Many experts recognize that the government will still step in to support some financial institutions rather than allow them to go through bankruptcy. This “too-big-to-fail” doctrine remains at least as prominent now—and as costly to taxpayers—as it was prior to the 2008 crisis, partly because the Dodd–Frank bill exacerbated the problem. For instance, in the post–Dodd–Frank world, any firm deemed a high risk to U.S. financial stability enjoys implicit government protection.

One of the many ways in which Dodd–Frank worsened the too-big-to-fail problem is its expansion of the capital requirements that contributed to the 2008 financial crisis. For decades, federal regulators have required banks to hold a certain amount of capital based on how much money they lend to customers. These rules are supposed to force banks to build a cushion against unexpected losses, but they ultimately contributed to the financial meltdown because they were filled with arbitrary measures of risk.

Although quite simple in theory, these capital requirements have always been incredibly complex, and Dodd–Frank has only made the situation worse. The new risk-based requirements are not yet fully implemented but have already placed an enormous regulatory burden on financial firms, even small banks for which these rules were never intended. There is no reason to believe that these new capital regulations will prevent or even mitigate future financial crises, much less solve the too-big-to-fail problem. Implementing these rules will most likely impede economic growth without any real reduction in systemic risk.

Ending Too Big to Fail

The best way to end too big to fail would be for the government to announce credibly that it will not use taxpayer funds to support failing firms. A credible commitment to let troubled firms fail would alleviate the need for regulatory capital standards because markets would price risk and develop their own capital standards accordingly. Such a commitment is not possible in the current environment, so the best way to lessen the impact of the too-big-to-fail problem is to make regulatory changes that can lead to a believable no-bailout policy.

For example, people would be likely to lower their expectations of government bailouts if banks’ capital requirements were reformed to make financial distress less disruptive to the economy.[1] Despite many different proposals to reform capital standards, Dodd–Frank essentially imposed an updated version of the requirements that were in place before the 2008 crisis. This development is counterproductive because risk-based capital requirements, a centerpiece of the Dodd–Frank rules, were a key contributor to the meltdown.

Risk-based standards are not part of the solution to the too-big-to-fail problem. A better approach, more in line with basic free-market principles, would be to simplify, lower, and improve the incentive effects of capital standards. This plan should be implemented by eliminating risk-based capital standards and removing other costly regulations, which ultimately lead bank managers to use more debt to increase their shareholders’ returns.[2] Merely increasing the percentage of required equity that banks must hold against their assets does not solve the problems that contributed to the 2008 crisis. Instead, increasing the percentage of required equity arguably amplifies those difficulties.

The Main Problem with Higher Capital Standards

In the present context, capital refers to money that people can use to run a corporation. Business owners can raise this money by borrowing or by selling shares of equity in their company.[3] While borrowed funds must be paid back to avoid bankruptcy, money raised by selling equity does not need to be repaid. In the event a firm fails, equity holders can lose all of their investment while the firm’s assets are sold to pay back the lenders. Thus, investors who buy equity in a business take on more risk than those who lend money to the company.

In general, firms do not employ large amounts of equity capital because it is too expensive and because it produces incentives to take high risks. When a company enjoys abnormally high profits, only the shareholders benefit because lenders agree (ahead of time) to receive a fixed rate of interest for providing funds. For instance, lenders would be due 4 percent interest on their investment in the company whether the firm has minimal, abnormally large, or zero profit. Managers that employ large amounts of equity capital (relative to debt) have an incentive to take on high-risk, high-reward projects to satisfy shareholders’ required return.

Therefore, from a bank safety standpoint, requiring too much equity capital is a bad idea because only shareholders can profit from these high-risk earnings. Excessively high equity requirements also impose higher costs that, to some extent, will be passed on to customers through some combination of higher interest rates and less lending. Thus, while requiring any given percentage of equity for financial firms is somewhat arbitrary, setting them “too high” will most likely be self-defeating. This arbitrary nature applies even to the risk-based capital standards that have been used for decades because markets have essentially never determined bank capital standards.

The Basel I Risk-Based Capital Standards

The Federal Reserve and the Federal Deposit Insurance Corporation (FDIC) jointly adopted risk-based capital requirements for U.S. commercial banks in 1988. These rules, phased in through 1990, were based on the Basel I accords, an international agreement reached through the Basel Committee on Banking and Supervision.[4] In recognition of the high cost and inherent problems associated with equity capital, the Basel accords sought to better match capital requirements to the risk level of banks’ assets.

Under these rules, U.S. commercial banks have been required to maintain several different minimum equity capital ratios. Banks that fail to meet these requirements can ultimately be dissolved by the FDIC.[5] U.S. banking regulators were implementing Basel II, an updated version of the original rules, at the onset of the financial crisis. As a result of the crisis, regulators stopped that process and, instead, went to work on developing Basel III. These newest rules have not yet been fully implemented in the U.S.

Basel’s Tiers and Risk Weights. The Basel I rules use a tiered definition of capital that distinguishes between different “qualities” of capital. In this framework, Tier 1 (core) capital consists of common stock, retained earnings, some preferred stock, and certain intangible assets.[6] Tier 2 (supplementary) capital includes reserve allowances for loan losses, several types of debt, other types of preferred stock, and several types of debt/equity hybrid instruments.[7] A detailed discussion of these components is beyond the scope of this paper, but these definitions of Tier 1 and Tier 2 capital highlight the difficulty of defining exactly what makes up a bank’s capital.

Under the Basel I rules, regulators determine whether a bank is adequately capitalized by using these tiered capital figures to calculate several ratios. For instance, a bank is considered adequately capitalized if its ratio of total capital (the sum of Tier 1 and Tier 2 capital) to total risk-weighted assets is at least 8 percent and if its ratio of Tier 1 capital to total risk-weighted assets is at least 4 percent. To calculate its risk-weighted assets, a bank must apply a predefined (by regulators) weight to each asset on its balance sheet as well as to “off-balance-sheet” assets.[8]

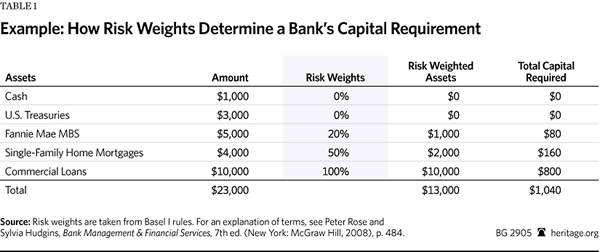

Table 1 provides a simplified example of how these risk weights are used to calculate a bank’s total capital ratio. Each asset’s risk weight is provided in the middle column. The risk weight is used to calculate both the required amount of capital and the total amount of the bank’s risk-weighted assets. The bank’s total risk-weighted assets, rather than total assets, are used to calculate the capital ratio. The riskier the asset is perceived, the more capital is required in case that asset loses value. Because cash and U.S. Treasury securities are deemed risk-free, no capital is required against these assets. Hence, they have risk weights of zero.

Basel I assigned risk weights of 20 percent for government-sponsored enterprise (GSE) mortgage-backed securities (MBS), so they contribute only $1,000 to this hypothetical bank’s risk-weighted assets ($5,000 x 0.20 = $1,000).[9] This bank would also be required to hold $80 in capital against its MBS ($5,000 x 0.20 x 0.08 = $80). At the other end of the perceived risk spectrum, commercial loans have a risk weight of 100 percent, so every dollar of these loans counts as a dollar of risk-weighted assets, and the bank must hold the full 8 percent in total capital.

As shown on Table 1, the total capital ratio for this bank is 8 percent (1,040/13,000 = 0.08). However, measured against the bank’s total assets, this amount represents less than 8 percent. In other words, the risk weights reduce the total amount of required capital versus a non-weighted scheme. More specifically, the weights allow the bank to hold capital of less than 5 percent of its total assets.

While somewhat oversimplified, this example replicates the manner in which banks were required to estimate their capital ratios under Basel I. Although brief, the example provides a glimpse into the complexity and subjectivity of estimating bank safety and soundness under these rules. For example, MBS proved to be much riskier than even regulators thought.

That mistake is not entirely surprising because regulators set risk weights based on how risky they think various assets will be in the future—a process that is inherently error prone. Mistakes are likely not only because people lack clairvoyance, but also because the process essentially prevents the private sector from finding norms for capital requirements. In other words, managers have been forced to adhere to—and influence—arbitrary standards as opposed to letting their own losses dictate the amount of capital they should hold.[10] Although it is not entirely clear that any form of legal capital requirements is economically necessary, the Basel risk-based system certainly did not provide financial safety.

Basel I and the 2008 Financial Crisis

In the wake of the 2008 crisis, the Basel I risk-based standards were clearly inadequate. According to the FDIC, U.S. commercial banks exceeded their minimum capital requirements by 2 to 3 percentage points (on average) for six years leading up to the crisis.[11] One factor contributing to the risk-based standards’ failure was that purchasing MBS enabled banks to reduce their capital and remain (nominally) adequately capitalized.

As noted, the Basel I capital standards called for banks to maintain 8 percent total capital against their risk-weighted assets. This system gave banks the incentive to invest in assets with low risk weights to reduce their cost of capital. Banks employed this strategy by investing heavily in the MBS issued by Fannie Mae and Freddie Mac, two GSEs. The MBS carried only a 20 percent risk weight and had the advantage of providing a higher return than government bonds.

Banks needed to hold only $1.60 in capital per $100 of MBS ($100 x 0.08 x 0.20 = $1.60) because of the lower risk weight. Home mortgages, on the other hand, carried a 50 percent risk weight, requiring capital of $4 for every $100 ($100 x 0.08 x 0.50 = $4.00). Thus, selling its mortgages to GSEs and then buying GSE-issued MBS allowed banks to lower their required capital by 60 percent (from $4 to $1.60) while earning a return (on MBS) that was higher than what was available on risk-free securities.

Stating these facts is not meant to suggest that banks “gamed” the system or did anything nefarious by purchasing MBS. In fact, there is very little reason to believe that banks thought the MBS they were buying would lose so much value—bank managers tend to prefer staying in business, after all. Regardless, the Basel requirements were—and still are—a system designed to match lower capital requirements against lower risk assets.

It is this part of the Basel standards that broke down. The Basel standards were inadequate not because they required too little capital per se, but because regulators failed to measure risk properly. This problem will always exist because the true risk of any financial asset can never be known until after the fact. People poorly estimated the risk of MBS prior to 2008, but the same could have happened with virtually any other asset.

Dodd–Frank and Basel III

The 2010 Dodd–Frank Wall Street Reform and Consumer Protection Act required federal banking agencies to develop countless rules and regulations. Although the legislation did not explicitly require adoption of the Basel III rules, the bill included language—mostly in Sections 165 and 171—that effectively directed federal banking agencies to implement the Basel III proposals.[12] These new regulations go well beyond minor adjustments to banks’ capital requirements.

With some exceptions for the smallest banks, U.S. depository institutions will need to adhere to higher risk-based capital, leverage (overall debt), and liquidity (short-term debt) standards as well as to a new countercyclical capital conservation buffer. This capital conservation buffer is supposed to maintain credit availability by increasing banks’ capital when economic conditions improve and decreasing it when economic conditions worsen.[13] In general, the new Basel III rules are supposed to be an improvement over earlier versions because they apply a “macro” regulatory view as opposed to micro-level scrutiny.

This approach is supposed to be better because Basel III’s predecessors focused too much on the safety and soundness of individual institutions. Purportedly, the new rules are tailored to prevent financial difficulties at any one institution from carrying over into the broader economy. One problem with this claim is that it ignores a basic justification for creating the Federal Reserve. Congress created the Fed in 1913 to prevent banking crises from causing widespread economic harm, not to save a few individual banks. Yet the new rules are supposed to improve financial stability because now the Fed will finally shift to a macro-oriented view of regulation.

The Fed, Congress, and the U.S. Treasury have openly discussed their roles in stemming economy-wide systemic risk and financial stability for decades. In fact, these concepts were mentioned in Federal Reserve testimony before the House Subcommittee on Economic Stabilization in 1991, shortly after the Basel I accords were accepted.[14] Aside from these issues, no empirical evidence shows that any of the new Basel III regulations will prevent financial crises any better than the old rules did.[15] The fact that some of the most glaring weaknesses of the original Basel framework remain unchanged in the Basel III rules offers little hope for success. For example, Fannie and Freddie MBS still carry only a 20 percent risk weight.[16]

A Better Approach

Specific capital requirements could be improved in many ways, but any changes should be balanced against the enormous regulatory burden that Dodd–Frank imposed on financial firms. For example, a much simpler approach to minimum capital ratios would be to require banks to maintain a 5 percent common equity to total asset ratio. However, regulators should move cautiously because this sort of “flat” capital requirement would actually increase the capital buffer that many banks hold. Simply increasing capital ratios without reducing banks’ regulatory burden will likely harm economic growth and do nothing to improve managerial incentives toward taking risks.

Other proposals, such as requiring banks to issue contingent convertible bonds (CoCos), could supplement simplified capital requirements and mitigate excessive risk taking. CoCo bonds serve the dual purpose of bringing market discipline to firm managers and, in the event of financial stress, automatically providing new equity capital through the private sector. Several different types of CoCos have been proposed, but they all share the same basic principles: They are issued as long-term debt securities (bonds) that may convert into shares of equity if the firm runs into financial trouble.[17]

Ideally, CoCos convert from debt to equity when a pre-agreed trigger event occurs. For instance, a capital-ratio trigger would impose conversion if the firm’s capital ratio falls below its required minimum.[18] Naturally, this type of CoCo would still require an arbitrarily selected minimum capital ratio because markets have not been allowed to determine the “correct” amount of CoCos that banks should hold. Ultimately, policymakers should fix this glaring weakness in the financial industry and let banks interact with their customers to determine what their capital requirements should be.

What Congress Should Do

The Basel risk-weighted capital standards have proven inadequate. Congress should direct regulators to replace the Basel III capital standards that are being implemented with standards that do not require subjective risk assessments of individual assets. Simultaneously, Congress should begin to dismantle the regulations that Dodd–Frank imposed on the financial sector.

Going forward, Congress’s best courses of action include:

- Repealing the Dodd–Frank Wall Street Reform and Consumer Protection Act.

- Short of a full repeal of the Dodd–Frank act, repealing Title I and Title II of Dodd–Frank or, at the very least, eliminating the Financial Stability Oversight Council.

- Until these changes are politically possible, allowing banks to opt out of all federal banking regulations and government assistance if they convert to a partnership entity. This option should be paired with an explicit statement that these entities will not be eligible for any federal assistance, including FDIC deposit insurance.

The best way to ensure that firms do not take undue risk is to state credibly that owners and creditors—not taxpayers—will be responsible for financial losses. Such a commitment is not possible in the current environment, so Congress can lessen the impact of the too-big-to-fail problem by making the structural changes suggested above. In exchange for relief from the federal regulatory burden, Congress can allow bank owners to assume the risk of their operation, as should be the case with any businesses in any sector of the economy.

Conclusion

The desire to end the too-big-to-fail problem has led to calls for everything from steep increases in capital requirements to arbitrarily breaking up financial institutions deemed too large. These types of proposals are not the answer because they would unduly harm consumers and would not end government bailouts. The new Dodd–Frank rules are similarly misguided because they essentially force financial institutions to comply with recycled versions of old risk-based capital, leverage, and liquidity standards that have already proven themselves inadequate.

The best way to end the too-big-to-fail problem is through a credible federal commitment not to use taxpayer funds to save financially troubled companies. A credible commitment to let firms fail would allow markets to price risk as accurately as possible and would alleviate the need for formal capital standards. A good first step toward making such a commitment believable would be to eliminate subjective risk projections from capital requirements and to expose financial firms’ managers to more market discipline.

—Norbert J. Michel, PhD, is a Research Fellow in Financial Regulations in the Thomas A. Roe Institute for Economic Policy Studies, and John L. Ligon is Senior Policy Analyst and Research Manager in the Center for Data Analysis, at The Heritage Foundation.