economics in the Center for Data Analysis at The Heritage Foundation.