More than five years after the 2008 financial crisis, the Federal Reserve’s role is still the subject of much debate. One source of controversy has been the extent to which the Fed allocated credit directly to possibly insolvent institutions. Critics argue that the Fed should have allowed insolvent firms to restructure through bankruptcy and should have provided credit only to sound banks on a short-term basis. Instead, the Fed facilitated bailouts to financially troubled institutions by invoking its so-called emergency lending authority. The government even forced some banks to take the money against their objections.[1]

Even after financial markets stabilized, the Fed expanded its asset purchases because the recovery was slow to materialize. These ongoing monetary policies have come under fire for being ineffective, for exposing taxpayers to further losses, and for increasing the likelihood of future inflation because they were so aggressive. The scale of these operations is reflected in the growth of the Fed’s balance sheet.

In particular, the Fed now holds more than five times the amount of securities it had prior to the 2008 crisis. The Fed’s balance sheet expanded from about $850 billion to more than $4.4 trillion. (See Chart 1.) The questionable value of these securities, as well as the Fed’s various lending programs, has led many to question the financial strength of the Federal Reserve itself. This Backgrounder provides a brief discussion of the Fed’s recent expansionary policies and their implications.

The Federal Reserve’s Recent Expansionary Policies

Since 2007, the Fed has followed an expansionary monetary policy in an effort to stimulate economic growth.[2] One key part of this effort was to buy short-term Treasury securities through its open-market operations. Through these asset purchases, the Fed injects more money into the economy. These purchases, in other words, were supposed to boost economic activity because they add reserves to the commercial banking system, thus allowing banks to lend more money.

Partly due to the ineffectiveness of these open-market operations in terms of unusually slow economic growth, the Fed instituted several rounds of additional securities purchases known as quantitative easing (QE). Under its QE policies, the Fed purchased longer-term securities in an effort to push longer-term interest rates down and, ultimately, further stimulate borrowing. The Fed engaged in three successive rounds of QE since 2008, and each had its own unique characteristics.

- QE1 (December 2008). In December 2008, the Fed started buying longer-term Treasury securities as well as the debt and the mortgage-backed securities (MBS) of Fannie Mae and Freddie Mac, two government-sponsored enterprises (GSEs).[3] The Fed announced it would purchase up to $100 billion of the GSEs’ debt and up to $500 billion of their MBS from both banks and the GSEs themselves.

- QE2 (November 2010). In November 2010, the Fed announced that it would purchase $75 billion per month of longer-termed Treasuries, for a total of $600 billion. These purchases were to be concentrated in Treasury securities with maturities of two to 10 years, though the Fed also intended to purchase some shorter-term and some longer-term securities.

- QE3 (September 2012). In September 2012, the Fed announced its third round of easing, now referred to as QE3. Under QE3, the Fed’s combined securities purchases (long-term Treasuries, GSE debt, and MBS) were increased to approximately $85 billion per month. Unlike its counterparts, QE3 was an open-ended commitment. Rather than commit to purchasing a fixed amount of securities by a certain date, the Fed declared that it would make purchases until it decided that the labor market had sufficiently improved.

Although the Fed has not announced an official end to the program, it began purchasing smaller amounts of bonds, referred to as tapering, in January 2014.[4] The Fed has been reducing its purchases by approximately $10 billion per month. Beginning in July 2014, the Fed was set to purchase only $35 billion of these securities ($15 billion in MBS and $20 billion in long-term Treasuries) each month.[5] The Fed is still expanding its balance sheet, merely at a slower rate than in the past.

As of this writing, the Fed holds approximately $2.3 trillion in long-term Treasuries, and $1.7 trillion in GSE securities.[6] According to Richard Fisher, president of the Dallas Federal Reserve Bank, the Fed now holds more than 30 percent of the stock of outstanding MBS and nearly 25 percent of outstanding Treasuries.[7] All three rounds of the QEs, as well as the Fed’s “normal” open-market purchases, were supposed to increase economic activity through additional lending.

Quantitative Easing: Was It Worth It?

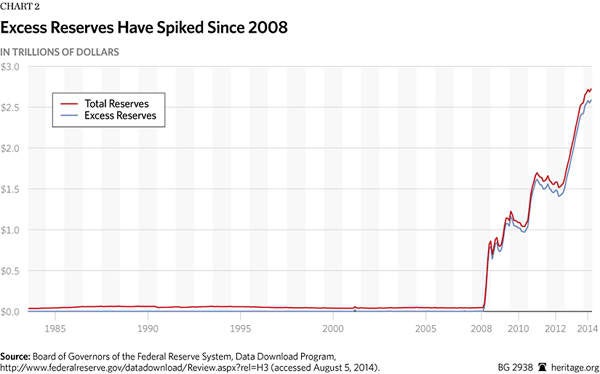

Instead of creating new money through additional lending, the Fed’s QE policies have greatly expanded the amount of excess reserves in the banking system. (See Chart 2.) In other words, banks have mostly decided to hold onto the cash that the Fed gave them when it executed all those securities purchases. Consequently, it is rather difficult to argue that these Fed policies have done much to expand the economy.[8]

In fact, by the Fed’s own admission, its expansionary programs have not sufficiently boosted economic activity. The Fed would not have implemented successive rounds of QE if the previous rounds had worked, and it would not have implemented the first QE program if more traditional open-market operations had worked. The reason that banks are holding on to all these excess reserves is debatable, but the fact that they are holding them highlights the limits of monetary policy.

Banks earn profits when they create new money through lending, but they lose money when they make bad loans.[9] Many banks are likely waiting for economic conditions to improve, and simply do not have many profitable lending opportunities. Similarly, banks are likely hesitant to make too many loans given the regulatory uncertainties surrounding the 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act. There is strong reason to believe these regulatory chokeholds on banks have slowed growth.

The fact that the Fed started paying interest on reserves in October 2008, something it had not previously done, could also explain the buildup in (idle) excess reserves. This new policy lowered banks’ incentive to create more money with new reserve balances because it reduced the cost of holding excess reserves. On the surface, it makes little sense for the Fed to flood the market with trillions in reserves and simultaneously induce banks to forgo using them to make new loans.

A large portion of these QE purchases, however, removed some of the riskiest assets—Fannie’s and Freddie’s debt and MBS—from commercial banks’ balance sheets. This fact has led some to argue that the Fed designed the QE programs as a way to bail out banks, not merely as a new form of expansionary monetary policy.[10] Regardless of the true intent, the QE programs have been so controversial because they effectively exchanged cash—created out of thin air—for bank assets that had dramatically declined in value. From the perspective of banks, the QEs could be judged a success because the purchases strengthened their financial position.

Controversy arises because those assets—including the MBS frequently referred to as “toxic” assets—have not simply disappeared. As seen on Chart 1, these assets are now on the Federal Reserve’s balance sheet. Put differently, the Fed now holds trillions of dollars in debt of two insolvent companies as well as the same securities that led to the 2008 financial crisis.

The solvency of any commercial bank holding these assets would be in doubt, and most of these purchases came after the Fed allocated credit directly to struggling financial firms.[11] Combined, these policies cast doubt on the financial health of the Fed as well as on the validity of the Fed’s function as lender of last resort. Consequently, many people have started asking what Federal Reserve insolvency would look like. The answer to this question is complicated, though, because a central bank is quite different from a commercial bank.

What Is an Insolvent Bank?

In general, a private company can be considered insolvent in one of two ways: Either it can no longer meet its debt obligations (its liabilities), or its capital becomes worthless. A commercial bank, for instance, holds customers’ deposits and is obligated to redeem them. When the bank is no longer able to honor these liabilities, it would be considered insolvent. A bank could also be considered insolvent if the value of the company’s capital—its net worth—falls to zero (or below).

This type of insolvency is sometimes referred to as balance-sheet insolvency because of the way firms’ assets, liabilities, and net worth are displayed on financial statements. On a balance sheet, a company’s assets must be equal to the sum of its liabilities and owners’ equity. Put differently, a firm’s total assets (the things it owns) less its liabilities (the money it owes) represent the company’s net worth.

A commercial bank’s assets consist primarily of loans to the public and securities, while its liabilities consist mostly of customer deposits. So, a commercial bank’s net worth could become negative if too many of its loans default (meaning its assets drop in value). Of course, if too many of its loans default, the bank may also run out of cash to meet its obligations. Commercial banks are heavily regulated in order to prevent this situation from occurring. Typically, regulators step in and force banks to raise new capital or to merge with healthier banks so that customers’ deposits (a bank’s liabilities) remain safe.

Can the Federal Reserve Become Insolvent?

Technically, a central bank could become insolvent in a manner similar to a commercial bank. In practice, the situation is very different because a central bank’s assets and liabilities are different from those of a commercial bank, and because the central bank can issue money to meet its obligations.[12] In effect, the Federal Reserve can bail itself out by printing money. The Federal Reserve’s liabilities, for example, consist of all U.S. currency in circulation plus commercial banks’ reserves.

These liabilities are referred to as base money or high-powered money because the central bank controls how much of this money exists, and because this amount ultimately determines the maximum quantity of money that can be created in the banking system.[13] In the U.S., these liabilities take the form of Federal Reserve Notes, commonly referred to as dollars.

In theory, a central bank finances these liabilities with its assets. In other words, the Fed can use its assets to earn money so that it can make money. The main assets on the Fed’s balance sheet are securities and loans to financial institutions. For most of its history, the Fed’s securities holdings have consisted mainly of short-term U.S. Treasury securities.[14] The Fed uses the income earned from these assets—historically, mostly interest payments on nearly risk-free Treasury securities—to pay its operating expenses. Any “profit” left over has to be remitted to the U.S. Treasury.

Because the Fed’s liabilities are essentially costless—it does not pay interest on Federal Reserve Notes and typically pays no interest on reserves—it almost always remits money to the Treasury.[15] Since 2008, however, the Fed has sold off virtually all of its short-term Treasury securities and acquired instead longer-term Treasuries and the debt and MBS issued by Fannie Mae and Freddie Mac. These securities are riskier relative to those normally held by the Fed for two reasons.

First, the value of long-term debt is particularly sensitive to a change in interest rates, and rates are expected to climb because they are currently near or at historic lows. As rates rise, a condition largely out of the Fed’s control, these long-term securities will lose value.[16] (Even Fed chair Janet Yellen admits that the Fed has little control over long-term interest rates.)[17] Second, a decline in the value of these very same MBS was a main cause of the financial crisis, so even their current worth is highly questionable.

Finally, such a large volume of these purchases presents political risk because, effectively, holding these securities amounts to lending to the federal government. In effect, the federal government pays interest on these securities to the Fed, and the Fed simply returns the interest to the federal government, thus allowing the federal government to borrow more money. The architects of the Federal Reserve System were leery of this sort of activity because it would be seen as “lending to the crown.” Regardless, if the Federal Reserve were a typical commercial bank, its regulators would have almost certainly disallowed these asset purchases or required the bank to raise new capital. The Fed is not, however, a commercial bank.

The Fed’s “Failure” Hinges on Its Special Government Status

The Fed does not face the same insolvency problem that confronts commercial banks. Nonetheless, the Fed is now exposed to heightened financial risks because of its recent operations. To fully appreciate these risks, the Federal Reserve has to be viewed as what it truly is: an extension of the United States government. As such, the Fed can nominally bail out any institution, even itself, but the true costs of these bailouts ultimately fall on U.S. taxpayers.

Generally speaking, the typical balance-sheet insolvency faced by commercial banks is not one of these costs. For instance, its newly acquired risky assets could cause the Fed to experience a type of balance-sheet insolvency if those assets dropped in value. But this fact alone means virtually nothing. There is no regulator, for instance, that can step in and shut down the Fed because its net worth is negative.

Even if the Fed were to suffer such large losses on its MBS holdings that it could no longer use those securities to meet its obligations, it could still create more base money to meet its obligations. The main limiting factor to this solution—printing more money to meet its obligations—is the (unknown) level of inflation the public will tolerate. Ultimately, if the Fed’s excessive money creation causes too much inflation, people would not want to use the U.S. dollar.

Another scenario—one that is not entirely unrelated to the excessive inflation story—is that the Fed could suffer such heavy losses on its securities holdings that it can no longer remit “profits” to the Treasury. Under normal circumstances, the Fed regularly remits funds to the Treasury because it holds very-low-risk securities. Now that the Fed has exchanged those low-risk securities for risky debt, this flow of money into the Treasury is much less certain.[18]

The failure to remit funds to the Treasury is not necessarily a problem because of the Fed’s special status. Just as the Fed can withstand losses on paper, neither Treasury nor Congress would be required to do anything if the Fed failed to remit funds. However, continued large losses could become a problem if Treasury had to start supporting the Fed instead of the other way around. This scenario would be much worse if it occurred during a period of high inflation, because the Fed’s ability to create base money would be constrained.

These issues would be further compounded if they occurred when the U.S. Treasury was already running a deficit, because the Treasury is the ultimate backstop for the Fed. In other words, the federal government would have to run an even bigger deficit to support the Fed. Though the Fed can withstand balance-sheet insolvency indefinitely, a combination of continued losses on its securities, high inflation, as well as large federal deficits and debt, presents both economic and political problems. Because the Fed’s ability to create more money in such a situation would be severely constrained, it may eventually have to turn to the Treasury for support.[19]

In other words, a scenario could arise whereby the Fed would need an injection of capital from the Treasury because it could no longer credibly print money. If the federal government were running a deficit at that time, one unpleasant option would be to issue new debt and transfer the proceeds (or the bonds themselves) to the Fed. This sort of Federal Reserve bailout would almost surely require congressional action, thus threatening the Fed’s operational independence.[20] Both domestically and internationally, these types of actions would not inspire confidence in the dollar as a stable currency.

What Should Be Done?

Arguably, the most immediate risk from the Fed’s policies is that banks could use those newly created excess reserves too quickly. Banks now have an additional $2.6 trillion in excess reserves, which means that they can create up to approximately $26 trillion in new money.[21] In other words, banks now have the power to create more than twice the amount of money currently in the U.S. economy, thus heightening the risk of future inflation.[22] As the economy improves, the Fed may have to pay higher interest rates on these reserves to keep banks from dramatically increasing their lending. Paying higher rates, all else being constant, would exacerbate any “losses” suffered by the Fed, thus increasing the political problems discussed in this Backgrounder.

For those same political reasons, there are risks to the Fed simply holding all of these assets indefinitely because interest rates are expected to rise in the future. If those rates rise, the Fed would suffer “losses” due to paying higher rates on its liabilities than it receives on its assets, again putting the central bank in a difficult political position. Also, as the world’s largest debtor, the federal government is highly vulnerable to an interest rate shock that could make the federal budget deficit much worse. A rule of thumb is that every one percentage point rise in interest rates increases the budget deficit by about $1 trillion over a decade. The safest course of action, therefore, is to start undoing the QE policies by selling off these securities.

Securities sales are typically associated with contractionary monetary policies, but because these reserves are excess reserves, and since they have done little to increase economic activity in the first place, removing these reserves should not have an adverse impact on the economy. Nonetheless, the Fed should minimize any negative effects by announcing a deliberate plan to sell the bulk of these securities over, for instance, the next six years. The Fed can also partly offset (or sterilize) these sales with its normal temporary open-market purchases of short-term Treasuries.[23]

As an example, the Fed could announce the following plan:

- Through 2020, 75 percent of the long-term securities and MBS will be sold, and the remainder will be held until maturity.

- Each month, the Federal Reserve will sell $45 billion of its long-term securities and MBS.

The Fed may still suffer some “losses” on these securities sales, but the danger of future inflation and political pressure outweigh the consequences of these losses. In fact, the longer it holds on to these securities, the greater the danger the Fed will not be able to control future inflation. At some point, the Fed will have to sell securities to try to slow down inflation, and if it does so after interest rates start rising, the losses on its securities sales will most likely be worse than they would be now. Such a situation would only magnify the Treasury’s fiscal problems, thus adding to the political pressure on the Fed. As bad as the QE policies may have been, letting Congress direct monetary policy operations would surely be worse.

Long-Term Monetary Policy Reforms. The Federal Reserve’s original purpose was to stem seasonal currency shortages at member banks, and its operations were constrained by the gold standard. The Fed began as a decentralized system in which most of the decision-making authority was left to the respective district banks. By the end of the 1930s, the constraints of the gold standard were gone, and the role of the district banks had been greatly diminished. Since at least the 1950s, the Federal Reserve has actively tried to stabilize the private economy and thus calm business cycles.

The U.S. has just lived through a period of very rapid money buildup and activist Fed policy to try to jump-start faster growth under Fed chairs Ben Bernanke and Yellen. But the result has been a very slow recovery with growth rates at about half the rate of growth during many previous recoveries. The Fed’s monetary policies are looking increasingly futile in terms of creating more jobs or accelerating economic growth.

Evidence suggests that the Fed has not been effective in accomplishing its stabilization goals, and some argue that there is little reason to believe it could ever do so with discretionary monetary policy.[24] The central bank’s 100th anniversary is the perfect time to publicize this debate with a formal monetary commission, such as proposed by Representative Kevin Brady (R–TX) and Senator John Cornyn (R–TX) in the Centennial Monetary Commission Act of 2013 (H.R. 1176 and S. 1895).[25]

Conclusion

The final backstop for the Fed is the U.S. taxpayer, and the only time a capital injection would be necessary is if the Fed can no longer “print” money, either due to a general lack of confidence, too much inflation, or a combination of the two. So far, the Fed’s expansionary policies have not created the rapid inflation that some predicted—but how much longer that can continue without a financial crisis as between 2007 and 2009 is anyone’s guess. It makes sense as an insurance policy against another massive Fed-sponsored bubble, as in 1999 and 2007, to rein in money to reduce the probability of another financial crisis.

Essentially, the only way that a central bank can truly become insolvent—in the sense that it can no longer operate—is if the public is no longer willing to accept the currency that it issues. The answer to whether a central bank can become insolvent, therefore, centers on what it can do to cause the public to lose confidence in its currency. A good first step in avoiding such a lack of confidence would be to start unwinding the QE policies. If the Fed waits too long, its policies could more easily risk the status of the dollar as the world reserve currency and jeopardize American economic competitiveness.

—Norbert J. Michel, PhD, is a Research Fellow in Financial Regulations in the Thomas A. Roe Institute for Economic Policy Studies, of the Institute for Economic Freedom and Opportunity, at The Heritage Foundation. Stephen Moore is Chief Economist in the Institute for Economic Freedom and Opportunity at The Heritage Foundation.