Executive Summary: The Road to Inflation: How an Unprecedented Federal Spending Spree Created Economic Turmoil

This Special Report provides an overarching analysis of the federal spending spree that began with the onset of the COVID-19 pandemic and continued through the end of 2022, along with the economic consequences. Although the spending spree was initially predicated on combatting the pandemic and stabilizing the economy, each significant piece of spending legislation contained a combination of special interest favoritism and misguided economic policy. The scale of the spending and degree of economic malfeasance was followed quickly by economic turmoil that has reduced purchasing power for American households and created tremendous economic uncertainty.

Part I of the Special Report contains a comprehensive review of new federal spending enacted between March 2020 and December 2022, with analysis of legislation along with a focus on policy flaws that crossed over between bills. Fundamentally, legislators in both parties used the pandemic as an opportunity to ignore any pretense of fiscal responsibility and use deficit spending to enact a panoply of new programs that would have been difficult to pass had they been coupled with equally sized tax increases.

Part II examines the Federal Reserve’s role in enabling the spending spree, followed by attempts to manage the economic aftermath. As the Treasury issued massive volumes of debt securities during the spree, the Fed absorbed a majority of the debt in order to prevent the Treasury from overwhelming global debt markets. However, as Washington continued the spree long after the economy had stabilized in mid-2020, the enormous amount of deficit spending—coupled with counterproductive policy decisions—led to the worst wave of inflation since the 1970s. The Fed’s decision to aggressively raise interest rates to combat inflation caused tremendous turmoil in financial markets, most notably for mortgages.

Part III considers the rapid growth of the national debt in the context of unfunded liabilities for programs such as Social Security and Medicare, and then provides recommendations for policymakers to repair the fiscal and economic damage caused by the spending spree—and to prevent further economic calamity.

The Road to Inflation: How an Unprecedented Federal Spending Spree Created Economic Turmoil

The COVID-19 pandemic was a world-changing event. The disease exacted a vast human toll, and that toll was compounded by government actions, such as excessive lockdowns that caused tremendous social and economic damage without meaningfully preventing contagion or substantially improving health outcomes.REF

In addition to public health measures, Washington deployed an enormous fiscal response initially predicated on compensating people and businesses for the harm caused by government-imposed lockdowns, along with stabilizing the economy. Opportunistic legislators from both parties used the crisis as cover for massive handouts to political constituencies, counterproductive expansions of welfare programs, and a variety of ill-conceived slush funds for state and local government entities.REF

It is a tragic reality of the pandemic that policymakers at all levels of government could have chosen a path with fewer impositions on the public, fewer costly economic interventions, and less disruption of social and religious life. Instead, the commitment to tremendous new spending programs and central bank money-printing steered the economy into a devastating inflation spiral and a shaky recovery while also enabling (and implicitly encouraging) further lockdowns through intergovernmental subsidies and lengthy welfare expansions.

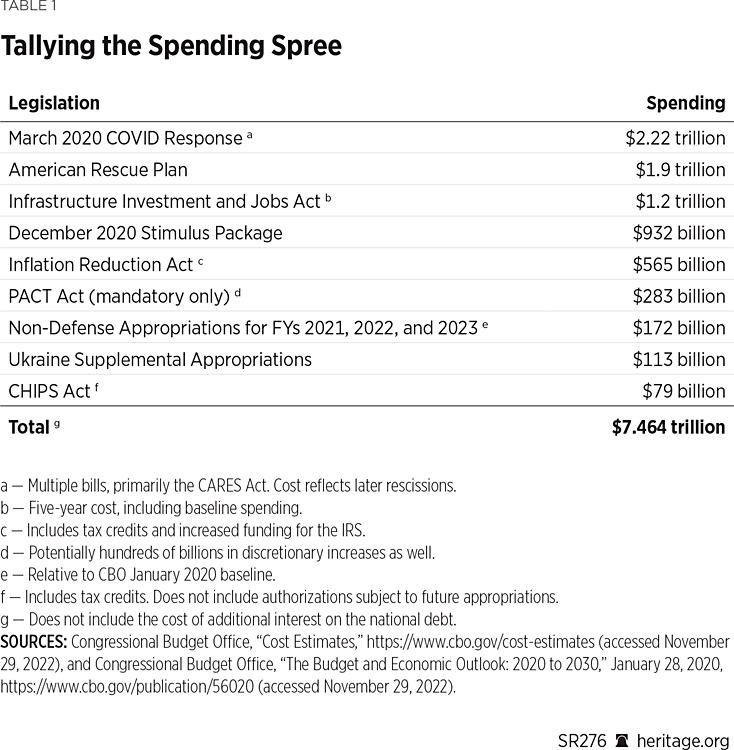

The amount of additional spending resulting from legislation passed between March 2020 and December 2022 is astonishing: $7.5 trillion—more than $57,400 dollars per household. While federal spending per American has steadily increased in real terms over the past several decades, the pace of the increase in recent years has been shocking. As this Special Report demonstrates, most of the spending during the pandemic was unnecessary. Congress should also have accounted for justifiable pandemic-response spending at the time of passage by enacting measures to reduce future deficits.

The deficit-fueled federal spending spree delivered painful economic consequences. The average American household has already lost $7,000 to the inflation and interest rate spike largely caused by this spending spree.REF Employment has stagnated, and millions of workers are still missing from the labor force more than two years after the start of the pandemic.REF

Further, these reckless actions—such as adding more to the federal debt in a 27-month span than was added in the first two centuries of the country’s history—exacerbated already mountainous long-term federal obligations and propelled the country close to a debt crisis.REF

As the nation seeks to regain its pre-pandemic economic health, legislators and citizens alike must understand what happened during the spending spree, and lawmakers must steer the nation’s economic and fiscal policy in the opposite direction.

This Special Report details the myriad reckless and counterproductive provisions of this unprecedented spending spree, the Federal Reserve’s role in facilitating it, the economic fallout these actions created, and how to get out from under the weight of these disastrous policies and back to a prosperous society.

Part I. Washington Sows the Wind with a Historic Spending Spree

The following sections discuss the many discrete parts of the spending spree, including analysis of both the contemporaneous debate and the subsequent performance for each initiative.

Early 2020: The Pre-Pandemic Economy and the CARES Act. In early 2020, the U.S. economy was enjoying a period of sustained low unemployment and strong real wage growth, with the largest gains accruing to the lowest-income earners. These positive trends were partly due to the 2017 Tax Cuts and Jobs Act.REF Economic expansion was especially welcome after the prolonged misery of the Great Recession.REF Although there was still room to improve prospects through policy reform and fiscal restraint,REF the economy was certainly in robust health when the pandemic began.

When COVID-19 emerged, it quickly became apparent that the virus was considerably more dangerous for the elderly than the rest of the population. However, the widespread approach of strict lockdowns (followed over time by mask and vaccine mandates) meant imposing high costs on all members of society, including damage to mental and physical health, as well as severe educational and economic costs, for marginal public health benefit.

Governmental restrictions on work and public activity struck the economy with tremendous force. The official unemployment rate quadrupled from February 2020 to April 2020, and a broader unemployment measure—which accounts for workers only marginally attached to the labor force—tripled over the same period.REF

Congress hastily assembled and passed three COVID-19 response spending bills in March 2020, most notably the Coronavirus Aid, Relief, and Economic Security (CARES) Act.REF Costing roughly $2.22 trillion in total, the bills contained a mix of checks to individuals, business supports (loans, grants, and tax changes), welfare expansions, new federal unemployment insurance programs with $600 per week bonuses, handouts to state and local governments, and more.REF

The tremendous uncertainty caused by the pandemic-related societal and economic upheaval led to a strong impulse in Congress to produce a comparably dramatic legislative response. This reaction suffered from several flaws from the outset,REF such as:

- The failure to fully consider the already substantial set of existing safety net programs automatically designed to respond to economic downturns. Most notably, unemployment insurance and a variety of means-tested welfare programs provide a cushion for families.REF Congress could have adjusted existing programs as the situation progressed rather than assuming that benefit expansions were needed immediately.

- The failure to recognize the capacity of private responses to fill gaps. Americans are incredibly charitable, donating hundreds of billions of dollars in a typical year.REF The overwhelming rush of federal dollars disincentivized charitable organizations and civil society groups from providing a commensurate response to the pandemic. This is part of an unfortunate trend of discounting the importance of civil society, which damages the nation’s social fabric in the process.REF

- The inclusion of Keynesian stimulus spending. This spending demonstrated that legislators had learned little from the previous recession. Checks were distributed in such a haphazard manner that even inmates (including the Boston Marathon bomber) and the deceased received handouts.REF

- The suspension of payment requirements for federal student loans. The suspension was a sop to progressive activists seeking an outright cancellation of loan obligations and provided a pretext for a needlessly prolonged payment suspension.REF

- A poorly designed bailout of the airline industry. The bailout led to bizarre overpayments to airports and forced airlines to run empty flights.REF

Sabotaging the Labor Market. The most flawed and damaging provision in the CARES Act was a reckless expansion of unemployment insurance benefits, including weekly $600 “bonus” payments, which meant that two-thirds of recipients could earn more by not working than by returning to work or accepting a new job, and federal lawmakers’ imposition of extremely loose eligibility criteria, which opened the floodgates to massive fraud and abuse.REF Instead of lasting for four months, the pandemic unemployment programs and bonus unemployment insurance benefits were extended multiple times and did not end until 18 months after the pandemic began. Even after the unemployment bonuses ended, a roughly 25 percent increase in food stamp benefits, massive increases in Medicaid eligibility and Obamacare subsidies, and the student loan repayment pause all remained in effect for three years or longer after the pandemic began.

This prolonged expansion of welfare-without-work benefits created perverse incentives. In the first place, it gave many workers the choice of being paid to leave the workforce and allowing their skills to atrophy or accepting the job with the best income they could obtain for themselves and their families. Further, it made finding workers unnecessarily difficult for businesses, undermining the recovery.REF The unprecedented labor shortage caused primarily by government policies that discouraged work and artificially stimulated demand for goods and services has, in turn, exacerbated inflation. When employers must pay workers more to do the exact same thing, price increases inevitably follow.

Additionally, the unemployment benefit expansion led to historic amounts of fraud.REF Federal lawmakers opened the floodgates to widespread fraud and abuse by imposing massively expanded eligibility criteria onto state systems that were incapable of verifying whether claims were valid, and they directed states to make payments and then seek verification after the money was out the door. Consequently, the U.S. pandemic unemployment insurance benefits became the targets of global organized crime rings stealing Americans’ identities and taxpayers’ money.REF A Heritage Foundation analysis estimated that at least $357 billion in unemployment insurance benefits went to people who were not unemployed.REF

Hundreds of billions of dollars in additional handouts that were unrelated to work made the labor problem even worse. Many of those programs lasted long after the unemployment insurance benefits ended, and some continue today. Beginning with the CARES Act, Congress repeatedly waived work requirements for food stamp recipients. The CARES Act also contained the first of three rounds of stimulus checks that were disconnected from considerations such as income and wealth. These checks led to a sharp increase in savings and debt repayment, while also making it easier for millions of people to choose to remain unemployed.REF There was also a 21 percent increase in food stamp benefits, an eviction moratorium, Medicaid and Obamacare expansions, and an initial six-month student loan repayment “pause” that is now going on 35 months and counting. All these welfare-without-work benefits make it easier for individuals to get by with little or no work, and the impact has been most pronounced among young Americans who should be launching their careers, gaining education and experience instead of languishing on the sidelines.

Paycheck Protection Problems. The Paycheck Protection Program (PPP), which provided forgivable “loans” ostensibly to prevent closures and layoffs, was drafted in a broad manner that invited oversubscription.REF To qualify for PPP money, businesses simply had to claim to have been impacted by the COVID-19 pandemic, which made nearly every business potentially eligible. In fact, despite the CARES Act’s inclusion of $330 billion for the program, Congress provided an additional $483 billion just a few weeks later to allow additional businesses to qualify.REF

As with unemployment insurance, fraudsters abused the PPP to the tune of hundreds of billions of dollars.REF Both Congress and the Small Business Administration (SBA) went too far in relaxing loan standards, and the SBA was simply overwhelmed by the task of managing and overseeing the program.REF A textbook example of PPP fraud involved a Georgia man who received support from the SBA for a fake business, and who subsequently used taxpayer dollars to purchase personal goods, such as a $57,000 Pokémon trading card.REF More disturbingly, dozens of Planned Parenthood affiliates received PPP loans despite a strict prohibition on loans for affiliate organizations.REF

From an economic standpoint, the PPP was extremely inefficient, with estimates of six-figure costs for each job year supposedly preserved by the program.REF A substantial amount—perhaps a majority—of PPP funds were ultimately captured by business owners and shareholders instead of workers, which was not the goal of the program.REF The choice to sacrifice responsible governance and oversight of the PPP for the sake of expedient delivery of benefits led to real costs for taxpayers. In addition, by subsidizing many unproductive businesses and employees using deficit financing, the PPP was tremendously inflationary.REF

Despite problems flowing from the CARES Act, there would have been a chance to avoid most of today’s economic turmoil if Congress put a stop to the spending spree in spring 2020. Although the initial economic downturn was sharp, most of the losses in terms of jobs and gross domestic product (GDP) were recovered within a few months,REF meaning there was no meaningful risk of a protracted recession at that time.

The Un-Heroic HEROES Act. Many Members of Congress had not yet lost their appetite for spending. In May 2020, the House took up and passed the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act, another multi-trillion-dollar deficit-financed spending package.REF With funds from the enormous CARES Act still in the process of being distributed and used by governments, businesses, and households, there was fierce debate about whether to move forward with an even larger package.

Examining the provisions of the HEROES Act made clear that the package was not intended as a continuation of what had been a largely bipartisan response to the pandemic but was instead an opportunistic attempt to promote contentious progressive policy goals with no connection to the pandemic. These goals included student loan forgiveness, enormous handouts to state and local governments, lifting the cap on the state and local tax deduction, extending enhanced unemployment benefits, and bailing out the postal service.REF

The HEROES Act made it clear that the left intended to use the pandemic as an excuse to maximize federal spending. Although the bill stalled in the Senate, progressives maintained a pressure campaign in support of its provisions that lasted through the rest of the year—and beyond.

Late 2020 “Christmas Tree” Package: A Lump of Coal. The long-standing dysfunction of the annual appropriations process manifests itself in many harmful practices. One of these is that all 12 individual appropriations bills are often merged into an omnibus package. Rank-and-file legislators are pressured to support the “must-pass” omnibus. Meanwhile, opportunistic Members vie to attach non-appropriations legislative provisions to the package, which causes it to expand into a “Christmas tree” bill. These legislative behemoths are typically voted on without sufficient time for proper review and debate.REF

With the COVID-19 virus surging during the 2020 holiday season, many expected that the pending omnibus package would contain supplemental spending for a public health response. However, despite the stabilized economy and the already enormous amount of debt issued during the previous nine months, a bipartisan group of Senators cobbled together a supplemental package. They named the supplemental package the Response and Relief Act (RRA), and it cost $932 billion while having little to do with combatting COVID-19.REF

This was an extraordinarily large supplemental package to attach to the omnibus: $932 billion was 36 percent larger than the entirety of regular non-defense discretionary spending in fiscal year (FY) 2021.REF

The RRA included new rounds of funding for several programs of the CARES Act, including the PPP, extended unemployment insurance benefits, and additional stimulus checks to individuals.

While extensions of ongoing federal activity are commonplace, what made the RRA’s spending especially problematic is legislators’ choice to ignore completely both the improved economic outlook and glaring policy problems with the economic response initiatives that were well established by the time of the bill’s passage. The extension of unemployment insurance benefits further impeded businesses’ efforts to find workers as state and local governments lifted pandemic restrictions.REF The second round of untargeted checks for individuals was especially unjustified, since it came after data showed that the CARES Act checks were heavily used for debt repayment and savings, meaning that there was minimal effect on consumer demand to support businesses.

The RRA also included special interest handouts for airlines, transit agencies, and the postal service.REF Such corrupt gifts are unfortunately part and parcel of “Christmas tree” exercises, pointing to the need for both institutional reforms and a return to constitutionally limited government.REF

Even with a COVID-19 spike at the time of the RRA’s drafting and passage, there was simply no excuse for legislators to prioritize a wide range of special interest giveaways while reducing actual pandemic provisions to a fiscal and legislative afterthought.

From an economic perspective, the RRA was profoundly misguided. Adding the front-loaded spending of the RRA to the already enormous amount of deficit spending authorized earlier in 2020 meant that Congress was setting the stage for inflation for the sake of providing unnecessary handouts.

A few months later, Congress tripled down on each of the RRA’s flaws.

American Rescue Plan: Opportunism Leads to Economic Catastrophe. With Democrats obtaining unified legislative control in January 2021, they quickly deployed the budgetary tool known as reconciliation to facilitate passage of a massive legislative package along party lines.REF This package, known as the American Rescue Plan (ARP) Act, contained $1.9 trillion in funding for a wide range of leftwing interests.REF

Among the ARP’s provisions: a third round of untargeted stimulus checks; an extension of bonus payments for those on unemployment insurance; $350 billion for state and local governments, generally, plus additional set-asides for state and local activity in areas such as education and public transportation; a bailout for private labor union pension plans; an expansion of the refundable child tax credit and the Earned Income Tax Credit; an expansion of Obamacare premium subsidies; and public health funding that amounted to less than 5 percent of the bill’s total.

Congress had already overspent with the RRA, yet the Democratic consensus supported another large stimulus package. This belief stemmed in part from the failure of the 2009 stimulus package to restore growth during the Great Recession, which some on the left claimed was due to insufficient spending.REF

However, this progressive view ignored the true lessons of the 2009 stimulus and the economic realities in the spring of 2021:

- The 2009 stimulus was wasteful and ineffective.REF

- While the 2009 stimulus package was preceded by smaller stimulus measures in 2008, the ARP was preceded by more than $4 trillion of supplemental federal spending in 2020, the vast majority of which focused on the economy rather than public health or national security.

- At the time of the ARP’s passage, the economy was in considerably better condition than it was in 2009. By March 2021, the main unemployment rate had declined to 6 percent and the broader unemployment measure (U-6) stood at 10.7 percent. During the Great Recession, unemployment remained above those levels for five years.REF

The ARP was so massive, so badly designed, and so poorly timed, that it made inflation impossible to avoid. Incredibly, the ARP even failed as a short-term stimulus. In February 2021, the Congressional Budget Office (CBO) projected that the economy would create 6.252 million jobs by the end of the year. Yet following the ARP’s passage, the actual number was 6.116 million—136,000 below what was expected in the absence of an additional stimulus package.REF

Flawed macroeconomics were only the beginning of the ARP’s errors. Roughly half of the bill’s funds went to transfer payments for individuals and households. Most of this was pure demand-side stimulus, such as individual checks and tax credits, which were deficit-financed and highly inflationary. Welfare expansions, such as expanded unemployment, health, and housing benefits, significantly discouraged work at a time when job openings were quickly heading towards record levels.REF

The ARP also dished out favors to unions. Most notably, the ARP included a first-in-history taxpayer bailout of private union pension plans, despite their recklessness having nothing to do with the pandemic. Two years before the pandemic, in 2018, private union pensions had already promised $757 billion more in benefits than they set aside to pay.REF

Further, the ARP gave another round of bailouts to the heavily unionized public transit and aviation sectors.REF In the case of transit, the total supplemental funding passed between March 2020 and March 2021 was $67 billion—more than three years’ worth of operating revenue for all transit systems in the country.REF

RRA and ARP: “COVID-19 Response” Not Focused on COVID-19. Despite the RRA’s asserted justification—response to the COVID-19 pandemic—the public health portion of the RRA was strikingly substandard. For example, the legislation failed to promote COVID-19 rapid tests or give the public more control over their own health.REF At a time when most of the public would not be eligible to receive newly created vaccines for several months, and with so much money dedicated to an assortment of dubious causes, this amounted to legislative negligence.

That pattern repeated itself with the ARP, which was also sold as a pandemic response despite containing a relatively small amount of funding for public health. The RRA and ARP packages contained a combined $2.8 trillion in total authorizations, yet less than 10 percent of each package went to COVID-19-targeted public health measures.REF

Handouts to State Governments: Pointless, Inflationary, Wasteful. The ARP authorized more than $500 billion in transfers to state and local governments, the largest portion of which was $350 billion in “fiscal recovery funds.” This was on top of $360 billion in state and local aid from earlier packages, which was already more than sufficient to make whole any state that experienced a revenue decline.REF Even the unstated assumption behind these handouts—that Washington should step in if there are dips in state revenue—is badly flawed. Many states are fiscally mismanaged, and federal bailouts enable them to avoid much-needed discipline.REF

The results of the wildly excessive handouts to governments were entirely predictable. State spending increased in FYs 2020, 2021, and 2022, with an especially large bump for 2022 in the wake of the ARP, compared to a brief state spending decline during the Great Recession.REF

In fact, the main fiscal dilemma facing state legislators in 2022 was how to address burgeoning (and often record-setting) budget surpluses.REF Some states used the opportunity to cut taxes.REF While this is an understandable impulse, cutting taxes based on short-term federal stimulus while leaving spending growth unchecked sets the table for budget deficits in the future. A subset of tax cuts involved states cutting or suspending taxes on selected goods such as gasoline as a response to worsening inflation.REF These tax-cutting half measures did not meaningfully address the economy’s supply-side problems.REF Other states resorted to “rebate” checks that have also worsened inflation.REF

The economic effectiveness of federal handouts to state and local governments has been poor. For example, a June 2022 working paper examined the direct employment effect of the handouts on state and local government employment for the first 18 months of the pandemic and found an estimated cost of $855,000 per government job-year, with a lower-bound estimate of $433,000 per job-year.REF

More egregious are billions of dollars in wasteful and inappropriate spending and tax incentives that were directly funded or indirectly enabled by the federal handouts. Examples include:

- Massive amounts of corporate welfare;REF

- Bailouts for government-owned operations, such as golf courses and hotels;REF

- Special deals for movie and television production;REF

- Food stamp expansions for the wealthy;REF

- Recreation and tourism pork projects;REF and

- Bonuses for government workers.REF

Finally, these handouts have the subversive effect of making state and local governments even more dependent on federal subsidies than they already were. This undermines one of the core tenants of the American system of government—federalism. The increasing centralization of governance damages transparency, accountability, access, and promotes one-size-fits-all policymaking that is especially incompatible with a large, diverse country.REF

Rewarding Teachers Unions for Holding Schools Hostage. In addition to the $350 billion in general funds for state and local government, the ARP provided an additional $126 billion in funding for K–12 education, 98 percent of which was earmarked for public schools.REF Although advocates claimed that the handout was an urgent necessity brought on by the pandemic, such assertions were dubious and have since been proven completely false.

For starters, the December 2020 RRA provided $52 billion to K–12 schools, yet only $98 million of that amount had been spent by May 2021.REF Congress simply ignored the fact that schools were already sitting on a windfall at the time of the ARP’s passage.

A study published by Centers for Disease Control and Prevention (CDC) in December 2020 estimated that the cost to implement COVID-19 safety measures in all public schools would be $55 to $442 per student.REF Applying the high-end cost to the 49 million students in public schools would yield a total cost of $21.8 billion, meaning that schools already had more than sufficient resources to address health concerns.REF

Further emphasizing that there was no crisis requiring an urgent rush of funds to public education, the CBO estimated that nearly half of authorized K–12 funding in the ARP would not go out the door until FY 2024, and only 30 percent would be spent by September 2022.REF Remarkably, even this underestimated the glacial pace of the spending, as only 7 percent had been used by May 2022.REF

While there are some resources available for the public to see how school districts have used or plan to use the ARP education funds, there are also serious deficiencies that hinder complete and badly needed transparency for such a substantial amount of taxpayer dollars.REF The available information points to states devoting funds to supplementing normal school operations rather than implementing health measures.REF Many districts went on hiring sprees that will lead to budget shortfalls when the federal funds run out, continuing the long-running massive expansion of the number of school administrators rather than focusing resources on the classroom.REF

Attempting to justify the reason for providing $126 billion in school funding in the ARP is next to impossible from a policy standpoint yet comes into sharp relief in the political context at the time the ARP was drafted.

The American Federation of Teachers (AFT) called for $175 billion of supplemental federal educational funding in April 2020, specifically linked to reopening schools.REF This request was reduced to $116 billion after passage of the CARES Act.REF Despite relative stability in state and local tax resources (especially when considering the excessive backfill provided by the federal government), national teachers union leaders behaved as though they were still entitled to substantial taxpayer largesse.

Reopening public schools after the winter 2020–2021 surge of COVID-19 was the subject of fierce debate. School closures had imposed tremendous costs on families, with many parents struggling to juggle job requirements and the need to monitor children participating in remote learning, along with children suffering from severe learning disruptions.REF

In February 2021, the CDC released guidance on reopening schools.REF The CDC strongly recommended a multi-layered regime of mask mandates, social distancing, and testing individuals for infection. Supporters of more federal education spending cited the report as proof that more than $100 billion in additional funds were needed.REF Alongside teachers union intransigence on school reopening, the threat was communicated: Schools serving millions of students would be closed or hobbled until the federal government forked over a 12-digit sum of taxpayer money.REF

Freedom of Information Act requests have revealed that the CDC’s reopening guidance was heavily influenced by the AFT: The CDC was acting as a stealth lobbyist for the AFT’s spending push.REF Excessive school closures have done tremendous damage to academic outcomes in public schools.REF It is impossible to know how much damage has been done to the institutional reputations of the CDC and public schools in the wake of this man-made disaster.

All told, the ARP injected huge sums of deficit spending into the economy at a time when things were already beginning to run hot, showered a few special interest groups with cash, and worsened the nation’s already poor fiscal condition. Despite all that, the spending spree rolled along.

Infrastructure Plan Derailed by Waste and Inflation. In 2020, Congress passed a one-year extension for spending from the Highway Trust Fund. It was expected that the next session of Congress would pass a five-year reauthorization with the possibility of expanding the bill into a larger infrastructure package.

Following passage of the ARP, the Biden Administration quickly began promoting the American Jobs Plan, which was touted as an “infrastructure” package. However, this was largely an attempt to use the politically popular concept of infrastructure as rhetorical camouflage for a vast expansion of federal power, more welfare benefits, cronyist corporate welfare, and job-killing tax hikes.REF

When the Administration’s gambit failed, Congress shifted to producing an infrastructure package that began with Highway Trust Fund reauthorization and expanded from there. A bipartisan group of Senators reached an agreement on a package that would dramatically increase spending on all forms of transportation, along with new programs for “green” energy, electric vehicles, broadband Internet subsidies, and a thick layer of cost-increasing regulations.REF

The package was eventually named the Infrastructure Investment and Jobs Act (IIJA).REF Rather than address the profound flaws of the Highway Trust Fund status quo, such as wasteful spending diversions and cost-increasing regulatory mandates,REF the bill compounded those flaws by providing outsized spending increases for low-demand transportation modes such as mass transit and Amtrak, creating new carve-outs for programs favored by anti-automobile activists on the left, exacerbating the trust fund’s fiscal imbalance, and increasing state and local dependence on Washington for infrastructure funding.REF

The IIJA also included an array of unrelated budget gimmicks as a half-hearted attempt to pay for the spending increases.REF However, the attempt did not come close to covering the full cost, and as a result the package was out of balance even from the perspective of the bill’s supporters, further damaging the nation’s financial outlook.REF

The promised benefits of the IIJA are already in jeopardy. While the economy has experienced significant inflation, costs for infrastructure construction have skyrocketed to an astonishing degree. According to the Federal Highway Administration, costs for highway and street construction inputs rose 49.8 percent from the fourth quarter of 2020 to the third quarter of 2022.REF

Regardless of the specific factors underlying road construction inflation, there is no denying that it will have a strong negative effect on the implementation of the IIJA. Sustained high inflation could overtake even the dramatic funding increases provided by the IIJA, and at minimum will reduce the number of projects that can be completed, preventing the legislation from having the “transformational” effect that its supporters promised.REF Congress and the Biden Administration have exacerbated the problem of diminishing infrastructure project value through a variety of mandates governing labor, materials, and funding carve-outs for special interests.REF

Rather than ignore the wave of inflation and continue blindly spending money regardless of how little benefit the public receives in return, Congress should reconsider the wisdom of proceeding with an increase to infrastructure spending during an inflation crisis that is especially bad for road construction. Instead, legislators should reduce the federal government’s heavy hand by removing layers of cost-increasing red tape, along with returning power to state and local governments and the private sector, which have stronger incentives to control costs.REF

Ignoring Inflation in Summer 2022. Despite the devastating economic consequences of the extravagant overspending in 2020 and 2021, Congress passed three pieces of legislation that increased federal spending by hundreds of billions of dollars apiece during the summer of 2022. While the issues involved were varied, the result further increased the size, scope, and power exercised in the nation’s capital, along with a still unknown amount of additional deficit spending.

While the three bills will not add to deficits on the same scale as the pandemic-era spending spree, they demonstrate that Members of Congress in both parties remain wedded to the false notion that greater federal control over the nation’s resources is the solution to most problems, even after the disastrous results of the earlier spending binge.REF

The Inflation Reduction Act (IRA). The most controversial of the bills was inappropriately marketed as the IRA. Passed on party lines through the budget reconciliation process, the IRA was the final form of the package previously known as Build Back Better. The IRA included massive new spending to subsidize so-called green energy, funds to facilitate an army of new enforcement agents at the IRS, a gimmicked short-term extension of Obamacare subsidies, tax hikes for businesses that will especially hammer manufacturing, and exposing drug manufacturers to unfair “negotiations” in the Medicare system.REF

Including tax credits (which function as spending through the tax code), the final cost of the package was initially projected to be $565 billion. However, subsequent analysis suggests that the cost will be dramatically higher, which likely means hundreds of billions of dollars in additional deficits along with tremendous levels of economic inefficiency.REF Accordingly, the legislation’s title (based on assertions that it would lower deficits) was not merely political theater, but, in fact, a complete misnomer. By adding to already high federal deficits, the bill stands to exacerbate the effects of inflation.

The Honoring Our Promise to Address Comprehensive Toxics (PACT) Act. In August 2022, Congress passed the PACT ActREF to address exposure by veterans to toxic substances while serving in Iraq and Afghanistan. Passing legislation in response to such widespread toxic exposure was the right thing to do, since caring for those who put their lives and health at risk in service to the nation is a core responsibility of the federal government.

The PACT Act dictates that for qualifying veterans who served in Iraq or Afghanistan, conditions such as lung disease and 11 different types of cancer are presumed to have been caused by their military service. This presumption means that the federal government is obligated to pay for treatments. Due to the uncertainty surrounding the precise cause of many individual instances of cancer, coupled with the desire to ensure that veterans receive the medical care they deserve, the PACT Act’s use of a presumptive eligibility standard is understandable.

Unfortunately, the PACT Act is emblematic of the complete erosion of fiscal discipline in Washington. Caring for veterans is among the most broadly supported categories of federal spending. In theory, this ought to make it easier to build a political coalition in support of cutting wasteful and low-priority programs to pay for an expansion of veterans’ benefits. Instead, and as in this case, Congress usually takes the opposite approach, assuming that there will be no consequences from increasing deficits for the sake of veterans and thus not making any attempt to pay for the increases.

This feckless approach to budgeting is exactly backwards. Legislators should have found ways to pay for the PACT Act, achieving fiscal responsibility while starting the new benefit on firm financial footing.

The CBO estimates that the PACT Act will lead to $283 billion in new mandatory spending and up to $397 billion in spending subject to appropriations over a decade.REF Further, the legislation makes it possible to shift a large portion of Department of Veterans Affairs spending from the discretionary spending category to mandatory, which would further exacerbate the trend of placing a growing majority of federal spending on autopilot.REF

It is not yet clear which effect this will have on discretionary spending levels, as some appropriators could seek to use the false “savings” from a potential category shift as an excuse to increase other types of non-defense discretionary spending.REF However, even if the discretionary-to-mandatory trade does not occur or does not result in a spending increase for other discretionary accounts, the PACT Act will mean at least $283 billion in new deficit spending over the next decade, and potentially trillions more over the decades to come.

Unlike other legislation mentioned in this report, the PACT Act does not increase inappropriate federal activity or represent a grossly wasteful use of taxpayer resources. Rather, it exemplifies the dereliction of duty that most of Washington’s political class is guilty of when it comes to fiscal policy.

The Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act. The CHIPS Act will funnel public funds to the semiconductor industry while increasing authorization levels for several federal agencies, adding at least $79 billion in deficits.REF The law is drafted in a way that will do nothing to address the underlying reasons for the slump in U.S. chip manufacturing in the first place: the administrative state and tax policy that targets manufacturing. It is also likely that subsidized firms will use a portion of the grant money to promote investments that are physically in China and other foreign countries due to a lack of sufficient guardrails.

Confronting the Chinese Communist Party and reducing U.S. overreliance on China or countries aligned with China is a worthy goal. However, the CHIPS Act is in fact an exemplar of corporate welfare. The bill’s passage shows that legislators put too much faith in government incentives and control and fail to acknowledge the cost of the regulatory and tax regime that has stifled American manufacturing. Instead, legislators should lean toward pro-growth tax reform, deregulatory action, targeted restrictions on business with China, and encouraging friend-shoring, near-shoring, and re-shoring businesses through smart policy and economic freedom.REF

In addition to the cornucopia of cost-increasing mandates in pre-existing statutes and the CHIPS Act, the Biden Administration has added—without legislative guidance—a mandate that companies seeking large CHIPS handouts must provide childcare to workers, share “excess profits” with the government, and avoid stock buybacks.REF This is merely the latest example of the Biden Administration making the federal government even more inefficient than it already is for the sake of advancing its agenda of increasing federal control over businesses and imposing an unfunded mandate outside statutory authority.REF

Unwarranted Non-Defense Appropriations Increases. The Budget Control Act (BCA) of 2011 imposed caps on discretionary spending through FY 2021.REF While this approach had numerous flaws, such as separate caps for defense and non-defense spending rather than a single combined limit, the BCA spending caps did result in significant deficit reduction for several years.REF

Yet, the existence of separate defense and non-defense limits led to a series of deals to increase both categories of discretionary spending. Worse, these deals often provided an equally sized boost to non-defense spending based on the concept of “parity,” even though this meant that non-defense spending grew at a faster rate.REF Additionally, the increases relied heavily on deficit financing.REF

Despite the rapid growth of non-defense discretionary spending in the years immediately before the pandemic, Congress provided additional increases to the category across FYs 2021, 2022, and 2023. Relative to the pre-pandemic baseline, non-defense discretionary spending over the three years grew by a total of $172 billion—8.4 percent.REF These spending increases were unwarranted, and the FY 2022 and FY 2023 packages included a return to the corrupting and wasteful practice of “earmark” spending.REF

Rapid and sustained increases to non-defense appropriations can have long-term ramifications. Congress typically increases spending levels relative to those in the previous year, meaning that a significant increase in one year leads to compounding increases in the future. After the FY 2022 package, the CBO projected a non-defense spending increase of $781 billion over the FY 2021 through FY 2030 period (10.5 percent), relative to the pre-pandemic baseline.REF The increases in the FY 2023 omnibus will only exacerbate the problem.

Congress has a long-held aversion to proper budgeting, which requires prioritizing between competing policy areas and interest groups rather than simply providing across-the-board annual increases. America is now paying a steep price for this sustained legislative failure.

Part II. Reaping the Whirlwind: Economic Consequences of the Spending Spree

While it is easy to focus on the budgetary impacts of these bills, the economic effects are equally real and important. These bills, their spending, their deficits, and distortions of economic behavior have not existed, and will not exist, in a vacuum.REF

Policymakers often assess their proposals based on a static understanding of the economy and society. Such analysis, including formal scoring from the CBO, often overlook the externalities and adjustments to broad behavior patterns created by policy proposals. In truth, all fiscal policies alter incentives and thus alter the economy and economic behavior. Though standard congressional scoring procedures do not account for the economic effects of policies, policymakers should be aware of them while considering legislation.

The COVID-19 spending bills created two broad distortions of the U.S. economy: the aforementioned reduction of the labor supply through increased transfer and subsidy payments, and the creation of inflationary pressures through large deficits and the pressure for the Federal Reserve to monetize them—both of which helped to create the current economic struggles.REF

This section focuses on the impacts of the unprecedented federal deficits and the Fed’s response. These compounded the impact of the diminished labor supply and have driven price inflation to levels not seen in 40 years.

Rising Prices. There is no doubt that prices have skyrocketed since 2020. Though many refer to this trend as simple inflation, two different price increases are going on at the same time: inflation as a result of monetary policy, and price increases as a result of increasing real costs of production. Both phenomena were heavily caused by government interventions during and after the pandemic.

Inflation is the result of the unit of currency losing value, leading to a general rise in prices. Separately, the prices of particular goods and services convey the relative demand and supply (including production and distribution costs) associated with such products.

The COVID-19 spending bills put the U.S. economy between a rock and a hard place that has led to the dramatic price increases that the country is experiencing. The massive deficits produced by these bills, and resulting Fed action to monetize the debt, created inflationary pressures.REF

Simultaneously, as explained below under “Effects of High Deficits on Financial Markets,” federal deficits not covered by the Fed caused crowd-out in financial markets. The increased transfer payments and subsidies from these bills constricted the labor market. The financial crowd-out and constricted labor market, respectively, made it harder for firms to employ both capital and labor, so both policy outcomes led to increased costs of production for firms.

Together, this monetary inflation and the increased cost of production have created the whirlwind of rising prices and declining real net worth that have stymied the U.S. economy’s emergence from the pandemic. These price increases and the sluggish economy are both legacies of the spending bills highlighted in this Special Report.

Effects of High Deficits on Financial Markets. The spending required the federal government to acquire substantial financing very quickly.REF Governments have three, and only three, options to finance their spending: raise taxes, borrow from existing capital markets, or collect revenue through seigniorage (the profit made through the creation and use of new money).

This process of using seigniorage to cover what would otherwise be deficit spending is also referred to as monetizing the debt—when the government covers its deficits by creating new money. In a traditional sense, the goal of a currency system is to provide a stable and robust metric to value economic activity and assets and to serve as a useful tool to exchange goods and services, and labor and capital.

However, the creation of new money for the sole purpose of covering government deficits introduces a competing use for currency. As more currency is created to cover government deficits, the new currency devalues existing units of currency. The resulting devaluation creates inflation.

The late economist Milton Friedman noted that “inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”REF The COVID-19-era process of monetizing the debt is a case study in such a phenomenon.

Though the U.S. federal government has seldom resorted to monetizing the debt, it did so during to the pandemic to tragic ends. By December 2021, the dramatic increase in the Fed’s holding of federal Treasury debt had soaked up roughly 56 percent of new pandemic-era federal debt. Thus, the Fed ultimately financed more than half the pandemic era’s new federal debt through monetization.REF

For the period of FY 2020 to FY 2022, federal outlays rose by 32 percent ($4.7 trillion), relative to the January 2020 CBO baseline.REF Compounded with underlying structural deficits, gross federal debt rose by $7.5 trillion from March 2020 through September 2022.REF To put this into perspective: It took the federal government 215 years to accumulate $7.5 trillion in gross debt.REF

The magnitude of these deficits created a compounding problem for the U.S. economy throughout the pandemic. Government deficits reduce national saving. Another way of looking at the issue is that domestic savings can be used to either build new capital, the physical tools that grow the economy, or to cover the government’s deficits. The federal government has the legal power to agree to whichever parameters it needs to borrow sufficient funds to cover its deficits.

When a household or private firm borrows money, it does so with the promise that it can pay those sums back from earnings. However, when a government borrows, it does so with the promise of either taxing households and firms in the future or creating new money to pay back its loans.

The federal government has the power to crowd out private borrowing. Currency can easily traverse the globe. However, governments, especially the U.S. federal government, have taken advantage of this to diffuse their crowding out across the global economy for decades. The ratio of global debt and total worldwide government debt to the size of the world economy set records at 256 percent and 99 percent, respectively, in 2020.REF This pressure on global capital markets set the stage for unprecedented global crowd-out and the economic catastrophes that have followed so far.

This development has raised the cost of capital for firms, thereby reducing annual private capital formation and reducing total economic output. As an illuminating comparison, the increase in the federal debt from the start of the pandemic through FY 2022 was equal to roughly 65 percent of total gross private investment made in the U.S. from FY 2020 through FY 2022.REF

This gave the Fed a choice—allow the new pandemic-related federal deficits to crowd out private investment or create new money to cover the deficits. Essentially, the Fed had the ability to trade a debt crisis for an inflation crisis—which is exactly what happened.REF

Had the Fed chosen to not increase the money supply to cover federal deficits, the crowd-out would have been far greater, leading to suppressed business investment and spiking federal interest rates and interest rates on consumer debt, such as mortgages. Increased interest rates on federal debt would also have meant much higher annual debt servicing costs for the federal government, creating a feedback loop, which would have fed even larger federal deficits.REF

Instead, the Fed chose to increase the money supply dramatically to pick up much of the initial slack and a majority of the new federal debt during the pandemic. By doing so, the Fed kept interest rates on federal debt artificially low and allowed a larger portion of existing lending markets to ultimately go toward private investment. The downside was that this process of monetizing debt devalued the dollar, leading to the spike in inflation since January 2021. In response to the inflation, the Fed halted monetization of the debt. But it could trade a debt crisis for an inflation crisis for only so long. Now the country has both.

As an example, during the height of the pandemic, and as the Fed was buying most new federal debt, average 30-year fixed mortgage rates dropped from 3.45 percent to 3.1 percent.REF However, Fed holdings of federal debt declined by $19 billion while the federal debt, from December 2021 through September 2022, increased by more than $2.24 trillion.REF This level of crowding out and lack of monetization of the federal debt sent 30-year fixed mortgage rates shooting up from 3.05 percent to a peak average of 7.08 percent, making affordable housing that much rarer. Though mortgage rates have come down slightly, to more than 6.3 percent, they remain stubbornly high.REF

Using Monetary Policy to Enable Expanded Deficits. Monetary policy is a prime determinant of the stability of an economy’s prices and interest rates. It is crucial that monetary policy be focused on stabilizing prices. A central purpose of a currency is to be a stable and reliable yardstick to measure economic activity. Without stable prices, a nation’s currency fluctuates wildly and ceases to serve as a useful yardstick. However, clearly, that requires something else—a fiscally responsible government. Regular and tremendous government deficits make sound monetary policy impossible.REF

Recent trends in the velocity of money demonstrate the issue. The velocity of money can be thought of in two ways. The first way is as the average number of times that a dollar circulates through the economy in a given year. The second way is to think of it as the volume of annual economic production for each dollar in circulation. A stable money velocity means the same ratio of goods and services to currency in circulation. Tragically, federal fiscal policy has forced monetary velocity into a dramatic transition. This change in velocity destroys vital and delicate economic information stored in prices and diminishes the usefulness of the U.S. dollar as a reliable measuring tool.

The Monetary Base and M2. The monetary base and M2REF are the two most commonly used metrics. The monetary base represents the total amount of U.S. dollars in circulation. In contrast, M2 represents the monetary base plus demand deposits, money market accounts, and other items that are essentially U.S. dollars. Thus, M2 captures the effective creation of money through the private banking sector in response to economic activity and federal monetary policy (including the size of the monetary base).

From 1959, for M2, and from 1981, for the monetary base, through 2008 these velocities were relatively stable.REF However, the stark drop in these monetary velocities after 2008 is reflective of the various rounds of so-called quantitative easing (QE) that the Fed has engaged in over the past 14 years. Moreover, the drop in velocity has been significantly worse since 2020 in direct response to monetary policy designed to facilitate dramatic expansions of federal deficits.

The cratering of money velocity in the past two years indicates that, relatively, far more dollars are now in circulation per nominal dollar of annual economic production than before the current period of the Fed monetizing the debt. This wild swing is far from the Fed’s mandate to maintain moderate price changes. Further, it serves to make economic planning and coordination murkier by making the dollar a less accurate conveyor of economic information.

While this was not the original intent, the QE process has monetized much of the new federal debt during this period, specifically during the COVID-19 pandemic. This process can also be demonstrated by analyzing changes in the trends of Fed assets during this period.

The Fed increased its asset holdings from roughly $900 billion to more than $8.9 trillion (mostly Treasuries) from 2008 through April 2022 during the multiple rounds of QE.REF Fifty-eight percent of this increase has been in the past two and a half years. The Fed’s assets increased by 138 percent, from roughly $3.7 trillion to $8.9 trillion from before the pandemic through April 2022 owing to this shift in monetary policy toward monetizing the debt.

To highlight how dramatic the shift in monetary policy has been: The first $3.6 trillion in the increase in Fed assets occurred from September 2008 to roughly January 2015, at a rate of $576 billion per year. The Fed’s assets plateaued, then declined slightly to $3.76 trillion by September 2019 as the Fed attempted to return to the normal interaction between monetary policy and the overall economy.

However, that brief plateau period was ended by the COVID-19 pandemic and a resurgence of federal deficits. From February 2020 through April 2022, the Fed’s assets increased by $4.77 trillion, a rate of $2.2 trillion per year—almost four times the rate as during the QE rounds in the wake of the Great Recession.REF This spike in Fed assets, paid for by new money creation, served only one purpose—to cover the federal government’s new deficits.

Over the same period, from February 2020 through April 2022, federal debt rose by $7.1 trillion as Fed assets rose by $4.77 trillion.REF So, the Fed created and injected into the economy an amount of currency equal to two-thirds of the money the federal government would go on to drain out of capital markets during this time.

Compared to the CBO’s January 2020 baseline, actual outlays for FY 2020 and FY 2021 were $3.9 trillion higher than projected. Fed purchases of federal government debt covered 87 percent of the increase. During this time, the Fed purchased $3.4 trillion in federal debt. Another stark comparison is that the increase in federal outlays for FY 2020 through FY 2022 amounted to $4.7 trillion, which is almost exactly equal to the increase in total Fed assets during this period ($4.77 trillion).REF Thus, essentially all of the pandemic spending spree was indirectly financed through the use of newly created inflationary dollars.

This tragic inflationary reality is illuminated through the relationship of the pandemic-era increase in transfer payments and price-level changes. Chart 6 shows that the three pandemic-era spikes in nationwide personal savings perfectly tracked increases in transfer payments. As households spent these savings of newly created money, price levels began spiking.

Though not all the Fed’s recent asset purchases have been of federal debt, other asset purchases indirectly facilitated the federal spending spree as well. By creating and injecting these funds into the economy, the Fed helped to suppress interest rates on federal debt and provide cash to lending markets. This new money, divorced from any real production of goods and services, subsidized borrowers by devaluing the dollar. In this case, the principal borrower subsidized by Fed action was the federal government. This, of course, was ultimately done at the expense of household purchasing power by injecting new currency into money markets.

Rapidly Rising Interest Rates. To press its assault on inflation, the Fed has been selling off federal debt and significantly raised interest rates to reduce the money supply. While this may have helped to slow down price increases due to surplus currency, these actions have also increased the cost of capital—and thus, reduced economic output—helping to drive the current recessionary environment.REF

This increases interest rates on consumer debt, such as mortgages. These actions also increase interest rates on loans to businesses and on federal debt. The Fed hopes that reduced levels of commerce will be offset by reductions in the rate of inflation. However, as the Fed works to undo the inflation created by reckless levels of federal spending, it is making it harder for the economy to properly function.

The Fed has worked to dramatically raise the Fed Funds Effective Rate from 0.08 percent to 4.57 percent between February 2022 and February 2023.REF From February 26, 2020, through the March 9, 2022 (just before the first Fed Funds Effective Rate increase), the Fed purchased an average of $136 billion of federal debt per month.REF However, from March 9, 2022, through March 2, 2023, the Fed has reduced its holdings of federal debt by roughly $35 billion per month.REF

Overall, the Fed nearly doubled the monetary base between February 2020 and December 2021, from $3.45 trillion to $6.41 trillion.REF This represented a rate of new monetary base creation of roughly $135 billion per month during this period—similar to the rate of increase in Fed holdings of federal debt. However, from December 2021 through August 2022, the Fed constricted the monetary base by $831 billion, a rate of reduction of roughly $103 billion per month.REF

While the first part of this story—a rapid increase in money creation—led to the inflation crisis, the second part—a rapid constriction of the money supply—is causing economic stagnation. Increasing the Fed Funds Effective Rate, constricting the money supply, and allowing federal government deficits to crowd out private investment has led to spiking interest rates for households and firms across the country and all economic sectors. This has increased costs for Americans, adding to the inflation crunch hitting wallets across the country.

Further, this upward pressure on interest rates is compounded by the ongoing inflationary scourge. In the same way that goods and services prices are affected by both a change in the value of the currency and a change in underlying market conditions, so too is the price of money—interest rates.

As the dollar loses value, debt securities also lose value. A loan, bond, or other debt repayment agreement carries an interest rate that the borrower is willing to pay, and the lender believes will produce a sufficient real return on investment. However, if inflation rates spike, inflation will eat an increasing portion of the lender’s interest income—reducing the real (inflation-adjusted) rate of return.

A loan at an interest rate below the rate of inflation will yield negative real returns for the lender. When inflation rates are low and stable, lenders will be more confident about setting rates. Conversely, in a period of high, wildly fluctuating, and increasing inflation, that confidence rightly dissolves. As with the goods and services markets, inflation and the real actions of the Fed and federal government have caught Americans in a whirlwind.

For example, from March 9, 2022, through March 30, 2023, the prime bank lending rate more than doubled from 3.25 percent to 8 percent.REF From December 23, 2021, through March 30, 2022, average 30-year fixed mortgage rates more than doubled from 3.05 percent to a staggering 6.32 percent (and peaked briefly at 7.08 percent).REF Despite these actions, increases in a common measure of inflation, the Personal Consumption Expenditures (PCE) Price Index, have remained stubbornly high.

In March 2022, when the Fed began constricting the money supply, PCE inflation stood at 6.76 percent. PCE inflation then peaked at 7.0 percent in June 2022 and came down slightly to 6.25 percent in August 2022.REF So, though the Fed’s promise of reducing the inflation tax on Americans—estimated annually at $2,900 for a median-income family—has not come to fruition, doublings of interest rates and their effect on American’s wallets have.REF

Interest Rate Spike Causes Chaos for Mortgage and Banking Sectors. The stark reality of the cost imposed on Americans by these interest rate hikes can be seen in housing markets. The aforementioned mortgage rate increased from 3.05 percent to a peak of 7.08 percent and has resulted in crushing interest payments for Americans hoping to own a home. A homeowner with a mortgage on a median priced home at a rate of 7.08 percent would pay $11,000 more per year in interest, and $332,000 more in interest over the life of the mortgage than a homeowner with a mortgage rate of 3.05 percent.REF

Additionally, sputtering economic conditions led to a stunning 14.1 percent decline in gross private domestic investment in the second quarter of 2022.REF In particular, construction, nondurable goods manufacturing, wholesale trade, and durable goods manufacturing were the top four industries to see real output declines in the second quarter of 2022.REF This represents a dramatic reduction in the formation of new capital—meaning less construction of factories, equipment, office buildings, and the other physical tools that could drive economic expansion.

Similarly, Fed action to curb inflation led to spiking interest rates on newly issued federal debt securities. From December 23, 2022 (when average 30-year fixed rates were at 3.05 percent), through March 9, 2023 (just before the collapse of Silicon Valley Bank (SVB)), the interest rate on new 10-year maturity Treasury securities spiked from 1.5 percent to 3.93 percent.REF During this period, new one-year maturity Treasury security rates spiked from 0.031 percent to 5.18 percent, a shocking 1,571 percent increase and yield curve inversion.REF This will undoubtedly lead to dramatic increases in federal net interest costs and thus increase federal deficits even further, because all the prior spending created such a gargantuan national debt.

The feedback loop created by this situation will intensify federal crowd-out of private investment as the federal government’s desire to cover its deficits will continue to suck the remaining oxygen out of the economy. A comparison of projected federal net interest costs between the March 2021 and February 2023 CBO baselines adds a disturbing note to what is happening in financial markets. March 2021 CBO estimates expected roughly $4.4 trillion in federal net interest costs during the FY 2024-to-FY 2033 budget window.REF However, the current (February 2023) CBO estimate projects more than $10.4 trillion in federal net interest costs during the FY 2024-to-FY 2033 budget window—a $6 trillion, 136 percent increase in less than two years of high inflation and high interest rates.REF

The economy’s dire straits have more recently created a banking crisis. The March 10, 2023, SVB collapse has opened up a new chapter in the saga of the COVID-19-era federal spending spree. The failure of SVB is yet another result of reckless federal spending and Fed money creation. Despite the complexity of the banking sector, most of the risk of this sector comes down to one concept: Banks match savers with investments. Banking is a sector devoted to figuring out which investments today will lead to the most growth tomorrow. These delicate relationships and the confidence in such investments are highly dependent on the stability of interest rates and the monetary system. Due to recent reckless fiscal and monetary policy, both have been anything but stable.

Banks have an intrinsic maturity mismatch between assets and liabilities. The vast majority of bank liabilities are deposits (82.6 percent as of March 31, 2023) that can be claimed either instantly or with only a few weeks’ or months’ notice.REF However, banks will then invest that money by offering loans or buying bonds or other securities that usually have much longer maturities (such as 30-year mortgages). Banks take a risk that their assets will hold market value. If depositors quickly claim a large portion of deposits (a run on the bank), banks could be forced to sell those assets quickly to pay back the depositors. That is why it is essential that bank assets have stable interest rates and maintain their value. Rapidly changing interest rates lead to wild fluctuations in the value of loans and bonds.

In the recent period of steep interest rate climbs, the value of older bonds has fallen dramatically. If a bank could offer a new mortgage at 6.3 percent now, why would one instead buy a 30-year mortgage with a yield rate of only 3 percent? For precisely that reason, bank assets have been falling as the combination of Fed action to reduce the money supply and the crowd-out from federal deficits has sent interest rates sky high. So, as these old bonds fall in current market value because interest rates on new debt continue to increase, it pushes bank assets down close to the level of liabilities or even below water. As the risk of a bank going underwater increases, depositors may panic and cause a bank run. Though the Federal Deposit Insurance Corporation’s (FDIC’s) insurance covers the needs of most American households, many small and large businesses have working capital accounts that are beyond FDIC insurance limits and are thus greatly exposed to the risk of a run. This risk impedes business planning and action and introduces yet another way that current fiscal policy has made the economy falter.

The pressure created by enormous federal deficits leaves the Fed with a Sophie’s choice—trying to tame inflation while risking bank collapses or saving the banks by letting inflation run rampant. Truthfully, there is only one positive long-run solution: Dramatically cut federal spending.

Part III. Surviving the Consequences of the Spending Spree

The enormity of the recent spending spree and the resulting economic consequences highlight the importance of fiscal responsibility. However, the magnitude of fiscal imbalances in the years to come utterly dwarfs today’s problems.

Is the Worst Yet to Come? Prior to the pandemic, the federal government already faced long-term structural deficits of more than $1 trillion per year.REF Even in the absence of a recession or war, the CBO now projects that federal deficits will exceed $2 trillion per year starting in FY 2031.REF

While a multitude of irresponsible decisions led to the broken status quo, the driving force behind long-term imbalance is unsustainable spending growth, most notably in major benefit programs, such as Social Security, Medicare, and Medicaid.REF

Social Security currently has an unfunded obligation of $20.4 trillion, driven by a combination of poor program design and demographic changes. The program has been operating in the red for more than a decade, and the notional Social Security Trust Fund will go bankrupt in 2034.REF Blunt options for addressing the imbalance, such as a combination of across-the-board benefit reductions and tax hikes, are only avoidable if Congress enacts reforms quickly to address programmatic flaws.

The situation is even more dire for Medicare, which has an unfunded obligation of $52.6 trillion—larger than the gross federal debt and the long-term Social Security shortfall combined—and which faces insolvency by 2028.REF As with Social Security, enacting reforms soon is the only way to prevent runaway Medicare spending from wreaking financial havoc.REF

Medicaid presents yet another problem for taxpayers. A series of eligibility expansions (most notably through the Affordable Care Act) coupled with long-standing flaws has resulted in explosive spending growth, despite the substandard quality of care provided to beneficiaries.REF Improving the program’s design can enhance the value of benefits for the truly needy while reducing the strain on federal and state budgets.

The politically sensitive nature of these benefit programs has led most elected officials to shy away from promoting or even discussing reforms. However, ignoring the problem of unfunded liabilities and unsustainable spending growth is no longer an option. Maintaining the status quo of increasing the national debt in relation to the size of the economy threatens to cause an unsustainable increase in the cost of debt service. Even a modest sustained rise in interest rates relative to recent historic lows would create interest payments far beyond any historical precedent for the nation.REF

Should this scenario take place, the results would be catastrophic.REF Instead of measured reforms to programs, legislators would face pressure to enact a combination of dramatic benefit cuts and job-killing tax increases. Federal interest spending on this scale would also cause enormous investment crowd-out effects, extinguishing the growth and vitality that has been America’s hallmark for centuries. Any attempt to take a shortcut, such as defaulting on the debt or embracing currency devaluation,REF would almost certainly plunge both the country and the world into the greatest economic crisis since the Great Depression.

The financial laws of gravity have caught up to dozens of countries over the years, and the U.S. is not exempt from those laws. Accordingly, fiscally responsible governance is vital for preventing an even worse fiscal crisis, in addition to relieving contemporary problems of rapid inflation and rising interest rates.

Recommendations for Putting Out the Fire. While much of the damage of the spending spree has already been done, policymakers still have many opportunities to change course and reduce the severe economic pain facing average Americans across the country. The following would be a good start to address the spending and debt challenge. Congress should:

-

Stop the Spending Spree. Deficit spending is what lit the inflationary fire in the first place, and additional deficit spending would only add fuel to the fire.

-

Enact Serious Fiscal Restraints to Reduce Spending as Soon as Possible. Many elected officials hesitate to push for meaningful spending reductions due to concerns of political fallout. Programmatic changes and spending cuts would reduce deficit spending and accordingly lower inflationary pressure in the short-term while also improving the nation’s long-term economic trajectory.REF

The Heritage Foundation’s “Budget Blueprint for Fiscal Year 2023” includes a $523 billion reduction in federal outlays and a $444 billion reduction in the deficit for the first year, with even greater fiscal improvements after that.REF These changes include a combination of long-overdue program reforms, pulling back spending increases enacted over the past two years, and tax changes what would fight inflation by boosting productivity and supply. The result would be the creation of 6 million full-time-equivalent jobs, a 6.2 percent increase in long-term GDP, and faster growth in wages over the course of a decade.REF

-

Give the Fed a Single Mandate. Congress should repeal the current dual mandate on the Fed and give the Fed a single mandate related to maintaining stable prices and moderate long-term interest rates. Under current law, the Fed is required to act to promote maximum employment and to promote stable prices and moderate long-term interest rates.REF This dual mandate has served as a source of the current economic hardship facing the American public.

The core function of a central bank should be the latter goal, to maintain the value and usefulness of the currency as a medium of exchange and store of value. A central bank cannot magically create jobs, nor can it efficiently direct the allocation of capital. What a central bank can influence is the value of the currency it manages.

The employment mandate on the Fed has led the Fed to conduct the past 14 years of QE rounds, injecting $8 trillion of new currency into the economy and bringing its assets to more than 35 percent of GDP—all of which has led to surging inflation and spiking interest rates.REF In essence, the disastrous focus on the employment mandate has led to the effective abandonment of the stable price and moderate interest rate mandate. It is time to end the dual mandate and allow the Fed to focus solely on maintaining stable prices and moderate long-term interest rates.REF

-

Conduct Vigorous Oversight. While some of the fraud perpetrated during the spending spree has been uncovered, there is much more work to do. The unprecedented amount of spending was conducted with the goal of pumping cash into the economy as quickly as possible, meaning that guardrails to prevent criminal activity or merely inappropriate uses of taxpayer funds were often weak. The American people deserve accountability, and Congress should use investigations and hearings to shine a light on how public funds were mishandled or stolen.

-

Require the CBO to Use Dynamic Scoring. The CBO’s formal scores estimating the impacts of legislation are required to use static estimating methods. This current practice, as the name implies, ignores the effects of legislation on the broader economy. A bill that, if enacted, would cripple the U.S. economy and exclude those impacts from the CBO’s formal scores. It is vital that lawmakers receive accurate information about the legislation they consider. Congress must also ensure that the scorekeeping agencies use best practices for dynamic scoring, including taking into account the sources of financing new spending rather than using flawed multiplier assumptions.REF

-

Recognize How the Spending Spree Affected the CBO Baseline. Many discussions about future spending hinge on expectations set by the CBO baseline. For example, if the CBO baseline projects a spending increase, and a legislative proposal would reduce the amount of the increase, the proposal is typically called a “cut” even if spending on that item still increases year over year. In some areas, most notably infrastructure, the CBO baseline assumes permanent spending increases based on supposedly time-limited spending enacted since the start of the pandemic.REF Legislators must not view current spending levels as “normal” and should be prepared to push back against proposals that assume current spending is the floor.

Conclusion