When Congress adopted the fiscal year 2002 budget resolution on May 10, it included an additional $73 billion for agricultural spending on top of the $95 billion base approved over the next 10 years, including an historic 65 percent increase in farm subsidies. Many policymakers believed these increases would be affordable in the era of huge budget surpluses. By September, however, estimates of the five-year budget surplus had dropped by almost 50 percent to just over $1 trillion.1 In the wake of the September 11 terrorist attacks, the next estimate is sure to be much less. But rather than reassess America's national, economic, and budgetary priorities at this difficult time, Members of Congress have initiated a feeding frenzy at the federal trough. They are rushing to pass a farm bill that will lock in favored subsidy programs--primarily benefiting wealthy farmers--before the surplus is gone.

As Senator Kent Conrad (D-ND), chairman of the Senate Budget Committee, explains:

The money is in the budget now. If we do not use the money--it is very likely not going to be available next year. When we write the next budget resolution, we are going to be facing a totally different circumstance than we faced in the spring of this year when we wrote the budget.2

He is right. Those most intent on passing farm legislation this year, even though current authorization will not expire until next fall, recognize that Americans will not support irresponsible increases in farm subsidies next year when there may be little money to fund them. They renamed the Agriculture Act of 20013 (which had less chance of passing before September 11) the Farm Security Act of 2001, implying that it was now a component of the national strategy to eradicate terrorism. The strategy worked. The House passed it by a vote of 291 to 120 on October 5.

Those who want to rush the Farm Security Act to the President portray subsidies as a safety net for impoverished farmers. The sad truth is that far too many of these dollars never reach the farmers with the lowest incomes. Instead, much of the money goes to millionaire farm owners, Fortune 500 companies, and even some legislators who serve on Congress's agricultural committees. While 60 percent of America's farmers are not even allowed to apply for a subsidy, billionaire Ted Turner, for example, has received subsidies over the past five years that are 38 times greater than the median farm subsidy over that period.4

Rather than rush to pass a bill that concentrates more subsidies in the pockets of the wealthy and well-connected, Congress should study ways to assure that farm subsidies reach those who need them. At a time of dwindling surpluses, pressing national security priorities, and an agriculture sector that is faring well, taxing working people to swell the coffers of millionaires is irresponsible.

SAFETY NET OR CORPORATE WELFARE?

For two-thirds of a century, the favored rationale for farm subsidy programs has been America's romantic connection to its agricultural past and a desire to preserve the small family farm. But in reality, agriculture policy has become an exercise in "trickle-up" economics--taxing working Americans to subsidize the wealthiest farms. Before Congress rushes headlong into increasing farm subsidies by 65 percent, it should examine who really needs them.

The outlook for most American farms today is far from bleak:

- Record farm incomes. Despite claims that farm legislation must be passed to avert disaster, the U.S. Department of Agriculture now forecasts that net farm income in 2001 will be $3 billion higher than it was in 2000, continuing a trend of annual increases that began in 1998 and surpassing the previous record set in 1993.5

- Record average net worth. The average net worth of U.S. farmers increased steadily throughout the decade by more than 38 percent. In fact, the average net worth of all U.S. farmers is three times that of the average American. The average net worth of the relatively small group of large commercial farms that account for less than one-fifth of all U.S. farms is substantially higher.6

- Record industry net worth. Throughout the last decade, U.S. agriculture's overall balance sheet has strengthened steadily, with farm assets increasing more rapidly than liabilities. In current dollars, net farm worth in 2001 is forecast to exceed $1 trillion, up almost $31 billion over 2000.7

How the Subsidies Discriminate

Payments Are Based on Crop, Not Need. Federal farm subsidies are based on crop, not need. Only 40 percent of U.S. farmers receive federal subsidies, and 90 percent of these subsidies are for five specific crops: corn, wheat, cotton, rice, and soybeans.8

The other 60 percent of farmers produce products for which there is no government program, like eggs, poultry, cattle, nuts, and most vegetables. The federal government, in an attempt to increase farmer incomes, arbitrarily subsidizes wealthy farmers simply for planting favored crops while excluding many low-income farmers who do not grow the right crops.

Payment Levels Increase with Production. There are approximately 2 million farms in the United States. Farms with annual sales of over $100,000, which account for 16 percent of all farms, bring in nearly 60 percent of total farm income. Farms with annual sales of between $20,000 and $100,000, which account for 18 percent of all farms, bring in 15 percent of total farm income. And the two-thirds of farms with annual sales of less than $20,000 account for only 25 percent of all farm income.9

Because government payment levels are based on production volume rather than need, the overwhelming percentage of payments goes to large farms that have considerably more net worth and, due to economies of scale, are much more profitable than small farms.

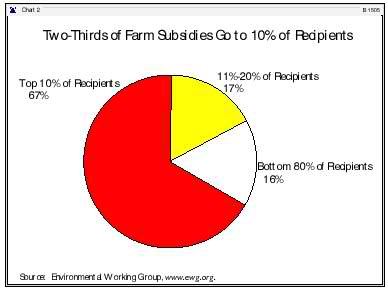

Wealthy Farmers Receive More Subsidies. According to the Environmental Working Group, a nonprofit environmental research organization, the top 10 percent of individual farm subsidy recipients receive two-thirds of farm subsidy dollars, whereas the bottom 80 percent of recipients combine for just 16 percent of farm support spending. (See Chart 2.) Of the 1.6 million individual farms, organizations, businesses, and government agencies receiving farm subsidies in 2000, approximately 57,500 received over $100,000, and 154 received at least $1 million.10

Although farm subsidies are supposedly designed to help farmers, much of the benefits actually accrue to their landowners, in the short run through rising rental rates and in the longer term through capitalization into land values. The 42 percent of farmers working mostly rented acres in 1999 received little benefit from the programs.11

Examples of the Rich and Famous Who Benefit

The trickle-up nature of U.S. farm subsidies today can best be seen by examining some of the wealthiest farm subsidy recipients who walk the halls of Congress, live in large mansions, or enjoy Fortune 500 status. (See Table 1.)

Vote Yourself a Subsidy. Several Members of Congress--including some who sit on the agricultural committees that craft the subsidy programs--accept subsidies for interests they either own or co-own. For example:

- Representative Doug Ose (R-CA), a member of the House Agriculture Committee, has a net worth of $12.5 million and is listed as the 22nd richest Member of Congress by Roll Call. Two companies in which he has partial ownership received approximately $149,000 in rice subsidies over the past five years.12

- Representative Marion Berry (D-AK) also serves on the House Agriculture Committee. This former farm policy advisor to President Clinton has received $750,449 in subsidies since 1996 for farm and land-owning companies he owns with relatives. This subsidy places him in the top one-fifth of 1 percent of subsidy recipients.13

- Senator Blanche Lincoln (D-AK), a member of the Senate Agriculture, Nutrition and Forestry Committee, owns a one-ninth share in a family farm that has received $351,085 in farm subsidies since 1996. She admits that the $10,000 check she receives annually from taxpayers is "not critical to my sustenance or my sustainability."14

-

Although not on the Agriculture, Nutrition and Forestry Committee, Senator Mike

DeWine (R-OH) and his wife have collected almost $50,000 in combined subsidies since 1996 for two family companies of which they own shares. Roll Call estimates Senator DeWine's net worth at $7 million.15

Over that same five-year period, the median farm subsidy was just $4,675.16

Pork for the Fortunate. Among the multimillionaires and billionaires who cashed in on the farm subsidies during that period are:

- Portland Trailblazers basketball star Scottie Pippen, who has received $131,575 in farm subsidies over the past five years for not planting crops on land he purchased in Arkansas. The Trailblazers will pay Pippen a salary of $18.1 million this year alone.

- Ted Turner, the 25th wealthiest person in America. Although his net worth is $6.2 billion, Turner still applies for and receives taxpayer subsidies to grow wheat, oats, and barley on his ranches. Since 1996, he has received $176,077 in farm subsidies.

- David Rockefeller, the grandson of oil tycoon John D. Rockefeller, who himself became Chairman of Chase Manhattan. He secured a five-year total of $352,187 in subsidies for growing crops like corn, wheat, and soybeans on the family farm in Hudson, New York.17

Fortune 500 Fluff. The design of farm programs means that money also goes to major corporations, many of which have no significant commercial interest in farming. Several Fortune 500 companies receive farm subsidies. Though the dollar value may be small, and overlooked by stockholders and corporate officers alike, it is still much more money than most farmers receive:

- Chevron, whose net income reached a record $5.2 billion in 2000,18 nevertheless received $260,223 in federal farm subsidies over the past five years.19

- The John Hancock Mutual Life Insurance Web site touts the value of the over 150,000 acres of prime farmland it owns in 12 states, with a combined value of $460 million. With $9 billion in annual revenues, the company still has received $211,368 in farm subsidies since 1996.20

Table 1: Farm Subsidies, 1996-2000

FORTUNE 500 Companies |

Subsidy |

Westvaco Corporation |

$268,740 |

Chevron |

$260,223 |

John Hancock Mutual Life Insurance |

$211,368 |

DuPont |

$188,732 |

Caterpillar |

$171,698 |

International Paper |

$75,393 |

Georgia Pacific |

$37,156 |

Archer Daniels Midland |

$36,305 |

Mead Corporation |

$15,115 |

Deere & Company |

$12,875 |

Boise Cascade Corporation |

$11,024 |

Kimberly-Clark |

$8,495 |

Eli Lilly Co. |

$2,315 |

Pfizer |

$2,011 |

Navistar |

$1,980 |

CONGRESS |

Subsidy |

| Rep. Marion Berry (D-AK) | $750,449[1] |

| Sen. Blanche Lincoln (D-AK) | $351,085[2] |

Rep. Cal Dooley (D-CA) |

$306,902[3] |

Rep. Tom Latham (R-IA) |

$286,862 |

Rep. Doug Ose (R-CA) |

$149,000[4] |

| Sen. Charles Grassley (R-IA) | $110,936 |

| Sen. Mike DeWine (R-OH) and his wife | $50,000 [5] |

Sen. Richard Lugar (R-IN) |

$48,464 [6] |

Rep. Charles Stenholm (D-TX), his wife, and a trust |

$39,298 |

Rep. Bob Stump (R-AZ) |

$20,798 |

Rep. Dennis Hastert (R-IL) |

$17,214 |

Sen. Sam Brownback (R-KS) |

$16,913 |

Sen. Phil Gramm (R-TX) |

$12,571 |

Rep. Phil Crane (R-IL) |

$7,397 |

OTHER NOTABLES |

Subsidy |

David Rockefeller |

$352,187 |

Ted Turner |

$176,077 |

Scottie Pippen |

$131,575 |

Sam Donaldson |

$29,106 |

Bob Dole (living trust) |

$18,550 |

Ben Bradlee |

$3,500 |

John Ashcroft (trust) |

$1,620 |

National Median Farm Subsidy, 1996-2000 |

$4,675 |

Note: Amounts include properties in which the individual is only a partial owner.

Source: Data from the Environmental Working Group at www.ewg.org unless otherwise noted.