Introduction

The public is often told that the current welfare system does not promote long-term dependence. This is untrue.

- The 4.7 million families currently receiving Aid to Families with Dependent Children (AFDC) have already spent, on average, six-and-a-half years on welfare.

- When past and estimated future receipt of AFDC are combined, the estimated average length of stay on AFDC, among those families currently receiving benefits, is an astonishing 13 years.

- Among the 4.7 million families currently receiving AFDC, over 90 percent will spend over two years on the AFDC caseload. More than three quarters will spend over five years on AFDC.

The current liberal system is based on the assumption that higher welfare benefits and expanded welfare eligibility are good for children. According to this theory, "poverty" is harmful for children, and welfare, by allegedly reducing poverty, will increase children's lifetime well-being and attainment. This is untrue. Higher welfare payments do not assist children; they increase dependence and illegitimacy, which have a devastatingly negative effect on children's development. It is welfare dependence, rather than poverty, which has the most negative effect on children.

- Recent research by Congressional Budget Office Director June O'Neill shows that increasing the length of time a child spends on welfare may reduce the child's IQ by as much as 20 percent.

- welfare receipt as a child has a negative effect on the earnings and employment capacity of young men. The more welfare income received by a boy's family during his childhood, the lower will be the boy's earnings as an adult, even when compared to boys in families with identical non-welfare income.

- Receipt of welfare and living in a single-parent family during childhood are strongly associated with criminal activity among young men and having illegitimate children among young women.

Overall, welfare operates as a form of social toxin. The more of this toxin received by a child's family, the less successful will be the child as an adult.

The House and Senate will soon pass welfare reform legislation based on three key principles:

1) Reducing the growth of illegitimacy;

2) Reducing dependence by requiring welfare recipients to work; and

3) Limiting the explosive growth of welfare spending.

The public strongly supports the key provisions of the congressional reforms. According to recent polls:

- By a margin of 84 percent to 13 percent, Americans support a "family cap." Eighty-four percent "oppose increasing a welfare mother's monthly welfare check if she has another child out-of-wedlock."

- Three out of four Americans believe welfare encourages illegitimacy. By a ratio of two to one, Americans feel that reducing illegitimacy is a more important goal in welfare reform than attempting merely to make single mothers self-sufficient.

- Still, nine out of ten Americans feel that welfare recipients should have "to work for their benefits." However, they feel overwhelmingly that work requirements should be imposed on welfare mothers with older children before they are imposed on mothers with pre-school children.

The Pattern of Dependence: Length of Time on welfare

The public is often told that the current welfare system does not promote long-term dependence. According to this picture, AFDC generally provides temporary aid, and very few recipients receive welfare for extended periods. This picture is inaccurate.

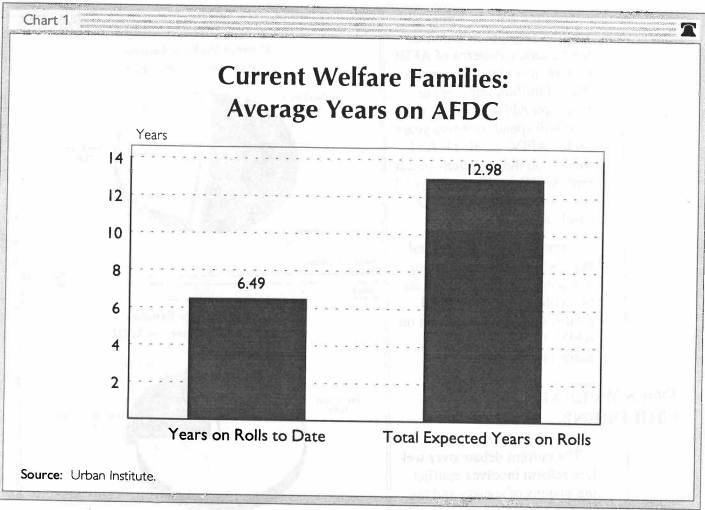

Of the 4.7 million families currently receiving AFDC, most will be dependent on welfare for very long periods of time. As Chart 1 shows, families receiving AFDC at the present time have already spent, on average, six-and-a-half years enrolled in AFDC.1 When past receipt and estimated future receipt of AFDC are combined, the estimated average length of stay on AFDC among those families currently receiving AFDC benefits is an astounding 13 years.2 Moreover, these figures actually underestimate the length of welfare dependence, since such families are very likely to receive other welfare benefits (such as food stamps, SSI, Medicaid, and housing) even after they leave the AFDC caseload.

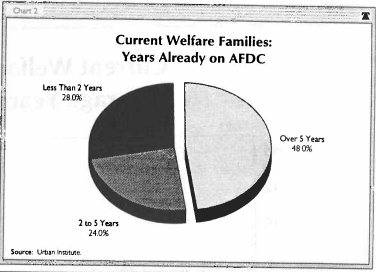

As Chart 2 shows, among those families currently receiving AFDC, 72 percent have already spent over two years on AFDC, and nearly half have already spent over five years on AFDC.

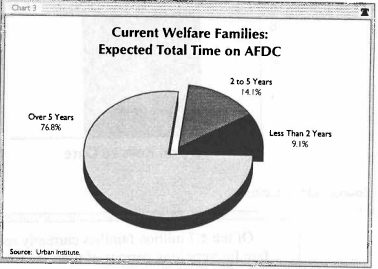

Looking into the future and making projections based on the historical patterns of AFDC receipt, it is clear that among the 4.7 million families currently on AFDC, over 90 percent will spend over two years on the AFDC caseload. And more than three quarters of current AFDC families will spend over five years on the AFDC caseload.

Long-term welfare dependence is most common among women who have children out of wedlock. Never-married mothers, in general, remain on AFDC twice as long as divorced mothers.

Does welfare Benefit Children?

The current debate over welfare reform involves conflicting visions of society and the impact of welfare on human behavior. Real reform will not be achieved until specific core assumptions which form the foundation of the modern welfare state have been overturned and discarded. From its onset, the liberal welfare state has been founded on faulty logic. This flawed logic, embedded in nearly all liberal thinking about welfare, runs something like this:

PREMISE #1: Children in families with higher income seem to do better in life.

PREMISE #2: welfare can easily raise family income.

Conclusion: Therefore, welfare is good for kids.

From this logic has sprung a relentless thirty-year effort to raise welfare benefits, expand welfare eligibility, create new welfare programs, and increase welfare spending. The current proposal from Congress to slow down the automatic growth of welfare spending violates these cardinal tenets of the liberal welfare system and thus has led to cries of alarm from the welfare establishment.

In fact, each of the central tenets of modern welfare is misleading and deeply flawed. Together they become a recipe for a disastrous system of aid which harms rather than helps, aggressively crushing the hopes and future of an increasing number of young Americans.

It is useful to examine each of these cardinal liberal tenets individually. The first is that raising incomes is crucial to the well-being and success of children. The common liberal corollary to this premise is that poverty "causes" such problems as crime, school failure, low cognitive ability, illegitimacy, low work ethic and skills, and drug use. Hence, reducing poverty through greater welfare spending will reduce most social problems. history refutes this belief. In 1950, nearly a third of the U.S. population was poor (twice the current rate). In the 1920s, roughly half of the population was poor by today's standard. If the theory that "poverty" causes social problems were true, we should have had far more social problems in those earlier periods then we do today. But crime and most other social problems have increased rather than fallen since these earlier periods.

history and common sense both show that values and abilities within families, not family income, lead to children's success. Families with higher incomes tend to have sound values concerning self-control, deferred gratification, work, education, and marriage which they pass on to their children. It is those values, rather than the family income, that are key to the children's attainment. Attempting to raise the family income artificially through welfare is very unlikely to do much to benefit the child, but it is likely to destroy the very values which are key to the child's success.

The second flawed liberal premise is that it is very easy to raise family income through welfare. This also is untrue. Because welfare reduces work effort and promotes illegitimacy and poverty-prone single-parent families, it actually may cause an overall decrease in family incomes. welfare is extremely efficient at replacing self-sufficiency with dependence, but relatively ineffective in raising incomes and eliminating poverty.

This is borne out by experimental evidence. During the late 1960s and early 1970s, social scientists at the Office of Economic Opportunity (OEO) conducted a series of controlled experiments to examine the effect of welfare benefits on work effort. The longest running and most comprehensive of these experiments was conducted between 1971 and 1978 in Seattle and Denver, and became known as the Seattle/Denver Income Maintenance Experiment, or "SIME/DIME."3

Advocates of expanding welfare had hoped that SIME/DIME and similar experiments conducted in other cities would prove that generous welfare benefits did not affect "work effort" adversely. Instead, the SIME/DIME experiment found that each $1.00 of extra welfare given to low-income persons reduced labor and earnings by an average of $0.80.4 The significant anti-work effects of welfare benefits were shown in all social groups, including married women, single mothers, and husbands. The results of the SIME/DIME study are directly applicable to existing welfare programs: Nearly all have strong anti-work effects like those studied in the SIME/DIME experiment.

The third liberal tenet is that higher welfare benefits and broadened eligibility will help children and improve their success in later life. In certain limited cases, such as when welfare is needed to eliminate serious malnutrition, welfare can help. But there is no evidence that enlarging benefits and expanding enrollments in most U.S. welfare programs will improve children's lives. While higher welfare payments and spending do not benefit children directly, they do increase dependence and illegitimacy, both of which have devastating negative effects on child well-being. Thus, overall, welfare operates as a system of organized, well-funded child abuse.

The available scientific evidence clearly refutes the liberal hypothesis that attempting to raise family income through more generous welfare payments will benefit children. For example, the average monthly value of welfare benefits (AFDC and food stamps combined) varies between states. The conventional liberal assumption is that children on welfare in states with lower benefit levels will be markedly worse off than children in states with higher benefits. Children on AFDC in high benefit states, according to the theory, should have improved cognitive ability when compared to children without access to more generous welfare. However, recently published research by Congressional Budget Office Director June O'Neill and Anne Hill of Queens College, City University of New York, demonstrates that this theory is incorrect. O'Neill and Hill examined the IQs of young children who were long-term welfare dependents, having spent at least half of their lives on AFDC. Contrary to the expected theory, they found that the higher welfare benefit did not improve children's cognitive performance. The IQs of long-term welfare-dependent children in low-benefit states were not appreciably different from those in high benefit states.5

Moreover, this picture is overly optimistic. In restricting the sample to long-term dependent children, the analysis ignores the effects of higher welfare benefits in encouraging welfare enrollment and lengthening the time spent on welfare. O'Neill and Hill have shown that a 50 percent increase in monthly AFDC and food stamp benefit levels will lead to a 75 percent increase in the number of mothers with children enrolling in AFDC and a 75 percent increase in the number of years spent on welfare.6 Once the effects of increased dependence are included, it becomes clear that higher welfare benefits have a decisively negative effect on children.

Comparing children who were identical in social and economic factors such as race, family structure, mothers' IQ and education, family income, and neighborhood residence, Hill and O'Neill found that the more years a child spent on welfare, the lower the child's IQ. The authors make it clear that it is not poverty but welfare itself which has a damaging effect on the child. Examining the young children (with an average age of five-and-a-half), the authors found that those who had spent at least two months of each year since birth on AFDC had cognitive abilities 20 percent below those who had received no welfare, even after holding family income, race, parental IQ, and other variables constant.7

O'Neill and Hill conclude:

A similar study by Mary Corcoran and Roger Gordon of the University of Michigan shows that receipt of welfare income has negative effects on the long-term employment and earnings capacity of young boys. The study shows that, holding constant race, parental education, family structure, and a range of other social variables, higher non-welfare income obtained by the family during a boy's childhood was associated with higher earnings when the boy became an adult (over age 25).9 However, welfare income had the opposite effect: The more welfare income received by a family while a boy was growing, up the lower the boy's earnings as an adult.10

Typically, liberals would dismiss this finding, arguing that families which receive a lot of welfare payments have lower total incomes than other families in society, and that it is the low overall family income, not welfare, which had a negative effect on the young boys. But the Corcoran and Gordon study compares families whose average non-welfare incomes were identical. In such cases, each extra dollar in welfare represents a net increase in overall financial resources available to the family. This extra income, according to conventional liberal welfare theory, should have positive effects on the well-being of the children. But the study shows that the extra welfare income, even though it produced a net increase in resources available to the family, had a negative impact on the development of young boys within the family. The higher the welfare income received by the family, the lower the earnings obtained by the boys upon reaching adulthood. The study suggests an increase of $1,000 per year in welfare received by a family decreased a boy's future earnings by as much as 10 percent.

A further refinement of the Corcoran and Gordon study adjusted for differences in years spent by a family in poverty. The study showed that, in general, if two families had the same level of non-welfare income and spent the same amount of time "in poverty," the more welfare income received by the family, the worse the consequences for a boy raised in the family. For example, if two boys were raised in families with identical non-welfare incomes and spent the same time "in poverty," the more welfare received by one of the families, the lower the earnings of the boy raised in that family when he becomes an adult.

Other studies have confirmed the negative effects of welfare on the development of children. For example, young women who are raised in families dependent on welfare are two to three times more likely to drop out and fail to graduate from high school than are young women of similar race and socioeconomic background not raised on welfare.11 Similarly, single mothers who were raised as children in families receiving welfare remain on AFDC longer as adult parents than do single mothers who were not raised in welfare families, even when all other social and economic variables are held constant.12

Boys raised in single-parent households receiving public housing aid are more than five times more likely to engage in criminal activity than are boys who are not raised in such conditions. Young girls raised in single-parent homes in public housing are roughly five times more likely to bear children out of wedlock themselves than are girls who are not raised in such conditions.13 In short, welfare usually operates as a form of social toxin. The more of this toxin received by a child's family, the less successful will be the child as an adult.

In attacking the welfare reform legislation passed by the House and Senate, the Clinton Administration has embraced the central erroneous tenets of liberal welfarism. The Administration's report on welfare makes clear its belief that rapid automatic increases in welfare spending are essential to the well-being of children and that any attempts to slow the growth of future welfare spending will significantly harm children.14

The Administration report is founded unequivocally on the failed hypothesis that combating "poverty" through more generous welfare spending is crucial to children's future. This thinking is simply wrong. An expanded and more expensive welfare system will not benefit children. Instead, expansion of welfare leads to greater dependence and illegitimacy which, in turn, have devastatingly negative consequences on children. Those truly concerned with the welfare of children must seek a radical transformation of the welfare system aimed, not (as the Clinton Administration does) at increasing welfare spending and enrollment, but at reducing dependence and illegitimacy. That is the core of Congress's plan.

Public Supports Congressional welfare Reform

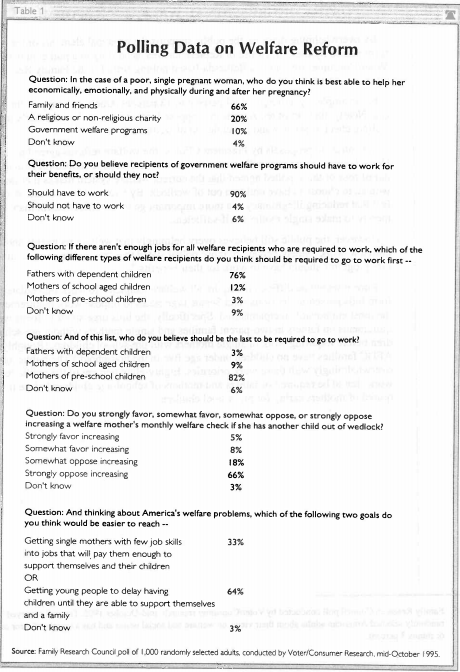

By overwhelming margins, the public supports the principal elements of the welfare reform passed by the U.S. House of Representatives, according to a poll conducted by Voter/Consumer Research, a Bethesda-based polling firm, for the family Research Council in mid-October 1995.15

For example, by a margin of 84 percent to 13 percent Americans support the family cap. Nearly nine out of ten Americans "oppose increasing a welfare mother's monthly welfare check if she has another child out of wedlock."

In contrast to proposals by President Clinton, the welfare reforms agreed to in the House/Senate conference will contain modest but real steps to reduce illegitimacy. Three out of four of those polled agreed that the current welfare system makes it easier for women to choose to have children out of wedlock. By a ratio of two to one, Americans feel that reducing illegitimacy is a more important goal in welfare reform than attempting merely to make single mothers self-sufficient.

However, the public still believes overwhelmingly that welfare recipients should be required to work. Ninety percent of those polled stated that "recipients of government welfare programs should have to work for their benefits."

Since it would be difficult to require all welfare recipients to work immediately, the reform bills passed in the House and Senate urge states to impose work requirements on the most employable recipients first. Specifically, the bills urge states to focus work requirements on fathers in two-parent families and single mothers without pre-school children before requiring work of single mothers with pre-school children. (Roughly half of AFDC families have no children under age five in the household.) The public agrees overwhelmingly with these work priorities. Eighty-eight percent of the public feels that work should be required of fathers and mothers of school-age children before it is required of mothers caring for pre-school children.

Conclusion

The welfare reform legislation which will be approved by the House/Senate conference proposes a reform of the current welfare system based on three central themes:

Reducing the growth of illegitimacy;

Reducing dependence by requiring welfare recipients to work; and

Limiting the explosive growth of welfare spending.

Among the many elements of reform in the legislation, seven are crucial:

1) The bill will end the automatic entitlement nature of AFDC spending. Under the legislation, states which increase their welfare caseloads will no longer be rewarded by an automatic increase in federal funding. This change imposes a fundamental fiscal discipline at the state level which is essential to real reform.

2) The bill establishes a family cap. Under the bill, mothers already enrolled in AFDC will not receive an automatic increase in federal welfare benefits if they give birth to an additional child while on welfare. (However, states will be permitted to enact legislation to "opt out" of this requirement.)

3) The bill provides a funding mechanism to reward states which reduce out-of-wedlock births without increasing abortions.

4) The bill provides $75 million per year in funding for a new block grant for abstinence education.

5) For the first time in the history of AFDC, the bill establishes serious work requirements for welfare recipients. Under the bill, up to 40 percent of the AFDC caseload will be required to work or become self-sufficient by the year 2002.

6) In contrast to all previous "work" requirements, in the AFDC program, the work requirements in the proposed legislation are real. Recipients who do not obtain private-sector jobs will be required to perform community service in exchange for benefits according to a "pay after performance" rule. Recipients will not receive benefits until the required work has been performed satisfactorily. If the recipient fails to perform the required hours of work, benefits will be reduced pro-rata.

7) The bill properly recognizes that the goal of "workfare" is to reduce welfare dependence and welfare caseloads, not to maximize the number of welfare recipients in "make work" public service jobs. It recognizes that the best road to self-sufficiency is to reduce the number of persons who become dependent and get "hooked" on welfare in the first place. In contrast to President Clinton's plan, which rewards states for expanding "welfare addiction," the approach in Congress for the first time focuses on rewarding states that reduce the number of individuals who get "hooked" on welfare in the first place.

Overall, the proposed legislation represents a significant and badly needed first step in overhauling a bloated and destructive welfare system. The proposed reforms will be of great benefit to society, the taxpayers, and, most important, welfare recipients themselves.