Are lower tax rates more or less important than accelerated depreciation or expensing for economic growth? Long at the heart of debate surrounding corporate tax reform, this question may soon be center stage.

Welcome pressure is building to lower corporate income tax rates to strengthen the economy and to level the global playing field. Other nations have reduced their corporate tax rates, leaving the United States as number one in this highly dubious category. A popular target for the federal corporate tax rate is 25 percent, roughly in line with the average of the other industrialized countries.

Corporate tax reform should be revenue neutral to avoid the appearance of merely covering for an exercise in revenue enhancement and thus negating much of the intended economic benefits while likely dooming the effort to political defeat at the outset. Nor should the effort depend on developing a miraculous consensus for shifting tax burden onto individuals from corporations. To lower rates as intended, policymakers will need to broaden the base by eliminating loopholes and related means.

Another long-standing goal for corporate tax reform is to reduce the tax bias against business investment. Many of the tax policy reforms during the 1980s pursued this goal in part by moving from economic depreciation to accelerated depreciation. More recently, political support has built for full expensing—allowing companies to deduct immediately the full cost of their capital purchases in calculating taxable income.[1]

Policymakers today face the difficult task of resolving the conflicting goals of corporate revenue neutrality while significantly reducing rates through appropriate base broadening, possibly including the choice of an alternative depreciation system. Contrary to the popular myth, there just are not enough corporate tax preferences or “loopholes” to close to achieve all three goals simultaneously. Something has to give.

Assuming revenue neutrality is maintained, policymakers need some guide on how to balance depreciation considerations and rate reduction. In traditional tax theory with its simplifying assumptions, the guidance is to pursue expensing first, rates second. In practice, a key simplifying assumption—economists’ beloved assumption of perfectly competitive markets—is substantially untenable. Relaxing this assumption leads to a possible trade-off between the depreciation system and tax rates—a trade-off that may help to resolve the corporate tax reform conundrum.

Why Expensing?

The desire for lower tax rates may be obvious, but what is the case for expensing? In plain English, the answer is that time is money. In economic terms, the answer is the time value of money and the cost of capital or hurdle rate on new investment. Of course, a profitable business can deduct the full value of its capital purchases. However, under current law the deduction is generally taken piecemeal over a number of years through a system of depreciation deductions, sometimes called capital consumption allowances. Time is money, so the delay in deducting the full value of the investment means the present value of the deductions is less than the purchase price. Tax neutrality is violated, and this in turn raises the cost of capital leading to a smaller stock of capital employed, lower wages, and a smaller economy.

Expensing remains a centerpiece of most tax reform proposals following the traditional mantra: Get the tax base right first, and then try to keep rates low. For example, expensing was included in the growth and investment tax advanced by President Bush’s tax reform panel,[2] the canonical flat tax, and the modernized version called the New Flat Tax.[3] Recently, expensing has been advocated as one-off economic stimulus in the face of a weak economy.

The Ambivalence Toward Expensing

Historically, the most perplexing response to expensing advocates is not theoretical, but the business community’s ambivalence. This is understandable coming from labor-intensive firms, such as retailers with little capital to expense, which would obviously prefer rate reductions. Recently, however, a stronger preference for lower tax rates is often expressed by relatively capital-intensive firms, such as manufacturers that would especially benefit from expensing. These firms occasionally respond, in essence, that expensing is fine, but they really need lower statutory tax rates to compete more effectively in the global economy.

This relative ambivalence toward expensing by even capital-intensive firms is a relatively recent phenomenon. Prior to the Reagan tax cuts of 1981 and the Tax Reform Act of 1986, capital-intensive firms banded together for mighty and highly technical battles over the merits of competing depreciation systems and depreciation supplements, such as the investment tax credit. To one accustomed to these past arguments, the present near silence on the subject across industry types and across ideologies is stunning. To be sure, there is now a consensus to allow expensing for small businesses, but this is motivated as much by the desire to relieve small businesses of complex accounting requirements and possible cash flow constraints as it is by the economic merits.

There is broad agreement that lower tax rates are important to the economic health of businesses of all sizes. Yet the instinctive reaction of expensing proponents to business leaders’ relative indifference is that the business leaders must not really understand the power of expensing to improve investment incentives and thus the competitiveness of their companies. It is ironic and ultimately untenable that instinctive defenders of the free market system try to explain corporate leaders’ subdued support for expensing by arguing that these same leaders are persistently and systematically ill informed.

Another more substantive and only slightly more satisfactory explanation is that lower tax rates filter straight into the almighty corporate earnings statement, whereas expensing does not. A lower tax rate immediately shows up as a higher level of after-tax earnings from current operations. Expensing improves current net cash flow and future profitability and reduces the current tax burden somewhat, but faster depreciation write-offs do not alter the financial accounting governing the reporting of earnings and profits, leaving reported earnings and profits largely unaffected.

The implication of the financial statement argument is that corporate leaders are somewhat myopic, focused unduly on short-term results reflecting their own performance—and influencing their bonus packages. It also implies corporate boards are so ineffective that current management’s self-interest can consistently and substantially slight shareholder value. One need not place enormous faith in the corporate board system to doubt the adequacy of the financial statement explanation.

In recent years, exceptionally low interest rates have reinforced this ambivalence toward expensing. Low interest rates substantially reduce the consequential difference between economic depreciation and expensing. Yet there appears to be more to the story than low interest rates. Many companies manifested ambivalence toward expensing long before the current era of low interest rates.

Each of these explanations may play a role to some extent, but none of them is altogether convincing, individually or collectively. Economists have been accused of finding something failing in practice, only to prove it works flawlessly in theory. When some behavior freely persists on the part of well-informed, duly self-interested individuals and that behavior runs contrary to theory, at some point we must ask whether the theory is missing something fundamental.

Is the Traditional Model Too Naïve?

Every economic model is built on simplifying assumptions. These assumptions are often necessary to make the model tractable, but also necessarily render it somewhat naïve. The question is whether the simplifying assumptions ultimately lead to misleading results.

A simple thought experiment reveals a sense of what may be amiss. Using traditional theoretical tools, one finds the incentives facing equity-financed investments are unaffected by tax rates if the tax system allows for expensing. That is, the tax rate does not affect the hurdle rate or cost of capital on investment (the minimum, required pre-tax return on investment) if the business can expense its capital purchases.[4] This result forms the basis for the conclusion that expensing promotes tax neutrality because then investment decisions are unaffected by tax policy at the margin.[5]

This is all well and good, but what if the tax rate is 100 percent? According to the usual theory, the business owner will still invest up to the point where the marginal return on investment is equal to the cost of capital even though the owner will receive no after-tax proceeds from the investment beyond the bare minimum required to compensate for the time value of money plus a risk premium. In short, according to the textbook theory, a 100 percent tax rate would have no effect on the level of business investment. In practice, even textbook publishers getting expensing would stop investing if facing a 100 percent tax rate.

The theoretical problem may lie in how the theory reflects a company’s investment decision process. Perhaps business owners in the real world are less interested in the pre-tax marginal returns on the individual business investments than theory suggests. Theory suggests a business will invest until the marginal return on investment equals the cost of capital. At that point, the firm earns or expects to earn only the minimum return overall as market pressures generally squeeze out all extra or economic profits.

Further, theory suggests market pressures will ensure no business is able to earn extra profit (economic profits or, more technically, economic “rents”) on a regular basis absent some extraordinary conditions, such as government intervention or technological advantages that temporarily permit monopolistic behaviors. These observations are natural extensions of the neoclassical approach to economic decision making based on perfect competition.

However, what if businesses—and their owners—in fact demand some level of economic profits? In economic terms, what if the assumption of perfectly competitive markets were relaxed?

Mature and stable markets may evolve to the point where economic profits are competed away, aligning practice with theory, but dynamic and rapidly changing markets and technologies are constantly creating new opportunities to earn extra profit. The suggestion of persistent economic profits certainly violates the usual assumption of perfect markets bidding away excess profits, but relaxing that assumption may explain the preference for lower rates. Businesses in fact do seek out extraordinary profit opportunities as a result of technological innovation, market dynamics, market research, or just dumb luck.

Alternatively, the problem may lie in a related, innocuous simplifying assumption. In calculating the cost of capital used to determine the level of investment, the typical framework is a profit-maximizing firm making a discrete investment or a series of identical, discrete investments over time. This is fine to a point, but it abstracts from the key question: What do the firm’s shareholders require? The firm’s shareholders cannot distinguish between the first and last dollar earned or between the profits from diverse investments. The firm does not generally make a discrete investment, but rather a series of evolving investments generating returns reflecting a variety of patterns over time. The firm aggregates its returns and presents the owners with an aggregated stream of income. The owners, in turn, present management with their expectations for their after-tax average returns on the use of their saving.

In sum, we can think of the firm as maximizing marginal after-tax profit as usual, but subject to a constraint imposed by the owners that the firm’s average return on investment must match or exceed some minimum level. This is intuitive because owners ultimately care nothing about marginal returns per se. They care about the pool of profits generated that can be distributed among the owners (or reinvested). A shareholder in a company demands a certain return given the usual factors, such as risk and market correlation, and the company’s management is expected to find the level of investment that can generate that return.

The analysis presented below suggests that under certain reasonable circumstances there is an inherent trade-off between lower tax rates and the structure of depreciation deductions. This trade-off arises because business owners demand not only that investments achieve a minimum marginal pre-tax return on their investments, but also a minimum average pre-tax return consistent with the pursuit of economic profits. The study further suggests that depreciation may now be sufficiently accelerated that, in terms of investment incentives, businesses are generally correct in pressing for lower rates in preference to expensing.

To explore these issues and how they affect the level of investment, a simple, standard two-period model of business investment is developed. This model is then used to show the conditions under which expensing is superior to other depreciation systems for achieving tax neutrality. The model is then expanded to include a constraint expressing a minimum average return on investment required by the firms’ owners.

Tax Neutrality in a Simple Model

Under traditional theory the federal tax system would ideally aspire to tax neutrality in the tax base married to low tax rates. However, as long as an aggregated tax is levied on businesses operating in a dynamic economy, a potential policy trade-off may exist between the choice of depreciation system and the tax rate. On what basis should policymakers choose between rates and the depreciation system to preserve a strong economy?

To begin to answer this question, we consider a simple two-period model of business investment.[6] The firm seeks to maximize the net present value of after-tax cash flow π by purchasing an amount of capital K in the first period, employing this capital plus an amount of labor L in the second period in a simple production function F = F (K, L) displaying the usual properties. From the income earned in the second period the firm pays wages w to its labor and interest r to any creditors involved in the acquisition of K. As we are interested in the decisions relating to the level of investment, we can simplify by defining gross income net of labor costs as

![]()

To complete the initial model, we assume the capital employed depreciates by δK and is resold at the market price at the end of the first period. Interest income and business income are each subject to tax at rate τ, and all flows are discounted by the after-tax interest rate ρ = r (1—τ). To keep the model simple, we assume all prices are constant.

One additional element that is sometimes ignored in models of taxation and investment is cost basis recapture under Section 1250 of the Internal Revenue Code. An asset’s cost basis for tax purposes is its purchase price. The adjusted cost basis is the cost basis adjusted to reflect tax depreciation taken on the asset. If the asset is sold at a price that exceeds its adjusted cost basis, then the excess over the original basis is taxed as capital gain, while any excess over the adjusted cost basis is taxed as ordinary income, in effect recapturing excess depreciation taken.[7] For example, if the purchase price is $100, the amount of tax depreciation taken is $60, and the resale price is $50, then $10 of excess depreciation is recaptured as ordinary income from the sale of the asset.

For a firm financing its operations through equity subject to tax on its net income and able to expense its capital outlays, the investment decision process can be described simply as

The first term –K represents the initial capital outlay occurring in the first period. The second term τK represents the tax value of expensing, which also accrues in the first period. The third G(K)(1 – τ) represents the after-tax income from production earned in the second period. The fourth K(1 – δ) represents the income from selling the depreciated capital, and the fifth term τK(1 – δ) represents the tax on the adjusted cost basis, all of which is taxable income because the firm was able to expense its initial outlay.[8]

Setting the derivative of Equation 2 with respect to K equal to zero yields the traditional result that expensing allows the required pre-tax return on investment or cost of capital to reflect the time value of money plus the rate of depreciation and allows for the required pre-tax return to be invariant to the tax rate:

![]()

where G’(K) refers to the derivative of G(K) with respect to K.

With Recapture, Interest Deductibility and Expensing Can Be Neutral

An alternative case arises if the firm finances itself entirely through debt, in which case Equation 2 can be rewritten as

Equation 4 differs from Equation 2 in that the firm must first raise capital in the amount of K in the first period, and in the second period must repay the principal in the amount of K and pay after-tax interest in the amount of rK(1 – τ). Solving Equation 4 in the same way as Equation 2 once again yields the neutral result shown in Equation 3.

This result may be surprising to some who have mistakenly argued that allowing a firm to expense capital outlays and deduct interest expense would go beyond neutrality to subsidizing capital investment. The explanation is that the expression in Equation 4 includes the recapture of income from the sale of capital. For example, if one ignores the recapture element, then Equation 4 is written as

This yields the more familiar result for this case of

For many reasonable values of δ and τ, the expression (δ – τ)/(1 – τ) δ leads to the result that combining expensing with deductibility of interest subsidizes capital investment. However, the source of the result is the failure to account for the recapture of income when the productive asset is sold.

Demanding Owners

This paper’s central issue is whether a required after-tax average return imposed by the firm’s owners can shift the policy preference toward lower tax rates relative to more accelerated depreciation or expensing. This shareholders’ constraint can be expressed in many forms, but a simple rendering is to express the minimum average after-tax return in terms of a minimum return on equity. This can then be expressed as the need to maximize Π over the choice of investment level K, subject to the constraint that Π ≥ βK, where β is the required average after-tax return per dollar of investment. This can then be written out as

such that the expression in Equation 7 now reflects the possibility of expensing (ε = 1) or a depreciation rule (ε 1).[9]

Performing the maximization yields an expression for the cost of capital of

where λ is the usual Lagrangian multiplier.

In Equation 8, if the shareholders’ constraint is not binding (λ = 0), then the cost of capital is equivalent to what we found in the base case after adjusting for the possibility of partial expensing.

On the other hand, if the constraint is binding so the cost of capital is higher as the marginal return is driven up to satisfy the requirement of a binding minimum average return, then the shareholder constraint as posited suggests an explanation for the preference for low tax rates over more accelerated depreciation. A lower tax rate provides a higher after-tax average return, while a more accelerated depreciation system does not. The constraint is binding, so further investment incentives such as more accelerated depreciation have little appeal to the firm’s owners and thus do not encourage a higher level of capital employed.

Furthermore, if the shareholders’ constraint in Equation 8 is binding, then the tax rate plays an important role in determining the hurdle rate on investment even under expensing. In other words, if the company’s owners impose a binding constraint of a minimum average after-tax return, then a trade-off arises between tax rates and the structure of the depreciation system. This demonstrates one theoretical explanation for even capital-intensive firms preferring lower tax rates, at least under some circumstances.

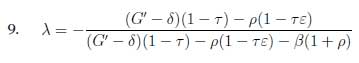

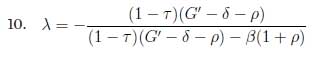

The Lagrangian multiplier itself is an interesting factor as can be seen if we take the first-order condition from Equation 7 and solve instead for λ, yielding

The intuition of λ becomes more intuitive if we simplify by assuming expensing:

In Equation 10, the expression (1 – τ)(G′ – δ – ρ) is the after-tax excess marginal return on investment needed because of the binding constraint. The denominator then compares the after-tax excess marginal return to the required average return on investment adjusted for the time value of money.

Lower Rates or More Accelerated Depreciation?

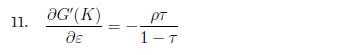

We consider next whether at some point the advantage shifts from moving toward expensing to lower the traditional cost of capital to moving toward reducing the tax rate to lower the effective hurdle rate on investment. To explore this question, we look at the derivative of G′(K) with respect to τ and ε, ∂G′(K)/∂τ and ∂G′K)/∂ε. Specifically, we assume for a moment that 0 ≤ ε

From Equation 8, we find:

In Equation 11, it is interesting to note that the consequences of altering the depreciation system are not dependent on the shareholders’ constraint.

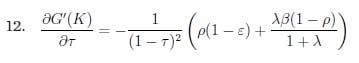

Also from Equation 8, we find:

Combining Equations 11 and 12 yields:

We know that, if both λ and β are greater than zero, then the last term in Equation 13 must be positive. Given that β is the required average pre-tax return and ρ is the discount rate, if we assign values for β and ρ (β = 20 percent and ρ = 5 percent), then the latter term in Equation 13 varies from a value approaching zero for λ approaching zero to a value of about 0.2 as λ goes to infinity. These values will be useful in what follows.

We now consider the first elements in the numerator of the right-hand side of Equation 13: ρ(1 – ε – τ(1 – τ)). As the present value of depreciation allowances declines (ε approaches 0), this term is clearly positive for all values of τ. However, as the present value of depreciation allowances increases toward expensing (ε approaches 1), the expression becomes –ρτ(1 – τ), which is clearly negative for all values of τ.

The expression ρ(1 – ε – τ(1 – τ)) goes from positive to negative as ε varies from zero to one. This suggests that the expression in Equation 13 could shift from positive to negative as well, which is what is needed to find circumstances in which ε is sufficiently high that reducing the tax rate would tend to be more advantageous than further movement toward full expensing.

To explore this further, Table 1 shows a few possible values for ε and τ assuming ρ = 0.05.

As these figures suggest, when depreciation rules are especially miserly (ε, the present value of depreciation allowances is below 50 percent, for example), then the relative advantage of accelerating depreciation over tax rate reduction is plain. However, the relative advantage of rate reduction over further depreciation acceleration appears as depreciation approaches expensing (ε approaches unity)—as it is today for many types of equipment.[10] For example, the present value of the depreciation allowed for short-lived assets is typically above 85 percent of the purchase price (or 85 percent of expensing) using the discounts prevalent today.

Conclusion

The genesis of this discussion is that, contrary to theory, even capital-intensive firms often appear to prefer lower tax rates to more accelerated depreciation, and that this preference has been evident for many years. The typical response from expensing advocates is that the theoreticians are right and business leaders are simply mistaken. At some point, we need to query whether maybe the theoreticians are putting too much faith in the assumptions underlying their theory.

One assumption in particular stands out for questioning: the assumption of perfectly competitive markets giving rise to the expectation by investors and firm managers alike that economic profits should generally be bid away. This very useful theoretical assumption does not appear to hold as a rule in the U.S. economy. Relaxing this assumption to allow for systematic, expected economic profits then changes the typical firm optimization problem into a constrained optimization in which the firm seeks to maximize marginal after-tax returns subject to a minimum average return requirement.

Exploring the case of a binding constraint indeed suggests the possibility that raising the depreciation share—what otherwise might be defined as the present value of depreciation allowances—is more important for lowering the cost of capital than lowering the tax rate if the depreciation share is low. However, reducing the tax rate may become relatively more important to reducing the cost of capital as the depreciation system approaches the equivalent of expensing. As most forms of business investment are subject to accelerated depreciation, the question framed here may offer a theoretical resolution to the question of why even capital-intensive businesses often seem to prefer lower rates over expensing.

—J. D. Foster, PhD, is Norman B. Ture Senior Fellow in the Economics of Fiscal Policy in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation. A version of the paper was previous published in Tax Notes.11