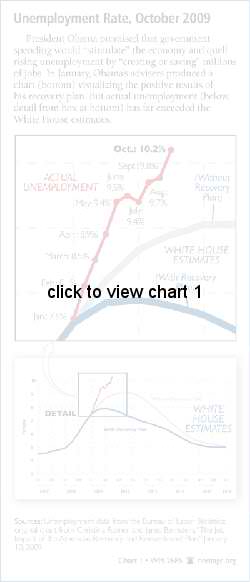

On November 6, the Bureau of Labor Statistics announced that the unemployment rate had soared from 9.8 percent to 10.2 percent in October. Jobs losses in October--190,000--were higher than expected. As job losses mount, the monthly jobs report continues to demonstrate both the failure of the stimulus bill and the hollowness of the Administration's claim that it created or saved 640,000 jobs. Congress and the Administration should encourage private-sector investment and entrepreneurship instead of attempting to plan a recovery from Washington.

October Report

The unemployment rate jumped to 10.2 percent, the highest level since 1983. The unemployment rate for males is 10.7 percent while the teenage unemployment rate is 27.6 percent. These are the highest levels of unemployment for these groups since the Great Depression.

The unemployment rate increased even as 31,000 potential workers left the labor force. The labor force participation rate has now fallen to 65.1 percent--the lowest since 1986. When people reenter the labor market to find work, the unemployment rate will further increase.

The report did have some bright spots: Job losses for the previous months were revised down by 91,000. Overtime work also increased last month, and the number of weekly hours worked appears to have stabilized.

The best news in the report is that the temporary service industry increased employment (33,700). An increase in temporary service hiring is a prelude to more permanent hiring by companies. If hiring continues to increase in this sector over the next few months, it will be a positive omen for an increase in permanent job creation.

Other sectors did not fare as well. Construction (-62,000) continued to fall. Heavy construction (-13,700) lost jobs as well, despite the stimulus hype of creating jobs working on highways and bridges. Manufacturing (-61,000) was down as well, but automobile manufacturing (4,600) climbed for the second straight month.

Stimulus Numbers Exaggerated

Despite this ongoing deterioration in the job market, the Obama Administration continues to argue that the $800 billion stimulus bill has improved the economy. On October 30, the Administration released data claiming that the stimulus has created or saved 640,000 jobs. These claims are mistaken, as demonstrated by the 2.8 million jobs that have been lost since the stimulus became law. The Administration's figures greatly exaggerate the positive effect of the stimulus for two reasons:

- The data used to create these estimates contains serious flaws. The Administration provided unclear guidelines for how to report jobs created or saved. Media analyses of these jobs reports have found severe errors. For instance, the Associated Press found that two-thirds of the 15,000 jobs one agency reported creating or saving did not really exist. Rather, the agency reported workers who received raises with stimulus funding as having their jobs "saved."[1] In another case, a shoe store in Kentucky that provided nine pairs of boots to the Army Corps of Engineers for $889.60 reported saving nine jobs.[2] Such errors pervade the stimulus job creation estimates.

- A deeper problem with the Administration's numbers is that they estimate the wrong figures. The Administration estimates the jobs directly funded by stimulus spending. However, they ignore the jobs that the money spent on the stimulus would have otherwise created. Congressional spending does not create wealth; it redistributes it. Had Congress not passed the stimulus bill, the private sector would have used those funds on other projects that would have also created jobs.

Broken Window Fallacy

The Obama Administration has committed Bastiat's "broken window fallacy." Bastiat's contemporaries had argued that when vandals break a house's window, it hurts the homeowner but benefits the whole economy. They argued the homeowner would spend money to fix his window. These repairs would provide income for the glazier, who would in turn spend that money at the grocers, who would in turn spend that money elsewhere in the economy: The homeowner's misfortune created jobs throughout the entire economy.

Bastiat observed that this analysis was correct but incomplete. The broken window did create income for the glazier. If, however, the vandals had not broken the window, the homeowner would have spent his money elsewhere, like at a tailor's to buy a new suit. The tailor would then spend that money at the grocers, creating jobs there, and so on. The vandalism did not create jobs; it merely shifted them from the tailor to the glazier while depriving the homeowner of the suit he could have bought. The broken window fallacy consists of looking only at the jobs created by spending on an item while ignoring the jobs that would have been created had that money been used otherwise. Furthermore, under this fallacy society is poorer--only in Bastiat's scenario was something new (a suit) created.

Other governments have committed this fallacy in evaluating the effectiveness of their spending programs. The Spanish government has spent heavily on creating "green jobs." Economic research, however, shows that each green job created in Spain came at the cost of destroying 2.2 other private sector jobs.[3]

The Obama Administration's job creation estimates also commit this fallacy. They attempt to measure the number of jobs the stimulus bill has funded. They ignore the jobs lost because the money that would have funded them went to the stimulus. In economic terms, it ignores the opportunity cost of the stimulus. Consequently, the Administration can claim to have created jobs even as unemployment has hit a 26-year high.

Business Investment Falling

The data suggests that the opportunity cost of the stimulus bill has primarily been the result of government borrowing. Absent the stimulus bill, private lenders would have either loaned their money to other borrowers in the private sector or spent it. Instead they lent it to the government, leaving that money unavailable to others.

This has hurt private-sector borrowers severely. Chart 2 shows the year-on-year percentage change in business loans over the past 20 years. In September, business loans contracted at an 11 percent annual rate.[4] This is the worst business environment for business loans in over 50 years, considerably worse than when the President signed the stimulus into law. Businesses that want to expand and invest have much greater difficulty obtaining credit. Many potential business investments cannot obtain funding.

As the ability to fund business investment has plummeted, job creation has withered. Chart 3 shows the year-on-year percentage change in equipment and software investment and new hires. They have risen and fallen together. Over the past year, business investment has fallen by 19 percent and new hires have fallen 17 percent. Business investment has fallen and with it new jobs. The stimulus has funded some jobs--at the cost of preventing businesses from creating even more.

Government Interference Is Impeding Economic Recovery

The October report continues to show the ineffectiveness of the stimulus bill. Administration economists had promised that the stimulus bill would cause a decline in the unemployment rate in the fourth quarter of 2009. Instead, the unemployment rate soared past 10 percent and is at record highs for some groups.

While the labor market will eventually recover and return to a period of job creation, policies in Washington are not speeding the recovery. The stimulus spending has come at the cost of private-sector jobs that would have been created absent government intervention. Some policies are even slowing job growth as companies face higher labor costs due to numerous government interventions. Washington should promote business investment and entrepreneurship instead of attempting to plan a recovery from Washington.

Rea S. Hederman, Jr., is Assistant Director of and Senior Policy Analyst in, and James Sherk is Bradley Fellow in Labor Policy in, the Center for Data Analysis at The Heritage Foundation.